Академический Документы

Профессиональный Документы

Культура Документы

Investment Analysis 79: Figure 2.4-9 Relative Performance of Australian Dollar Versus CRB Index

Загружено:

YeimsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Investment Analysis 79: Figure 2.4-9 Relative Performance of Australian Dollar Versus CRB Index

Загружено:

YeimsАвторское право:

Доступные форматы

investment Analysis 79

1.3 500

US $/A$

1.2

CRB Index 450

1.1

400

CRB Index (1967 = 100)

1.0

350

0.9

US$/A$

0.8 300

0.7

250

0.6

200

0.5

150

0.4

0.3 100

Jan-80

Jul-81

Jan-83

Jul-84

Jan-86

Jul-87

Jan-89

Jul-90

Jan-92

Jul-93

Jan-95

Jul-96

Jan-98

Jul-99

Jan-01

Jul-02

Jan-04

Jul-05

Jan-07

Jul-08

figure 2.4-9 Relative performance of Australian dollar versus CRB index

handle political risk; listen to minority shareholders’ views;

and take social, environmental, and safety risks seriously. In 150%

short, investors are prepared to pay a premium for a com- Net Debt/Market

pany whose management they can trust. In the 2008 market Capitalization as of

meltdown, stretched balance sheets or M&A deals that have Dec. 31, 2008

100% 2008 Share Price

gone bad have led to a reassessment of the perceived quality

Performance

of management teams. In bull markets, most get the benefit

of the doubt, but in bear markets, few are trusted fully.

50%

external environment: geopolitical, Tax,

financing, legal

When evaluating a company, the location of its exploration 0%

BHP Billiton Anglo American Rio Tinto Xstrata

assets or mines is integral in determining its risk profile.

Riskier companies often require a higher rate of return from

investors and debt holders because of greater uncertainty –50%

about the future cash flows of its operations. This is especially

true for mining companies, which can be higher-risk compa-

nies because of the assets’ location. –100%

Generally, companies with operations in countries with

established mining industries and laws, such as Australia and

Canada, are deemed to be lower risk, owing to low sovereign figure 2.4-10 net debt/market cap for the “Big 4” mining

risk, strong legal systems, stable tax laws and royalty arrange- companies versus 2008 share price performance

ments, and lower probabilities of government intervention.

In high-risk countries, including many parts of Africa and with the majority of its exports and therefore foreign cur-

other developing nations, a number of uncertainties may arise, rency. For example, in Zambia, mining accounts for 90% of

the first of these being sovereign risk. Higher sovereign risk the country’s exports. Therefore, governments have a vested

causes debt providers to require a higher rate of return to com- interest in keeping mining projects in operation, which may

pensate for the greater uncertainty of developing a project. limit the scale of any downsizing or cuts in production that

This may lead to financing becoming unobtainable for some may be needed in a downturn.

exploration projects, no matter what the grade or resource. Spotting step changes in the external environment can be

Additionally, the legal system in these countries may be weak a key to anticipating large changes in the value of listed mining

or ad hoc, providing no protection from government interven- companies. How will a global credit crunch differentially affect

tion or challenges to mineral and property rights. There is also various listed mining companies? How will a banking crisis in

greater risk that mining laws or royalties may change, result- Kazakhstan affect a mining company with assets there? (Clue:

ing in uncertainty of future cash flows or contributions from What will happen to exchange rates and exchange controls?)

operations. This has been evident in Zambia, where new wind- How does equity issuance across all sectors affect the returns

fall taxes were proposed for copper producers. for liquid and nonliquid mining companies?

In developing nations, it is often the case that mines pro-

vide a large source of employment and income to the gov- ConCluSionS

ernment through royalties and corporate tax. In the absence This chapter conveys two points. First, the usefulness of

of other major industries, mining may also provide a country the analytical community goes beyond making money for a

Вам также может понравиться

- Applied Time Series Econometrics: A Practical Guide for Macroeconomic Researchers with a Focus on AfricaОт EverandApplied Time Series Econometrics: A Practical Guide for Macroeconomic Researchers with a Focus on AfricaРейтинг: 3 из 5 звезд3/5 (1)

- Habitacion 2 S.H. S.H.: 1. Piso (1) 1:75Документ1 страницаHabitacion 2 S.H. S.H.: 1. Piso (1) 1:75Gary HurtadoОценок пока нет

- Tier Index V Delta Dec 2010Документ2 страницыTier Index V Delta Dec 2010kettle1Оценок пока нет

- Coff Fondation PDFДокумент1 страницаCoff Fondation PDFStéphane OuyengaОценок пока нет

- CARTA PSICO Sea - Level - IPДокумент1 страницаCARTA PSICO Sea - Level - IPSeñor PolloОценок пока нет

- A B C D: Junta Lateral E 0.065MДокумент1 страницаA B C D: Junta Lateral E 0.065MLuis GalindoОценок пока нет

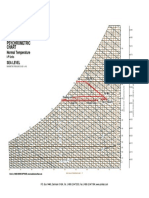

- AHU 3 PsychrometricДокумент1 страницаAHU 3 PsychrometricIzaaz AhamedОценок пока нет

- Jan 2009 Housing OutlookДокумент5 страницJan 2009 Housing Outlookkettle1Оценок пока нет

- Psychrometric Chart: Normal Temperature Sea LevelДокумент1 страницаPsychrometric Chart: Normal Temperature Sea LevelIzaaz AhamedОценок пока нет

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Документ7 страницBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraОценок пока нет

- Distribucion Electrica: Planta de Techos Planta Mecanica-CimientosДокумент1 страницаDistribucion Electrica: Planta de Techos Planta Mecanica-CimientosBenito_Camelas2021Оценок пока нет

- PsychrometricChart IPДокумент1 страницаPsychrometricChart IPmalikimranaliОценок пока нет

- 2-PEDESTRIAN BRIDGE STA 3+358-ModelДокумент1 страница2-PEDESTRIAN BRIDGE STA 3+358-ModelAnandaNukeJulfahОценок пока нет

- Segundo Piso Casa A1Документ1 страницаSegundo Piso Casa A1santiago paris beltranОценок пока нет

- Initial Report September 4th, 2008: Analyst: Lisa Springer, CFAДокумент22 страницыInitial Report September 4th, 2008: Analyst: Lisa Springer, CFAbeacon-docs100% (1)

- ASHRAE Chart2 PDFДокумент2 страницыASHRAE Chart2 PDFalialavi2Оценок пока нет

- ASHRAE-Chart No1 PDFДокумент2 страницыASHRAE-Chart No1 PDFaukanaiiОценок пока нет

- Ashrae Psychrometric+ChartДокумент2 страницыAshrae Psychrometric+ChartASHNA K NAVADОценок пока нет

- Ashrae-Psychart Eng N SI PDFДокумент2 страницыAshrae-Psychart Eng N SI PDFJonaz CruzОценок пока нет

- Ashrae Chart PDFДокумент2 страницыAshrae Chart PDFNapoleon Low100% (2)

- Ashrae Chart PDFДокумент2 страницыAshrae Chart PDFLemuel GerardsОценок пока нет

- ASHRAE Chart PDFДокумент2 страницыASHRAE Chart PDFalialavi2Оценок пока нет

- ASHRAE Chart PDFДокумент2 страницыASHRAE Chart PDFvitaliskcОценок пока нет

- Ashrae ChartДокумент2 страницыAshrae Chartimo konsensyaОценок пока нет

- Psychrometric Chart PDFДокумент2 страницыPsychrometric Chart PDFvitaliskcОценок пока нет

- ASHRAEPSYCHROMETRICa206119 PDFДокумент2 страницыASHRAEPSYCHROMETRICa206119 PDFAlexandre Jusis BlancoОценок пока нет

- Ashrae Chart PDFДокумент2 страницыAshrae Chart PDFEdmar AbuboОценок пока нет

- Ashrae Chart PDFДокумент2 страницыAshrae Chart PDFZaid Tariq AlabiryОценок пока нет

- Psychrometric Chart Ashrae PDFДокумент2 страницыPsychrometric Chart Ashrae PDFambuenaflorОценок пока нет

- ASHRAE-Psychrometric Chart PDFДокумент2 страницыASHRAE-Psychrometric Chart PDFBrian MayОценок пока нет

- Ashrae ChartДокумент2 страницыAshrae ChartCarlo Ray SelabaoОценок пока нет

- ASHRAE Chart PDFДокумент2 страницыASHRAE Chart PDFpatricio-1703Оценок пока нет

- Schedule of Doors: D 01 D 02 D 03 D 04 D 05 D 06 D 07Документ1 страницаSchedule of Doors: D 01 D 02 D 03 D 04 D 05 D 06 D 07christian de leonОценок пока нет

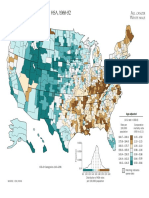

- Cancer Death Rates by Health Service AreaДокумент8 страницCancer Death Rates by Health Service AreamikalraОценок пока нет

- 1 2 3 4 5 A B C D: Buenviaje Marcelo &Документ1 страница1 2 3 4 5 A B C D: Buenviaje Marcelo &Johnvirgo CorpuzОценок пока нет

- Glorieta Pa Wiobert-ModelДокумент1 страницаGlorieta Pa Wiobert-ModelGary ArcОценок пока нет

- Taman Dapur Taman Dapur: Denah Lantai 1Документ1 страницаTaman Dapur Taman Dapur: Denah Lantai 1Alistair SОценок пока нет

- 3G - RTWP - 14BAG116 - LEBO - TENGAH - BAG - TB FFT Scan Band900Документ13 страниц3G - RTWP - 14BAG116 - LEBO - TENGAH - BAG - TB FFT Scan Band900falcon032Оценок пока нет

- Comp1 (All) (Mo Su) (Summer Spring) (ALL)Документ1 страницаComp1 (All) (Mo Su) (Summer Spring) (ALL)Vanessa GirondaОценок пока нет

- 3-Day Advanced High Load (12week) - DR WorkoutДокумент29 страниц3-Day Advanced High Load (12week) - DR Workoutloxowe6416Оценок пока нет

- Shaft Rotor BДокумент1 страницаShaft Rotor BDanil AdityaОценок пока нет

- CasetaДокумент1 страницаCaseta1971humbertoОценок пока нет

- GroundДокумент1 страницаGroundأحمد شوكتОценок пока нет

- 1,2Документ2 страницы1,2shubham basarkarОценок пока нет

- Gereja Baptis Print Untuk ProposalДокумент5 страницGereja Baptis Print Untuk ProposalTambolang MarayaОценок пока нет

- Low 25 PDFДокумент1 страницаLow 25 PDFOre Ulil DesuОценок пока нет

- Sea Level: Ashrae Psychrometric Chart No.1Документ1 страницаSea Level: Ashrae Psychrometric Chart No.1Minh TranОценок пока нет

- Sea Level: Ashrae Psychrometric Chart No.1Документ1 страницаSea Level: Ashrae Psychrometric Chart No.1Minh TranОценок пока нет

- Ashrae ChartДокумент2 страницыAshrae Chartsophia arellanoОценок пока нет

- ASEREP v4.2.1.0Документ1 страницаASEREP v4.2.1.0anthonySinchi KlkОценок пока нет

- Ch03 Functions 3rd EdДокумент60 страницCh03 Functions 3rd EdShahril MohamadОценок пока нет

- Sample 1 - Rawdata Bahan Baku 3 - RawdataДокумент1 страницаSample 1 - Rawdata Bahan Baku 3 - RawdataM Zainuddin M SaputraОценок пока нет

- TOMO - Konstrukcija - 1. StoryДокумент1 страницаTOMO - Konstrukcija - 1. StoryMatej RajičОценок пока нет

- Atlanta TieredДокумент1 страницаAtlanta Tieredkettle1Оценок пока нет

- Roof Framing Plan Purlin Connections: A' B C D E AДокумент1 страницаRoof Framing Plan Purlin Connections: A' B C D E ATrisha Marie Bustria MartinezОценок пока нет

- Casa ModelДокумент1 страницаCasa ModelROXANA ANDREA PONCE PORTUGALОценок пока нет

- Bar Counter Details - LukfooДокумент1 страницаBar Counter Details - LukfooKyl SkyОценок пока нет

- Plantas, Elevacion y CortesДокумент1 страницаPlantas, Elevacion y CortesJheins Amaro GuizabaloОценок пока нет

- Superior Railing DetailДокумент1 страницаSuperior Railing DetailRyan ChinОценок пока нет

- PTE-PWS-01 Rev BДокумент1 страницаPTE-PWS-01 Rev BbjjknОценок пока нет

- Link 3Документ1 страницаLink 3YeimsОценок пока нет

- Block Caving 1443: Figure 13.10-7 Extraction Level Under Construction Using An Advanced Undercut, Doz Mine, IndonesiaДокумент1 страницаBlock Caving 1443: Figure 13.10-7 Extraction Level Under Construction Using An Advanced Undercut, Doz Mine, IndonesiaYeimsОценок пока нет

- Mineral Property Feasibility Studies 235: Volume 2: Project EconomicsДокумент1 страницаMineral Property Feasibility Studies 235: Volume 2: Project EconomicsYeimsОценок пока нет

- 260 Sme Mining Engineering Handbook: Volume 5: Operating PlanДокумент1 страница260 Sme Mining Engineering Handbook: Volume 5: Operating PlanYeimsОценок пока нет

- LinkДокумент1 страницаLinkYeimsОценок пока нет

- Link 3Документ1 страницаLink 3YeimsОценок пока нет

- A Global Perspective On Mining Legislation: Diana DaltonДокумент1 страницаA Global Perspective On Mining Legislation: Diana DaltonYeimsОценок пока нет

- Heavy Mineral Separations: Geochemical Prospecting 133Документ1 страницаHeavy Mineral Separations: Geochemical Prospecting 133YeimsОценок пока нет

- Underground Ore Movement 1287: Integration AspectsДокумент1 страницаUnderground Ore Movement 1287: Integration AspectsYeimsОценок пока нет

- 1286 Sme Mining Engineering Handbook: Figure 12.8-14 Ore-Handling System at Olympic Dam MineДокумент1 страница1286 Sme Mining Engineering Handbook: Figure 12.8-14 Ore-Handling System at Olympic Dam MineYeimsОценок пока нет

- Geologic Interpretation, Modeling, and Representation 179Документ1 страницаGeologic Interpretation, Modeling, and Representation 179YeimsОценок пока нет

- Conveyors: 1288 Sme Mining Engineering HandbookДокумент1 страницаConveyors: 1288 Sme Mining Engineering HandbookYeimsОценок пока нет

- Limits of Application: Underground Ore Movement 1289Документ1 страницаLimits of Application: Underground Ore Movement 1289YeimsОценок пока нет

- Cost Considerations Safety Considerations: Underground Ore Movement 1285Документ1 страницаCost Considerations Safety Considerations: Underground Ore Movement 1285YeimsОценок пока нет

- 104 Sme Mining Engineering Handbook: Type 10Документ1 страница104 Sme Mining Engineering Handbook: Type 10YeimsОценок пока нет

- 1284 Sme Mining Engineering Handbook: Drilling Pilot Hole Down Attaching Reamer Reaming UpДокумент1 страница1284 Sme Mining Engineering Handbook: Drilling Pilot Hole Down Attaching Reamer Reaming UpYeimsОценок пока нет

- Health and Medical Issues in Global Mining 1575Документ1 страницаHealth and Medical Issues in Global Mining 1575YeimsОценок пока нет

- References: 126 Sme Mining Engineering HandbookДокумент1 страницаReferences: 126 Sme Mining Engineering HandbookYeimsОценок пока нет

- Index Terms Links: Next PageДокумент1 страницаIndex Terms Links: Next PageYeimsОценок пока нет

- 1376 Sme Mining Engineering Handbook: Advantages and DisadvantagesДокумент1 страница1376 Sme Mining Engineering Handbook: Advantages and DisadvantagesYeimsОценок пока нет

- 148 Sme Mining Engineering Handbook: SymbolsДокумент1 страница148 Sme Mining Engineering Handbook: SymbolsYeimsОценок пока нет

- Sub-Subtype 9.2.2.1: Algoma Bif: Geological Features and Genetic Models of Mineral Deposits 97Документ1 страницаSub-Subtype 9.2.2.1: Algoma Bif: Geological Features and Genetic Models of Mineral Deposits 97YeimsОценок пока нет

- 108 Sme Mining Engineering Handbook: Geochemical Analytical MethodsДокумент1 страница108 Sme Mining Engineering Handbook: Geochemical Analytical MethodsYeimsОценок пока нет

- Page 1846 PDFДокумент1 страницаPage 1846 PDFYeimsОценок пока нет

- Acknowledgments: 80 Sme Mining Engineering HandbookДокумент1 страницаAcknowledgments: 80 Sme Mining Engineering HandbookYeimsОценок пока нет

- 74 Sme Mining Engineering HandbookДокумент1 страница74 Sme Mining Engineering HandbookYeimsОценок пока нет

- 84 Sme Mining Engineering Handbook: Destructive Plate MarginsДокумент1 страница84 Sme Mining Engineering Handbook: Destructive Plate MarginsYeimsОценок пока нет

- 86 Sme Mining Engineering Handbook: Surface or Seafloor HydrothermalДокумент1 страница86 Sme Mining Engineering Handbook: Surface or Seafloor HydrothermalYeimsОценок пока нет

- 70 Sme Mining Engineering Handbook: Cost of CapitalДокумент1 страница70 Sme Mining Engineering Handbook: Cost of CapitalYeimsОценок пока нет

- Interview Experiences 2024Документ3 страницыInterview Experiences 2024Shourya PanchalОценок пока нет

- Cambridge English Business Vantage Sample Paper 1 Listening v2Документ5 страницCambridge English Business Vantage Sample Paper 1 Listening v2Carlos Carlitos BottinelliОценок пока нет

- SAP-APO - Create Field Material ViewДокумент8 страницSAP-APO - Create Field Material ViewPArk100Оценок пока нет

- Bank of N.Y. Mellon Corp. v. Commissioner of Internal RevenueДокумент25 страницBank of N.Y. Mellon Corp. v. Commissioner of Internal RevenueCato InstituteОценок пока нет

- A Research Paper On Investment Awareness Among IndianДокумент18 страницA Research Paper On Investment Awareness Among IndianElaisa AurinОценок пока нет

- Topic 1 - Creating Customer Value and EngagementДокумент27 страницTopic 1 - Creating Customer Value and EngagementZhi YongОценок пока нет

- Supply Chain Management of Pharmaceuticals: "Working Together For Healthier World"Документ19 страницSupply Chain Management of Pharmaceuticals: "Working Together For Healthier World"Shahrukh Ghulam NabiОценок пока нет

- List of Accredited Agents Training Institutes in Nothern Zone Approved by The Authority - As Per Data Received Upto 31/07/2006Документ118 страницList of Accredited Agents Training Institutes in Nothern Zone Approved by The Authority - As Per Data Received Upto 31/07/2006arbaz khanОценок пока нет

- Royal Enfield Project 36 Organisation StudyДокумент45 страницRoyal Enfield Project 36 Organisation StudyVijay AravindОценок пока нет

- InvestmentДокумент3 страницыInvestmentAngelica PagaduanОценок пока нет

- Right of Way - AccountingДокумент3 страницыRight of Way - AccountingVeronica RiveraОценок пока нет

- The Toilet Paper Entrepreneur PDFДокумент198 страницThe Toilet Paper Entrepreneur PDFMarco Gómez Caballero83% (6)

- Minola Luxus 674Документ2 страницыMinola Luxus 674emir.muderizovicОценок пока нет

- Commissioner Vs Manning Case DigestДокумент2 страницыCommissioner Vs Manning Case DigestEKANGОценок пока нет

- Philippine Bank of Communications vs. Commissioner of Internal Revenue (GR 112024. Jan. 28, 1999)Документ2 страницыPhilippine Bank of Communications vs. Commissioner of Internal Revenue (GR 112024. Jan. 28, 1999)Col. McCoyОценок пока нет

- A Descriptive Analysis of Consumer'S Adoption of E-WalletsДокумент19 страницA Descriptive Analysis of Consumer'S Adoption of E-WalletsAndrea TugotОценок пока нет

- 1 - Finance Short NotesДокумент12 страниц1 - Finance Short NotesSudhanshu PatelОценок пока нет

- Bus Fin - QTR 2 Week 3 - Personal FinanceДокумент33 страницыBus Fin - QTR 2 Week 3 - Personal FinanceSheila Marie Ann Magcalas-GaluraОценок пока нет

- BIZPLANДокумент6 страницBIZPLANGwen MañegoОценок пока нет

- Customer Persona and Value PropositionДокумент24 страницыCustomer Persona and Value PropositionVishnu KompellaОценок пока нет

- Bill of Lading AustriaДокумент2 страницыBill of Lading AustriaTitik KurniyatiОценок пока нет

- Connecting Strategy To ExecutionДокумент13 страницConnecting Strategy To ExecutionrpreidОценок пока нет

- IMS Brochure NewДокумент4 страницыIMS Brochure NewCoCgamer ProОценок пока нет

- NSHM College of Management and Technology, KolkataДокумент4 страницыNSHM College of Management and Technology, KolkataMishti CHakoriОценок пока нет

- PepperfryДокумент8 страницPepperfrySakshiОценок пока нет

- PhilipsVsMatsushit Case AnalysisДокумент7 страницPhilipsVsMatsushit Case AnalysisGaurav RanjanОценок пока нет

- Check List For Various Noc's: ../affidavit For Consent To Establish ../affidavit For Consent To Operate PDFДокумент23 страницыCheck List For Various Noc's: ../affidavit For Consent To Establish ../affidavit For Consent To Operate PDFshubham kumarОценок пока нет

- SLT eBill-00372777690152ImageДокумент1 страницаSLT eBill-00372777690152ImageDushshantha Gayashan0% (1)

- Financial Accounting Chapter 1-3Документ3 страницыFinancial Accounting Chapter 1-3Israel MoraОценок пока нет

- Yahoo Symbol ListДокумент21 страницаYahoo Symbol ListShubham RohatgiОценок пока нет

- The New York Times Presents Smarter by Sunday: 52 Weekends of Essential Knowledge for the Curious MindОт EverandThe New York Times Presents Smarter by Sunday: 52 Weekends of Essential Knowledge for the Curious MindРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Emotional Intelligence: How to Improve Your IQ, Achieve Self-Awareness and Control Your EmotionsОт EverandEmotional Intelligence: How to Improve Your IQ, Achieve Self-Awareness and Control Your EmotionsОценок пока нет

- 71 Ways to Practice English Writing: Tips for ESL/EFL LearnersОт Everand71 Ways to Practice English Writing: Tips for ESL/EFL LearnersРейтинг: 5 из 5 звезд5/5 (3)

- Purposeful Retirement: How to Bring Happiness and Meaning to Your Retirement (Retirement gift for men)От EverandPurposeful Retirement: How to Bring Happiness and Meaning to Your Retirement (Retirement gift for men)Рейтинг: 4.5 из 5 звезд4.5/5 (4)

- The Food Almanac: Recipes and Stories for a Year at the TableОт EverandThe Food Almanac: Recipes and Stories for a Year at the TableРейтинг: 4 из 5 звезд4/5 (1)

- Stargazing: Beginner’s guide to astronomyОт EverandStargazing: Beginner’s guide to astronomyРейтинг: 5 из 5 звезд5/5 (1)

- The Everyday Guide to Special Education Law: A Handbook for Parents, Teachers and Other Professionals, Third EditionОт EverandThe Everyday Guide to Special Education Law: A Handbook for Parents, Teachers and Other Professionals, Third EditionОценок пока нет

- Brilliant Bathroom Reader (Mensa®): 5,000 Facts from the Smartest Brand in the WorldОт EverandBrilliant Bathroom Reader (Mensa®): 5,000 Facts from the Smartest Brand in the WorldОценок пока нет

- Restore Gut Health: How to Heal Leaky Gut Naturally and Maintain Healthy Digestive SystemОт EverandRestore Gut Health: How to Heal Leaky Gut Naturally and Maintain Healthy Digestive SystemОценок пока нет

- 71 Ways to Practice Speaking English: Tips for ESL/EFL LearnersОт Everand71 Ways to Practice Speaking English: Tips for ESL/EFL LearnersРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Publishers Weekly Book Publishing Almanac 2022: A Master Class in the Art of Bringing Books to ReadersОт EverandPublishers Weekly Book Publishing Almanac 2022: A Master Class in the Art of Bringing Books to ReadersОценок пока нет

- 100 Great African Kings and Queens ( Volume 1, Revised Enriched Edition )От Everand100 Great African Kings and Queens ( Volume 1, Revised Enriched Edition )Оценок пока нет

- The World Almanac Road Trippers' Guide to National Parks: 5,001 Things to Do, Learn, and See for YourselfОт EverandThe World Almanac Road Trippers' Guide to National Parks: 5,001 Things to Do, Learn, and See for YourselfОценок пока нет

- Florida Almanac, 2012От EverandFlorida Almanac, 2012Bernie McGovernОценок пока нет