Академический Документы

Профессиональный Документы

Культура Документы

Exam - Tax - 2019 - Key

Загружено:

Kenneth Bryan Tegerero TegioОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Exam - Tax - 2019 - Key

Загружено:

Kenneth Bryan Tegerero TegioАвторское право:

Доступные форматы

INTERMEDIATE EXAMINATION TAXATION

1. In what doctrine does the proscription to seek immediate judicial recourse as regards

tax disputes finds legal basis?

a. Doctrine of poisonous tree

b. Doctrine of exhaustion of administrative remedies

c. Doctrine of res ipsa loquitor

d. Doctrine of strictissimi juris

2. The Dark Princess & Co. received a final assessment notice last June 15, 2018 for

deficiency income taxes for covered period 2015, 2016, and 2017. After 20 days from

such receipt, the CFO filed a motion to the CIR. As of the present day, the latter is

yet to issue a decision on the protest. Considering the lapse of time since the date

of protest, the CFO now asks for your advice whether he can still file protest before

the CTA.

a. Yes, protest is still allowed since the BIR has not yet acted on the protest.

b. Protest to the CTA is no longer allowed. As a rule, protest must be made only

within the jurisdictional 180-day period to file an appeal to the CTA.

c. Yes. Protest is a matter of right to the taxpayer. He has the option to exercise

the right anytime he deems it proper.

d. Protest is not allowed. More than 180 days have lapsed since filing of protest. The

inaction of the CIR is a “deemed denial” which should have been the proper subject

of appeal.

3. The RATE program of the BIR stands for?

a. Run After Tax Evaders c. Remedy Against Tax Exemptions

b. Run Against Tax Evaders d. Right Against Tax Exemptions

4. These are administrative rulings, more specific and less general interpretations of

tax laws issued from time to time by CIR.

a. BIR Ruling c. Revenue regulation

b. Revenue Orders d. Revenue Memorandum Circulars

5. Princess KT has been assessed deficiency income tax P1,000,000, exclusive of interest

and surcharges, for the taxable year 2018. The tax liability has remained unpaid

despite the lapse of June 30, 2020 (442 days), the deadline for payment stated in the

notice and demand issued by the Commissioner. Payment was made by the taxpayer on

February 10, 2021; 225 days past due date. Compute the total tax due.

a. P1,498,530 c. P1,799,448

b. P1,395,315 d. P1,492,192

6. Princess KT has been assessed deficiency income tax of P1,000,000, exclusive of

interest and surcharge, for taxable year2015. The tax liability has remained unpaid

despite the lapse of June 30, 2017, the deadline for payment stated in the notice and

demand issued by the Commissioner, Payment was made by the taxpayer only on February

10, 2018. Compute the amount due on February 10, 2018.

a. P1,491,644 c. P1,662,141

b. P1,762,963 d. Some other amounts

7. Examine the following statements:

Statement 1: Protest against PAN is allowed through a motion for reconsideration only.

Statement 2: Protest against FAN is allowed either through a motion for

reconsideration or reinvestigation.

Statement 3: Protest against Final Decision on Disputed Assessment (FDDA) is either

through a motion for reconsideration or reinvestigation.

Which is legally incorrect?

a. Statement 1 is correct.

b. Statement 2 is correct.

c. Statement 3 is correct.

d. Not all statements are correct.

8. Examine the following statements:

Statement 1: As regards inaction of a representative, the appeal should be made

directly to the CTA and not to the CIR.

Statement 2: As regards denial of a representative, the appeal should be made to the

CTA or to the CIR.

Statement 3: Only VAT zero-rated transactions are allowed tax credit, refund, and

carry-over options.

Which is correct?

a. Only statements 2 and 3 are correct.

b. Only statements 1 and 2 are correct.

c. Statement 1 is correct; statement 3 is incorrect.

d. All statements are correct.

1 ADMISSION YEAR 2018 - 2019 | 2ND SEMESTER

INTERMEDIATE EXAMINATION TAXATION

Items 9 – 13. A PEZA-registered entity reported the following items:

Details Registered Activities Unregistered Activities

Gross sales P 121,700,000 P 10,425,000

Cost of sales 103,400,000 7,297,500

Gross income P 18,300,000 P 3,127,500

Other income - 550,500

Total gross income P 18,300,000 P 3,678,000

Operating expense (90%

allocated to registered

activities and the rest P9,890,100

to unregistered

activities)

CWTs from the first 3 quarters amounted to P98,000 (including P10,000 dated 2019)

while CWTs for the 4th quarter totaled P33,600 (excluding P5,000 CWTs not in the

name of the company).

9. Determine the 2% MCIT

a. P439,560 b. P62,550 c. P73,560 d. None of the choices

10. Determine the 30% RCIT

a. P0 b. P1,103,400 c. P806,697 d. None of the choices

11. Income tax still due

a. P0 b. P685,097 c. P675,097 d. None of the choices

12. How much tax has been paid to the provincial government where the PEZA entity is

located?

a. P0 b. P366,000 c. P364,022 d. P915,000

13. How much income tax should be remitted to the BIR?

a. P1,234,097 b. P1,224,097 c. P1,600,097 d. None of the choices

14. Lagrio, a Filipino resident and single, owns a restaurant in Session Road, Baguio City

and in Dagupan, Pangasinan. In 2016, it had the following data:

Gross receipts Expenses

Baguio City P 4,055,015.20 P 3,296,423.10

Dagupan, Pangasinan 3,624,980.60 3,025,114.80

In 2017 the total basic and additional community tax payable by Lagrio is

a. P7,074 c. P1,363

b. P7,699 d. P5,005

15. Helen Corporation, a domestic corporation had the following data for 2016:

Cash sales P 3,954,245

Sales on accounts 1,689,341

Cost of sales 3,453,957

Expenses 1,142,190

Dividend from Zeus Corporation 43,096

Interest income 950

Real properties Zonal value Assessed value

Land P 1,234,590 P 945,687

Building 2,985,043 2,545,890

The total community tax to be paid by Helen Corporation in 2017 is

a. P2,994 c. P4,170

b. P3,494 d. P3,033

Items 16 – 20. Enumerate at least five (5) taxes which are not allowed to be imposed in

local government units. Include the exceptions, if there is any.

--- end of intermediate examination in taxation ---

2 ADMISSION YEAR 2018 - 2019 | 2ND SEMESTER

Вам также может понравиться

- TaxДокумент3 страницыTaxArven FrancoОценок пока нет

- PRTC - Final Preboard - Taxation - 2017Документ5 страницPRTC - Final Preboard - Taxation - 2017Kenneth Bryan Tegerero Tegio50% (2)

- Taxation - Final ExamДокумент4 страницыTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- TAX Assessment October 2020Документ8 страницTAX Assessment October 2020FuturamaramaОценок пока нет

- Pre-Test 1 - ProblemsДокумент3 страницыPre-Test 1 - ProblemsKenneth Bryan Tegerero TegioОценок пока нет

- Mcq-Opt and Excise TaxesДокумент3 страницыMcq-Opt and Excise TaxesRandy ManzanoОценок пока нет

- (Tax) CPAR PreweekДокумент4 страницы(Tax) CPAR PreweekNor-janisah PundaodayaОценок пока нет

- Second Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who IsДокумент5 страницSecond Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who IsLeilalyn NicolasОценок пока нет

- 1.1 MC - Exercises On Estate Tax (PRTC)Документ8 страниц1.1 MC - Exercises On Estate Tax (PRTC)marco poloОценок пока нет

- BLT 101Документ14 страницBLT 101NIMOTHI LASEОценок пока нет

- Mock Deparmentals MASQДокумент6 страницMock Deparmentals MASQHannah Joyce MirandaОценок пока нет

- Answer Midterm - Docx 1Документ8 страницAnswer Midterm - Docx 1Yolly DiazОценок пока нет

- PSW2 Tax1 SetbДокумент1 страницаPSW2 Tax1 Setb'Bhandamme ParagasОценок пока нет

- Tax LawДокумент8 страницTax LawAmie Jane MirandaОценок пока нет

- S C Test Bank Income TaxationДокумент135 страницS C Test Bank Income Taxationthenikkitr50% (6)

- Transfer Taxes Theory QuizzerДокумент15 страницTransfer Taxes Theory QuizzerKenОценок пока нет

- Tax CPAR Final Pre Board2Документ5 страницTax CPAR Final Pre Board2No Longer Existing67% (3)

- Midterm Examination BSAISДокумент11 страницMidterm Examination BSAISAlexis Kaye DayagОценок пока нет

- Final Preboard Tax PDFДокумент16 страницFinal Preboard Tax PDFElla AlmazanОценок пока нет

- Rfbt1 Oblico Lecture NotesДокумент40 страницRfbt1 Oblico Lecture NotesGizel BaccayОценок пока нет

- Fringe Benefit - QuizДокумент3 страницыFringe Benefit - QuizArlea AsenciОценок пока нет

- Opt Review QuestionsДокумент5 страницOpt Review QuestionsSantiago BuladacoОценок пока нет

- Other Percentage TaxДокумент2 страницыOther Percentage TaxGerald SantosОценок пока нет

- A Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsДокумент1 страницаA Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsAmie Jane MirandaОценок пока нет

- Estate Tax Gross Estate GuideДокумент6 страницEstate Tax Gross Estate GuideCharry Ramos67% (3)

- TAX Preweek Lecture (B42)Документ24 страницыTAX Preweek Lecture (B42)Bernadette Panican100% (1)

- Evaluate 1 - Estate Taxation Answer KeyДокумент3 страницыEvaluate 1 - Estate Taxation Answer KeyNicolas AlonsoОценок пока нет

- Vat 2Документ4 страницыVat 2Allen KateОценок пока нет

- Documentary Stamp TaxДокумент6 страницDocumentary Stamp TaxchrizОценок пока нет

- Chapter 3 - Gross Estate2013Документ8 страницChapter 3 - Gross Estate2013Marvin Celedio100% (8)

- TAX2 3RD ED Solutions Manual 1Документ51 страницаTAX2 3RD ED Solutions Manual 1Nadine Isabelle OsisОценок пока нет

- Installment Basis: Page 1 of 7Документ7 страницInstallment Basis: Page 1 of 7Kenneth Bryan Tegerero Tegio100% (1)

- Arturo Died Leaving The Following PropertiesДокумент1 страницаArturo Died Leaving The Following PropertiesCristine Salvacion PamatianОценок пока нет

- KEY Level 2 QuestionsДокумент5 страницKEY Level 2 QuestionsDarelle Hannah MarquezОценок пока нет

- Excise Tax BIR FinalДокумент11 страницExcise Tax BIR FinalmixxОценок пока нет

- Taxation Law ReviewДокумент8 страницTaxation Law ReviewShirliz Jane Benitez100% (2)

- Final ExamДокумент10 страницFinal ExamAllen Fey De JesusОценок пока нет

- TAX ON INDIVIDUALS PART 1Документ14 страницTAX ON INDIVIDUALS PART 1Veel Creed100% (1)

- Cash BasisДокумент4 страницыCash BasisMark DiezОценок пока нет

- Exclusion from gross incomeДокумент11 страницExclusion from gross incomeMychie Lynne MayugaОценок пока нет

- 0310 TX Final PreboardДокумент5 страниц0310 TX Final PreboardAlvin John San JuanОценок пока нет

- UL Taxation: Introduction to Income, Final and Capital Gains TaxДокумент7 страницUL Taxation: Introduction to Income, Final and Capital Gains TaxJimmyChaoОценок пока нет

- Estate Tax Chapter SummaryДокумент4 страницыEstate Tax Chapter SummaryPJ PoliranОценок пока нет

- Gross Estate Tax QuizzerДокумент6 страницGross Estate Tax QuizzerLloyd Sonica100% (1)

- Taxation Quizzer Quizzes For Tax PDFДокумент62 страницыTaxation Quizzer Quizzes For Tax PDFCelestino AlisОценок пока нет

- Estate Tax Activities (Questions)Документ4 страницыEstate Tax Activities (Questions)Christine Nathalie BalmesОценок пока нет

- Income Taxation QuizzerДокумент41 страницаIncome Taxation QuizzerMarriz Tan100% (4)

- Tax - FBT and de MinimisДокумент19 страницTax - FBT and de Minimisryan rosalesОценок пока нет

- Taxes TransferДокумент52 страницыTaxes TransferGrayl TalaidОценок пока нет

- Ast TX 801 Items of Gross Income (Batch 22)Документ5 страницAst TX 801 Items of Gross Income (Batch 22)Elijah MontefalcoОценок пока нет

- Revenue Etc For Income TaxationДокумент286 страницRevenue Etc For Income TaxationpurplebasketОценок пока нет

- 2nd Quizzer 1st Sem SY 2020-2021 - AKДокумент6 страниц2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarОценок пока нет

- Philippine Taxation Questions GuideДокумент36 страницPhilippine Taxation Questions GuideShaira BugayongОценок пока нет

- 2020NMBE Taxation With AnswersДокумент21 страница2020NMBE Taxation With AnswersWilsonОценок пока нет

- Name: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2Документ3 страницыName: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2うん こ100% (1)

- Global Power Battery Solutions Tax Protest LetterДокумент4 страницыGlobal Power Battery Solutions Tax Protest LetterConrad BrionesОценок пока нет

- TAXДокумент10 страницTAXJeana Segumalian100% (3)

- Arellano University Income Tax QuizДокумент8 страницArellano University Income Tax QuizKim RoqueОценок пока нет

- Which of The Following Is/are False?: Taxation EasyДокумент5 страницWhich of The Following Is/are False?: Taxation EasysophiaОценок пока нет

- TAXATIONДокумент5 страницTAXATIONsophiaОценок пока нет

- RPC 2 - CasesДокумент2 страницыRPC 2 - CasesKenneth Bryan Tegerero TegioОценок пока нет

- Bar Bulletin 7Документ20 страницBar Bulletin 7Alimozaman DiamlaОценок пока нет

- Bernas - Conflict of Laws Syllabus (Reading List) Nov 2008 To 2009 FinalДокумент7 страницBernas - Conflict of Laws Syllabus (Reading List) Nov 2008 To 2009 Finallex libertadore100% (1)

- Actrev 4 2019Документ2 страницыActrev 4 2019Kenneth Bryan Tegerero TegioОценок пока нет

- Accountancy Department Preliminary Examination in INCOME TAXATIONДокумент6 страницAccountancy Department Preliminary Examination in INCOME TAXATIONKenneth Bryan Tegerero TegioОценок пока нет

- CPA Review - BMBE Notes - 2019Документ1 страницаCPA Review - BMBE Notes - 2019Kenneth Bryan Tegerero TegioОценок пока нет

- Donor's Tax Ruling AppealДокумент11 страницDonor's Tax Ruling AppealKenneth Bryan Tegerero Tegio100% (1)

- Project BCДокумент1 страницаProject BCKenneth Bryan Tegerero TegioОценок пока нет

- DAM - Special ProceedingsДокумент41 страницаDAM - Special ProceedingsKenneth Bryan Tegerero TegioОценок пока нет

- CPA Review - VAT Quizzer - 2019Документ11 страницCPA Review - VAT Quizzer - 2019Kenneth Bryan Tegerero Tegio50% (2)

- Representation - Concealment - Q and A - For DistributionДокумент3 страницыRepresentation - Concealment - Q and A - For DistributionKenneth Bryan Tegerero TegioОценок пока нет

- Bv&eps ToaДокумент2 страницыBv&eps ToaKenneth Bryan Tegerero TegioОценок пока нет

- Taxation - Review - BSA - LGC, OIC - 2018NДокумент9 страницTaxation - Review - BSA - LGC, OIC - 2018NKenneth Bryan Tegerero TegioОценок пока нет

- Obe Course Syllabus: BlawregДокумент3 страницыObe Course Syllabus: BlawregKenneth Bryan Tegerero TegioОценок пока нет

- Lesson PlanДокумент2 страницыLesson PlanKenneth Bryan Tegerero TegioОценок пока нет

- Determine Applicable Tax Rates ForДокумент1 страницаDetermine Applicable Tax Rates ForKenneth Bryan Tegerero TegioОценок пока нет

- Law On Evidence PointersДокумент6 страницLaw On Evidence PointersKenneth Bryan Tegerero TegioОценок пока нет

- Chapter 27 Forensics MCQbarbosaДокумент4 страницыChapter 27 Forensics MCQbarbosaKenneth Bryan Tegerero TegioОценок пока нет

- Special Exam TaxДокумент11 страницSpecial Exam TaxKenneth Bryan Tegerero TegioОценок пока нет

- Special Exam TaxДокумент11 страницSpecial Exam TaxKenneth Bryan Tegerero TegioОценок пока нет

- Taxation - Gross Income - Quizzer - 2018 - MayДокумент5 страницTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioОценок пока нет

- General provisions on insurable interestДокумент5 страницGeneral provisions on insurable interestKenneth Bryan Tegerero TegioОценок пока нет

- Special Exam TaxДокумент1 страницаSpecial Exam TaxKenneth Bryan Tegerero TegioОценок пока нет

- Special Exam TaxДокумент11 страницSpecial Exam TaxKenneth Bryan Tegerero TegioОценок пока нет

- Actrev2 - InvestmentsДокумент19 страницActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- Answer Key - Conflict of Laws - TegioДокумент1 страницаAnswer Key - Conflict of Laws - TegioKenneth Bryan Tegerero TegioОценок пока нет

- AsapДокумент3 страницыAsapKenneth Bryan Tegerero TegioОценок пока нет

- Chapter 1 - FS AnalysisДокумент40 страницChapter 1 - FS AnalysisKenneth Bryan Tegerero Tegio100% (2)

- Module 8 Market StructureДокумент3 страницыModule 8 Market Structure이시연Оценок пока нет

- Ashwagandha: Decision Sciences 2 End Term Answer KeyДокумент14 страницAshwagandha: Decision Sciences 2 End Term Answer KeyHarshal WankhedeОценок пока нет

- AssignmentДокумент12 страницAssignmentpavnijainОценок пока нет

- Nigeria OML 42 Purchase CompletedДокумент5 страницNigeria OML 42 Purchase Completedroyal highprinceОценок пока нет

- Difference between variable and absorption costingДокумент8 страницDifference between variable and absorption costingJc QuismundoОценок пока нет

- Maharaj Industry PVTДокумент62 страницыMaharaj Industry PVTThippesh R100% (1)

- The Ecuadorean Rose IndustryДокумент2 страницыThe Ecuadorean Rose IndustryFabian HagemannОценок пока нет

- Universiti Teknologi Mara Assignment 3 Project Delivery MethodДокумент9 страницUniversiti Teknologi Mara Assignment 3 Project Delivery MethodBICHAKA MELKAMUОценок пока нет

- Session 2 QuestionsДокумент10 страницSession 2 QuestionsreemmajzoubОценок пока нет

- ACCA FR D19 Notes PDFДокумент152 страницыACCA FR D19 Notes PDFMohammed DanishОценок пока нет

- Bearish PatternsДокумент41 страницаBearish PatternsKama Sae100% (1)

- Dog Grooming SWOT AnalysisДокумент9 страницDog Grooming SWOT Analysismba Section06dОценок пока нет

- MB 4054 S TRACKTOR 6x4 (Full Spec.)Документ18 страницMB 4054 S TRACKTOR 6x4 (Full Spec.)Mar Dha ZudyanОценок пока нет

- Hindalco'S Acquisition of Novelis: The Making of A GiantДокумент11 страницHindalco'S Acquisition of Novelis: The Making of A GiantHarshShahОценок пока нет

- Indian Retail Industry: Structure, Drivers of Growth, Key ChallengesДокумент15 страницIndian Retail Industry: Structure, Drivers of Growth, Key ChallengesDhiraj YuvrajОценок пока нет

- V Audit of Property Plant and Equipment-3Документ4 страницыV Audit of Property Plant and Equipment-3jomelОценок пока нет

- Final PPT - Airline 4aprilДокумент15 страницFinal PPT - Airline 4aprilSadanand RamugadeОценок пока нет

- DTI Leyte Negosyo ChronicleДокумент18 страницDTI Leyte Negosyo ChronicleDTI Leyte100% (1)

- Unit5 - Structure of Indian IndustryДокумент13 страницUnit5 - Structure of Indian IndustryNayna GuptaОценок пока нет

- Economics - Paper 02Документ7 страницEconomics - Paper 02lalОценок пока нет

- Advance Futures & OptionsДокумент6 страницAdvance Futures & OptionsJkОценок пока нет

- Pricing Policy AnalysisДокумент14 страницPricing Policy AnalysisArnnava SharmaОценок пока нет

- Indian shipping industry holds ocean of opportunitiesДокумент17 страницIndian shipping industry holds ocean of opportunitiesASHOKОценок пока нет

- Macd Indicator Moving Average Convergence Divergence: Part TwoДокумент6 страницMacd Indicator Moving Average Convergence Divergence: Part TwoAzariahJohnОценок пока нет

- Green Marketing: An IntroductionДокумент20 страницGreen Marketing: An IntroductionAbhishek ChaddaОценок пока нет

- Strategic FitДокумент49 страницStrategic FitMayank PrakashОценок пока нет

- Lecture 1: Introduction to International Financial ManagementДокумент17 страницLecture 1: Introduction to International Financial ManagementMahbubul Islam KoushickОценок пока нет

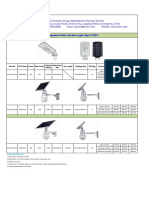

- Anern Integrated Solar Garden Light-201604Документ1 страницаAnern Integrated Solar Garden Light-201604Godofredo VillenaОценок пока нет

- Sodexo CPFДокумент24 страницыSodexo CPFApurva SharmaОценок пока нет

- FOREIGN EXCHANGE MARKETS AND RATES GUIDEДокумент22 страницыFOREIGN EXCHANGE MARKETS AND RATES GUIDETanu GuptaОценок пока нет