Академический Документы

Профессиональный Документы

Культура Документы

Q2 FY11 Result Update Infosys Technologies LTD (Infosys)

Загружено:

sumitkhannaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Q2 FY11 Result Update Infosys Technologies LTD (Infosys)

Загружено:

sumitkhannaАвторское право:

Доступные форматы

Q2 FY11 Result Update Infosys Technologies Ltd (Infosys)

Recommendation HOLD Results broadly in line with expectations

CMP (15/10/2010) Rs. 3076

Sector IT & Software • Infosys’ Q2 FY11 revenues grew 12.1% QoQ to Rs.6947 Crs

beating its guidance of Rs.6626 on the back of improving

Stock Details

demand. Revenue was above our estimates because of

BSE Code 500209 higher volumes & an increase in pricing during the quarter.

NSE Code INFOSYSTCH • EBITDA margin improved to 33.3%. (+167 bps QoQ) The

Bloomberg Code INFO IN increase in topline was reflected in the improved EBITDA

Market Cap (Rs. cr) 1,76,581 margins.

Free Float (%) 85% • PAT increased by 16.7% QoQ to Rs. 1737 in Q2 FY11 because of

52- wk HI/Lo 3249.0/2127.1 improvement in the EBITDA margin and foreign exchange

gains. PAT exceeded our estimate reflecting higher-than-

Avg. volume BSE (Quarterly) 96107

expected revenues.

Face Value Rs.5.00

Dividend (FY 2010) 300% Particulars (Rs. Crs) NBS estimate Actual Variation

Shares o/s (No.) 57.14 Crs Revenues 6,652 6,947 4.4%

Relative Performance 1Mth 3Mth 1 Yr PAT 1,655 1,737 4.9%

Infosys 0.85% 11.50% 38.84%

Sensex 3.19% 12.37% 17.04% • Volumes witnessed a growth of 7.2% QoQ while pricing

4000 30000

increased by approximately 3.2% in dollar terms.

• Gross addition of employees stood at 14,264 in Q2 FY11 as

3000

20000 compared to 8,859 in Q1 FY11. Company plans to hire

2000 40,000 employees in FY 2011 to manage the increased

1000

10000 attrition rate and build capacity for higher growth.

• Revenue share of fixed price contracts increased by 90 bps

0 0

QoQ and the utilization rate improved by 130 bps QoQ

Oct-09 Feb-10 Jun-10 Oct-10

Infosys SENSEX

Valuation and Recommendation

Shareholding Pattern as of 30/09/2010 At the current price of Rs.3076, Infosys is trading at a PE of

Promoters Holding 25.34x on FY 2011 EPS & 21.66x on FY 2012 estimated EPS.

16.04%

Institutional (Incl. FII) 43.73% Based on our estimated EPS of Rs. 142.02 for FY 2012 and our

Corporate Bodies 6.38% target PE multiple of 22.0x we arrive at a target price of Rs.3125

per share for Infosys. Therefore, the company looks fairly valued

Public & others 33.85%

at current levels and doesn’t offer much upside from current

Ashish Khetan, Research Analyst (+91 22 3027 8201) levels in near term. Considering the improved scenario for the IT

ashish.khetan@nirmalbang.com sector, we recommend to HOLD the stock.

Niraj Garhyan, Research Associate (+91 22 3027 8215)

niraj.garhyan@nirmalbang.com

Net Sales Rs Growth EBITDA Rs Margin PAT

Year EPS PE P/BV ROE %

Crs % Crs % Rs Crs

FY 2009A 21693 30.0% 7195 33.17% 5988 104.43 29.46 7.69 37.4%

FY 2010A 22742 4.8% 7969 35.04% 6376 111.18 27.67 7.13 30.9%

FY 2011E 27599 21.4% 9220 33.41% 6936 121.39 25.34 5.73 27.7%

FY 2012E 33295 20.6% 11006 33.06% 8114 142.02 21.66 4.63 27.3%

Q2 FY11 Result Update Infosys Technologies Ltd (Infosys)

Quarterly Performance

• Infosys Q2 FY11 revenues grew 12.1% QoQ to Rs.6947 Crs

above the management guidance. The growth in top-line in Q2

FY11 was driven by strong volume growth (7.2% QoQ), a 3.2%

increase in pricing, higher utilization rates and a greater share

of onsite business.

• EBITDA grew 18% QoQ to Rs. 2315 Crs in Q2 FY11 reflecting the

growth in top-line. EBITDA margin improved 167 bps QoQ in Q2

FY11 on the back of increased in top-line, improved pricing and

higher utilization rate.

• Net margin increased by 100 bps to 25.0% reflecting the

improvement in the EBITDA margin and higher other income

due to foreign exchange gains.

• Infosys reported a diluted EPS of Rs. 30.40 in Q2 FY11 which

was significantly higher than its guidance.

• Infosys declared an interim dividend of Rs.10/share and a 30th

year special dividend of Rs.30/share

Consolidated in Rs Crs Q2 FY11 Q1 FY11 QoQ Q2 FY10 YoY

Income 6,947 6,198 12.1% 5,585 24.4%

Software development expenses 3,754 3,441 9.1% 2,970 26.4%

Gross profit 3,193 2,757 15.8% 2,615 22.1%

GP Margin 46.0% 44.5% 148 bps 46.8% -86 bps

SG&A Expenses 878 795 10.4% 689 27.4%

EBITDA 2,315 1,962 18.0% 1,926 20.2%

EBITDA Margin 33.3% 31.7% 167 bps 34.5% -116 bps

Interest 0 0 0

Depreciation and amortization 217 207 4.8% 233 -6.9%

Op profit after Int & Dep 2,098 1,755 19.5% 1,693 23.9%

Other income 267 239 11.7% 239 11.7%

Provision for investments 0 0 0

Profit before tax (PBT) 2,365 1,994 18.6% 1,932 22.4%

Provision for taxation 628 506 24.1% 397 58.2%

Net profit after tax (PAT) 1,737 1,488 16.7% 1,535 13.2%

Exceptional items net of taxes 0 0 0

Adjusted PAT 1,737 1,488 16.7% 1,535 13.2%

PAT Margin 25.0% 24.0% 100 bps 27.5% -248 bps

Adjusted EPS Diluted 30.40 26.05 16.7% 26.83 13.3%

Source: Company data, Nirmal Bang Research

Q2 FY11 Result Update Infosys Technologies Ltd (Infosys)

As per IFRS GAAP

Consolidated figs in US$ mn Q2 FY11 Q1 FY11 QoQ Q2 FY10 YoY

Revenue 1,496 1,358 10.2% 1,154 29.6%

Gross Profit 641 558 14.9% 492 30.3%

Margin 42.8% 41.1% 176 bps 42.6% 21 bps

Operating Profit 452 384 17.7% 350 29.1%

Margin 30.2% 28.3% 194 bps 30.3% -12 bps

PBT 509 437 16.5% 399 27.6%

PAT 374 326 14.7% 317 18.0%

Margin 25.0% 24.0% 99 bps 27.5% -247 bps

Diluted EPS 0.65 0.57 14.0% 0.56 16.1%

Source: Company data, Nirmal Bang Research

In US dollar terms revenues increased 10.2% QoQ, much higher than

the growth witnessed in Q1 FY11. Net margin improved by 99 bps in

Q2 FY11 at 25.0% and the diluted EPS stood at US$ 0.65.

Guidance

Management has increased its guidance for top-line growth from 19-

21% to around 24-25% for FY 2011 in US dollar terms. This is primarily

due to improving demand scenario for offshore IT spending. The

company is seeing an improving traction from its US clients as well as

an uptick in demand in Europe. In rupee terms, management has

guided for an annual revenue growth of 18.5-19.4% for FY 2011

compared to earlier guidance of 16.3-18.2%. The company is

conservative on its revenue guidance in rupee terms because of the

currency volatility witnessed over the past couple of months. The

revised rupee guidance is based on the exchange rate of 1 US$ = Rs.

44.50 as while the previous guidance was based on a rate of 1 US$=

Rs. 46.45.

In US dollar terms, Management expects EPS to increase 10.4-12.2%

in FY 2011. Management is expecting a decline in net margin in FY

2011 by around 260 bps primarily due to cross currency movements

and increased tax liability. Also, it intends to hire around 40000

employees in FY 2011 and promote around 12,000 employees across

levels in Q3 FY11. This will have further negative impact on margins.

Yrly Guidance Rs.in Cr US $ million

FY 2011 Earlier Revised Earlier Revised

Revenue 26441-26885 26951-27165 5720-5810 5950-6000

Adj.EPS 112.21-116.73 115.07-117.07 2.42-2.52 2.54-2.58

Source: Company data

Q2 FY11 Result Update Infosys Technologies Ltd (Infosys)

Management expects an increase of 3.9% QoQ in the revenues for Q3

FY11 in dollar terms and a marginal decline of -0.4% QoQ in rupee

terms in Q3 FY11. The management expects the rupee to remain

strong in near term, which will put pressures on revenues & margins

in rupee terms. Profitability is expected to decline due to increase in

employee costs, cross currency volatility and increase in tax liability.

Rs in Crs US$ mn

Quarterly Q2 FY11 Q3 FY11 Var % Q2 FY11 Q3 FY11 Var %

Guidance Actual Guidance Actual Guidance

Revenue 6947 6884-6953 -0.4% 1496 1547-1562 3.9%

Adj.EPS 30.41 29.37-29.89 -2.6% 0.65 0.66-0.67 2.3%

Source: Company data

Aggressive hiring plans

Infosys had a record addition of 14264 employees in Q2 FY11 as

compared to 8859 in Q1 FY11. Net addition of employees was 7646 in

Q2 FY11. Going forward, Management expects to add 11000

employees in Q3 FY11 and has increased the hiring target for FY 2011

to 40,000 from the earlier plans of addition of 36000 employees.

These aggressive hiring plans indicate that company is gearing up for

the anticipated uptick in demand from developed economies. The

salary hikes, bonuses and promotions doled out by the company has

enabled it to reduce the attrition rate in Q2 FY11 on a sequential

basis. On an absolute basis, attrition was down by 1215 resources in

Q2 FY11.

QoQ increase in Client Addition

60 49

47 47

50 40 40 38

37 35

40 30 32

27 27

30

20

10

0

Q3 FY08

Q4 FY08

Q1 FY09

Q2 FY09

Q3 FY09

Q4 FY09

Q1 FY10

Q2 FY10

Q3 FY10

Q4 FY10

Q1 FY11

Q2 FY11

The Client addition in Q2 FY11 stood at 27 as compared to 38 in Q1

FY11. During 1H FY2011, Infosys has signed 9 transformational deals.

Q2 FY11 Result Update Infosys Technologies Ltd (Infosys)

Volumes and Pricing in Q2 FY11

10.0% 4.0%

8.0% 2.0%

6.0% 0.0%

4.0% -2.0%

2.0% -4.0%

0.0% -6.0%

-2.0% -8.0%

Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

FY09 FY09 FY09 FY10 FY10 FY10 FY10 FY11 FY11

Volume growth Inc / Dec in Pricing

Volumes witnessed a growth of 7.2% QoQ which was

marginally lower than the growth of 7.6% achieved in Q1

FY11. Pricing increased by around 3.2% in dollar terms and

2.5% in constant currency terms. Going ahead the company

sees stronger volume growth with greater traction in

financial services and retail and expects prices to remain

stable as not much renegotiations underway. This is

expected to boost the top-line going forward.

Revision in Estimates

• We have revised our sales estimates upwards for FY 2011 and FY 2012

to reflect better-than-expected improvement in demand scenario and

higher pricing achieved by the company which is expected to remain

firm.

• PAT estimate are revised marginally upwards for FY 2011 to reflect the

upward revision of revenues partially offset by upward revision in

salary and wages.

Particulars FY 2011 FY 2012

Previous Revised Previous Revised

Estimates Estimates Variation Estimates Estimates Variation

Sales 26,896 27,599 2.6% 31,981 33,295 4.1%

PAT 6,774 6,936 2.4% 7,842 8,114 3.5%

Q2 FY11 Result Update Infosys Technologies Ltd (Infosys)

Valuation & Recommendation

The Q2 FY11 results reflect the improvement in the recovery of demand from

the US and the Europe. The company is seeing an improved traction in Retail,

BFSI and Energy & Utility verticals among its US clients. Also, Europe is

witnessing an uptick in demand with an incremental spending in

Manufacturing, BFSI and Retail segments. In Europe, manufacturing has shown

a healthy growth particularly in Switzerland, Germany and France as

companies attempt to achieve cost efficiency through better systems. During

the quarter, growth was led by Retail segment where in Infosys caters to 8 out

of the top 10 retailers in US and 5 out of the top 10 retail companies in Europe.

The company has won 9 transformational which few are in excess of US$100

mn. Attrition has declined on a sequential basis, but it still remains a concern

and Infosys plans to hire around 40,000 employees during FY 2011 to build up

capacity in expectation of an increased demand in future. Overall, the

Management remains optimistic in short term and have a cautious view over

the long term as budgets for FY 2012 are yet to be finalized. The exchange rate

remains a major concern as the recent appreciation of rupee will impact the

company’s profitability in near term.

At the current price of Rs.3076, Infosys is trading at a PE of 25.34x on FY 2011

EPS & 21.66x on FY 2012 estimated EPS. Based on our estimated EPS of Rs.

142.02 for FY 2012 and our target PE multiple of 22.0x we arrive at a target

price of Rs.3125 per share for Infosys. Therefore, the company looks fairly

valued at current levels and doesn’t offer much upside from current levels in

near term. Considering the improved scenario for the IT sector, we

recommend to HOLD the stock.

Q2 FY11 Result Update Infosys Technologies Ltd (Infosys)

Financials

Profitability (Rs. In Cr) FY09A FY10A FY11E FY12E Financial Health (Rs. In Cr) FY09A FY10A FY11E FY12E

Revenues 21693 22742 27599 33295 Share Capital 286 286 286 286

% change 30.0% 4.8% 21.4% 20.6% Reserves & Surplus 17968 22763 26344 31768

EBITDA 7195 7969 9220 11006 Deferred Tax Liabilities 37 232 232 232

% change in EBIDTA 37.4% 10.8% 15.7% 19.4% Net Worth 18291 23281 26862 32286

Interest 0 0 0 0 Total Loans 0 0 0 0

EBDT 7195 7969 9220 11006 Total Liabilities 18291 23281 26862 32286

Depreciation 761 906 877 943 Net Fixed Assets 5354 5355 5567 5983

Other Income 473 946 1099 1183 Investments 0 3712 3712 3712

Extraordinary 0.0 48.0 0.0 0.0 Deferred Tax Assets 163 432 432 432

PBT 6907 8057 9442 11247 Sundry Debtors 3672 3494 4293 5272

Tax 919 1681 2506 3149 Cash & Bank 9695 10556 13692 17640

PAT 5988 6376 6936 8098 Loans & Advances 3279 4187 4692 5660

Adj PAT 5988 6424 6936 8098 C A L&A 16646 18237 22677 28572

Shares o/s ( No. in Cr.) 57.3 57.3 57.1 57.1 CL & P 3872 4455 5526 6414

EPS 104.42 111.18 121.39 141.73 Working Capital 12774 13782 17151 22158

Adj EPS 104.42 112.02 121.39 141.73 Misc Exp 0 0 0 0

Cash EPS 117.69 126.98 136.74 158.23 Total Assets 18291 23281 26862 32286

Quarterly (Rs. In Cr) Sep.09 Dec.09 Mar.10 Jun.10 Cash Flow (Rs. In Cr) FY09A FY10A FY11E FY12E

Revenue 5585 5741 5944 6198 Operating `

EBITDA 1926 2038 2022 1962 Net Income 6005 6256 6936 8098

Interest 0 0 0 0 Change in WC -460 -40 -232 -1059

EBDT 1926 2038 2022 1962 Other Adjustment -220 99 877 943

Dep 233 231 220 207 CF from Opeartion 5325 6315 7580 7981

Other Inc. 239 231 198 239 Investment

Extraordinary 0 0 48 0 Capex -1341 -846 -1089 -1359

PBT 1932 2038 2048 1994 Other Investment 1128 -2774 0 0

Tax 397 455 441 506 Total Investment -213 -3620 -1089 -1359

PAT 1535 1583 1607 1488 Financing

EPS (Rs.) 26.83 27.72 28.29 26.05 Diviend Paid -2494 -1574 -3355 -2674

Performance Ratio FY09A FY10A FY11E FY12E Share Capital 64 89 0 0

PAT growth (%) 28.5% 6.5% 8.8% 16.8% Total Financing -2430 -1485 -3355 -2674

EBITDA margin (%) 33.2% 35.0% 33.4% 33.1% Net Chg. in Cash 2682 1210 3136 3948

Adj.PAT margin (%) 27.6% 28.2% 25.1% 24.3% Eff of exch diff on trans 76 -31 0 0

ROE (%) 37.4% 30.9% 27.9% 27.6% Cash at beginning 8235 11043 10556 13692

ROIC (%) 54.1% 52.2% 52.5% 54.3% Cash at end (incl dep with F 10917 12253 13692 17640

Valuation Ratio FY09A FY10A FY11E FY12E Per Share Data FY09A FY10A FY11E FY12E

Price Earnings (x) 29.46 27.88 25.34 21.70 Reported EPS 104.60 111.18 121.39 141.73

Price / Book Value (x) 9.66 7.65 6.60 5.48 Adjusted EPS 104.43 108.87 121.39 141.73

EV / Sales 7.69 7.13 5.74 4.64 BV per share 318.31 401.93 466.10 561.03

EV / EBIDTA 23.17 20.35 17.17 14.03 Cash per share 169.06 248.80 304.62 373.73

Dividend Yield 1.59% 1.16% 1.63% 1.30% Dividend per share 23.50 25.00 50.00 40.00

Source: Nirmal Bang Research, Company data

Q2 FY11 Result Update Infosys Technologies Ltd (Infosys)

NOTE

Disclaimer

This Document has been prepared by Nirmal Bang Research (Nirmal Bang Securities PVT LTD).The information, analysis and estimates

contained herein are based on Nirmal Bang Research assessment and have been obtained from sources believed to be reliable. This

document is meant for the use of the intended recipient only. This document, at best, represents Nirmal Bang Research opinion and is

meant for general information only. Nirmal Bang Research, its directors, officers or employees shall not in anyway be responsible for the

contents stated herein. Nirmal Bang Research expressly disclaims any and all liabilities that may arise from information, errors or

omissions in this connection. This document is not to be considered as an offer to sell or a solicitation to buy any securities. Nirmal Bang

Research, its affiliates and their employees may from time to time hold positions in securities referred to herein. Nirmal Bang Research or

its affiliates may from time to time solicit from or perform investment banking or other services for any company mentioned in this

document.

Вам также может понравиться

- Executive Placement Service Revenues World Summary: Market Values & Financials by CountryОт EverandExecutive Placement Service Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Daiwa Capital MarketДокумент6 страницDaiwa Capital MarketRongye Daniel LaiОценок пока нет

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportОт EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportОценок пока нет

- Asian Paints Jan 2011Документ3 страницыAsian Paints Jan 2011shahavОценок пока нет

- Exporting Services: A Developing Country PerspectiveОт EverandExporting Services: A Developing Country PerspectiveРейтинг: 5 из 5 звезд5/5 (2)

- INFY - NoДокумент12 страницINFY - NoSrОценок пока нет

- Nirmal Bang PDFДокумент11 страницNirmal Bang PDFBook MonkОценок пока нет

- Concor - Q1FY20 - Result Update PDFДокумент6 страницConcor - Q1FY20 - Result Update PDFBethany CaseyОценок пока нет

- Centrum_Suryoday_Small_Finance_Bank___Q3FY23_Result_UpdateДокумент10 страницCentrum_Suryoday_Small_Finance_Bank___Q3FY23_Result_UpdateDivy JainОценок пока нет

- 141342112021251larsen Toubro Limited - 20210129Документ5 страниц141342112021251larsen Toubro Limited - 20210129Michelle CastelinoОценок пока нет

- Angel One: Revenue Misses Estimates Expenses in LineДокумент14 страницAngel One: Revenue Misses Estimates Expenses in LineRam JaneОценок пока нет

- NRB Bearing ILFSДокумент3 страницыNRB Bearing ILFSapi-3775500Оценок пока нет

- Ganesha Ecosphere 3QFY20 Result Update - 200211 PDFДокумент4 страницыGanesha Ecosphere 3QFY20 Result Update - 200211 PDFdarshanmadeОценок пока нет

- State Bank of India (SBI) : Decent Performance in Q4Документ5 страницState Bank of India (SBI) : Decent Performance in Q4deveshОценок пока нет

- Blue Star: Performance HighlightsДокумент8 страницBlue Star: Performance HighlightskasimimudassarОценок пока нет

- HDFCДокумент2 страницыHDFCshankyagarОценок пока нет

- Ashok Leyland: Performance HighlightsДокумент9 страницAshok Leyland: Performance HighlightsSandeep ManglikОценок пока нет

- 637957201521149984_Godrej Consumer Products Result Update - Q1FY23Документ4 страницы637957201521149984_Godrej Consumer Products Result Update - Q1FY23Prity KumariОценок пока нет

- Axis Bank LTDДокумент12 страницAxis Bank LTDMera Birthday 2021Оценок пока нет

- SBI 2009-10 Press ReleaseДокумент6 страницSBI 2009-10 Press ReleaseRohit ParasharОценок пока нет

- Cummins India: Capitalising On Infrastructure ThrustДокумент16 страницCummins India: Capitalising On Infrastructure Thrustaussie707Оценок пока нет

- Infosys Tech NomuraДокумент15 страницInfosys Tech NomuraameyahardasОценок пока нет

- Nomura - Jul 24 - SBI CardsДокумент9 страницNomura - Jul 24 - SBI CardsAjish CJ 2015Оценок пока нет

- Cellular+ +India+BullsДокумент6 страницCellular+ +India+Bullsapi-3862995Оценок пока нет

- ZEE Q4FY20 RESULT UPDATEДокумент5 страницZEE Q4FY20 RESULT UPDATEArpit JhanwarОценок пока нет

- File 1686286056102Документ14 страницFile 1686286056102Tomar SahaabОценок пока нет

- Tata Consultancy Services: Good 3QFY06 Reinforcing Offshore Traction, Remains One of Our Top PicksДокумент14 страницTata Consultancy Services: Good 3QFY06 Reinforcing Offshore Traction, Remains One of Our Top Pickstdog66Оценок пока нет

- ICICI Securities 1QFY23 - MoSLДокумент10 страницICICI Securities 1QFY23 - MoSLResearch ReportsОценок пока нет

- Alok Industries Strong Buy on Global Demand and Capacity ExpansionДокумент20 страницAlok Industries Strong Buy on Global Demand and Capacity ExpansionGirish RaskarОценок пока нет

- IDFC Bank: CMP: Inr63 TP: INR68 (8%)Документ8 страницIDFC Bank: CMP: Inr63 TP: INR68 (8%)Devendra SarafОценок пока нет

- Teamlease: Near Term Impact To Be ManageableДокумент8 страницTeamlease: Near Term Impact To Be ManageableAnand KОценок пока нет

- Q3FY22 Result Update DLF LTD.: Strong Residential Performance ContinuesДокумент10 страницQ3FY22 Result Update DLF LTD.: Strong Residential Performance ContinuesVanshika BiyaniОценок пока нет

- 211428182023567dabur India Limited - 20230808Документ5 страниц211428182023567dabur India Limited - 20230808Jigar PitrodaОценок пока нет

- Deepak Nitrite - FinalДокумент24 страницыDeepak Nitrite - Finalvajiravel407Оценок пока нет

- Nomura - May 6 - CEATДокумент12 страницNomura - May 6 - CEATPrem SagarОценок пока нет

- XL Axiata TBK: (EXCL)Документ4 страницыXL Axiata TBK: (EXCL)Hamba AllahОценок пока нет

- Angel One - Update - Jul23 - HSIE-202307170719227368733Документ9 страницAngel One - Update - Jul23 - HSIE-202307170719227368733Ram JaneОценок пока нет

- Tvs Motor PincДокумент6 страницTvs Motor Pincrajarun85Оценок пока нет

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Документ10 страницSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoОценок пока нет

- 20230227 UNVR SekuritasДокумент7 страниц20230227 UNVR Sekuritasfaizal ardiОценок пока нет

- Teamlease Services (Team In) : Q4Fy19 Result UpdateДокумент8 страницTeamlease Services (Team In) : Q4Fy19 Result Updatesaran21Оценок пока нет

- Ki Isat 20240213Документ8 страницKi Isat 20240213muh.asad.amОценок пока нет

- Results in Line, Sales Momentum Continues: PL Mid-Cap DayДокумент5 страницResults in Line, Sales Momentum Continues: PL Mid-Cap DaymaheshhaseОценок пока нет

- Dabur India Q1FY22 results updateДокумент5 страницDabur India Q1FY22 results updateMichelle CastelinoОценок пока нет

- RIL 4QFY20 Results Update | Sector: Oil & GasДокумент34 страницыRIL 4QFY20 Results Update | Sector: Oil & GasQUALITY12Оценок пока нет

- India Bulls Infosys 20jan09Документ5 страницIndia Bulls Infosys 20jan09mansi07Оценок пока нет

- CDSL-Stock RessearchДокумент13 страницCDSL-Stock RessearchSarah AliceОценок пока нет

- Iiww 031210Документ4 страницыIiww 0312109913004606Оценок пока нет

- CDSL TP: 750: in Its Own LeagueДокумент10 страницCDSL TP: 750: in Its Own LeagueSumangalОценок пока нет

- Apollo Hospitals Enterprise Companyname: Sets The Stage For ExpansionДокумент13 страницApollo Hospitals Enterprise Companyname: Sets The Stage For Expansionakumar4uОценок пока нет

- Indofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsДокумент6 страницIndofood Sukses Makmur TBK (INDF IJ) : Strong Performance From All SegmentsPutu Chantika Putri DhammayantiОценок пока нет

- SH Kelkar: All-Round Performance Outlook Remains StrongДокумент8 страницSH Kelkar: All-Round Performance Outlook Remains StrongJehan BhadhaОценок пока нет

- 636211045639174587Документ12 страниц636211045639174587yousufch069Оценок пока нет

- HDFC Bank: CMP: INR1,872 The JuggernautДокумент22 страницыHDFC Bank: CMP: INR1,872 The JuggernautSwapnil pawarОценок пока нет

- DCB Bank Limited: Investing For Growth BUYДокумент4 страницыDCB Bank Limited: Investing For Growth BUYdarshanmadeОценок пока нет

- Muthoot Finance: Steady QuarterДокумент7 страницMuthoot Finance: Steady QuarterMukeshChauhanОценок пока нет

- Apcotex Industries 230817 PDFДокумент7 страницApcotex Industries 230817 PDFADОценок пока нет

- Navigator The: From The Research DeskДокумент8 страницNavigator The: From The Research DeskMeghna Modi JoshiОценок пока нет

- State Bank of India: CMP: INR234 TP: INR300 (+28%)Документ22 страницыState Bank of India: CMP: INR234 TP: INR300 (+28%)ktyОценок пока нет

- Spanco Telesystems Initiating Cov - April 20 (1) .Документ24 страницыSpanco Telesystems Initiating Cov - April 20 (1) .KunalОценок пока нет

- Copia Zuleyka Gabriela Gonzalez Sanchez - ESB III Quarter Exam Review VocabularyДокумент4 страницыCopia Zuleyka Gabriela Gonzalez Sanchez - ESB III Quarter Exam Review Vocabularyzulegaby1409Оценок пока нет

- Search Suggestions: Popular Searches: Cost Accounting CoursesДокумент21 страницаSearch Suggestions: Popular Searches: Cost Accounting CoursesYassi CurtisОценок пока нет

- Mgnm581:Organizational Behaviour and Human Resource Dynamics-IДокумент2 страницыMgnm581:Organizational Behaviour and Human Resource Dynamics-IsudhaОценок пока нет

- Chapter-16: Developing Pricing Strategies and ProgramsДокумент16 страницChapter-16: Developing Pricing Strategies and ProgramsTaufiqul Hasan NihalОценок пока нет

- ACC Limited CEO Discusses Global Cement Industry and Indian Market OutlookДокумент15 страницACC Limited CEO Discusses Global Cement Industry and Indian Market OutlookNivedita KumraОценок пока нет

- Enterprise Structure OverviewДокумент5 страницEnterprise Structure OverviewAnonymous 7CVuZbInUОценок пока нет

- Promotion DecisionsДокумент21 страницаPromotion DecisionsLagishetty AbhiramОценок пока нет

- Indian FMCG Industry, September 2012Документ3 страницыIndian FMCG Industry, September 2012Vinoth PalaniappanОценок пока нет

- Tutorial 2-5 Submitted BY:SULAV GIRI (40765)Документ6 страницTutorial 2-5 Submitted BY:SULAV GIRI (40765)Smarika ShresthaОценок пока нет

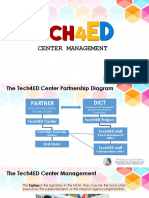

- BCMT Module 3 - Tech4ED Center ManagementДокумент46 страницBCMT Module 3 - Tech4ED Center ManagementCabaluay NHSОценок пока нет

- Srinagar Municipal Corporation: Office of The Executive Engineer Right River Works DivisionДокумент7 страницSrinagar Municipal Corporation: Office of The Executive Engineer Right River Works DivisionBeigh Umair ZahoorОценок пока нет

- Othm L7Документ50 страницOthm L7Ishan IsmethОценок пока нет

- Key Franchising PoliciesДокумент10 страницKey Franchising PoliciesBusiness Permit100% (1)

- Maithili AmbavaneДокумент62 страницыMaithili Ambavanerushikesh2096Оценок пока нет

- PRTC-FINAL PB - Answer Key 10.21 PDFДокумент38 страницPRTC-FINAL PB - Answer Key 10.21 PDFLuna VОценок пока нет

- Material Handling and ManagementДокумент45 страницMaterial Handling and ManagementGamme AbdataaОценок пока нет

- Affordable Lawn Care Financial StatementsДокумент8 страницAffordable Lawn Care Financial StatementsTabish TabishОценок пока нет

- Dana's HandbagsДокумент2 страницыDana's HandbagsJustin MandelОценок пока нет

- Ohsms Lead Auditor Training: Question BankДокумент27 страницOhsms Lead Auditor Training: Question BankGulfam Shahzad100% (10)

- Corporate Finance Chapter 3 ProblemsДокумент1 страницаCorporate Finance Chapter 3 ProblemsRidho Muhammad RamadhanОценок пока нет

- Policy Surrender Form CANARA HSBC OBC LIFE INSURANCEДокумент2 страницыPolicy Surrender Form CANARA HSBC OBC LIFE INSURANCEvikas71% (7)

- BAE Systems PresentationДокумент19 страницBAE Systems PresentationSuyash Thorat-GadgilОценок пока нет

- TQM DEFINITION AND PRINCIPLESДокумент6 страницTQM DEFINITION AND PRINCIPLESIsabel Victoria GarciaОценок пока нет

- CIO100 - Egov - BPR Strategy - Jackson Makewa-1Документ13 страницCIO100 - Egov - BPR Strategy - Jackson Makewa-1CIOEastAfricaОценок пока нет

- Ezi-Dock ChargebagsДокумент1 страницаEzi-Dock ChargebagsInos TechnologiesОценок пока нет

- Assignment 1.1Документ2 страницыAssignment 1.1Heina LyllanОценок пока нет

- Mago V SunДокумент8 страницMago V SunMatthew Evan EstevesОценок пока нет

- 1ST AssДокумент5 страниц1ST AssMary Jescho Vidal AmpilОценок пока нет

- ALL Quiz Ia 3Документ29 страницALL Quiz Ia 3julia4razoОценок пока нет

- Cips November 2014 Examination TimetableДокумент1 страницаCips November 2014 Examination TimetableajayikayodeОценок пока нет

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОт EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОценок пока нет

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.От EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Рейтинг: 5 из 5 звезд5/5 (82)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantОт EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantРейтинг: 4 из 5 звезд4/5 (104)

- Rich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouОт EverandRich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouОценок пока нет

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesОт EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesРейтинг: 4.5 из 5 звезд4.5/5 (30)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouОт EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouРейтинг: 5 из 5 звезд5/5 (5)

- How To Budget And Manage Your Money In 7 Simple StepsОт EverandHow To Budget And Manage Your Money In 7 Simple StepsРейтинг: 5 из 5 звезд5/5 (4)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessОт EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeОт EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeРейтинг: 5 из 5 звезд5/5 (4)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonОт EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonРейтинг: 5 из 5 звезд5/5 (9)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherОт EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherРейтинг: 5 из 5 звезд5/5 (14)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyОт EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyРейтинг: 5 из 5 звезд5/5 (1)

- Retirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyОт EverandRetirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyОценок пока нет

- Lean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeОт EverandLean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeОценок пока нет

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayОт EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayРейтинг: 3.5 из 5 звезд3.5/5 (2)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningОт EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningРейтинг: 4.5 из 5 звезд4.5/5 (8)

- How to Save Money: 100 Ways to Live a Frugal LifeОт EverandHow to Save Money: 100 Ways to Live a Frugal LifeРейтинг: 5 из 5 звезд5/5 (1)