Академический Документы

Профессиональный Документы

Культура Документы

Tax 1 General Principles

Загружено:

Gillian Alexis Colegado0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров2 страницыTax 1 General Principles

Оригинальное название

TAX 1 GENERAL PRINCIPLES

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTax 1 General Principles

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров2 страницыTax 1 General Principles

Загружено:

Gillian Alexis ColegadoTax 1 General Principles

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

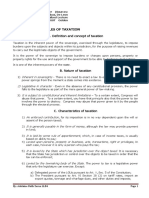

1. What are taxes?

Taxes are the enforced proportional contributions from properties and persons levied by the

State by virtue of its sovereignty for the support of the government and all public needs.

2. What are the essential characteristics of taxes?

ESSENTIAL CHARACTERISTICS OF TAXES

A. Enforced contribution – Not dependent upon the will or contractual assent of the person

taxed. Hence, whether the taxpayer likes it or not, he is compelled to pay taxes. It is a legal and

mandatory obligation.

B. Generally payable in money – Tax is a pecuniary burden payable in money.

Exceptions: 1. Tax credit certificate or backpay certificate – When taxes are paid in excess of that

due, the government issues a certificate where said excess in taxes will be deducted from the

taxes payable the following year.

2. Tax liens – Forfeiture of property by reason of failure to pay real property tax – but this

property will be sold and the proceeds shall be used to satisfy the tax obligation.

C. Proportionate in character – It is assessed in accordance with some reasonable rule of

apportionment which is usually based on the ability of the taxpayer to pay.

D. Levied on persons, property, exercise of a right or privilege, act or transactions – within the

taxing authority‘s jurisdiction in accordance with the principle of territoriality.

Ex. Persons – Cedula; Property – Real Property Tax; Exercise of a right or privilege – Income tax,

Donor‘s Tax

E. Levied by the State which has jurisdiction over the subject or object of taxation

F. Levied by the lawmaking body of the State – The power to tax is a legislative power but is also

granted to local governments, subject to such guidelines and limitations as law may provide.

G. Levied for public purpose – The public purpose of the imposition is implied in the levy of tax.

A tax levied for a private purpose constitutes taking of property without due process

3. Tax v License Fee - page 10

Tax v Toll Fee – page 10 of transcript, (pls copy it nalang gretz, tabular kasi nasa transcript, hehe)

Tax v Special Assessment – page 11

Tax v Debt – page 11

Tax v Subsidy – page 11

4. The inherent limitations are the following: [PENIT]

A. Public purpose

B. Exemption from taxation of government entities

C. Non-delegation of the legislative power to tax

D. International comity

E. Territorial jurisdiction

5. Direct constitutional limitations

A. Revenue bill must originate exclusively in the House of Representatives but the Senate

may propose or amendments

B. Concurrence of a majority of all the members of Congress for the passage of a law

granting tax exemption

C. Rule of uniformity and equity in taxation

D. Progressive system of taxation

E. Exemption of religious, charitable and educational entities, nonprofit cemeteries, and

churches from property taxation.

F. Exemption of non-stock, non-profit educational institutions from taxation

G. Non-imprisonment for non-payment of a poll tax

H. Non-impairment of the jurisdiction of the SC in tax cases

I. Prohibition on the use of special fund

J. Power of the President to veto any particular items in a revenue or tariff bill

INDIRECT CONSTITUTIONAL LIMITATIONS

A. Due process of law B. Equal protection of the laws C. Non-impairment of the obligations

of contracts D. Non-infringement of religious freedom E. No appropriation for religious

purposes F. Non-infringement of the freedom of the press

Вам также может понравиться

- Income-Taxation-Notes - 01 06 24Документ6 страницIncome-Taxation-Notes - 01 06 24Gregzilla YoloMcswaginsОценок пока нет

- Pointers - TaxДокумент11 страницPointers - Taxjulius art maputiОценок пока нет

- Income Taxation Assignment Discussion 1Документ5 страницIncome Taxation Assignment Discussion 1Evelyn LabhananОценок пока нет

- Basic Concepts of Taxation1Документ6 страницBasic Concepts of Taxation1Angela CanayaОценок пока нет

- TAx JulianoДокумент3 страницыTAx Julianojanel anne yvette sorianoОценок пока нет

- Quicknotes in Income TaxДокумент13 страницQuicknotes in Income TaxTrelle DiazОценок пока нет

- 1 Fundamental Principles of Taxation PART 2Документ5 страниц1 Fundamental Principles of Taxation PART 2hunter kimОценок пока нет

- Buslaw3 No AnswersДокумент3 страницыBuslaw3 No AnswersRyanKingОценок пока нет

- General Principles of Taxation - CДокумент2 страницыGeneral Principles of Taxation - Ctough mamaОценок пока нет

- Chapter 1 - Introduction To Taxation: Page 1 of 15Документ15 страницChapter 1 - Introduction To Taxation: Page 1 of 15Kristine dela CruzОценок пока нет

- Fundamental Principles of Taxation: ObjectivesДокумент12 страницFundamental Principles of Taxation: ObjectivesChristelle JosonОценок пока нет

- I. General Principles of TaxationДокумент62 страницыI. General Principles of TaxationJeanne Pabellena DayawonОценок пока нет

- General Principle TaxationДокумент10 страницGeneral Principle TaxationTOLENTINO, Joferose AluyenОценок пока нет

- Taxation Law ReviewerДокумент81 страницаTaxation Law ReviewerSimeon SuanОценок пока нет

- TAXATION - PrelimsДокумент8 страницTAXATION - PrelimsPrincess Dianne CamachoОценок пока нет

- Taxation Law ReviewerДокумент66 страницTaxation Law ReviewerElla Lopez AcostaОценок пока нет

- Chapter 4: General Principles in Taxation Lesson 1 Power of Taxation TaxationДокумент22 страницыChapter 4: General Principles in Taxation Lesson 1 Power of Taxation TaxationJeeren PepitoОценок пока нет

- Taxation Law ReviewerДокумент62 страницыTaxation Law ReviewerAdelaine Faith Zerna96% (23)

- A4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicsДокумент38 страницA4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicscharlesjoshdanielОценок пока нет

- Taxation - ch1Документ5 страницTaxation - ch1Jannah CayabyabОценок пока нет

- Bukidnon State University Alubijid Satellite CampusДокумент16 страницBukidnon State University Alubijid Satellite CampusJames Bryle GalagnaraОценок пока нет

- Chapter 1 Fundamental PrinciplesДокумент10 страницChapter 1 Fundamental Principlesdenver solisОценок пока нет

- A - General Principles - 2020 Part 1Документ3 страницыA - General Principles - 2020 Part 1Russel Saez ReyОценок пока нет

- TX01 General Principles of TaxationДокумент9 страницTX01 General Principles of TaxationAce DesabilleОценок пока нет

- Tax 1Документ8 страницTax 1Romeo ViernesОценок пока нет

- Introduction of TaxationДокумент3 страницыIntroduction of TaxationKristine LuarcaОценок пока нет

- Taxation NotesДокумент91 страницаTaxation NotesRoma JayОценок пока нет

- Income TaxationДокумент211 страницIncome Taxationfritz100% (2)

- Taxation 1Документ37 страницTaxation 1julsarcalonia2024Оценок пока нет

- Taxation 8Документ62 страницыTaxation 8Nelson BJ OstiqueОценок пока нет

- Icare TaxxxxДокумент84 страницыIcare TaxxxxInny Agin100% (3)

- Basic Principles of TaxationДокумент33 страницыBasic Principles of TaxationHenicel Diones San Juan100% (1)

- Taxation Module 2Документ8 страницTaxation Module 2Julius MuicoОценок пока нет

- Tax 1Документ18 страницTax 1Billie Jan Louie JardinОценок пока нет

- Chapter 1 TaxationДокумент13 страницChapter 1 TaxationGlomarie Gonayon100% (1)

- Income Taxation - Quiz1Документ3 страницыIncome Taxation - Quiz1lindsay boncodinОценок пока нет

- TAXATIONДокумент16 страницTAXATIONJaime ClemeniaОценок пока нет

- Income TaxationДокумент211 страницIncome Taxationfritz100% (5)

- Basic Principles - Taxn01bДокумент28 страницBasic Principles - Taxn01bJericho PedragosaОценок пока нет

- TX01 GeneralPrinciplesofTaxationДокумент9 страницTX01 GeneralPrinciplesofTaxationARISОценок пока нет

- Taxation Law ReviewerДокумент62 страницыTaxation Law ReviewerThemis ArtemisОценок пока нет

- General Principles of TaxationДокумент5 страницGeneral Principles of TaxationClaude Peña100% (1)

- General Principles: Acuario Notes Taxation Law ReviewДокумент11 страницGeneral Principles: Acuario Notes Taxation Law ReviewGretch MaryОценок пока нет

- Viii. TaxationДокумент23 страницыViii. TaxationAnghelikaaaОценок пока нет

- TaxationДокумент7 страницTaxationlenllera09Оценок пока нет

- Income TaxationДокумент220 страницIncome TaxationJoanna RojoОценок пока нет

- Chapter 1 Income TaxationДокумент7 страницChapter 1 Income TaxationAihla Michelle Berido100% (1)

- Handout #1 Income Taxation: 1. Power To TaxДокумент8 страницHandout #1 Income Taxation: 1. Power To TaxFlorenz AmbasОценок пока нет

- BAM 031 Part 1 - HandoutДокумент25 страницBAM 031 Part 1 - HandoutEuli Mae SomeraОценок пока нет

- General Principles of TaxationДокумент24 страницыGeneral Principles of TaxationPines MacapagalОценок пока нет

- TaxДокумент22 страницыTaxalphecca_adolfo25Оценок пока нет

- QUIZ 2 Chapter 1 3 Income TaxationДокумент9 страницQUIZ 2 Chapter 1 3 Income TaxationShawn VerzalesОценок пока нет

- Taxation - Defined - August 22, 2013Документ93 страницыTaxation - Defined - August 22, 2013Asdqwe ZaqwsxОценок пока нет

- Chapter 1 TaxationДокумент6 страницChapter 1 TaxationCharlotte CañeteОценок пока нет

- General Principles of Taxation Taxation DefinedДокумент10 страницGeneral Principles of Taxation Taxation DefinedGraceОценок пока нет

- 1 - Introduction To Taxation PDFДокумент26 страниц1 - Introduction To Taxation PDFRieven BaracinasОценок пока нет

- Fundamental Principles OF Taxation: Mr. Mario M. Castro, Cpa, Mba Tax ConsultantДокумент19 страницFundamental Principles OF Taxation: Mr. Mario M. Castro, Cpa, Mba Tax ConsultantKristine Aubrey AlvarezОценок пока нет

- Bar Review Companion: Taxation: Anvil Law Books Series, #4От EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Оценок пока нет

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- Rodriguez Sr. vs. Tan - de Facto OfficerДокумент4 страницыRodriguez Sr. vs. Tan - de Facto OfficerGillian Alexis ColegadoОценок пока нет

- Terms and Conditions On The Issuance and Use of RCBC Credit CardsДокумент15 страницTerms and Conditions On The Issuance and Use of RCBC Credit CardsGillian Alexis ColegadoОценок пока нет

- DPWH Do - 059 - S2011Документ13 страницDPWH Do - 059 - S2011Gillian Alexis ColegadoОценок пока нет

- Dilg Legalopinions 2014828 10848b4df0Документ2 страницыDilg Legalopinions 2014828 10848b4df0Gillian Alexis ColegadoОценок пока нет

- Dilg Legalopinions 2022428 2b302887daДокумент5 страницDilg Legalopinions 2022428 2b302887daGillian Alexis ColegadoОценок пока нет

- Survival PassageДокумент5 страницSurvival PassageGillian Alexis ColegadoОценок пока нет

- Achevara v. RamosДокумент10 страницAchevara v. RamosGillian Alexis ColegadoОценок пока нет

- Plaintiff-Appellee Vs Vs Defendant-Appellant Alfredo Chicote Solicitor-General CorpusДокумент11 страницPlaintiff-Appellee Vs Vs Defendant-Appellant Alfredo Chicote Solicitor-General CorpusGillian Alexis ColegadoОценок пока нет

- PNR v. VizcaraДокумент10 страницPNR v. VizcaraGillian Alexis ColegadoОценок пока нет

- 3 Kapalaran Bus Line Vs CoronadoДокумент9 страниц3 Kapalaran Bus Line Vs CoronadoGillian Alexis ColegadoОценок пока нет

- Geluz vs. Ca - Case DigestДокумент2 страницыGeluz vs. Ca - Case Digestchatmche-06100% (2)

- Denr Application For Agricultural Free PatentДокумент3 страницыDenr Application For Agricultural Free PatentAngelica DulceОценок пока нет

- Contoh Case ReviewДокумент6 страницContoh Case ReviewAqilahAzmi100% (1)

- 1.-People v. EnriquezДокумент5 страниц1.-People v. EnriquezKim LawОценок пока нет

- Revised Corporation Code (Sec. 45-139)Документ21 страницаRevised Corporation Code (Sec. 45-139)Scribd ScribdОценок пока нет

- Police Law EnforcementДокумент5 страницPolice Law EnforcementRonalyn PaunalОценок пока нет

- M.P.warehousng & Logistics Policy 2012 Rules - EnglishДокумент6 страницM.P.warehousng & Logistics Policy 2012 Rules - EnglishSantoshh MishhОценок пока нет

- Payroll08142020 PDFДокумент2 страницыPayroll08142020 PDFShana RushОценок пока нет

- Sample Document: Prenuptial AgreementДокумент3 страницыSample Document: Prenuptial AgreementEulaArias JuanPabloОценок пока нет

- Municipality of San Miguel v. FernandezДокумент6 страницMunicipality of San Miguel v. FernandezSheena Reyes-BellenОценок пока нет

- Proposed Record On Appeal-Pre Stipulation PDFДокумент421 страницаProposed Record On Appeal-Pre Stipulation PDFKenОценок пока нет

- Philippine Red Cross HistoryДокумент2 страницыPhilippine Red Cross HistoryAna LaurenteОценок пока нет

- Oxfam Codes of ConductДокумент2 страницыOxfam Codes of ConductGISCAR MINJAОценок пока нет

- Acebedo V CAДокумент2 страницыAcebedo V CACecille Mangaser100% (1)

- BPI VS BPI EMPLOYEES UNION DAVAO CHAPTER Case DigestДокумент1 страницаBPI VS BPI EMPLOYEES UNION DAVAO CHAPTER Case DigestKornessa Paras100% (1)

- Why The United Nations Is A Useless FailureДокумент3 страницыWhy The United Nations Is A Useless FailurevenuОценок пока нет

- Proclamation No. 635 S. 1995 - Official Gazette of The Republic of The PhilippinesДокумент6 страницProclamation No. 635 S. 1995 - Official Gazette of The Republic of The PhilippinesEric NagumОценок пока нет

- 100 Things You Should Know About Communism in The USAДокумент32 страницы100 Things You Should Know About Communism in The USAYorgos MiОценок пока нет

- International Students Paperwork Guide For Foreign Bureaucratic AffairsДокумент8 страницInternational Students Paperwork Guide For Foreign Bureaucratic AffairsJoana Laus CamposОценок пока нет

- Tavaana Exclusive Case Study: The Velvet Revolution - A Peaceful End To Communism in CzechoslovakiaДокумент9 страницTavaana Exclusive Case Study: The Velvet Revolution - A Peaceful End To Communism in CzechoslovakiaTavaana E-InstituteОценок пока нет

- Disloyalty of A DirectorДокумент2 страницыDisloyalty of A DirectorDailyn Jaectin0% (1)

- Settlement Deed-Rajavel-FinalДокумент6 страницSettlement Deed-Rajavel-FinalNaren K100% (1)

- How Are Your Paperwork Headaches?: How To Use This TemplateДокумент10 страницHow Are Your Paperwork Headaches?: How To Use This TemplatedrixОценок пока нет

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsДокумент2 страницыCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsОценок пока нет

- Oral Reasons For Judgment (Short Leave Application Seeking Stay of Injection Passport)Документ2 страницыOral Reasons For Judgment (Short Leave Application Seeking Stay of Injection Passport)Canadian Society for the Advancement of Science in Public PolicyОценок пока нет

- Airworthiness Directive Bombardier/Canadair 070404Документ8 страницAirworthiness Directive Bombardier/Canadair 070404bombardierwatchОценок пока нет

- Affdavit of Loss Passport SampleДокумент1 страницаAffdavit of Loss Passport Samplemorningmindset90% (10)

- UCSP Quarter Examination (2nd Quarter)Документ9 страницUCSP Quarter Examination (2nd Quarter)GIO JASMINОценок пока нет

- The Mindanao Peace ProcessДокумент81 страницаThe Mindanao Peace ProcessRam Toledo100% (1)

- GR No. 165060 - Josef Vs SantosДокумент16 страницGR No. 165060 - Josef Vs SantosJobi BryantОценок пока нет