Академический Документы

Профессиональный Документы

Культура Документы

Icaew Cfab Asr 2019 Syllabus

Загружено:

Anonymous ulFku1vАвторское право

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Icaew Cfab Asr 2019 Syllabus

Загружено:

Anonymous ulFku1vАвторское право:

Certificate in Finance, Accounting

and Business (ICAEW CFAB)

Syllabus and technical knowledge

grids

ASSURANCE

For exams in 2019

2019 ICAEW CFAB Assurance syllabus.docx Page 1 of 12

CONTENTS

ICAEW CFAB OVERVIEW……………………………………………………………………………...… 3

ASSURANCE…………………………...………………………..………………………………..……….. 5

TECHNICAL KNOWLEDGE GRIDS……………………………………………………………………… 9

2019 ICAEW CFAB Assurance syllabus.docx Page 2 of 12

ICAEW CFAB overview

The ICAEW Certificate in Finance, Accounting and Business (ICAEW CFAB) is an internationally

recognised qualification, providing the practical skills and essential knowledge needed for today’s

competitive business world.

ICAEW CFAB will introduce you to the fundamentals of accountancy, finance and business, and is

made up of six exams:

ICAEW CFAB is a respected qualification that can be studied and completed as a standalone

qualification or as part of the Level 4 Accounting Technician Apprenticeship. It can also serve as a

stepping stone to the ICAEW Business and Finance Professional (BFP) designation and chartered

accountancy with the ACA qualification.

Assessment

Each exam is computer-based and can be sat in any order, at a time that is convenient for you.

Each exam is 90 minutes long and has a 55% pass mark. Students have a maximum of four

attempts at each exam.

Ethics

Ethics is embedded throughout the qualification and there are specific learning outcomes included

in a number of the exams. The syllabus has been designed to ensure students understand the

fundamental principles of ethics, can apply relevant ethical guidance and are able to recommend

actions to resolve ethical issues.

Credit for prior learning

Students who are studying for, or already hold a qualification that we recognise, may be eligible for

credit for prior learning.

2019 ICAEW CFAB Assurance syllabus.docx Page 3 of 12

Credit for prior learning is also known as CPL and exemptions. It recognises areas of the ICAEW

CFAB syllabus that you have studied. Find out more at icaew.com/cfabcpl

Syllabus

This document presents the learning outcomes for each ICAEW CFAB exam. The learning

outcomes in each exam should be read in conjunction with the relevant technical knowledge grid at

the end of this document.

2019 ICAEW CFAB Assurance syllabus.docx Page 4 of 12

Assurance

MODULE AIM

To ensure that students understand the assurance process and fundamental principles of ethics,

and are able to contribute to the assessment of internal controls and gathering of evidence on an

assurance engagement.

On completion of this module, students will be able to:

explain the concept of assurance, why assurance is required and the reasons for assurance

engagements being carried out by appropriately qualified professionals with an attitude of

professional scepticism and the exercise of professional judgement;

explain the nature of internal controls and why they are important, document an organisation’s

internal controls and identify weaknesses in internal control systems;

select sufficient and appropriate methods of obtaining assurance evidence and recognise when

conclusions can be drawn from evidence obtained or where issues need to be referred to a

senior colleague; and

understand the importance of ethical behaviour to a professional and identify issues relating to

integrity, objectivity, professional competence and due care, confidentiality, professional

behaviour and independence.

METHOD OF ASSESSMENT

The Assurance module is assessed by a 1.5 hour computer-based exam. The exam consists of 50

questions worth two marks each, covering the areas of the syllabus in accordance with the

weightings set out in the specification grid. The questions are presented in the form of multiple

choice, multi-part multiple choice, or multiple response.

SPECIFICATION GRID

This grid shows the relative weightings of subjects within this module and should guide the relative

study time spent on each. Over time the marks available in the assessment will equate to the

weightings below, while slight variations may occur in individual assessments to enable suitably

rigorous questions to be set.

Syllabus area Weighting (%)

1 The concept, process and need for assurance 20

2 Internal controls 25

3 Gathering evidence on an assurance engagement 35

4 Professional ethics 20

The following learning outcomes should be read in conjunction with the relevant sections of the

technical knowledge grids at the end of this document.

1 The concept, process and need for assurance

Students will be able to explain the concept of assurance, why assurance is required and the

reasons for assurance engagements being carried out by appropriately qualified professionals.

2019 ICAEW CFAB Assurance syllabus.docx Page 5 of 12

In the assessment, students may be required to:

a. define the concept of assurance;

b. state why users desire assurance reports and provide examples of the benefits gained from

them such as to assure the quality of an entity’s published corporate responsibility or

sustainability report;

c. compare the functions and responsibilities of the different parties involved in an assurance

engagement;

d. compare the purposes and characteristics of, and levels of assurance obtained from, different

assurance engagements;

e. identify the issues which can lead to gaps between the outcomes delivered by the assurance

engagement and the expectations of users of the assurance reports, and suggest how these

can be overcome;

f. define the assurance process, including:

obtaining the engagement

continuous risk assessment

engagement acceptance

the scope of the engagement

planning the engagement

performing the engagement

obtaining evidence

evaluation of results of assurance work

concluding and reporting on the engagement

reporting to the engaging party

keeping records of the work performed;

g. recognise the need to plan and perform assurance engagements with an attitude of

professional scepticism and the exercise of professional judgement;

h. define the concept of reasonable assurance; and

i. recognise the characteristics of fraud and distinguish between fraud and error.

2 Internal controls

Students will be able to explain the nature of internal controls and why they are important,

document an organisation’s internal controls and identify weaknesses in internal control systems.

In the assessment, students may be required to:

a. state the reasons for organisations having effective systems of control;

b. identify the fundamental principles of effective control systems;

c. identify the main areas of a business that need effective control systems;

d. identify the components of internal control in both manual and IT environments, including:

the overall control environment

preventative and detective controls

internal audit;

e. define and classify different types of internal control, with particular emphasis upon those

which impact upon the quality of financial information;

f. show how specified internal controls mitigate risk, including cyber risks, and state their

limitations;

g. identify internal controls for an organisation in a given scenario;

h. identify internal control deficiencies in a given scenario; and

i. identify, for a specified organisation, the sources of information which will enable a sufficient

record to be made of accounting or other systems and internal controls.

2019 ICAEW CFAB Assurance syllabus.docx Page 6 of 12

3 Gathering evidence on an assurance engagement

Students will be able to select sufficient and appropriate methods of obtaining assurance evidence

and recognise when conclusions can be drawn from evidence obtained or where issues need to be

referred to a senior colleague.

In the assessment, students may be required to:

a. state the reasons for preparing and keeping documentation relating to an assurance

engagement;

b. identify the different methods of obtaining evidence from the use of tests of control, substantive

procedures, including analytical procedures and data analytics;

c. recognise the strengths and weaknesses of the different methods of obtaining evidence;

d. identify the situations within which the different methods of obtaining evidence should and

should not be used;

e. compare the reliability of different types of assurance evidence;

f. select appropriate methods of obtaining evidence from tests of control and from substantive

procedures for a given business scenario;

g. recognise when the quantity (including factors affecting sample design) and quality of evidence

gathered is of a sufficient and appropriate level, after taking account of sampling risk, to draw

conclusions on which to base a report;

h. identify the circumstances in which written confirmation of representations from management

should be sought and the reliability of such confirmation as a form of assurance evidence; and

i. recognise issues arising while gathering assurance evidence that should be referred to a

senior colleague.

4 Professional ethics

Students will be able to understand the importance of ethical behaviour to a professional and

identify issues relating to integrity, objectivity, professional competence and due care,

confidentiality, professional behaviour and independence.

In the assessment, students may be required to:

a. state the role of ethical codes and their importance to the profession;

b. recognise the differences between a rules-based ethical code and one based upon a set of

principles;

c. recognise how the principles of professional behaviour protect the public and fellow

professionals;

d. identify the key features of the system of professional ethics adopted by IESBA and ICAEW;

e. identify the fundamental principles underlying the IESBA and the ICAEW Code of Ethics;

f. recognise the importance of integrity and objectivity to professional accountants, identifying

situations that may impair or threaten integrity and objectivity;

g. suggest courses of action to resolve ethical conflicts relating to integrity and objectivity;

h. respond appropriately to the request of an employer to undertake work outside the confines of

an individual’s expertise or experience;

i. recognise the importance of confidentiality and identify the sources of risks of accidental

disclosure of information;

j. identify steps to prevent the accidental disclosure of information;

k. identify situations in which confidential information may be disclosed;

l. define independence and recognise why those undertaking an assurance engagement are

required to be independent of their clients;

m. identify the following threats to the fundamental ethical principles and the independence of

assurance providers:

self-interest threat

self-review threat

management threat

2019 ICAEW CFAB Assurance syllabus.docx Page 7 of 12

advocacy threat

familiarity threat

intimidation threat;

n. identify safeguards to eliminate or reduce threats to the fundamental ethical principles and the

independence of assurance providers; and

suggest how a conflict of loyalty between the duty a professional accountant has to their

employer and the duty to their profession could be resolved.

2019 ICAEW CFAB Assurance syllabus.docx Page 8 of 12

Technical knowledge

The tables contained in this section show the technical knowledge in the disciplines of financial

reporting, audit and assurance, business analysis, ethics and taxation covered in the ACA syllabus

by module.

For each individual standard the level of knowledge required in the relevant Certificate and

Professional Level module and at the Advanced Level is shown.

The knowledge levels are defined as follows:

Level D

An awareness of the scope of the standard.

Level C

A general knowledge with a basic understanding of the subject matter and training in its application

thereof sufficient to identify significant issues and evaluate their potential implications or impact.

Level B

A working knowledge with a broad understanding of the subject matter and a level of experience in

the application thereof sufficient to apply the subject matter in straightforward circumstances.

Level A

A thorough knowledge with a solid understanding of the subject matter and experience in the

application thereof sufficient to exercise reasonable professional judgement in the application of

the subject matter in those circumstances generally encountered by chartered accountants.

Key to other symbols:

→ The knowledge level reached is assumed to be continued

2019 ICAEW CFAB Assurance syllabus.docx Page 9 of 12

Ethics Codes and Standards

Ethics Codes and Standards Level Modules

IESBA Code of Ethics for Professional Accountants Certificate Level

(parts A, B and C and Definitions) C/D Accounting

B Assurance

ICAEW Code of Ethics C/D Business, Technology and Finance

D Law

C Management Information

C Principles of Taxation

Professional Level

A Audit and Assurance

B Business Strategy and Technology

B Financial Accounting and Reporting

B/C Financial Management

B Tax Compliance

B Business Planning

Advanced Level

A Corporate Reporting

A Strategic Business Management

A Case Study

FRC Revised Ethical Standard (2016) B Assurance

A Audit and Assurance

Advanced Level

A Corporate Reporting

A Strategic Business Management

A Case Study

2019 ICAEW CFAB Assurance syllabus.docx Page 10 of 12

Assurance and Audit

Assurance

Assurance

Audit and

Advanced

Topic

Level

The International Auditing and Assurance Standards Board D C

The Authority Attaching to Standards Issued by the International Auditing and C A

Assurance Standards Board

The Authority Attaching to Practice Statements Issued by the International Auditing A

and Assurance Standards Board

Discussion Papers C

Working Procedures C

International Standards on Auditing (UK)

200 (Revised June 2016) Overall Objectives of the Independent Auditor and the B A→ →

Conduct of an Audit in Accordance with International Standards on Auditing (UK)

210 (Revised June 2016) (Updated July 2017) Agreeing the Terms of Audit B →

Engagements

220 (Revised June 2016) (Updated July 2017) Quality Control for an Audit of B →

Financial Statements

230 (Revised June 2016) Audit Documentation C B A

240 (Revised June 2016) (Updated July 2017) The Auditor’s Responsibilities C B A

Relating to Fraud in an Audit of Financial Statements

250 A (Revised December 2017) Consideration of Laws and Regulations in an Audit B A

of Financial Statements

250 B(Revised June 2016) The Auditor’s Statutory Right and Duty to Report to C

Regulators of Public Interest Entities and Regulators of Other Entities in the

Financial Sector

260 (Revised June 2016) (Updated July 2017) Communication with Those Charged B A

with Governance

265 Communicating Deficiencies in Internal Control to Those Charged with B A

Governance and Management

300 (Revised June 2016) Planning an Audit of Financial Statements B A →

315 (Revised June 2016) Identifying and Assessing the Risks of Material C A →

Misstatement Through Understanding of the Entity and its Environment

320 (Revised June 2016) (Updated July 2017) Materiality in Planning and C A →

Performing an Audit

330 (Revised July 2017) The Auditor’s Responses to Assessed Risks Ccas C B A

402 Audit Considerations Relating to an Entity Using a Service Organisation C B

450 (Revised June 2016) (Updated July 2017) Evaluation of Misstatements C A

Identified during the Audit

500 (Updated July 2017) Audit Evidence B A →

501 Audit Evidence - Specific Considerations for Selected Items B A

505(Updated July 2017) External Confirmations (Revised July 2017) B B A

510 (Revised June 2016) Initial Audit Engagements - Opening Balances C B A

520 Analytical Procedures B A A

530 Audit Sampling B B A

540 (Revised June 2016) Auditing Accounting Estimates, Including Fair Value C B A

Accounting Estimates and Related Disclosures

550 Related Parties C B A

2019 ICAEW CFAB Assurance syllabus.docx Page 11 of 12

560 Subsequent Events B A

570 (Revised June 2016) Going Concern A →

580 Written Representations C B A

600 (Revised June 2016) Special Considerations – Audits of Group Financial C A

Statements (including the Work of Component Auditors)

610 (Revised June 2013) Using the Work of Internal Auditors C B A

620 (Revised June 2016) Using the Work of an Auditor’s Expert B A

700 (Revised June 2016) Forming an Opinion and Reporting on Financial B A →

Statements

701 Communicating Key Audit Matters in the Independent Auditor’s Report B A

705 (Revised June 2016) Modifications to the Opinion in the Independent Auditor’s A →

Report

706 (Revised June 2016) Emphasis of Matter Paragraphs and Other Matter A →

Paragraphs in the Independent Auditor’s Report

710 Comparative Information – Corresponding Figures and Comparative Financial B A

Statements

720 The Auditor’s Responsibility Relating to Other Information B A

800 Special Considerations – Audits of Financial Statements prepared in B A

Accordance with Special Purpose Frameworks

805 (Revised October 2016) Special Considerations – Audits of Single Financial B A

Statements and Specific Elements, Accounts or items of a Financial Statement

International Standards on Auditing

810 (Revised) Engagements to Report on Summary Financial Statements B

International Auditing Practice Note (IAPN)

1000 Special Considerations in Auditing Financial Instruments B

International Standards on Review Engagements (ISREs)

2400 (Revised September 2012) Engagements to Review Historical Financial C B

Statements

International Standards on Review Engagements (UK & Ireland)

2410 Review of Interim Financial Information Performed by the Independent Auditor C B

of the Entity

International Standards on Assurance Engagements (ISAEs)

3000 (Revised) Assurance Engagements Other than Audits or Reviews of Historical C B

Financial Information

3400 The Examination of Prospective Financial Information C A

3402 Assurance Reports on Controls at a Service Organisation C B

3410 Assurance Engagements on Greenhouse Gas Statements C →

International Standards on Related Services (ISRSs)

4400 Engagements to Perform Agreed-upon Procedures Regarding Financial B

Information

4410 Compilation Engagements (Revised March 2012) B

IAASB Statements

ISQC1 (Revised June 2016) (Updated July 2017) Quality Control for Firms that C B

Perform Audits and Reviews of Financial Statements, and Other Assurance and

Related Services Engagements

Other Guidance

Bulletin (October 2016): Compendium of Illustrative Auditor’s Reports on United B B

Kingdom Private Sector Financial Statements for periods commencing on or after 17

June 2016

FRC Briefing Paper B B

Professional Scepticism – establishing a common understanding and reaffirming its

central role in delivering audit quality

2019 ICAEW CFAB Assurance syllabus.docx Page 12 of 12

Вам также может понравиться

- Icaew Cfab BTF 2019 SyllabusДокумент14 страницIcaew Cfab BTF 2019 SyllabusAnonymous ulFku1vОценок пока нет

- Chapter - 01, Concept and Need For AssuranceДокумент5 страницChapter - 01, Concept and Need For Assurancemahbub khanОценок пока нет

- New Cima p1 2019 NotesДокумент112 страницNew Cima p1 2019 NotesNassib SongoroОценок пока нет

- ICAEW - Accounting 2020 - Chap 4Документ78 страницICAEW - Accounting 2020 - Chap 4TRIEN DINH TIENОценок пока нет

- Sample Exam - AssuranceДокумент57 страницSample Exam - AssuranceHương MaiОценок пока нет

- Acca f9 Class Notes 2010 Final 21 JanДокумент184 страницыAcca f9 Class Notes 2010 Final 21 JanArshadul Hoque Chowdhury75% (4)

- Cima c02 - NotesДокумент112 страницCima c02 - Notesrenny2064775% (4)

- Business & Finance PDFДокумент63 страницыBusiness & Finance PDFpronab sarkerОценок пока нет

- P5 Course Note 2018Документ266 страницP5 Course Note 2018Nguyen Binh MinhОценок пока нет

- C. Law Answers in Addition To 3rd EditionДокумент17 страницC. Law Answers in Addition To 3rd EditionMuhammad Hassan TahirОценок пока нет

- Certification in Integrated Treasury Management SyllabusДокумент4 страницыCertification in Integrated Treasury Management Syllabusshubh.icai0090Оценок пока нет

- Case Study ExamnationДокумент4 страницыCase Study ExamnationEduardo GreatОценок пока нет

- CL Suggested Ans - Nov Dec 2019 PDFДокумент63 страницыCL Suggested Ans - Nov Dec 2019 PDFMd SelimОценок пока нет

- Exam and Question Tutorial Operational Case Study 2019 CIMA Professional QualificationДокумент61 страницаExam and Question Tutorial Operational Case Study 2019 CIMA Professional QualificationMyDustbin2010100% (1)

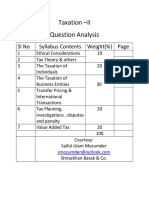

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Документ68 страницQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Optimal Management SolutionОценок пока нет

- Case Study July 2016 Exam PaperДокумент17 страницCase Study July 2016 Exam PaperWazeer ToraballyОценок пока нет

- ICAEW - Accounting 2020 - Chap 2Документ56 страницICAEW - Accounting 2020 - Chap 2TRIEN DINH TIENОценок пока нет

- Management Level Exam Blueprints 2023 2024 Final For WebДокумент29 страницManagement Level Exam Blueprints 2023 2024 Final For WebSANG HOANG THANHОценок пока нет

- ASSIGNMENT of Management AbdullahДокумент2 страницыASSIGNMENT of Management AbdullahanamОценок пока нет

- Essentials of Corporate Financial Management 2ndДокумент99 страницEssentials of Corporate Financial Management 2ndcharlisyuenОценок пока нет

- SFM Theory Booklet PDFДокумент132 страницыSFM Theory Booklet PDFManoj VenkatОценок пока нет

- Cima Ba4 2020Документ96 страницCima Ba4 2020Jonathan GillОценок пока нет

- Business Technology and Finance 2020 Study Manual for Vietnam trang 109 111 đã chuyển đổiДокумент3 страницыBusiness Technology and Finance 2020 Study Manual for Vietnam trang 109 111 đã chuyển đổiĐinh AnhОценок пока нет

- July 2020 Case Study Advanced InformationДокумент38 страницJuly 2020 Case Study Advanced InformationWazeer Torabally100% (1)

- Sunway University College THE INSTITUTE OF CHARTERED ACCOUNTANTS (ICAEW) Programme 2010Документ12 страницSunway University College THE INSTITUTE OF CHARTERED ACCOUNTANTS (ICAEW) Programme 2010Sunway University100% (1)

- The Fall of Enron: Group 1Документ20 страницThe Fall of Enron: Group 1Thiện NhânОценок пока нет

- TOPCIMA Analysis Hanging by A ThreadДокумент9 страницTOPCIMA Analysis Hanging by A ThreadGeorge KauteОценок пока нет

- Tareq Ahmed (Faisal) M.J.Abedin & CoДокумент49 страницTareq Ahmed (Faisal) M.J.Abedin & Cotusher pepolОценок пока нет

- Delta Life Insurance 2012Документ90 страницDelta Life Insurance 2012OliviaDuchessОценок пока нет

- Multi Task Questions.Документ8 страницMulti Task Questions.wilbertОценок пока нет

- Far Ifrs Sept 2020 PDFДокумент6 страницFar Ifrs Sept 2020 PDFhertzberg 1Оценок пока нет

- ARMANI F1 (1100 MCQS) ExДокумент326 страницARMANI F1 (1100 MCQS) ExSeeta Gilbert100% (1)

- Pages From BPP CIMA C2 COURSE NOTE 2012 New SyllabusДокумент50 страницPages From BPP CIMA C2 COURSE NOTE 2012 New Syllabusadad9988100% (1)

- ACCA p1 Notes PDFДокумент230 страницACCA p1 Notes PDFmullazakОценок пока нет

- C02 Sample Questions Feb 2013Документ20 страницC02 Sample Questions Feb 2013Elizabeth Fernandez100% (1)

- AssuranceДокумент39 страницAssuranceLinh MaiОценок пока нет

- Nguyễn Bùi Thanh Tùng 16071262Документ38 страницNguyễn Bùi Thanh Tùng 16071262Nghiêm Thu HiềnОценок пока нет

- ManagementДокумент16 страницManagementSahar Al-JoburyОценок пока нет

- ACCA P3 Course NotesДокумент219 страницACCA P3 Course NotesSyed Wajahat AliОценок пока нет

- Accounting Chapter 2 MCQ by Nobel Professional AcademyДокумент16 страницAccounting Chapter 2 MCQ by Nobel Professional AcademytafsirmhinОценок пока нет

- Jun 2008 - Qns DB1Документ13 страницJun 2008 - Qns DB1Hubbak Khan100% (1)

- 1-Knowledge Assurance SM PDFДокумент350 страниц1-Knowledge Assurance SM PDFShahid MahmudОценок пока нет

- FA1 - MM - Pocket NotesДокумент25 страницFA1 - MM - Pocket NotesMirza NoumanОценок пока нет

- SL 1 Advanced Business ReportingДокумент300 страницSL 1 Advanced Business Reportingsanu sayed100% (1)

- Ch01-Casesstudy For UMAДокумент3 страницыCh01-Casesstudy For UMAjklbnm12345100% (1)

- ICAEW - MA1 - LECTURE NOTES - For StudentsДокумент108 страницICAEW - MA1 - LECTURE NOTES - For StudentsNga Đào Thị Hằng100% (1)

- Diploma in Business and Marketing Strategy (SCQF Level 11/ RQF Level 7) (Standard Mode)Документ4 страницыDiploma in Business and Marketing Strategy (SCQF Level 11/ RQF Level 7) (Standard Mode)GibsonОценок пока нет

- 8int 2006 Jun QДокумент4 страницы8int 2006 Jun Qapi-19836745Оценок пока нет

- Cima C01 Samplequestions Mar2013Документ28 страницCima C01 Samplequestions Mar2013Abhiroop Roy100% (1)

- CMA MCQ MergedДокумент224 страницыCMA MCQ Mergedsaikat karmakarОценок пока нет

- ACCA F8-2015-Jun-QДокумент10 страницACCA F8-2015-Jun-QSusie HopeОценок пока нет

- Accounting: The Institute of Chartered Accountants in England and WalesДокумент26 страницAccounting: The Institute of Chartered Accountants in England and WalesPhuong ThanhОценок пока нет

- ACCA P2 December 2015 NotesДокумент262 страницыACCA P2 December 2015 NotesopentuitionID100% (2)

- CIMA F1 2019 NotesДокумент164 страницыCIMA F1 2019 Notessolstice567567Оценок пока нет

- Viewpdf 22Документ25 страницViewpdf 22ibrahimbdОценок пока нет

- DRAFT syllabus-Certificate-01-Feb-18Документ24 страницыDRAFT syllabus-Certificate-01-Feb-18Jahirul IslamОценок пока нет

- 5117ICAB Syllabus-2023Документ109 страниц5117ICAB Syllabus-2023mizanacmaОценок пока нет

- Icaew Cfab Mi 2019 SyllabusДокумент12 страницIcaew Cfab Mi 2019 SyllabusAnonymous ulFku1vОценок пока нет

- AUD 1 Attestation Engagements 2021Документ34 страницыAUD 1 Attestation Engagements 2021Y not me??Оценок пока нет

- Accounting Sample Exam 1 2018Документ20 страницAccounting Sample Exam 1 2018Naomi NovelinОценок пока нет

- Icaew Cfab Acc 2019 SyllabusДокумент10 страницIcaew Cfab Acc 2019 SyllabusAnonymous ulFku1v0% (1)

- ICAEW CFAB ACC 2019 Presentation SlidesДокумент16 страницICAEW CFAB ACC 2019 Presentation SlidesAnonymous ulFku1vОценок пока нет

- Icaew Cfab Acc 2019 Study GuideДокумент40 страницIcaew Cfab Acc 2019 Study GuideAnonymous ulFku1v0% (1)

- Icaew Cfab Mi 2019 SyllabusДокумент12 страницIcaew Cfab Mi 2019 SyllabusAnonymous ulFku1vОценок пока нет

- Accounting Sample Exam 2 2018Документ21 страницаAccounting Sample Exam 2 2018Naomi Novelin100% (2)

- Icaew Cfab Asr 2019 Sample ExamДокумент28 страницIcaew Cfab Asr 2019 Sample ExamAnonymous ulFku1v100% (1)

- Icaew Cfab Mi 2018 Sample Exam 1Документ29 страницIcaew Cfab Mi 2018 Sample Exam 1Anonymous ulFku1v100% (1)

- Icaew Cfab Mi 2019 Study GuideДокумент42 страницыIcaew Cfab Mi 2019 Study GuideAnonymous ulFku1vОценок пока нет

- Icaew Cfab Mi 2016 IntroductionДокумент31 страницаIcaew Cfab Mi 2016 IntroductionAnonymous ulFku1vОценок пока нет

- Icaew Cfab Mi 2018 Sample Exam 3Документ30 страницIcaew Cfab Mi 2018 Sample Exam 3Anonymous ulFku1v100% (2)

- Icaew Cfab Law 2019 Study GuideДокумент28 страницIcaew Cfab Law 2019 Study GuideAnonymous ulFku1v100% (1)

- ICAEW CFAB ASR 2015 Introduction SlidesДокумент35 страницICAEW CFAB ASR 2015 Introduction SlidesAnonymous ulFku1vОценок пока нет

- Icaew Cfab Asr 2019 Study GuideДокумент36 страницIcaew Cfab Asr 2019 Study GuideAnonymous ulFku1v50% (2)

- Icaew Cfab BTF 2019 Study GuideДокумент50 страницIcaew Cfab BTF 2019 Study GuideAnonymous ulFku1v100% (3)

- Icaew Cfab Pot 2019 Study GuideДокумент44 страницыIcaew Cfab Pot 2019 Study GuideAnonymous ulFku1vОценок пока нет

- Icaew Cfab Pot 2018 Tax TablesДокумент12 страницIcaew Cfab Pot 2018 Tax TablesAnonymous ulFku1vОценок пока нет

- Icaew Cfab Pot 2019 SyllabusДокумент10 страницIcaew Cfab Pot 2019 SyllabusAnonymous ulFku1vОценок пока нет

- Icaew Cfab Pot 2018 Sample ExamДокумент30 страницIcaew Cfab Pot 2018 Sample ExamAnonymous ulFku1vОценок пока нет

- ICAEW CFAB PoT 2016 IntroductionДокумент12 страницICAEW CFAB PoT 2016 IntroductionAnonymous ulFku1vОценок пока нет

- Icaew Cfab Law 2019 SyllabusДокумент9 страницIcaew Cfab Law 2019 SyllabusAnonymous ulFku1vОценок пока нет

- Icaew Cfab BTF 2018 Sample ExamДокумент24 страницыIcaew Cfab BTF 2018 Sample ExamAnonymous ulFku1vОценок пока нет

- Icaew Cfab Law 2019 Sample ExamДокумент26 страницIcaew Cfab Law 2019 Sample ExamAnonymous ulFku1v100% (1)

- Notes On Guenter Lee PDEs PDFДокумент168 страницNotes On Guenter Lee PDEs PDF123chessОценок пока нет

- Culture and Cultural GeographyДокумент6 страницCulture and Cultural GeographySrishti SrivastavaОценок пока нет

- Sample PREP-31 Standard Sample Preparation Package For Rock and Drill SamplesДокумент1 страницаSample PREP-31 Standard Sample Preparation Package For Rock and Drill SampleshОценок пока нет

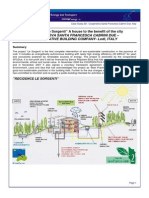

- Case Study Sustainable ConstructionДокумент5 страницCase Study Sustainable ConstructionpraisethenordОценок пока нет

- Andrew Haywood CV 2010Документ6 страницAndrew Haywood CV 2010Dobber0Оценок пока нет

- Method Statement For FDTДокумент7 страницMethod Statement For FDTMs UndergroundОценок пока нет

- Mann Whitney U: Aim: To Be Able To Apply The Mann Whitney U Test Data and Evaluate Its EffectivenessДокумент16 страницMann Whitney U: Aim: To Be Able To Apply The Mann Whitney U Test Data and Evaluate Its EffectivenessAshish ThakkarОценок пока нет

- Jillin ExplosionДокумент10 страницJillin ExplosionArjun ManojОценок пока нет

- Stone ColumnДокумент116 страницStone ColumnNur Farhana Ahmad Fuad100% (1)

- Discovery Issues Resolution Naga NotesДокумент7 страницDiscovery Issues Resolution Naga NotesNagaPrasannaKumarKakarlamudi100% (1)

- Trading Psychology - A Non-Cynical Primer - by CryptoCred - MediumДокумент1 страницаTrading Psychology - A Non-Cynical Primer - by CryptoCred - MediumSlavko GligorijevićОценок пока нет

- Handling Qualities For Vehicle DynamicsДокумент180 страницHandling Qualities For Vehicle DynamicsLaboratory in the WildОценок пока нет

- Talon Star Trek Mod v0.2Документ4 страницыTalon Star Trek Mod v0.2EdmundBlackadderIVОценок пока нет

- Yaskawa Product CatalogДокумент417 страницYaskawa Product CatalogSeby Andrei100% (1)

- Fundamentals of Physics Sixth Edition: Halliday Resnick WalkerДокумент3 страницыFundamentals of Physics Sixth Edition: Halliday Resnick WalkerAhmar KhanОценок пока нет

- A Presentation ON Office Etiquettes: To Be PresentedДокумент9 страницA Presentation ON Office Etiquettes: To Be PresentedShafak MahajanОценок пока нет

- A Brief Tutorial On Interval Type-2 Fuzzy Sets and SystemsДокумент10 страницA Brief Tutorial On Interval Type-2 Fuzzy Sets and SystemstarekeeeОценок пока нет

- (SQP2) Sample Question Paper 2Документ2 страницы(SQP2) Sample Question Paper 2Vraj M BarotОценок пока нет

- Appa Et1Документ4 страницыAppa Et1Maria Theresa Deluna MacairanОценок пока нет

- EBCPG-management of Adult Inguinal HerniaДокумент12 страницEBCPG-management of Adult Inguinal HerniaJoy SantosОценок пока нет

- Planetary DescriptionsДокумент6 страницPlanetary DescriptionsshellymaryaОценок пока нет

- CIVL4903 2014 Semester 2 StudentДокумент3 страницыCIVL4903 2014 Semester 2 StudentSuman SahaОценок пока нет

- 11 Technical Analysis & Dow TheoryДокумент9 страниц11 Technical Analysis & Dow TheoryGulzar AhmedОценок пока нет

- Els2204 Sinsis 1718 CepДокумент7 страницEls2204 Sinsis 1718 CepChristian MarpaungОценок пока нет

- Fourier Transform Infrared Quantitative Analysis of Sugars and Lignin in Pretreated Softwood Solid ResiduesДокумент12 страницFourier Transform Infrared Quantitative Analysis of Sugars and Lignin in Pretreated Softwood Solid ResiduesDaisyOctavianiОценок пока нет

- Effects of Water, Sanitation and Hygiene (WASH) Education On Childhood Intestinal Parasitic Infections in Rural Dembiya, Northwest Ethiopia An Uncontrolled (2019) Zemi PDFДокумент8 страницEffects of Water, Sanitation and Hygiene (WASH) Education On Childhood Intestinal Parasitic Infections in Rural Dembiya, Northwest Ethiopia An Uncontrolled (2019) Zemi PDFKim NichiОценок пока нет

- Ascc Catalog 2014-2016Документ157 страницAscc Catalog 2014-2016api-261615090Оценок пока нет

- This Study Resource Was: Memory TestДокумент8 страницThis Study Resource Was: Memory TestDanica Tolentino67% (3)

- Telephone Operator 2021@mpscmaterialДокумент12 страницTelephone Operator 2021@mpscmaterialwagh218Оценок пока нет

- Academics: Qualification Institute Board/University Year %/CGPAДокумент1 страницаAcademics: Qualification Institute Board/University Year %/CGPARajesh KandhwayОценок пока нет

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideОт Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideРейтинг: 2.5 из 5 звезд2.5/5 (2)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowОт EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowОценок пока нет

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyОт EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyОценок пока нет

- Business Process Mapping: Improving Customer SatisfactionОт EverandBusiness Process Mapping: Improving Customer SatisfactionРейтинг: 5 из 5 звезд5/5 (1)

- Bribery and Corruption Casebook: The View from Under the TableОт EverandBribery and Corruption Casebook: The View from Under the TableОценок пока нет

- Frequently Asked Questions in International Standards on AuditingОт EverandFrequently Asked Questions in International Standards on AuditingРейтинг: 1 из 5 звезд1/5 (1)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekОт EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekОценок пока нет

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersОт EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersРейтинг: 4.5 из 5 звезд4.5/5 (11)

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksОт EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksРейтинг: 4 из 5 звезд4/5 (1)

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsОт EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsОценок пока нет

- The Layman's Guide GDPR Compliance for Small Medium BusinessОт EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessРейтинг: 5 из 5 звезд5/5 (1)

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceОт EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceРейтинг: 4 из 5 звезд4/5 (1)

- GDPR for DevOp(Sec) - The laws, Controls and solutionsОт EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsРейтинг: 5 из 5 звезд5/5 (1)

- Audit and Assurance Essentials: For Professional Accountancy ExamsОт EverandAudit and Assurance Essentials: For Professional Accountancy ExamsОценок пока нет

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachОт EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachРейтинг: 4 из 5 звезд4/5 (1)