Академический Документы

Профессиональный Документы

Культура Документы

JS05855569 PDF

Загружено:

anilОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

JS05855569 PDF

Загружено:

anilАвторское право:

Доступные форматы

Prefered Branch : KANDIVALI EAST LOKHANDWALA CIRCLE [MUMBAI-KANDIVALI-LOKHANDWALA-1434]

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

CRN :

Account Number :

Account Type : Savings Account

Welcome to Kotak Mahindra Bank

JS05855569_PG01

Welcome MR. ANIL GHENBAD

We thank you for choosing Kotak Mahindra Bank.

At Kotak Mahindra Bank it is our constant endeavour to enrich our customer's banking experience and to fulfill the emerging and changing banking & investment needs of

our customers.

Our account goes beyond the traditional role of savings, to provide a range of services from funds transfer options to attractive returns earned through a comprehensive

suite of investment options that can be booked through Internet or Phone Banking services.

This form has been designed for ease of completion, with simple instructions at relevant places to guide you along.

Should you face any difficulty in understanding the requirements, please do not hesitate to contact our staff who will be willing to assist / guide you.

It shall be our endeavour as always to provide you a truly satisfying service.

INDICATIVE LIST OF DOCUMENTS THAT CAN BE PROVIDED WHILE OPENING THE BANK ACCOUNT

Identification proof / Signature proof for each applicant

* Passport

* Driving License

* PAN (Income Tax) Card

* Valid Identity Documents with Photo issued by Govt. Org., PSU, Statutory/Regulatory Authority

* Voters ID Card

* NREGA Job Card

* Aadhar Card

Address proof for each applicant

* Passport

* Driving License

* Registered Leave & License Agreement (For Tenants)

* Utility Bill (Elec./Tele/Mobile/Piped Gas not more than 3 months)

* Voters ID Card

* NREGA Job Card

* Consumer Gas connection card/latest bill which is not more than 3 months old (only computer generated)

* Bank Statement (Active Account) - Last 3 months

* Aadhar Card

Please note:

* In case of non-availability of any of the above documents, please contact the Bank official for a detailed list of acceptable documents

* The original documents should be produced for verification

* Nomination facility is available

* Customer education brochure available on Bank's website provides you important information on Account opening and operations

* All service charges applicable to the product are available at the branch and on the Bank's website

* The Net Banking, Phone Banking and Payment Gateway access, if applied for, is applicable for all Deposit Accounts and Investment Accounts, existing or to be opened in future

* Transaction rights on Direct Channel for Investment Accounts are subject to the customer executing a mandate in favour of the Bank

* All account(s) existing or to be opened in future will be linked to the Debit Card/payment Gateway. Customer to give specific instructions if he/she wishes to de-link any account(s).

* Customer can avail SMS Banking Services to receive transaction details/information relating to your Bank account through SMS on the mobile number registered with the Bank

* “Jointly held” Accounts would not be given transaction rights through SMS Banking and Net Banking Services

* All accounts will be opened in the same combination as provided in the Account Opening Form by the Customer

* All account(s) existing or to be opened in future will get the account statement as per Account Statement Option chosen in this Account Opening Form / as per the Bank policy from time to time

* The age considered for Minor is Below 18 years; for Senior Citizens as 60 years & above

* Photo copies needs to be self-attested by the applicant

* All alerts, e-newsletter and promotional mails will be sent to the preferred mobile number and e-mail ID

Contact Us

Website : www.kotak.com Email : service.bank@kotak.com

Phone Banking : Letters : Kotak Mahindra Bank, P.O. Box – 16344, Mumbai 400 013.

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 1

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

Primary Holder Details

JS05855569_PG02

Please ensure you sign next to all changes you make on the form.

Personal Details

Name MR. ANIL KUNDLIK GHENBAD Date of Birth: 26-DEC-1988

Gender: Mother's maiden Name: MISS

Pan No.: Marital Status: SINGLE

Occupation: SERVICE Nationality:

Annual Income: LESS THAN INR 2 LACS Mobile: 9004316824

Email: GHEMBADAK1@GMAIL.COM

Company Name:

Residential Address (Communication Address)

Address Line1: RAM NAGAR NAVYUG CHAWL Address Line2: KANDIVALI

Address Line3: City: MUMBAI

Postal Code: 400101 State: MAHARASHTRA

Telephone: 000-00000000

Office Address

Address Line1: Address Line2:

Address Line3: City:

Postal Code: State:

Telephone: -

Other Details

Preferred Home Branch: KANDIVALI EAST LOKHANDWALA CIRCLE [MUMBAI-KANDIVALI-LOKHANDWALA-1434], City : MUMBAI

Do you have any other Kotak account? NO

Customer Relationship Number (CRN): _____________________________

NET001RISIGN

Primary Holders Signature

MR. ANIL KUNDLIK GHENBAD

Form reviewed and submitted online by MR. ANIL GHENBAD

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 2

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

Joint Holder Details

JS05855569_PG03

Yes No

Please ensure you sign next to all changes you make on the form.

Personal Details

Name: Date of Birth:

Gender: Mother's maiden Name:

Pan No.: Marital Status:

Occupation: Nationality:

Annual Income: Email:

Mobile: Company Name:

Residential Address

Address Line1: Address Line2:

Address Line3: City:

Postal Code: State:

Telephone: -

Office Address

Address Line1: Address Line2:

Address Line3: City:

Postal Code: State:

Telephone: -

Other Details

What type of access do you want for the Joint Holder? JOINT EITHER_OR_SURVIVOR Others

Do you have any other Kotak account? YES NO

Customer Relationship Number (CRN): _____________________________

NET001RISIGN

Joint Holders Signature

Form reviewed and submitted online by MR. ANIL GHENBAD

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 3

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

SMS BANKING & ALERT FACILITY (Refer General Schedule of Features and Charges for Charges Applicable)

SMS Banking facility is available to all account holders for all products. Alert Facility enables you to receive alerts on your Email and / or Mobile regarding account

transactions and maintenances. New alerts may be added from time to time.

Alert Type 1st Applicant

SMS Email

a) Daily Balance + Transaction and Value Added Alerts

Please select either (a) or (b) as per your requirement

b) Weekly Balance + Transaction and Value Added

Alerts

** Bank will send all alerts to the preferred mobile number and E-mail address mentioned in this form. The Bank will also use these details for sending out transaction

information and updates about Product and Services.

In case you do not wish to receive information / updates, you can register yourself for Do Not Call on the Bank's website www.kotak.com

Alerts that have been mandated by RBI and such alerts as deemed appropriate by the Bank will be sent even if you have not subscribed for the facility.

* Transaction and Value Added Alerts will be sent to First Holder / Guardian for all Individual accounts where the mode of operation is "Singly" or "Either / Survivor" and to

all holders where mode of operation is "Jointly" for Non-Individual Accounts such alerts will be sent to allAuthorized Signatories, irrespective of the mode of operation

Primary Holders Signature

MR. ANIL KUNDLIK GHENBAD

Form reviewed and submitted online by MR. ANIL GHENBAD

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 4

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

Nomination (Form DA1)

YES NO (Bank Use Only) Nomination under section 45ZA of the Banking Registration Act, 1949 and the rule 2(1)of

The Banking Companies (Nomination) Rules, 1985, in respect of bank deposits

I/We __________________________________________________ Address(es) ______________________________________________

nominate the following person to whom in the event of my /our /minor's death the amount of the deposit, particulars whereof are given below, may be returned by

Kotak Mahindra Bank Limited.

Nature of Deposit ___________ Distinguishing No ___________ Additional details, if any ____________

Nominee Name ________________________________________________________________

Address ___________________________________________________________________

Relationship with Depositor, if any _____________ Age ____ (if nominee is a minor, his/her date of birth)

As the nominee is minor on this date, I/We appoint Shri/Smt/Kum* ____________ Relation With Minor Nominee ___________

Address _______________________________________________________ Age ______

to recieve the amount of the deposit on behalf of the nominee,in the event of my/our/minor's death during the minority of the nominee.

Nominee Name to be printed on the Statements/Advices YES NO Date & Place __________________________

_________________ _________________ _________________

Signature(s)/Thumb impression*** Depositor Depositor Depositor

_________________ _________________

Signature Of First Witness*** Signature Of Second Witness***

*Strike out if nominee is not a minor ***Thumb impression(s) shall be attested by two witnesses and signature will be attested by one witness.

** where deposit is made in the name of minor, the nomination should be signed by a person lawfully entitled to act on behalf of the minor.

Applicable, If no nomination is provided in a Single Holder A/c For Bank Use Only

The Bank, through its authorized representative had explained to me the I have clearly explained to the customer the advantage of nomination facility and

advantages of nomination facility as per the extant guidlines of RBI. However, I inspite of the same he/she still does not want to nominate and he/she also refused to

hereby decline to presently nominate any individual and understand the risks and provide a specific letter to the effect that he/she does not want to make a

consequences of my failure to give nomination and am fully aware of the hardships nomination.

my legal heirs would face in the event of my death without nomination registered in

your Bank records.

__________________________ __________________________

Customers Signature Employees Signature & Code

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 5

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

Decline Nomination (Form DA1) - <Kotak 811>

JS05855569_PG06

Nomination under section 45Z A of the Banking Regulation Act, 1949, and the Rule 2 (1) of The Banking Companies (Nomination) Rules, 1985, in respect of bank deposits

If you have not appointed any nominee for Kotak 811 , then please fill the details below agreeing to the conditions.

The Bank, through its authorized representative had explained to me the FOR BANK USE ONLY

advantages of nomination facility as per the extant guidelines of RBI.

However, I hereby decline to presently nominate any individual and understand the I have clearly explained to the customer the advantages of nomination facility and

risks and consequences of my failure to give nomination and am fully aware of the inspite of the same he / she still does not want to nominate and he / she also

hardships my legal heirs would face in the event of my death without nomination refused to provide a specific letter to the effect that he / she does not want to make

registered in your Bank records. a nomination

Primary Holders Signature Employee Signature & Code

Form reviewed and submitted online by MR. ANIL GHENBAD

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 6

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

“FORM NO. 60”

[See second proviso to rule 114B]

Form for declaration to be filed by an individual or a person (not being a company or firm) who does not have a permanent account number

and who enters into any transaction specified in rule 114B

1 First Name 2 Date of Birth / Incorporation of declarant

Middle Name D D M M Y Y Y Y

Surname

3 Father's Name (in First Name

case of individual)

Middle Name

Surname

4 Flat / Room No. 5 Floor No.

6 Name of premises 7 Block Name / No.

8 Road / Street / Lane 9 Area/ Locality

10 Town / City 11 District 12 State

13 Pin Code 14 Telephone Number (with STD code) 15 Mobile Number

16 Amount of transaction (Rs.) 18 In case of transaction in joint names,

number of persons involved in the

17 Date of transaction D D M M Y Y Y Y transaction

19 Mode of transaction: Cash Cheque Card Draft / Online Other

(Please tick appropriate box) Banker's Transfer

Cheque

20 Aadhaar Number issued by UIDAI (if available)

21 If applied for PAN and it is not yet generated enter D D M M Y Y Y Y Acknowledgment Number

date of application and acknowledgement number

22 If PAN not applied, fill estimated total income (including income of spouse, minor child etc. as per section 64 of Income-tax Act, 1961) for the financial year in

which the above transaction is held

A Agricultural income (Rs.)

B Other than agricultural income (Rs.)

23 Details of document being produced in Document code Document identification number Name and address of the authority

support of Identify in Column 1 (Refer issuing the document

Instruction overleaf)

24 Details of document being produced in Document code Document identification number Name and address of the authority

support of Address in Columns 4 to 13 (Refer issuing the document

Instruction overleaf)

25 Transaction code (Refer Instruction overleaf) Nature of Transaction (Refer

Instruction overleaf)

Verification

I, _______________________________________________ do hereby declare that what is stated above is true to the best of my knowledge and belief.I further declare

that I do not have a Permanent Account Number and my / our estimated total income (including income of spouse, minor child etc. as per section 64 of Income-tax Act,

1961) computed in accordance with the provisions of Income-tax Act, 1961 for the financial year in which the above transaction is held will be less than maximum amount

not chargeable to tax.

Verified today, the ______________ day of ______________ 20_____

Place: ___________________________

(Signature of declarant)

Note:

1. Before signing the declaration, the declarant should satisfy himself that the information furnished in this form is true, correct and complete in all respects.

Any person making a false statement in the declaration shall be liable to prosecution under section 277 of the Income-tax Act, 1961 and on conviction be

punishable,-

(i) in a case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous imprisonment which shall not be less than six

months but which may extend to seven years and with fine;

(ii) in any other case, with rigorous imprisonment which shall not be less than three months but which may extend to two years and with fine.

2. The person accepting the declaration shall not accept the declaration where the amount of income of the nature referred to in item 22b exceeds the

maximum amount which is not chargeable to tax, unless PAN is applied for and column 21 is duly filled.

Kotak Mahindra Bank Ltd.CIN: L65110MH1985PLC038137

Registered Office:27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051.

www.kotak.com

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 7

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

Instructions to the form:

1) Documents which can be produced in support of identity and address (not required if applied for PAN and item 20 is filled): -

Sl. Nature of Document Document Proof of Proof of

Code Identity Address

A For Individuals and HUF

1. AADHAR card 01 Yes Yes

2. Bank/Post office passbook bearing photograph of the person 02 Yes Yes

3. Elector’s photo identity card 03 Yes Yes

4. Ration/Public Distribution System card bearing photograph of the person 04 Yes Yes

5. Driving License 05 Yes Yes

6. Passport 06 Yes Yes

7. Pensioner Photo card 07 Yes Yes

8. National Rural Employment Guarantee Scheme (NREGS) Job card 08 Yes Yes

9. Caste or Domicile certificate bearing photo of the person 09 Yes Yes

10. Certificate of identity/address signed by a Member of Parliament or Member of Legislative Assembly or 10 Yes Yes

Municipal Councillor or a Gazetted Officer as per annexure A prescribed in Form 49A

11. Certificate from employer as per annexure B prescribed in Form 49A 11 Yes Yes

12. Kisan Passbook bearing photo 12 Yes No

13. Arm’s license 13 Yes No

14. Central Government Health Scheme /Ex-servicemen Contributory Health Scheme card 14 Yes No

15. Photo identity card issued by the government./ Public Sector Undertaking 15 Yes No

16. Electricity bill (Not more than 3 months old) 16 No Yes

17. Landline Telephone bill (Not more than 3 months old) 17 No Yes

18. Water bill (Not more than 3 months old) 18 No Yes

19. Consumer gas card/book or piped gas bill (Not more than 3 months old) 19 No Yes

20. Bank Account Statement (Not more than 3 months old) 20 No Yes

21. Credit Card statement (Not more than 3 months old) 21 No Yes

22. Depository Account Statement (Not more than 3 months old) 22 No Yes

23. Property registration document 23 No Yes

24. Allotment letter of accommodation from Government 24 No Yes

25. Passport of spouse bearing name of the person 25 No Yes

26. Property tax payment receipt (Not more than one year old) 26 No Yes

B For Association of persons (Trusts)

Copy of trust deed or copy of certificate of registration issued by Charity Commissioner 27 Yes Yes

C For Association of persons (other than Trusts) or Body of Individuals or Local authority or Artificial

Juridical Person)

Copy of Agreement or copy of certificate of registration issued by Charity commissioner or Registrar of 28 Yes Yes

Cooperative society or any other competent authority or any other document originating from any Central or

State Government Department establishing identity and address of such person.

2) In case of a transaction in the name of a Minor, any of the above mentioned documents as proof of Identity and Address of any of parents/guardians of

such minor shall be deemed to be the proof of identity and address for the minor declarant, and the declaration should be signed by the parent/guardian.

3) For HUF, any document in the name of Karta of HUF is required.

4) In case the transaction is in the name of more than one person the total number of persons should be mentioned in Sl. No. 18 and the total amount of

transaction is to be filled in Sl. No. 16.

5) In case the estimated total income in column 22b exceeds the maximum amount not chargeable to tax the person should apply for PAN, fill out item 21

and furnish proof of submission of application.

Kotak Mahindra Bank Ltd.CIN: L65110MH1985PLC038137

Registered Office:27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051.

www.kotak.com

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 8

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

6) Transaction code and type should be selected from the below list only:

Permissible values are:

01-Sale of immovable property

02-Purchase of immovable property

03-Sale of motor vehicle

04-Purchase of motor vehicle

05-Investment in Time deposit

06-Deposit in cash

07-Sale of securities

08-Purchase of securities

09-Opening an account (other than savings and time deposit)

10-Account with balance exceeding Rs.50,000

Transaction Type 11-Purchase of bank drafts or pay orders

12-Application for issue of a credit or debit card

13-Payment to hotel

14-Payment in connection with travel to any foreign country

15-Payment for purchase, or remittance outside India,

16-Payment to Mutual Fund for purchase of its units

17-Payment for acquiring shares

18-Payment for acquiring debentures or bonds

19-Payment as life insurance premium

20-Sale of shares of a company

21-Purchase of shares of a company

22-Not classified above

Kotak Mahindra Bank Ltd.CIN: L65110MH1985PLC038137

Registered Office:27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051.

www.kotak.com

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 9

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

Declarations

Please ensure you sign next to all changes you make on the form.

Customer Declaration

* I/ We would like to open a savings account with your bank.

* I/we have read through and understood the General schedule of fees and charges of the product.Download schedule

* I agree to bind by the banks Terms and conditions available in the link www.kotak.com/termsandconditions.

* I/we understand that 6% p.a. interest on savings account balance over Rs 1 lakh and up to Rs 5 crs. Earn 5% p.a. interest on savings account balance up to Rs 1 lakh and 5.5% p.a. interest on savings account balance above Rs 5 crs on

Resident Accounts only.

* The particulars contained here in shall be valid for all accounts opened by me / us or to be opened by me / us here after either singly or with other(s) and / or by me /us in any representative capacity with the Bank unless informed

otherwise.

* I /We have read,understood and agree the Terms and Conditions governing the opening of an account with Kotak Mahindra Bank Ltd. (the Bank), and those relating to various Services including but not limited to a) ATMs b) Phone

Banking c) Debit Card d) Net Banking e) Payment Gateway f)Kotak Bill Pay g) SMS Banking h) Alerts Service i)Term Deposits/Recurring Deposits, available at bank’s website www.kotak.com

* I/We understand and agree that Payment Gateway will be activated by default for the customers registered for Netbanking with unconditional transaction rights.

* I/We understand and agree that Net Banking, Phone Banking access, if applied for, is applicable to all Deposit accounts, existing or to be opened in the future. I/We understand and agree that existing/future accounts will be linked by

default to Debit Card/Payment Gateway and for delinking Debit Card/Payment Gateway from the account, I/We have to visit the nearest branch to place the request. I/We agree to be bound by the said Terms & Conditions including those

excluding/limiting the Bank liability. I/We understand that the Bank may at its absolute discretion, suspend any of the services completely or partially without any notice to me/us.

* Sweep-in Facility & Activmoney (Applicable only if opted for): I/We have been explained about the features and benefits of Sweep-in facility and ActivMoney (Auto Sweep-Out, Sweep-In) and I/We have understood and agree for the same.

* Statement of Account: I/We am/are aware that the Bank will share statements by Email on monthly basis to my/our registered Email ID. I/We agree that the Bank would be deemed to have delivered the statement to me/us, on Bank

sending the Email containing the Statement as an attachment to my/our registered Email ID. In case Email ID has not been provided by me/us, physical statements at quarterly intervals would be sent to my/our mailing address. I/We

am/are also aware that if I/We have provided my/our Emnil ID but still wish to opt for physical statements at quarterly intervals, I/We need to provide a specific request for the same. Any person resident in India collecting and

effecting/remitting payments directly/indirectly outside India in any form towards foreign exchange trading through electronic/internet trading portals would make himself/herself/themselves liable to be proceeded against with for

Contravention of the Foreign Exchange Management Act (FEMA) 1999, besides being liable for violation of regulations related to Know Your Customer (KYC) Norms/Anti Money Laudering (AML) standards.

* The bank will have a right to close the account in case of any incorrect representation, information given by the customer and the Customer acknowledges and agrees that Bank may at any time without notice as the circumstances in the

Bank's absolute discretion may require, discontinue /modify/cancel/terminate the services, if the Bank is of the opinion that continuation of services is prejudicial to Bank's interests. Bank shall not be made liable for any consequences

arising out of such closure of Account or termination of Services.

* The Customer shall indemnify and keep the Bank indemnified against any loss or damage that the Bank may suffer on account of dishonor of cheque after the closure of the Account.

* I/We agree that the Bank may debit my account for service charges as applicable from time to time.

* I/We hereby agree, declare & confirm that the funds routed by me/us in my/our account will be from my/our source of funds acquired legitimately and such funds are acquired not in contravention of any applicable laws or rules in force,

enacted/issued by Statutory or Regulatory Authority from time to time or funds so routed have not been on acquired by way of evasion of government levies/taxes. I/We shall advice the Bank immediately in the manner as agreed by me/us

and acceptable to the Bank, in case of any change in the above details and information given by me/us.

* I/We understand that the above account will be opened on the basis of the statements/declarations made by me/us in this application as well as on the supporting documents to be submitted with the applications.

* I/We also agree that if any of the statements/declarations made is found to be not correct in material particulars and/or the relevant supporting documents/proof is not provided by me in one month's time, you are not bound to pay any

interest on the deposit made by me/us.

* I/We have read & agreed to the following method of transaction point calculation (only applicable for JIFI Pro customers)

- Only online shopping and online bill payments are eligible for gaining transaction point. NEFT, IMPS, RTGS, PoS transactions are not eligible for transaction rewards.

- For every transaction in multiple of Rs. 1000, Bank will award 100 transaction points against every 1000 rupees. 50% additional transaction points will be awarded on using Kotak bank’s m-store for shopping.

- Maximum transaction points that will be awarded for one transaction are 500 points.

- 4 transaction points are equivalent to Re. 1. Bank may revise the conversion rate of transaction points to Rupee from time to time.

- Transaction Points can be redeemed on www.kotakjifi.com

* I/We understand that, in case I chose to open JIFI Neo Account type, then I/we will receive 5 free cheque leaves on account opening, & agree to pay for additional cheques/chequebook thereafter.

* I/We hereby declare the above information is true to the best of our knowledge.

* I/We shall advise the Bank immediately in the manner as agreed by me/us and in the form acceptable to the Bank, in case of any change in the above details and information given by me/us.

* I/We agree that the Bank may choose to close my account/s if I/ we do not submit the required documents or resolve discrepancies within 90 days from the date of initiation of online account opening process.

* I/We agree that in case of discrepancies in the details provided by me /us on the form, the Bank will consider details of actual proofs of documents submitted by me or funding received from me/ us as correct and final.

* I/we agree that in case the account opening form and/or introduction documents and/or remittance of funds that I / we submit or make in due course to the Bank are found by the Bank to be incomplete or discrepant or not as per

prescribed documentary requirements, therefore requiring my/our account to be closed, any funds remitted by me to Kotak Mahindra Bank may be returned by the Bank to me / us (without requiring my / our instructions) in the mode

deemed best by the Bank.

* I / we agree to bear any applicable expense or charges or exchange loss that may be incurred on returning of these funds.

* I/ we also agree that the return payment may be made by the Bank to the original remitting account number available to the Bank from my/ our original remittance and in case this information is not clear or unavailable, I / we agree to

provide the same.

* I / we also agree to bear any interest loss in the event my/ our funds are not credited to my/ our account and therefore lying with the Bank due to non-receipt of my/our account opening documents or due to discrepancies in funding or

documentation noted by the Bank or due to any other non-compliance with the Bank's prescribed policies or the laws of the land. In this context, I/ we agree that the Bank shall hold my/ our funds pending credit to my/ our account or

deposit for want of clearance of discrepancies for a period of at least one month from the date of receipt of funds and the Bank shall not be liable to pay any interest on the said funds during the said period.

* I/We do hereby authorise the bank to conduct my/our account for credit history verification with CIBIL or any other credit rating agency.

* I / We expressly consent and authorise the Bank to make Telephone Calls and Send SMS and / or Emails to inform me / us on any information or updates relating to Bank's existing / new Product / Services. The said consent is valid till

such time I / We withdraw the same in writing. This will overrule a National do Not Call if any.

Declaration for Channel Access

* I accept auto-registration for access to my account through various channels, namely Debit Card, Net Banking, Phone Banking, Payment Gateway. I have read and understood the Terms and Conditions relating to various services and

products, as also conditions prescribed herein, including, but not limited to (a) ATMs (b) Phone Banking (c) Debit Card (d) Net Banking (e) Payment Gateway. I accept and agree to be bound by the said Terms and Conditions including

those excluding/limiting the Bank Ãs liability. I understand that the Bank may at its absolute discretion, discontinue any of the services completely or partially without any notice to me. I agree that the Bank may debit my primary account

stated above for service charges as applicable from time to time. I agree that charges if applicable, will be recovered from this account or accessed through International and Domestic debit card respectively, on all Kotak Mahindra Bank

ATMs, this is the account that will be available on any VISA ATMs or merchant establishments. In case I /we do not specify any accounts, the first account I / we open with the bank will be treated primary account for each card respectively

and that Domestic Debit Cards issued can be used for transactions in India only.

I / We agree/ consent to the following

* The account number given to me/us to be in debit freeze, i.e the funds can be deposited, but the withdrawal can only be done once the account is regularized with proper documents. Incase for any reason the account cannot be

regularized, the funding done to the account will be returned back to the originating account without any payment of interest on the account.

* This application is available for opening account or TD booking by Resident Indian Individuals only.

Form reviewed and submitted online by MR. ANIL GHENBAD

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 10

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

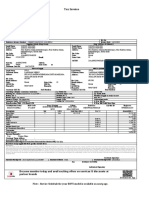

NET001RIIDVU

BRANCH USE

Source/Promo Code: DIGI LG Code: J N C L A S Category: D A B C S T G

Opty ID : 1-8274650179

LC Code: Customer Seg RL WM CB

CORP/GRP Co.Code

Emp Code * Risk Profile H M L

RM Code: N A V

Fulfillment Code: _________________ LOB: CRN _________________

Status: _________________ CHANL Code DIGITAL

A/C No. _________________

4 1 8 2 4 Product Kotak 811 Kotak 811 Edge

PBO Code:

IMPORTANT OTHER DETAILS

1434 ( KANDIVALI EAST LOKHANDWALA CIRCLE Passport No.

Branch Code: [MUMBAI-KANDIVALI-LOKHANDWALA-1434] )

Driving License No.

*Principal CRN:

Voter ID

*Principal A/c No.:

(*Applicable in case of Family Saving account)

SR No: _________________

Primary Ticket No: _________________

Child Ticket No: _________________

FUNDING DETAILS

Transaction Date : _________________ Transaction Amount (In Rs.) : _________________ Status : _________________

Mode Of Payment : _________________ Lead Generated Date : _________________ Transaction Id: _________________

For funding details , kindly refer to old tracking id ______________________

CPC/RPC USE ONLY

ONLY FOR TD Relation ___________________(MOP = Others)

V-Date OTHER DETAILS Tenure

Special Card Type ___________________

Tran.ID

(Intentionally left blank) ISG/15H Attached Yes No

No. of CRFs attached ___________________

Amount(Rs.) Tran.Srl.No.

Vernacular App1 App2 Both

Photo Card Yes No

Document Collected

Applicant 1: DL PASS ELE_ID PAN PHOTO_CR

ID_DOC L_L RATION EMP_AOF UTILITY

AADHAAR CARD PASSBOOK MID IP CHEQUE FORM 60

AFFIDAVIT VERDEC VC OTHERS ________________________

Applicant 2: DL PASS ELE_ID PAN PHOTO_CR

ID_DOC L_L RATION EMP_AOF UTILITY

AADHAAR CARD PASSBOOK MID IP CHEQUE FORM 60

AFFIDAVIT VERDEC VC OTHERS ________________________

Branch Stamps Operation Stamps Form Details

Approved by:Sales Official (Sign & Code)

Designation _____________

Branch Official (Sign & Code)

Designation _____________

Form reviewed and submitted online by MR. ANIL GHENBAD

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 11

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

FATCA / CRS DECLARATION FOR INDIVIDUAL ACCOUNTS

Note - The information in this section is being collected because of enhancements to Kotak Mahindra Bank's new account on-boarding procedures in order to comply with

Foreign Account Tax Compliance Act (FATCA) requirements pursuant to amendments made to Income-tax Act,1961 read with Income-tax Rules, 1962.

For more information refer:

http://www.incometaxindia.gov.in/dtaa/other%20agreements/india_iga_final-_india_english.pdf

http://www.oecd.org/ctp/exchange-of-tax-information/automatic-exchange-financial-account-information-common-reporting-standard.pdf

(We are unable to provide advice about your tax residency. If you have any questions about your tax residency, please contact your tax advisor)

Office/Bank use only

OPTY ID/SR Number :_______________________

Part A (All fields are mandatory)

Section I Details of Account Holder

1 Customer Relationship Number (CRN)[if any]

2 Name of Account Holder MR. ANIL KUNDLIK GHENBAD

3 Address for Tax Residence (include City, State, Country and Pin

code)

4 Address Type(Tick whichever applicable) (a) Residential (b) Business (c) Registered Office

5 Do you satisfy any of the criteria mentioned below? YES NO

a. Citizen of any country other than India (dual /

multiple)[including Green card]

b. Country of birth is any country other than India

c. Tax resident of ANY country / ies other than India

d. POA or a mandate holder who has an address outside India

e. Address or telephone number outside India

If your answer to any of the above questions is a YES, please fill Section II of the form, else go to declaration & acknowledgment

Section II - Other information(Please fill in BLOCK LETTERS)

Father's name _________________________________ (If PAN not available, then mandatory)

Country of Birth * _______________________________ Place within the country of birth _______________________________

*(In case of Country of Birth is USA, however Nationality and Country of Tax Residency is other than USA , please provide documentary

evidence as mentioned in instruction 1)

Source of Wealth _________________________________________ Nationality ________________________________________

Please list below the details, confirming ALL countries of tax residency/ permanent residency/ citizenship and ALL Tax Identification Numbers

$

Country of Tax residency Tax Identification No Tax identification document (TIN or functional equivalent)

$

It is mandatory to supply a TIN or functional equivalent (in case TIN not available) if the country in which you are tax resident issues such identifiers. If no TIN/ functional

equivalent is yet available or has not yet been issued, please provide an explanation below:

___________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 12

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

Declaration & Acknowledgement I _________________________ being the beneficial owner of the account opened / to

be opened with Kotak Mahindra Bank Limited and the income credited therein, declare

that the above information and information in the submitted documents to be true,

correct and updated, and the submitted documents are genuine and duly executed.

I acknowledge that towards compliance with tax information sharing laws, such as

FATCA / CRS, the Bank may be required to seek additional personal, tax and beneficial

owner information and certain certifications and documentation from the account holder.

Such information may be sought either at the time of account opening or any time

subsequently. In certain circumstances (including if the Bank does not receive a valid

self-certification from me) the Bank may be obliged to share information on my account

with relevant tax authorities. Should there be any change in any information provided by

me I ensure that I will intimate the Bank promptly, i.e., within 30 days.

Towards compliance with such laws, the Bank may also be required to provide

information to any institutions such as withholding agents for the purpose of ensuring

appropriate withholding from the account or any proceeds in relation thereto. As may

be required by domestic or overseas regulators/ tax authorities, the Bank may also be

constrained to withhold and pay out any sums from my account or close or suspend my

account(s).

I also understand that the account will be reported if any one of the aforesaid FATCA /

CRS criteria for any of the account holders i.e. primary or joint are met.

Customer Signature

Date

Bank Use Section:

Signature Verified By Receiver's Stamp

Documents sent to CPC/RPC on

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 13

Location ( IP : 10.240.22.34 Country : India)

Customer Tracking ID: J S 0 5 8 5 5 5 6 9

Instructions to the Form

In case customer has the following Indicia pertaining to a foreign country and yet declares self to be non-tax resident in the respective country, customer to provide relevant

Curing Documents as mentioned below:

Sr no FATCA/ CRS Indicia observed (ticked) Documentation required for Cure of FATCA/ CRS indicia

1 U.S. place of birth 1. Self-certification(FATCA Declaration) that the account holder is neither a citizen of

United States of America nor a resident for tax purposes;

2. Non-US passport or any non-US government issued document evidencing

nationality or citizenship (refer list below); AND

3. Any one of the following documents:

- Certified Copy of Certificate of Loss of Nationality or

- Reasonable explanation of why the customer does not have such a certificate

despite renouncing US citizenship; or

- Reason the customer did not obtain U.S. citizenship at birth

2 Residence/mailing address in a country other than India 1. Self-certification that the account holder is neither a citizen of United States of America

nor a tax resident of any country other than India; and

or

2. Documentary evidence (refer list below)

Telephone number in a country other than India

3 Standing instructions to transfer funds to an account 1. Self-certification that the account holder is neither a citizen of United States of America

maintained in a country other than India (other than nor a tax resident of any country other than India; and

depository accounts)

2. Documentary evidence (refer list below)

4 POA granted to a person with an address in a country 1. Self-certification that the account holder is neither a citizen of United States of America

outside India nor a tax resident for tax purposes of any country other than India; OR

2. Documentary evidence (refer list below)

List of acceptable documentary evidence needed to establish the residence(s) for tax purposes:

1. Certificate of residence issued by an authorized government body*

2. Valid identification issued by an authorized government body* (e.g. Passport, National Identity card, etc.)

* Government or agency thereof or a municipality of the country or territory in which the payee claims to be a resident.

Kotak Mahindra Bank Ltd. CIN: L65110MH1985PLC038137.

Registered Office: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051. www.kotak.com

Kotak Mahindra Bank | Account Opening Form for Resident Individuals 14

Location ( IP : 10.240.22.34 Country : India)

Вам также может понравиться

- JsoДокумент11 страницJsovenkat yeluriОценок пока нет

- Account Opening Form (Via Video Kyc) : Customer Id: 102427265 Account No.: 2082104000058405Документ3 страницыAccount Opening Form (Via Video Kyc) : Customer Id: 102427265 Account No.: 2082104000058405dipankardutta200Оценок пока нет

- IDFCFIRSTBankstatement 10099557734Документ2 страницыIDFCFIRSTBankstatement 10099557734Surya NarayanaОценок пока нет

- WL CZ1689 Grp1 19092019 PDFДокумент1 страницаWL CZ1689 Grp1 19092019 PDFSuji KkОценок пока нет

- Acknowledgement Slip: Fixed DepositДокумент1 страницаAcknowledgement Slip: Fixed DepositAneesh BangiaОценок пока нет

- Summary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012Документ3 страницыSummary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012skbansal1976Оценок пока нет

- 0066XXXXXXXXX605817 10 2022Документ1 страница0066XXXXXXXXX605817 10 2022Sachin SharmaОценок пока нет

- IDFCFIRSTBankstatement 10168107370Документ2 страницыIDFCFIRSTBankstatement 10168107370MD GOLAM MAINUDDIN HOQUEОценок пока нет

- Compliance MSVRG May 2021 TL29T2122 7099Документ1 страницаCompliance MSVRG May 2021 TL29T2122 7099Saurabh KatiyarОценок пока нет

- Compliance MSVRG August 2021 TL29T2122 17954Документ1 страницаCompliance MSVRG August 2021 TL29T2122 17954Saurabh KatiyarОценок пока нет

- Annexure 1 PDFДокумент3 страницыAnnexure 1 PDFSumit DeyОценок пока нет

- Fan Proposal Cum Evaluation Form: Shiv Kumar Chandak Shiv Kumar ChandakДокумент4 страницыFan Proposal Cum Evaluation Form: Shiv Kumar Chandak Shiv Kumar ChandakAshish AgarwalОценок пока нет

- NOC116589620Документ1 страницаNOC116589620propvisor real estateОценок пока нет

- Ludo Culture - IO For First DepositДокумент3 страницыLudo Culture - IO For First DepositSudhanshu SwamiОценок пока нет

- For Bank Use Only For Bank Use Only: EP001057957 Sourcing Channel EP001057957 Sourcing ChannelДокумент5 страницFor Bank Use Only For Bank Use Only: EP001057957 Sourcing Channel EP001057957 Sourcing ChannelKishore L NaikОценок пока нет

- SijiДокумент2 страницыSijiamal sugathanОценок пока нет

- Welcome LetterДокумент2 страницыWelcome LetterSantosh KumarОценок пока нет

- Statement of Account 201003072715: Eljos 40/1 GF Muktidham Estate Opp Danav Park Nikol AHMEDABAD 382350 Gujarat IndiaДокумент6 страницStatement of Account 201003072715: Eljos 40/1 GF Muktidham Estate Opp Danav Park Nikol AHMEDABAD 382350 Gujarat IndiaAnonymous n30qTRQPoIОценок пока нет

- Module 2 - Technical AnalysisДокумент3 страницыModule 2 - Technical AnalysisManmohan TiwariОценок пока нет

- ABL Modification FormДокумент1 страницаABL Modification FormPochender VajrojОценок пока нет

- Noc MaesteroДокумент3 страницыNoc MaesterojoygnagulykolОценок пока нет

- Application Form IciciДокумент5 страницApplication Form IciciEsuresh5454Оценок пока нет

- Application Form IciciДокумент5 страницApplication Form IciciEsuresh5454Оценок пока нет

- 02062019105858t13pdxmwzeiag20kby Estatement 052019 997 PDFДокумент3 страницы02062019105858t13pdxmwzeiag20kby Estatement 052019 997 PDFNikhil KumarОценок пока нет

- IDFCFIRSTBankstatement 10171676841 214940570Документ2 страницыIDFCFIRSTBankstatement 10171676841 214940570Amar NalawadeОценок пока нет

- Application Form For New SBI CSPДокумент1 страницаApplication Form For New SBI CSPT satya leakageОценок пока нет

- SUNDARAMДокумент2 страницыSUNDARAMKellie RamosОценок пока нет

- IDFCFIRSTBankstatement 10086068635 212540711Документ2 страницыIDFCFIRSTBankstatement 10086068635 212540711sagarsharma0929Оценок пока нет

- Income Document UpdateДокумент2 страницыIncome Document Update恩恩Оценок пока нет

- Customer No.: 21385154 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressДокумент8 страницCustomer No.: 21385154 IFSC Code: DBSS0IN0811 MICR Code: Branch Addresssyed sabeerОценок пока нет

- PDFДокумент2 страницыPDFSanjiv VermaОценок пока нет

- IDFCFIRSTBankstatement 10168737914Документ2 страницыIDFCFIRSTBankstatement 10168737914MD GOLAM MAINUDDIN HOQUEОценок пока нет

- Poa PDFДокумент2 страницыPoa PDFrahul raoОценок пока нет

- Statement of Account 259994632289Документ4 страницыStatement of Account 259994632289crmfinance.tnОценок пока нет

- Vendor Onboarding Details FormsДокумент2 страницыVendor Onboarding Details FormsarifОценок пока нет

- 1577525816241Документ4 страницы1577525816241geetanjalis_4Оценок пока нет

- HDFC Loan Closure010Документ3 страницыHDFC Loan Closure010Aditya Adi Singh100% (1)

- 24 July 2015 Governor, DR Raghuram G. Rajan Governor, DR Raghuram G.RajanДокумент1 страница24 July 2015 Governor, DR Raghuram G. Rajan Governor, DR Raghuram G.RajanaaryanОценок пока нет

- Summary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013Документ2 страницыSummary of Accounts Held Under Customer Id: 501622621 As On 28-02-2013S Deva PrasadОценок пока нет

- IDFCFIRSTBankstatement 10051177724 170334404Документ2 страницыIDFCFIRSTBankstatement 10051177724 170334404Samson PereiraОценок пока нет

- 1 KM HDFC-impДокумент3 страницы1 KM HDFC-impHARSHAL MITTALОценок пока нет

- Statement of Account 100047478115Документ11 страницStatement of Account 100047478115Prabath D Narayan0% (1)

- Stay Connected Address Change FormДокумент2 страницыStay Connected Address Change Formनित्यानंद पाटीलОценок пока нет

- StatementДокумент2 страницыStatementSaif AhmedОценок пока нет

- Customer No.: 24114979 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressДокумент5 страницCustomer No.: 24114979 IFSC Code: DBSS0IN0811 MICR Code: Branch Addressnitin doonОценок пока нет

- Application FormДокумент5 страницApplication Formswadhish venugopalОценок пока нет

- Loan Closure LetterДокумент1 страницаLoan Closure Letterrahulkasera12.rkОценок пока нет

- Aatma Bodha667 Knowledge of SelfДокумент6 страницAatma Bodha667 Knowledge of SelfAnvith KingОценок пока нет

- CreditCardStatement PDFДокумент3 страницыCreditCardStatement PDFSrinivasDukkaОценок пока нет

- PDFДокумент1 страницаPDFSandeep RajbharОценок пока нет

- No Objection CertificateДокумент2 страницыNo Objection Certificatepropvisor real estateОценок пока нет

- Fan Proposal Form - Shiv Iifl 2Документ4 страницыFan Proposal Form - Shiv Iifl 2Ashish AgarwalОценок пока нет

- Customer No.: 2904052 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressДокумент3 страницыCustomer No.: 2904052 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressGargi ShuklaОценок пока нет

- Customer No.: 21058097 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressДокумент5 страницCustomer No.: 21058097 IFSC Code: DBSS0IN0811 MICR Code: Branch Addresskiran gangurdeОценок пока нет

- MR - Augustin Mathew: Page 1 of 1 M-6163060Документ1 страницаMR - Augustin Mathew: Page 1 of 1 M-6163060AUGUSTINMATHEWОценок пока нет

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountОт EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountРейтинг: 2 из 5 звезд2/5 (1)

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОт EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОценок пока нет

- Cyber Security PDFДокумент1 страницаCyber Security PDFanilОценок пока нет

- Draft PPT For PresentationДокумент11 страницDraft PPT For PresentationNILESH0% (2)

- 2C00455 1554017093431Документ845 страниц2C00455 1554017093431anilОценок пока нет

- Debt Market 307698770 PDFДокумент42 страницыDebt Market 307698770 PDFanilОценок пока нет

- Stylus - Pro - 4400 201 300 (067 100)Документ34 страницыStylus - Pro - 4400 201 300 (067 100)Joso CepuranОценок пока нет

- Purposive Communication NotesДокумент33 страницыPurposive Communication NotesAlexis DapitoОценок пока нет

- HPB Brochure 0708Документ12 страницHPB Brochure 0708musaluddinОценок пока нет

- Geometallurgical Modelling of The Collahuasi Flotation CircuitДокумент6 страницGeometallurgical Modelling of The Collahuasi Flotation CircuitFrancisco CampbellОценок пока нет

- Operator'S Manual AND Set-Up Instructions For The: WDL-2070-FAДокумент49 страницOperator'S Manual AND Set-Up Instructions For The: WDL-2070-FAМаксим ЛитвинОценок пока нет

- PCI Express Test Spec Platform 3.0 06182013 TSДокумент383 страницыPCI Express Test Spec Platform 3.0 06182013 TSDeng XinОценок пока нет

- SK AccBro CI Update - FABIA - Unpriced - SEPT 2023 AW v4Документ34 страницыSK AccBro CI Update - FABIA - Unpriced - SEPT 2023 AW v4Vlad TiurinОценок пока нет

- Missouri Department of Transportation: Standard Inspection and Testing Plan (ITP)Документ32 страницыMissouri Department of Transportation: Standard Inspection and Testing Plan (ITP)mohamedamine.zemouriОценок пока нет

- Nature'S Numbers: - BasicbooksДокумент39 страницNature'S Numbers: - Basicbooksyeol pacisОценок пока нет

- Assignment 9 Nomor 1Документ2 страницыAssignment 9 Nomor 1Alexander Steven ThemasОценок пока нет

- APCO CSAA ANS2 101 1webfinalДокумент38 страницAPCO CSAA ANS2 101 1webfinalJUAN CAMILO VALENCIA VALENCIAОценок пока нет

- Nassaji - Schema TheoryДокумент37 страницNassaji - Schema TheoryAtiq AslamОценок пока нет

- Exercicios de PhonicsДокумент51 страницаExercicios de Phonicsms. TeixeiraОценок пока нет

- Lesson 15 Validity of Measurement and Reliability PDFДокумент3 страницыLesson 15 Validity of Measurement and Reliability PDFMarkChristianRobleAlmazanОценок пока нет

- Problems Involving Sequences: Grade 10Документ9 страницProblems Involving Sequences: Grade 10Jhiemalyn RonquilloОценок пока нет

- Digital Album On Prominent Social ScientistsДокумент10 страницDigital Album On Prominent Social ScientistsOliver Antony ThomasОценок пока нет

- FWD Week 47 Learning Material For Alaric YeoДокумент7 страницFWD Week 47 Learning Material For Alaric YeoarielОценок пока нет

- Flotech Corporate FlyerДокумент6 страницFlotech Corporate FlyerPrasetyo PNPОценок пока нет

- Norsok Well IntegrityДокумент162 страницыNorsok Well IntegrityAshish SethiОценок пока нет

- PSCADДокумент10 страницPSCADkaran976Оценок пока нет

- Robit Forepoling Catalogue ENG 03-2015Документ36 страницRobit Forepoling Catalogue ENG 03-2015Purwadi Eko SaputroОценок пока нет

- Classical Electromagnetism 1st Edition Franklin Solutions ManualДокумент21 страницаClassical Electromagnetism 1st Edition Franklin Solutions ManualBrianYorktnqsw100% (15)

- Sherman Notes PDFДокумент213 страницSherman Notes PDFAbdul Hamid Bhatti100% (1)

- International Journal of Agricultural ExtensionДокумент6 страницInternational Journal of Agricultural Extensionacasushi ginzagaОценок пока нет

- Uenr0997 12 00 - Manuals Service Modules - Testing & AdjustingДокумент90 страницUenr0997 12 00 - Manuals Service Modules - Testing & Adjustingmostafa aliОценок пока нет

- Optimal Control Development System For ElectricalДокумент7 страницOptimal Control Development System For ElectricalCRISTIAN CAMILO MORALES SOLISОценок пока нет

- Legislation Statutory Inspection ChecklistДокумент2 страницыLegislation Statutory Inspection ChecklistAry PutraОценок пока нет

- TGA Interpretation of Data, Sources of ErrorДокумент28 страницTGA Interpretation of Data, Sources of ErrorUsman GhaniОценок пока нет

- Ubd Template DiltzДокумент6 страницUbd Template Diltzapi-281020585Оценок пока нет

- Series Portable Oscilloscopes: Keysight DSO1000A/BДокумент15 страницSeries Portable Oscilloscopes: Keysight DSO1000A/BNestor CardenasОценок пока нет