Академический Документы

Профессиональный Документы

Культура Документы

Citystate Savings Bank vs. Teresita Tobias and Shellidie Valdez

Загружено:

Junelyn T. EllaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Citystate Savings Bank vs. Teresita Tobias and Shellidie Valdez

Загружено:

Junelyn T. EllaАвторское право:

Доступные форматы

Citystate Savings Bank Vs.

Teresita Tobias and Shellidie Valdez

G.R. No. 227990. March 7, 2018

FACTS: Rolando Robles (hereinafter referred to as Robles), a certified public accountant, has been

employed with Citystate Savings Bank (hereinafter referred to as the petitioner) since July 1998 then as

Accountant-trainee for its Chino Roces Branch. On September 6, 2000, Robles was promoted as acting

manager for petitioner's Baliuag, Bulacan branch, and eventually as manager. Sometime in 2002,

respondent Teresita Tobias (hereinafter referred to as Tobias), a meat vendor at the Baliuag Public

Market, was introduced by her youngest son to Robles, branch manager of petitioner's Baliuag, Bulacan

branch. Robles persuaded Tobias to open an account with the petitioner, and thereafter to place her

money in some high interest rate mechanism, to which the latter yielded.

Thereafter, Robles would frequent Tobias' stall at the public market to deliver the interest earned by her

deposit accounts in the amount of Php 2,000.00. In turn, Tobias would hand over her passbook to Robies

for updating. The passbook would be returned the following day with typewritten entries but without the

corresponding counter signatures.

Tobias was later offered by Robles to sign-up in petitioner's back-to-back scheme which is supposedly

offered only to petitioner's most valued clients. Under the scheme, the depositors authorize the bank to

use their bank deposits and invest the same in different business ventures that yield high interest. Robies

allegedly promised that the interest previously earned by Tobias would be doubled and assured her that

he will do all the paper work. Lured by the attractive offer, Tobias signed the pertinent documents without

reading its contents and invested a total of Php 1,800,000.00 to petitioner through Robies. Later, Tobias

became sickly, thus she included her daughter and herein respondent Shellidie Valdez (hereinafter

referred to as Valdez), as co-depositor in her accounts with the petitioner.

In 2005, Robles failed to remit to respondents the interest as scheduled. Respondents tried to reach

Robles but he can no longer be found; their calls were also left unanswered. In a meeting with Robles'

siblings, it was disclosed to the respondents that Robles withdrew the money and appropriated it for

personal use. Robiles later talked to the respondents, promised that he would return the money by

installments and pleaded that they do not report the incident to the petitioner. Robles however reneged

on his promise. Petitioner also refused to make arrangements for the return of respondents' money

despite several demands. On January 8, 2007, respondents filed a Complaint for sum of money and

damages. against Robles and the petitioner. In their Complaint, respondents alleged that Robles

committed fraud in the performance of his duties as branch manager when he lured Tobias in signing

several pieces of blank documents, under the assurance as bank manager of petitioner, everything was in

order. After due proceedings, the Regional Trial Court (RTC), on February 12, 2014, rendered its Decision,

viz.:

WHEREFORE, in light of the foregoing, judgment is hereby rendered ordering defendant Robles to pay

plaintiff the following:

1. the amount of Php1,800,000.00 as actual damages plus legal rate of interest from the

filing of the complaint until fully paid;

2. the amount of Php100,000.00 as moral damages; and

3. the amount of Php50,000.00 as exemplary damages.

The plaintiffs claim for attorney's fees and litigation expenses are DENIED for lack of merit.

Further, defendant bank is absolved of any liability. Likewise, all counterclaims and cross-claims are

DENIED for lack of merit.

The matter was elevated to the CA. The CA in its Decision dated May 31, 2016, found the appeal

meritorious and accordingly, reversed and set aside the RTC's decision. Petitioner sought a

reconsideration of the decision, but it was denied by the CA in its Resolution.

ISSUE: Whether the CA seriously erred in ruling that citystate is jointly and solidarily liable for attorney's

fees.

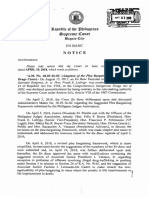

RULING: NO. The last of the three consolidated cases, assails the decision and resolution of the CA which

held Citibank, the drawee bank, solely liable for the amount of crossed check nos. SN-10597 and 16508 as

actual damages, the proceeds of which have been misappropriated by a syndicate involving the

employees of the drawer Ford, and the collecting bank PCIB.

This Court in resolving the issue of liability in PCIB v. CA, considered the degree of negligence of the parties.

While recognizing that the doctrine of imputed negligence makes a principal liable for the wrongful acts

of its agents, this Court noted that the liability of the principal would nonetheless depend on whether the

act of its agent is the proximate cause of the injury to the third person.

In the case of Ford, this Court ruled that its negligence, if any, cannot be considered as the proximate

cause, emphasizing in this regard the absence of confirmation on the part of Ford to the request of its

General Ledger Accountant for replacement of the checks issued as payment to the CIR. In absolving Ford

from liability, this Court clarified that the mere fact that the forgery was committed by the

drawer/principal's employee or agent, who by virtue of his position had unusual facilities for perpetrating

the fraud and imposing the forged paper upon the bank, does not automatically shift the loss to such

drawer-principal, in the absence of some circumstance raising estoppel against the latter.

Вам также может понравиться

- Citystate Savings Bank V TobiasДокумент2 страницыCitystate Savings Bank V TobiasSha Santos100% (1)

- Citystate Savings Bank V. Teresita Tobias and Shellidie Valdez G.R. No. 227990, March 07, 2018 Reyes, JR., JДокумент3 страницыCitystate Savings Bank V. Teresita Tobias and Shellidie Valdez G.R. No. 227990, March 07, 2018 Reyes, JR., JMichael Vincent BautistaОценок пока нет

- Bordador v. LuzДокумент2 страницыBordador v. LuzdelayinggratificationОценок пока нет

- Lim Vs SabanДокумент2 страницыLim Vs SabanwesleybooksОценок пока нет

- VALENZUELA v. CA G.R. No. 83122Документ3 страницыVALENZUELA v. CA G.R. No. 83122SSОценок пока нет

- Central Bank vs. CAДокумент2 страницыCentral Bank vs. CAxx_stripped52Оценок пока нет

- AF Realty & Development v. Dieselman Freight ServicesДокумент1 страницаAF Realty & Development v. Dieselman Freight ServicesIan Cabana100% (1)

- Digest of Lim v. Saban (G.R. No. 163720)Документ1 страницаDigest of Lim v. Saban (G.R. No. 163720)Rafael PangilinanОценок пока нет

- Manila Remnant Vs CAДокумент2 страницыManila Remnant Vs CARobert Ramirez100% (2)

- Lopez vs. CaДокумент1 страницаLopez vs. Caabbywinster100% (1)

- G.R. No. L-5953 February 24, 1912 ANTONIO M. PABALAN, Plaintiff-Appellant, vs. FELICIANO VELEZ, DefendantДокумент3 страницыG.R. No. L-5953 February 24, 1912 ANTONIO M. PABALAN, Plaintiff-Appellant, vs. FELICIANO VELEZ, DefendantMaceda KadatuanОценок пока нет

- Sing Juco Toyota Remnants TerradoДокумент4 страницыSing Juco Toyota Remnants TerradoKeangela LouiseОценок пока нет

- Development Bank of The Philippines vs. Prudential BankДокумент2 страницыDevelopment Bank of The Philippines vs. Prudential BankKaye Miranda LaurenteОценок пока нет

- Lopez Vs Del Rosario DigestДокумент1 страницаLopez Vs Del Rosario DigestChicoRodrigoBantayog100% (1)

- Valenzuela V CA DigestДокумент2 страницыValenzuela V CA DigestXhin CagatinОценок пока нет

- Tuazon v. Heirs of Bartolome RamosДокумент2 страницыTuazon v. Heirs of Bartolome RamosAngelica Abalos100% (1)

- Valenzuela Vs Court of Appeals - Case DigestДокумент2 страницыValenzuela Vs Court of Appeals - Case DigestMan2x Salomon100% (3)

- 5 Fultron Iron Works Co. vs. China Banking CorporationДокумент1 страница5 Fultron Iron Works Co. vs. China Banking CorporationBOEN YATORОценок пока нет

- First Phil. International Bank v. CA, G.R. No. 115849Документ2 страницыFirst Phil. International Bank v. CA, G.R. No. 115849xxxaaxxx50% (4)

- Vitug vs. Court of Appeals: GR. No. 82027, March 29, 1990Документ2 страницыVitug vs. Court of Appeals: GR. No. 82027, March 29, 1990Lucas Gabriel Johnson67% (3)

- PNB vs. Lo Et Al G.R. No. L-26937, October 5, 1927 DigestedДокумент1 страницаPNB vs. Lo Et Al G.R. No. L-26937, October 5, 1927 DigestedJacquelyn AlegriaОценок пока нет

- Barretto Vs Sta Maria DigestДокумент2 страницыBarretto Vs Sta Maria DigestRafaelAndreiLaMadrid100% (2)

- CreditTrans Calibo Vs Abella GR No. 120528Документ3 страницыCreditTrans Calibo Vs Abella GR No. 120528Jimenez LorenzОценок пока нет

- Heirs of Lim v. LimДокумент2 страницыHeirs of Lim v. LimGia DimayugaОценок пока нет

- LOPEZ V CAДокумент3 страницыLOPEZ V CANicole PT100% (1)

- Spouses Villaluz Vs Land BankДокумент2 страницыSpouses Villaluz Vs Land Bankjovifactor100% (1)

- Agency Case Spouses Yulo vs. Bank of The Philippines IslandsДокумент2 страницыAgency Case Spouses Yulo vs. Bank of The Philippines IslandsabbywinsterОценок пока нет

- In Re Petition For Assistance V BIR DigestДокумент2 страницыIn Re Petition For Assistance V BIR DigestLiana AcubaОценок пока нет

- Lim Vs Court of AppealsДокумент1 страницаLim Vs Court of AppealsLilibeth Dee GabuteroОценок пока нет

- Banas Vs Asia Pacific NILДокумент2 страницыBanas Vs Asia Pacific NILBeverlyn JamisonОценок пока нет

- Case No. 7 Philippine National Bank v. Spouses TajoneraДокумент3 страницыCase No. 7 Philippine National Bank v. Spouses TajoneraJohn Mark Magbanua100% (1)

- Si-Boco v. Yap TengДокумент2 страницыSi-Boco v. Yap TengJewelОценок пока нет

- Go V BacaronДокумент1 страницаGo V BacaronMiguel Luis GayaresОценок пока нет

- Digest of Liwanag v. CA (G.R. No. 114398)Документ1 страницаDigest of Liwanag v. CA (G.R. No. 114398)Rafael Pangilinan100% (1)

- Strong v. RepideДокумент2 страницыStrong v. RepideIllia ManaligodОценок пока нет

- Emnace v. CA - DigestДокумент2 страницыEmnace v. CA - Digestkathrynmaydeveza100% (4)

- CONSOLIDATED BANK AND TRUST CORP Vs CAДокумент2 страницыCONSOLIDATED BANK AND TRUST CORP Vs CARmLyn MclnaoОценок пока нет

- China Banking Corporation V Asian Construction CorpДокумент3 страницыChina Banking Corporation V Asian Construction CorpElah Viktoria100% (3)

- Cir Vs SuterДокумент2 страницыCir Vs Suter001nooneОценок пока нет

- Lyons v. RosenstockДокумент2 страницыLyons v. RosenstockToptopОценок пока нет

- Fieldmen's Insurance Co. v. Vda. de SongcoДокумент2 страницыFieldmen's Insurance Co. v. Vda. de SongcoIldefonso Hernaez100% (1)

- Belo v. PNBДокумент1 страницаBelo v. PNBMikkoArdina0% (1)

- DOLAR Vs SUNDIAM Case DigestДокумент2 страницыDOLAR Vs SUNDIAM Case DigestCharmaine MejiaОценок пока нет

- Vivas vs. Monetary BoardДокумент2 страницыVivas vs. Monetary BoardCaroline A. LegaspinoОценок пока нет

- Inland Realty vs. CA, 273 SCRA 70 - CDДокумент1 страницаInland Realty vs. CA, 273 SCRA 70 - CDJoseph James BacayoОценок пока нет

- FELISA ROMAN vs. ASIA BANKING CORPORATIONДокумент2 страницыFELISA ROMAN vs. ASIA BANKING CORPORATIONKiethe MyraОценок пока нет

- Central Surety and Insurance Co. Vs Ubay-1Документ2 страницыCentral Surety and Insurance Co. Vs Ubay-1Deanne Mitzi SomolloОценок пока нет

- International Exchange Bank vs. BrionesДокумент3 страницыInternational Exchange Bank vs. BrionesLupin the Third78% (9)

- 11 Phil. Virginia Tobacco Administration v. de Los Angeles (Magbanua)Документ2 страницы11 Phil. Virginia Tobacco Administration v. de Los Angeles (Magbanua)jrvyeeОценок пока нет

- Orient Air Vs Court of Appeals Case Digest On AgencyДокумент1 страницаOrient Air Vs Court of Appeals Case Digest On Agencykikhay1175% (4)

- Credit Transactions - Sps. Paray Vs RodriguezДокумент2 страницыCredit Transactions - Sps. Paray Vs RodriguezJp tan brito100% (1)

- 1CBIC Vs Keppel ShipyardДокумент2 страницы1CBIC Vs Keppel ShipyardJana Felice Paler Gonzalez100% (1)

- Victorias Milling V CAДокумент2 страницыVictorias Milling V CAwesleybooksОценок пока нет

- Tan Tiong Tick Vs American Apothecaries Co., Et AlДокумент5 страницTan Tiong Tick Vs American Apothecaries Co., Et AlJoni Aquino100% (1)

- William Ong Genato Vs Benjamin Bayhon Et - Al. GR. No. 171035, August 24, 2009Документ4 страницыWilliam Ong Genato Vs Benjamin Bayhon Et - Al. GR. No. 171035, August 24, 2009Zachary SiayngcoОценок пока нет

- Sally Yoshizaki Vs Joy Trining Center of Aurora, Inc., G.R. No. 174978 DigestДокумент2 страницыSally Yoshizaki Vs Joy Trining Center of Aurora, Inc., G.R. No. 174978 DigestKarmille Buenacosa100% (2)

- Manila Memorial Park Cemetery Vs LinsanganДокумент3 страницыManila Memorial Park Cemetery Vs LinsanganTeresa CardinozaОценок пока нет

- 6 City State Savings Vs TobiasДокумент8 страниц6 City State Savings Vs TobiasMary Fatima BerongoyОценок пока нет

- Citystate Savings Bank Vs Tobias GR No. 227990, March 7, 2018-Unathorized Bank Transactions in Behalf of OthersДокумент9 страницCitystate Savings Bank Vs Tobias GR No. 227990, March 7, 2018-Unathorized Bank Transactions in Behalf of OthersDuko Alcala EnjambreОценок пока нет

- G.R. No. 227990Документ12 страницG.R. No. 227990Chito TolentinoОценок пока нет

- Exam CasesДокумент128 страницExam CasesJunelyn T. EllaОценок пока нет

- Even Page Numbers ReversedДокумент31 страницаEven Page Numbers ReversedJunelyn T. EllaОценок пока нет

- GR No. 76951 August 24, 2010Документ7 страницGR No. 76951 August 24, 2010Junelyn T. EllaОценок пока нет

- Letter of Tony ValencianoДокумент2 страницыLetter of Tony ValencianoJunelyn T. Ella100% (3)

- Topic Doctrine of Operative Fact 2Документ5 страницTopic Doctrine of Operative Fact 2Junelyn T. EllaОценок пока нет

- People vs. Sison (2017)Документ2 страницыPeople vs. Sison (2017)Junelyn T. Ella0% (1)

- House Members: Encroachment On Congressional PowerДокумент3 страницыHouse Members: Encroachment On Congressional PowerJunelyn T. EllaОценок пока нет

- Barangay Report On The Utilization of SK Funds For Fy 2018Документ2 страницыBarangay Report On The Utilization of SK Funds For Fy 2018Junelyn T. Ella100% (1)

- Ans No. 1 Quo WarrantoДокумент2 страницыAns No. 1 Quo WarrantoJunelyn T. EllaОценок пока нет

- House Members: Encroachment On Congressional PowerДокумент14 страницHouse Members: Encroachment On Congressional PowerJunelyn T. EllaОценок пока нет

- Smart Communication Vs The City of DavaoДокумент1 страницаSmart Communication Vs The City of DavaoJunelyn T. EllaОценок пока нет

- Lucido vs. People (2017)Документ2 страницыLucido vs. People (2017)Junelyn T. Ella100% (1)

- I. Instructions: To Be Answered in Essay Format, Handwritten in Yellow Pad Paper, and To Be Submitted When Quarantine Is OverДокумент1 страницаI. Instructions: To Be Answered in Essay Format, Handwritten in Yellow Pad Paper, and To Be Submitted When Quarantine Is OverJunelyn T. EllaОценок пока нет

- Limpan Investment Corporation Vs CIRДокумент1 страницаLimpan Investment Corporation Vs CIRJunelyn T. EllaОценок пока нет

- Madrigal vs. RaffertyДокумент1 страницаMadrigal vs. RaffertyJunelyn T. EllaОценок пока нет

- Bishop of Nueva Segovia vs. Provincial Board of Ilocos NorteДокумент1 страницаBishop of Nueva Segovia vs. Provincial Board of Ilocos NorteJunelyn T. EllaОценок пока нет

- FACTS: One Set of Creditors Includes Albert Looyuko and Jose Uy. Their LawyerДокумент6 страницFACTS: One Set of Creditors Includes Albert Looyuko and Jose Uy. Their LawyerJunelyn T. EllaОценок пока нет

- SMI-Ed Philippines Technology Inc., Vs Commissioner of Internal RevenueДокумент2 страницыSMI-Ed Philippines Technology Inc., Vs Commissioner of Internal RevenueJunelyn T. EllaОценок пока нет

- Lasam Vs UmenganДокумент1 страницаLasam Vs UmenganJunelyn T. EllaОценок пока нет

- Aint Ouis Niversity: School of Engineering and Architecture Mechanical and Mechatronics Engineering DepartmentДокумент1 страницаAint Ouis Niversity: School of Engineering and Architecture Mechanical and Mechatronics Engineering DepartmentJor Dan100% (1)

- NLSIU Bangalore 2015Документ1 страницаNLSIU Bangalore 2015rohitОценок пока нет

- USDC Awards MFE Founder Bradford Over $40K in TILA LawsuitДокумент5 страницUSDC Awards MFE Founder Bradford Over $40K in TILA LawsuitStorm BradfordОценок пока нет

- Citizen's Alliance V Energy Regulatory CommissionДокумент1 страницаCitizen's Alliance V Energy Regulatory CommissionJason KingОценок пока нет

- Abada Vs CaponongДокумент2 страницыAbada Vs CaponongChaОценок пока нет

- I. The Actus Reus: It Is A Well Known Fact That As Long As AДокумент4 страницыI. The Actus Reus: It Is A Well Known Fact That As Long As AShaguolo O. Joseph100% (1)

- Land Titles and Deeds Case Digest: Lee Hong Kok V. David (1972) G.R. No. L-30389Документ2 страницыLand Titles and Deeds Case Digest: Lee Hong Kok V. David (1972) G.R. No. L-30389Aljay LabugaОценок пока нет

- Jp-05-Special Laws Related To Criminal LawДокумент3 страницыJp-05-Special Laws Related To Criminal LawJvnRodz P GmlmОценок пока нет

- Working Capital TOOLSДокумент11 страницWorking Capital TOOLSJelimae LantacaОценок пока нет

- Criminal Law Review Manila Law College 1 Sem, SY 2020-2021 Selected Bar Examination Questions in Criminal Law and Related Supreme Court RulingsДокумент5 страницCriminal Law Review Manila Law College 1 Sem, SY 2020-2021 Selected Bar Examination Questions in Criminal Law and Related Supreme Court RulingsChristine Aev OlasaОценок пока нет

- Pre-Bid Joint Venture AgreementДокумент6 страницPre-Bid Joint Venture AgreementMarx de Chavez67% (3)

- Action de in Rem Verso Is An Action For Unjust EnrichmentДокумент2 страницыAction de in Rem Verso Is An Action For Unjust EnrichmentAndreo Miguel H. ZamoraОценок пока нет

- Clarkson14e PPT ch03Документ58 страницClarkson14e PPT ch03AngelicaОценок пока нет

- Full Judgement On Republic V Eugene Baffoe Bonnie and Four OthersДокумент67 страницFull Judgement On Republic V Eugene Baffoe Bonnie and Four OthersThe Independent GhanaОценок пока нет

- 8 Stages of Development by Erik EriksonДокумент2 страницы8 Stages of Development by Erik EriksonLloyd GalonОценок пока нет

- UNICEF WHO UNESCO Handbook School Based ViolenceДокумент72 страницыUNICEF WHO UNESCO Handbook School Based Violencesofiabloem100% (1)

- United States v. Liverman, 4th Cir. (1997)Документ5 страницUnited States v. Liverman, 4th Cir. (1997)Scribd Government DocsОценок пока нет

- Republic of The Philippines V Sunvar Relaty DevtДокумент2 страницыRepublic of The Philippines V Sunvar Relaty DevtElah ViktoriaОценок пока нет

- Corp Law CasesДокумент15 страницCorp Law CasesNoel IV T. BorromeoОценок пока нет

- Amended Complaint - AAPS v. Texas Medical BoardДокумент15 страницAmended Complaint - AAPS v. Texas Medical BoardAssociation of American Physicians and SurgeonsОценок пока нет

- Business Associations Outline + ChecklistДокумент44 страницыBusiness Associations Outline + ChecklistCAlawoutlines100% (27)

- LAW ON BUSINESS ORGS Midterm ReviewerДокумент6 страницLAW ON BUSINESS ORGS Midterm ReviewerAdenielle DiLaurentisОценок пока нет

- Exam Final Coaching 2014 Mock Board Part I QuestionsДокумент5 страницExam Final Coaching 2014 Mock Board Part I Questionsjade123_129Оценок пока нет

- Director of Lands vs. CA & Salazar - LTDДокумент2 страницыDirector of Lands vs. CA & Salazar - LTDJulius Geoffrey TangonanОценок пока нет

- Group 6 - Navarro V PV Pajarillo LinerДокумент2 страницыGroup 6 - Navarro V PV Pajarillo LinerCharles Bill RafananОценок пока нет

- Introduction To Psychology ASSIGNMENT 4Документ4 страницыIntroduction To Psychology ASSIGNMENT 4CRAIG JOSEPHОценок пока нет

- Land Bank of The Philippines Vs Court of AppealsДокумент2 страницыLand Bank of The Philippines Vs Court of AppealsAbbyAlvarezОценок пока нет

- SANGGUNIANG PANLUNGSOD NG BAGUIO vs. JADEWELL PARKING (G.R. No. 160025. April 20, 2005)Документ3 страницыSANGGUNIANG PANLUNGSOD NG BAGUIO vs. JADEWELL PARKING (G.R. No. 160025. April 20, 2005)Keenan K Mangiwet67% (3)

- Supreme Court 2018: Plea Bargaining in Drugs Cases FrameworkДокумент8 страницSupreme Court 2018: Plea Bargaining in Drugs Cases FrameworkNami Buan80% (5)

- Public International Law PDFДокумент734 страницыPublic International Law PDFHexzy JaneОценок пока нет