Академический Документы

Профессиональный Документы

Культура Документы

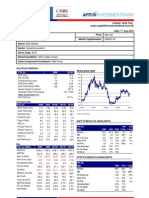

FORTE OIL NIGERIA PLC. FY:2016 Result - Financial Highlights (NGN Billion)

Загружено:

Law0 оценок0% нашли этот документ полезным (0 голосов)

31 просмотров1 страницаEarnings_Highlight_-_FORTE_OIL_NIGERIA_PLC_FY_2016

Оригинальное название

Earnings_Highlight_-_FORTE_OIL_NIGERIA_PLC_FY_2016

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документEarnings_Highlight_-_FORTE_OIL_NIGERIA_PLC_FY_2016

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

31 просмотров1 страницаFORTE OIL NIGERIA PLC. FY:2016 Result - Financial Highlights (NGN Billion)

Загружено:

LawEarnings_Highlight_-_FORTE_OIL_NIGERIA_PLC_FY_2016

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

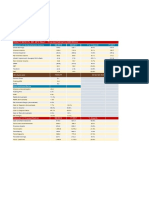

FORTE OIL NIGERIA PLC.

FY:2016 Result - Financial Highlights (NGN Billion)

Statement of Comprehensive Income FY:2016 FY:2015 Y-o-Y Growth

Gross Revenue 148.6 124.6 19.3%

Cost of Sales (128.0) (106.3) 20.5%

Gross Profit 20.6 18.3 12.3%

OPEX (13.3) (13.7) -2.9%

Other Income 2.3 4.1 -42.0%

Net Finance (Cost)/Income (4.3) (1.7) 154.9%

PBT 5.3 7.0 -23.8%

Taxation (2.4) (1.2) 104.2%

PAT 2.9 5.8 -50.3%

Per share data FO Corporate Actions

Current Price 74.00 Proposed Dividend N/A

Trailing EPS 2.22

BVPS 33.3 Dividend Yield N/A

Price multiples/Ratios

Shares Outstanding(bn) 1.3 Qualification Date N/A

Trailing P/E 33.3x

P/BV 2.2x Closure Date N/A

RoAE (Annualised) 6.5%

RoAA (Annualised) 2.2% Payment Date N/A

Gross Profit Margin 13.9% 14.7%

Cost of Sales Margin 86.1% 85.3% AGM Venue N/A

OPEX Margin 9.0% 11.0%

Net Margin 1.9% 4.7% AGM Date N/A

Debt to Equity 114.1% 82.1%

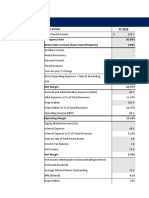

Statement of Financial Position FY:2016 FY:2015 % Growth

Inventories 4.7 10.1 -53.9%

Trade and Other Receivables 46.8 34.9 34.2%

Cash and Cash equivalents 17.0 11.7 45.7%

Total Borrowings 49.4 38.0 30.1%

Total Liabilities 97.4 75.5 29.1%

Total Assets 140.8 121.8 15.6%

Total Equity 43.3 46.3 -6.4%

Вам также может понравиться

- Earnings Highlight - Forte Oil Nigeria PLC Fy 2017Документ1 страницаEarnings Highlight - Forte Oil Nigeria PLC Fy 2017LawОценок пока нет

- Earnings Highlight - DANGSUGAR PLC 9M 2016Документ1 страницаEarnings Highlight - DANGSUGAR PLC 9M 2016LawОценок пока нет

- Earnings Highlight - Stanbic IBTC Full Year 2017Документ1 страницаEarnings Highlight - Stanbic IBTC Full Year 2017LawОценок пока нет

- Bank of Kigali Announces AuditedДокумент10 страницBank of Kigali Announces AuditedinjishivideoОценок пока нет

- Hoàng Lê Hải Yến-Internal AuditДокумент3 страницыHoàng Lê Hải Yến-Internal AuditHoàng Lê Hải YếnОценок пока нет

- Hiap Teck RN 20100701 AffinДокумент3 страницыHiap Teck RN 20100701 Affinlimml63Оценок пока нет

- Comparison ResultДокумент3 страницыComparison ResultSanjhi ParasharОценок пока нет

- Key Operating Financial DataДокумент1 страницаKey Operating Financial DataShbxbs dbvdhsОценок пока нет

- Keppel Pacific Oak US REIT Financial StatementsДокумент155 страницKeppel Pacific Oak US REIT Financial StatementsAakashОценок пока нет

- Comparative Analysis With Key Retail Sector OrganizationsДокумент3 страницыComparative Analysis With Key Retail Sector OrganizationsMuhammad ImranОценок пока нет

- RatioДокумент11 страницRatioAnant BothraОценок пока нет

- AccretionDilution AnalysisДокумент14 страницAccretionDilution AnalysisJayash KaushalОценок пока нет

- Masonite Corp DCF Analysis FinalДокумент5 страницMasonite Corp DCF Analysis FinaladiОценок пока нет

- Appendix 1 Conservative Approach: (In FFR Million)Документ6 страницAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaОценок пока нет

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsДокумент4 страницы(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanОценок пока нет

- Finance Term PaperДокумент23 страницыFinance Term PaperTawsiq Asef MahiОценок пока нет

- M1 14-AZ2 PENROSE Part 1 (Analysis) - BlankДокумент5 страницM1 14-AZ2 PENROSE Part 1 (Analysis) - BlankKhushi singhalОценок пока нет

- Metro Pacific Inv. Corp: A No Surprise Quarter: Earnings AnalysisДокумент3 страницыMetro Pacific Inv. Corp: A No Surprise Quarter: Earnings AnalysisJОценок пока нет

- %sales Discount %yoy 18.5% 22.5% 1.8%Документ2 страницы%sales Discount %yoy 18.5% 22.5% 1.8%Linh NguyenОценок пока нет

- Analisis FinancieroДокумент124 страницыAnalisis FinancieroJesús VelázquezОценок пока нет

- Momo Operating Report 2022 Q4Документ5 страницMomo Operating Report 2022 Q4Harris ChengОценок пока нет

- Earnings Presentation Q1FY22Документ13 страницEarnings Presentation Q1FY22Bhav Bhagwan HaiОценок пока нет

- Session 1 RatiosДокумент1 страницаSession 1 Ratios100507861Оценок пока нет

- CH 13 Mod 3 Financial IndicatorsДокумент2 страницыCH 13 Mod 3 Financial IndicatorsAkshat JainОценок пока нет

- Aboitiz Equity Ventures: 4Q11 Core Income Declines 1.8%, Full Year Results in Line With Consensus EstimatesДокумент3 страницыAboitiz Equity Ventures: 4Q11 Core Income Declines 1.8%, Full Year Results in Line With Consensus EstimatesJОценок пока нет

- Investor Update For December 31, 2016 (Company Update)Документ17 страницInvestor Update For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Financial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismДокумент18 страницFinancial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismPham Thuy HuyenОценок пока нет

- Aboitiz Equity Ventures: AEV 1Q11 Core Net Income Fell 28.3%, Below Consensus EstimateДокумент3 страницыAboitiz Equity Ventures: AEV 1Q11 Core Net Income Fell 28.3%, Below Consensus EstimateJОценок пока нет

- DCF ConeДокумент37 страницDCF Conejustinbui85Оценок пока нет

- Aboitiz Equity Ventures: 3Q10 Core Net Income Rises 116.7%, 9M10 Results Above Consensus EstimateДокумент3 страницыAboitiz Equity Ventures: 3Q10 Core Net Income Rises 116.7%, 9M10 Results Above Consensus EstimateJОценок пока нет

- DCF ModelДокумент6 страницDCF ModelKatherine ChouОценок пока нет

- Assumptions For Forecasting Model: Income StatementДокумент9 страницAssumptions For Forecasting Model: Income StatementRadhika SarawagiОценок пока нет

- Group BДокумент10 страницGroup BHitin KumarОценок пока нет

- STORAENSO RESULTS Key Figures 2018Документ11 страницSTORAENSO RESULTS Key Figures 2018Paula Tapiero MorenoОценок пока нет

- Financial Analysis OrascomДокумент11 страницFinancial Analysis OrascomMahmoud Elyamany100% (1)

- Singapore Exchange Limited: Firing On All CylindersДокумент6 страницSingapore Exchange Limited: Firing On All CylindersCalebОценок пока нет

- Excel Model The Body Shop International PLC 2001: An Introduction To Financial ModelingДокумент29 страницExcel Model The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka33% (6)

- Teuer B DataДокумент41 страницаTeuer B DataAishwary Gupta100% (1)

- GPA (Y) Test Score (X) Month Earnings ExpensesДокумент20 страницGPA (Y) Test Score (X) Month Earnings ExpensesJipin ThomasОценок пока нет

- Technical Interview WSOmodel2003Документ7 страницTechnical Interview WSOmodel2003Li HuОценок пока нет

- Act 410Документ3 страницыAct 410Rafid Shahriar PrantoОценок пока нет

- December 31 2004 2005 2006 2007 2008 2009Документ2 страницыDecember 31 2004 2005 2006 2007 2008 2009adilroseОценок пока нет

- Momo Operating Report 2Q20Документ5 страницMomo Operating Report 2Q20Wong Kai WenОценок пока нет

- Max S Group Inc PSE MAXS FinancialsДокумент36 страницMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniОценок пока нет

- Tarson Products (Woking Sheet - FRA)Документ9 страницTarson Products (Woking Sheet - FRA)RR AnalystОценок пока нет

- 1Q21 Core Operating Performance Beats Estimates: International Container Terminal Services IncДокумент8 страниц1Q21 Core Operating Performance Beats Estimates: International Container Terminal Services IncJajahinaОценок пока нет

- This Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)Документ7 страницThis Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)karanОценок пока нет

- Iblf Excel (Mehedi)Документ12 страницIblf Excel (Mehedi)Md. Mehedi HasanОценок пока нет

- Financial Model TemplateДокумент30 страницFinancial Model Templateudoshi_1Оценок пока нет

- IS Participant - Simplified v3Документ7 страницIS Participant - Simplified v3luaiОценок пока нет

- Monmouth VfinalДокумент6 страницMonmouth VfinalAjax100% (1)

- Is Excel Participant - Simplified v2Документ9 страницIs Excel Participant - Simplified v2dikshapatil6789Оценок пока нет

- BoeingДокумент11 страницBoeingPreksha GulatiОценок пока нет

- 4211 XLS EngДокумент22 страницы4211 XLS Engvictor vasquezОценок пока нет

- PI Industries Limited BSE 523642 Financials RatiosДокумент5 страницPI Industries Limited BSE 523642 Financials RatiosRehan TyagiОценок пока нет

- Revised ModelДокумент27 страницRevised ModelAnonymous 0CbF7xaОценок пока нет

- Crams Icici SecuritiesДокумент68 страницCrams Icici SecuritiesKoushik BhattacharyyaОценок пока нет

- Financial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMДокумент27 страницFinancial Model - Colgate Palmolive (Solved) : Prepared by Dheeraj Vaidya, CFA, FRMMehmet Isbilen100% (1)

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachОт EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachРейтинг: 3 из 5 звезд3/5 (3)

- Spe 167573 MSДокумент23 страницыSpe 167573 MSLawОценок пока нет

- Earnings Highlight - FIDELITY BANK Plc. 9M 2018Документ1 страницаEarnings Highlight - FIDELITY BANK Plc. 9M 2018LawОценок пока нет

- Earnings Highlight - Access Bank Full Year 2017Документ1 страницаEarnings Highlight - Access Bank Full Year 2017LawОценок пока нет

- The New BicycleДокумент1 страницаThe New BicycleLawОценок пока нет

- Trade GuideДокумент41 страницаTrade GuideVictor BenОценок пока нет

- Earnings Highlight - NESTLE FYДокумент1 страницаEarnings Highlight - NESTLE FYLawОценок пока нет

- Earnings Highlight - Forte Oil Nigeria PLC Fy 2017Документ1 страницаEarnings Highlight - Forte Oil Nigeria PLC Fy 2017LawОценок пока нет

- Earnings Highlight - Guaranty Trust Bank PLC Fy 2018Документ1 страницаEarnings Highlight - Guaranty Trust Bank PLC Fy 2018LawОценок пока нет

- Earnings Highlight - Wema Bank Full Year 2017Документ1 страницаEarnings Highlight - Wema Bank Full Year 2017LawОценок пока нет

- SPE-192942-MS - An Innovative Workflow For The Petrophysical Characterization of Tight Gas Reservoirs in Argentina PDFДокумент21 страницаSPE-192942-MS - An Innovative Workflow For The Petrophysical Characterization of Tight Gas Reservoirs in Argentina PDFLawОценок пока нет

- Basics of Business ValuationДокумент24 страницыBasics of Business ValuationLawОценок пока нет

- Earnings Highlight - PRESCO PLC FY 2016Документ1 страницаEarnings Highlight - PRESCO PLC FY 2016LawОценок пока нет

- Earnings Highlight - Okomu Oil PLC FY 2017Документ1 страницаEarnings Highlight - Okomu Oil PLC FY 2017LawОценок пока нет

- A Common Sense Approach To Analyzing Bank StocksДокумент1 страницаA Common Sense Approach To Analyzing Bank StocksLawОценок пока нет

- ExcelFormulas PDFДокумент9 страницExcelFormulas PDFLawОценок пока нет

- Market Update For February 6, 2019Документ3 страницыMarket Update For February 6, 2019LawОценок пока нет

- LBSDecember2018 ProshareДокумент73 страницыLBSDecember2018 ProshareLawОценок пока нет

- SPE-193424-MS Chevron 2018Документ17 страницSPE-193424-MS Chevron 2018LawОценок пока нет

- Valuation Factors&MethodsДокумент10 страницValuation Factors&MethodsPavan GVSОценок пока нет

- SPE-192600-MS - Use of Multi Detector Pulsed Neutron Technologies To Address The Challenges With Saturation Surveillance in Rumaila, IraqДокумент15 страницSPE-192600-MS - Use of Multi Detector Pulsed Neutron Technologies To Address The Challenges With Saturation Surveillance in Rumaila, IraqLawОценок пока нет

- SPE-192600-MS - Use of Multi Detector Pulsed Neutron Technologies To Address The Challenges With Saturation Surveillance in Rumaila, IraqДокумент15 страницSPE-192600-MS - Use of Multi Detector Pulsed Neutron Technologies To Address The Challenges With Saturation Surveillance in Rumaila, IraqLawОценок пока нет

- Captain Extended Well Test Program - Project Management and ExecutionДокумент12 страницCaptain Extended Well Test Program - Project Management and ExecutionLawОценок пока нет

- IRP 22 Risk Register 2015Документ30 страницIRP 22 Risk Register 2015Jeya Kumar100% (1)

- IRP 22 Risk Register 2015Документ11 страницIRP 22 Risk Register 2015LawОценок пока нет

- 7th NFC Award 2010Документ4 страницы7th NFC Award 2010humayun313Оценок пока нет

- Republic Vs CaguioaДокумент6 страницRepublic Vs CaguioaKim Lorenzo CalatravaОценок пока нет

- Government Grant and Borrowing CostДокумент2 страницыGovernment Grant and Borrowing CostMaximusОценок пока нет

- PersonalFN Services GuideДокумент4 страницыPersonalFN Services GuideafsplОценок пока нет

- PNB Vs CA - DigestДокумент2 страницыPNB Vs CA - DigestGladys Viranda100% (1)

- Summary of Angelina Hernandez Defendant Estafa CaseДокумент1 страницаSummary of Angelina Hernandez Defendant Estafa CaseJay Mark Albis SantosОценок пока нет

- Advanced Accounting MCQ Part-IДокумент8 страницAdvanced Accounting MCQ Part-ISavani KibeОценок пока нет

- Pasig Revenue Code PDFДокумент295 страницPasig Revenue Code PDFJela Oasin33% (9)

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographДокумент1 страницаAlphaex Capital Candlestick Pattern Cheat Sheet InfographTW INGOОценок пока нет

- Cambodian Standard On Auditing - English VersionДокумент51 страницаCambodian Standard On Auditing - English Versionpostbox855100% (8)

- 1ed93719-2adb-4d95-979a-8a978e846df6Документ11 страниц1ed93719-2adb-4d95-979a-8a978e846df6jim912Оценок пока нет

- Group Assignment Cover Sheet: Student DetailsДокумент9 страницGroup Assignment Cover Sheet: Student DetailsMinh DucОценок пока нет

- Chapter 13. CH 13-11 Build A Model: (Par Plus PIC)Документ7 страницChapter 13. CH 13-11 Build A Model: (Par Plus PIC)AmmarОценок пока нет

- Chem Med CaseДокумент6 страницChem Med CaseChris100% (1)

- Redemption Application Form: Day Year MonthДокумент2 страницыRedemption Application Form: Day Year MonthSyed Mustafa Ali Zaidi (IA-Fact)Оценок пока нет

- CFNetworkDownload EuhV1D.tmpДокумент2 страницыCFNetworkDownload EuhV1D.tmpCiera StuverОценок пока нет

- Insurance Law ProjectДокумент14 страницInsurance Law Projectlokesh4nigamОценок пока нет

- General Purpose Loan - FillableДокумент2 страницыGeneral Purpose Loan - Fillablenemo_nadalОценок пока нет

- Curriculum Vitae Anis Abidi: Membership in Professional SocietiesДокумент3 страницыCurriculum Vitae Anis Abidi: Membership in Professional SocietiesJalel SaidiОценок пока нет

- Hyundai Pricelist CSDДокумент2 страницыHyundai Pricelist CSDNandish KumarОценок пока нет

- Cash Flow statement-AFMДокумент27 страницCash Flow statement-AFMRishad kОценок пока нет

- Investment Theory Body Kane MarcusДокумент5 страницInvestment Theory Body Kane MarcusPrince ShovonОценок пока нет

- Nirav Modi CaseДокумент14 страницNirav Modi CaseParthОценок пока нет

- Lesson 1 Definition of Finance Goals of The Financial ManagerДокумент14 страницLesson 1 Definition of Finance Goals of The Financial ManagerJames Deo CruzОценок пока нет

- CH 07 Account Receivables and Inventory MGTДокумент61 страницаCH 07 Account Receivables and Inventory MGTElisabeth LoanaОценок пока нет

- Finance Module 8 Capital Budgeting - InvestmentДокумент8 страницFinance Module 8 Capital Budgeting - InvestmentKJ Jones100% (1)

- ComputationДокумент4 страницыComputationIshita shahОценок пока нет

- Determinants of Profitability of Non Bank Financial Institutions' in A Developing Country: Evidence From BangladeshДокумент12 страницDeterminants of Profitability of Non Bank Financial Institutions' in A Developing Country: Evidence From BangladeshNahid Md. AlamОценок пока нет

- BaupostДокумент20 страницBaupostapi-26094277Оценок пока нет

- CIR Vs Negros Consoliated FarmersДокумент14 страницCIR Vs Negros Consoliated FarmersMary.Rose RosalesОценок пока нет