Академический Документы

Профессиональный Документы

Культура Документы

Scan 0058

Загружено:

Zeyad El-sayedОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Scan 0058

Загружено:

Zeyad El-sayedАвторское право:

Доступные форматы

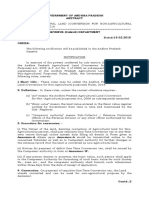

46 MODULE 33 TAXES: INDIVIDUAL

6

III.A. Medical and Dental Expenses payer is treated as having paid those expenses. Here, the

106. (b) The requirement is to determine Carroll's maxi- Sloans can deduct the child's medical expenses of $5,000

mum medical expense deduction after the applicable thresh- that they paid. On the other band, the legal expenses of

old limitation for the year. An individual taxpayer's unre- $9,000 and agency fee of $4,000 incurred in connection with

the adoption are treated as nondeductible personal expenses.

imbursed medical expenses are deductible to the extent in

However, the Sloans will qualify to claim a nonrefundable

excess of7.5% of the taxpayer's adjusted gross income.

tax credit of up to $12,150 (for 2009) for these qualified

Although the cost of cosmetic surgery is generally not de-

adoption expenses.

ductible, the cost is deductible if the cosmetic surgery or

procedure is necessary to ameliorate a deformity related to a 111. (a) The requirement is to determine the amount that

congenital abnormality or personal injury resulting from an can be claimed by the Clines in their 2009 return as quali-

accident, trauma, or disfiguring disease. Here, Carroll's fying medical expenses. No medical expense deduction is

deduction is ($5,000 + $15,000) - ($100,000 x 7.5%) = allowed for cosmetic surgery or similar procedures, unless

$12,500. the surgery or procedure is necessary to ameliorate a de-

formity related to a congenital abnormality or personal in-

107. (b) The requirement is to determine the Blairs' item- jury resulting from an accident, trauma, or disfiguring dis-

ized deduction for medical expenses for 2009. A taxpayer ease. Cosmetic surgery is defined as any procedure that is

can deduct the amounts paid for the medical care of himself, directed at improving a patient's appearance and does not

spouse, or dependents. The Blairs' qualifying medical ex- meaningfully promote the proper function of the body or

penses include the $800 of medical insurance premiums, prevent or treat illness or disease. Thus, Ruth's face-lift and

$450 of prescribed medicines, $1,000 of unreimbursed doc- Mark's hair transplant do not qualify as deductible medical

tor's fees, and $150 of transportation related to medical care. expenses in 2009.

These expenses, which total $2,400, are deductible to the

extent they exceed 7.5% of adjusted gross income, and result 112. (d) The requirement is to determine the amount that

in a deduction of $150. Note that nonprescription medi- Scott can claim as deductible medical expenses. The medi-

cines, including aspirin and over-the-counter cold capsules, . cal expenses incurred by a taxpayer for himself, spouse, or a

are not deductible. Additionally, the Blairs cannot deduct dependent are deductible when paid or charged to a credit

the emergency room fee they paid for their son because they card. The $4,000 of medical expenses for his dependent son

did not provide more than half of his support and he there- are deductible by Scott in 2009 when charged on Scott's

fore does not qualify as their dependent. credit card. It does not matter that payment to the credit

card issuer had not been made when Scott filed his return.

108. (a) The requirement is to determine the amount the Expenses paid for the medical care of a decedent by the de-

Whites may deduct as qualifying medical expenses without cedent's spouse are deductible as medical expenses in the

regard to the adjusted gross income percentage threshold. ·1 year they are paid, whether the expenses are paid

The Whites' deductible medical expenses include the $600 before or

spent On repair and maintenance of the motorized wheelchair after the decedent's death. Thus, the $2,800 of medical ex-

and the $8,000 spent for tuition, meals, and lodging at the penses for his deceased spouse are deductible by Scott when

special school for their physically handicapped dependent paid in 2009, even though his spouse died in 2008.

child. Payment for meals and lodging provided by an insti-

tution as a necessary part of medical care is deductible as a 113. (d) The requirement is to determine which expendi-

medical expense if the main reason for being in the institu- ture qualifies as a deductible medical expense. Premiums

tion is to receive medical care. Here, the item indicates that paid for Medicare B supplemental medical insurance qualify

the Whites' physically handicapped dependent child was in as a deductible expense: Diaper service, funeral expenses,

the institution primarily for the availability of medical care, and nursing care for a healthy baby are not deductible as

and that meals and lodging were furnished as necessary in- medical expenses. .

cidents to that care. 114. (b) The requirement is to determine Stenger's net

109. (c) The requirement is to determine the amount medical expense deduction for 2009. It would be computed

Wells can deduct as qualifying medical expenses without as follows:

Prescription drugs $300

regard to the adjusted gross income percentage threshold. Medical insurance premiums 750

Wells' deductible medical expenses include the $500 pre- Doctors ($2,550 - $900) 1,650

mium on the prescription drug insurance policy and the $500 Eyeglasses ----12

unreimbursed payment for physical therapy. The earnings $2,775

Less 7.5% of AGI ($35,000)

protection policy is not considered medical insurance be- Medical expense deduction for 2009 2.ru

cause payments are not based on the amount of medical $---.l.5

expenses incurred. As a result, the $3,000 premium is a 115. (d) The requirement is to determine the total amount

Q

nondeductible personal expense. of deductible medical expenses for the Bensons before the

application of any limitation rules. Deductible medical ex-

110. (d) The requirement is to determine the amount of penses include those incurred by a taxpayer, taxpayer's

expenses incurred in connection with the adoption of a child spouse, dependents of the taxpayer, or any person for whom

that can be deducted by the Sloans on their 2009 joint re- the taxpayer could claim a dependency exemption except

turn. A taxpayer can deduct the medical expenses paid for a that the person had gross income of $3,650 or more, or filed

child at the time of adoption if the child qualifies as the tax- a joint return. Thus, the Bensons may deduct medical ex-

payer's dependent when the medical expenses are paid. penses incurred for themselves, for John (i.e., no depen-

Additionally, if a taxpayer pays an adoption agency for dency exemption only because his gross income is $3,650 or

medical expenses the adoption agency already paid, the tax- more), and for Nancy (i.e., a dependent of the Bensons).

Вам также может понравиться

- Module 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOOДокумент1 страницаModule 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOOAnonymous JqimV1EОценок пока нет

- US Internal Revenue Service: I1040sa - 1997Документ7 страницUS Internal Revenue Service: I1040sa - 1997IRSОценок пока нет

- SolutionsДокумент25 страницSolutionsapi-3817072100% (4)

- ACCT 450 CH Chapter 5 - GROSS INCOME: EXCLUSIONSДокумент9 страницACCT 450 CH Chapter 5 - GROSS INCOME: EXCLUSIONSacctg46100% (1)

- Prentice Halls Federal Taxation 2014 Comprehensive Rupert 27th Edition Solutions ManualДокумент28 страницPrentice Halls Federal Taxation 2014 Comprehensive Rupert 27th Edition Solutions ManualBrittanyMorrismxgo100% (41)

- Top Personal Injury Lawyer in SingaporeДокумент5 страницTop Personal Injury Lawyer in SingaporesingaporelawyerОценок пока нет

- Essentials of Federal Taxation 3rd Edition Spilker Test BankДокумент67 страницEssentials of Federal Taxation 3rd Edition Spilker Test Bankdilysiristtes5Оценок пока нет

- Chapter 10Документ4 страницыChapter 10张心怡Оценок пока нет

- US Internal Revenue Service: p502 - 1999Документ19 страницUS Internal Revenue Service: p502 - 1999IRSОценок пока нет

- Chapter 8 - AnswersДокумент4 страницыChapter 8 - Answersiqiz1998Оценок пока нет

- How To Pay IRSДокумент15 страницHow To Pay IRSPortgas D. AceОценок пока нет

- Essentials of Federal Taxation 2016 Edition 7th Edition Spilker Test Bank 1Документ36 страницEssentials of Federal Taxation 2016 Edition 7th Edition Spilker Test Bank 1whitneyreynoldsnzrtkbamfd100% (26)

- I 1040 ScaДокумент15 страницI 1040 Scaapi-173610472Оценок пока нет

- Essentials of Federal Taxation 2017 8th Edition Spilker Test Bank 1Документ36 страницEssentials of Federal Taxation 2017 8th Edition Spilker Test Bank 1whitneyreynoldsnzrtkbamfd100% (23)

- TaxДокумент14 страницTaxXinyi JiangОценок пока нет

- Feldblum (Discounting Note)Документ8 страницFeldblum (Discounting Note)Anna KrylovaОценок пока нет

- Pearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Solutions ManualДокумент24 страницыPearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Solutions Manualalyssahoffmantbqfyjwszi100% (26)

- Ebook CCH Federal Taxation Comprehensive Topics 2013 1St Edition Harmelink Test Bank Full Chapter PDFДокумент40 страницEbook CCH Federal Taxation Comprehensive Topics 2013 1St Edition Harmelink Test Bank Full Chapter PDFlionelthitga2100% (12)

- 2022 Instructions For Schedule A: Itemized DeductionsДокумент17 страниц2022 Instructions For Schedule A: Itemized DeductionsNikhil_gherwarОценок пока нет

- US Internal Revenue Service: I1040sa - 2004Документ8 страницUS Internal Revenue Service: I1040sa - 2004IRSОценок пока нет

- US Internal Revenue Service: rr-02-41Документ4 страницыUS Internal Revenue Service: rr-02-41IRSОценок пока нет

- US Internal Revenue Service: p907 - 1997Документ8 страницUS Internal Revenue Service: p907 - 1997IRSОценок пока нет

- Deductions Under Chapter VIДокумент4 страницыDeductions Under Chapter VIMonisha ParekhОценок пока нет

- Direct TaxДокумент13 страницDirect TaxUMMYSALMA DAMANIAОценок пока нет

- AR CC Finance Committee February 2018.2 - 01 17 2018Документ10 страницAR CC Finance Committee February 2018.2 - 01 17 2018The Daily LineОценок пока нет

- 2022 Patriot America Plus PATAP PGTAPДокумент37 страниц2022 Patriot America Plus PATAP PGTAPmaОценок пока нет

- US Internal Revenue Service: I1040sa - 2003Документ8 страницUS Internal Revenue Service: I1040sa - 2003IRSОценок пока нет

- Pearsons Federal Taxation 2017 Individuals 30th Edition Pope Test BankДокумент39 страницPearsons Federal Taxation 2017 Individuals 30th Edition Pope Test Bankhenrycpwcooper100% (13)

- Cruz16e Chap09 IMДокумент10 страницCruz16e Chap09 IMJosef Galileo SibalaОценок пока нет

- Chapter 5Документ26 страницChapter 5Reese Parker33% (3)

- US Internal Revenue Service: p907 - 1998Документ8 страницUS Internal Revenue Service: p907 - 1998IRSОценок пока нет

- US Internal Revenue Service: p502 - 1995Документ20 страницUS Internal Revenue Service: p502 - 1995IRSОценок пока нет

- Industrial Disability RetirementДокумент3 страницыIndustrial Disability RetirementZack MarksОценок пока нет

- QBE PA Prestige - Brochure - 051120 - BrochureДокумент10 страницQBE PA Prestige - Brochure - 051120 - BrochureCheah Chee MunОценок пока нет

- SGPS - Travel Insurance BrochureДокумент4 страницыSGPS - Travel Insurance Brochuremackenziebromstad1265Оценок пока нет

- Assa How Does It WorkДокумент1 страницаAssa How Does It WorklackinglatinОценок пока нет

- Bacc 403 Tax, Law & Practice 1Документ8 страницBacc 403 Tax, Law & Practice 1ItdarareОценок пока нет

- Essentials of Federal Taxation 2018 Edition 9th Edition Spilker Solutions Manual 1Документ49 страницEssentials of Federal Taxation 2018 Edition 9th Edition Spilker Solutions Manual 1carrie100% (35)

- US Internal Revenue Service: p907 - 2000Документ11 страницUS Internal Revenue Service: p907 - 2000IRSОценок пока нет

- Star Health and Allied Insurance Company Limited: Prospectus - Mediclassic Insurance Policy (Individual)Документ8 страницStar Health and Allied Insurance Company Limited: Prospectus - Mediclassic Insurance Policy (Individual)mfsrajОценок пока нет

- SolutionsДокумент23 страницыSolutionsapi-3817072Оценок пока нет

- Patriot America Plus: Certificate of InsuranceДокумент35 страницPatriot America Plus: Certificate of InsuranceNavidadОценок пока нет

- HealthSaverBrochureNew PDFДокумент13 страницHealthSaverBrochureNew PDFumangОценок пока нет

- Problem Set 6Документ2 страницыProblem Set 6ShaoPuYuОценок пока нет

- AMA - State Patient Compensation FundsДокумент4 страницыAMA - State Patient Compensation FundsjojobagginsОценок пока нет

- Lecture 9 - Insurance 2Документ30 страницLecture 9 - Insurance 2Phí Thị Hoàng HàОценок пока нет

- Taxation - Direct and Indirect 2022Документ10 страницTaxation - Direct and Indirect 2022Sagar JindalОценок пока нет

- US Internal Revenue Service: p907 - 2002Документ12 страницUS Internal Revenue Service: p907 - 2002IRSОценок пока нет

- US Internal Revenue Service: I1040as2 - 2005Документ3 страницыUS Internal Revenue Service: I1040as2 - 2005IRSОценок пока нет

- US Internal Revenue Service: p907 - 2001Документ12 страницUS Internal Revenue Service: p907 - 2001IRSОценок пока нет

- Certificate of Insurance: Patriot America PlusДокумент24 страницыCertificate of Insurance: Patriot America PlusKARTHIK145Оценок пока нет

- SB 530 531Документ10 страницSB 530 531WWMTОценок пока нет

- Vi K. Credit For The E E Yandthed Sab Ed: M Ule Taxes: Ind Vi UalДокумент3 страницыVi K. Credit For The E E Yandthed Sab Ed: M Ule Taxes: Ind Vi UalZeyad El-sayedОценок пока нет

- Paying For National Health Insurance-And Not Getting ItДокумент11 страницPaying For National Health Insurance-And Not Getting Itcaneman85Оценок пока нет

- Essentials of Federal Taxation 2017 8th Edition Spilker Solutions ManualДокумент47 страницEssentials of Federal Taxation 2017 8th Edition Spilker Solutions Manualkieraquachbs2ir100% (23)

- Essentials of Federal Taxation 2017 8th Edition Spilker Solutions Manual Full Chapter PDFДокумент67 страницEssentials of Federal Taxation 2017 8th Edition Spilker Solutions Manual Full Chapter PDFdilysiristtes5100% (13)

- IG CH 03Документ20 страницIG CH 03Basa TanyОценок пока нет

- Scan 0001Документ2 страницыScan 0001Zeyad El-sayedОценок пока нет

- Scan 0001Документ2 страницыScan 0001Zeyad El-sayedОценок пока нет

- Fede Al Securities Acts: OvervieДокумент2 страницыFede Al Securities Acts: OvervieZeyad El-sayedОценок пока нет

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateДокумент3 страницыS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedОценок пока нет

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Документ2 страницыModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedОценок пока нет

- Scan 0013Документ2 страницыScan 0013Zeyad El-sayedОценок пока нет

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossДокумент3 страницыSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedОценок пока нет

- Deduct From Book Income: - B - T F Dul - .Документ2 страницыDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedОценок пока нет

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEДокумент3 страницыP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedОценок пока нет

- Scan 0010Документ3 страницыScan 0010Zeyad El-sayedОценок пока нет

- Scan 0012Документ2 страницыScan 0012Zeyad El-sayedОценок пока нет

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZДокумент2 страницыModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedОценок пока нет

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateДокумент2 страницыI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedОценок пока нет

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateДокумент2 страницы80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedОценок пока нет

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Документ2 страницыThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedОценок пока нет

- Revocation of Discharge: 2M Module27 BankruptcyДокумент2 страницыRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedОценок пока нет

- Scan 0010Документ2 страницыScan 0010Zeyad El-sayedОценок пока нет

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CДокумент3 страницыModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedОценок пока нет

- Scan 0018Документ1 страницаScan 0018Zeyad El-sayedОценок пока нет

- Bankruptcy:: y y S e S Owed SДокумент3 страницыBankruptcy:: y y S e S Owed SZeyad El-sayedОценок пока нет

- Module 21 Professional Responsibilities: Interpretation 101-2. A FirmДокумент2 страницыModule 21 Professional Responsibilities: Interpretation 101-2. A FirmZeyad El-sayedОценок пока нет

- B Nkruptcy: Discharge of A BankruptДокумент2 страницыB Nkruptcy: Discharge of A BankruptZeyad El-sayedОценок пока нет

- Scan 0008Документ2 страницыScan 0008Zeyad El-sayedОценок пока нет

- ET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsДокумент2 страницыET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsZeyad El-sayedОценок пока нет

- Scan 0006Документ2 страницыScan 0006Zeyad El-sayedОценок пока нет

- Scan 0008Документ2 страницыScan 0008Zeyad El-sayedОценок пока нет

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsДокумент2 страницыProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedОценок пока нет

- Article I Responsibilities. Article Il-The Public InterestДокумент2 страницыArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedОценок пока нет

- Scan 0009Документ2 страницыScan 0009Zeyad El-sayedОценок пока нет

- Scan 0008Документ2 страницыScan 0008Zeyad El-sayedОценок пока нет

- BURTON, The Roman Imperial State, Provincial Governors and The Public Finances of Provincial Cities, 27 B.C.-A.D. 235Документ33 страницыBURTON, The Roman Imperial State, Provincial Governors and The Public Finances of Provincial Cities, 27 B.C.-A.D. 235seminariodigenovaОценок пока нет

- HSC Business Studies Syllabus Revision GuideДокумент96 страницHSC Business Studies Syllabus Revision GuideEdward Pym100% (3)

- IT-2 2011 With Formula and Surcharge and Annex DДокумент15 страницIT-2 2011 With Formula and Surcharge and Annex DPatti DaudОценок пока нет

- ILS in BFДокумент10 страницILS in BFNicole Andrea TuazonОценок пока нет

- FINANCE Interview QuestionsДокумент3 страницыFINANCE Interview Questionssakthi80856595Оценок пока нет

- Special Commercial Law Case DigestsДокумент69 страницSpecial Commercial Law Case DigestsSuri LeeОценок пока нет

- Chief Engineer IBIS-Indus Telemetry - HP CLJ 255dw Printer - Q171123 - NomanДокумент3 страницыChief Engineer IBIS-Indus Telemetry - HP CLJ 255dw Printer - Q171123 - NomanMumtaz Ali QaziОценок пока нет

- InvoiceДокумент1 страницаInvoiceVipin Kumar ChandelОценок пока нет

- Test Bank For Corporate Finance The Core, 5e Jonathan BerkДокумент13 страницTest Bank For Corporate Finance The Core, 5e Jonathan Berksobiakhan52292Оценок пока нет

- Equipment Lease AgreementДокумент10 страницEquipment Lease AgreementtewngomОценок пока нет

- CA Ann Rita Linson KДокумент2 страницыCA Ann Rita Linson Kdeepaktt7Оценок пока нет

- Tax by ItemДокумент18 страницTax by ItemBrooke ReaОценок пока нет

- Business Permits RequirementsДокумент2 страницыBusiness Permits RequirementsJurilBrokaPatiño100% (1)

- Bir Ruling 047-2013Документ8 страницBir Ruling 047-2013Ar Yan SebОценок пока нет

- Rodwin - The French Health Care SystemДокумент7 страницRodwin - The French Health Care SystemChris HarrisОценок пока нет

- Problems and Prospect of Garments Industry in Bangladesh and The Supportive Policy Regime/ Current State of AffairsДокумент38 страницProblems and Prospect of Garments Industry in Bangladesh and The Supportive Policy Regime/ Current State of AffairsZafour82% (17)

- Taxation CasesДокумент296 страницTaxation CasesshelОценок пока нет

- Grade 10 Ontario Business Exam ReviewДокумент6 страницGrade 10 Ontario Business Exam ReviewxSubliminalОценок пока нет

- Who Benefits From The Child Tax Credit?Документ26 страницWho Benefits From The Child Tax Credit?Katie CrolleyОценок пока нет

- Nigeria WHT Need To KnowДокумент6 страницNigeria WHT Need To KnowphazОценок пока нет

- CIR V Acesite Hotel Corp.Документ4 страницыCIR V Acesite Hotel Corp.'mhariie-mhAriie TOotОценок пока нет

- FO LDO Bitumen 01 10 2023Документ1 страницаFO LDO Bitumen 01 10 2023HAVI KADALIОценок пока нет

- Ra 7171Документ3 страницыRa 7171John Paul GarciaОценок пока нет

- Corporate Social Responsibility (CSR) As A Model of "Extended" Corporate Governance. An Explanation Based On The Economic Theories of Social Contract, Reputation and Reciprocal ConformismДокумент49 страницCorporate Social Responsibility (CSR) As A Model of "Extended" Corporate Governance. An Explanation Based On The Economic Theories of Social Contract, Reputation and Reciprocal ConformismronaqvОценок пока нет

- Group Activity Mina HanДокумент4 страницыGroup Activity Mina HanLevi's DishwasherОценок пока нет

- Tax 1 Midterms Reviewer-AuslДокумент18 страницTax 1 Midterms Reviewer-AuslAlyanna Gayle FajardoОценок пока нет

- 2010 State of The StateДокумент119 страниц2010 State of The StatemattОценок пока нет

- Xuv700 DieselДокумент1 страницаXuv700 DieselSUDHIR SINGH PATYALОценок пока нет

- Nala 2018Документ6 страницNala 2018Raghu RamОценок пока нет

- Duplichecker Plagiarism ReportДокумент3 страницыDuplichecker Plagiarism ReportMadan ViswanathanОценок пока нет