Академический Документы

Профессиональный Документы

Культура Документы

Attachment

Загружено:

Haezel Santos VillanuevaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Attachment

Загружено:

Haezel Santos VillanuevaАвторское право:

Доступные форматы

BATCH 2019

BALIWAG POLYTECHNIC COLLEGE

2ND FLOOR STAR MALL BLDG, POBLACION, BALIWAG, BULACAN FAR 2

FINANCIAL ACCOUNTING AND REPORTING A. Almine

THEORIES

Similarity is that these securities entitle holders to acquire shares at an exercise rate ordinary lower than the prevailing market rate. The

difference however lies on how to account for the issuance, exercise and expiration of such, to wit:

Issuance Exercise Expiration

RIGHTS – are issued to entitle the No entry (memo entry only) Normal entry for issuance of No entry (memo entry only)

general stockholders in relation shares:

to their pre-emptive rights, to 1 right for every 1 stock issued

protect their proportional Cash (Ex. P) XX

interest whenever corporations OS XX

issue fresh new shares. Share Prem XX

WARRANTS – normally issued PS with warrants:

attached to a principal security Cash XX Cash (Ex P) xx OSWO** xx

(Bond or Preference Shares) as PS XX OSWO** xx Share Prem from

an inducement to buyers of the Share Prem XX OS xx Expired warrants xx

principal securities. OSWO XX Share Prem xx

*Use pro-rata or residual **debit OSWO at the carrying

approach value of the warrants exercised.

Bonds with warranrs:

Cash XX

Discount XX (or)

Premium XX

Bonds Payable XX

OSWO XX

*Use residual approach

OPTIONS - normally issued to Comp. exp. xx Cash (Ex P) xx OSOO** XX

key executives and officers as OSOO xx OSOO** xx Share Prem from

additional compensation for At FMV of options or the OS xx Expired options XX

either past or future services intrinsic value, whichever is Share Prem xx

provided to the company. appropriate

**debit OSOO at the carrying

(see note below) value of the options exercised.

PROBLEMS

Problem 1: Prepare all indicated entries for each of the following independent cases affecting shareholders’ equity.

Case 1. Issued 20,000 right to shareholders, 1 right on each share, permitting holders to acquire one ordinary share of P50 par value at P60 with

every 5 rights submitted. Shares are selling at P30 per share at this time.

Subsequently, 25,000 rights are exercised and 5,000 rights expired.

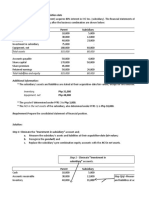

Case 2. Issued P2,000,000 12% face value bonds for P2,600,000 with share warrants – 5 warrants for every P1,000 bond.

Two warrants can be used to acquire one ordinary share par value P50, at P60. The market values on the date of the issuance of the bonds are:

12% bond ex-warrant 120

Warrant P10

Ordinary Share 65

All warrants were subsequently exercised.

Share Rights, Share Warrants and Share

Options P a g e 1|4

BATCH 2019

BALIWAG POLYTECHNIC COLLEGE

2ND FLOOR STAR MALL BLDG, POBLACION, BALIWAG, BULACAN FAR 2

FINANCIAL ACCOUNTING AND REPORTING A. Almine

Case 3: The Company issued 5,000 shares of P25 par preferred stock with detachable warrants. The package of the stock and warrants sells for

P105. Each warrant enables the holder to purchase two shares of P10 par common stock at P30 per share. Immediately following the issuance of

the stock, the stock warrants are selling at P14 each. The market value of the preferred stock without warrants is P96.

Subsequently, 70 percent of the warrants are exercised.

Case 4: Issued 20,000 preference shares of P100 par value for P2,500,000 with 20,000 warrants to acquire 10,000 ordinary shares, P50 par, at P60.

On the date of issuance, the warrants have a market value of P10, but the preference share has no known market value ex-warrant.

Subsequently, 18,000 warrants were exercised and the remainder lapsed.

Case 5: Issued 50,000 preference shares of P100 par value for P6,000,000 with 50,000 warrants to acquire 25,000 ordinary shares, P50 par, at P60

per share. On the date of issuance, the market values are:

Preference share ex-warrant none

Warrant none

Ordinary share 80

Subsequently, all the warrants were exercised.

Problem 2: On January 1, 2013, Easy Company granted 30,000 share options to employees. The share options vest at the end of three years

provided the employees remain in service until then.

The option price is P60 and the share price is also P60 at the date of grant. The par value of the share is P50.

At the date of grant, the entity concluded that the fair value of the share options cannot be estimated reliably.

All share options vested at the end of three years and no employees left during the three-year period.

The share prices and the number of share options exercised are set out below.

Share price

2013 63

2014 66

2015 75

Required: Determine the compensation expense for each year from 2013 to 2015 using the intrinsic value method.

Problem 3: The Fire Red Company granted 100 share option to each of its 200 employees on January 1,2009. The option plan entitles the

employees to buy share of the entity’s P200 par ordinary capital at P220 per share.

Based on an option pricing model used by Fire Red, the fair value of the option on January 1, 2009 was determined to be P32. The plan further

provides that the employees should be in the service of the company until at least December 31, 2011. The options are exercisable starting January

1, 2012 and expire on December 31, 2013.

At January 1, 2009, it was estimated that 15% of the employees who received the options will resign during the next three years.

Share Rights, Share Warrants and Share

Options P a g e 2|4

BATCH 2019

BALIWAG POLYTECHNIC COLLEGE

2ND FLOOR STAR MALL BLDG, POBLACION, BALIWAG, BULACAN FAR 2

FINANCIAL ACCOUNTING AND REPORTING A. Almine

During 2009, 10 employees left the company. At December 31, 2009, 15 employees were expected to leave before December 31, 2011. During

2010, 12 more employees left, and at the end of the year, it was expected that 5 more would resign before December 31, 2011; although 8

employees left during 2011.

140 employees exercised their options during 2012, another 10 employees exercise their options during 2013. The rest of the options expired.

Required:

a. Compute the compensation expense resulting from share options for the years 2009, 2010 and 2011..

b. Prepare the entries for the years 2009 and 2013..

Problem 4: On January 1, 2009, Cherry Company issued 10,000 share options for the purchase of P100 par value ordinary share at a strike price

(exercise price) of P120 per share, to its key employees. The share option vest anytime once the share price reached P200, up to December 31,

2011. The options are exercisable until the end of 2012.

Based on the pricing model used by the company, the market value of the share on January 1, 2009 is P20.

Required:

a. Assume the market price of the company’s share reached P200 in December 2010 and the share options were exercised in 2011. Prepare

entries for the years 2009 through 2011.

b. Assume that the market price of the company’s share reached P200 in December 2011. 80% of the options were exercised in 2012 and

the remainder lapsed. Prepare the entries for the years 2009 through 2012.

c. How will the entries differ if the company’s share reached a market price of P200 only in June 2012, such that none of the options vested

during the prescribed period?

Problem 5: On January 1, 2010, Panda Company granted 80 share options to each of its 400 employees for the purchase of P100 par ordinary share

at P140 per share. The employees are required to be in the employ of the company at least until the option vested. The share options will vest as

follows:

End of 2010, if earnings in 2010 increased by 15%

End of 2011, if average annual earnings during 2010 and 2011 increased by 12%.

The company reported increase in 2010 earnings by 13%. At December 31, 2011 reported earnings increased by 12%.

No employees left the company during the two-year periods 2010-2011. All options were exercise during 2012. The market value of each option at

January 1, 2010 was 22.

Required:

a. All entries during 2010 through 2012

b. Assume that the reported earnings in 2010 increased by 15%. How much compensation expense would be recognized during 2010 as a

result of option plan.

Problem 6: On January 1, 2010, Joey Corporation issued 10,000 share appreciation rights (SAR) to selected employees that vest after three years,

provided the employees remain employees by the company at least until the exercise date. Each SAR entitles the employee a cash payment for an

amount the share price of the company’s ordinary share exceeds P120.

The market price of Joey’s ordinary share at the end of each investing year is as follows:

December 31, 2010 P140

December 31, 2011 150

December 31, 2012 165

Required :

a. Prepare all entries in the books of Joey Corporation for years 2010, 2011 and 2012.

b. Give the entry for the exercise of the SAR assuming that

(1) The rights were exercised on January 1, 2013, when the market price of the ordinary share is P165

(2) The rights were exercised on December 31, 2013, when the market price of the ordinary share is P172.

Share Rights, Share Warrants and Share

Options P a g e 3|4

BATCH 2019

BALIWAG POLYTECHNIC COLLEGE

2ND FLOOR STAR MALL BLDG, POBLACION, BALIWAG, BULACAN FAR 2

FINANCIAL ACCOUNTING AND REPORTING A. Almine

Problem 7: On January 1, 2013, Bumble Company granted to an employee the right to choose either:

a. 12,000 shares (share or equity alternative)

b. Cash payment equal to market value of 10,000 shares (cash alternative)

The grant is conditional upon the completion of three years of service. If the employee chooses the share alternative, the shares must be held for

three years after vesting date.

The par value of the share is P25 and at grant date on January 1, 2013, the share price is P51. The share prices the three-year vesting period are P54

on December 31, 2013, P60 on December 31, 2014 and P65 on December 31, 2015.

After taking into account the effects of post-vesting restrictions, the entity has estimated that the fair value of the share or equity alternative is P48

per share.

Required: Determine the compensation expense from 2013 to 2015 as a result of the share alternative and cash alternative.

Problem 8: On January 1, 2013, Beauty Company purchased an equipment for the cash price of P5,000,000. The supplier can choose how the

purchase is to be settled.

The choices are 50,000 shares with par value of P50 in one year’s time, or a cash payment equal to the market value of 40,000 shares on December

31, 2013.

At grant date on January 1, 2013, the market price of each share is P110 and on the date of settlement on December 31, 2013, the market price of

each share is P130.

Required: Prepare journal entries to record the foregoing transactions.

FULL PFRS SMEs

Share-based payment transactions The share options shall be measured at fair The share options must be measured at fair

value on the date of grant. value on the date of grant.

However, if the fair value of the share options The intrinsic value is not mentioned as an

cannot be measured reliably, the intrinsic alternative

value of the share options is used. The

intrinsic value is the excess of the market

price of the shared over the option price.

Share Rights, Share Warrants and Share

Options P a g e 4|4

Вам также может понравиться

- Kiplinger's Personal Finance - January 2018 PDFДокумент74 страницыKiplinger's Personal Finance - January 2018 PDFjkavinОценок пока нет

- RSI Pro The Core Principles PDFДокумент34 страницыRSI Pro The Core Principles PDFpankaj thakur100% (11)

- Sample TermsheetДокумент4 страницыSample Termsheetkborah100% (7)

- Valix 2019 Chapter 7Документ4 страницыValix 2019 Chapter 7M100% (2)

- AFAR Notes by Dr. Ferrer PDFДокумент21 страницаAFAR Notes by Dr. Ferrer PDFjexОценок пока нет

- Far410 Chapter 4 EquityДокумент34 страницыFar410 Chapter 4 EquityAQILAH NORDINОценок пока нет

- Training Material On Intraday TradingДокумент40 страницTraining Material On Intraday TradingSavidh ShajuОценок пока нет

- Chap 25 Share Based Compensation, Share Option Fin Acct 2 - Barter Summary TeamДокумент4 страницыChap 25 Share Based Compensation, Share Option Fin Acct 2 - Barter Summary TeamKimberly Ann Lumanog AmarОценок пока нет

- Volume Zone OscillatorДокумент15 страницVolume Zone Oscillatormatsumoto0% (1)

- Module 5 - Ia2 Final CBLДокумент13 страницModule 5 - Ia2 Final CBLErik Lorenz Palomares0% (1)

- Work Immersion Portfolio LHS SHSДокумент61 страницаWork Immersion Portfolio LHS SHSSon Yong75% (48)

- Audit Prob ReceivablesДокумент30 страницAudit Prob ReceivablesMagnana Kaw81% (21)

- Compound Financial Instruments ExplainedДокумент4 страницыCompound Financial Instruments ExplainedJulie Mae Caling MalitОценок пока нет

- CIIE Term Sheet TemplateДокумент9 страницCIIE Term Sheet TemplateSURAJ SINGHОценок пока нет

- IPO/FPO Book Building Process ExplainedДокумент80 страницIPO/FPO Book Building Process Explainedvinodvarghese123100% (1)

- P1 Part4.2Документ8 страницP1 Part4.2Minie KimОценок пока нет

- Shares and DebenturesДокумент20 страницShares and DebenturesVíshál RánáОценок пока нет

- Companies Act - Chapter 3 - ProspectusДокумент10 страницCompanies Act - Chapter 3 - Prospectusshreyuttam82Оценок пока нет

- Session 6 Long Term+raising CapitalДокумент35 страницSession 6 Long Term+raising CapitalSakshi VermaОценок пока нет

- Far 410: Chapter 4: EquityДокумент44 страницыFar 410: Chapter 4: EquityJung KookieОценок пока нет

- Desired Learning Outcomes: ST NDДокумент4 страницыDesired Learning Outcomes: ST NDNoeme LansangОценок пока нет

- Chap 9 Compound Financial Instruments Fin Acct 2 - Barter Summary Team PDFДокумент6 страницChap 9 Compound Financial Instruments Fin Acct 2 - Barter Summary Team PDFAbigail TumabaoОценок пока нет

- RFP For Firm UnderWritten Syndicated LoansДокумент9 страницRFP For Firm UnderWritten Syndicated Loansoratschilde.aiОценок пока нет

- Private Equity Assignment: Submitted byДокумент4 страницыPrivate Equity Assignment: Submitted bySAURABH SINGHОценок пока нет

- Chapter 3 Prospectus Lyst1912Документ16 страницChapter 3 Prospectus Lyst1912Rambo HereОценок пока нет

- Accounting-Bonus Issue and Right-Issue-1653399018535704Документ9 страницAccounting-Bonus Issue and Right-Issue-1653399018535704Badhrinath ShanmugamОценок пока нет

- Accounting for Equity Transactions in a CorporationДокумент37 страницAccounting for Equity Transactions in a CorporationJulius B. OpriasaОценок пока нет

- HDFC Mutual Fund (Children Gift) - 042008Документ20 страницHDFC Mutual Fund (Children Gift) - 042008bapisroy100% (1)

- Book 18 Dec 2023Документ8 страницBook 18 Dec 2023Saurabh KonduskarОценок пока нет

- (Chapter 1) Compliance and Supervision in Capital MarketДокумент21 страница(Chapter 1) Compliance and Supervision in Capital MarketAbdul BatenОценок пока нет

- Intermediate Accounting 3 Chapter 4 Share-Based PaymentsДокумент5 страницIntermediate Accounting 3 Chapter 4 Share-Based Paymentshappy240823100% (1)

- Share-Based PaymentДокумент8 страницShare-Based PaymentChrisus Joseph SarchezОценок пока нет

- Module - IA Chapter 7Документ8 страницModule - IA Chapter 7Kathleen EbuenОценок пока нет

- 2.capital Structure QB 25-40Документ12 страниц2.capital Structure QB 25-40Towhidul IslamОценок пока нет

- AC Theory - Pref Share, Valuation, CR, AmalgamationДокумент8 страницAC Theory - Pref Share, Valuation, CR, Amalgamationjimmyadamskl69Оценок пока нет

- Bonus Shares Explained in DetailДокумент17 страницBonus Shares Explained in DetailMunawar MapkarОценок пока нет

- ESOPДокумент8 страницESOPKiran GvОценок пока нет

- Episode 20 - Corpo LawДокумент16 страницEpisode 20 - Corpo LawBarem Salio-anОценок пока нет

- For PFC Website Policy For Equity Investment in Power ProjectsДокумент4 страницыFor PFC Website Policy For Equity Investment in Power ProjectsPawan Kumar RaiОценок пока нет

- Compound Financial Instruments Bafacr4x OnlineglimpsenujpiaДокумент6 страницCompound Financial Instruments Bafacr4x OnlineglimpsenujpiaAga Mathew MayugaОценок пока нет

- Redemption of Preference SharesДокумент34 страницыRedemption of Preference SharesManasОценок пока нет

- Leases: Key Accounting ConceptsДокумент5 страницLeases: Key Accounting ConceptsJeffer Jay GubalaneОценок пока нет

- 07.2 - Shareholders EquityДокумент5 страниц07.2 - Shareholders EquityDonna Abogado100% (1)

- Allotment of Shares, Share & Share CapitalДокумент9 страницAllotment of Shares, Share & Share Capitalkavya.aroraОценок пока нет

- Partnership 1Документ64 страницыPartnership 1jayasandhya mОценок пока нет

- Bonds PayableДокумент31 страницаBonds PayableMerlyn ManaloОценок пока нет

- Finals, Part 2Документ6 страницFinals, Part 2Eliza BethОценок пока нет

- Yuken India Limited Announces Bonus Share IssueДокумент6 страницYuken India Limited Announces Bonus Share IssueShawn SabuОценок пока нет

- Chapter 2 - EPS - IAS 33 - 3 - DilutedДокумент12 страницChapter 2 - EPS - IAS 33 - 3 - DilutedXuyên LươngОценок пока нет

- Practical problems with capital markets green shoe options and FCCBsДокумент9 страницPractical problems with capital markets green shoe options and FCCBsGautamSinghОценок пока нет

- Capital Markets - Practical ProblemsДокумент9 страницCapital Markets - Practical ProblemsGautamSinghОценок пока нет

- Chapter Three: Valuation of Financial Instruments & Cost of CapitalДокумент68 страницChapter Three: Valuation of Financial Instruments & Cost of CapitalAbrahamОценок пока нет

- Chapter 07 Stocks and Stock ValuationДокумент36 страницChapter 07 Stocks and Stock ValuationAai NurrОценок пока нет

- Katten - ESOP Fact SheetДокумент8 страницKatten - ESOP Fact SheetRichandCo100% (1)

- D0683SP Ans2Документ18 страницD0683SP Ans2Tanmay SanchetiОценок пока нет

- SMEsДокумент14 страницSMEsudmjoanaelicastro10Оценок пока нет

- Company Ownership StructureДокумент5 страницCompany Ownership Structureehsan_sheikh2004Оценок пока нет

- Sources of FinanceДокумент44 страницыSources of FinanceKALAI ARASANОценок пока нет

- Workshop Debt Securities STAFFДокумент42 страницыWorkshop Debt Securities STAFFIshan MalakarОценок пока нет

- 9.pak Qfipme Topic1 Hfis 12 Corporate BondsДокумент13 страниц9.pak Qfipme Topic1 Hfis 12 Corporate BondsNoodles FSAОценок пока нет

- Financial Management Core Concepts 2nd Edition Brooks Solutions Manual 1Документ35 страницFinancial Management Core Concepts 2nd Edition Brooks Solutions Manual 1tom100% (37)

- Key Amendments in Relation To IPO Under SEBI (ICDR) Reg. 2018Документ5 страницKey Amendments in Relation To IPO Under SEBI (ICDR) Reg. 2018jayaram gОценок пока нет

- Chapter # 1 Issuance of SharesДокумент16 страницChapter # 1 Issuance of SharesRooh Ullah KhanОценок пока нет

- What Is Finance All About?Документ40 страницWhat Is Finance All About?Asad razaОценок пока нет

- Bact 310 Topic 2 Accounting For Pension and Employee BenefitsДокумент11 страницBact 310 Topic 2 Accounting For Pension and Employee BenefitsPa HabbakukОценок пока нет

- Im M3 NotesДокумент40 страницIm M3 NotesJauhar Ul HaqОценок пока нет

- Category Title Artist Year Genre Suggested by Assigned DifficultyДокумент2 страницыCategory Title Artist Year Genre Suggested by Assigned DifficultyHaezel Santos VillanuevaОценок пока нет

- Company Name (Logo) : College of Accountancy, Business, Information Technology and EngineeringДокумент1 страницаCompany Name (Logo) : College of Accountancy, Business, Information Technology and EngineeringHaezel Santos VillanuevaОценок пока нет

- Going After YouДокумент1 страницаGoing After YouJether Gil OrendainОценок пока нет

- 14 Letr Inventoryrelease PDFДокумент1 страница14 Letr Inventoryrelease PDFHaezel Santos VillanuevaОценок пока нет

- Table of Contents - CWRДокумент7 страницTable of Contents - CWRHaezel Santos VillanuevaОценок пока нет

- 03 Correction of Error - CTDIДокумент15 страниц03 Correction of Error - CTDIrubydelacruzОценок пока нет

- Cost AccountingДокумент18 страницCost AccountingHaezel Santos VillanuevaОценок пока нет

- Manual of Policies and Procedures on AccountingДокумент5 страницManual of Policies and Procedures on AccountingHaezel Santos VillanuevaОценок пока нет

- News ArticleДокумент3 страницыNews ArticleHaezel Santos VillanuevaОценок пока нет

- AttachmentДокумент20 страницAttachmentHaezel Santos VillanuevaОценок пока нет

- Class Disturbances' Impact on Student LearningДокумент19 страницClass Disturbances' Impact on Student LearningHaezel Santos VillanuevaОценок пока нет

- Cost12 Study03 PDFДокумент12 страницCost12 Study03 PDFVINCENT GAYRAMON100% (1)

- Strama ReviewerДокумент11 страницStrama ReviewerHaezel Santos VillanuevaОценок пока нет

- Auditing ProblemДокумент1 страницаAuditing ProblemHaezel Santos VillanuevaОценок пока нет

- Fs of Target CompanyДокумент108 страницFs of Target CompanyHaezel Santos VillanuevaОценок пока нет

- Audit Planning DoneДокумент3 страницыAudit Planning DoneJay-r PlazaОценок пока нет

- Manual of Policies and Procedures on AccountingДокумент5 страницManual of Policies and Procedures on AccountingHaezel Santos VillanuevaОценок пока нет

- Company OverviewДокумент12 страницCompany OverviewHaezel Santos VillanuevaОценок пока нет

- Desktop PDFДокумент13 страницDesktop PDFHaezel Santos VillanuevaОценок пока нет

- 12 x10 Financial Statement AnalysisДокумент18 страниц12 x10 Financial Statement AnalysisJohn Bryan100% (3)

- Narrative Report For OJT 2016Документ4 страницыNarrative Report For OJT 2016Haezel Santos VillanuevaОценок пока нет

- Ias 24 Related Party Disclosures Summary PDFДокумент3 страницыIas 24 Related Party Disclosures Summary PDFHaezel Santos VillanuevaОценок пока нет

- Financial StatementДокумент112 страницFinancial StatementHaezel Santos VillanuevaОценок пока нет

- CBA Management Consultancy UpdatedДокумент3 страницыCBA Management Consultancy UpdatedJassel TulodОценок пока нет

- Desktop PDFДокумент13 страницDesktop PDFHaezel Santos VillanuevaОценок пока нет

- Manual of Policies and Procedures on AccountingДокумент5 страницManual of Policies and Procedures on AccountingHaezel Santos VillanuevaОценок пока нет

- Total Assets 335,000 80,000: Additional InformationДокумент8 страницTotal Assets 335,000 80,000: Additional InformationHohohoОценок пока нет

- Zerodha ComДокумент25 страницZerodha ComBalakrishna BoyapatiОценок пока нет

- FINS2624 Final Exam 2010 Semester 2Документ22 страницыFINS2624 Final Exam 2010 Semester 2AnnabelleОценок пока нет

- Debt Market in IndiaДокумент5 страницDebt Market in IndiaBasavaraju K R100% (1)

- The VIX Finally Went Bananas - Morgan Stanley's Post Mortem of Everything That Happened - Zero HedgeДокумент12 страницThe VIX Finally Went Bananas - Morgan Stanley's Post Mortem of Everything That Happened - Zero HedgeeliforuОценок пока нет

- FTU Thesis on Impacts of Info Asymmetry on Cost of EquityДокумент79 страницFTU Thesis on Impacts of Info Asymmetry on Cost of EquityLớp Cao họcОценок пока нет

- Rational Numbers (HIndi)Документ32 страницыRational Numbers (HIndi)Bindu MenonОценок пока нет

- Public Islamic Sector Select FundДокумент4 страницыPublic Islamic Sector Select FundArmi Faizal AwangОценок пока нет

- Case 3 Report - 1208 2056Документ26 страницCase 3 Report - 1208 2056api-3748540Оценок пока нет

- Capital Market TheoryДокумент5 страницCapital Market TheoryZakia ElhamОценок пока нет

- Study on Performance of India's Bond MarketДокумент62 страницыStudy on Performance of India's Bond MarketNaresh KumarОценок пока нет

- What Do Financial Managers DoДокумент5 страницWhat Do Financial Managers DoSerena Van Der WoodsenОценок пока нет

- The Cost of Capital at AmeritradeДокумент44 страницыThe Cost of Capital at Ameritradesaleem24120% (1)

- ACompanyДокумент12 страницACompanypiyushffrtОценок пока нет

- M1 C2 Case Study WorkbookДокумент30 страницM1 C2 Case Study WorkbookHasan Md ErshadОценок пока нет

- Transaction Analysis and Preparation of Statements Practice Problem SolutionДокумент6 страницTransaction Analysis and Preparation of Statements Practice Problem SolutionAshish BhallaОценок пока нет

- Coca-Cola and Best Buy Income Statements and Financial ProjectionsДокумент9 страницCoca-Cola and Best Buy Income Statements and Financial ProjectionsEvelDerizkyОценок пока нет

- SLG SL Green Realty 2010 Corporate Investor Presentation Slides Deck PDFДокумент135 страницSLG SL Green Realty 2010 Corporate Investor Presentation Slides Deck PDFAla BasterОценок пока нет

- C6 Lecture NotesДокумент2 страницыC6 Lecture NotesJonathan NavalloОценок пока нет

- The Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Документ3 страницыThe Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Matt BrennanОценок пока нет

- Florida SBA Private Equity Fund Performance Summary Through June 2020Документ7 страницFlorida SBA Private Equity Fund Performance Summary Through June 2020mautumnОценок пока нет

- VNO LetterДокумент15 страницVNO LetterZerohedgeОценок пока нет

- Accounting 12 Summative AdidasДокумент57 страницAccounting 12 Summative AdidasWensen LiОценок пока нет

- Top Ten Pitch Tips: Contact: Patrick Lor / Pat@lor - VC / WWW - Lor.vcДокумент9 страницTop Ten Pitch Tips: Contact: Patrick Lor / Pat@lor - VC / WWW - Lor.vcscribd2601RОценок пока нет

- PT Blue Bird Tbk 2019 Financial StatementsДокумент111 страницPT Blue Bird Tbk 2019 Financial StatementsKarmilaОценок пока нет

- Ito PredictДокумент79 страницIto PredictGallo SolarisОценок пока нет