Академический Документы

Профессиональный Документы

Культура Документы

Module 36 Taxes Corporat: Multipl - HOI E RS

Загружено:

Anonymous JqimV1E0 оценок0% нашли этот документ полезным (0 голосов)

13 просмотров2 страницыfgt567hjkl

Оригинальное название

Scan 0078

Авторское право

© © All Rights Reserved

Доступные форматы

RTF, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документfgt567hjkl

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате RTF, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

13 просмотров2 страницыModule 36 Taxes Corporat: Multipl - HOI E RS

Загружено:

Anonymous JqimV1Efgt567hjkl

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате RTF, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

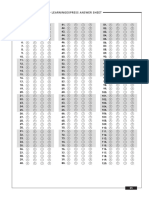

MODULE 36

·

TAXES: CORPORATE

-, -I

617

I

MULTIPLE-CHOICE ANSWERS

I. c - - 29. a - - 57. d - - 85. c - - 113. b - - 14I. c - -

2. c - - 30. d - - 58. a - - 86. c - - 114. c - - 142. d - -

3. d - - 3I. a - - 59. c - - 87. .d ,- - 115. b - - 143. b - -

4. d - - 32. d - - 60. c - - 88. c - - 116. c - - 144. c - -

5. c - - ·33. c - - 61. d '- - 89. c - - 117. d - - 145. d - -

6. a - - 34. d - - 62. c - - 90. b - - 118. d - - 146. d - -

7. d - - 35. a - - 63. c - - 9I. d - - 119. b - - 147. d - -

S. a - - 36. a - - 64. c - - 92. a - - 120. c - - 148. d - -

9. c - - 37. d - - 65. d - - 93. c - - 121. d - - 149. b - -

10. b - - 38. c - - 66. d - - 94. a - - 122. d - - 150. c - -

11. c -

39. b -

67. c - - 95. b -

123. a ,-- 15I. d.~ -

- - - -

12. d - - 40. d - - 68. d - - 96. a - - 124. c - 152. a - -

13. a - - 41. a - - 69. c - - 97. d - - 125. b - - 153. b - -

14. b - - 42. d - - 70. a - - 98. d - - 126. cl - - 154. b - -

15. b - - 43. a - - 7I. d - 99. b - - 127. b - - 155. a - -

16. a - - 44. c -

- 72. a - - 100. d - - 128. d - - 156. c - -

17. c - - 45. d - - 73. d - - 10 I. a - 129. a - - 157. d - -

18. d - - 46. c - - 74. d' - - 102. c - - 130. d - - 158. a - -

19. c - - 47. b - - 75. d - - 103. d - - 13I. b - - 159. c - -

20. b - - 48. b - - 76. b - - 104. d - - 132. b - - 160. a - -

21,. b - - 49. b - - 77. d - - 105. b - - 133. d - - 161. a - -

22. a - - 50. b - - 78. c - - 106. a - - 134. c - - 162. a - -

23. c - - 5I. b - - 79. b - - 107. c - - 135. d - - 163. b - -

24. c - - 52. b - - 80. b - - 108. d - - 136. b - -

25. IC - - 53. b - - 8I. a - - 109. a - - 137. c - -

26. b

-- - 54. b

- - 82. c

-- - 110. b

- - 13,8. c

- - ,

27. d - 55. d - - 83. c - 11 I. c - - 139. b - - 1 t: _/163 = - %

28. c - - 56. c - - 84. c - - 112. d - - 140. d - - 2nd: _/163 = - %

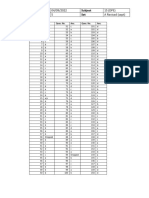

MULTIPLE-CHOICE ANSWER EXPLANATIONS

A. Transfers to a Controlled Corporation control of the corporation immediately after the exchange.

/ "Control" means that the transferors of property must, in the

1. "(c) The requirement is to determine Dexter Corpora-

aggregate, 'own at least 80% of the corporation's stock im-

tion's tax basis for the property received in the incorporation

mediately after the exchange. Since both Beck and Carr

from Alan. Since A1an and Baker .are the only transferors of

transferred property in exchange for stock, and in the aggre-

property and they, in the-aggregate, own only 800 of the

gate they own 90% of Flexo's stock immediately after the

1,050 shares outstanding immediately after the incorpora-

exchange, the requirements for uonrecognition are met.

tion, Sec. 351 does not apply to provide nonrecognition

treatment for Alan's transfer of property. As a result, Alan 4. (d) The requirement is to determine the percentage

is taxed on his realized gain of $15,000, and Dexter Corpo- of Nu's stock that Jones must own to qualify for a tax-free

ration has a cost (i.e., FMV) basis of $45,000 for the trans- incorporation. No gain or loss is recognized if property is

ferred property. transferred to a corporation solely in exchange for stock and

2. (c) The requirement is to determine Clark's basis the transferor(s) are in control of the corporation immedi-

ately after the exchange. For this purpose, the term "con-

for the Jet Corp. stock received in exchange for a contribu-

trol" means the ownership of at least 80% of the combined

tion of cash and other property. Generally, no gain or loss is

voting power of stock entitled to vote, and at least 80% of

recognized if property is transferred to a corporation solely

each class of nonvoting stock.

in exchange for stock, if immediately after the transfer, the

transferors of property are in control of the corporation. S. (c) The requirement is to determine Feld's stock

Since Clark and Hunt both transferred property solely in basis following the contribution Of a parcel of land to his

exchange for stock, and together own all of the corporation's solely owned corporation. When a shareholder makes a

stock, their realized gains on the "other property" transferred contribution to the capital of a corporation; no gain or loss is

are not recognized. As a result, Clark's basis for his Jet recognized to the shareholder, the corporation has a trans-

stock is equal to the $60,000 of cash plus the $50,000 ad- ferred (carryover) basis for the property, and the share-

justed basis of other property transferred, or $11 0,000. holder's original stock basis is increased by the adjusted

Hunt's basis for his Jet stock is equal to the $120,000 ad- basis of the additional property contributed. Here, Feld' s

justed basis of the other property that he transferred. beginning stock basis of $50,000 is increased by the $10,000

3. (d) The requirement is to determine Carr's recog- basis for the contributed land, resulting in a stock basis of

$60,000.

nized gain on the transfer of appreciated property in connec-

tion with the organization of Flexo Corp. No gain or loss is 6_ (a) The requirement is to determine whether gain or

recognized if property is transferred to a corporation solely loss is recognized On the incorporation of Rela Associates (a

in exchange for stock, if the transferors of property are in partnership). No gain or loss is recognized if property is

Вам также может понравиться

- THE BOH WAY - v1Документ13 страницTHE BOH WAY - v1mrrrkkk100% (2)

- Gebiz SUPPLY HeadsДокумент14 страницGebiz SUPPLY HeadsYam BalaoingОценок пока нет

- Strategic Human Resource ManagementДокумент104 страницыStrategic Human Resource Managementshweta_4666494% (18)

- Inventory ModelДокумент43 страницыInventory Modelndc6105058Оценок пока нет

- ALCPT - Answer - Key FORM 103 PDFДокумент1 страницаALCPT - Answer - Key FORM 103 PDFEDEM50% (2)

- Material Handling and PackagingДокумент30 страницMaterial Handling and PackagingShivkarVishalОценок пока нет

- Valuation Services MatrixДокумент2 страницыValuation Services MatrixNational Association of REALTORS®70% (10)

- America Language Course Placement Test. Form 103Документ1 страницаAmerica Language Course Placement Test. Form 103EDEMОценок пока нет

- Module 5 - Real and Personal Property AppraisalДокумент37 страницModule 5 - Real and Personal Property AppraisalAllan Cris RicafortОценок пока нет

- 16 Personality Factors, Editia A 5-A: Raport Pregatit PentruДокумент4 страницы16 Personality Factors, Editia A 5-A: Raport Pregatit Pentruaraduflorin3942Оценок пока нет

- M ULE Taxes Individual: Multiple CHO Ce Answers'Документ3 страницыM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedОценок пока нет

- M ULE Taxes Individual: Multiple CHO Ce Answers'Документ3 страницыM ULE Taxes Individual: Multiple CHO Ce Answers'Anonymous JqimV1EОценок пока нет

- M ULE Taxes Individual: Multiple CHO Ce Answers'Документ3 страницыM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedОценок пока нет

- 3 2 1 Code It 6th Edition Green Solutions ManualДокумент3 страницы3 2 1 Code It 6th Edition Green Solutions Manualisaacnorrisezwasfmtgi100% (32)

- 3 2 1 Code It 5th Edition Green Solutions ManualДокумент3 страницы3 2 1 Code It 5th Edition Green Solutions Manualalanquangfmrw100% (32)

- 3 2 1 Code It 6th Edition Green Solutions Manual Full Chapter PDFДокумент24 страницы3 2 1 Code It 6th Edition Green Solutions Manual Full Chapter PDFheathercamposnwqbyitgsc100% (15)

- MCQ PRДокумент1 страницаMCQ PREl-Sayed MohammedОценок пока нет

- Scan 0001Документ1 страницаScan 0001El-Sayed MohammedОценок пока нет

- MCQ PRДокумент1 страницаMCQ PREl-Sayed MohammedОценок пока нет

- Module 21 Professional Responsi Ilities: MU EAДокумент1 страницаModule 21 Professional Responsi Ilities: MU EAHazem El SayedОценок пока нет

- Jawaban UT Lv-1 PDFДокумент2 страницыJawaban UT Lv-1 PDFIqfal ZulhendriОценок пока нет

- Jawaban UT Lv-2 PDFДокумент2 страницыJawaban UT Lv-2 PDFIqfal ZulhendriОценок пока нет

- LET Reviewer General Education Answer KeysДокумент1 страницаLET Reviewer General Education Answer KeysBOBOKOОценок пока нет

- MO ULE Taxes: Partne Ships: Multiple Choice AnswersДокумент3 страницыMO ULE Taxes: Partne Ships: Multiple Choice AnswersZeyad El-sayedОценок пока нет

- Answer - Mock Test Paper - 2016 PDFДокумент1 страницаAnswer - Mock Test Paper - 2016 PDFsanjeevОценок пока нет

- Hoja de Respuesta Mbti Nombre: EdadДокумент1 страницаHoja de Respuesta Mbti Nombre: EdadAlf Contreras LobosОценок пока нет

- Mock Test 01 - Ailet Based Answer KeyДокумент1 страницаMock Test 01 - Ailet Based Answer KeyAyush RajОценок пока нет

- Test-1 GC Leong AnswerKey 1706012920346Документ1 страницаTest-1 GC Leong AnswerKey 1706012920346ishugautam777Оценок пока нет

- Answers To Celp Practice Test 3: Listening Grammar ReadingДокумент1 страницаAnswers To Celp Practice Test 3: Listening Grammar ReadingChristos VeisОценок пока нет

- MSU CELP Practice Test 6 - Answer KeyДокумент1 страницаMSU CELP Practice Test 6 - Answer KeyΒασιλική ΠαπαδημητρίουОценок пока нет

- CELC Practice Test 3 Answer Key - FINAL (Spring 2013) PDFДокумент1 страницаCELC Practice Test 3 Answer Key - FINAL (Spring 2013) PDFMarcela García DíazОценок пока нет

- New Invert Levels SR - 13 To Existing MH No House Invert Level PCC Bottom SlopeДокумент5 страницNew Invert Levels SR - 13 To Existing MH No House Invert Level PCC Bottom SlopeSantosh ChowdaryОценок пока нет

- 02) Answer Key (29-01-2017) - 1Документ1 страница02) Answer Key (29-01-2017) - 1Alokdev MishraОценок пока нет

- E 1 PDFДокумент17 страницE 1 PDFJaytee TiryadОценок пока нет

- Answer SheetДокумент2 страницыAnswer Sheetvima.acostaОценок пока нет

- Jewar Silver City Phase-2 Free Inventory-2Документ6 страницJewar Silver City Phase-2 Free Inventory-2deepak kashyapОценок пока нет

- RevisedAnswerKeySetA03 11 2022Документ1 страницаRevisedAnswerKeySetA03 11 2022hifalog364Оценок пока нет

- Kunci JAwabanДокумент2 страницыKunci JAwabansdn 4kabatОценок пока нет

- ATTPLANSДокумент2 страницыATTPLANSJoel KidsonОценок пока нет

- MELAB 2012 SampleTestKey UpdateДокумент1 страницаMELAB 2012 SampleTestKey UpdatealexandraОценок пока нет

- VK KSTD % Y (Kuå Fo'Ofo - Ky ) Y (Kuå: Mùkj Dqath Answer KeyДокумент4 страницыVK KSTD % Y (Kuå Fo'Ofo - Ky ) Y (Kuå: Mùkj Dqath Answer KeyPrdptiwariОценок пока нет

- 2nd Shift Answer Key Series A ExportДокумент1 страница2nd Shift Answer Key Series A ExportGhjОценок пока нет

- 3rd Shift Answer Key Series AДокумент97 страниц3rd Shift Answer Key Series AKeshav MeenaОценок пока нет

- LEED Green Associate Practice Paper AnswerДокумент1 страницаLEED Green Associate Practice Paper Answerhanimamoo7Оценок пока нет

- PGMP Program Management Professional Study GuideДокумент2 страницыPGMP Program Management Professional Study GuideSerges FokouОценок пока нет

- Answer Sheet For Placement TestДокумент2 страницыAnswer Sheet For Placement Testkunthea hak100% (2)

- Process Costing THEORIES AK - DayagДокумент1 страницаProcess Costing THEORIES AK - DayagRania NatangcopОценок пока нет

- Holding A Hose: DesertedДокумент5 страницHolding A Hose: DesertedNguyễn Thúy QuỳnhОценок пока нет

- MOD LE T XES Gift and Estate: MUL E C CE N EДокумент3 страницыMOD LE T XES Gift and Estate: MUL E C CE N EZeyad El-sayedОценок пока нет

- MATERIALSANSWERSHEETДокумент1 страницаMATERIALSANSWERSHEETJeiel ValenciaОценок пока нет

- Correction KeysДокумент4 страницыCorrection KeysRania JarmakaniОценок пока нет

- Isro Ans Key 2017 IIДокумент1 страницаIsro Ans Key 2017 IIjithinaravind007Оценок пока нет

- Prof Ed Key Answer 1 150 ItemsДокумент1 страницаProf Ed Key Answer 1 150 ItemsJoyce MagdaongОценок пока нет

- (Answer Key) Mock 1 (Clat Based-Masterclass)Документ1 страница(Answer Key) Mock 1 (Clat Based-Masterclass)Legalight OfficialОценок пока нет

- (Answer Key) Mock 1 (Clat Based-Masterclass)Документ1 страница(Answer Key) Mock 1 (Clat Based-Masterclass)Legalight OfficialОценок пока нет

- 2009 Sample Test Answer Key: Listening, Part 1 Listening, Part 2 Grammar Vocabulary ReadingДокумент2 страницы2009 Sample Test Answer Key: Listening, Part 1 Listening, Part 2 Grammar Vocabulary Readingjonathan CunalataОценок пока нет

- 4th Shift Answer Key Series AДокумент97 страниц4th Shift Answer Key Series AMurari lal yadavОценок пока нет

- JPSC P-II Final Ans Key Set - ABCD by Team S4G ???Документ5 страницJPSC P-II Final Ans Key Set - ABCD by Team S4G ???UJJWALОценок пока нет

- Answer Key & SolutionsДокумент4 страницыAnswer Key & SolutionsNaman MishraОценок пока нет

- KEAM 2014 Medical Entrance Biology Answer KeyДокумент3 страницыKEAM 2014 Medical Entrance Biology Answer KeyKhushi RoyОценок пока нет

- Answer Key To Practice TestДокумент2 страницыAnswer Key To Practice TestAmelita TupazОценок пока нет

- Multiple Choice AnswersДокумент3 страницыMultiple Choice AnswersrenОценок пока нет

- Answers To Paper 3 SbaДокумент2 страницыAnswers To Paper 3 Sbatolo toloОценок пока нет

- Name: Ave de Guzman Codename: PeriwinkleДокумент1 страницаName: Ave de Guzman Codename: PeriwinkleAve de GuzmanОценок пока нет

- Answer Key To English Model ExamДокумент1 страницаAnswer Key To English Model ExamAberra TayeОценок пока нет

- Chapter1. Financial Accounting Theoretical FrameworkДокумент5 страницChapter1. Financial Accounting Theoretical FrameworkadiОценок пока нет

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Документ2 страницыTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1EОценок пока нет

- Scan 0090Документ2 страницыScan 0090Anonymous JqimV1EОценок пока нет

- Module 36 Taxes: Corporate: RationДокумент2 страницыModule 36 Taxes: Corporate: RationAnonymous JqimV1EОценок пока нет

- Module 36 Taxes: CorporateДокумент2 страницыModule 36 Taxes: CorporateAnonymous JqimV1EОценок пока нет

- Module 36 Taxes: Corporate: RationДокумент2 страницыModule 36 Taxes: Corporate: RationAnonymous JqimV1EОценок пока нет

- Scan 0089Документ2 страницыScan 0089Anonymous JqimV1EОценок пока нет

- Taxes: Corporate: Sec. S OcДокумент2 страницыTaxes: Corporate: Sec. S OcAnonymous JqimV1EОценок пока нет

- Module 36 Taxes: CorporateДокумент1 страницаModule 36 Taxes: CorporateAnonymous JqimV1EОценок пока нет

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Документ2 страницыTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1EОценок пока нет

- MOD L S: Corporat: U E AXE EДокумент2 страницыMOD L S: Corporat: U E AXE EAnonymous JqimV1EОценок пока нет

- Module 36 Taxes: CorporateДокумент1 страницаModule 36 Taxes: CorporateAnonymous JqimV1EОценок пока нет

- I.C. Items To Be Included in Gross Income: ( (. y - , V A Ed SДокумент1 страницаI.C. Items To Be Included in Gross Income: ( (. y - , V A Ed SAnonymous JqimV1EОценок пока нет

- Scan 0084Документ2 страницыScan 0084Anonymous JqimV1EОценок пока нет

- Taxes: Corporate: Sio ZSCДокумент2 страницыTaxes: Corporate: Sio ZSCAnonymous JqimV1EОценок пока нет

- U I T U: Module 33 Taxes I Divi UALДокумент1 страницаU I T U: Module 33 Taxes I Divi UALAnonymous JqimV1EОценок пока нет

- Module 35 Taxes: PartnershipsДокумент3 страницыModule 35 Taxes: PartnershipsAnonymous JqimV1EОценок пока нет

- Taxes: Corporate: Sec. S OcДокумент2 страницыTaxes: Corporate: Sec. S OcAnonymous JqimV1EОценок пока нет

- Scan 0054Документ2 страницыScan 0054Anonymous JqimV1EОценок пока нет

- Module 33 Taxes: I Dividual: I F e R C AДокумент2 страницыModule 33 Taxes: I Dividual: I F e R C AAnonymous JqimV1EОценок пока нет

- Module 33 Taxes: IndividualДокумент2 страницыModule 33 Taxes: IndividualAnonymous JqimV1EОценок пока нет

- Module 33 Taxes: IndividualДокумент2 страницыModule 33 Taxes: IndividualAnonymous JqimV1EОценок пока нет

- Module 33 Taxes: IndividualДокумент2 страницыModule 33 Taxes: IndividualAnonymous JqimV1EОценок пока нет

- Taxes: Individual: S S, S A - , CДокумент2 страницыTaxes: Individual: S S, S A - , CAnonymous JqimV1EОценок пока нет

- K. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsДокумент2 страницыK. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsAnonymous JqimV1EОценок пока нет

- Scan 0049Документ2 страницыScan 0049Anonymous JqimV1EОценок пока нет

- Module 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOOДокумент1 страницаModule 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOOAnonymous JqimV1EОценок пока нет

- B 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceДокумент1 страницаB 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceAnonymous JqimV1EОценок пока нет

- B 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceДокумент1 страницаB 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceAnonymous JqimV1EОценок пока нет

- Export FinanceДокумент59 страницExport FinanceSagarОценок пока нет

- 2 - m1 Sap OverviewДокумент64 страницы2 - m1 Sap OverviewOscar Edgar BarreraОценок пока нет

- Transform Your Business Using Design ThinkingДокумент3 страницыTransform Your Business Using Design ThinkingLokesh VaswaniОценок пока нет

- Research MethodologyДокумент8 страницResearch MethodologySandip DankharaОценок пока нет

- Final ResearchДокумент60 страницFinal ResearchLoduvico LopezОценок пока нет

- Kumar Mangalam Birla Committee - Docxkumar Mangalam Birla CommitteeДокумент3 страницыKumar Mangalam Birla Committee - Docxkumar Mangalam Birla CommitteeVanessa HernandezОценок пока нет

- Business Plan DewsoftДокумент29 страницBusiness Plan DewsoftSanjeev AgarwalОценок пока нет

- Engleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFДокумент384 страницыEngleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFHarini SreedharanОценок пока нет

- CQI Project Assignment PDFДокумент14 страницCQI Project Assignment PDFSarah LaytonОценок пока нет

- The Appraisal of Real Estate Mortgages in Joint Stock Commercial Bank For Investment and Development of Vietnam (BIDV)Документ50 страницThe Appraisal of Real Estate Mortgages in Joint Stock Commercial Bank For Investment and Development of Vietnam (BIDV)Tieu Ngoc LyОценок пока нет

- INBTable 1Документ519 страницINBTable 1anaysukenkarОценок пока нет

- Chapter 3 - Class 11 NCERT Accounts Recording of Transaction 1Документ8 страницChapter 3 - Class 11 NCERT Accounts Recording of Transaction 1Arvind KumarОценок пока нет

- Seminar 4Документ5 страницSeminar 4Ethel OgirriОценок пока нет

- Mittal School of BusinessДокумент17 страницMittal School of BusinessAnkitОценок пока нет

- f5 PDFДокумент12 страницf5 PDFSteffiОценок пока нет

- Fundamentals of Investment Management 10th Edition Hirt Solutions ManualДокумент15 страницFundamentals of Investment Management 10th Edition Hirt Solutions Manualtanyacookeajtzmonrd100% (28)

- PT ManunggalДокумент4 страницыPT Manunggalnimasz nin9szihОценок пока нет

- (By Cash Only) : State Bank of IndiaДокумент2 страницы(By Cash Only) : State Bank of IndiaPiyushОценок пока нет

- Theory Madison Proposal LowresДокумент68 страницTheory Madison Proposal Lowresinfo.giantholdingsОценок пока нет

- Contract Administration Works-Sbd 1Документ200 страницContract Administration Works-Sbd 1Rajaratnam TharakanОценок пока нет

- Mobile Invoice ICSДокумент1 страницаMobile Invoice ICSchetanОценок пока нет

- Negotiating With Wal-Mart: 28 Apr 2008 Hbs CaseДокумент2 страницыNegotiating With Wal-Mart: 28 Apr 2008 Hbs CaseTrần Hùng DươngОценок пока нет

- Edmark M. Bumanlag ABM 12 "Blossom Snack"Документ3 страницыEdmark M. Bumanlag ABM 12 "Blossom Snack"Edmark BumanlagОценок пока нет