Академический Документы

Профессиональный Документы

Культура Документы

Beta Management Questions

Загружено:

bjhhjИсходное описание:

Авторское право

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Beta Management Questions

Загружено:

bjhhjАвторское право:

PHBS School of Business

Peking University

Investment

Prof. Wei Xu

Case Study Questions: Beta Management and Portfolio Choice Example

A manager of a small investment company has been successfully using index funds for limited

market timing. Growth has allowed her to move into picking stocks. She is considering two

small and highly variable listed stocks, but is concerned about the risk that these investments

might add to her portfolio. This case provides you with an opportunity to learn about total risk,

non-diversifiable (or portfolio risk), and (CAPM) beta. You will calculate variability of the

stocks separately, and portfolio variance with and without the stocks, as well as stock betas.

Part A: Beta Management Company

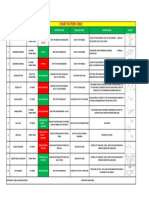

These questions relate to the Beta Management Company case in your course packet. You can

find the data for this case on the course website in a spreadsheet named: Beta Management

Company Exhibits.xls.

1. How risky are the three investments? Calculate the variability (standard deviation) of

the stock returns of California REIT and Brown Group during the past 2 years. How

variable are they compared with the Vanguard Index 500 Trust? Which stock appears to be

riskiest? Based on these risk estimates, which investment should have the highest expected

return?

2. To analyze the effect of the asset allocation decision at Beta Management, you should

examine three possible modifications. Assume Beta Management presently has 99% of its

assets in the Vanguard Index 500 (and 1% in the riskless asset). Consider moving 1% of the

assets to either (A) an additional holding in the Vanguard Index; (B) California REIT; or (C)

Brown Group. Calculate the variability of the portfolio using each asset. How does each

asset affect the variability of the total investment, and which asset produces the riskiest

portfolio? Explain how this makes sense in view of your answer to Question (1) above.

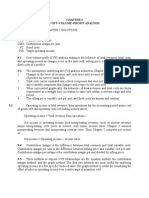

3. Perform a regression of each stock’s monthly returns on the Vanguard Index returns to

compute the “beta” for each stock1. How do these “betas” relate to your answer to Question

(2) above?

4. How might the expected return for each stock relate to the measures of riskiness

obtained in Question (1) and (2)? In other words, what return does each of the two stocks

need to provide to make investors interested in buying them?

1

Hint: In this regression the return of each stock will be your left hand side variable (or your “y” variable) and the

return on the index fund will be your right hand side variable (or your “x” variable). The beta will be the estimated

coefficient on your x variable. If you are working in Excel, the functions SLOPE and LINEST will both estimate

the beta. You should choose to have a constant in your regression – this is the default option for both commands.

You can also use the statistics tool in Excel, or any other statistical software you are accustomed to.

Вам также может понравиться

- 18-Conway IndustriesДокумент5 страниц18-Conway IndustriesKiranJumanОценок пока нет

- Financial Management at Bajaj AutoДокумент8 страницFinancial Management at Bajaj AutoNavin KumarОценок пока нет

- Accounting in Action: Assignment Classification TableДокумент50 страницAccounting in Action: Assignment Classification TableChi IuvianamoОценок пока нет

- Valuing ProjectsДокумент5 страницValuing ProjectsAjay SinghОценок пока нет

- 07 Time Value of Money - BE ExercisesДокумент26 страниц07 Time Value of Money - BE ExercisesMUNDADA VENKATESH SURESH PGP 2019-21 BatchОценок пока нет

- Case 5Документ12 страницCase 5JIAXUAN WANGОценок пока нет

- Nike AnalysisДокумент27 страницNike Analysisriz4winОценок пока нет

- Bond Problem - Fixed Income ValuationДокумент1 страницаBond Problem - Fixed Income ValuationAbhishek Garg0% (2)

- Tata Motors ValuationДокумент38 страницTata Motors ValuationAkshat JainОценок пока нет

- Super ProjectДокумент1 страницаSuper ProjectVaibhav SaithОценок пока нет

- Sun Brewing Case ExhibitsДокумент26 страницSun Brewing Case ExhibitsShshankОценок пока нет

- SCM - Managing Uncertainty in DemandДокумент27 страницSCM - Managing Uncertainty in DemandHari Madhavan Krishna KumarОценок пока нет

- GM588 - Practice Quiz 1Документ4 страницыGM588 - Practice Quiz 1Chooy100% (1)

- Daktronics E Dividend Policy in 2010Документ26 страницDaktronics E Dividend Policy in 2010IBRAHIM KHANОценок пока нет

- JHT Case ExcelДокумент4 страницыJHT Case Excelanup akasheОценок пока нет

- CH 22: Lease, Hire Purchase and Project FinancingДокумент7 страницCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanОценок пока нет

- Integrative Case 4.0Документ3 страницыIntegrative Case 4.0Archit SharmaОценок пока нет

- Baldwin Bicycle Company - Final Assignment - Group F - 20210728Документ4 страницыBaldwin Bicycle Company - Final Assignment - Group F - 20210728ApoorvaОценок пока нет

- Working Capital Problem SolutionДокумент10 страницWorking Capital Problem SolutionMahendra ChouhanОценок пока нет

- Final Draft - MFIДокумент38 страницFinal Draft - MFIShaquille SmithОценок пока нет

- ZomatoДокумент56 страницZomatopreethishОценок пока нет

- Fonderia Case AssignmentДокумент1 страницаFonderia Case Assignmentpoo_granger5229Оценок пока нет

- Case 26 An Introduction To Debt Policy AДокумент5 страницCase 26 An Introduction To Debt Policy Amy VinayОценок пока нет

- EX 1 - WilkersonДокумент8 страницEX 1 - WilkersonDror PazОценок пока нет

- Hitungan Kuis 6 Bethesda Mining CompanyДокумент6 страницHitungan Kuis 6 Bethesda Mining Companyrica100% (1)

- Zong BДокумент3 страницыZong BAbdul Rehman AmiwalaОценок пока нет

- Case Study Beta Management Company: Raman Dhiman Indian Institute of Management (Iim), ShillongДокумент8 страницCase Study Beta Management Company: Raman Dhiman Indian Institute of Management (Iim), ShillongFabián Fuentes100% (1)

- Tata MotorsДокумент2 страницыTata MotorsTanvi SharmaОценок пока нет

- Case Case:: Colorscope, Colorscope, Inc. IncДокумент4 страницыCase Case:: Colorscope, Colorscope, Inc. IncBalvinder SinghОценок пока нет

- Bearn Sterns and Co.Документ10 страницBearn Sterns and Co.eidel18400% (1)

- West Teleservice: Case QuestionsДокумент1 страницаWest Teleservice: Case QuestionsAlejandro García AcostaОценок пока нет

- Shimano 3Документ14 страницShimano 3Tigist AlemayehuОценок пока нет

- Vyaderm Caseanalysis PDFДокумент6 страницVyaderm Caseanalysis PDFSahil Azher RashidОценок пока нет

- Super ProjectДокумент6 страницSuper ProjectMônica MelloОценок пока нет

- Nike Case AnalysisДокумент9 страницNike Case AnalysisRizka HendrawanОценок пока нет

- Baldwin Bicycle CompanyДокумент19 страницBaldwin Bicycle CompanyMannu83Оценок пока нет

- Case 75 The Western Co DirectedДокумент10 страницCase 75 The Western Co DirectedHaidar IsmailОценок пока нет

- Worldwide Paper CompanyДокумент1 страницаWorldwide Paper CompanyendiaoОценок пока нет

- Numerical ExampleДокумент2 страницыNumerical ExampleVishal GoyalОценок пока нет

- Impairing The Microsoft - Nokia PairingДокумент54 страницыImpairing The Microsoft - Nokia Pairingjk kumarОценок пока нет

- Vyaderm-Case Analysis 2006Документ4 страницыVyaderm-Case Analysis 2006Mridul SharmaОценок пока нет

- FM11 CH 11 Mini CaseДокумент13 страницFM11 CH 11 Mini CasesushmanthqrewrerОценок пока нет

- Chapter 13 MK 2Документ5 страницChapter 13 MK 2Novelda100% (1)

- Homework Assignment 1 KeyДокумент6 страницHomework Assignment 1 KeymetetezcanОценок пока нет

- Cafe Monte BiancoДокумент21 страницаCafe Monte BiancoWilliam Torrez OrozcoОценок пока нет

- Kamoki Poultry FeedsДокумент2 страницыKamoki Poultry Feedssidra imtiazОценок пока нет

- Integrative Case 10 1 Projected Financial Statements For StarbucДокумент2 страницыIntegrative Case 10 1 Projected Financial Statements For StarbucAmit PandeyОценок пока нет

- Jaga: Managing Creativity and Open Innovation: Neelu, Parthib, Saurabh, Shikhar, Yash SagarДокумент22 страницыJaga: Managing Creativity and Open Innovation: Neelu, Parthib, Saurabh, Shikhar, Yash SagarSAURABH YADAVОценок пока нет

- Debt Policy at UST IncДокумент5 страницDebt Policy at UST Incggrillo73Оценок пока нет

- Sneaker Excel Sheet For Risk AnalysisДокумент11 страницSneaker Excel Sheet For Risk AnalysisSuperGuyОценок пока нет

- Chapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldДокумент25 страницChapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldPayal ChauhanОценок пока нет

- Investment Analysis and Lockheed TristarДокумент9 страницInvestment Analysis and Lockheed TristarRajesh KumarОценок пока нет

- Problem Set 2 SolutionДокумент10 страницProblem Set 2 SolutionLawly GinОценок пока нет

- Chapter 6 Review in ClassДокумент32 страницыChapter 6 Review in Classjimmy_chou1314Оценок пока нет

- Corporate Financial Analysis with Microsoft ExcelОт EverandCorporate Financial Analysis with Microsoft ExcelРейтинг: 5 из 5 звезд5/5 (1)

- Chapter 27: The Theory of Active Portfolio Management: Problem SetsДокумент1 страницаChapter 27: The Theory of Active Portfolio Management: Problem SetsMehrab Jami Aumit 1812818630Оценок пока нет

- Effecient Frontier Stock PortfoliosДокумент60 страницEffecient Frontier Stock Portfoliosee1993Оценок пока нет

- Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank CH 5Документ4 страницыModern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank CH 5HarshОценок пока нет

- Analyzing Mutal Fund PerformanceДокумент4 страницыAnalyzing Mutal Fund PerformanceMeghananda s oОценок пока нет

- DiversificationPremium PDFДокумент7 страницDiversificationPremium PDFCorey PageОценок пока нет

- Depreciation AnswersДокумент13 страницDepreciation AnswersGabrielle Joshebed Abarico100% (2)

- IBT Lesson 5Документ19 страницIBT Lesson 5De Leon LeizylОценок пока нет

- Derivatives and Risk Management (2017)Документ10 страницDerivatives and Risk Management (2017)ashok kumar vermaОценок пока нет

- Nilamadhab Mohanty CimpДокумент14 страницNilamadhab Mohanty CimpSuraj KumarОценок пока нет

- Chart Pattern Table: S.No Types of Chart Pattern Found Trend Pattern Interpretation Measure Target Identification SymbolДокумент1 страницаChart Pattern Table: S.No Types of Chart Pattern Found Trend Pattern Interpretation Measure Target Identification SymbolGoogleuser googleОценок пока нет

- Module 1 Product & Brand Management1Документ36 страницModule 1 Product & Brand Management1amuliya v.sОценок пока нет

- Walt Disney Yen Financing I - Group 8Документ6 страницWalt Disney Yen Financing I - Group 8Sonal Choudhary100% (1)

- Can Price Anomalies Been Obtained by Using Candlestick Patterns?Документ27 страницCan Price Anomalies Been Obtained by Using Candlestick Patterns?Adnan WasimОценок пока нет

- 1DSAP CHEAT SHEET Order To Cash (OTC) Process For SAP Functional Consultants Summary TabletДокумент12 страниц1DSAP CHEAT SHEET Order To Cash (OTC) Process For SAP Functional Consultants Summary TabletKunjunni MashОценок пока нет

- Valuation of Joina City MallДокумент5 страницValuation of Joina City MallrudolfОценок пока нет

- Receipt PDFДокумент2 страницыReceipt PDFObi ToОценок пока нет

- Activity-Based CostingДокумент20 страницActivity-Based CostingamartyadasОценок пока нет

- By Emran Mohammad (Emd) MKT 337 (Sections 3)Документ16 страницBy Emran Mohammad (Emd) MKT 337 (Sections 3)Asif RafiОценок пока нет

- NBP Nafa Funds PDFДокумент23 страницыNBP Nafa Funds PDFHamid AliОценок пока нет

- Enf HDR Global Trading Complaint 100120Документ40 страницEnf HDR Global Trading Complaint 100120MichaelPatrickMcSweeney100% (1)

- Pricing-Good NightДокумент17 страницPricing-Good NightSanjeev ThadaniОценок пока нет

- Global Integrated Energy May 13Документ14 страницGlobal Integrated Energy May 13Ben ChuaОценок пока нет

- CHAPTER 3 Question SolutionsДокумент3 страницыCHAPTER 3 Question Solutionscamd12900% (1)

- Assignment Oligopoly SolutionsДокумент12 страницAssignment Oligopoly SolutionsJoris Jannis0% (1)

- Long-Run Cost: The Production FunctionДокумент11 страницLong-Run Cost: The Production FunctionPUBG LOVERSОценок пока нет

- Differential Cost AnalysisДокумент1 страницаDifferential Cost AnalysisNinaОценок пока нет

- Mie L1 AbДокумент38 страницMie L1 AbSakshi MОценок пока нет

- Top Seven HR Challenges.Документ20 страницTop Seven HR Challenges.myasirnsОценок пока нет

- Tamil Nadu TRB Tet TNPSC - Class 12 - Eco-commerce-Accountancy em - Minimum Material Download - Plus Two Study MaterialsДокумент94 страницыTamil Nadu TRB Tet TNPSC - Class 12 - Eco-commerce-Accountancy em - Minimum Material Download - Plus Two Study Materialsvb_krishnaОценок пока нет

- 3rd Qrtr. First Summative Grade 6Документ3 страницы3rd Qrtr. First Summative Grade 6daryl tulangОценок пока нет

- Service MarketingДокумент14 страницService MarketingShivani JoshiОценок пока нет

- Workout QuestionsДокумент5 страницWorkout Questionssam100% (1)

- Thesis Data Analysis SectionДокумент5 страницThesis Data Analysis Sectioniinlutvff100% (2)

- Brand Centric Transformation - Brand LadderДокумент23 страницыBrand Centric Transformation - Brand LadderGabriela SiquieroliОценок пока нет

- BancomundialpaperДокумент32 страницыBancomundialpaperpaulo.bessa.antunesОценок пока нет