Академический Документы

Профессиональный Документы

Культура Документы

Spyder

Загружено:

HelloАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Spyder

Загружено:

HelloАвторское право:

Доступные форматы

Legen Dairy Consulting

Spyder Active Sports, Inc. April 22, 2010

Spyder is a successful family owned company that currently has the

following three options: sell to a financial buyer via an LBO, sell to a Recommendation:

strategic buyer, or hold the company and sell at a later date. Sell to Strategic

Assuming 2008 projections become reality, the best financial option

for the CEO is to hold the company and increase ownership to

Acquirer

experience greater growth before selling the company. However,

consideration of the CEO’s personal interests and objectives, a

strategic acquisition would be ideal.

Exit Options

Option 1: Sell to Financial Buyer

A financial buyer like a private equity firm, would likely engage in

a LBO. Spyder currently has low existing debt and strong cash

flows, making it ideal for a LBO. The PE firm would seek to

finance the purchase of the firm through debt, devote a few years

to increase operational efficiency in order to sell the company to a

strategic buyer. Furthermore, LBOs are becoming increasingly

popular. Given the speed at which a LBO can take place and the

general industry trends, selling to a financial buyer is an attractive

option. However, because a financial buyer would most likely engage in a LBO, Spyder would

be highly levered.

Option 2: Sell to Strategic Buyer

Spyder could sell its business to a larger company of a similar line of business like Nike that is

seeking to develop its presence in this niche market. The strategic buyer would not use debt to

acquire Spyder. It would gain from Spyder's proprietary designs, brand equity, and established

cstoumer base. As a result, it would be willing to pay a premium for the synergies it would hope

to achieve. Spyder has achieved success, but would benefit from the support a large company

would provide. The large strategic buyer will have additional expertise in marketing, product life

cycle management, and new market entry. As Spyder continues to grow and Jacobs seeks a less

active role, the strategic buyer would have the resources and capabilities to steer Spyder toward

greater success. A strategic buyer typically maintains current management, reducing integration

concerns. As a result, Jacobs would have confidence in the strategic buyer's ability to steer the

Spyder toward success and ensure job security for his sons.

Option 3: Become Sole Owner of Spyder

Jacobs also has the option to buy out the shares of his partner, Shimokubo. In order to have

majority ownership of the company, he would borrow to purchase an additional 37.9% of the

company. The result of this additional stake is complete decision-making power. Given Spyder's

strong financial performance and positive economy indicators, Spyder will have a higher

valuation and be in a good position for acquisition, offering Jacobs many acquisition decisions.

In addition to the issue of financing the additional stake, Jacobs' desire to end his involvement in

Spyder makes this option unattractive.

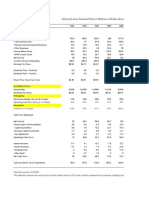

Potential IRR

Buyers would require an IRR of at least 40% because CHP used an IRR of 30%, which included

contractual benefits. Therefore, any external buyers would require an even higher IRR,

potentially around 40%.

Method of Calculating WACC

Tax Rate When calculating WACC, we assumed a constant corporate tax rate of 35% because

varying tax rates would lead to inconsistencies. We also assumed that the deferred tax rates and

liabilities would ultimately average to 35%.

Cost of Debt Based on 20-year Treasury bond rate and the Reuter Corporate Spread, we

calculated the cost of debt as 6%.

Cost of Equity We used the given risk free rate of 4.77%. Because Spyder is a large company

with inconsistent earnings, we assumed that Spyder would have a high MRP of 6%. We used an

unlevered beta of 0.824 by evaluating comparables and averaging the unlevered betas. We

omitted Adidas and Nike because of their size and extremely differing market cap and lines of

business. We kept all other comparables because we sought to avoid a slippery slope situation of

finding issues with each comparable and ending with only one comparable.

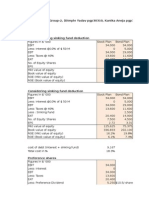

We then relevered the beta with three different capital structures: (1) Financial LBO Buyer:

Assuming 80% debt, result in 22.6% cost of equity (2) Strategic Buyer: Assuming no debt, result

in 9.7% cost of equity (3) Gain complete ownership of company by buying partner’s share:

Assuming Jacobs raises debt to buy out remaining 37.9% share, result in 11.7% cost of equity

WACC With our method, we calculated a WACC of 7.6% for a financial LBO buyer, 9.7%

WACC for a strategic buyer, and 8.7% WACC for complete ownership.

Method of Calculating Multiples

We used the lowest average and the highest multiple when calculating each multiple. For

strategic acquirers, we calculated the sales multiple, but omitted the VF Corp acquisition of The

North Face and the Nike acquisition of Converse because both acquisitions used have sales

multiples that were extremely different from the other comparable acquisitions. When

considering financial acquirers, we used the average EBITDA multiple, but eliminated only one

the Cerberus Partners acquisition of Fila Holding because among the other comparables, it was

an outlier. We did not eliminate any others so not to fall into a “slippery slope” of using

comparables.

Method of Calculating Terminal Value

We calculated terminal values for financial LBO and holding situations by multiplying the 2008

EBITDA by the range of TV exit multiples. For the strategic buyer situation, we multiplied the

2008 Expected sales by the second range of TV exit multiples.

The End of Spyder’s High-Growth Period

Over the four year period, Spyder’s implied growth rate in TV slows down considerably. From

about a 28% implied growth rate, it slows down to 7.08% in the most ideal situation. Thus, it

becomes increasingly clear that Spyder’s high-growth period ends in March 2008.

Recommendation to Jacobs

From a financial perspective, the best option is to hold the company and increase ownership by

purchasing Shimokubo’s share. By riding out the high growth until 2008, Jacobs could

potentially double his investment. However, given Jacobs’ current life stage and personal

interests, selling to a strategic buyer would be most advantageous. A strategic buyer would offer

a strong premium and retain current management. Thus, Jacobs can ensure not only a wise

financial choice for himself, but also for his sons. Since his son already worked for Nike, he

would probably be kept on or even promoted to business manager.

Recommendation to CHB

CHB should sell the company. The original investment was meant to be a short term investment.

However, the pre-2004 economic environment did not make sale of the company ideal. At this

point, given the high return CHB has already experienced, and Spyder’s anticipated growth,

CHB should take the return from its investment in Spyder and pursue other investments that have

higher growth potential.

Final Recommendation

If Spyder is acquired, whether by a strategic or financial buyer, Spyder will experience a period

of integration. Organizational structures will be heavily impacted, impacting employees, and

subsequently, corporate culture. Thus, it is imperative that after the acquisition, management

devote time to integrate the two cultures and ensure strong communication among management,

so not to alienate any employees.

After evaluating Spyder, it would be in Jacobs’ best financial interest to hold the company and

increase his ownership. However, given Jacobs’ age, interests, goal to offer his son job security,

the possibility that the growth rate between 2005-2008 decreases and if there are no interested

buyers in 2008, Jacobs should sell to a strategic buyer.

Вам также может понравиться

- Spyder Active Sports Case AnalysisДокумент2 страницыSpyder Active Sports Case AnalysisSrikanth Kumar Konduri100% (3)

- Spyder Case Intro: See Templates On Blackboard For WACC and DCF OutputДокумент11 страницSpyder Case Intro: See Templates On Blackboard For WACC and DCF Outputrock sinhaОценок пока нет

- Spyder Student ExcelДокумент21 страницаSpyder Student ExcelNatasha PerryОценок пока нет

- Scott & Sons Company Case Solution From Syndicate 3Документ3 страницыScott & Sons Company Case Solution From Syndicate 3Murni Fitri FatimahОценок пока нет

- Spyder Active SportsДокумент12 страницSpyder Active SportsShubham SharmaОценок пока нет

- Dividend Policy at Linear TechnologyДокумент9 страницDividend Policy at Linear TechnologySAHILОценок пока нет

- Linear TechnologyДокумент6 страницLinear Technologyprashantkumarsinha007100% (1)

- Reversing The AMD Fusion Launch (Case Study)Документ6 страницReversing The AMD Fusion Launch (Case Study)SanyamRajvanshiОценок пока нет

- LinearДокумент6 страницLinearjackedup211Оценок пока нет

- Questions - Linear Technologies CaseДокумент1 страницаQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Emerging Business Oportunities - Section2 Group 1Документ25 страницEmerging Business Oportunities - Section2 Group 1Rishabh KothariОценок пока нет

- Session 19 - Dividend Policy at Linear TechДокумент2 страницыSession 19 - Dividend Policy at Linear TechRichBrook7Оценок пока нет

- Accounting For Frequent Fliers CaseДокумент15 страницAccounting For Frequent Fliers CaseGlenPalmer50% (2)

- Case StudyДокумент10 страницCase StudyEvelyn VillafrancaОценок пока нет

- Marriott Solutions WACC LodgingДокумент3 страницыMarriott Solutions WACC LodgingPabloCaicedoArellanoОценок пока нет

- Team 14 - Boeing 7E7Документ10 страницTeam 14 - Boeing 7E7Tommy Suryo100% (1)

- Facebook IPO Valuation AnalysisДокумент13 страницFacebook IPO Valuation AnalysisMegha BepariОценок пока нет

- Case Study - Linear Tech - Christopher Taylor - SampleДокумент9 страницCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193Оценок пока нет

- Harvard CaseДокумент9 страницHarvard CaseGemar Singian0% (2)

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyДокумент11 страницUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Continental CarriersДокумент10 страницContinental Carriersnipun9143Оценок пока нет

- Finance Simulation: M&A in Wine Country Valuation ExerciseДокумент7 страницFinance Simulation: M&A in Wine Country Valuation ExerciseAdemola Adeola0% (2)

- Linear TechnologyДокумент4 страницыLinear TechnologySatyajeet Sahoo100% (2)

- Part 1Документ2 страницыPart 1Jia LeОценок пока нет

- Continental CarriersДокумент6 страницContinental CarriersVishwas Nandan100% (1)

- Corp Gov Group1 - Sealed AirДокумент5 страницCorp Gov Group1 - Sealed Airdmathur1234Оценок пока нет

- Investment Banking: Individual Assignment 2Документ5 страницInvestment Banking: Individual Assignment 2Aakash Ladha100% (3)

- ACFINA2 Case Study HanssonДокумент11 страницACFINA2 Case Study HanssonGemar Singian50% (2)

- Engn9 Final Paper Compass BoxДокумент10 страницEngn9 Final Paper Compass BoxMatthew GorhamОценок пока нет

- Sealed Air Corporation's Leveraged Recapitalization (A)Документ7 страницSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaОценок пока нет

- Linear Tech Dividend PolicyДокумент25 страницLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Case Studies On Cooper Industries IncДокумент12 страницCase Studies On Cooper Industries Inc黃靖順75% (4)

- Cooper Industries Case QuestionsДокумент3 страницыCooper Industries Case QuestionsChip choiОценок пока нет

- Cooper Case SolutionsДокумент6 страницCooper Case SolutionsDarshan Salgia100% (1)

- Linear Technology Payout Policy Case 3Документ4 страницыLinear Technology Payout Policy Case 3Amrinder SinghОценок пока нет

- Hansson ReportДокумент2 страницыHansson ReportFatima NazОценок пока нет

- Oracle's Acquisition of Sun MicrosystemsДокумент12 страницOracle's Acquisition of Sun MicrosystemsVarun Rana50% (2)

- Jones Electrical DistributionДокумент4 страницыJones Electrical Distributioncagc333Оценок пока нет

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Документ3 страницыSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajОценок пока нет

- Markstrat Report Round 0-3 Rubicon BravoДокумент4 страницыMarkstrat Report Round 0-3 Rubicon BravoDebadatta RathaОценок пока нет

- Cooper Industries - Group 5Документ11 страницCooper Industries - Group 5Rudro MukherjeeОценок пока нет

- Coursehero 40252829Документ2 страницыCoursehero 40252829Janice JingОценок пока нет

- Mergers and Acquisitions: Case: Cooper Industries. Inc. 1Документ12 страницMergers and Acquisitions: Case: Cooper Industries. Inc. 1Swati JainОценок пока нет

- Bausch N LombДокумент3 страницыBausch N LombRahul SharanОценок пока нет

- Cooper Industries CaseДокумент4 страницыCooper Industries CaseIni EjideleОценок пока нет

- Facebook, Inc: The Initial Public OfferingДокумент5 страницFacebook, Inc: The Initial Public OfferingHanako Taniguchi PoncianoОценок пока нет

- BCE: INC Case AnalysisДокумент6 страницBCE: INC Case AnalysisShuja Ur RahmanОценок пока нет

- Continental CarriersДокумент2 страницыContinental Carrierschch917100% (1)

- Panera BreadДокумент23 страницыPanera BreadtomОценок пока нет

- SCORE! Educational CentersДокумент4 страницыSCORE! Educational CentersdescataОценок пока нет

- Southport Minerals AnirbanДокумент3 страницыSouthport Minerals Anirbananirban880950% (1)

- RJR Nabisco 1Документ6 страницRJR Nabisco 1gopal mundhraОценок пока нет

- Kohler CompanyДокумент3 страницыKohler CompanyDuncan BakerОценок пока нет

- Financial Management - Case - Sealed AirДокумент7 страницFinancial Management - Case - Sealed AirAryan AnandОценок пока нет

- Valuation Report SPДокумент4 страницыValuation Report SPSubhashis GhoshОценок пока нет

- Diageo CaseДокумент5 страницDiageo CaseMeena67% (9)

- PGs Acquisition of GilletteДокумент9 страницPGs Acquisition of Gillettepradeep.kumar2Оценок пока нет

- Costco A Case StudyДокумент5 страницCostco A Case StudyPeejay BoadoОценок пока нет

- Pershing Square's Q1 Letter To InvestorsДокумент10 страницPershing Square's Q1 Letter To InvestorsDealBook100% (22)

- Questions For Preparation Macr 2019Документ4 страницыQuestions For Preparation Macr 2019Abhay PrakashОценок пока нет

- Comparable Write UpДокумент1 страницаComparable Write UpHelloОценок пока нет

- Motives & Benefits of MergingДокумент3 страницыMotives & Benefits of MergingHelloОценок пока нет

- McDonalds Comapny AnalysisДокумент14 страницMcDonalds Comapny AnalysisHelloОценок пока нет

- Motives & Benefits of MergingДокумент3 страницыMotives & Benefits of MergingHelloОценок пока нет

- LincolnДокумент1 страницаLincolnHelloОценок пока нет

- Evaluation of Disney - Pixar AcquisitionДокумент4 страницыEvaluation of Disney - Pixar AcquisitionHelloОценок пока нет

- Evaluation of Disney - Pixar AcquisitionДокумент4 страницыEvaluation of Disney - Pixar AcquisitionHelloОценок пока нет

- Evaluation of Disney - Pixar AcquisitionДокумент4 страницыEvaluation of Disney - Pixar AcquisitionHelloОценок пока нет

- Master TecДокумент188 страницMaster TeczimawibongОценок пока нет

- The Marketing Mix: Entrepreneurship Myra F. de LeonДокумент21 страницаThe Marketing Mix: Entrepreneurship Myra F. de LeonguiaОценок пока нет

- Test Bank - Chapter18 FS AnalysisДокумент83 страницыTest Bank - Chapter18 FS AnalysisMarvin Rae CadapanОценок пока нет

- Interest and Annuity Tables For Discrete CompoundingДокумент19 страницInterest and Annuity Tables For Discrete CompoundingWan Muhd FaizОценок пока нет

- Sovereignsociety Profit Seeker TradingmanualДокумент23 страницыSovereignsociety Profit Seeker TradingmanualHitesh ParmarОценок пока нет

- Chapter 3 Exponential Functions ReviewДокумент10 страницChapter 3 Exponential Functions Reviewstealthysky0129Оценок пока нет

- Basic Crypto Currency TradingДокумент34 страницыBasic Crypto Currency TradingAОценок пока нет

- Chapter 5 Final Income TaxationДокумент26 страницChapter 5 Final Income TaxationJason MablesОценок пока нет

- R17 Understanding Income Statements IFT NotesДокумент21 страницаR17 Understanding Income Statements IFT Notessubhashini sureshОценок пока нет

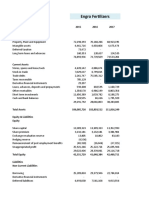

- Engro FertilizerДокумент9 страницEngro FertilizerAbdullah Sohail100% (1)

- BCG MatrixДокумент10 страницBCG MatrixshoaibmirzaОценок пока нет

- Illustrative-Financial-Statements - IGAAP PDFДокумент65 страницIllustrative-Financial-Statements - IGAAP PDFSubhash BhatОценок пока нет

- Vale Day - Capex, Iron Ore Market, Partnerships & Cost Cuts - 04dez13 - BBDДокумент13 страницVale Day - Capex, Iron Ore Market, Partnerships & Cost Cuts - 04dez13 - BBDbenjah2Оценок пока нет

- Lesson 05B. Inter-Company Transactions - A.TДокумент8 страницLesson 05B. Inter-Company Transactions - A.THayes HareОценок пока нет

- The Role and Environment of Managerial Finance: PowerpointДокумент24 страницыThe Role and Environment of Managerial Finance: PowerpointArif SharifОценок пока нет

- Finm 693 Asian Paints (2309)Документ10 страницFinm 693 Asian Paints (2309)Thakur Anmol RajputОценок пока нет

- Banks and Other Financial IntermediariesДокумент59 страницBanks and Other Financial IntermediariesCatherine Dela VegaОценок пока нет

- Banks of The PhilippinesДокумент6 страницBanks of The PhilippinesDaisuke InoueОценок пока нет

- Impact of Financial Reporting Standards On Quality of Financial StatementsДокумент4 страницыImpact of Financial Reporting Standards On Quality of Financial StatementsAnoosha AsimОценок пока нет

- Insurance AbbreviationsДокумент4 страницыInsurance Abbreviationskumaryashwant1984Оценок пока нет

- Catan Selina Mari Unit 2 Intacc3 099Документ12 страницCatan Selina Mari Unit 2 Intacc3 099Elc Elc ElcОценок пока нет

- Future of Trading - RefinitivДокумент8 страницFuture of Trading - Refinitivryan sharmaОценок пока нет

- Slides Macroeconomics 1 - FTUДокумент50 страницSlides Macroeconomics 1 - FTUK60 Nguyễn Ái Huyền TrangОценок пока нет

- Abdul Majeed - MBA CS #3 Emirates AirlineДокумент7 страницAbdul Majeed - MBA CS #3 Emirates AirlineSufi MajeedОценок пока нет

- Initiating Coverage On JP Associates LTDДокумент23 страницыInitiating Coverage On JP Associates LTDVarun YadavОценок пока нет

- Chapter 2 Foundations of International Financial ManagementДокумент33 страницыChapter 2 Foundations of International Financial ManagementVp RbОценок пока нет

- 2.SALES AND MARKE-WPS OfficeДокумент36 страниц2.SALES AND MARKE-WPS OfficeIts JohnОценок пока нет

- Diploma in Treasury, Investment and Risk Management PDFДокумент10 страницDiploma in Treasury, Investment and Risk Management PDFAbhishek Kaushik0% (6)

- Internal Rate of ReturnДокумент16 страницInternal Rate of ReturnAnnalie Alsado BustilloОценок пока нет