Академический Документы

Профессиональный Документы

Культура Документы

Etv 4

Загружено:

JKV APPA RAOОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Etv 4

Загружено:

JKV APPA RAOАвторское право:

Доступные форматы

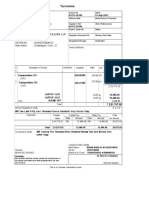

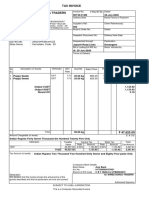

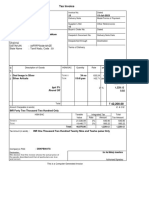

Tax Invoice

Srinivasa Tours and Travels Invoice No. Dated

Plot No. 275, CBI Colony, STT/1431/18-19 30-Mar-2019

Near Red Water Tank, NGO’s Colony Delivery Note Mode/Terms of Payment

Vanasthalipuram, Hyderabad

.

Supplier’s Ref. Other Reference(s)

GSTIN/UIN: 36AKVPK4495J1ZA

State Name : Telangana, Code : 36

Buyer’s Order No. Dated

Buyer

ETV Bharat (A Div of Ushodaya Enterprises) Despatch Document No. Delivery Note Date

Ramoji Film City, Hyderabad

GSTIN/UIN : 36AAACU2690P1ZS Despatched through Destination

State Name : Telangana, Code : 36

Terms of Delivery

Sl Particulars HSN/SAC Quantity Rate per Amount

No.

1 Vehicle Hire Charges -GST@5 996601 89,452.00

2 CGST 2.50 % 2,236.30

3 SGST 2.50 % 2,236.30

4 Rounded Off 0.40

Total 93,925.00

Amount Chargeable (in words) E. & O.E

INR Ninety Three Thousand Nine Hundred Twenty Five Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

996601 89,452.00 2.50% 2,236.30 2.50% 2,236.30 4,472.60

Total 89,452.00 2,236.30 2,236.30 4,472.60

Tax Amount (in words) : INR Four Thousand Four Hundred Seventy Two and Sixty paise Only

Remarks:

Being The Vehicle transportation charges from 26-2/19

to 25/03/19agst Veh no:AP29TB1344 Monthly Rent -

90000/- , Less Diesel Variation (1037/4.5 x 2.38 548/

-89452) accounted

Company’s PAN : AKVPK4495J

for Srinivasa Tours and Travels

Authorised Signatory

This is a Computer Generated Invoice

Вам также может понравиться

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОт EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОценок пока нет

- Tax Invoice: Ramoji Film City, Hyderabad Gstin/Uin: 36AAACU2690P1ZS State Name: Telangana, Code: 36Документ1 страницаTax Invoice: Ramoji Film City, Hyderabad Gstin/Uin: 36AAACU2690P1ZS State Name: Telangana, Code: 36JKV APPA RAOОценок пока нет

- Accounting VoucherДокумент1 страницаAccounting Voucheradposting wОценок пока нет

- Yeamin Pi 73Документ1 страницаYeamin Pi 73Tofail IslamОценок пока нет

- Tax InvoiceДокумент1 страницаTax InvoiceᴘᴇᴀᴄᴏᴄᴋОценок пока нет

- (Original For Recipient) : INR One Thousand and Seventy Six and Twenty Four Paise OnlyДокумент2 страницы(Original For Recipient) : INR One Thousand and Seventy Six and Twenty Four Paise OnlyElakya muniОценок пока нет

- H 191styleДокумент1 страницаH 191stylebhayupawar96Оценок пока нет

- Trainer Recognition InvoiceДокумент1 страницаTrainer Recognition InvoiceKiruba JacobОценок пока нет

- Sales TEL 017 24-25Документ1 страницаSales TEL 017 24-25purchase.tel18Оценок пока нет

- UPS InvoiceДокумент1 страницаUPS InvoiceMohammed NazimОценок пока нет

- Bill No. 001Документ1 страницаBill No. 001vishwajeetОценок пока нет

- Sales 3742Документ1 страницаSales 3742momskitchen.storeОценок пока нет

- Tax Invoice: Plot No.E1-E2, Riico Industr-Ial Ajmer Gstin/Uin: 08AACCT2953Q1ZQ State Name: Rajasthan, Code: 08Документ1 страницаTax Invoice: Plot No.E1-E2, Riico Industr-Ial Ajmer Gstin/Uin: 08AACCT2953Q1ZQ State Name: Rajasthan, Code: 08SHIV SHAKTI TRUCKSОценок пока нет

- Pranathi Answer For GST PracticalДокумент2 страницыPranathi Answer For GST PracticalMohammedShahrukhОценок пока нет

- Tax Invoice: Igst Round OffДокумент1 страницаTax Invoice: Igst Round OffNagoor ValiОценок пока нет

- Tax InvoiceДокумент1 страницаTax InvoiceAnjani KumariОценок пока нет

- Sales 373Документ2 страницыSales 373info.ashokchoudhary.icaОценок пока нет

- Kaizen Travels 189 23-24Документ1 страницаKaizen Travels 189 23-24jaylovsnehaОценок пока нет

- Invoice: Vechoochira, Chempanoli Pathanamthitta GSTIN/UIN: 32AAIFK3878Q1ZMДокумент1 страницаInvoice: Vechoochira, Chempanoli Pathanamthitta GSTIN/UIN: 32AAIFK3878Q1ZMRAVEENDRA OFFICEОценок пока нет

- Tax Invoice: Genesco SvsДокумент1 страницаTax Invoice: Genesco Svsshakir tkОценок пока нет

- 19 Mayur ProductДокумент1 страница19 Mayur Productchamundaxerox88Оценок пока нет

- Output CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionДокумент1 страницаOutput CGST 14% Output SGST 14% Round Off Fright Charge: 1 Kit Front SuspensionmadhurОценок пока нет

- Tax InvoiceДокумент1 страницаTax InvoiceMohammedShahrukhОценок пока нет

- Subhanila 110 20mmДокумент1 страницаSubhanila 110 20mmsubhanilavinayagaОценок пока нет

- SV Roofing-13Документ1 страницаSV Roofing-13bikkumalla shivaprasadОценок пока нет

- SahanaДокумент1 страницаSahanaShreenath AgarwalОценок пока нет

- 107-Falguni Gruh UdhyogДокумент1 страница107-Falguni Gruh UdhyogdeepОценок пока нет

- 0069 OcilabsДокумент1 страница0069 OcilabsOCI LABSОценок пока нет

- 11PKBДокумент1 страница11PKBBIKRAM KUMAR BEHERAОценок пока нет

- Accounting VoucherДокумент1 страницаAccounting Voucherramzanahmad14Оценок пока нет

- Tax Invoice: Gstin/Uin: 24AABCY0257H1ZI State Name: Gujarat, Code: 24Документ1 страницаTax Invoice: Gstin/Uin: 24AABCY0257H1ZI State Name: Gujarat, Code: 24jayshah_26Оценок пока нет

- Tax Invoice: Infinitytwins and Ropes 105 25/02/2023Документ1 страницаTax Invoice: Infinitytwins and Ropes 105 25/02/2023Sanjay GotiОценок пока нет

- Invoice 23Документ1 страницаInvoice 23kuldeep singhОценок пока нет

- Laxmi Trading.1Документ2 страницыLaxmi Trading.1SK NETОценок пока нет

- 669Документ1 страница669mundhrabharatОценок пока нет

- 10th PassДокумент1 страница10th PassDigital Seva KendraОценок пока нет

- Tri 18Документ1 страницаTri 18amitkv7Оценок пока нет

- Accounting VoucherДокумент2 страницыAccounting VoucherDhananjay PatilОценок пока нет

- The Raj Home INV 301Документ2 страницыThe Raj Home INV 301Ankesh MishraОценок пока нет

- Discount SGST CGST Round Off: Buyer (Bill To)Документ1 страницаDiscount SGST CGST Round Off: Buyer (Bill To)Dwivedi ShubhamОценок пока нет

- Tax Invoice: State Name: Gujarat, Code: 24Документ1 страницаTax Invoice: State Name: Gujarat, Code: 24jayshah_26Оценок пока нет

- Annavaram 25-12-23Документ1 страницаAnnavaram 25-12-23saisugunaaquaОценок пока нет

- Tax Invoice Shree Durga Traders: E-Way Bill NoДокумент1 страницаTax Invoice Shree Durga Traders: E-Way Bill NoRisi Spice industriesОценок пока нет

- Tax Invoice: I GST Rounding OffДокумент1 страницаTax Invoice: I GST Rounding OffAvinash TiwariОценок пока нет

- SubbareddyCnstrn 064Документ1 страницаSubbareddyCnstrn 064aes eventОценок пока нет

- Sample of Commission BillДокумент1 страницаSample of Commission BillmanojОценок пока нет

- Quotation: Subject To Hyderabad Jurisdiction This Is A Computer Generated Quotation and Does Not Require SignatureДокумент1 страницаQuotation: Subject To Hyderabad Jurisdiction This Is A Computer Generated Quotation and Does Not Require SignatureService FTPLОценок пока нет

- Accounting Voucher 1Документ1 страницаAccounting Voucher 1Daksh BavawalaОценок пока нет

- Bbe 6Документ2 страницыBbe 6Sanjay LoyalkaОценок пока нет

- 1 MergedДокумент11 страниц1 Mergedhimalaya.2343Оценок пока нет

- Srasti 1Документ1 страницаSrasti 1Jitendra PatidarОценок пока нет

- 8863 PDFДокумент1 страница8863 PDFmalar studioОценок пока нет

- Tax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Документ1 страницаTax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Abhinaya JoОценок пока нет

- Sudev Podder 084Документ1 страницаSudev Podder 084ssd dОценок пока нет

- Bill Format Gypusm BoardДокумент8 страницBill Format Gypusm BoardRamachandra SahuОценок пока нет

- Proforma Invoice: No-61, Om Sakthi Nagar, Madagadipet, Gstin/Uin: 34ABBFM1856E1ZK State Name: Puducherry, Code: 34Документ1 страницаProforma Invoice: No-61, Om Sakthi Nagar, Madagadipet, Gstin/Uin: 34ABBFM1856E1ZK State Name: Puducherry, Code: 34surajdoraОценок пока нет

- GoodДокумент1 страницаGoodEntertain with musicОценок пока нет

- Adobe Scan Jul 28, 2022Документ1 страницаAdobe Scan Jul 28, 2022Palani KumarОценок пока нет

- Rtgs FormДокумент1 страницаRtgs Formshree.sairamthangamaligaiОценок пока нет

- Tax Law Research Paper TopicsДокумент5 страницTax Law Research Paper Topicsxfdacdbkf100% (1)

- Supplementary Material: Illustration. The Following Series of Illustrations Are Based On The Figures ObtainedДокумент3 страницыSupplementary Material: Illustration. The Following Series of Illustrations Are Based On The Figures ObtainedGabrielle Joshebed AbaricoОценок пока нет

- Salary Slip XLXДокумент2 страницыSalary Slip XLXDeepak50% (4)

- Computation - Vijay SharmaДокумент2 страницыComputation - Vijay Sharmaankit sharmaОценок пока нет

- Tax SecretsДокумент16 страницTax SecretsVenkat SairamОценок пока нет

- InvoiceДокумент1 страницаInvoiceirusappan KrithickОценок пока нет

- Appendix 9D - Instructions - RAODCOДокумент1 страницаAppendix 9D - Instructions - RAODCOdinvОценок пока нет

- Aditya AS 22 23 2134Документ1 страницаAditya AS 22 23 2134Aditya AmbwaniОценок пока нет

- Tax Invoice/Retail Invoice: OptivalДокумент1 страницаTax Invoice/Retail Invoice: Optivalrangasamy.tnstcОценок пока нет

- Banco de Oro Vs RepublicДокумент2 страницыBanco de Oro Vs RepublicDanica Faye100% (4)

- IT-AE-36-G04 - Quick Guide On How To Complete The ITR12 Return For Individuals - External Guide PDFДокумент23 страницыIT-AE-36-G04 - Quick Guide On How To Complete The ITR12 Return For Individuals - External Guide PDFscribdtulasi100% (1)

- Who Are Required To File Income Tax ReturnsДокумент2 страницыWho Are Required To File Income Tax ReturnsJieLexie NollorОценок пока нет

- CIR v. Shinko Electric Industries Co. LTDДокумент2 страницыCIR v. Shinko Electric Industries Co. LTDMarien MontecalvoОценок пока нет

- CIR Vs MarubeniДокумент1 страницаCIR Vs MarubeniMon DreykОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ashutosh SinhaОценок пока нет

- May FinalДокумент1 страницаMay FinalvijeshwaranОценок пока нет

- Pims PDF in Stream WriterДокумент3 страницыPims PDF in Stream WriterBrianОценок пока нет

- Esteban Van Goor - Presentation at The European Bitcoin ConventionДокумент13 страницEsteban Van Goor - Presentation at The European Bitcoin Conventionm9500Оценок пока нет

- Payroll WorksheetДокумент2 страницыPayroll WorksheetGena Duresa100% (1)

- Important Theory Qutions Income TaxДокумент9 страницImportant Theory Qutions Income TaxPRANARITA BHOLОценок пока нет

- Finals Non Graded Exercises 002 - Journalizing Under Mechandising Concern With Vat Page 28Документ6 страницFinals Non Graded Exercises 002 - Journalizing Under Mechandising Concern With Vat Page 28Garpt KudasaiОценок пока нет

- Rent Vs Buy Calculator - AssetyogiДокумент10 страницRent Vs Buy Calculator - Assetyogijayonline_4uОценок пока нет

- Case A Case B Case CДокумент2 страницыCase A Case B Case Ckhiladi883Оценок пока нет

- Income Taxation CHAPTER 1Документ31 страницаIncome Taxation CHAPTER 1Armalyn CangqueОценок пока нет

- Your Invoice No. RE200143606Документ1 страницаYour Invoice No. RE200143606Erick MetzОценок пока нет

- Hypo Week 9Документ2 страницыHypo Week 9Jari JungОценок пока нет

- Manitoba PC 2016 Platform Costing DocumentДокумент3 страницыManitoba PC 2016 Platform Costing DocumentPCManitobaОценок пока нет

- General BHR Worksheet CalculatorДокумент2 страницыGeneral BHR Worksheet CalculatorEmba MadrasОценок пока нет

- Doc-20230213-Wa0015. (1) (1) (2) (2) (1) - 1-1Документ1 страницаDoc-20230213-Wa0015. (1) (1) (2) (2) (1) - 1-1Harsh SharmaОценок пока нет

- Reliance Insurance - Payment Receipt (1) 1Документ1 страницаReliance Insurance - Payment Receipt (1) 1dinesh.pyreddyОценок пока нет