Академический Документы

Профессиональный Документы

Культура Документы

Rf100 Vehicle

Загружено:

Maria KellyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Rf100 Vehicle

Загружено:

Maria KellyАвторское право:

Доступные форматы

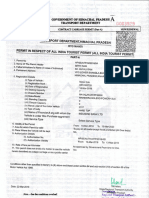

MOTOR TAX APPLICATION FOR A NEW VEHICLE

(Please complete the particulars and present this form at the Motor Tax Office with the receipt obtained at registration from NCTS)

APPLICATION: I apply for a licence (Tax Disc) for the vehicle described

A. VEHICLE PARTICULARS C. MOTOR TAX PARTICULARS - TAX CLASS

1. Make (Please tick, as appropriate)

2. Model PRIVATE AGRICULTURAL

TRACTOR

LARGE PUBLIC

3. Further Description/Body Type GOODS SERVICE VEHICLE

Unladen Service capacity

4. Colour/s C 5. Engine Capacity (cc) Weight (kg) (excluding driver)

O

D

E Will vehicle be Yes EXEMPT (state reason)

6. Engine Number used to carry

other people’s No State-Owned

goods for reward?

7. Chassis Number Fire Services

C HACKNEY Diplomatic

8. Engine/Fuel/Power Source/Type O 9. CO2 Emissions (g/km)

D TAXI Driver/Passenger

E with a disability

10. Statistical Code

SMALL DUMPER Other(Please specify)

11. EU Type- M1 Vehicles only Non M1 Vehicles Noise / Emissions Skip Capacity (m3)

Approval

Directive/s

OTHER TAX CLASS

12. Number of seats 13. Number of Windows (Please Specify)

14. Registration Number and Date Day Month Year D. INSURANCE PARTICULARS

of First Registration in the State.

Name of Insurance Company (NOT BROKER)

Receipt No. (where applicable)

Expiry date of insurance certificate under Day Month Year

Road Traffic Act, 1961, as amended

B. OWNER PARTICULARS

BLOCK CAPITALS ONLY

E. MOTOR TAX PERIOD

Mr, Ms, etc.

NON-USE PERIOD (if applicable Complete Declaration overleaf)

First Name(s)

MONTH YEAR MONTH YEAR

Surname to

Company Name ARREARS PERIOD (if applicable)

Address MONTH YEAR MONTH YEAR

to £

MONTH YEAR

TAX DISC From first day of

Town/City Tax Disc Period 3 months £

Required

County (Tick ONE Box) 6 months

Phone No. 12 months Total £

F. CARD PAYMENT OPTIONS

OFFICE USE ONLY

(Please tick, as appropriate)

INS

Cash £ Master Card Visa Amex Laser

CHQ £ Change £ Cardholder Signature:

KG PSV

PO £ Expiry Date:

BD £ Card Account No.:

SB EXNT Other £ G. DECLARATION

Date Received I declare that the particulars given on this form are correct

Disc Letter Date Issued

Signature:

FORM VRT3 (REV 5)

NOTES [To the completion of the RF100]

Please contact your local Motor Tax Office if you need any assistance completing this form

1. When to use this form

This form may be used to apply for a Motor Tax Disc for a vehicle which has already been registered by the Revenue Commissioners. This form should be

brought or posted to the Motor Tax Office of the District where the vehicle is ordinarily kept.

2. Before completing this form

- Ensure that the REGISTRATION MARK AND NUMBER assigned to the vehicle have ben inserted clearly and legibly at Section A, item 14 on the form.

3. How to complete this form

Section A All the vehicle information in this Section should already have been completed by the motor dealer or the person who paid the Vehicle

Registration Tax (VRT) to the Revenue Commissioners.

Section B If not already completed enter the name and address of the registered owner i.e. the keeper in whose name the vehicle is being licensed (taxed).

In the case of a LEGAL ENTITY, the full and correct legal title must be given, e.g. in the case of a registered company, the name should be stated as per the

Certificate of Incorporation. In the case of a private firm, the name by which it is ordinarily known and the names of the partners must be given, e.g. “John

and Mary Murphy trading as J & M Suppliers”.

Section C Tick the box opposite the Tax Class under which you wish to tax the vehicle. If the class required is not listed, please write the required class in

the box provided. You must provide all required information and include any necessary documentation as detailed in Note 4 below. IMPORTANT See tax

class definitions at you local Motor Tax Office and ensure that the vehicle is eligible to be taxed in the class selected.

Section D Enter details of your Insurance i.e. Name of Insurer, Policy No. and Date of Expiry of cover - Your insurance must be current when the tax disc

comes into force and the Insurance must be appropriate to the declared use of the vehicle.

Section E First Licence (Tax Disc) - Liability for Motor Tax

(i) Road Tax liability arises from the date the vehicle is first used in a public place after registration with the Revenue Commissioners. If you application for

motor tax does not commence from the date of registration because of non-use of the vehicle in a public place, this must be covered in the application.

(See (ii)). Motor Tax Discs are issued for periods of 3, 6 or 12 whole calendar months and are not issued in respect of months already elapsed. Vehicles

with an annual Tax of £129 or less can only be taxed for a 12 month period.

(ii) If you are declaring non-use of the vehicle, you must complete the declaration of non-use below at a Garda Station. Enter the period of non-use in the

boxes provided, starting with the date of registration of the vehicle e.g. if vehicle registered with the Revenue Commissioners in June, 2004, enter as:

06 04

Additional evidence in relation to non-use may also be required by the Motor Tax Office.

(iii) If arrears are due, enter in the boxes the start and end month of the arrears period and the relevant amount of money;

(iv) Insert the commencement month/year and tick the relevant box for the tax disc period required. Insert the amount of the fee and complete the total box.

Section F Complete this section if payment is being made by Credit Card or Debit Card.

Section G The signature on the application must be that of the keeper of the vehicle. (Under section 130 of the Finance Act, 1992, the ‘Owner’ is the ‘Keeper’)

4. What must accompany this form

You MUST include the following:

- Fee - You must include a cheque or postal order for the correct fee, made payable to the appropriate County Council/Corporation and crossed “Motor Tax

Account”. Do not send cash through the post. Contact your local Motor Tax Office for clarification of the appropriate fees and other payment methods.

- In cases where the Goods Tax Class is required and the vehicle does not exceed 1,524 kg unladen weight, a declaration should be made on the

appropriate form available from the Motor Tax Office stating the vehicle will not be used for non-commercial (private) purposes. A weight docket from an

approved weighbridge is required if the vehicle exceeds 1,524 kg unladen weight.

- PSV (plate) Licence - only applies to public service vehicles

- Article 60 licence - only applies to school buses

- Certificate of Exemption (e.g. Certificate of Approval from the Revenue Commissioners for Drivers/Passengers with Disabilities) - only applies to vehicles

exempt from Motor Tax.

5. Change of Ownership Prior to First Taxing

On the sale of the vehicle to a new owner (other than to a motor dealer) the registered owner selling the vehicle must forward this form RF100 and details in

writing of the name/address of the new owner and date of transfer of ownership to the Department of the Environment, Heritage and Local Government,

Shannon, Co. Clare. (If sale is to a motor dealer completed form RF105 must be forwarded)

WARNING - FALSE DECLARATIONS

Any person making a false declaration, or who subsequently fails to notify any changes in the licensing particulars now furnished, including disposal of the

vehicle, is liable to heavy penalties. A licensing authority may require appropriate evidence as to the accuracy of particulars declared.

DECLARATION OF NON-USE - Complete this section at a Garda Station if you are claiming non-use of the vehicle in any public place for any

period between the date of registration and commencement of the tax period.

(i) I declare that the vehicle bearing the registration number has not been used by me or with my consent

in a public place in the period

FROM first day of TO last day of

Month Year Month Year

Signature Date Garda

Station

(ii) The foregoing declaration was completed in my presence by the applicant. Stamp

Garda Signature Date

Вам также может понравиться

- F3529 CFDДокумент1 страницаF3529 CFDjmvuletichОценок пока нет

- Vehicle Registration FormДокумент2 страницыVehicle Registration FormMichel Bryan SemwoОценок пока нет

- Application For Texas Cerificate of TitleДокумент2 страницыApplication For Texas Cerificate of TitleRobert CookОценок пока нет

- BASHIR3Документ1 страницаBASHIR3zalwangogloria504Оценок пока нет

- National Indemnity - ID Truck ApplicationДокумент4 страницыNational Indemnity - ID Truck Applicationboy87216Оценок пока нет

- Truck ApplicationДокумент5 страницTruck ApplicationSj OnОценок пока нет

- Bashir 1Документ1 страницаBashir 1zalwangogloria504Оценок пока нет

- Registration Book: Section A: Current Registration in UgandaДокумент1 страницаRegistration Book: Section A: Current Registration in UgandaKman Soor100% (1)

- United India Insurance Company Limitedunited India Insurance Company LimitedДокумент9 страницUnited India Insurance Company Limitedunited India Insurance Company Limitedpradeepsj ReddyОценок пока нет

- Motor Tax Renewal Form: Do Not Use This Form To Register Changes of Ownership (See Note B)Документ2 страницыMotor Tax Renewal Form: Do Not Use This Form To Register Changes of Ownership (See Note B)Agatha BustamanteОценок пока нет

- BASHIR2Документ1 страницаBASHIR2zalwangogloria504Оценок пока нет

- Tata Aig Ratnala DavidcarДокумент1 страницаTata Aig Ratnala DavidcarTAMILNADU OPEN UNIVERSITYОценок пока нет

- Vehicle Permit Filled BikeДокумент1 страницаVehicle Permit Filled Bikenikatmapoojya3Оценок пока нет

- HONDA Application Form 2014 PDFДокумент12 страницHONDA Application Form 2014 PDFSrinibas Jena100% (1)

- IRDAI Regn No - 137Документ1 страницаIRDAI Regn No - 137Rajveer SinghОценок пока нет

- Stuff Covered by EasycareДокумент5 страницStuff Covered by EasycareSky WaterpeaceОценок пока нет

- United PolicyДокумент3 страницыUnited Policymuskan malhotraОценок пока нет

- Application For Title or Registration: CoachДокумент2 страницыApplication For Title or Registration: CoachJerry BeckОценок пока нет

- Mahindra Two Wheelers LTD.: Warranty Claim NoДокумент1 страницаMahindra Two Wheelers LTD.: Warranty Claim Nomanojkhadka23Оценок пока нет

- VIN Check Ford FocusДокумент1 страницаVIN Check Ford FocusVirgilio MoncadaОценок пока нет

- Tamilselvan VentoДокумент2 страницыTamilselvan VentoSabarishwaran ThangarajОценок пока нет

- Motor Private Car Package Policy Schedule Cum Certificate of InsuranceДокумент3 страницыMotor Private Car Package Policy Schedule Cum Certificate of InsuranceMartin SmartОценок пока нет

- LVGI Policy ProposalДокумент2 страницыLVGI Policy Proposals KollaОценок пока нет

- Bill of Sale and Odometer Disclosure StatementДокумент2 страницыBill of Sale and Odometer Disclosure StatementParker EastmanОценок пока нет

- UBJ073LДокумент1 страницаUBJ073LimdadplasticsОценок пока нет

- Engine Intallation and Test On Machine Form - MinSD1Документ1 страницаEngine Intallation and Test On Machine Form - MinSD1Harry RahmadОценок пока нет

- Application For Provisional Driver'S Licence: Form H3AДокумент1 страницаApplication For Provisional Driver'S Licence: Form H3AAngel KryptonОценок пока нет

- United India Insurance Company Limited: WWW - Uiic.co - inДокумент2 страницыUnited India Insurance Company Limited: WWW - Uiic.co - injaikrishnaa Maruti Driving SchoolОценок пока нет

- Connecticut Registration and Title Application: Department of Motor VehiclesДокумент2 страницыConnecticut Registration and Title Application: Department of Motor VehiclespoetdraculОценок пока нет

- United India Insurance Company LimitedДокумент2 страницыUnited India Insurance Company LimitedThoufeeq IbrahimОценок пока нет

- United India Insurance Company Limited: This Document Is Digitally SignedДокумент2 страницыUnited India Insurance Company Limited: This Document Is Digitally SignedMohit KachhwahaОценок пока нет

- MI 273 SIRB SQC ApplicationДокумент2 страницыMI 273 SIRB SQC ApplicationHERMAN DAGIOОценок пока нет

- Drivers License FormДокумент1 страницаDrivers License FormNehal GaurОценок пока нет

- UNITED INDIA INSURANCE MOTOR PROPOSALДокумент2 страницыUNITED INDIA INSURANCE MOTOR PROPOSALRajeev SinghОценок пока нет

- 2021 Motor Vehicle WorksheetДокумент2 страницы2021 Motor Vehicle WorksheetElenaОценок пока нет

- Application FormДокумент3 страницыApplication Formpelaq la weiОценок пока нет

- Mඎඅඍං-Sඁංൾඅൽ Sൾඋඏංർൾ Cඈඇඍඋൺർඍ ൿඈඋ Nൾඐ ൺඇൽ Uඌൾൽ Vൾඁංർඅൾඌ: Taylor Chevrolet 13801 Telegraph Road Taylor MI 48180Документ12 страницMඎඅඍං-Sඁංൾඅൽ Sൾඋඏංർൾ Cඈඇඍඋൺർඍ ൿඈඋ Nൾඐ ൺඇൽ Uඌൾൽ Vൾඁංർඅൾඌ: Taylor Chevrolet 13801 Telegraph Road Taylor MI 48180shekismail mvjОценок пока нет

- Cargo Booking Vendor FormДокумент3 страницыCargo Booking Vendor FormjeklinОценок пока нет

- RTO RCExtract NET011472670Документ1 страницаRTO RCExtract NET011472670Venugopal S RОценок пока нет

- United India Insurance Company Limited: WWW - Uiic.co - inДокумент2 страницыUnited India Insurance Company Limited: WWW - Uiic.co - inGulshan Datta0% (1)

- Motor Contract of Takaful Application FormДокумент5 страницMotor Contract of Takaful Application FormMuhd Izwan IshakОценок пока нет

- Department of State Growth: Application For RegistrationДокумент1 страницаDepartment of State Growth: Application For Registrationdibesh dhakalОценок пока нет

- UNITED INDIA INSURANCE PRIVATE CAR LIABILITY POLICYДокумент2 страницыUNITED INDIA INSURANCE PRIVATE CAR LIABILITY POLICYAkash kaushalОценок пока нет

- Application Form For PilotsДокумент8 страницApplication Form For PilotssaurabhОценок пока нет

- Certificate of Origin For A Vehicle TitleДокумент2 страницыCertificate of Origin For A Vehicle TitleRogelio MacielОценок пока нет

- ICICI Lombard insurance proposal for Toyota FortunerДокумент1 страницаICICI Lombard insurance proposal for Toyota FortuneranirudhОценок пока нет

- Price List - Ford New Endeavour - ICA Bhavna Ford: VariantsДокумент1 страницаPrice List - Ford New Endeavour - ICA Bhavna Ford: VariantsTanmay KhanolkarОценок пока нет

- International Motor Insurance Card ExplainedДокумент1 страницаInternational Motor Insurance Card ExplainedmaxОценок пока нет

- Company Name: Vehicle Fuel/Maintenance Reimbursement FormДокумент2 страницыCompany Name: Vehicle Fuel/Maintenance Reimbursement Formanon_933416755Оценок пока нет

- Report of Vehicle Mileage and CostsДокумент1 страницаReport of Vehicle Mileage and CostsJacob GiffenОценок пока нет

- Dealer LPGДокумент9 страницDealer LPGorcawaterstationОценок пока нет

- Insurance details for Suzuki Ertiga 2012 mini busДокумент1 страницаInsurance details for Suzuki Ertiga 2012 mini buskaratooОценок пока нет

- Steam Power India Vehicle RecordsДокумент1 страницаSteam Power India Vehicle RecordsSandeep kumarОценок пока нет

- Final Survey Report FormatДокумент5 страницFinal Survey Report FormatADHAR SHARMAОценок пока нет

- All India PermitДокумент1 страницаAll India PermitmeghnaloveОценок пока нет

- MVD 10002Документ2 страницыMVD 10002idnac moralesОценок пока нет

- Form No. 21 (See Rules 47 (C) and (D) ) Sale Certificate: TO, The Regional Transport OfficerДокумент1 страницаForm No. 21 (See Rules 47 (C) and (D) ) Sale Certificate: TO, The Regional Transport OfficerBadrika Auto House SalesОценок пока нет

- WeldBend CatalogДокумент186 страницWeldBend CatalogJaime I. de la RosaОценок пока нет

- Gas BallastДокумент7 страницGas BallastMiraNurhayaniОценок пока нет

- LindeДокумент24 страницыLindeMarcin MałysОценок пока нет

- Aplus CompactorДокумент8 страницAplus CompactorAlex ChewОценок пока нет

- 1 USA Tunisia SHSP Road Safety PlanДокумент22 страницы1 USA Tunisia SHSP Road Safety PlanChehem MohamedОценок пока нет

- Qatar Traffic ManualДокумент171 страницаQatar Traffic Manualynnas29sanny80% (10)

- Bikes Ecu Applications: Ecu Supported (All Vehicle Categories) New Genius & Flash Point Obdii/Boot ProtocolsДокумент8 страницBikes Ecu Applications: Ecu Supported (All Vehicle Categories) New Genius & Flash Point Obdii/Boot ProtocolsBudi100% (1)

- Audioscripts TN1Документ16 страницAudioscripts TN1Carlos SaavedraОценок пока нет

- RYA CompetentДокумент221 страницаRYA Competentsimion stefan100% (7)

- Prius EffectДокумент11 страницPrius Effectpocoyo91Оценок пока нет

- 2021-04-01 Motor TrendДокумент84 страницы2021-04-01 Motor Trendjoao a100% (1)

- MAN 6-cylinder D2066 truck enginesДокумент4 страницыMAN 6-cylinder D2066 truck enginesUsman Shah75% (4)

- Notice: Airport Noise Compatibility Program: Noise Exposure Maps— Ocala International Airport, FLДокумент2 страницыNotice: Airport Noise Compatibility Program: Noise Exposure Maps— Ocala International Airport, FLJustia.comОценок пока нет

- O5506v77 W Brochure SP1600 0916 ENДокумент32 страницыO5506v77 W Brochure SP1600 0916 ENMudduKrishna shettyОценок пока нет

- Good Manners and Decorum Jean ReportДокумент25 страницGood Manners and Decorum Jean ReportJunior PayatotОценок пока нет

- DL 600Документ108 страницDL 600timothycbautistaОценок пока нет

- Manegement Information System of Ethiopian Air LinesДокумент28 страницManegement Information System of Ethiopian Air Linesbayissa biratuОценок пока нет

- Passing Your Part 135 IFR-PIC CheckrideДокумент37 страницPassing Your Part 135 IFR-PIC CheckrideFedericoCalero100% (3)

- TELC Test-Angol b2 FeladatДокумент38 страницTELC Test-Angol b2 FeladatjОценок пока нет

- Arsrepaircatalog Websiteedition Hyster.69192443Документ13 страницArsrepaircatalog Websiteedition Hyster.69192443MA TotalforkliftОценок пока нет

- SIP CA1 Submission Cover and Scoresheet - AY1718S2Документ5 страницSIP CA1 Submission Cover and Scoresheet - AY1718S2seanhongwei100% (1)

- Strength Analysis of Hull Structures in TankersДокумент40 страницStrength Analysis of Hull Structures in TankersMahdiОценок пока нет

- 3 Wheeler Spare Parts Catalogue for Bajaj, Piaggio & Mohindra ModelsДокумент204 страницы3 Wheeler Spare Parts Catalogue for Bajaj, Piaggio & Mohindra ModelsBhusarapu Srinivas100% (1)

- Federal Aviation Administration, DOT 135.351: 135.349 Flight Attendants: Initial and Transition Ground TrainingДокумент2 страницыFederal Aviation Administration, DOT 135.351: 135.349 Flight Attendants: Initial and Transition Ground TrainingmollyОценок пока нет

- Vehicle Inspection Report SummaryДокумент1 страницаVehicle Inspection Report SummaryKanageswary AnandanОценок пока нет

- Table 3:list of Mandatory Omani Standards: Date of Issue No. of Min. Decree OS No. GS No. Name of Standard Shelf LifeДокумент5 страницTable 3:list of Mandatory Omani Standards: Date of Issue No. of Min. Decree OS No. GS No. Name of Standard Shelf LifeKapil RajОценок пока нет

- Dialysis ExperimentДокумент3 страницыDialysis ExperimentParis Panganiban BelberОценок пока нет

- SyllabusДокумент8 страницSyllabusdraj1875977Оценок пока нет

- Environmental Impacts of Fuel Dumping - GreentumbleДокумент11 страницEnvironmental Impacts of Fuel Dumping - GreentumbleShoonОценок пока нет

- Apm2Gk: Flight 1 Departing ArrivingДокумент2 страницыApm2Gk: Flight 1 Departing ArrivingVinod RangaОценок пока нет