Академический Документы

Профессиональный Документы

Культура Документы

Ppe Bio Asset

Загружено:

Evita Faith Leong0 оценок0% нашли этот документ полезным (0 голосов)

870 просмотров2 страницыОригинальное название

PPE-BIO-ASSET.docx

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

870 просмотров2 страницыPpe Bio Asset

Загружено:

Evita Faith LeongАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

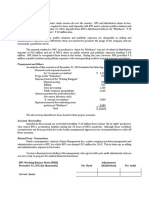

NAME: ______________________________________ 5.

During self-construction of an asset by Richardson

Company, the following were among the costs

1. During 2018 Dasmariñas Company installed a incurred: Fixed overhead for the year P1,000,000

production assembly line to manufacture furniture. Portion of P1,000,000 fixed overhead that would be

In 2018 Dasmariñas purchased a new machine and allocated to asset if it were normal production

rearranged the assembly line to install this machine. P60,000 Variable overhead attributable to self-

The rearrangement did not increase the estimated construction P75,000 What amount of overhead

useful life of the assembly line but it did result in should be included in the cost of the self-constructed

significantly more efficient production. The asset?

following expenditures were incurred in connection A. P1,135,000 C. P75,000

with this project: B. P1,075,000 D. P135,000

Machine 5,000,000 Temerity Company has different kinds of farm

Labor to install new machine 400,000 animals on January 1, 2015. During the current year,

Parts added in rearranging the assembly 2,000,000 several acquisitions occurred related to these farm

line to provide future benefits animals. A detailed summary of these transactions is

Labor and overhead to rearrange the 600,000 as follows:

assembly line Carrying amount on January 1:

15 Horses -1 year old 1,000,000

What amount of the above expenditures should be 10 Dairy cattle - 2 years old 400,000

capitalized in 2018? 8 Carabaos- 2.5 years old 200,000

A. 8,000,000 C. 7,400,000 20 Hogs - 3 years old 500,000

B. 5,400,000 D. 2,600,000

Purchases on June 30:

2. A schedule of plant assets owned by Bauan 4 Dairy cattle -1 year old 150,000

Company is presented below. 6 Carabaos - 6 months old 100,000

Fair value less cost of disposal on December 31

Cost Scrap Life 15 Horses - 1 year old 1,200,000

Building 8,800,000 800,000 20 years 10 Dairy cattle - 2 years old 520,000

Machinery 3,200,000 320,000 15 years 8 Carabaos - 2.5 years old 250,000

20 Hogs - 3 years old 550,000

Equipment 640,000 5 years

4 Dairy cattle -1 year old 170,000

Bauan computes depreciation on the straight 6 Carabaos - 6 months old 110,000

line method. The composite life of the assets

Fair value less cost of disposal on December 31

should be

15 Horses - 2 years old 1,350,000

A. 19.8 C. 18.0 10 Dairy cattle - 3 years old 580,000

B. 13.3 D. 16.0 8 Carabaos - 3.5 years old 290,000

3. Wilson Co. purchased land as a factory site for 20 Hogs - 4 years old 600,000

P800,000. Wilson paid P80,000 to tear down two 4 Dairy cattle - 1.5 years old 200,000

buildings on the land. Salvage was sold for P5,400. 6 Carabaos - 1 year old 140,000

Legal fees of P3,480 were paid for title investigation

and making the purchase. Architect's fees were There were no farm animals sold during the year and

P31,200. Title insurance cost P2,400, and liability neither were there any newborns nor deaths.

insurance during construction cost P2,600.

Excavation cost P10,440. The contractor was paid 6. What is the carrying amount of the biological assets

P2,500,000. An assessment made by the city for on December 31?

pavement was P6,400. Interest costs during A. 2,350,000 C. 2,380,000

construction were P170,000. B. 2,800,000 D. 3,160,000

The cost of the land that should be recorded by 7. What is the gain from change in fair value

Wilson Co. is attributable to price change?

A. P880,480. C. P889,880. A. No Change C. 450,000

B. P886,880. D. P896,280. B. 810,000 D. 360,000

4. On January 2, 2010, Stacy Company acquired 8. What is the gain from change in fair value

equipment to be used in its manufacturing attributable to physical change?

operations. The equipment has an estimated useful A. No Change C. 450,000

life of 10 years and an estimated salvage value of B. 810,000 D. 360,000

P30,000. The depreciation applicable to this

equipment was P140,000 for 2013, computed under Righteous Company provided the following data:

the sum-of-the-years'-digits method. What was the Value of biological asset at acquisition

acquisition cost of the equipment? cost on December 31, 2016 6,000,000

A. P1,070,000 C. P1,100,000

Fair valuation surplus on initial recognition

B. P1,130,000 D. P1,083,333

at fair value on December 31, 2016 500,000

Change in fair value on December 31, 2017 A physical inventory taken on December 31, 2005

due to growth and price fluctuation 900,000 resulted in an ending inventory of P4,500,000. The

Decrease in fair value due to harvest 100,000 gross profit on sales remained constant at 30% in

recent years. Benguet suspects some inventory may

9. What is the carrying amount of the biological asset have been taken by a new employee. At December

on December 31, 2017? 31, 2005 what is the estimated cost of missing

A. 6,500,000 C.7,400,000 inventory?

B. 7,500,000 D.7,300,000 A. P5,000,000

B. P500,000

10. What amount of net gain from the change in fair C. P4,500,000

value of biological asset be reported in 2017? D. P - 0 –

A. 900,000 C. 1,400,000

B. 800,000 D. 1,300,000

11. Walsh Retailers purchased merchandise with a list - End of Quiz -

price of P75,000, subject to trade discounts of 20%

and 10%, with no cash discounts allowable. Walsh

should record the cost of this merchandise as

A. P52,500. C. P58,500.

B. P54,000. D. P75,000.

12. Gonzaga Company uses the weighted average

method to determine the cost of its inventory.

Gonzaga recorded the following information

pertaining to its inventory:

Units Units cost Total cost

Balance 1/1 160,000 60 9,600,000

Sold on 1/15 140,000

Purchased 80,000 90 7,200,000

on 1/31

What amount of inventory should Gonzaga report in

its January 31, 2005 balance sheet?

Perpetual Periodic

A. P8,400,000 P7,000,000

B. P7,000,000 P8,400,000

C. P8,400,000 P7,500,000

D. P7,000,000 P7,500,000

Plank Co. uses the retail inventory method. The

following information is available for the current

year.

Cost Retail

Beginning inventory 156,000 244,000

Purchases 590,000 830,000

Freight-in 10,000 —

Employee discounts — 4,000

Net markups — 30,000

Net Markdowns — 40,000

Sales — 780,000

13. The ending inventory at retail should be

A. 320,000. C. 300,000.

B. 288,000. D. 280,000.

14. The approximate cost of the ending inventory by the

conventional retail method is

Believe that you can and it will happen.

A. 191,800. C. 196,000.

But don't just believe,

B. 189,840. D. 204,960.

you've also got to put in the work,

and you'll see that there

15. Benguet Company’s accounting records indicated are many opportunities ahead of you.

the following for 2005: Look in the bright side and there are greater things

coming your way! -iCPA

Inventory, January 1 P6,000,000

Purchases 20,000,000

Sales 30,000,000

Вам также может понравиться

- Cup 1 - FARДокумент8 страницCup 1 - FARJeric Lagyaban AstrologioОценок пока нет

- Related Standards: PAS 16, 20, 23 & 36: Property, Plant and Equipment - TheoryДокумент6 страницRelated Standards: PAS 16, 20, 23 & 36: Property, Plant and Equipment - Theorymae cruzОценок пока нет

- FarДокумент14 страницFarKenneth Robledo100% (1)

- K12 Philippines Whereabouts PDFДокумент37 страницK12 Philippines Whereabouts PDFsichhahaОценок пока нет

- FAR - PPE (Depreciation and Derecognition) - StudentДокумент3 страницыFAR - PPE (Depreciation and Derecognition) - StudentPamelaОценок пока нет

- Accounting 106 SeatworkДокумент2 страницыAccounting 106 SeatworkLaizashi Carin50% (2)

- Quiz - Ppe CostДокумент2 страницыQuiz - Ppe CostAna Mae HernandezОценок пока нет

- Lecture Notes On Receivable FinancingДокумент5 страницLecture Notes On Receivable Financingjudel ArielОценок пока нет

- Diagnostic Investments QuestionsДокумент5 страницDiagnostic Investments Questionscourse heroОценок пока нет

- Investment in Equity Securities 2Документ2 страницыInvestment in Equity Securities 2miss independentОценок пока нет

- Ia Test Bank 20 PGДокумент20 страницIa Test Bank 20 PGzee abadillaОценок пока нет

- Instructions: Choose The Letter That Corresponds To Your Answer and Write Them On A Crosswise YellowДокумент8 страницInstructions: Choose The Letter That Corresponds To Your Answer and Write Them On A Crosswise YellowRoseОценок пока нет

- Far NosolnДокумент11 страницFar NosolnStela Marie CarandangОценок пока нет

- P1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Документ2 страницыP1.001 - PPE Revaluation (Lecture Notes & Illustrative Problems)Patrick Kyle Agraviador0% (1)

- 9.3 Debt InvestmentsДокумент7 страниц9.3 Debt InvestmentsJorufel PapasinОценок пока нет

- 9.1 Equity Investments at Fair Value PDFДокумент4 страницы9.1 Equity Investments at Fair Value PDFJorufel PapasinОценок пока нет

- 19 - Revaluation and ImpairmentДокумент3 страницы19 - Revaluation and Impairmentjaymark canayaОценок пока нет

- P 1Документ8 страницP 1Ken Mosende TakizawaОценок пока нет

- DLSA AP Intangibles For DistributionДокумент7 страницDLSA AP Intangibles For DistributionJan Renee EpinoОценок пока нет

- Bvps and EpsДокумент30 страницBvps and EpsRenzo Melliza100% (1)

- What A ProblemДокумент4 страницыWhat A ProblemEleazar SalazarОценок пока нет

- Equity YyyДокумент33 страницыEquity YyyJude SantosОценок пока нет

- AUDProb TEST BANKДокумент28 страницAUDProb TEST BANKFrancine HollerОценок пока нет

- ExamView Pro - DEBT FINANCING - TST PDFДокумент15 страницExamView Pro - DEBT FINANCING - TST PDFShannon ElizaldeОценок пока нет

- Far FeДокумент9 страницFar FeMark Domingo Mendoza100% (1)

- p1 IaДокумент1 страницаp1 IaLeika Gay Soriano OlarteОценок пока нет

- Financial Accounting Part 1Документ5 страницFinancial Accounting Part 1Christopher Price100% (1)

- Audprob Answer 5 and 6Документ2 страницыAudprob Answer 5 and 6venice cambryОценок пока нет

- Lecture Notes: Nature of Intangible Assets RecognitionДокумент5 страницLecture Notes: Nature of Intangible Assets RecognitionRyan Carta50% (2)

- Quiz - Module 2Документ5 страницQuiz - Module 2Alyanna Alcantara67% (3)

- Conceptual FrameworkДокумент9 страницConceptual FrameworkAveryl Lei Sta.Ana0% (1)

- ExamДокумент7 страницExamKristen WalshОценок пока нет

- D8Документ11 страницD8neo14100% (1)

- FAR MaterialДокумент25 страницFAR MaterialJerecko Ace ManlangatanОценок пока нет

- 4 InventoriesДокумент5 страниц4 InventoriesandreamrieОценок пока нет

- Quiz 1 & 2 (Far)Документ26 страницQuiz 1 & 2 (Far)Leane MarcoletaОценок пока нет

- Answers - Chapter 5 Vol 2Документ5 страницAnswers - Chapter 5 Vol 2jamfloxОценок пока нет

- Case Study - Bordeos, Kristine - Sec 5Документ6 страницCase Study - Bordeos, Kristine - Sec 5Kristine Lirose BordeosОценок пока нет

- Far 6660Документ2 страницыFar 6660Glessy Anne Marie FernandezОценок пока нет

- FAR 2&3 Test BankДокумент63 страницыFAR 2&3 Test BankRachelle Isuan TusiОценок пока нет

- Financial StatementsДокумент6 страницFinancial StatementsLuiОценок пока нет

- Auditing Theory Red Sirug Ra 9298 - Philippine Accountancy Act of 2004 (Multiple Choice Questions)Документ10 страницAuditing Theory Red Sirug Ra 9298 - Philippine Accountancy Act of 2004 (Multiple Choice Questions)Jyznareth TapiaОценок пока нет

- Chapter 5 Audit of PPEДокумент29 страницChapter 5 Audit of PPELyka Mae Palarca IrangОценок пока нет

- Loans and Receivables - Long TermДокумент3 страницыLoans and Receivables - Long TermAleezaAngelaSanchezNarvadezОценок пока нет

- FAR - PRACTICE SET 5 PROPERTY PLANT AND EQUIPMENT UnprotectedДокумент9 страницFAR - PRACTICE SET 5 PROPERTY PLANT AND EQUIPMENT UnprotectedxjammerОценок пока нет

- Janet Wooster Owns A Retail Store That Sells New andДокумент2 страницыJanet Wooster Owns A Retail Store That Sells New andAmit PandeyОценок пока нет

- Andiam: January 2, 2019Документ5 страницAndiam: January 2, 2019Avox EverdeenОценок пока нет

- MSQ-03 - Working Capital FinanceДокумент11 страницMSQ-03 - Working Capital FinanceJade RamosОценок пока нет

- Ay16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 1Документ6 страницAy16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 1Maketh.Man33% (3)

- SQE - Financial Accounting and Reporting - Second Year - March 31, 2011Документ11 страницSQE - Financial Accounting and Reporting - Second Year - March 31, 2011Jerimiah MirandaОценок пока нет

- MidtermS2 InventoriesДокумент11 страницMidtermS2 InventoriesQueenie Dayagro0% (2)

- Finance Review Questions With Answer KeyДокумент14 страницFinance Review Questions With Answer KeyLoranisa BalorioОценок пока нет

- Intermediate Accounting 2 AnswersДокумент18 страницIntermediate Accounting 2 AnswersFery AnnОценок пока нет

- What Amount Should Be Recorded As Depletion For 2016?Документ3 страницыWhat Amount Should Be Recorded As Depletion For 2016?Alyanna Alcantara0% (1)

- Prelim L6 Assignment TestДокумент13 страницPrelim L6 Assignment TestGarp BarrocaОценок пока нет

- Cpar Practical Accounting II May 2012 Final Pre Board W AnswersДокумент13 страницCpar Practical Accounting II May 2012 Final Pre Board W Answersbobo kaОценок пока нет

- A6 Audit of Ppe Part 2Документ5 страницA6 Audit of Ppe Part 2KezОценок пока нет

- Inventory Valuation and Gross Profit MethodДокумент3 страницыInventory Valuation and Gross Profit MethodLuiОценок пока нет

- Bio AssetДокумент8 страницBio AssetJessie jorgeОценок пока нет

- UNIT 2 Discussion ProblemsДокумент6 страницUNIT 2 Discussion ProblemsCal PedreroОценок пока нет

- Investment in A Powerplant2Документ17 страницInvestment in A Powerplant2Evita Faith LeongОценок пока нет

- Deed of Absolute SaleДокумент6 страницDeed of Absolute SaleEvita Faith LeongОценок пока нет

- Special Power of AttorneyДокумент2 страницыSpecial Power of AttorneyEvita Faith LeongОценок пока нет

- 7.cash Flow UnsolvedДокумент16 страниц7.cash Flow UnsolvedEvita Faith LeongОценок пока нет

- 7.cash Flow UnsolvedДокумент16 страниц7.cash Flow UnsolvedEvita Faith LeongОценок пока нет

- 7.cash Flow UnsolvedДокумент16 страниц7.cash Flow UnsolvedEvita Faith LeongОценок пока нет

- 7.cash Flow UnsolvedДокумент16 страниц7.cash Flow UnsolvedEvita Faith LeongОценок пока нет

- REED 107 Report Group 1Документ12 страницREED 107 Report Group 1Evita Faith LeongОценок пока нет

- Bank ReconciliationДокумент3 страницыBank ReconciliationEvita Faith LeongОценок пока нет

- 7.cash Flow UnsolvedДокумент16 страниц7.cash Flow UnsolvedEvita Faith LeongОценок пока нет

- Leong, Larano, Morales Accounting For Hosptals and Other Health Care OrganizationДокумент32 страницыLeong, Larano, Morales Accounting For Hosptals and Other Health Care OrganizationEvita Faith LeongОценок пока нет

- 7.cash Flow UnsolvedДокумент16 страниц7.cash Flow UnsolvedEvita Faith LeongОценок пока нет

- 7.cash Flow UnsolvedДокумент16 страниц7.cash Flow UnsolvedEvita Faith LeongОценок пока нет

- Peer Mentoring CardДокумент1 страницаPeer Mentoring CardEvita Faith LeongОценок пока нет

- 2017 Far Aicpa Q-AДокумент58 страниц2017 Far Aicpa Q-AEvita Faith Leong100% (1)

- Case Study Vifel CoopДокумент12 страницCase Study Vifel CoopEvita Faith Leong78% (9)

- Decision Matrix Selection MatrixДокумент2 страницыDecision Matrix Selection MatrixEng Muhammad MarzoukОценок пока нет

- Case Study Analysis of STДокумент10 страницCase Study Analysis of STEvita Faith Leong60% (5)

- 2017 AICPA Newly Released Questions-AuditingДокумент62 страницы2017 AICPA Newly Released Questions-AuditingEvita Faith LeongОценок пока нет

- Day 06Документ8 страницDay 06Cy PenalosaОценок пока нет

- Sales Quiz For 2nd YearДокумент5 страницSales Quiz For 2nd YearEvita Faith Leong50% (2)

- Report of Business PolicyДокумент32 страницыReport of Business PolicyEvita Faith LeongОценок пока нет

- Trial Balance: Saint Paul As at 31 December 2018Документ1 страницаTrial Balance: Saint Paul As at 31 December 2018Evita Faith LeongОценок пока нет

- BackgroundДокумент3 страницыBackgroundEvita Faith LeongОценок пока нет

- BetawaccДокумент1 страницаBetawaccwelcome2jungleОценок пока нет

- #01 Accounting ProcessДокумент3 страницы#01 Accounting ProcessZaaavnn VannnnnОценок пока нет

- MidtermQ2 - Home Office Branch Accounting Billing Above CostДокумент13 страницMidtermQ2 - Home Office Branch Accounting Billing Above Costsarahbee100% (2)

- How To Evaluate Economic Feasibility of A Power Plant ProjectДокумент7 страницHow To Evaluate Economic Feasibility of A Power Plant Projectfundu123Оценок пока нет

- EnergyДокумент21 страницаEnergyEvita Faith LeongОценок пока нет

- Capital Budgeting Worksheet PDFДокумент73 страницыCapital Budgeting Worksheet PDFEvita Faith LeongОценок пока нет

- Teaching Plan - Math 8 Week 1-8 PDFДокумент8 страницTeaching Plan - Math 8 Week 1-8 PDFRYAN C. ENRIQUEZОценок пока нет

- Computer in Community Pharmacy by Adnan Sarwar ChaudharyДокумент10 страницComputer in Community Pharmacy by Adnan Sarwar ChaudharyDr-Adnan Sarwar Chaudhary100% (1)

- Business Plan - A TeahouseДокумент6 страницBusiness Plan - A TeahouseJoe DОценок пока нет

- Polyembryony &its ImportanceДокумент17 страницPolyembryony &its ImportanceSURIYA PRAKASH GОценок пока нет

- Differential Calculus ExamДокумент6 страницDifferential Calculus ExamCaro Kan LopezОценок пока нет

- Story 1Документ3 страницыStory 1api-296631749Оценок пока нет

- Ajsl DecisionMakingModel4RoRoДокумент11 страницAjsl DecisionMakingModel4RoRolesta putriОценок пока нет

- Wall Panel SystemsДокумент57 страницWall Panel SystemsChrisel DyОценок пока нет

- Gothic ArchitectureДокумент6 страницGothic ArchitectureleeОценок пока нет

- STD Specification For Design and Integration of Fuel Energy Storage F3063Документ7 страницSTD Specification For Design and Integration of Fuel Energy Storage F3063Kobus PretoriusОценок пока нет

- Microbial Diseases of The Different Organ System and Epidem.Документ36 страницMicrobial Diseases of The Different Organ System and Epidem.Ysabelle GutierrezОценок пока нет

- Exploded Views and Parts List: 6-1 Indoor UnitДокумент11 страницExploded Views and Parts List: 6-1 Indoor UnitandreiionОценок пока нет

- CAMEL Model With Detailed Explanations and Proper FormulasДокумент4 страницыCAMEL Model With Detailed Explanations and Proper FormulasHarsh AgarwalОценок пока нет

- Thesis Topics in Medicine in Delhi UniversityДокумент8 страницThesis Topics in Medicine in Delhi UniversityBecky Goins100% (2)

- Previous Year Questions Tnusrb S. I - 2010: Part - A': General KnowledgeДокумент21 страницаPrevious Year Questions Tnusrb S. I - 2010: Part - A': General Knowledgemohamed AzathОценок пока нет

- What Is Terrorism NotesДокумент3 страницыWhat Is Terrorism NotesSyed Ali HaiderОценок пока нет

- Makerere University Is Inviting Applications For Undergraduate Admissions On Private Sponsorship For Academic Year 2015/2016Документ9 страницMakerere University Is Inviting Applications For Undergraduate Admissions On Private Sponsorship For Academic Year 2015/2016The Campus TimesОценок пока нет

- Acc 106 Account ReceivablesДокумент40 страницAcc 106 Account ReceivablesAmirah NordinОценок пока нет

- Ladies Code I'm Fine Thank YouДокумент2 страницыLadies Code I'm Fine Thank YoubobbybiswaggerОценок пока нет

- Merchant Shipping MINIMUM SAFE MANNING Regulations 2016Документ14 страницMerchant Shipping MINIMUM SAFE MANNING Regulations 2016Arthur SchoutОценок пока нет

- Saes T 883Документ13 страницSaes T 883luke luckyОценок пока нет

- When I Was A ChildДокумент2 страницыWhen I Was A Childapi-636173534Оценок пока нет

- Forensic My Cology Mcgraw HillДокумент8 страницForensic My Cology Mcgraw HillJayanti RaufОценок пока нет

- SetupДокумент4 страницыSetupRsam SamrОценок пока нет

- PDF Synopsis PDFДокумент9 страницPDF Synopsis PDFAllan D GrtОценок пока нет

- Tso C197Документ6 страницTso C197rdpereirОценок пока нет

- Tylenol CrisisДокумент2 страницыTylenol CrisisNida SweetОценок пока нет

- 2018 H2 JC1 MSM Differential Equations (Solutions)Документ31 страница2018 H2 JC1 MSM Differential Equations (Solutions)VincentОценок пока нет

- Matokeo CBДокумент4 страницыMatokeo CBHubert MubofuОценок пока нет

- Letter Writing: An Informative Powerpoint About LetterДокумент11 страницLetter Writing: An Informative Powerpoint About LetterMalik KamranОценок пока нет

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageОт EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageРейтинг: 4.5 из 5 звезд4.5/5 (109)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 5 из 5 звезд5/5 (13)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditОт EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditРейтинг: 5 из 5 звезд5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyОт EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyРейтинг: 4.5 из 5 звезд4.5/5 (37)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОт EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОценок пока нет

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)От EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Рейтинг: 4.5 из 5 звезд4.5/5 (24)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanОт EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanРейтинг: 4.5 из 5 звезд4.5/5 (79)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОт EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОценок пока нет

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyОт EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyРейтинг: 5 из 5 звезд5/5 (1)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantОт EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantРейтинг: 4.5 из 5 звезд4.5/5 (146)