Академический Документы

Профессиональный Документы

Культура Документы

Withholding Tax Rate

Загружено:

Jamie Jimenez CerreroОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Withholding Tax Rate

Загружено:

Jamie Jimenez CerreroАвторское право:

Доступные форматы

Tax Rates

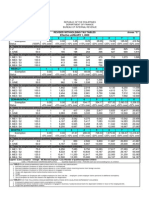

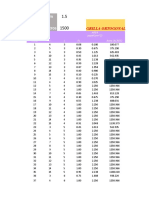

REVISED WITHHOLDING TAX TABLES

Effective January 1, 2009

DAILY 1 2 3 4 5 6 7 8

Exemption 0.00 0.00 1.65 8.25 28.05 74.26 165.02 412.54

Status (‘000P) +0% over +5% over +10% over +15% over +20% over +25% over +30% over +32% over

A. Table for employees without qualified dependent

1. Z 0.0 1 0 33 99 231 462 825 1,650

2. S/ME 50.0 1 165 198 264 396 627 990 1,815

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1 75.0 1 248 281 347 479 710 1,073 1,898

2. ME2 / S2 100.0 1 330 363 429 561 792 1,155 1,980

3. ME3 / S3 125.0 1 413 446 512 644 875 1,238 2,063

4. ME4 / S4 150.0 1 495 528 594 726 957 1,320 2,145

WEEKLY 1 2 3 4 5 6 7 8

Exemption 0.00 0.00 9.62 48.08 163.46 432.69 961.54 2,403.85

Status +0% over +5% over +10% over +15% over +20% over +25% over +30% over +32% over

A. Table for employees without qualified dependent

1. Z 0.0 1 0 192 577 1,346 2,692 4,808 9,615

2. S/ME 50.0 1 962 1,154 1,538 2,308 3,654 5,769 10,577

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1 75.0 1 1,442 1,635 2,019 2,788 4,135 6,250 11,058

2. ME2 / S2 100.0 1 1,923 2,115 2,500 3,269 4,615 6,731 11,538

3. ME3 / S3 125.0 1 2,404 2,596 2,981 3,750 5,096 7,212 12,019

4. ME4 / S4 150.0 1 2,885 3,077 3,462 4,231 5,577 7,692 12,500

SEMI-MONTHLY 1 2 3 4 5 6 7 8

Exemption 0.00 0.00 20.83 104.17 354.17 937.50 2,083.33 5,208.33

Status +0% over +5% over +10% over +15% over +20% over +25% over +30% over +32% over

A. Table for employees without qualified dependent

1. Z 0.0 1 0 417 1,250 2,917 5,833 10,417 20,833

2. S/ME 50.0 1 2,083 2,500 3,333 5,000 7,917 12,500 22,917

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1 75.0 1 3,125 3,542 4,375 6,042 8,958 13,542 23,958

2. ME2 / S2 100.0 1 4,167 4,583 5,417 7,083 10,000 14,583 25,000

3. ME3 / S3 125.0 1 5,208 5,625 6,458 8,125 11,042 15,625 26,042

4. ME4 / S4 150.0 1 6,250 6,667 7,500 9,167 12,083 16,667 27,083

MONTHLY 1 2 3 4 5 6 7 8

Exemption 0.00 0.00 41.67 208.33 708.33 1,875.00 4,166.67 10,416.67

Status +0% over +5% over +10% over +15% over +20% over +25% over +30% over +32% over

A. Table for employees without qualified dependent

1. Z 0.0 1 0 833 2,500 5,833 11,667 20,833 41,667

2. S/ME 50.0 1 4,167 5,000 6,667 10,000 15,833 25,000 45,833

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1 75.0 1 6,250 7,083 8,750 12,083 17,917 27,083 47,917

2. ME2 / S2 100.0 1 8,333 9,167 10,833 14,167 20,000 29,167 50,000

3. ME3 / S3 125.0 1 10,417 11,250 12,917 16,250 22,083 31,250 52,083

4. ME4 / S4 150.0 1 12,500 13,333 15,000 18,333 24,167 33,333 54,167

Legend: Z-Zero exemption S-Single ME-Married Employee 1;2;3;4-Number of qualified dependent children

S/ME = P50,000 EACH WORKING EMPLOYEE Qualified Dependent Child = P25,000 each but not exceeding four (4) children

USE TABLE A FOR SINGLE/MARRIED EMPLOYEES WITH NO QUALIFIED DEPENDENT

1. Married Employee (Husband or Wife) whose spouse is unemployed.

2. Married Employee (Husband or Wife) whose spouse is a non-resident citizen receiving income from foreign sources

3. Married Employee (Husband or Wife) whose spouse is engaged in business

4. Single

6. Zero Exemption for employees with multiple employers for their 2 nd, 3rd…..employers (main employer claims personal & additional

exemption

7. Zero Exemption for those who failed to file Application for Registration

USE TABLE B FOR THE FOLLOWING SINGLE/MARRIED EMPLOYEES WITH QUALIFIED DEPENDENT

1. Employed husband and husband claims exemptions of children

2. Employed wife whose husband is also employed or engaged in business; husband waived claim for dependent children in favor of

the employed wife

3. Single with qualified dependent children

Вам также может понравиться

- REVISED WITHHOLDING TAX TABLESДокумент1 страницаREVISED WITHHOLDING TAX TABLESVita DepanteОценок пока нет

- PHILIPPINE REVISED WITHHOLDING TAX TABLESДокумент1 страницаPHILIPPINE REVISED WITHHOLDING TAX TABLESJhon Karl AndalОценок пока нет

- For The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"Документ1 страницаFor The Period July 6, 2008 To December 31, 2008 Revised Transitional Withholding Tax Tables Annex "D"yousefОценок пока нет

- Revised tax withholding tablesДокумент2 страницыRevised tax withholding tablesShairaCerenoОценок пока нет

- Guide to Philippine Withholding TaxesДокумент33 страницыGuide to Philippine Withholding TaxesBfp Basud Camarines NorteОценок пока нет

- TablesДокумент1 страницаTablesArmelia CododОценок пока нет

- Withholding TaxДокумент46 страницWithholding TaxDura LexОценок пока нет

- Withholding Tax From BIR WebsiteДокумент37 страницWithholding Tax From BIR Websitepeanut47Оценок пока нет

- Revised Withholding Tax TablesДокумент2 страницыRevised Withholding Tax TablesReylan San PascualОценок пока нет

- Philippines BIR Tax Rates 2009Документ0 страницPhilippines BIR Tax Rates 2009kamkamtoy100% (1)

- Revised Withholding Tax TablesДокумент1 страницаRevised Withholding Tax TablesJonasAblangОценок пока нет

- Revised Withholding Tax TablesДокумент1 страницаRevised Withholding Tax Tablesrupertville12Оценок пока нет

- REVISED WITHHOLDING TAXДокумент1 страницаREVISED WITHHOLDING TAXEmil A. MolinaОценок пока нет

- Old Taxation TablesДокумент2 страницыOld Taxation TablesBai NiloОценок пока нет

- Payroll SystemДокумент21 страницаPayroll SystemyuunissОценок пока нет

- ANSI Pipe Schedule ChartДокумент2 страницыANSI Pipe Schedule ChartamevaluacionesОценок пока нет

- 04handout2 CostAcctgRecitationДокумент3 страницы04handout2 CostAcctgRecitationDummy GoogleОценок пока нет

- Mil Pay Table 1985Документ1 страницаMil Pay Table 1985Charles TurnerОценок пока нет

- TPP AprilДокумент3 страницыTPP AprilBu NurmalaОценок пока нет

- Espectro de Pseudoaceleraciones - Norma Tecnica de Edificacion E.030Документ1 страницаEspectro de Pseudoaceleraciones - Norma Tecnica de Edificacion E.030Yonel NúñezОценок пока нет

- Drainase ANGGIДокумент61 страницаDrainase ANGGImasriferdyОценок пока нет

- Reduced Mean (Yn) : Lampiran 1Документ62 страницыReduced Mean (Yn) : Lampiran 1NurulОценок пока нет

- Curva Theis Water Flow ChartДокумент4 страницыCurva Theis Water Flow ChartRodolfo PérezОценок пока нет

- Mil Pay Table 1991Документ2 страницыMil Pay Table 1991ASiCОценок пока нет

- Circlip CatalogueДокумент18 страницCirclip CatalogueCALVINОценок пока нет

- Drainase Dezty OkДокумент49 страницDrainase Dezty OkFaridОценок пока нет

- Lacrifresh PF Launch Plan - W5Документ23 страницыLacrifresh PF Launch Plan - W5zeeshanОценок пока нет

- Tubing, Casing and Drill Pipe Stretch DataДокумент34 страницыTubing, Casing and Drill Pipe Stretch DataNicasio AlonzoОценок пока нет

- Cable SizesДокумент1 страницаCable SizesShaheer ShaheenОценок пока нет

- Table I - VL & SL Credits Earned On A Monthly BasisДокумент3 страницыTable I - VL & SL Credits Earned On A Monthly BasisJane SantosОценок пока нет

- Grupo:: Seeger RenoДокумент4 страницыGrupo:: Seeger RenoandrelorandiОценок пока нет

- 16176946685314.JadualTransaksiSelangor2020Документ53 страницы16176946685314.JadualTransaksiSelangor2020Venice ChenОценок пока нет

- Friction Loss Chart - DixonДокумент1 страницаFriction Loss Chart - Dixonjzames001Оценок пока нет

- Measurement SHEET 1Документ7 страницMeasurement SHEET 1Seun QuadriОценок пока нет

- Georgian Bank Share Trading HistoryДокумент19 страницGeorgian Bank Share Trading HistoryNikoloz AbuashviliОценок пока нет

- T de StudentДокумент1 страницаT de StudentjuanОценок пока нет

- Stainless Stee Pipe Burst PressureДокумент1 страницаStainless Stee Pipe Burst PressurerijalharunОценок пока нет

- Excel Canal Trapezoidal FLUJO CRITICOДокумент7 страницExcel Canal Trapezoidal FLUJO CRITICOmarco vasquez lavadoОценок пока нет

- Ac 3 Mi: 1195.06 (Del UH Triangular)Документ1 страницаAc 3 Mi: 1195.06 (Del UH Triangular)Angie JadanОценок пока нет

- Edited 014 Payroll Sargen July 02-15, 2023Документ12 страницEdited 014 Payroll Sargen July 02-15, 2023Adolf OdaniОценок пока нет

- Blangko A2 PajakДокумент141 страницаBlangko A2 PajakHaris AriandyОценок пока нет

- AWG and Circular Mils GuideДокумент11 страницAWG and Circular Mils GuideAdrian GarciaОценок пока нет

- Circular Mils - AWG-Tables PDFДокумент11 страницCircular Mils - AWG-Tables PDFRichard TorrivillaОценок пока нет

- Pii-2006600-Sf PurДокумент2 страницыPii-2006600-Sf PurSayyid AzzamОценок пока нет

- IntegratedДокумент7 страницIntegratedRon Jay De VeraОценок пока нет

- Home TestДокумент22 страницыHome TestSelina ChenОценок пока нет

- E275 AWG-TablesДокумент11 страницE275 AWG-TablesAntonio AdorzaОценок пока нет

- Date Deposit Official Receipt NoДокумент24 страницыDate Deposit Official Receipt NoAllanis Rellik PalamianoОценок пока нет

- Abs-Corrigida-Substrato/Inibidor Kinetics AnalysisДокумент6 страницAbs-Corrigida-Substrato/Inibidor Kinetics AnalysisLucas MoreiraОценок пока нет

- Sii Smith International Inc. (713) 443 - 3370: DrilcoДокумент27 страницSii Smith International Inc. (713) 443 - 3370: DrilcoIvan Dario Benavides BonillaОценок пока нет

- Calendar Formula Gantt Chart with Delayed StartДокумент3 страницыCalendar Formula Gantt Chart with Delayed Startsahilsahni20Оценок пока нет

- Grillas OrtogonalesДокумент18 страницGrillas Ortogonalessantiago quispe mamaniОценок пока нет

- Home Financing-I Repayment Schedule (Normal) : Instalments For Completed / Under Construction / RefinancingДокумент1 страницаHome Financing-I Repayment Schedule (Normal) : Instalments For Completed / Under Construction / RefinancingMila AnnОценок пока нет

- Home+Financing i+Instalment+TableДокумент1 страницаHome+Financing i+Instalment+TableSyafi'ah BakaruddinОценок пока нет

- Task 1 CalculationsДокумент5 страницTask 1 Calculationsedmond nyakundiОценок пока нет

- Cia DAMДокумент24 страницыCia DAMvishalОценок пока нет

- OVER CURRENT PROTECTION CHARTSДокумент2 страницыOVER CURRENT PROTECTION CHARTSsalmanОценок пока нет

- Van Der Hoven SpectrumДокумент4 страницыVan Der Hoven SpectrumFirdous Ul NazirОценок пока нет

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesОт EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesРейтинг: 5 из 5 звезд5/5 (3)

- Brianna Patrizio Gender EqualityДокумент10 страницBrianna Patrizio Gender EqualityMarcoОценок пока нет

- McFarland Curtis.2004.the Philippine Language SituationДокумент17 страницMcFarland Curtis.2004.the Philippine Language SituationClaire EspirituОценок пока нет

- Society Vs Culture - Eric EriksonДокумент2 страницыSociety Vs Culture - Eric EriksonJamie Jimenez CerreroОценок пока нет

- Exam 1.2 MHB2Документ1 страницаExam 1.2 MHB2Jamie Jimenez CerreroОценок пока нет

- Dialect Variations by Region and Social ClassДокумент1 страницаDialect Variations by Region and Social ClassJamie Jimenez CerreroОценок пока нет

- Case Analysis: Gregoria de Jesus: By: Ablanida Arellano Cerrero Regoris RacelisДокумент15 страницCase Analysis: Gregoria de Jesus: By: Ablanida Arellano Cerrero Regoris RacelisJamie Jimenez CerreroОценок пока нет

- Research On Technological Innovation Efficiency of Tourist Equipment Manufacturing EnterprisesДокумент17 страницResearch On Technological Innovation Efficiency of Tourist Equipment Manufacturing EnterprisesJamie Jimenez CerreroОценок пока нет

- Name: Section: Marking The Filipino Children's Literacy DevelopmentДокумент2 страницыName: Section: Marking The Filipino Children's Literacy DevelopmentJamie Jimenez CerreroОценок пока нет

- OMGdrinks (Untilfinanciarplan) Officialcerr (Official)Документ45 страницOMGdrinks (Untilfinanciarplan) Officialcerr (Official)Jamie Jimenez CerreroОценок пока нет

- (Minutesofmeetingsamplenatin) (AutoRecovered) 22222Документ7 страниц(Minutesofmeetingsamplenatin) (AutoRecovered) 22222Jamie Jimenez CerreroОценок пока нет

- McFarland Curtis.2004.the Philippine Language SituationДокумент17 страницMcFarland Curtis.2004.the Philippine Language SituationClaire EspirituОценок пока нет

- Lab 7 Stock Investment Analysis - CERREROJAMESSTEPHENJ. SEC2 (Excel)Документ1 страницаLab 7 Stock Investment Analysis - CERREROJAMESSTEPHENJ. SEC2 (Excel)Jamie Jimenez CerreroОценок пока нет

- Argumentative Essay #2 (Pro-Singapore)Документ3 страницыArgumentative Essay #2 (Pro-Singapore)Jamie Jimenez CerreroОценок пока нет

- Adopted Questionnaire Business StatДокумент4 страницыAdopted Questionnaire Business StatJamie Jimenez CerreroОценок пока нет

- CASEANALYSISPHILHISTAYOKONAMABUHAYSIRISIDROOFFДокумент32 страницыCASEANALYSISPHILHISTAYOKONAMABUHAYSIRISIDROOFFJamie Jimenez CerreroОценок пока нет

- Case Analysis Group 6 SEC2officialcerreroДокумент24 страницыCase Analysis Group 6 SEC2officialcerreroJamie Jimenez CerreroОценок пока нет

- Gregoria de Jesus and The Katipunan: A Case Study AnalysisДокумент16 страницGregoria de Jesus and The Katipunan: A Case Study AnalysisJamie Jimenez CerreroОценок пока нет

- (Minutesofmeetingsamplenatin) (AutoRecovered) 22222Документ7 страниц(Minutesofmeetingsamplenatin) (AutoRecovered) 22222Jamie Jimenez CerreroОценок пока нет

- Math 11 First Depex FS AY 2018 2019 1Документ3 страницыMath 11 First Depex FS AY 2018 2019 1Jamie Jimenez CerreroОценок пока нет

- Adopted Questionnaire Business StatДокумент4 страницыAdopted Questionnaire Business StatJamie Jimenez CerreroОценок пока нет

- LSGH Model United Nations Organization Workshop #4 - Committee PapersДокумент5 страницLSGH Model United Nations Organization Workshop #4 - Committee PapersJamie Jimenez CerreroОценок пока нет

- Workshop 3 Speeches and Yields PDFДокумент2 страницыWorkshop 3 Speeches and Yields PDFJamie Jimenez CerreroОценок пока нет

- Workshop 3 Speeches and Yields PDFДокумент2 страницыWorkshop 3 Speeches and Yields PDFJamie Jimenez CerreroОценок пока нет

- SSM: Facts on fast food obesityДокумент6 страницSSM: Facts on fast food obesityMichelle Buntag100% (1)

- Workshop 3 Speeches and Yields PDFДокумент2 страницыWorkshop 3 Speeches and Yields PDFJamie Jimenez CerreroОценок пока нет

- Workshop #5 - Voting Procedures & Eligible AwardsДокумент2 страницыWorkshop #5 - Voting Procedures & Eligible AwardsJamie Jimenez CerreroОценок пока нет

- Workshop 3 Speeches and Yields PDFДокумент2 страницыWorkshop 3 Speeches and Yields PDFJamie Jimenez CerreroОценок пока нет

- If NO, Check "NO" and Skip To Question 6Документ2 страницыIf NO, Check "NO" and Skip To Question 6FirmansahSaputraОценок пока нет

- Worst Chronic MalnutritionДокумент4 страницыWorst Chronic MalnutritionJamie Jimenez CerreroОценок пока нет

- Lundin CMD Presentation 2011Документ60 страницLundin CMD Presentation 2011Samuel TsuiОценок пока нет

- CH03 QuizДокумент2 страницыCH03 QuizsabiliОценок пока нет

- Case 2Документ1 страницаCase 2Saurabh SinghОценок пока нет

- HR Valuation and AccountingДокумент10 страницHR Valuation and AccountingSanskar YadavОценок пока нет

- Juixs Floyd Morpheus Manalo: Tax Code: S Attendance Period Payroll Period Release DateДокумент1 страницаJuixs Floyd Morpheus Manalo: Tax Code: S Attendance Period Payroll Period Release DateFLOYD MORPHEUSОценок пока нет

- Draft Master Rent AgreementДокумент21 страницаDraft Master Rent AgreementAbhishek AgrawalОценок пока нет

- BIR v. Lepanto CeramicsДокумент5 страницBIR v. Lepanto CeramicsistefifayОценок пока нет

- Engineering Economy: Effective Interest RatesДокумент33 страницыEngineering Economy: Effective Interest RatesfathiОценок пока нет

- Record of Society of Actuaries 1988 VOL. 14 NO. 1Документ20 страницRecord of Society of Actuaries 1988 VOL. 14 NO. 1Nimrod WeinbergОценок пока нет

- Liquidity ratios analysisДокумент6 страницLiquidity ratios analysisJn Fancuvilla LeañoОценок пока нет

- Principles of Macroeconomics 10th Edition Solution Manual PDFДокумент44 страницыPrinciples of Macroeconomics 10th Edition Solution Manual PDFnishankОценок пока нет

- Dmpa 5-8Документ39 страницDmpa 5-8sebas matosОценок пока нет

- Persistent Systems Equity Research ModelДокумент65 страницPersistent Systems Equity Research ModelSANDHYA KHANDESHEОценок пока нет

- GSIS - Government Service Insurance SystemДокумент3 страницыGSIS - Government Service Insurance Systemlancekim21Оценок пока нет

- Basel IiiДокумент44 страницыBasel IiiƦƛj Thålèswäř100% (2)

- P.I. Industries (PI IN) : Q1FY20 Result UpdateДокумент7 страницP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoОценок пока нет

- ME Cio Weekly Letter PDFДокумент7 страницME Cio Weekly Letter PDFHiep KhongОценок пока нет

- AFARДокумент9 страницAFARRed Christian PalustreОценок пока нет

- Salary Slip: Month Employee Name: Year Designation: School Name Income Tax PANДокумент2 страницыSalary Slip: Month Employee Name: Year Designation: School Name Income Tax PANMohamad SallihinОценок пока нет

- ACC8008 Managerial Accounting Group AssignmentДокумент23 страницыACC8008 Managerial Accounting Group AssignmentKirat GillОценок пока нет

- Asm 2 Ac Tiếng Anh FullДокумент23 страницыAsm 2 Ac Tiếng Anh FullNguyen Duc Quang (BTEC HN)Оценок пока нет

- Langfield-Smith7e IRM Ch18Документ45 страницLangfield-Smith7e IRM Ch18Rujun Wu100% (3)

- Newmont MiningДокумент38 страницNewmont MiningHenry JenkinsОценок пока нет

- Recruitment Proposal-Vervve Corporate SolutionsДокумент7 страницRecruitment Proposal-Vervve Corporate SolutionsShukla Gaurav100% (3)

- CSSProfile GAA8GQL 3Документ12 страницCSSProfile GAA8GQL 3Aroush KhanОценок пока нет

- Multiple Choice. (Write Your Answers Before The Number. Use Capital Letter.)Документ4 страницыMultiple Choice. (Write Your Answers Before The Number. Use Capital Letter.)april bentadanОценок пока нет

- Reporter Pub. Co., Inc. v. Commissioner of Internal Revenue, 201 F.2d 743, 10th Cir. (1953)Документ4 страницыReporter Pub. Co., Inc. v. Commissioner of Internal Revenue, 201 F.2d 743, 10th Cir. (1953)Scribd Government DocsОценок пока нет

- 2.Md. Shamim Hossain & Abdul Alim Basher - Final PaperДокумент9 страниц2.Md. Shamim Hossain & Abdul Alim Basher - Final PaperiisteОценок пока нет

- CHAPTER 2 Statement of Comprehensive IncomeДокумент13 страницCHAPTER 2 Statement of Comprehensive IncomeJM MarquezОценок пока нет