Академический Документы

Профессиональный Документы

Культура Документы

Foreign Distributors 2017

Загружено:

ghuoiИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Foreign Distributors 2017

Загружено:

ghuoiАвторское право:

Доступные форматы

Dear FBOs,

Please find below the latest update reagarding foreign bonus payments from Forever Living Products Romania

. In accordance with our tax regulations, persons who are not resident in Romania but derive income from

activities related to Romania territory should provide us some specific documents.

Consequently, as FBO collecting bonus revenues from FLP Romania you should send us the following

documents:

EU residents:

A. INDIVIDUAL PERSON:

1. Fiscal Residency Certificate, which must be renewed annually (optional - in order to avoid double

taxation between your country and Romania)

2. Signed Agreement between FLP Romania and you/your entity, as fiscally registered (please see

attached the Agreement);

3. Copy to Identity Card or Passport Issued by authority from residence country

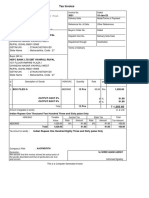

4. Invoices sent by you/your entity to FLP Romania for bonus amounts must contain the EU fiscal

registration (VAT) number. VAT registration number could be verified at

http://ec.europa.eu/taxation_customs/vies/vatResponse.html

B. LEGAL ENTITY:

1. Fiscal Residency Certificate, which must be renewed annually (optional - in order to avoid double taxation

between your country and Romania)

2. Signed Agreement between FLP Romania and you/your entity, as fiscally registered (please see

attached the Agreement);

3. Invoices sent by you/your entity to FLP Romania for bonus amounts must contain the EU fiscal registration

(VAT) number. VAT registration number could be verified at

http://ec.europa.eu/taxation_customs/vies/vatResponse.html

Non-EU residents:

A. INDIVIDUAL PERSON:

1. Fiscal Residency Certificate, which must be renewed annually (optional - in to avoid

double txation between your country and Romania)

2. Signed Agreement between FLP Romania and you/your entity, as fiscally registered (please see

attached the Agreement);

3. Copy to Identity Card or Passport Issued by authority from residence country

4. Invoices sent by you/your entity to FLP Romania for bonus amounts must contain your fiscal

registration number (TIN: Tax Identification Number).

B. LEGAL ENTITY:

1. Fiscal Residency Certificate, which must be renewed annually (optional - in to avoid

double txation between your country and Romania)

2. Signed Agreement between FLP Romania and you/your entity, as fiscally registered (please see attached

the Agreement);

3.Invoices sent by you/your entity to FLP Romania for bonus amounts must contain your fiscal registration

number (TIN: Tax Identification Number).

România, Bucureşti,Bd. Aviatorilor 3, CP 011852

C.I.F. RO11258030; J40/12036/1998; ANSPCDCP Nr 16472; CS 69,000 RON

Telefon 021 222 89 23 Fax 021 222 89 24

www.foreverliving.com; office@foreverliving.ro

According to our local tax regulations Forever Living Romania keeps any bonuses no longer than 36 months.

Minim payment is 100 euro.

Thank you very much for your understanding and cooperation.

Kind regards,

Forever Living Products Romania

Bd. Aviatorilor 3, Sector 1

011852 Bucharest

VAT number: RO11258030

România, Bucureşti,Bd. Aviatorilor 3, CP 011852

C.I.F. RO11258030; J40/12036/1998; ANSPCDCP Nr 16472; CS 69,000 RON

Telefon 021 222 89 23 Fax 021 222 89 24

www.foreverliving.com; office@foreverliving.ro

Вам также может понравиться

- Foreign - Distributors - Transfer Bonuses Procedure FLPRO - 2020Документ2 страницыForeign - Distributors - Transfer Bonuses Procedure FLPRO - 2020victorspanciocОценок пока нет

- Euroean Commision LithuaniaДокумент19 страницEuroean Commision LithuaniajemjamОценок пока нет

- E Taxfree InglesДокумент3 страницыE Taxfree InglesRandОценок пока нет

- EORI National Implementation enДокумент74 страницыEORI National Implementation en1601dejanОценок пока нет

- Info EORI 12 ENДокумент6 страницInfo EORI 12 ENMahmoud BadawiОценок пока нет

- 2021 Guidelines: Getting Your Número de Identificação Fiscal (NIF)Документ3 страницы2021 Guidelines: Getting Your Número de Identificação Fiscal (NIF)Sandipan RoyОценок пока нет

- RMO No. 43-2020Документ4 страницыRMO No. 43-2020Miming BudoyОценок пока нет

- Instructions For Complevvm No. 22T101Документ27 страницInstructions For Complevvm No. 22T101zzzzzzОценок пока нет

- CRS Doc EnglishДокумент2 страницыCRS Doc EnglishsanjeevnnОценок пока нет

- Bulgaria - TINДокумент4 страницыBulgaria - TINViktorОценок пока нет

- Whitelist" of VAT Taxpayers in PolandДокумент3 страницыWhitelist" of VAT Taxpayers in PolandAccaceОценок пока нет

- Vat Ec Fr-EnДокумент27 страницVat Ec Fr-EnDjema AntohiОценок пока нет

- Instructions For Completing Form No. 22t201int (07.03.2022)Документ7 страницInstructions For Completing Form No. 22t201int (07.03.2022)zzzzzzОценок пока нет

- Business Law - Course 11 - Introduction To Fiscal LawДокумент5 страницBusiness Law - Course 11 - Introduction To Fiscal LawMadalina CiobanuОценок пока нет

- Please Confirm Your Tax Residencies and Any Tax Identification NumbersДокумент7 страницPlease Confirm Your Tax Residencies and Any Tax Identification Numberssales4Оценок пока нет

- RomaniaДокумент4 страницыRomaniaKelz YouknowmynameОценок пока нет

- REVENUE MEMORANDUM CIRCULAR NO. 2-2018 Issued On January 8, 2018 ProvidesДокумент2 страницыREVENUE MEMORANDUM CIRCULAR NO. 2-2018 Issued On January 8, 2018 ProvidesAnonymous HQymOK61Оценок пока нет

- Manual Book 1770 PDFДокумент46 страницManual Book 1770 PDFHafiedz SОценок пока нет

- F6rom Jun 2011 QuДокумент13 страницF6rom Jun 2011 Qusorin8488Оценок пока нет

- 1601E BIR FormДокумент7 страниц1601E BIR FormAdonis Zoleta AranilloОценок пока нет

- Visa InformationДокумент3 страницыVisa InformationA Different HistoryОценок пока нет

- 80 2021 TT-BTC M 502560Документ69 страниц80 2021 TT-BTC M 502560XUnОценок пока нет

- Registration For VAT: The Ethiopian Experience: Yosef AlemuДокумент13 страницRegistration For VAT: The Ethiopian Experience: Yosef AlemuGedionОценок пока нет

- 715513e-Kyc Fatcacrs Pi Form Self-Certification IntranetДокумент2 страницы715513e-Kyc Fatcacrs Pi Form Self-Certification IntranetDavid NardaiaОценок пока нет

- 68120RR 1-2013Документ6 страниц68120RR 1-2013Allan AlcantaraОценок пока нет

- 2015 Tax Guideline For HungaryДокумент6 страниц2015 Tax Guideline For HungaryAccaceОценок пока нет

- Ucscinternational-Rinnovo Permesso Di Soggiorno2020 21Документ21 страницаUcscinternational-Rinnovo Permesso Di Soggiorno2020 21Sofi GagnaОценок пока нет

- 55153rr10 17Документ2 страницы55153rr10 17fatmaaleahОценок пока нет

- Manual Instruction - 1770 - 2010 - English PDFДокумент46 страницManual Instruction - 1770 - 2010 - English PDFHafiedz SОценок пока нет

- Carousel Fraud - Method For Tax Dodging in The Area of The Vat On Intra-Community LevelДокумент6 страницCarousel Fraud - Method For Tax Dodging in The Area of The Vat On Intra-Community LevelAnonymous H1yijrОценок пока нет

- Inbound 8239813781222450855Документ5 страницInbound 8239813781222450855Dannilyn Tequiapo Binay-anОценок пока нет

- BIR Form 1600Документ39 страницBIR Form 1600maeshach60% (5)

- AustriaДокумент2 страницыAustriafrankОценок пока нет

- Bir Form 0605Документ2 страницыBir Form 0605alona_245883% (6)

- 2016 Pulong PulongДокумент22 страницы2016 Pulong PulongJeromy VillarbaОценок пока нет

- UntitledДокумент18 страницUntitledbetty KemОценок пока нет

- VAT Refunds For Travellers Departing From The European Community (EC)Документ5 страницVAT Refunds For Travellers Departing From The European Community (EC)Annemarie SmithОценок пока нет

- Form 46G: Return of Third Party Information For The Year 2010Документ4 страницыForm 46G: Return of Third Party Information For The Year 2010billyhorganОценок пока нет

- Info On Vat in RomaniaДокумент16 страницInfo On Vat in RomaniaAd FelixОценок пока нет

- GPG DB T ColumbiaДокумент25 страницGPG DB T ColumbiaIușan MihaelaОценок пока нет

- The Simplified Invoice in SpainДокумент2 страницыThe Simplified Invoice in SpainArcos & Lamers Asociados, law firm in Spain, accountants in MarbellaОценок пока нет

- Choose The Legal FormДокумент2 страницыChoose The Legal FormLoana Miranda RojasОценок пока нет

- My German Tax Return: A step-by-step guide to file your taxes in GermanyОт EverandMy German Tax Return: A step-by-step guide to file your taxes in GermanyAkademische ArbeitsgemeinschaftОценок пока нет

- How to Restore the Greek Economy: Win 10 Million Dollar to Prove It WrongОт EverandHow to Restore the Greek Economy: Win 10 Million Dollar to Prove It WrongОценок пока нет

- The Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceОт EverandThe Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceОценок пока нет

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemОт EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemОценок пока нет

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxОт EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxОценок пока нет

- CRN7929292233Документ3 страницыCRN7929292233shamsehrОценок пока нет

- KRF ProgramДокумент15 страницKRF ProgramVlado SusacОценок пока нет

- E) Strategic Position and Action Evaluation (SPACE) Matrix: Financial Position (FP) RateДокумент3 страницыE) Strategic Position and Action Evaluation (SPACE) Matrix: Financial Position (FP) RateAleezah Gertrude RegadoОценок пока нет

- 5-Deductions From Gross IncomeДокумент7 страниц5-Deductions From Gross IncomeMs. AОценок пока нет

- AFAR Summative Assessment Problems (Kay Jared)Документ75 страницAFAR Summative Assessment Problems (Kay Jared)jajajaredred100% (1)

- Capstone ProjectДокумент10 страницCapstone ProjectLifeStacksОценок пока нет

- Return On Marketing InvestmentДокумент16 страницReturn On Marketing Investmentraj_thanviОценок пока нет

- Senka Dindic - CV EnglishДокумент2 страницыSenka Dindic - CV EnglishAntonela ĐinđićОценок пока нет

- GPC Investor Presentation 2017Документ58 страницGPC Investor Presentation 2017Ala BasterОценок пока нет

- Athol Furniture, IncДокумент21 страницаAthol Furniture, Incvinoth kumar0% (1)

- Blackstone 22Q1 Press Release and PresentationДокумент41 страницаBlackstone 22Q1 Press Release and Presentation魏xxxappleОценок пока нет

- Audit Module 1Документ13 страницAudit Module 1Danica GeneralaОценок пока нет

- Marketing Research 1Документ7 страницMarketing Research 1Arpita MehtaОценок пока нет

- Economic Evaluation AnalysisДокумент15 страницEconomic Evaluation AnalysisNAYOMI LOIS CISNEROSОценок пока нет

- Wage and Tax StatementДокумент4 страницыWage and Tax StatementRich1781Оценок пока нет

- ExamДокумент12 страницExamAvi SiОценок пока нет

- Icaew Cfab Mi 2018 Sample Exam 3Документ30 страницIcaew Cfab Mi 2018 Sample Exam 3Anonymous ulFku1v100% (2)

- 165 Stock Statement Msod Book DebtsДокумент4 страницы165 Stock Statement Msod Book DebtsRamakrishnan NatarajanОценок пока нет

- Planning Case StudyДокумент4 страницыPlanning Case StudyDin AbrenicaОценок пока нет

- AA Unit 2 IGCSE - Allocation of ResourcesДокумент89 страницAA Unit 2 IGCSE - Allocation of ResourcesBilal Khan100% (1)

- ADX The Trend Strength Ind..Документ4 страницыADX The Trend Strength Ind..pderby1Оценок пока нет

- Tax 2 Outline (Consolidated)Документ24 страницыTax 2 Outline (Consolidated)MRОценок пока нет

- Employment Law Outline PDFДокумент12 страницEmployment Law Outline PDFkatelyn.elliot01Оценок пока нет

- Nestle SpeechДокумент3 страницыNestle Speechkapil chandwaniОценок пока нет

- 3051 Revised DateДокумент1 страница3051 Revised DateElla and MiraОценок пока нет

- F5 RevДокумент69 страницF5 Revpercy mapetereОценок пока нет

- Energy Policy: Laura Tolnov Clausen, David RudolphДокумент10 страницEnergy Policy: Laura Tolnov Clausen, David RudolphDr. Muhammad ImranОценок пока нет

- Fund DisbursementДокумент33 страницыFund DisbursementNawal AbdulgaforОценок пока нет

- Tally Notes: Basic AccountingДокумент14 страницTally Notes: Basic AccountingAAC aacОценок пока нет

- Bill-Cum-Notice: Dial Toll Free 1912 For Bill & Supply ComplaintsДокумент1 страницаBill-Cum-Notice: Dial Toll Free 1912 For Bill & Supply Complaintsshekhar.mnnitОценок пока нет