Академический Документы

Профессиональный Документы

Культура Документы

Safari - 27 Mar 2019 at 1:02 PM

Загружено:

Richelle CartinАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Safari - 27 Mar 2019 at 1:02 PM

Загружено:

Richelle CartinАвторское право:

Доступные форматы

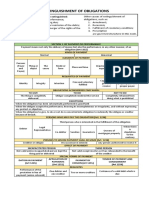

CONCURRENCE AND PREFERENCE MORE ABOUT THIS

TOPIC:

OF CREDITS (ARTICLES 2236-2251

2236-2251)) FRAUDULENT

PREFERENCES AND

TRANSFERS-

Insolvency

Category: Obligations and Contracts

COMPOSITION -

Insolvency Law

CONCURRENCE AND PREFERENCE OF CREDITS PROOF OF DEBTS -

Insolvency Law

(ARTICLES 2236-2251

2236-2251)) Assignees in

Insolvency

CLASSIFICATION AND ☰

PREFERENCE OF

CONCURRENCE OF

BATASnatin LIVE! Free legal CREDITS

advice every Wednesday and Friday at 6pm. CREDITORS

VOLUNTARY

Implies the possession by two or more creditors of equal rights or privileges over the same INSOLVENCY,

property or all the property of a debtor Insolvency Law- ACT

NO. 1956

THE INSOLVENCY LAW

PREFERENCE OF CREDIT - TITLE AND GENERAL

SUBJECT OF THE ACT

Right held by a creditor to be preferred in the payment of his claim above others out of the debtor’s SUSPENSION OF

assets PAYMENTS - Insolvency

Law

INSOLVENCY

NATURE AND EFFECT OF PREFERENCE PROCEEDINGS IN REM

REVOCATION AND

1. A preference is an exception to the general rule. For this reason, the law as to preferences is REDUCTION OF

strictly construed. DONATIONS,

2. Preference doesn’t create an interest in property. it creates simply a right of one creditor to be INOFFICIOUS

paid first the proceeds of the sale of property as against another creditor. DONATIONS

3. The law doesn’t give the creditor who has a preference a right to take the property or sell it as against

another creditor. It is not a question who takes or sells, it is one of the application of the proceeds after

the sale—of payment of the debt

4. The right of preference is one which can be made only by being asserted and maintained. If

the right claimed is not asserted or maintained, it is lost.

5. Where a creditor released his levy, leaving the property in possession of the debtor, thereby

indicating that he didn’t intend to press his claim further as to that specific property, after that act,

his claim to preference, if one had been asserted y him, could not exist because he had ceased to contest.

The Next LIVE Free Legal Advice

Episode

WHEN RULE OF PREFERENCE APPLICABLE

WE ARE LIVE MON, WED,

Apply only where two or more creditors have separate and distinct claims against the same debtor FRI

at 6:00 pm

who has an insufficient property

Facebook Event | YouTube Channel

Is applicable when the debtor is insolvent—having more liabilities than his assets

It is a matter of necessity and log that the question of preference should arise only when the Season One

debtor’s assets are insufficient to pay his debts in full Episode 1: August 31, 2018

Facebook Video | YouTube Video

GENERAL PROVISIONS Episode 2: September 7, 2018

Facebook Video | YouTube Video

Art. 2236. The debtor is liable with all his property, present and future, for the fulfillment of his Episode 3: September 13, 2018

obligations, subject to the exemptions provided by law. (1911a) Facebook Video | YouTube Video

Episode 4: September 21, 2018

Facebook Video | YouTube Video

AS A RULE, A DEBTOR IS LIABLE WITH ALL HIS PROPERTY, PRESENT

AND FUTURE, FOR THE FULFILLMENT OF HIS OBLIGATIONS Episode 5: September 28, 2018

Facebook Video | YouTube Video

Episode 6: October 5, 2018

EXEMPT PROPERTY Facebook Video | YouTube Video

1. Present property-Articles 152, 153, 154, 155, 205(Family Code); Section 13 Rule 39 of the Rules

of Court; Section 118 of CA 141

Art. 152. The family home, constituted jointly by the husband and the wife or by an

unmarried head of a family, is the dwelling house where they and their family

reside, and the land on which it is situated. (223a)

Art. 153. The family home is deemed constituted on a house and lot from the time it is

occupied as a family residence. From the time of its constitution and so long as any of

its

beneficiaries actually resides therein, the family home continues to be such and is

exempt from execution, forced sale or attachment except as hereinafter provided and to the

extent

of the value allowed by law. (223a)

Art. 154. The beneficiaries of a family home are:

(1) The husband and wife, or an unmarried person who is the head of a family;

(2) Their parents, ascendants, descendants, brothers and sisters, whether the

relationship be legitimate or illegitimate, who are living in the family home and who

depend upon the head of the family for legal support. (226a)

Art. 155. The family home shall be exempt from execution, forced sale or attachment

except:

(1) For nonpayment of taxes;

(2) For debts incurred prior to the constitution of the family home;

(3) For debts secured by mortgages on the premises before or after such constitution; and

(4) For debts due to laborers, mechanics, architects, builders, materialmen and others

who have rendered service or furnished material for the construction of the building.

(243a)

Art. 205. The right to receive support under this Title as well as any money or property

obtained as such support shall not be levied upon on attachment or execution. (302a)

Sec. 13. Property exempt from execution.

Except as otherwise expressly provided by law, the following property, and no other,

shall be exempt from execution:

(a) The judgment obligor's family home as provided by law, or the homestead in which he

resides, and land necessarily used in connection therewith;

(b) Ordinary tools and implements personally used by him in his trade, employment,

or livelihood;

(c) Three horses, or three cows, or three carabaos, or other beasts of burden such

as the judgment obligor may select necessarily used by him in his ordinary occupation;

(d) His necessary clothing and articles for ordinary personal use, excluding jewelry;

(e) Household furniture and utensils necessary for housekeeping, and used for

that purpose by the judgment obligor and his family, such as the judgment obligor

may

select, of a value not exceeding one hundred thousand pesos;

(f ) Provisions for individual or family use sufficient for four months;

(g) The professional libraries and equipment of judges, lawyers, physicians,

pharmacists, dentists, engineers, surveyors, clergymen, teachers, and other

professionals, not exceeding three hundred thousand pesos in value;

(h) One fishing boat and accessories not exceeding the total value of one hundred

thousand pesos owned by a fisherman and by the lawful use of which he earns his

livelihood;

(i) So much of the salaries, wages, or earnings of the judgment obligor of his

personal services within the four months preceding the levy as are necessary for the

support of

his family;

( j) Lettered gravestones;

(k) Monies benefits, privileges, or annuities accruing or in any manner growing out of any

life insurance;

(l) The right to receive legal support, or money or property obtained as such support,

or any pension or gratuity from the Government;

(m) Properties specially exempt by law.

But no article or species of property mentioned in his section shall be exempt from

execution issued upon a judgment recovered for its price or upon a judgment of

foreclosure of a mortgage thereon.

2. Future property—those related to the insolvency of a debtor

3. Property in custodia legis and of public dominion

Art. 2237. Insolvency shall be governed by special laws insofar as they are not

inconsistent with this Code. (n)

INSOLVENCY LAW WILL COME INTO PLAY AFTER THE RULES OF

PREFERENCE AND CONCURRENCE OF CREDITS.

DEBTOR MUST BE THE ABSOLUTE OWNER

Art. 2238. So long as the conjugal partnership or absolute community subsists, its property shall not

be among the assets to be taken possession of by the assignee for the payment of the insolvent

debtor's obligations, except insofar as the latter have redounded to the benefit of the family. If it

is the husband who is insolvent, the administration of the conjugal partnership of absolute

community may, by order of the court, be transferred to the wife or to a third person other than the

assignee. (n)

Art. 2239. If there is property, other than that mentioned in the preceding article, owned by two or

more persons, one of whom is the insolvent debtor, his undivided share or interest therein shall be

among the assets to be taken possession of by the assignee for the payment of the insolvent

debtor's obligations. (n)

RULES INVOLVING UNDIVIDED SHARE OR INTEREST OF A CO-

OWNER

If there is a co-ownership and of the co-owners is the insolvent debtor, his undivided share or

interest in the property shall be possessed by the assignee in insolvency proceedings because it is part

of his assets

The shares of the other co-owners of course cannot be taken possession of by the assignee

Art. 2240. Property held by the insolvent debtor as a trustee of an express or implied trust, shall

be excluded from the insolvency proceedings. (n)

RULE INVOLVING PROPERTY HELD IN TRUST

The trustee is not strictly speaking the owner of the trust property although he has legal title thereto

Hence, property held in trust by the insolvent debtor should be excluded from the insolvency

proceedings

CLASSIFICATION OF CREDITS

Art. 2241. With reference to specific movable property of the debtor, the following claims or liens shall

be preferred:

(1) Duties, taxes and fees due thereon to the State or any subdivision thereof;

(2) Claims arising from misappropriation, breach of trust, or malfeasance by public officials

committed in the performance of their duties, on the movables, money or securities obtained by

them;

(3) Claims for the unpaid price of movables sold, on said movables, so long as they are in the

possession of the debtor, up to the value of the same; and if the movable has been resold by the debtor

and the price is still unpaid, the lien may be enforced on the price; this right is not lost by the

immobilization of the thing by destination, provided it has not lost its form, substance and identity;

neither is the right lost by the sale of the thing together with other property for a lump sum, when

the price thereof can be determined proportionally;

(4) Credits guaranteed with a pledge so long as the things pledged are in the hands of the

creditor, or those guaranteed by a chattel mortgage, upon the things pledged or mortgaged, up to the

value thereof;

(5) Credits for the making, repair, safekeeping or preservation of personal property, on the

movable thus made, repaired, kept or possessed;

(6) Claims for laborers' wages, on the goods manufactured or the work done;

(7) For expenses of salvage, upon the goods salvaged;

(8) Credits between the landlord and the tenant, arising from the contract of tenancy on shares, on

the share of each in the fruits or harvest;

(9) Credits for transportation, upon the goods carried, for the price of the contract and incidental

expenses, until their delivery and for thirty days thereafter;

(10) Credits for lodging and supplies usually furnished to travelers by hotelkeepers, on the

movables belonging to the guest as long as such movables are in the hotel, but not for money loaned to

the guests;

(11) Credits for seeds and expenses for cultivation and harvest advanced to the debtor, upon the fruits

harvested;

(12) Credits for rent for one year, upon the personal property of the lessee existing on the

immovable leased and on the fruits of the same, but not on money or instruments of credit;

(13) Claims in favor of the depositor if the depositary has wrongfully sold the thing deposited,

upon the price of the sale.

In the foregoing cases, if the movables to which the lien or preference attaches have been

wrongfully taken, the creditor may demand them from any possessor, within thirty days from the

unlawful seizure. (1922a)

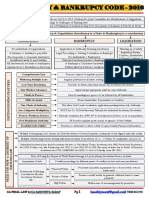

GENERAL CATEGORIES OF CREDIT

1. Special preferred credits listed in Articles 2241 and 2242

2. Ordinary preferred credits listed in Article 2244

3. Common credits under Article 2245

PREFERRED CREDITS WITH RESPECT TO SPECIFIC MOVABLE

PROPERTY

1. Duties, taxes and fees due thereon to the State or any subdivision thereof

2. Claims arising from misappropriation, breach of trust, or malfeasance by public officials

committed in the performance of their duties, on the movables, money or securities obtained by

them

3. Claims for the unpaid price of movables sold, on said movables, so long as they are in the

possession of the debtor, up to the value of the same; and if the movable has been resold by the

debtor and the price is still unpaid, the lien may be enforced on the price; this right is not lost by the

immobilization of the thing by destination, provided it has not lost its form, substance and identity;

neither is the right lost by the sale of the thing together with other property for a lump sum, when the

price thereof can be determined proportionally

4. Credits guaranteed with a pledge so long as the things pledged are in the hands of the

creditor, or those guaranteed by a chattel mortgage, upon the things pledged or mortgaged, up to

the value thereof

a. Should be registered

b. Binding against third parties

5. Credits for the making, repair, safekeeping or preservation of personal property, on the movable thus

made, repaired, kept or possessed

6. Claims for laborers' wages, on the goods manufactured or the work done

7. For expenses of salvage, upon the goods salvaged

8. Credits between the landlord and the tenant, arising from the contract of tenancy on shares, on the

share of each in the fruits or harvest

9. Credits for transportation, upon the goods carried, for the price of the contract and incidental

expenses, until their delivery and for thirty days thereafter

10. Credits for lodging and supplies usually furnished to travelers by hotel keepers, on the

movables belonging to the guest as long as such movables are in the hotel, but not for money

loaned to the guests

11. Credits for seeds and expenses for cultivation and harvest advanced to the debtor, upon the fruits

harvested

12. Credits for rent for one year, upon the personal property of the lessee existing on the immovable

leased and on the fruits of the same, but not on money or instruments of credit

13. Claims in favor of the depositor if the depositary has wrongfully sold the thing deposited, upon

the price of the sale.

PREFERRED CREDITS WITH RESPECT TO SPECIFIC MOVABLE

PROPERTY

Articles 2241 and 2242 don’t give the order of preference or priority of payment

They merely enumerate the credits which enjoy preference with respect to specific movables or

immovables

With respect to the same specific movable or immovable, creditors with the exception of the State,

merely concur

REMEMBER that preference is only given to #1 and the rest shall be treated equally

WRONGFUL TAKING OF MOVABLES TO WHICH LIEN ATTACHES

Last paragraph applies only when the right of ownership in such property continues in the debtor,

and therefore, is not applicable to cases where the debtor has parted his ownership therein, as

where he has sold the property

Art. 2242. With reference to specific immovable property and real rights of the debtor, the

following claims, mortgages and liens shall be preferred, and shall constitute an encumbrance on the

immovable or real right:

(1) Taxes due upon the land or building;

(2) For the unpaid price of real property sold, upon the immovable sold;

(3) Claims of laborers, masons, mechanics and other workmen, as well as of architects,

engineers and contractors, engaged in the construction, reconstruction or repair of buildings, canals

or other works, upon said buildings, canals or other works;

(4) Claims of furnishers of materials used in the construction, reconstruction, or repair of

buildings, canals or other works, upon said buildings, canals or other works;

(5) Mortgage credits recorded in the Registry of Property, upon the real estate mortgaged;

(6) Expenses for the preservation or improvement of real property when the law authorizes

reimbursement, upon the immovable preserved or improved;

(7) Credits annotated in the Registry of Property, in virtue of a judicial order, by attachments or

executions, upon the property affected, and only as to later credits;

(8) Claims of co-heirs for warranty in the partition of an immovable among them, upon the real

property thus divided;

(9) Claims of donors or real property for pecuniary charges or other conditions imposed upon the

donee, upon the immovable donated;

(10) Credits of insurers, upon the property insured, for the insurance premium for two years. (1923a)

PREFERRED LIEN ON SPECIFIC IMMOVABLE PROPERTY

1. Taxes due upon the land or building

2. For the unpaid price of real property sold, upon the immovable sold

3. Claims of laborers, masons, mechanics and other workmen, as well as of architects,

engineers and ontractors, engaged in the construction, reconstruction or repair of buildings, canals or

other works, upon said buildings, canals or other works

4. Claims of furnishers of materials used in the construction, reconstruction, or repair of buildings,

canals or other works, upon said buildings, canals or other works

5. Mortgage credits recorded in the Registry of Property, upon the real estate mortgaged

6. Expenses for the preservation or improvement of real property when the law authorizes

reimbursement, upon the immovable preserved or improved

7. Credits annotated in the Registry of Property, in virtue of a judicial order, by attachments or

executions, upon the property affected, and only as to later credits

8. Claims of co-heirs for warranty in the partition of an immovable among them, upon the real

property thus divided

9. Claims of donors or real property for pecuniary charges or other conditions imposed upon the

donee, upon the immovable donated

10. Credits of insurers, upon the property insured, for the insurance premium for two years.

Art. 2243. The claims or credits enumerated in the two preceding articles shall be

considered as mortgages or pledges of real or personal property, or liens within the

purview of legal provisions governing insolvency. Taxes mentioned in No. 1, Article

2241, and No. 1, Article 2242, shall first be satisfied. (n)

NATURE OF CLAIMS OR CREDITS IN ARTICLES 2241 AND 2242

Articles 2241 and 2242 apply only when there is a concurrence of credits when the same specific

property of the debtor is subjected to the claims of several creditors and the value of such property is

insufficient to pay in full all the creditors

In such situation, the question of preference will arise, there will be a need to determine

which of the creditors will be paid ahead of the others

Art. 2244. With reference to other property, real and personal, of the debtor, the

following claims or credits shall be preferred in the order named:

(1) Proper funeral expenses for the debtor, or children under his or her parental

authority who have no property of their own, when approved by the court;

(2) Credits for services rendered the insolvent by employees, laborers, or

household helpers for one year preceding the commencement of the proceedings

in insolvency;

(3) Expenses during the last illness of the debtor or of his or her spouse and

children under his or her parental authority, if they have no property of their own;

(4) Compensation due the laborers or their dependents under laws providing for

indemnity for damages in cases of labor accident, or illness resulting from the nature

of the employment;

(5) Credits and advancements made to the debtor for support of himself or

herself, and family, during the last year preceding the insolvency;

(6) Support during the insolvency proceedings, and for three months thereafter;

(7) Fines and civil indemnification arising from a criminal offense;

(8) Legal expenses, and expenses incurred in the administration of the

insolvent's estate for the common interest of the creditors, when properly authorized

and approved by the court;

(9) Taxes and assessments due the national government, other than those

mentioned in Articles 2241, No. 1, and 2242, No. 1;

(10) Taxes and assessments due any province, other than those referred to in Articles

2241, No. 1, and 2242, No. 1;

(11) Taxes and assessments due any city or municipality, other than those

indicated in Articles 2241, No. 1, and 2242, No. 1;

(12) Damages for death or personal injuries caused by a quasi-delict;

(13) Gifts due to public and private institutions of charity or beneficence;

(14) Credits which, without special privilege, appear in(a) a public instrument; or (b) in

a final judgment, if they have been the subject of litigation. These credits shall have

preference among themselves in the order of priority of the dates of the instruments

and of the judgments, respectively. (1924a)

SPECIAL PREFERRED CREDITS

1. Proper funeral expenses for the debtor, or children under his or her parental authority who have

no property of their own, when approved by the court

2. Credits for services rendered the insolvent by employees, laborers, or household helpers for one

year preceding the commencement of the proceedings in insolvency

3. Expenses during the last illness of the debtor or of his or her spouse and children under his or

her parental authority, if they have no property of their own

4. Compensation due the laborers or their dependents under laws providing for indemnity for damages

in cases of labor accident, or illness resulting from the nature of the employment

5. Credits and advancements made to the debtor for support of himself or herself, and family, during

the last year preceding the insolvency

6. Support during the insolvency proceedings, and for three months thereafter

7. Fines and civil indemnification arising from a criminal offense

8. Legal expenses, and expenses incurred in the administration of the insolvent's estate for

the common interest of the creditors, when properly authorized and approved by the court

9. Taxes and assessments due the national government,

other than those mentioned in Articles 2241, No. 1, and 2242, No. 1 (10) Taxes and

assessments due any province, other than those referred to in Articles 2241, No. 1, and 2242, No. 1

10. Taxes and assessments due any city or municipality, other than those indicated in Articles 2241, No. 1,

and 2242, No. 1

11. Damages for death or personal injuries caused by a quasi-delict

12. Gifts due to public and private institutions of charity or beneficence

13. Credits which, without special privilege, appear in a. public instrument; or b. in a final judgment, if

they have been the subject of litigation.

These credits shall have preference among themselves in the order of priority of the dates of the

instruments and of the judgments, respectively.

ORDER OF PRIORITY ONLY WITH RESPECT TO INSOLVENT’S FREE

PROPERTY

1. Specially preferred credits—credits which are specially preferred because they constitute liens

take precedence over ordinary preferred credits so far as concerns the property to which the liens are

attached

a. Specific property involved of greater value

b. Specific property involved of lesser value—will be treated as ordinary preferred credits and to be

paid

in the order of preference therein provided

2. Ordinary preferred credits—only in respect of the insolvent’s free property, is an order of

priority established. In this sequence, certain taxes and assessments also figure but, as already

pointed out, these don’t have the same kind of overriding preference

Art. 2245. Credits of any other kind or class, or by any other right or title not comprised

in the four preceding articles, shall enjoy no preference. (1925)

NON-PREFERRED OR COMMON CREDITS

Credits other than those mentioned in 2241, 2242, and 2244 shall enjoy no preference and such

common credits shall be paid pro rata regardless of dates

ORDER OF PREFERENCE OF CREDITS

Art. 2246. Those credits which enjoy preference with respect to specific movables, exclude all

others to the extent of the value of the personal property to which the preference refers.

Art. 2247. If there are two or more credits with respect to the same specific movable property, they shall

be satisfied pro rata, after the payment of duties, taxes and fees due the State or any subdivision

thereof. (1926a)

Art. 2248. Those credits which enjoy preference in relation to specific real property or real rights, exclude

all others to the extent of the value of the immovable or real right to which the preference refers.

Art. 2249. If there are two or more credits with respect to the same specific real property or real rights,

they shall be satisfied pro rata, after the payment of the taxes and assessments upon the

immovable property or real right. (1927a)

Art. 2250. The excess, if any, after the payment of the credits which enjoy preference with respect

to specific property, real or personal, shall be added to the free property which the debtor may have,

for the payment of the other credits. (1928a)

TWO-TIER ORDER OF PREFERENCE

First tier includes only taxes, duties and fees due on a specific movable or immovable property

All other special preferred credits stand on the second tier to be satisfied pari passu and pro rata, out

of the residual value of the specific property to which such other credits relate

The pro-rata rule however doesn’t apply to credits annotated in the RD in virtue of a

judicial order, by attachments and executions, which are preferred to later credits. In satisfying

several credits annotated by attachments and executions, the rule is still preference according to

the priority of credits in the order of time.

PROCEEDING FOR PAYMENT PRO RATA OF PREFERRED CREDITORS

Proceeding required for adjudication of claims of preferred creditors

Pro rata rule contemplates more than one creditor

Art. 2251. Those credits which do not enjoy any preference with respect to specific

property, and those which enjoy preference, as to the amount not paid, shall be

satisfied according to the following rules:

(1) In the order established in Article 2244;

(2) Common credits referred to in Article 2245 shall be paid pro rata regardless of dates.

(1929a)

SUMMARY AS TO ORDER OF PREFERENCE

1. Preferred lien on specific immovables

2. Preferred lien on specific movables

3. Special preferred credits

4. Distribute pro-rata to creditors without preference

Prev Next

FRAUDULENT PREFERENCES AND TRANSFERS- Insolvency

COMPOSITION - Insolvency Law

PROOF OF DEBTS - Insolvency Law

Assignees in Insolvency

CLASSIFICATION AND PREFERENCE OF CREDITORS

VOLUNTARY INSOLVENCY, Insolvency Law- ACT NO. 1956

THE INSOLVENCY LAW - TITLE AND GENERAL SUBJECT OF THE ACT

SUSPENSION OF PAYMENTS - Insolvency Law

INSOLVENCY PROCEEDINGS IN REM

REVOCATION AND REDUCTION OF DONATIONS, INOFFICIOUS DONATIONS

BATASnatin Legal Civil Law Criminal Law Land Titles and Socials

Services Deeds

Collection of Debts All crimes as defense lawyer or private

"Excellence is our Standard" Unlawful Detainer prosecutor.

Mobile Globe: +63 (915

915) 954

954-6080

6080 Forcible Entry

Corporation Law Election Law

Mobile Smart: +63 (949

949) 589

589-8377

8377 Recovery of Real or Personal Property,

Landline: (632) 359

359-4203

4203 Damages, etc... Creation of Corporate Bodies

Litigation of Corporate Courts

Email: batasnatin@gmail.com Labor Standards and Relations Alternative Dispute

Law Others

Resolution

2nd Floor LC Building,

Illegal Termination Environmental Law

31 Gen. Luna St., Tuktukan

1632 Taguig City, Philippines Constructive Dismissal Writ of Kalikasan

Non-payment / Underpayment of Protection of the Environment and

Salaries and Benefits Natural Resources

Others...

Terms and Conditions Privacy Policy

© 2019 BATASnatin - Filipino's Comprehensive Online Law Resource and Community Back to Top

Вам также может понравиться

- Lecture Notes On Partnerships Articles 1767-1867, NCCДокумент34 страницыLecture Notes On Partnerships Articles 1767-1867, NCCKarina Graile HumidingОценок пока нет

- Family TherapyДокумент16 страницFamily TherapySANU RAMASWAMY100% (2)

- Social Justice: Calalang vs. WilliamsДокумент7 страницSocial Justice: Calalang vs. WilliamsThea Pabillore100% (1)

- SLP FormatДокумент4 страницыSLP Formatshanika100% (3)

- Administrative LawДокумент5 страницAdministrative LawDandolph TanОценок пока нет

- Piagets Stages of Cognitive DevelopmentДокумент14 страницPiagets Stages of Cognitive DevelopmentKinneth AguilarОценок пока нет

- Give and Take Ebook Final PDFДокумент340 страницGive and Take Ebook Final PDFradiocatifea100% (1)

- Concept of Insolvency and BankruptcyДокумент68 страницConcept of Insolvency and BankruptcyNavin Man Singh ShresthaОценок пока нет

- Chapter I: Introduction: Obligations and Contracts Book IV: Civil Code of The PhilippinesДокумент32 страницыChapter I: Introduction: Obligations and Contracts Book IV: Civil Code of The PhilippinesArtisticLawyer100% (1)

- Summary Note - EXTINGUISHMENT OF OBLIGATIONSДокумент8 страницSummary Note - EXTINGUISHMENT OF OBLIGATIONSGiah Mesiona100% (2)

- Table Comparison of ObligationsДокумент9 страницTable Comparison of ObligationsThirdy DefensorОценок пока нет

- Ethics Book Values and VirtuesДокумент237 страницEthics Book Values and Virtuessarang11100% (1)

- Solomon MotivationДокумент36 страницSolomon MotivationJR JRovaneshwaranОценок пока нет

- 31.DBP vs. NLRC, March 19, 1990Документ3 страницы31.DBP vs. NLRC, March 19, 1990Lance Christian ZoletaОценок пока нет

- Ebook - Big John PDFДокумент29 страницEbook - Big John PDFElg Here Ü100% (1)

- Ibc ChartsДокумент7 страницIbc Chartspiyush bansalОценок пока нет

- HUMSS - Disciplines and Ideas in The Applied Social Sciences CG - 1Документ7 страницHUMSS - Disciplines and Ideas in The Applied Social Sciences CG - 1Owen Radaza Pirante100% (3)

- Demystifying The Insolvency and Bankruptcy CodeДокумент27 страницDemystifying The Insolvency and Bankruptcy CodemickeyОценок пока нет

- Philippine Export and Foreign Loan Guarantee Corp. v. CAДокумент3 страницыPhilippine Export and Foreign Loan Guarantee Corp. v. CAmichelle zatarainОценок пока нет

- Workers preference over mortgage lienДокумент1 страницаWorkers preference over mortgage lienTeacherEliОценок пока нет

- WILLAWARE VS JESICHRIS (Digest) PDFДокумент2 страницыWILLAWARE VS JESICHRIS (Digest) PDFRichelle CartinОценок пока нет

- WILLAWARE VS JESICHRIS (Digest) PDFДокумент2 страницыWILLAWARE VS JESICHRIS (Digest) PDFRichelle CartinОценок пока нет

- MTBC VS JMCДокумент4 страницыMTBC VS JMCRichelle CartinОценок пока нет

- UNODC Prison Program Report 2007Документ31 страницаUNODC Prison Program Report 2007JazzОценок пока нет

- DBP Vs NLRCДокумент2 страницыDBP Vs NLRCBenedicto Eulogio C. Manzon100% (1)

- Llorente Vs CAДокумент6 страницLlorente Vs CARichelle CartinОценок пока нет

- Gilat Satellite Networks, Ltd. v. United Coconut Planters Bank Insurance Co. - Bingbing WandersДокумент8 страницGilat Satellite Networks, Ltd. v. United Coconut Planters Bank Insurance Co. - Bingbing WandersPatricia Anne CabanlongОценок пока нет

- RFBTДокумент22 страницыRFBTMary Ann ChoaОценок пока нет

- IBC - Presentation 20th May, 2017.Документ27 страницIBC - Presentation 20th May, 2017.Beejal AhujaОценок пока нет

- Obligations Contracts: The Law OnДокумент131 страницаObligations Contracts: The Law Onrikki marie pajaresОценок пока нет

- CONSTITUTIONAL LAW 2 NOTES AND CASES (NON-IMPAIRMENT CLAUSEДокумент10 страницCONSTITUTIONAL LAW 2 NOTES AND CASES (NON-IMPAIRMENT CLAUSEAndrea Gural De GuzmanОценок пока нет

- Performance of The Obligation Irregularity in The PerformanceДокумент3 страницыPerformance of The Obligation Irregularity in The PerformanceLuis de leonОценок пока нет

- Insolvency LawДокумент18 страницInsolvency LawAlysa Ashley BienОценок пока нет

- SARFAESI, Debt Recovery Laws: Recent Important DecisionsДокумент1 страницаSARFAESI, Debt Recovery Laws: Recent Important DecisionsHarshit SinghОценок пока нет

- Kinds of Obligations TableДокумент12 страницKinds of Obligations TableAngel BangasanОценок пока нет

- OBLICON Definitions of TermsДокумент8 страницOBLICON Definitions of TermsAR ALTARОценок пока нет

- (2022) 5 SCC 661Документ43 страницы(2022) 5 SCC 661Swati PandaОценок пока нет

- CLA1501-chapter 6 - Agreement Must Be PossibleДокумент25 страницCLA1501-chapter 6 - Agreement Must Be Possibledlomosibonelo12Оценок пока нет

- IBC DemystifiedДокумент47 страницIBC DemystifiedAmbuj JainОценок пока нет

- 5 CCC PDFДокумент44 страницы5 CCC PDFMosesОценок пока нет

- Obligations and Contracts Ch 3 & 4 ReviewДокумент24 страницыObligations and Contracts Ch 3 & 4 ReviewAdrian RoxasОценок пока нет

- Worker preference applies only in bankruptcy or liquidationДокумент26 страницWorker preference applies only in bankruptcy or liquidationIsabelle CaspilloОценок пока нет

- Cri Part 2Документ340 страницCri Part 2M.RajpalОценок пока нет

- Insolvency Law: Requisites OF Petition Forsuspension of PaymentsДокумент45 страницInsolvency Law: Requisites OF Petition Forsuspension of PaymentsEljhon ManguiatОценок пока нет

- Restriction Repugnant To Interest Created Under Transfer of Property ActДокумент4 страницыRestriction Repugnant To Interest Created Under Transfer of Property ActFakhar -ul-ZamanОценок пока нет

- USC ObliconДокумент107 страницUSC ObliconSophia Mae SungcogОценок пока нет

- CRI Part 2 - CS Vaibhav Chitlangia - Yes Academy, PuneДокумент317 страницCRI Part 2 - CS Vaibhav Chitlangia - Yes Academy, Puneswapnil tiwariОценок пока нет

- K BHBBBДокумент14 страницK BHBBBHasimada YAОценок пока нет

- Draft PPT For ReviewДокумент33 страницыDraft PPT For ReviewAkshay Raj YerabatiОценок пока нет

- PRE LAW1 02 General ProvisionsДокумент39 страницPRE LAW1 02 General ProvisionsWally AranasОценок пока нет

- Indian Contract Act, 1872Документ1 страницаIndian Contract Act, 1872Parth TipreОценок пока нет

- Concurrence of Credits - Civil Code and Labor CodeДокумент5 страницConcurrence of Credits - Civil Code and Labor CodeEm DavidОценок пока нет

- Only An Ancillary Remedy in Ordinary Labor DisputesДокумент50 страницOnly An Ancillary Remedy in Ordinary Labor DisputesCamille DuterteОценок пока нет

- Law On Sales - Assignment TopicДокумент29 страницLaw On Sales - Assignment TopicKobe BullmastiffОценок пока нет

- Debentures & Loan Capital (Part 2)Документ36 страницDebentures & Loan Capital (Part 2)David Yew Jie MingОценок пока нет

- Collateral SecuritiesДокумент2 страницыCollateral SecuritiesJoey SulteОценок пока нет

- Right of First Preference of Unpaid Wages (Article 110 of The Labor Code)Документ1 страницаRight of First Preference of Unpaid Wages (Article 110 of The Labor Code)Jin YangyangОценок пока нет

- TheMighttoUndo AvoidableTransactionsundertheInsolvДокумент4 страницыTheMighttoUndo AvoidableTransactionsundertheInsolvDivija PiduguОценок пока нет

- National University Manila - Obligations and ContractsДокумент7 страницNational University Manila - Obligations and Contractsmnd lghОценок пока нет

- Merge ExtinguishmentДокумент20 страницMerge ExtinguishmentMyra ViusОценок пока нет

- Liability Insurance Certificate SummaryДокумент1 страницаLiability Insurance Certificate SummaryEstuardo RodasОценок пока нет

- Finals Oblicon DoctrinesДокумент39 страницFinals Oblicon DoctrinesAleezah Gertrude RaymundoОценок пока нет

- GSIS - GSIS v. City Treasurer of ManilaДокумент12 страницGSIS - GSIS v. City Treasurer of ManilaYang AlcoranОценок пока нет

- Earlier Insolvency Regimes in India to IBCДокумент21 страницаEarlier Insolvency Regimes in India to IBCArushi JindalОценок пока нет

- Concurrence AND Preference of Credits: (ART. 2236-2251 OF THE Civil Code)Документ52 страницыConcurrence AND Preference of Credits: (ART. 2236-2251 OF THE Civil Code)Ianna Carmel QuitayenОценок пока нет

- God Bless! Law On ObligationsДокумент10 страницGod Bless! Law On ObligationsMa. Kristine Laurice AmancioОценок пока нет

- Pure and Conditional ObligationДокумент47 страницPure and Conditional ObligationLmark VerdadОценок пока нет

- Extinguishment OF Obligations Extinguishment OF ObligationsДокумент39 страницExtinguishment OF Obligations Extinguishment OF ObligationsCamillus Carillo AngelesОценок пока нет

- Obl IconДокумент7 страницObl IconDensel James Abua SilvaniaОценок пока нет

- General Overview: Taxation Law ReviewДокумент2 страницыGeneral Overview: Taxation Law ReviewHannah Keziah Dela CernaОценок пока нет

- OBLIGATIONSДокумент173 страницыOBLIGATIONSAlea Foby GelidoОценок пока нет

- Finals Oblicon DoctrinesДокумент45 страницFinals Oblicon DoctrinesAleezah Gertrude RaymundoОценок пока нет

- I. Read Chapter 3: Kinds of Obligations and Complete The Table Below. Other Pertinent FactsДокумент5 страницI. Read Chapter 3: Kinds of Obligations and Complete The Table Below. Other Pertinent FactsGerwin AbejarОценок пока нет

- California Bus Lines Novated Promissory Notes Case ExplainedДокумент18 страницCalifornia Bus Lines Novated Promissory Notes Case ExplainedRobert Jayson UyОценок пока нет

- Deposit InsuranceBrochure FinalДокумент2 страницыDeposit InsuranceBrochure FinalKatreena Mae ConstantinoОценок пока нет

- De Roy v. CAДокумент2 страницыDe Roy v. CARichelle CartinОценок пока нет

- Dpa Irr PDFДокумент49 страницDpa Irr PDFHelena HerreraОценок пока нет

- Guilatco v. City of DagumpanДокумент4 страницыGuilatco v. City of DagumpanRichelle CartinОценок пока нет

- G.R. No. 231989Документ12 страницG.R. No. 231989Richelle CartinОценок пока нет

- Air France v. CarrascosoДокумент9 страницAir France v. Carrascosoeasa^belleОценок пока нет

- Bar Review Tracker - LEXploreДокумент8 страницBar Review Tracker - LEXploreRichelle CartinОценок пока нет

- People v. Manabat PDFДокумент19 страницPeople v. Manabat PDFJessica mabungaОценок пока нет

- Bermudez v. HerreraДокумент3 страницыBermudez v. HerreraRichelle CartinОценок пока нет

- Court of Appeals Holds Customs Officials Personally Liable Despite Finding of No Bad FaithДокумент5 страницCourt of Appeals Holds Customs Officials Personally Liable Despite Finding of No Bad FaithRichelle CartinОценок пока нет

- Bermudez v. HerreraДокумент3 страницыBermudez v. HerreraRichelle CartinОценок пока нет

- Ampatuan DecisionДокумент761 страницаAmpatuan DecisionGMA News Online100% (1)

- Rem Rev - Antiporda Vs Garchitorena G.R. No. 133289Документ4 страницыRem Rev - Antiporda Vs Garchitorena G.R. No. 133289Richelle CartinОценок пока нет

- OCA Circular No. 251 2018Документ10 страницOCA Circular No. 251 2018Richelle CartinОценок пока нет

- Tabuena Vs SandiganbayanДокумент55 страницTabuena Vs SandiganbayanRichelle CartinОценок пока нет

- Rem Rev - Antiporda Vs Garchitorena G.R. No. 133289Документ4 страницыRem Rev - Antiporda Vs Garchitorena G.R. No. 133289Richelle CartinОценок пока нет

- Rem Rev - People Vs Montenegro G.R. No. L-45772Документ6 страницRem Rev - People Vs Montenegro G.R. No. L-45772Richelle CartinОценок пока нет

- Rem Rev - People Vs Montenegro G.R. No. L-45772Документ6 страницRem Rev - People Vs Montenegro G.R. No. L-45772Richelle CartinОценок пока нет

- Social Justice Society V Dangerous Drugs BoardДокумент11 страницSocial Justice Society V Dangerous Drugs BoardRichelle CartinОценок пока нет

- Safari - 29 Jul 2019 at 10:32 AMДокумент1 страницаSafari - 29 Jul 2019 at 10:32 AMRichelle CartinОценок пока нет

- R.A. 9262 - VawcДокумент8 страницR.A. 9262 - VawcRichelle CartinОценок пока нет

- Willaware VS JesichrisДокумент2 страницыWillaware VS JesichrisRichelle CartinОценок пока нет

- Republic V ManaloДокумент1 страницаRepublic V ManaloRichelle CartinОценок пока нет

- APA Pilots Legal Rights After Airline RestructureДокумент7 страницAPA Pilots Legal Rights After Airline RestructureDaniel Goh100% (1)

- CA Rules on Customs Broker Accreditation InvalidДокумент9 страницCA Rules on Customs Broker Accreditation InvalidIya LumbangОценок пока нет

- Extreme NegotiationsДокумент8 страницExtreme Negotiationsgaurav aroraОценок пока нет

- Sihi V IacДокумент2 страницыSihi V IacFrancis Kyle Cagalingan SubidoОценок пока нет

- Principles of TQMДокумент2 страницыPrinciples of TQMmacОценок пока нет

- 02 McGuigan CH 01Документ14 страниц02 McGuigan CH 01Zoran BosevskiОценок пока нет

- Probation Law of 1976Документ3 страницыProbation Law of 1976Roland MarananОценок пока нет

- 1853 LIEBER On Civil Liberty and Self-GovernmentДокумент621 страница1853 LIEBER On Civil Liberty and Self-Governmentpythias returnsОценок пока нет

- A Roadmap For Stability and Growth April 8Документ115 страницA Roadmap For Stability and Growth April 8Mansoor GoharОценок пока нет

- Wcms 228592 PDFДокумент64 страницыWcms 228592 PDFAregawi GebreyesusОценок пока нет

- Scientific Attitude and Values: Francis John V. SicosanaДокумент17 страницScientific Attitude and Values: Francis John V. SicosanaeselОценок пока нет

- EQUITABLE PRINCIPLES IN ISLAMIC LAWДокумент5 страницEQUITABLE PRINCIPLES IN ISLAMIC LAWAimi Azemi100% (1)

- Sabah SarawakДокумент22 страницыSabah SarawakWilliam AnthonyОценок пока нет

- Fichte's Conception of GodДокумент12 страницFichte's Conception of GodAWHOFОценок пока нет

- Eden Llamas Vs Ocean GatewayДокумент2 страницыEden Llamas Vs Ocean GatewaymennaldzОценок пока нет

- Coyne 2017 Pow Boom Kablam Effects of ViewingДокумент13 страницCoyne 2017 Pow Boom Kablam Effects of ViewingElefinaОценок пока нет

- HSP - What Is KnowledgeДокумент13 страницHSP - What Is KnowledgeAde Muhammad AlifОценок пока нет

- Drugs ActivityДокумент1 страницаDrugs ActivityISTJ hohohoОценок пока нет

- Saemaul Undong Global Training for 45 CountriesДокумент4 страницыSaemaul Undong Global Training for 45 CountriesCarlos RiveraОценок пока нет

- James Midgley Perspectives On Globalization and Culture - Implications For International Social Work PracticeДокумент11 страницJames Midgley Perspectives On Globalization and Culture - Implications For International Social Work PracticemasnoerugmОценок пока нет

- Chapter 05 Organizational Ethics and The Law: Answer KeyДокумент6 страницChapter 05 Organizational Ethics and The Law: Answer KeyMaryam Al-Samhan100% (1)