Академический Документы

Профессиональный Документы

Культура Документы

Algebra Test No. 7

Загружено:

AMIN BUHARI ABDUL KHADERИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Algebra Test No. 7

Загружено:

AMIN BUHARI ABDUL KHADERАвторское право:

Доступные форматы

Sunday, May 24, 2009

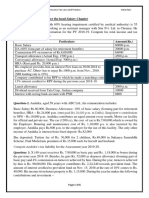

1. For a person (man) monthly salary is Rs. 8650 (exclusive of C.A.) and his deductions are as follows:

LIC – Rs.135 p.m., GPF – Rs. 500 p.m., Professional Tex – Rs. 2500 p.a., Infrastructure bonds – Rs. 5000.

Find his taxable amount, for the financial year 2006 – 07.

2. Mr. A.P. Deshmukh is serving in a company and earns Rs. 23,700 p.m. He deposited Rs. 2300 p.m. towards

provident fund. He bought NSC of Rs. 10,000 and donated Rs. 6000 to Chief Minister Relief Fund. Find income

tax he has to pay for the financial year 2006 – 07.

3. Smt. C. Archana has her gross annual income for the year 2006 – 07 of Rs. 1,48,000 and her savings are as

follows. LIC – Rs. 4800 p.a. PLI- Rs. 2750 p.a. Find the net income tax to be paid by Smt. C. Archana , for the

financial year 2006 – 07.

Sunday, May 24, 2009

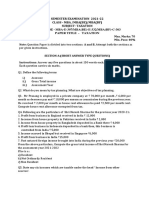

1. Ganesh Rathod is working in an advertising company. His gross annual income is Rs. 2,00,000. His age is about

67 years. He pays Rs. 3000 to Prime Minister Relief Fund and buys NSC of Rs. 10,000. What will be the income

tax in the year 2006 – 07 he has to pay?

2. Vimalaben is below 65 years. Her monthly salary is Rs. 21,000 (exclusive of C.A., ) ; and deductions are as

follows: Profession tax Rs. 2500 p.a.; GPF Rs. 4000 p.m; PLI Rs. 295 p.m. Fixed deposits Rs. 20000. Find net tax

to be paid for the financial year 2006 – 07.

3. For a senior citizen monthly income is Rs. 18,440 and deductions are as follows: Fixed deposits of one month

salary. Find the tax to be paid and Education cess for the financial year 2006 – 07.

Sunday, May 24, 2009

1. For a person [woman below 65 years], monthly salary is Rs. 9160 (exclusive of C.A.). Deductions: Professional

tax Rs. 2500 p.a., NSC Rs. 6000; PLI – Rs. 295 p.m. Find the tax to be paid, for the financial year 2006 – 07.

2. For a person (man), monthly salary is Rs. 18,900 (exclusive of CA) and the deductions are as follows: Interest

on house loan Rs. 2000 p.m., profession tax Rs. 2500 p.a. , GPF Rs. 3000 p.m., LIC Rs. 10,000 p.a. and the

principal of house loan is Rs. 6500 p.m. Find the income tax to be paid for the financial year 2006 – 07.

3. John Albert is a junior engineer in Electricity Company. He earns Rs. 18,700 p.m. from salary. He donates Rs.

6000 in the funds of National Defense. He pays Rs. 4750 as a house loan per month. Also he deposited Rs.

1200 and Rs. 1500 toward GPF and PLI respectively per month. What amount he will have to pay as net tax in

the financial year 2006-07.

Вам также может понравиться

- Business Taxation MBA III 566324802Документ5 страницBusiness Taxation MBA III 566324802mohanraokp2279Оценок пока нет

- Astm D7928 - 17Документ25 страницAstm D7928 - 17shosha100% (2)

- Tax AssignmentДокумент4 страницыTax AssignmentkaRan GUptД100% (1)

- Employt Revision Qns. 2023Документ8 страницEmployt Revision Qns. 2023Mbeiza MariamОценок пока нет

- Salary QuestionsДокумент3 страницыSalary QuestionsgixОценок пока нет

- Numericals of SalaryДокумент7 страницNumericals of SalaryAnas ShaikhОценок пока нет

- Income Tax Question BankДокумент8 страницIncome Tax Question Banksurya.notes19Оценок пока нет

- 4.2 Home Assignment Questions - Income From SalaryДокумент3 страницы4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Bachelor's Degree Programme (BDP) : Assignment 2015-16Документ4 страницыBachelor's Degree Programme (BDP) : Assignment 2015-16Paras JainОценок пока нет

- Income From SalaryДокумент9 страницIncome From Salaryvinod nainiwalОценок пока нет

- +++C$C, CCC$ CДокумент7 страниц+++C$C, CCC$ CKomal Damani ParekhОценок пока нет

- Ed Practice Problems For TaxationДокумент6 страницEd Practice Problems For TaxationKIYYA QAYYUM BALOCH100% (1)

- MCQ Taxation 2Документ24 страницыMCQ Taxation 2Mahesh VekariyaОценок пока нет

- India Budget 2010 HighlightsДокумент25 страницIndia Budget 2010 HighlightsadipjksОценок пока нет

- TAX Papers - Paper 1Документ2 страницыTAX Papers - Paper 1syedshahОценок пока нет

- MBA Sem 1 Indirect Tax PaperДокумент4 страницыMBA Sem 1 Indirect Tax PaperVedvati PetkarОценок пока нет

- QIP Is A Process Which Was Introduced by SEBI So As To Enable The Listed Companies To RaiseДокумент5 страницQIP Is A Process Which Was Introduced by SEBI So As To Enable The Listed Companies To Raisekaviya.vОценок пока нет

- Tax Management ModelДокумент17 страницTax Management ModelZacharia VincentОценок пока нет

- Assignment On SalaryДокумент4 страницыAssignment On SalarySohel MahmudОценок пока нет

- Calculate Income from Salaries Including Entertainment Allowance and House Rent AllowanceДокумент3 страницыCalculate Income from Salaries Including Entertainment Allowance and House Rent AllowanceSiva SankariОценок пока нет

- Income Tax II Illustration Computation of Total Income PDFДокумент7 страницIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilОценок пока нет

- Income From SalaryДокумент10 страницIncome From SalaryShubham BajajОценок пока нет

- Short Numerical Practice Problems for Income Tax ComputationДокумент3 страницыShort Numerical Practice Problems for Income Tax ComputationFarhan CheemaОценок пока нет

- I.TAx 302Документ4 страницыI.TAx 302tadepalli patanjaliОценок пока нет

- IFS QuestionДокумент6 страницIFS QuestionHdkakaksjsbОценок пока нет

- 4 SalariesДокумент6 страниц4 SalariesSrinishaОценок пока нет

- Mba E307 - Mbe E332 - MBF C303Документ4 страницыMba E307 - Mbe E332 - MBF C303Shashank TripathiОценок пока нет

- Salaries 3Документ2 страницыSalaries 3soumyajeetkundu123Оценок пока нет

- Dpsidocsecontent 2020 21senior08.04.2020XIIACC PDFДокумент4 страницыDpsidocsecontent 2020 21senior08.04.2020XIIACC PDFSamayОценок пока нет

- CIA 1 Taxation LawsДокумент1 страницаCIA 1 Taxation LawsNALIN.S 19111423Оценок пока нет

- September: (CBCS) (F +R) (2016-17 and Onwards)Документ7 страницSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeОценок пока нет

- Test 4 PDFДокумент2 страницыTest 4 PDFHåris Khån MøhmånďОценок пока нет

- COMPENSATION BENEFITS BANK KPOДокумент33 страницыCOMPENSATION BENEFITS BANK KPORinky NarangОценок пока нет

- Assignment of Personal Financial Planning: TopicДокумент4 страницыAssignment of Personal Financial Planning: Topicvikas anandОценок пока нет

- Income from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionДокумент53 страницыIncome from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionSiva SankariОценок пока нет

- Calculating Compensation Income TaxДокумент1 страницаCalculating Compensation Income TaxLoudie Ann MarcosОценок пока нет

- Mba 3 Sem Tax Planning and Management Jan 2019Документ3 страницыMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhОценок пока нет

- Individual Taxation (Ay 2019-20)Документ29 страницIndividual Taxation (Ay 2019-20)Mudit SinghОценок пока нет

- Income Tax Law & PracticeДокумент29 страницIncome Tax Law & PracticeMohanОценок пока нет

- Financial Planning Pre-Retirement StageДокумент14 страницFinancial Planning Pre-Retirement StageHIGGSBOSON304Оценок пока нет

- Salary IllustrationДокумент10 страницSalary IllustrationSarvar Pathan100% (1)

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsДокумент4 страницыFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiОценок пока нет

- Sections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021Документ6 страницSections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021BablooОценок пока нет

- FPДокумент20 страницFPRadhika ParekhОценок пока нет

- QUESTION BANK ITLP SK NOV 2022 BBA 6 Nov 2022 FINAL UNIT1&2Документ5 страницQUESTION BANK ITLP SK NOV 2022 BBA 6 Nov 2022 FINAL UNIT1&2Hemant WadhwaniОценок пока нет

- Questions On Income From SalaryДокумент3 страницыQuestions On Income From SalaryAniket AgrawalОценок пока нет

- Final Spotlight February 2019Документ98 страницFinal Spotlight February 2019RanjanОценок пока нет

- Individual Txation FY 203 24Документ44 страницыIndividual Txation FY 203 24Smarty ShivamОценок пока нет

- 6 PGBPДокумент8 страниц6 PGBPSrinishaОценок пока нет

- Calculating Income Tax for Individuals and BusinessesДокумент36 страницCalculating Income Tax for Individuals and BusinessesVelayudham ThiyagarajanОценок пока нет

- Retirement Planning: Part - 1: Your Monthly Expenses - Now & ThenДокумент4 страницыRetirement Planning: Part - 1: Your Monthly Expenses - Now & ThensridharОценок пока нет

- Computation of Total Income & TaxДокумент3 страницыComputation of Total Income & TaxkhushhalibajajОценок пока нет

- BudgetДокумент12 страницBudgetmbapritiОценок пока нет

- Business TaxationДокумент3 страницыBusiness TaxationatvishalОценок пока нет

- Correct AnswerДокумент20 страницCorrect AnswerToji ThomasОценок пока нет

- Income Tax Declaration Form 2022-2023Документ2 страницыIncome Tax Declaration Form 2022-2023ARUN CHAUHANОценок пока нет

- PTP SolutionsДокумент5 страницPTP SolutionsSanah SahniОценок пока нет

- ESOPs Policy & CTC Structure - Urban Tribe 2022 2Документ8 страницESOPs Policy & CTC Structure - Urban Tribe 2022 2guptaaditya1108Оценок пока нет

- PFTP - Unit II - Income From Salary - Short SumsДокумент3 страницыPFTP - Unit II - Income From Salary - Short Sumsgeetagupta2974Оценок пока нет

- Finance Management Specialisation - Ii 304 - B: Direct TaxationДокумент3 страницыFinance Management Specialisation - Ii 304 - B: Direct TaxationRohit ParmarОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- Algebra Question Paper For Board Exam 4Документ3 страницыAlgebra Question Paper For Board Exam 4AMIN BUHARI ABDUL KHADER100% (2)

- The Magic of Chemical ReactionsДокумент3 страницыThe Magic of Chemical ReactionsAMIN BUHARI ABDUL KHADER100% (1)

- Formal LettersДокумент9 страницFormal LettersAMIN BUHARI ABDUL KHADER100% (2)

- Political Science: Try This Question Paper As Per New SyllabusДокумент2 страницыPolitical Science: Try This Question Paper As Per New SyllabusAMIN BUHARI ABDUL KHADERОценок пока нет

- Algebra Question Paper 3Документ4 страницыAlgebra Question Paper 3AMIN BUHARI ABDUL KHADERОценок пока нет

- Algebra Question Paper 5 PDFДокумент3 страницыAlgebra Question Paper 5 PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Trigonometry and Mensuration FormulaeДокумент2 страницыTrigonometry and Mensuration FormulaeAMIN BUHARI ABDUL KHADERОценок пока нет

- Personality Development PDFДокумент7 страницPersonality Development PDFAMIN BUHARI ABDUL KHADER80% (5)

- Science and Technology Paper I PDFДокумент2 страницыScience and Technology Paper I PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Algebra Question Paper 2Документ2 страницыAlgebra Question Paper 2AMIN BUHARI ABDUL KHADERОценок пока нет

- Algebra Question Paper For Practise: 1. Attempt Any Five Sub - QuestionsДокумент3 страницыAlgebra Question Paper For Practise: 1. Attempt Any Five Sub - QuestionsAMIN BUHARI ABDUL KHADERОценок пока нет

- Algebra Home Work PDFДокумент6 страницAlgebra Home Work PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Trigonometry and Mensuration FormulaeДокумент2 страницыTrigonometry and Mensuration FormulaeAMIN BUHARI ABDUL KHADERОценок пока нет

- Science Revision Notes PDFДокумент6 страницScience Revision Notes PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Science Unit Test Paper PDFДокумент3 страницыScience Unit Test Paper PDFAMIN BUHARI ABDUL KHADER100% (1)

- Science Question Paper With Solution PDFДокумент10 страницScience Question Paper With Solution PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- O.C.M. Test Paper III PDFДокумент2 страницыO.C.M. Test Paper III PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Personality Development PDFДокумент7 страницPersonality Development PDFAMIN BUHARI ABDUL KHADER80% (5)

- Secretarial Practice Paper Ii PDFДокумент2 страницыSecretarial Practice Paper Ii PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Secretarial Practice Paper Iii PDFДокумент2 страницыSecretarial Practice Paper Iii PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- History Political Science Paper I PDFДокумент2 страницыHistory Political Science Paper I PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Geometry Question Paper I PDFДокумент5 страницGeometry Question Paper I PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Secretarial Practice Paper I PDFДокумент2 страницыSecretarial Practice Paper I PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Geometry Homework PDFДокумент3 страницыGeometry Homework PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- O.C.M. Test Paper II PDFДокумент2 страницыO.C.M. Test Paper II PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Geometry Question Paper Ii PDFДокумент1 страницаGeometry Question Paper Ii PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- O.C.M. Test Paper I PDFДокумент2 страницыO.C.M. Test Paper I PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Algebra Question Paper 5 PDFДокумент3 страницыAlgebra Question Paper 5 PDFAMIN BUHARI ABDUL KHADERОценок пока нет

- Algebra Question Paper For Practise PDFДокумент7 страницAlgebra Question Paper For Practise PDFAMIN BUHARI ABDUL KHADER0% (1)

- Chromate Free CoatingsДокумент16 страницChromate Free CoatingsbaanaadiОценок пока нет

- Technical specifications for JR3 multi-axis force-torque sensor modelsДокумент1 страницаTechnical specifications for JR3 multi-axis force-torque sensor modelsSAN JUAN BAUTISTAОценок пока нет

- Mutual Fund PDFДокумент22 страницыMutual Fund PDFRajОценок пока нет

- Ecc Part 2Документ25 страницEcc Part 2Shivansh PundirОценок пока нет

- Hydraulics Engineering Course OverviewДокумент35 страницHydraulics Engineering Course Overviewahmad akramОценок пока нет

- Kalley Ltdn40k221twam Chassis msd6308 SM PDFДокумент49 страницKalley Ltdn40k221twam Chassis msd6308 SM PDFjulio cesar calveteОценок пока нет

- OS LabДокумент130 страницOS LabSourav BadhanОценок пока нет

- EIRA v0.8.1 Beta OverviewДокумент33 страницыEIRA v0.8.1 Beta OverviewAlexQuiñonesNietoОценок пока нет

- CTR Ball JointДокумент19 страницCTR Ball JointTan JaiОценок пока нет

- Basic Features of The Microcredit Regulatory Authority Act, 2006Документ10 страницBasic Features of The Microcredit Regulatory Authority Act, 2006Asif Hasan DhimanОценок пока нет

- BenchmarkДокумент4 страницыBenchmarkKiran KumarОценок пока нет

- Done - NSTP 2 SyllabusДокумент9 страницDone - NSTP 2 SyllabusJoseph MazoОценок пока нет

- GS16 Gas Valve: With On-Board DriverДокумент4 страницыGS16 Gas Valve: With On-Board DriverProcurement PardisanОценок пока нет

- 2010 HD Part Cat. LBBДокумент466 страниц2010 HD Part Cat. LBBBuddy ButlerОценок пока нет

- Civil Service Exam Clerical Operations QuestionsДокумент5 страницCivil Service Exam Clerical Operations QuestionsJeniGatelaGatillo100% (3)

- 2021 JHS INSET Template For Modular/Online Learning: Curriculum MapДокумент15 страниц2021 JHS INSET Template For Modular/Online Learning: Curriculum MapDremie WorksОценок пока нет

- Shopping Mall: Computer Application - IiiДокумент15 страницShopping Mall: Computer Application - IiiShadowdare VirkОценок пока нет

- Shouldice Hospital Ltd.Документ5 страницShouldice Hospital Ltd.Martín Gómez CortésОценок пока нет

- Learning Activity Sheet: 3 Quarter Week 1 Mathematics 2Документ8 страницLearning Activity Sheet: 3 Quarter Week 1 Mathematics 2Dom MartinezОценок пока нет

- Draft SemestralWorK Aircraft2Документ7 страницDraft SemestralWorK Aircraft2Filip SkultetyОценок пока нет

- Lecture NotesДокумент6 страницLecture NotesRawlinsonОценок пока нет

- Display PDFДокумент6 страницDisplay PDFoneoceannetwork3Оценок пока нет

- Mounting InstructionДокумент1 страницаMounting InstructionAkshay GargОценок пока нет

- Simba s7d Long Hole Drill RigДокумент2 страницыSimba s7d Long Hole Drill RigJaime Asis LopezОценок пока нет

- CFO TagsДокумент95 страницCFO Tagssatyagodfather0% (1)

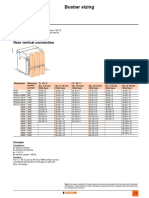

- Busbar sizing recommendations for Masterpact circuit breakersДокумент1 страницаBusbar sizing recommendations for Masterpact circuit breakersVikram SinghОценок пока нет

- Crystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationДокумент1 страницаCrystallizers: Chapter 16 Cost Accounting and Capital Cost EstimationDeiver Enrique SampayoОценок пока нет

- Committee History 50yearsДокумент156 страницCommittee History 50yearsd_maassОценок пока нет

- Bengali (Code No - 005) COURSE Structure Class - Ix (2020 - 21Документ11 страницBengali (Code No - 005) COURSE Structure Class - Ix (2020 - 21Břîšťỹ ÃhmęđОценок пока нет