Академический Документы

Профессиональный Документы

Культура Документы

Well Positioned For Growth Buy: India Cements

Загружено:

divyakashИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Well Positioned For Growth Buy: India Cements

Загружено:

divyakashАвторское право:

Доступные форматы

Produced by: ABN AMRO

Bank NV India Branch

Tuesday 27 November 2007 Change of target price

India Cements Buy

Absolute performance

n/a

Well positioned for growth Short term (0-60 days)

Neutral

IC's recently announced plan to set up 4mmt of capacity in North Market relative to region

India should not only secure a 20% volume CAGR for the next four Materials

years, but also reduce its exposure to a single region. We raise our India

FY08-10F EPS by 2-5% and our target price to Rs350.65.

Price

Rs285.00

Key forecasts

Target price

FY06A FY07A FY08F FY09F FY10F Rs350.65 (from Rs287.76)

Revenue (Rsm) 15401.1 20498.6 31323.0 39466.5 43996.2 Market capitalisation

EBITDA (Rsm) 2593.2 6618.5 11794.7% 14832.9% 14479.0%

Rs68.40bn (US$1.72bn)

Reported net profit (Rsm) 436.8 4496.2 7769.6% 9277.1% 8807.4%

Avg (12mth) daily turnover

Normalised net profit (Rsm)¹ 341.1 4496.2 7769.6 9277.1 8807.4

Normalised EPS (Rs) 1.55 20.5 28.6 34.2 32.5 Rs166.28m (US$3.96m)

Dividend per share (Rs) 0.00 1.00 3.00% 3.50% 3.50% Reuters Bloomberg

Dividend yield (%) 0.00 0.35 1.05 1.23 1.23 ICMN.BO ICEM IN

Normalised PE (x) 183.4 13.9 9.95 8.34 8.78

EV/EBITDA (x) 32.1 12.1 5.64 4.60 4.89

Price/book value (x) 6.95 4.38 2.45 1.89 1.56

ROIC (%) 2.62 8.41 14.2 15.5 11.2

1. Post-goodwill amortisation and pre-exceptional items year to Mar, fully diluted

Accounting Standard: Local GAAP

Source: Company data, ABN AMRO forecasts

Price performance (1M) (3M) (12M)

Price (Rs) 295.4 217.3 227.4

Company prepares itself for the next leg of growth Absolute % -3.5 31.2 25.3

Rel market % -3.5 -1.7 -10.8

IC is working on capex of Rs8.4bn to raise capacity from 9.5mmt to 14.1mmt by

Rel sector % 2.9 24.5 0.8

FY09 at its plants in South India. Last week it announced a plan to set up greenfield

cement plants in Rajasthan and Himachal Pradesh, totalling 3.5-4mmt, at a capital Nov 04 Dec 05 Dec 06

350

cost of Rs14.5bn. The board has approved an equity fund raising of US$150m (about 300

Rs6bn) for the proposed expansion. IC expects to become an 18mmt cement 250

company by end-FY10, with around 25% of its sales generated in North India. 200

150

Stay positive on the cement sector, but we see little upside to margins 100

We expect overall capacity in the Indian cement industry to rise 96.5mmt over FY08- 50

10 - 14mmt in FY08, 54.1mmt in FY09 and 28.5mmt in FY10. We forecast a 0

moderate surplus of 4.2mmt on an all-India basis, adjusting for initial low utilisation ICMN.BO Sensex

and as we expect most of the capacity addition in 2H09. However, the surplus would Stock borrowing: n/a

be more evident in the northern and central markets, where we expect some pricing Volatility (30-day): 57.06%

pressure in late FY09. In FY10, we expect the surplus to rise to 21.5mmt, putting Volatility (6-month trend): ↑

52-week range: 322.80-145.00

further pressure on cement prices. We assume a 5% drop in average realisations in

Sensex: 19247.54

FY10. BBG AP Construction: 346.08

Source: ABN AMRO, Bloomberg

We raise our EPS estimates by 2-5% on a fully diluted basis

We raise our FY09 and FY10 volume estimates by 5% each, and now expect cement

sales of 11.5mmt in FY09 and 13.5mmt in FY10. We also dilute the equity to factor in

the proposed fundraising of US$150m. We raise our EBITDA estimates by 12-14%

and EPS estimates by 2-5% for FY08-10.

Maintain Buy with a increased target price of Rs350.65

We value IC at a 28% discount to the average FY09F EV/EBITDA valuations of ACC

and Ambuja Cements, due to the risks inherent in the geographical concentration of

IC's capacity. Reflecting our earnings revisions, we raise our target price to Rs350.65

Analyst

(from Rs287.76), implying an FY09F PER of 10.2x.

Mohan Swamy

India

+91 22 6715 5304

mohan.swamy@in.abnamro.com

Important disclosures can be found in the Disclosures Appendix.

Priced at close of business 23 November 2007. Use of %& indicates that the line item has changed by at least 5%.

www.abnamroresearch.com

83/84 Sakhar Bhawan, Nariman Point, Mumbai 400 021, India

I N V E S T M E N T V I E W

Strong visibility on volumes

IC plans to raise capacity at its existing plants from 9.5mmt to 18mmt by

FY10. The expansion is to be at a very economical capital cost of US$33/mt

(a third of the cost of setting up a greenfield plant).

IC plans to invest Rs8.5bn over the next 15 months to raise its cement capacity from

the current 9.5mmt to 14mmt. These expansions are being done at its existing

cement plants in South India at a very economical cost of US$33/mt (the cost of

setting up a greenfield cement plant is around US$100).

Table 1 : India Cement's expansion plans

Expansion plans Capacity increase (mmt) Status of commissioning

Modernisation of Sankaridurg plant 0.6 Commissioned

Expansion of Vishnupuram plant 0.8 April-June 2008

Upgradation of capacities in other plants 0.6 Dec 07-Sep 08

Cement grinding unit at Chennai 1 April-June 2008

Cement grinding unit at Perili 1 April-June 2008

Second line at Visaka, A.P 1.2 Oct-December 2008

Source: India Cement

The board of directors, at its 19 November meeting, also announced a plan to set up

two greenfield units in Rajasthan and Himachal Pradesh, where the company has

secured mining rights for limestone. This expansion is to be done at a capital cost of

Rs14.5bn, which is to be partly funded by an equity fundraising of US$150m. The

company expects to commission the plants in 2010. The move is in line with the

company’s strategy of diversifying geographically into the northern markets.

An 18% CAGR in cement volumes over the next four years

We expect IC’s cement volumes to show an 18% CAGR over the four years, ensuring

above-industry average earnings growth. We expect cement prices to fall in FY10,

but IC’s strong volume growth should largely mitigate the negative impact of this.

Table 2 : Summary of cement volume momentum

Strong visibility of cement volumes

FY08F FY09F FY10F FY11F FY12F

Capacity (mmt) 9.5 14.1 14.1 18.1 18.1

Volumes mmt 9.3 11.5 13.5 15.5 18

% change 23% 24% 17% 19% 16%

Source: ABN AMRO forecasts

IN DIA CEMENT S 27 NOVE MBE R 20 07

2

A P P E N D I X

Table 3 : Forecast revision

FY08F FY09F FY10F

EPS (Old) 28.17 32.68 31.485

EPS (New) 28.63 34.19 32.46

% change 2% 5% 3%

EBITDA (old) 10500.1 13065.6 12971.4

EBITDA (new) 11794.73 14832.94 14479.01

% change 12% 14% 12%

Source: ABN AMRO forecasts

Table 4 : Relative performance of cement companies ( April-September 2007)

Ambuja India Madras

Ultratech ACC

Cements Cements Cements

Cement sales (mmt) 8.2 8 10.2 4.6 2.8

EBITDA (Rsbn) 10.45 8.2 9.9 5.87 4.02

EBITDA/mt 1273 1014 971 1283 1423

EBITDA margin (%) 36.9% 31.5% 29.7% 39.7% 41.3%

Growth in EBITDA (yoy) 28.3% 24.7% 27.1% 70.5% 34.4%

Source: Company releases

Table 5 : India Cements’ valuations on a EV/mt basis

India Cements's valuation when all expansions are completed

Fully diluted equity

Current (Rsm) 2,514

Proposed fund raising of US$150m (Rsm) 200.00

(assuming an issue price of Rs300/share)

Fully diluted equity (Rsm) 2,714

Market cap (Rsm) 81408

Debt as of FY10F 2743.753

Enterprise value (Rsm) of India Cements 84,151

Capacity (mmt) 18

EV/mt (Rs) 116.9

Enterprise value of Ambuja Cements for 18mmt, currently (Rsm) 217,362

Source: ABN AMRO estimates

IN DIA CEMENT S 27 NOVE MBE R 20 07

3

APP ENDI X

Table 6 : All India cement demand supply scenario

Cement Total

Net effective Potential Supply Domestic exports Exports Demand/Supply

FY08E Capacity # at 95% utilisation demand

North 47.1 41.8 50.6 -8.8

East 17.5 15.3 25.7 0.7 -11.1

Central 32.4 30.6 7.6 23.0

North+East+Central 97.1 87.7 83.9 0.7 3.1

West 28.4 27.0 31.1 7 -11.1

South 52.4 48.0 49.7 -1.8

South+West 80.8 74.9 80.8 7 -12.9

Total All India 177.8 162.6 164.7 4.5 7.7 -9.7

Total Cement sales 169.17 9.1%

Total sales 172.37 9.0%

Incremental 14.00 9.3 15.5

Cement demand growth 9.1%

Capacity utilisation rate 96.9%

Capacity growth 8.5%

# Gross capacity would be 6.2mmt more, adding the non-operational capacity

FY09E

North 62.5 52.4 57.2 -4.8

East 24.7 20.3 28.0 0.7 -8.5

Central 35.4 32.3 8.5 23.8

North+East+Central 122.6 105.0 93.8 0.7 10.5

West 33.9 29.7 35.1 6 -11.4

South 75.4 61.3 56.2 5.1

South+West 109.3 91.0 91.3 6 -6.3

Total All India 231.9 196.0 185.1 4.5 6.7 4.2

Total Cement sales 189.55

Total sales 191.75

Incremental 54.1 33.3 20.38

Cement demand growth 12.0%

Capacity utilisation rate 82.7%

Capacity growth 30.4%

# Gross capacity would be 6.2mmt more, adding the non-operational capacity

FY10E

North 70.0 63.1 64.0 -1.0

East 29.7 26.0 31.0 0.7 -5.7

Central 35.9 33.9 9.6 24.3

North+East+Central 135.6 123.0 104.6 0.7 17.7

West 44.9 37.7 39.3 5.5 -7.1

South 79.9 73.9 62.9 10.9

South+West 124.8 111.6 102.3 5.5 3.8

Total All India 260.4 234.5 206.8 4.5 6.2 21.5

Total Cement sales 211.34

Total sales 213.04

Incremental 28.5 38.6 21.8

Cement demand growth 11.5%

Capacity utilisation rate 81.8%

Capacity growth 12.3%

Source: ABN AMRO and Cement Manufacturers’ Association

IN DIA CEMENT S 27 NOVE MBE R 20 07

4

DISCLOSURES APPENDIX

Recommendation structure

Absolute performance, short term (trading) recommendation: A Trading Buy recommendation implies upside of 5% or more and a Trading Sell indicates downside

of 5% or more. The trading recommendation time horizon is 0-60 days. For Australian coverage, a Trading Buy recommendation implies upside of 5% or more

from the suggested entry price range, and a Trading Sell recommendation implies downside of 5% or more from the suggested entry price range. The trading

recommendation time horizon is 0-60 days.

Absolute performance, long term (fundamental) recommendation: The recommendation is based on implied upside/downside for the stock from the target price. A

Buy/Sell implies upside/downside of 10% or more and a Hold less than 10%. For listed property trusts (LPT) or real estate investment trusts (REIT) the

recommendation is based upon the target price plus the dividend yield, ie total return. This structure applies to research on Asian and European stocks published

from 1 November 2005; on Australian stocks from 7 November 2006; on continental European small and mid cap stocks from 23 November 2006; and on Brazilian

stocks from 18 June 2007.

Performance parameters and horizon: Given the volatility of share prices and our pre-disposition not to change recommendations frequently, these performance

parameters should be interpreted flexibly. Performance in this context only reflects capital appreciation and the horizon is 12 months.

Sector relative to market: The sector view relative to the market is the responsibility of the strategy team. Overweight/Underweight implies upside/downside of

10% or more and Neutral implies less than 10% upside/downside.

Target price: The target price is the level the stock should currently trade at if the market were to accept the analyst's view of the stock and if the necessary

catalysts were in place to effect this change in perception within the performance horizon. In this way, therefore, the target price abstracts from the need to take a

view on the market or sector. If it is felt that the catalysts are not fully in place to effect a re-rating of the stock to its warranted value, the target price will differ

from 'fair' value.

Asset allocation: The asset allocation is the responsibility of the economics team. The recommended weight (Over, Neutral and Under) for equities, cash and bonds

is based on a number of metrics and does not relate to a particular size change in one variable.

Stock borrowing rating: The stock borrowing rating is the subjective view and responsibility of the ABN AMRO equity finance team: Easy implies ready availability.

Moderate implies some availability. Hard implies availability is tight. Impossible implies no availability.

Distribution of recommendations

The tables below show the distribution of ABN AMRO's recommendations (both long term and trading). The first column displays the distribution of

recommendations globally and the second column shows the distribution for the region. Numbers in brackets show the percentage for each category where ABN

AMRO has an investment banking relationship.

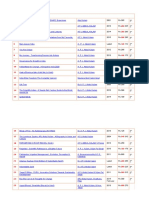

Long Term recommendations (as at 27 Nov 2007) Trading recommendations (as at 27 Nov 2007)

Global total (IB%) Asia Pacific total Global total (IB%) Asia Pacific total

(IB%) (IB%)

Buy 596 (15) 392 (4) Trading Buy 6 (0) 6 (0)

Add 1 (0) 1 (0)

Hold 427 (19) 258 (4)

Reduce 0 (0) 0 (0)

Sell 76 (5) 52 (0) Trading Sell 0 (0) 0 (0)

Total (IB%) 1100 (16) 703 (3) Total (IB%) 6 (0) 6 (0)

Valuation and risks to target price

India Cements (RIC: ICMN.BO, Rec: Buy, CP: Rs285.00, TP: Rs350.65): Our target price is based on a 28% discount (20% previously) to ACC and Ambuja

Cement's 2009F EV/EBITDA. We have raised this discount as we see a premium in ACC and Ambuja Cement due to Holcim's pending open offer, and due to IC's

heavy dependence on the south. The key risk would be lower-than-expected incremental demand in South India, which would put our cement price assumptions at

risk. Also, any delay in expansion in the north would impact our FY08-09F volume, and hence our earnings estimates.

India Cements

Stock performance, recommendations and coverage (as at 26 Nov 2007) Trading recommendation

history (as at 27 Nov 2007)

Date Rec Analyst

n/a

Mohan Swamy started covering this stock on 12 Jan 06

Moved to new recommendation structure between 1 November 2005 and 31 January 2006

Regulatory disclosures

Subject companies: ICMN.BO

ABN AMRO beneficially own 1% or more of a class of common equity securities of this company: ICMN.BO

IN DIA CEMENT S 27 NOVE MBE R 20 07

5

DISCLOSURES APPENDIX

Global disclaimer

Copyright 2007 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO"). All rights reserved.

This material was prepared by the ABN AMRO affiliate named on the cover or inside cover page. It is provided for informational purposes only and does not

constitute an offer to sell or a solicitation to buy any security or other financial instrument. While based on information believed to be reliable, no guarantee is

given that it is accurate or complete. While we endeavour to update on a reasonable basis the information and opinions contained herein, there may be regulatory,

compliance or other reasons that prevent us from doing so. The opinions, forecasts, assumptions, estimates, derived valuations and target price(s) contained in

this material are as of the date indicated and are subject to change at any time without prior notice. The investments referred to may not be suitable for the

specific investment objectives, financial situation or individual needs of recipients and should not be relied upon in substitution for the exercise of independent

judgement. The stated price of any securities mentioned herein is as of the date indicated and is not a representation that any transaction can be effected at this

price. Neither ABN AMRO nor other persons shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost

profits arising in any way from the information contained in this material. This material is for the use of intended recipients only and the contents may not be

reproduced, redistributed, or copied in whole or in part for any purpose without ABN AMRO's prior express consent. In any jurisdiction in which distribution to

private/retail customers would require registration or licensing of the distributor which the distributor does not currently have, this document is intended solely for

distribution to professional and institutional investors.

Australia: Any report referring to equity securities is distributed in Australia by ABN AMRO Equities Australia Ltd (ABN 84 002 768 701, AFS Licence 240530), a

participant of the ASX Group. Any report referring to fixed income securities is distributed in Australia by ABN AMRO Bank NV (Australia Branch) (ABN 84 079 478

612, AFS Licence 238266). Australian investors should note that this document was prepared for wholesale investors only.

Brazil: ABN AMRO Corretora de Cambio e Valores Mobiliarios S.A. is responsible for the part of this report elaborated by research analysts registered at Comissao

de Valores Mobiliarios - CVM, as indicated. Investors resident in Brazil who receives this report should rely only on research prepared by research analysts

registered at CVM. In addition to other representations contained in this report, such research analysts state that the views expressed and attributed to them

accurately reflect solely and exclusively their personal opinions about the subject securities and issuers and/or other subject matter as appropriate, having such

opinion(s) been produced freely and independently from any party, including from ABN AMRO or any of its affiliates.

Canada: The securities mentioned in this material are available only in accordance with applicable securities laws and may not be eligible for sale in all

jurisdictions. Persons in Canada requiring further information should contact ABN AMRO Incorporated.

EEA: This material constitutes "investment research" for the purposes of the Markets in Financial Instruments Directive and as such contains an objective or

independent explanation of the matters contained in the material. Any recommendations contained in this document must not be relied upon as investment advice

based on the recipient's personal circumstances. In the event that further clarification is required on the words or phrases used in this material, the recipient is

strongly recommended to seek independent legal or financial advice.

Denmark: ABN AMRO Bank N.V. is authorised and regulated in the Netherlands by De Nederlandsche Bank. In addition, ABN AMRO Bank N.V., Copenhagen Branch

is subject to local supervision by Finanstilsynet, the Danish Financial Supervisory Authority. All analysts located in Denmark follow the recommendations from the

Danish Securities Dealers Association.

Finland: ABN AMRO Bank N.V. is authorised and regulated in the Netherlands by De Nederlandsche Bank. In addition, ABN AMRO Bank N.V., Helsinki Branch is

subject to local supervision by Rahoitustarkastus, the Finnish Financial Supervision Authority.

Hong Kong: This document is being distributed in Hong Kong by, and is attributable to, ABN AMRO Asia Limited which is regulated by the Securities and Futures

Commission of Hong Kong.

India: Shares traded on stock exchanges within the Republic of India may only be purchased by different categories of resident Indian investors, Foreign

Institutional Investors registered with The Securities and Exchange Board of India ("SEBI") or individuals of Indian national origin resident outside India called Non

Resident Indians ("NRIs") and Overseas Corporate Bodies ("OCBs"), predominantly owned by such persons or Persons of Indian Origin (PIO). Any recipient of this

document wanting additional information or to effect any transaction in Indian securities or financial instrument mentioned herein must do so by contacting a

representative of ABN AMRO Asia Equities (India) Limited.

Italy: Persons in Italy requiring further information should contact ABN AMRO Bank N.V. Milan Branch.

Japan: This report is being distributed in Japan by ABN AMRO Securities Japan Ltd to institutional investors only.

Malaysia: ABN AMRO research, except for economics and FX research, is not for distribution or transmission into Malaysia.

New Zealand: This document is distributed in New Zealand to institutional investors by ABN AMRO Securities NZ Limited, an NZX accredited firm, and to retail

investors by ABN AMRO Craigs Limited, an NZX accredited firm. ABN AMRO Craigs Limited and/or its partners and employees may, from time to time, have a

financial interest in respect of some or all of the matters discussed.

Russia: The Russian securities market is associated with several substantial risks, legal, economic and political, and high volatility. There is a relatively high

measure of legal uncertainty concerning rights, duties and legal remedies in the Russian Federation. Russian laws and regulations governing investments in

securities markets may not be sufficiently developed or may be subject to inconsistent or arbitrary interpretation or application. Russian securities are often not

issued in physical form and registration of ownership may not be subject to a centralised system. Registration of ownership of certain types of securities may not

be subject to standardised procedures and may even be effected on an ad hoc basis. The value of investments in Russian securities may be affected by fluctuations

in available currency rates and exchange control regulations.

Singapore: Any report referring to equity securities is distributed in Singapore by ABN AMRO Asia Securities (Singapore) Pte Limited (RCB Regn No. 198703346M)

to clients who fall within the description of persons in Regulation 49 of the Securities and Futures (Licensing and Conduct of Business) Regulations and Regulations

34 and 35 of the Financial Advisers Regulations. Any report referring to non-equity securities is distributed in Singapore by ABN AMRO Bank NV (Singapore Branch)

Limited to clients who fall within the description of persons in Regulations 34 and 35 of the Financial Advisers Regulations. Investors should note that this material

was prepared for accredited investors only. Recipients who do not fall within the description of persons under Regulation 49 of the Securities and Futures

(Licensing and Conduct of Business) Regulations or Regulations 34 and 35 of the Financial Advisers Regulations should seek the advice of their independent

financial advisor prior to taking any investment decision based on this document or for any necessary explanation of its contents.

Sweden: ABN AMRO Bank N.V. is authorised and regulated in the Netherlands by De Nederlandsche Bank. In addition, ABN AMRO Bank N.V., Stockholm Branch is

subject to local supervision by the Swedish Financial Supervisory Authority.

Thailand: Pursuant to an agreement with Asia Plus Securities Public Company Limited (APS), reports on Thai securities published out of Thailand are prepared by

APS but distributed outside Thailand by ABN AMRO Bank NV and affiliated companies. Responsibility for the views and accuracy expressed in such documents

belongs to APS.

United Kingdom: All research is distributed by ABN AMRO Bank NV, London Branch, which is authorised by De Nederlandsche Bank and regulated by the Financial

Services Authority for the conduct of UK business. The investments and services contained herein are not available to private customers in the United Kingdom.

United States: Except for any documents relating to foreign exchange, FX or global FX, distribution of this document in the United States or to US persons is

intended to be solely to major institutional investors as defined in Rule 15a-6(a)(2) under the US Securities Act of 1934. All US persons that receive this document

by their acceptance thereof represent and agree that they are a major institutional investor and understand the risks involved in executing transactions in

securities. Any US recipient of this document wanting additional information or to effect any transaction in any security or financial instrument mentioned herein,

must do so by contacting a registered representative of ABN AMRO Incorporated, Park Avenue Plaza, 55 East 52nd Street, New York, N.Y. 10055, US, tel + 1 212

409 1000, fax +1 212 409 5222.

- Material means all research information contained in any form including but not limited to hard copy, electronic form, presentations, e-mail, SMS or WAP.

_________________________________________________________________________________________________________________________________

The research analyst or analysts responsible for the content of this research report certify that: (1) the views expressed and attributed to the research analyst or

analysts in the research report accurately reflect their personal opinion(s) about the subject securities and issuers and/or other subject matter as appropriate; and,

(2) no part of his or her compensation was, is or will be directly or indirectly related to the specific recommendations or views contained in this research report.

On a general basis, the efficacy of recommendations is a factor in the performance appraisals of analysts.

_________________________________________________________________________________________________________________________________

For a discussion of the valuation methodologies used to derive our price targets and the risks that could impede their achievement, please refer to our latest

published research on those stocks at www.abnamroresearch.com.

Disclosures regarding companies covered by ABN AMRO group can be found on ABN AMRO's research website at www.abnamroresearch.com.

ABN AMRO's policy on managing research conflicts of interest can be found at https://www.abnamroresearch.com/Disclosure/Disclosure.AspX?MI=5.

Should you require additional information please contact the relevant ABN AMRO research team or the author(s) of this report.

IN DIA CEMENT S 27 NOVE MBE R 20 07

6

INDIA CEMENTS: KEY FINANCIAL DATA

Income statement

Rsm FY06A FY07A FY08F FY09F FY10F

Revenue 15401.1 20498.6 31323.0 39466.5 43996.2

Cost of sales -12808 -13880 -19528 -24634 -29517

Operating costs n/a n/a n/a n/a n/a

EBITDA 2593.2 6618.5 11794.7 14832.9 14479.0

DDA & Impairment (ex gw) -788.7 -776.8 -1124.7 -1412.2 -1293.4

EBITA 1804.5 5841.7 10670.0 13420.7 13185.6

Goodwill (amort/impaired) n/a n/a n/a n/a n/a

EBIT 1804.5 5841.7 10670.0 13420.7 13185.6

Net interest -1489.3 -1430.3 -1007.6 -272.7 -144.6

Associates (pre-tax) n/a n/a n/a n/a n/a

Forex gain / (loss) n/a n/a n/a n/a n/a

Exceptionals (pre-tax) n/a n/a n/a n/a n/a

Other pre-tax items 72.5 101.6 333.9 155.0 155.0

Reported PTP 387.8 4513.0 9996.4 13303.0 13196.1

Taxation -46.7 -16.8 -2226.8 -4025.9 -4388.7

Minority interests n/a n/a n/a n/a n/a

Exceptionals (post-tax) 95.7 0.00 0.00 0.00 0.00

Other post-tax items 0.00 0.00 0.00 0.00 0.00

Reported net profit 436.8 4496.2 7769.6 9277.1 8807.4

Normalised Items Excl. GW 95.7 0.00 0.00 0.00 0.00

Normalised net profit 341.1 4496.2 7769.6 9277.1 8807.4

Source: Company data, ABN AMRO forecasts year to Mar

Balance sheet

Rsm FY06A FY07A FY08F FY09F FY10F

Cash & market secs (1) 436.2 3357.8 7157.8 300.0 350.0

Other current assets 14687.9 15406.8 18075.8 20083.8 21800.7

Tangible fixed assets 12269.7 12492.9 14868.2 18456.0 18162.6

Intang assets (incl gw) 417.0 417.0 417.0 417.0 417.0

Oth non-curr assets 658.2 658.2 1158.2 6658.2 17658.2

Total assets 28469.0 32332.5 41676.9 45914.9 58388.4

Short term debt (2) n/a n/a n/a n/a n/a

Trade & oth current liab 3731.3 2722.5 4280.2 4399.1 5469.5

Long term debt (3) 15252.3 14846.7 5306.0 148.0 2743.8

Oth non-current liab 486.4 486.4 486.4 486.4 486.4

Total liabilities 19470.0 18055.5 10072.6 5033.5 8699.6

Total equity (incl min) 8999.0 14277.0 31604.3 40881.4 49688.8

Total liab & sh equity 28469.0 32332.5 41676.9 45914.9 58388.4

Net debt (2+3-1) 14816.1 11488.9 -1851.7 -152.0 2393.8

Source: Company data, ABN AMRO forecasts year ended Mar

Cash flow statement

Rsm FY06A FY07A FY08F FY09F FY10F

EBITDA 2593.2 6618.5 11794.7 14832.9 14479.0

Change in working capital -374.1 -1727.6 -1111.3 -1889.0 -646.5

Net interest (pd) / rec -1489.3 -1430.3 -1007.6 -272.7 -144.6

Taxes paid 23.3 16.8 -2226.8 -4025.9 -4388.7

Other oper cash items n/a n/a n/a n/a n/a

Cash flow from ops (1) 706.5 3443.8 7449.0 8645.3 9299.2

Capex (2) -1007.2 -1000.0 -4000.0 -10500 -11000

Disposals/(acquisitions) -9.16 1090.6 876.3 -481.3 -1481.3

Other investing cash flow -1191.5 -714.1 3435.6 1361.0 1361.0

Cash flow from invest (3) -2207.9 -623.5 311.8 -9620.3 -11120

Incr / (decr) in equity 6360.3 625.6 0.00 0.00 0.00

Incr / (decr) in debt -4620.1 -405.6 -9540.6 -5158.1 2595.8

Ordinary dividend paid 0.00 -220.4 -814.1 -949.8 -949.8

Preferred dividends (4) 0.00 0.00 0.00 0.00 0.00

Other financing cash flow 168.2 101.6 333.9 155.0 155.0

Cash flow from fin (5) 1908.4 101.2 -10021 -5952.8 1801.0

Forex & disc ops (6) n/a n/a n/a n/a n/a

Inc/(decr) cash (1+3+5+6) 407.0 2921.5 -2260.0 -6927.8 -20.0

Equity FCF (1+2+4) -300.7 2443.8 3449.0 -1854.7 -1700.8

Lines in bold can be derived from the immediately preceding lines. year to Mar

Source: Company data, ABN AMRO forecasts

IN DIA CEMENT S 27 NOVE MBE R 20 07

7

INDIA CEMENTS: PERFORMANCE AND VALUATION

Standard ratios India Cements Ambuja Cements Associated Cement

Performance FY06A FY07A FY08F FY09F FY10F FY07F FY08F FY09F FY07F FY08F FY09F

Sales growth (%) 32.9 33.3 53.1 26.1 11.5 -12.7 13.5 11.0 17.7 12.9 7.24

EBITDA growth (%) 89.9 155.2 78.2 25.8 -2.39 2.08 15.5 5.57 29.5 15.8 -2.83

EBIT growth (%) 212.4 223.7 82.7 25.8 -1.75 8.42 13.2 -1.54 29.1 13.8 -9.45

Normalised EPS growth (%) n/a 1218.3 39.7 19.4 -5.06 1.23 14.1 -2.25 22.0 16.4 -7.82

EBITDA margin (%) 17.0 32.5 37.8 37.7 33.0 39.8 40.5 38.5 30.8 31.6 28.6

EBIT margin (%) 11.8 28.7 34.2 34.1 30.0 35.8 35.7 31.7 25.9 26.1 22.0

Net profit margin (%) 2.23 22.1 24.9 23.6 20.1 27.8 28.0 24.6 19.1 19.7 16.9

Return on avg assets (%) 3.10 16.4 21.9 21.4 17.0 26.4 25.7 21.6 20.5 20.2 16.6

Return on avg equity (%) 5.56 39.1 33.9 25.6 19.4 34.7 31.7 25.8 35.8 32.2 24.2

ROIC (%) 2.62 8.41 14.2 15.5 11.2 29.2 27.2 21.5 30.6 26.2 19.5

ROIC - WACC (%) 0.00 0.00 0.00 0.00 0.00 18.2 16.2 10.5 20.1 15.8 9.09

year to Mar year to Dec year to Dec

Valuation

EV/sales (x) 5.44 3.92 2.13 1.73 1.61 3.66 3.26 2.92 3.09 2.73 2.46

EV/EBITDA (x) 32.1 12.1 5.64 4.60 4.89 9.20 8.04 7.59 10.1 8.65 8.61

EV/EBITDA @ tgt price (x) 38.2 14.5 6.98 5.66 5.98 9.72 8.49 8.02 9.57 8.23 8.18

EV/EBIT (x) 46.1 13.7 6.24 5.09 5.37 10.2 9.12 9.23 12.0 10.5 11.2

EV/invested capital (x) 3.42 3.04 2.20 1.66 1.35 3.78 3.07 2.68 4.24 3.47 3.18

Price/book value (x) 6.95 4.38 2.45 1.89 1.56 4.58 3.72 3.16 5.02 3.94 3.31

Equity FCF yield (%) -0.48 3.91 4.46 -2.40 -2.20 4.10 3.36 6.30 0.39 2.09 5.11

Normalised PE (x) 183.4 13.9 9.95 8.34 8.78 14.7 12.9 13.2 16.0 13.7 14.9

Norm PE @tgt price (x) 225.6 17.1 12.2 10.3 10.8 15.5 13.6 13.9 15.2 13.0 14.1

Dividend yield (%) 0.00 0.35 1.05 1.23 1.23 2.03 2.37 2.50 1.44 1.80 1.89

year to Mar year to Dec year to Dec

Per share data FY06A FY07A FY08F FY09F FY10F Solvency FY06A FY07A FY08F FY09F FY10F

Tot adj dil sh, ave (m) 219.4 219.4 271.4 271.4 271.4 Net debt to equity (%) 164.6 80.5 -5.86 -0.37 4.82

Reported EPS (INR) 1.99 20.5 28.6 34.2 32.5 Net debt to tot ass (%) 52.0 35.5 -4.44 -0.33 4.10

Normalised EPS (INR) 1.55 20.5 28.6 34.2 32.5 Net debt to EBITDA 5.71 1.74 -0.16 -0.01 0.17

Dividend per share (INR) 0.00 1.00 3.00 3.50 3.50 Current ratio (x) 4.05 6.89 5.90 4.63 4.05

Equity FCF per share (INR) -1.37 11.1 12.7 -6.83 -6.27 Operating CF int cov (x) 1.49 3.42 10.6 47.5 95.7

Book value per sh (INR) 41.0 65.1 116.5 150.7 183.1 Dividend cover (x) 0.00 20.4 9.54 9.77 9.27

year to Mar year to Mar

Priced as follows: ICMN.BO - Rs285.00; GACM.BO - Rs148.30; ACC.BO - Rs1129.05

Source: Company data, ABN AMRO forecasts

INDIA CEMENTS: VALUATION METHODOLOGY

Target price calculation of India cements FY09

Average EV/EBITDA valuation of ACC & Ambuja Cement at our target price (x) 8.1

EV/EBITDA valuation for India Cements at a 28% discount to ACC & Ambuja Cement (x) 6.3

EBITDA (Rs m) 14833

Enterprise value (Rs m) 93299

Less: net debt (Rs m) -1852

Value of equity (Rs m) 95151

Number of shares 271

Fair value per share of India Cements (Rs) 350.65

PER on the above estimated fair price (x) 10.2x

Source: ABN AMRO estimates

IN DIA CEMENT S 27 NOVE MBE R 20 07

8

Strategic & competitive overview

India Cements

Company description Buy Price relative to country

India Cements is the largest cement company in south India with a market share of 20%. It 300

operates 7.69mmt of cement capacity across six plants throughout the region. Its subsidiary,

250

Visaka Cements, operates another 1.4mmt unit. India Cements was a two-plant company in 1990

with a capacity of 1.4mmt and has scaled up 6x through a mix of acquisitions and greenfield 200

capacity additions.

150

100

50

Nov Mar Jun Oct Feb May Sep Dec Apr Jul Nov

04 05 05 05 06 06 06 06 07 07 07

Strategic analysis Average SWOT company score: 3 State-wise sales FY07

Strengths 3 Karnataka Tamil

IC looks best positioned to service the south Indian market, with six plants across two states. The 18% Nadu

30%

company has a 20% market share and strong retail brand equity, which enables it to command a Andhra Kerela

15%

price premium in major southern markets. Pradesh

Exports

25% Maharash-

Others 1%

Weaknesses 3 tra

8%

3%

IC is dependent entirely on the south Indian market, hence any demand slowdown or price

weakness in the region affects its entire sales. Source:Company data

Opportunities 3 Market data

IC could increase cement capacity by de-bottlenecking and modernising its wet process unit at Headquarters

Sankari, Tamil Nadu, to a dry process unit. This would involve lower capital cost and, hence, "Dhun Building", 827 Anna Salai, Chennai

600 002, India

improve overall returns.

Website

Threats 2 www.indiacements.co.in

Major capacity creation by any of the large cement companies in south India could impact pricing in Shares in issue

the region. This would impact the outlook for IC. 240.0m

Freefloat

Scoring range is 1-5 (high score is good) 73%

Majority shareholders

Fis and Indian Banks (17%), FIIs (11%),

Indian Mutual Funds (4%)

India

Country view Neutral Country rel to Asia Pacific

The ABN AMRO Indian PMI suggests the economy is still powering ahead despite the global 230

headwinds, thanks to its domestically-oriented economic structure. Moreover inflationary pressure 210

has eased with the recent rate hikes by the RBI. At the sector level, we still like autos (commercial

190

vehicles), software and construction-related stocks as infrastructure spending should be a growth

170

driver in FY08.

150

The country view is set in consultation with the relevant company analyst but is the ultimate responsibility of the Strategy Team.

130

110

90

Nov Mar Jun Oct Feb Jun Sep Dec Apr Aug Nov

04 05 05 05 06 06 06 06 07 07 07

Competitive position Average competitive score: 3+ Broker recommendations

Supplier power 3+ 14

India Cements can leverage its reasonable scale to obtain better terms of trade from suppliers of 12

raw materials and freight operators. Its multi-location plants give it scale to negotiate. 10

8

Barriers to entry 3+

6

Cement is a commodity business, hence entry barriers are low. However, large limestone reserves

4

are not available in IC's key markets of Tamil Nadu and Kerala, hence there is an entry barrier. 2

Customer power 3+ 0

IC commands 20% market share in south India. Its brands have good retail equity, hence it has Buy Hold Sell

some pricing premium. It sells over 75% of its volumes in the retail market.

Source: Bloomberg

Substitute products 3+

There is no substitute product for cement in civil construction. As for imports being a threat to

domestic players, port infrastructure in India prevents large-scale imports.

Rivalry 3+

While the top end of the industry is well consolidated with top five players accounting for 60%

capacity, there are around 30 small players, at times leading to price competition in some markets.

Scoring range 1-5 (high score is good) Plus = getting better Minus = getting worse

IN DIA CEMENT S 27 NOVE MBE R 20 07

9

Вам также может понравиться

- Immediate Life Support PDFДокумент128 страницImmediate Life Support PDFShilin-Kamalei Llewelyn100% (2)

- LAW OF ContractДокумент1 страницаLAW OF ContractKhurshid Manzoor Malik50% (2)

- BHEL - Rock Solid - RBS - Jan2011Документ8 страницBHEL - Rock Solid - RBS - Jan2011Jitender KumarОценок пока нет

- Ashok Leyland: Performance HighlightsДокумент9 страницAshok Leyland: Performance HighlightsSandeep ManglikОценок пока нет

- JBM Auto (Q2FY21 Result Update)Документ7 страницJBM Auto (Q2FY21 Result Update)krippuОценок пока нет

- Earnings To Provide A Reality Check Sell: Reliance IndustriesДокумент33 страницыEarnings To Provide A Reality Check Sell: Reliance IndustriesChetankumar ChandakОценок пока нет

- Tata MotorsДокумент5 страницTata Motorsapi-3826612Оценок пока нет

- Peninsula+Land 10-6-08 PLДокумент3 страницыPeninsula+Land 10-6-08 PLapi-3862995Оценок пока нет

- Q2FY24 Post Results Review - SMIFS Institutional ResearchДокумент17 страницQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyОценок пока нет

- TVS Motor Company: CMP: INR549 TP: INR548Документ12 страницTVS Motor Company: CMP: INR549 TP: INR548anujonwebОценок пока нет

- Angel Broking M&MДокумент5 страницAngel Broking M&Mbunny711Оценок пока нет

- IDBI Capital Century Plyboards Q1FY23 Result ReviewДокумент10 страницIDBI Capital Century Plyboards Q1FY23 Result ReviewTai TranОценок пока нет

- Latest Ceat ReportДокумент6 страницLatest Ceat Reportshubhamkumar.bhagat.23mbОценок пока нет

- Alembic Angel 020810Документ12 страницAlembic Angel 020810giridesh3Оценок пока нет

- Hero Motocorp: CMP: Inr3,707 TP: Inr3,818 (+3%)Документ12 страницHero Motocorp: CMP: Inr3,707 TP: Inr3,818 (+3%)SAHIL SHARMAОценок пока нет

- Ambuja Cement (ACEM IN) : Q3CY20 Result UpdateДокумент6 страницAmbuja Cement (ACEM IN) : Q3CY20 Result Updatenani reddyОценок пока нет

- Indsec ABFRL Q1 FY'21Документ9 страницIndsec ABFRL Q1 FY'21PriyankaОценок пока нет

- Motilal Oswal PVR Q2FY21 Result UpdateДокумент12 страницMotilal Oswal PVR Q2FY21 Result Updateumaj25Оценок пока нет

- A E L (AEL) : Mber Nterprises TDДокумент8 страницA E L (AEL) : Mber Nterprises TDdarshanmadeОценок пока нет

- Kossan Rubber Industries Berhad :FY09 Core Earnings Surged 62% YoY, Beating Estimates - 01/03/2010Документ3 страницыKossan Rubber Industries Berhad :FY09 Core Earnings Surged 62% YoY, Beating Estimates - 01/03/2010Rhb InvestОценок пока нет

- Ramco Cement Q2FY24 ResultsДокумент8 страницRamco Cement Q2FY24 ResultseknathОценок пока нет

- Shanthi Gears PDFДокумент10 страницShanthi Gears PDFGurnam SinghОценок пока нет

- Airtel AnalysisДокумент15 страницAirtel AnalysisPriyanshi JainОценок пока нет

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadДокумент13 страницIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaОценок пока нет

- Tvs Motor PincДокумент6 страницTvs Motor Pincrajarun85Оценок пока нет

- AxisCap - PEL - FN - 29 Feb 2024Документ6 страницAxisCap - PEL - FN - 29 Feb 2024Mohammed Israr ShaikhОценок пока нет

- Sharda Motor - Initiating Coverage - 131221Документ11 страницSharda Motor - Initiating Coverage - 131221deepsarode007Оценок пока нет

- CB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Документ3 страницыCB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Rhb InvestОценок пока нет

- SMIFSLimited SwarajEnginesLtd Q3FY24ResultUpdate TractorsontheedgeofpickingupSwarajpositionedwellAccumulate SMIFSInstitutionalResearch Jan 25 2024Документ10 страницSMIFSLimited SwarajEnginesLtd Q3FY24ResultUpdate TractorsontheedgeofpickingupSwarajpositionedwellAccumulate SMIFSInstitutionalResearch Jan 25 2024karankumar432447634784Оценок пока нет

- Tata Motors LTD: Result Update Aiming Near Net Debt Free (Automotive) by FY24Документ5 страницTata Motors LTD: Result Update Aiming Near Net Debt Free (Automotive) by FY24Shiv NarangОценок пока нет

- In Line Performance... : (Natmin) HoldДокумент10 страницIn Line Performance... : (Natmin) HoldMani SeshadrinathanОценок пока нет

- Bharat Forge: Performance HighlightsДокумент13 страницBharat Forge: Performance HighlightsarikuldeepОценок пока нет

- Larsen & Toubro: On TrackДокумент9 страницLarsen & Toubro: On TrackalparathiОценок пока нет

- CEAT Annual Report 2019Документ5 страницCEAT Annual Report 2019Roberto GrilliОценок пока нет

- VATW Q1FY24 ResultsДокумент7 страницVATW Q1FY24 ResultsVishalОценок пока нет

- Greaves +angel+ +04+01+10Документ6 страницGreaves +angel+ +04+01+10samaussieОценок пока нет

- Redington - Analyst Meet Update - Axis Direct - 05062017 - 05!06!2017 - 11Документ10 страницRedington - Analyst Meet Update - Axis Direct - 05062017 - 05!06!2017 - 11Hariharan SelvarajuОценок пока нет

- ABG+Shipyard 11-6-08 PLДокумент3 страницыABG+Shipyard 11-6-08 PLapi-3862995Оценок пока нет

- NRB Bearing ILFSДокумент3 страницыNRB Bearing ILFSapi-3775500Оценок пока нет

- Tata Motors: Performance HighlightsДокумент10 страницTata Motors: Performance HighlightsandrewpereiraОценок пока нет

- Ganesha Ecosphere 3QFY20 Result Update - 200211 PDFДокумент4 страницыGanesha Ecosphere 3QFY20 Result Update - 200211 PDFdarshanmadeОценок пока нет

- Escorts: Expectation of Significant Recovery Due To A Better Monsoon BuyДокумент7 страницEscorts: Expectation of Significant Recovery Due To A Better Monsoon BuynnsriniОценок пока нет

- Ashok Leyland: Robust Volume GuidanceДокумент4 страницыAshok Leyland: Robust Volume GuidancemittleОценок пока нет

- Amara Raja Batteries LTD: 1Q FY11 ResultsДокумент5 страницAmara Raja Batteries LTD: 1Q FY11 ResultsveguruprasadОценок пока нет

- Birla Corp - 2QFY18 - HDFC Sec-201711131327011015336Документ12 страницBirla Corp - 2QFY18 - HDFC Sec-201711131327011015336Anonymous y3hYf50mTОценок пока нет

- India Grid Q3FY18 - Result Update - Axis Direct - 22012018 - 22!01!2018 - 14Документ5 страницIndia Grid Q3FY18 - Result Update - Axis Direct - 22012018 - 22!01!2018 - 14saransh saranshОценок пока нет

- Provogue - Anand RathiДокумент2 страницыProvogue - Anand RathiBhagwan BachaiОценок пока нет

- Escorts Initiate Coverage CSДокумент33 страницыEscorts Initiate Coverage CSVaibhav ShahОценок пока нет

- Himatsingka Seide - 1QFY20 Result - EdelДокумент12 страницHimatsingka Seide - 1QFY20 Result - EdeldarshanmadeОценок пока нет

- PVR Q3FY18 - Result Update - Axis Direct - 06022018 - 06-02-2018 - 14Документ6 страницPVR Q3FY18 - Result Update - Axis Direct - 06022018 - 06-02-2018 - 14Shubham siddhpuriaОценок пока нет

- Repco Home Finance Ltd. (Repco) : Background Stock Performance DetailsДокумент7 страницRepco Home Finance Ltd. (Repco) : Background Stock Performance DetailstsrupenОценок пока нет

- Kossan Rubber (KRI MK) : Regional Morning NotesДокумент5 страницKossan Rubber (KRI MK) : Regional Morning NotesFong Kah YanОценок пока нет

- Q2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsДокумент10 страницQ2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsbradburywillsОценок пока нет

- Initiating Coverage - Orient Cement 171220 PDFДокумент16 страницInitiating Coverage - Orient Cement 171220 PDFJayshree JadhavОценок пока нет

- Castrol Stock Update - 211217Документ4 страницыCastrol Stock Update - 211217SAM SAMОценок пока нет

- Andhra Bank: Quality Franchise at Attractive ValuationДокумент3 страницыAndhra Bank: Quality Franchise at Attractive ValuationBharatОценок пока нет

- Ambuja Cement: Weak Despite The BeatДокумент8 страницAmbuja Cement: Weak Despite The BeatDinesh ChoudharyОценок пока нет

- BUY ITC: On A Steady PathДокумент19 страницBUY ITC: On A Steady PathTatsam VipulОценок пока нет

- Exide Industries: Performance HighlightsДокумент4 страницыExide Industries: Performance HighlightsMaulik ChhedaОценок пока нет

- Foodothe 20090319Документ12 страницFoodothe 20090319nareshsbcОценок пока нет

- Economic Indicators for South and Central Asia: Input–Output TablesОт EverandEconomic Indicators for South and Central Asia: Input–Output TablesОценок пока нет

- Economic Insights from Input–Output Tables for Asia and the PacificОт EverandEconomic Insights from Input–Output Tables for Asia and the PacificОценок пока нет

- Vocabulary 1Документ25 страницVocabulary 1divyakashОценок пока нет

- Shul53dzbetwgaukbzvhsvqpДокумент7 страницShul53dzbetwgaukbzvhsvqpdivyakashОценок пока нет

- Para MedicalДокумент1 страницаPara Medicalmmohamedsuhail108Оценок пока нет

- Insurance Awareness PDF by ExampunditДокумент9 страницInsurance Awareness PDF by ExampunditKathleen StephensonОценок пока нет

- Final Ibps Po Mains Capsule 20153 PDFДокумент71 страницаFinal Ibps Po Mains Capsule 20153 PDFRyan WootenОценок пока нет

- Itr 62 Form 15 GДокумент2 страницыItr 62 Form 15 GAccounting & TaxationОценок пока нет

- Icmnbo Abn AmroДокумент9 страницIcmnbo Abn AmrodivyakashОценок пока нет

- Revised Application ECHSДокумент17 страницRevised Application ECHSdivyakashОценок пока нет

- TRAI External Communication - Promotional Traffic CustomersДокумент5 страницTRAI External Communication - Promotional Traffic CustomersdivyakashОценок пока нет

- You Have Two ChoicesДокумент59 страницYou Have Two ChoicesdivyakashОценок пока нет

- Aka SHДокумент9 страницAka SHdivyakashОценок пока нет

- Atm Thefts-1Документ17 страницAtm Thefts-1martin_seaОценок пока нет

- Rele A Gas BuchholtsДокумент18 страницRele A Gas BuchholtsMarco GiraldoОценок пока нет

- KalamДокумент8 страницKalamRohitKumarSahuОценок пока нет

- Q3 Grade 8 Week 4Документ15 страницQ3 Grade 8 Week 4aniejeonОценок пока нет

- Magnetic Effect of Current 1Документ11 страницMagnetic Effect of Current 1Radhika GargОценок пока нет

- Roberts, Donaldson. Ante-Nicene Christian Library: Translations of The Writings of The Fathers Down To A. D. 325. 1867. Volume 15.Документ564 страницыRoberts, Donaldson. Ante-Nicene Christian Library: Translations of The Writings of The Fathers Down To A. D. 325. 1867. Volume 15.Patrologia Latina, Graeca et OrientalisОценок пока нет

- Field Assignment On Feacal Sludge ManagementДокумент10 страницField Assignment On Feacal Sludge ManagementSarah NamyaloОценок пока нет

- HTTP Parameter PollutionДокумент45 страницHTTP Parameter PollutionSpyDr ByTeОценок пока нет

- Multi Grade-ReportДокумент19 страницMulti Grade-Reportjoy pamorОценок пока нет

- 37 Sample Resolutions Very Useful, Indian Companies Act, 1956Документ38 страниц37 Sample Resolutions Very Useful, Indian Companies Act, 1956CA Vaibhav Maheshwari70% (23)

- Introduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTДокумент27 страницIntroduction To Philosophy of The Human Person: Presented By: Mr. Melvin J. Reyes, LPTMelvin J. Reyes100% (2)

- DMSCO Log Book Vol.25 1947Документ49 страницDMSCO Log Book Vol.25 1947Des Moines University Archives and Rare Book RoomОценок пока нет

- 60617-7 1996Документ64 страницы60617-7 1996SuperhypoОценок пока нет

- An Etymological Dictionary of The Scottivol 2Документ737 страницAn Etymological Dictionary of The Scottivol 2vstrohmeОценок пока нет

- A Comprehensive Guide To HR Best Practices You Need To Know This Year (Infographic)Документ42 страницыA Comprehensive Guide To HR Best Practices You Need To Know This Year (Infographic)MALATHI MОценок пока нет

- KBC Autumn Regatta 2023 Saturday Race ScheduleДокумент2 страницыKBC Autumn Regatta 2023 Saturday Race SchedulezainОценок пока нет

- Narcissist's False Self vs. True Self - Soul-Snatching - English (Auto-Generated)Документ6 страницNarcissist's False Self vs. True Self - Soul-Snatching - English (Auto-Generated)Vanessa KanuОценок пока нет

- LIM Gr7 Q4W3Документ9 страницLIM Gr7 Q4W3Eto YoshimuraОценок пока нет

- Sarcini: Caiet de PracticaДокумент3 страницыSarcini: Caiet de PracticaGeorgian CristinaОценок пока нет

- Skype OptionsДокумент2 страницыSkype OptionsacidwillОценок пока нет

- Concept of HalalДокумент3 страницыConcept of HalalakОценок пока нет

- Security Questions in UPSC Mains GS 3 2013 2020Документ3 страницыSecurity Questions in UPSC Mains GS 3 2013 2020gangadhar ruttalaОценок пока нет

- Weill Cornell Medicine International Tax QuestionaireДокумент2 страницыWeill Cornell Medicine International Tax QuestionaireboxeritoОценок пока нет

- Samsung LE26A457Документ64 страницыSamsung LE26A457logik.huОценок пока нет

- Transfer Pricing 8Документ34 страницыTransfer Pricing 8nigam_miniОценок пока нет

- BirdLife South Africa Checklist of Birds 2023 ExcelДокумент96 страницBirdLife South Africa Checklist of Birds 2023 ExcelAkash AnandrajОценок пока нет

- PHD Thesis - Table of ContentsДокумент13 страницPHD Thesis - Table of ContentsDr Amit Rangnekar100% (15)

- Language Analysis - GRAMMAR/FUNCTIONS Context Anticipated ProblemsДокумент2 страницыLanguage Analysis - GRAMMAR/FUNCTIONS Context Anticipated Problemsshru_edgyОценок пока нет

- Entrep Bazaar Rating SheetДокумент7 страницEntrep Bazaar Rating SheetJupiter WhitesideОценок пока нет