Академический Документы

Профессиональный Документы

Культура Документы

March 2018 High Dividend Stocks List

Загружено:

Rock110 оценок0% нашли этот документ полезным (0 голосов)

73 просмотров36 страницОригинальное название

March 2018 High Dividend Stocks List.xlsx

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

73 просмотров36 страницMarch 2018 High Dividend Stocks List

Загружено:

Rock11Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 36

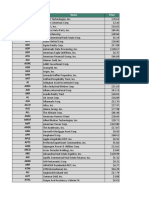

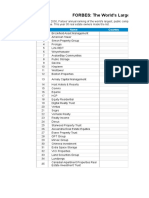

Symbol Name Market Cap

WMC Western Asset Mortgage $ 378

AB AllianceBernstein Holding $ 2,530

CIM Chimera Investment $ 3,191

MITT AG Mortgage Investment $ 472

CCUR CCUR Holdings $ 53

CLNC Colony NorthStar Credit Real Estate #N/A

BANX StoneCastle Financial $ 140

JMP JMP Group $ 114

HNP Huaneng Power $ 9,705

FEDU Four Seasons Education $ 363

BGCP BGC Partners $ 4,058

BKEP Blueknight Energy $ 193

VOD Vodafone Group $ 74,823

PEGI Pattern Energy Group $ 1,659

FRO Frontline $ 684

ORC Orchid Island Capital $ 392

SOHO Sotherly Hotels $ 87

TRGP Targa Resources $ 9,994

CPTA Capitala Finance $ 116

DEA Easterly Government Props $ 857

GOV Government Properties IT $ 1,354

GCI Gannett $ 1,179

USAC USA Compression Partners $ 1,100

CIO City Office REIT $ 386

KRG Kite Realty Group Trust $ 1,297

GOOD Gladstone Commercial $ 505

MGP MGM Growth Properties $ 6,709

KCAP KCAP Financial $ 112

SNR New Senior Investment Gr $ 684

CHCT Community Healthcare $ 441

EVA Enviva Partners $ 710

NS NuStar Energy $ 1,939

GNL Global Net Lease $ 1,065

WSR Whitestone $ 418

GEL Genesis Energy $ 2,431

OHI Omega Healthcare $ 5,279

APAM Artisan Partners Asset $ 2,525

SPH Suburban Propane Partners $ 1,446

NYLD.A NRG Yield $ 2,975

NYLD NRG Yield $ 3,031

OAKS Five Oaks Investment $ 74

BPY Brookfield Property $ 5,146

VGR Vector Group $ 2,683

STAG Stag Industrial $ 2,216

MMLP Martin Midstream Partners $ 528

SRC Spirit Realty Capital $ 3,559

MPLX MPLX $ 27,450

CAFD 8point3 Energy Partners $ 962

VET Vermilion Energy $ 3,909

SHLX Shell Midstream Partners $ 5,537

CAPL CrossAmerica Partners $ 785

MAC Macerich $ 8,316

DOC Physicians Realty Trust $ 2,686

HESM Hess Midstream Partners $ 1,118

AI Arlington Asset Inv $ 311

SELF Global Self Storage $ 33

GARS Garrison Capital $ 127

APTS Preferred Apartment $ 550

ANDX Andeavor Logistics $ 10,013

LMRK Landmark Infrastructure $ 414

CATO Cato $ 296

AMID American Midstream $ 617

DLNG Dynagas LNG Partners $ 370

GPT Gramercy Property Trust $ 3,537

SUN Sunoco $ 2,820

UMH UMH Properties $ 415

MDLY Medley Management $ 173

HCAP Harvest Capital Credit $ 70

CLNS Colony NorthStar $ 3,141

BKS Barnes & Noble $ 342

SIR Select Income REIT $ 1,648

NCMI National CineMedia $ 591

BKCC BlackRock Capital $ 402

GSK GlaxoSmithKline $ 89,793

WELL Welltower $ 19,672

SNH Senior Housing Properties $ 3,652

MIC Macquarie Infrastructure $ 3,271

GLOP GasLog Partners $ 983

SO Southern $ 44,561

EEP Enbridge Energy Partners $ 5,484

NAP Navios Maritime Midstream $ 194

DCP DCP Midstream $ 5,219

EDR Education Realty Trust $ 2,367

IRM Iron Mountain $ 9,002

FPI Farmland Partners $ 258

FPIPRB Farmland Partners $ 829

CVA Covanta Holding $ 1,958

APU AmeriGas Partners $ 3,885

OMP Oasis Midstream Partners $ 460

HASI Hannon Armstrong $ 962

SMLP Summit Midstream Partners $ 1,217

O Realty Income $ 14,136

HRZN Horizon Tech Finance $ 122

OKE ONEOK $ 23,439

AHH Armada Hoffler Properties $ 602

CTRE CareTrust REIT $ 1,006

LXP Lexington Realty $ 1,912

UBS UBS Group $ 68,909

ENBL Enable Midstream Partners $ 6,069

BX Blackstone Group $ 40,031

SKT Tanger Factory Outlet $ 2,146

TCRD THL Credit $ 272

LSI Life Storage $ 3,680

PAA Plains All American $ 15,599

CPLP Capital Product Partners $ 398

CBL CBL & Associates $ 823

E Eni $ 60,382

BP BP $ 128,553

OFS OFS Capital $ 151

AROC Archrock $ 674

CLDT Chatham Lodging $ 834

AINV Apollo Investment $ 1,156

ATAX America First Multifamily $ 377

IRT Independence Realty Trust $ 732

HCP HCP $ 10,253

CDR Cedar Realty Trust $ 367

CCR CONSOL Coal Resources $ 391

OUT Outfront Media $ 2,803

PSEC Prospect Capital $ 2,372

GEO The GEO Group $ 2,729

WPC W.P. Carey $ 6,430

WES Western Gas Partners $ 7,612

SBRA Sabra Health Care REIT $ 3,046

EQM EQT Midstream Partners $ 5,064

BPL Buckeye Partners $ 6,528

ETP Energy Transfer Partners $ 20,941

NVEC NVE $ 366

APLE Apple Hospitality REIT $ 3,911

STB Student Transportation $ 712

SFL Ship Finance Intl $ 1,487

MRCC Monroe Capital $ 260

PSXP Phillips 66 Partners $ 5,975

HPT Hospitality Props Tst $ 4,004

GLPI Gaming and Leisure Props $ 6,998

SEP Spectra Energy Partners $ 18,911

SRLP Sprague Resources $ 524

GSBD Goldman Sachs BDC $ 779

CHSP Chesapeake Lodging Trust $ 1,565

RLJ RLJ Lodging $ 3,408

MN Manning & Napier $ 51

SSW Seaspan $ 755

SPG Simon Property Group $ 49,819

MRT MedEquities Realty Trust $ 327

BSM Black Stone Minerals $ 3,470

EFC Ellington Financial $ 439

STOR STORE Capital $ 4,661

SALM Salem Media Group $ 107

HTGC Hercules Capital $ 1,016

EPD Enterprise Products $ 54,265

OLP One Liberty Properties $ 420

AY Atlantica Yield $ 2,004

TWO Two Harbors Investment $ 2,612

PFLT PennantPark Floating Rate $ 483

DKL Delek Logistics Partners $ 734

TCP TC Pipelines $ 3,502

CMO Capstead Mortgage $ 799

CORR CorEnergy Infr Trust $ 437

ANH Anworth Mortgage Asset $ 463

HEP Holly Energy Partners $ 3,015

HIFR InfraREIT $ 807

WPG Washington Prime Group $ 1,211

XHR Xenia Hotels & Resorts $ 2,102

CINR Ciner Resources $ 537

NNN National Retail Props $ 5,790

KIM Kimco Realty $ 6,505

GMLP Golar LNG Partners $ 1,355

ORIT Oritani Financial $ 732

DMLP Dorchester Minerals $ 504

PNNT Pennant Park Investment $ 499

NYMT New York Mortgage Trust $ 632

EPR EPR Properties $ 4,029

LHO LaSalle Hotel Properties $ 2,830

STWD Starwood Property Trust $ 5,337

RPT Ramco-Gershenson $ 953

ARI Apollo Commercial Real $ 1,980

EARN Ellington Residential $ 142

MPW Medical Properties Trust $ 4,581

CXW CoreCivic $ 2,519

TNP Tsakos Energy Navigation $ 287

TLP TransMontaigne Partners $ 595

MNDO MIND C.T.I. $ 53

QIWI QIWI $ 988

BXMT Blackstone Mortgage Trust $ 3,380

NSH NuStar Holdings $ 472

ACSF American Capital $ 109

HMLP Hoegh LNG Partners $ 571

PBFX PBF Logistics $ 838

VEDL Vedanta $ 18,289

ETE Energy Transfer Equity $ 16,878

BRX Brixmor Property Group $ 4,793

LADR Ladder Capital $ 1,669

UG United-Guardian $ 83

UBP Urstadt Biddle Properties $ 606

UBA Urstadt Biddle Properties $ 689

DX Dynex Capital $ 342

CTL CenturyLink $ 18,562

AGNC AGNC Investment $ 7,110

LTC LTC Properties $ 1,503

MFA MFA Financial $ 2,877

FSIC FS Investment $ 1,782

NRT North European Oil $ 77

LOAN Manhattan Bridge Capital $ 51

TPVG TriplePoint Venture Gwth $ 206

KNOP KNOT Offshore Partners $ 594

PIR Pier 1 Imports $ 263

ARCC Ares Capital $ 6,697

CYS CYS Investments $ 995

NHI National Health Investors $ 2,723

SUNS Solar Senior Capital $ 271

SLRC Solar Capital $ 866

NEWT Newtek Business Services $ 310

MCY Mercury General $ 2,515

IRET Investors Real Estate $ 571

ACRE Ares Commercial Real $ 352

AM Antero Midstream Partners $ 4,920

MMP Magellan Midstream $ 14,470

TCPC TCP Capital $ 843

BCE BCE $ 39,213

TEP Tallgrass Energy Partners $ 2,861

FUN Cedar Fair $ 3,757

CGBD TCG BDC $ 1,066

DM Dominion Energy Midstream Partners $ 2,538

GLAD Gladstone Capital $ 232

OAK Oaktree Capital Group $ 6,493

WRI Weingarten Realty $ 3,545

PAC Grupo Aeroportuario Del $ 5,384

ENLC EnLink Midstream $ 2,768

PBA Pembina Pipeline $ 16,061

PMT PennyMac Mortgage Inv $ 1,033

WPZ Williams Partners $ 35,875

JCAP Jernigan Capital $ 246

MAIN Main Street Capital $ 2,102

OMI Owens & Minor $ 1,020

WLKP Westlake Chemical $ 737

GTY Getty Realty $ 972

NLY Annaly Capital Management $ 11,735

PZN Pzena Investment Mgmt $ 752

TRTX TPG RE Finance Trust $ 1,134

RDS.A Royal Dutch Shell $ 263,168

RDS.B Royal Dutch Shell $ 268,507

SLD Sutherland Asset Management $ 443

HT Hersha Hospitality $ 673

AHGP Alliance Holdings $ 1,533

INN Summit Hotel Properties $ 1,343

GBDC Golub Capital BDC $ 1,076

SCM Stellus Capital Inv $ 182

TNH Terra Nitrogen Co $ 1,564

FDUS Fidus Investment $ 322

CMFN CM Finance $ 113

GRP.U Granite Real Estate Investment Trust $ 1,766

NMFC New Mountain Finance $ 999

SPKE Spark Energy $ 313

ARLP Alliance Resource $ 2,343

ENB Enbridge $ 52,057

TSLX TPG Specialty Lending $ 1,089

LAMR Lamar Advertising $ 6,500

CRT Cross Timbers Royalty $ 89

SAR Saratoga Investment $ 132

MBT Mobile Telesystems $ 11,827

WGP Western Gas Equity $ 7,720

CVI CVR Energy $ 2,622

WHF WhiteHorse Finance $ 239

LB L Brands $ 12,236

TICC TICC Capital $ 315

TAX Liberty Tax $ 109

TATT TAT Technologies $ 90

MVO MV Oil $ 90

PPL PPL $ 19,246

ABR Arbor Realty Trust $ 528

AJX Great Ajax $ 241

KREF KKR Real Estate Finance Trust $ 1,037

ICL Israel Chemicals $ 5,463

RPAI Retail Props of America $ 2,675

RWT Redwood Trust $ 1,120

MARPS Marine Petroleum Trust $ 7

PHI PLDT $ 6,305

OZM Och-Ziff Capital Mgmt Gr $ 1,312

NGG National Grid $ 35,091

VTR Ventas $ 17,759

FAT FAT Brands $ 77

IVR Invesco Mortgage Capital $ 1,736

APO Apollo Global Management $ 13,117

BRT BRT Apartments $ 146

WBK Westpac Banking $ 80,726

BGFV Big 5 Sporting Goods $ 136

RMP Rice Midstream Partners $ 1,958

NRZ New Residential Inv $ 5,503

GAIN Gladstone Investment $ 314

BGS B&G Foods $ 1,962

CCT Corporate Capital Trust $ 4,837

AYR Aircastle $ 1,552

CSWC Capital Southwest $ 280

BLX Banco Latinoamericano $ 1,122

PBI Pitney Bowes $ 2,395

MTGE MTGE Investment $ 790

CG The Carlyle Group $ 7,577

CMRE Costamare $ 661

ARR ARMOUR Residential REIT $ 912

IMOS ChipMOS TECHNOLOGIES $ 748

BBL BHP Billiton $ 105,677

WMB Williams Companies $ 22,429

GME GameStop $ 1,614

CNXM CNX Midstream Partners $ 1,146

MVC MVC Capital $ 190

JE Just Energy Group $ 705

T AT&T $ 223,245

CHMI Cherry Hill Mortgage Inv $ 207

TRTN Triton International $ 2,445

MSB Mesabi Trust $ 359

IRS IRSA Inversiones $ 1,528

TGLS Tecnoglass $ 314

F Ford Motor $ 41,323

NTRSP Northern Trust #N/A

SDLP Seadrill Partners $ 295

TOT Total $ 142,922

HSBC HSBC Holdings $ 197,879

NRP Natural Resources $ 369

SDT SandRidge Mississippian $ 23

SBR Sabine Royalty $ 625

PER SandRidge Permian $ 108

OSB Norbord $ 2,939

SHI Sinopec Shanghai $ 6,509

PK Park Hotels & Resorts $ 5,254

AEG Aegon $ 13,809

USDP USD Partners $ 286

ADES Advanced Emissions $ 223

MTLPR Mechel #N/A

IRCP IRSA Propiedades $ 1,481

IEP Icahn Enterprises $ 9,889

TEO Telecom Argentina $ 6,092

GPMT Granite Point Mortgage Trust $ 727

KEN Kenon Hldgs $ 1,699

BPT BP Prudhoe Bay $ 423

SDR SandRidge Mississippian $ 47

CHKR Chesapeake Granite Wash $ 102

ECT ECA Marcellus Trust I $ 36

HGT Hugoton Royalty $ 32

NDRO Enduro Royalty Trust $ 114

CVRR CVR Refining $ 1,845

SBGL Sibanye-Stillwater $ 2,125

GPP Green Plains Partners $ 569

VOC VOC Energy $ 86

SJT San Juan Basin Royalty $ 409

HIHO Highway Holdings $ 17

MTR Mesa Royalty $ 28

YIN Yintech Investment Hldgs $ 659

ROYT Pacific Coast Oil Trust $ 89

CAMT Camtek $ 244

VNOM Viper Energy Partners $ 2,658

ATAI ATA $ 127

GFA Gafisa $ 114

ATTO Atento $ 706

TERP TerraForm Power $ 1,672

FELP Foresight Energy $ 519

KRP Kimbell Royalty Partners $ 301

PBT Permian Basin Royalty $ 429

XIN Xinyuan Real Estate Co $ 397

HCLP Hi-Crush Partners $ 1,101

EBR.B Centrais Eletricas $ 11,579

CHL China Mobile $ 189,603

DRD DRDGold $ 131

BBVA BBVA $ 55,010

WIN Windstream Holdings $ 277

WMLP Westmoreland Resource $ 3

UAN CVR Partners $ 390

NAO Nordic American Offshore $ 73

DRYS DryShips $ 370

KND Kindred Healthcare $ 856

OHAI OHA Investment $ 26

ESND Essendant $ 303

RRD R.R.Donnelley & Sons $ 512

BBOX Black Box $ 29

DRAD Digirad $ 42

RESI Front Yard Residential $ 543

SSI Stage Stores $ 55

TAIT Taitron Components $ 9

BCRH Blue Capital Reinsurance $ 99

AHC A H Belo $ 113

TNK Teekay Tankers $ 335

OCSL Oaktree Specialty Lending $ 615

PAGP Plains GP Holdings $ 3,351

NAUH National American $ 26

NNA Navios Maritime $ 117

TUP Tupperware Brands $ 2,534

AMC AMC Entertainment Hldgs $ 2,032

NAT Nordic American Tankers $ 222

TEGP Tallgrass Energy GP $ 3,692

FI Frank's International $ 1,173

LKSD LSC Communications $ 524

CCLP CSI Compressco $ 292

FGP Ferrellgas Partners $ 379

MHLD Maiden Holdings $ 510

MCC Medley Capital $ 224

CEQP Crestwood Equity Partners $ 1,934

PMTS CPI Card Group $ 29

STON Stonemor Partners $ 235

GNE Genie Energy $ 112

VEON VEON $ 5,020

IDT IDT $ 289

AHT Ashford Hospitality Trust $ 591

NGL NGL Energy Partners $ 1,501

DDR DDR $ 2,924

GECC Great Elm Capital $ 97

TCAP Triangle Capital $ 553

NRE NorthStar Realty Europe $ 566

GLP Global Partners $ 554

CNSL Consolidated Comms Hldgs $ 838

WHLR Wheeler Real Estate IT $ 44

SCG SCANA $ 5,656

OCSI Oaktree Strategic Income $ 227

PEI Pennsylvania Real Estate $ 740

GMRE Global Medical REIT $ 144

SXCP SunCoke Energy Partners $ 890

CODI Compass Diversified Hldgs $ 991

NEWM New Media Inv Group $ 928

SEMG Semgroup $ 1,762

SKIS Peak Resorts $ 73

BEP Brookfield Renewable $ 9,364

UNIT Uniti Group $ 2,578

VER VEREIT $ 6,664

CELP Cypress Energy Partners $ 75

AHP Ashford Hospitality Prime $ 299

AFSI AmTrust Financial Servs $ 2,535

FTAI Fortress Transportation $ 1,353

ABDC Alcentra Capital $ 106

GES Guess? $ 1,353

ENLK EnLink Midstream Partners $ 5,180

APLP Archrock Partners $ 920

Dividend Yield (Forward) PE Ratio (TTM) PE Ratio (Forward)

13.8% 15.3 7.2

12.8% 12.0 10.3

11.8% 6.5 7.1

11.4% 5.8 8.7

9.0% 1.0 #N/A

8.3% #N/A #N/A

7.1% #N/A 13.1

6.8% #N/A #N/A

6.6% #N/A 11.0

5.6% #N/A 18.8

5.4% #N/A 9.8

12.1% #N/A 96.0

6.0% 859.3 21.2

10.0% 282.5 28.6

14.9% 201.5 #N/A

17.9% #N/A 5.1

7.5% #N/A #N/A

8.0% #N/A 432.4

13.7% 66.3 6.8

5.3% 195.3 102.8

12.6% 105.1 #N/A

6.1% 187.6 10.4

11.9% 95.6 34.0

8.8% #N/A 2242.7

8.2% 110.8 #N/A

8.7% #N/A #N/A

6.4% 34.0 29.1

13.3% 50.0 8.2

12.5% 55.5 #N/A

6.6% 110.3 #N/A

8.8% 44.2 18.5

21.1% 30.3 13.9

13.5% 51.0 #N/A

10.5% 63.9 35.0

10.3% 38.9 19.7

9.9% 52.1 17.5

7.3% 43.2 10.6

10.2% 36.2 14.2

7.4% 44.7 17.8

7.3% 45.6 11.7

12.0% 8.1 6.1

6.2% 39.7 9.0

8.1% 60.9 30.1

6.2% 103.6 325.5

14.6% 30.6 21.5

9.1% 49.6 31.8

7.0% 32.9 17.8

9.2% 29.7 20.8

6.3% 107.3 #N/A

5.0% 39.2 17.9

10.9% 41.5 24.5

5.0% 57.9 91.1

6.2% 67.2 51.0

6.3% 10.8 17.5

19.9% 18.7 5.2

6.0% 86.1 #N/A

14.1% 24.0 7.7

7.0% #N/A #N/A

8.7% 20.1 15.7

8.8% 31.3 #N/A

11.2% 24.6 15.8

14.1% #N/A #N/A

16.2% 32.7 29.2

6.8% 48.9 #N/A

11.6% 79.0 14.3

6.1% #N/A #N/A

13.5% 27.0 11.3

10.6% 22.9 8.5

16.2% #N/A #N/A

12.8% 21.4 12.9

11.1% 24.6 #N/A

11.7% 22.8 21.4

13.1% 21.2 6.5

7.1% 46.5 14.2

6.6% 41.7 33.2

10.2% 24.8 14.3

14.9% 18.7 17.1

8.7% 9.6 12.3

5.3% 53.3 15.3

11.3% 24.8 15.5

18.3% 13.4 10.8

8.6% 84.7 27.5

5.0% 52.1 51.6

7.5% 45.7 27.6

6.4% 34.7 57.0

5.9% 111.5 #N/A

6.7% 34.0 121.7

9.1% 35.4 15.0

9.0% #N/A 8.8

7.3% 32.2 13.8

13.8% 17.2 14.5

5.3% 45.2 38.3

11.4% 18.9 9.5

5.4% 45.3 22.2

6.0% 26.7 31.8

5.6% 37.7 19.7

8.9% 24.1 #N/A

6.6% 62.7 10.9

9.1% 15.3 14.5

10.2% 15.3 10.7

6.0% 32.4 22.3

13.0% 14.9 7.6

5.1% 38.2 25.6

5.6% 22.2 15.1

10.2% 14.3 11.0

16.6% 10.7 120.3

5.7% 33.1 14.9

6.2% 37.6 14.1

12.0% 12.3 8.2

5.1% 36.5 #N/A

7.3% 25.3 #N/A

11.2% 16.2 8.6

8.0% 20.8 25.0

8.4% 20.5 #N/A

6.8% 25.4 32.8

5.0% #N/A 53.2

14.4% 10.3 8.2

7.2% 22.4 21.7

11.0% 11.7 8.8

8.6% 20.1 16.4

6.7% 23.6 25.8

8.0% 36.1 19.4

10.5% 18.0 7.8

6.5% 12.1 12.3

11.4% 13.4 14.5

12.6% 9.8 20.1

5.3% 28.0 #N/A

7.1% 21.0 #N/A

5.9% 28.8 34.1

9.7% 12.5 15.1

10.9% 13.0 8.7

5.5% 18.9 15.4

8.5% 17.3 23.0

7.7% 18.4 16.3

7.4% 51.3 12.1

11.0% 13.0 9.9

9.3% 15.3 10.1

6.2% 23.4 23.1

5.1% 17.2 #N/A

9.4% 14.2 12.5

8.2% 13.0 6.9

5.0% 24.9 23.3

8.2% 16.0 #N/A

7.2% 22.2 17.9

11.5% 13.6 9.4

5.2% 26.7 27.9

6.3% 20.7 16.4

10.4% 12.5 9.6

6.8% 19.3 16.4

8.1% 17.1 #N/A

5.8% 71.4 41.4

12.6% 8.3 8.0

9.2% 13.4 14.7

9.6% 14.4 9.5

8.1% 15.5 14.7

8.9% 12.9 12.6

8.2% 15.9 9.8

12.7% 10.0 9.8

9.1% 13.6 18.1

5.4% 16.0 14.2

15.3% 6.7 #N/A

5.6% 21.4 30.8

8.3% 14.2 11.1

5.0% 26.0 26.6

7.3% 17.6 23.7

11.8% 7.6 17.2

6.3% 16.5 14.4

8.3% 16.1 #N/A

10.3% 10.1 9.4

14.2% 8.5 9.0

8.0% 16.1 15.0

7.2% 16.3 50.9

9.4% 12.3 9.5

7.3% 15.8 59.3

10.0% 12.0 9.5

13.9% 11.7 7.0

8.0% 15.3 12.3

8.1% 14.2 14.9

5.9% #N/A 9.1

8.6% 14.7 11.3

11.0% 9.4 #N/A

5.2% 22.9 12.9

7.9% 13.8 11.9

19.8% 5.5 9.9

10.7% 9.9 #N/A

9.9% 10.7 10.8

9.5% 9.2 9.8

6.1% 13.6 #N/A

7.8% 18.8 9.5

7.0% 16.2 17.5

8.4% 13.3 9.7

5.6% 23.1 #N/A

6.1% 17.8 #N/A

6.1% 20.3 31.6

11.8% 13.9 8.7

12.5% 9.9 16.6

11.9% 9.0 7.7

6.0% 17.0 17.3

11.1% 9.0 9.8

10.5% 8.1 9.0

9.3% 11.2 #N/A

7.0% 15.6 12.6

12.4% 8.3 7.9

10.4% 8.9 9.6

8.9% 11.3 15.0

9.7% 9.9 9.9

15.6% 6.1 7.4

6.1% 16.9 #N/A

8.3% 11.6 11.9

8.0% 12.3 11.2

9.3% 10.4 9.1

5.5% 17.4 18.2

5.9% 14.4 #N/A

9.1% 10.8 10.2

5.6% 20.4 14.3

5.8% 16.6 15.8

10.1% 11.9 9.2

5.5% 18.2 16.0

9.9% 10.0 12.8

5.3% 17.7 18.1

8.7% 11.7 10.7

5.0% 28.4 14.8

9.6% 9.7 10.2

8.0% 11.5 12.5

5.7% 10.7 28.4

6.2% 37.9 21.4

6.8% 13.2 43.7

5.4% 21.8 18.4

11.2% 11.4 11.5

6.5% 39.5 22.0

8.1% 11.9 5.9

6.4% 11.9 14.6

6.3% 13.8 8.2

6.5% 13.7 12.1

5.2% 20.6 #N/A

11.9% 7.4 8.8

15.3% 28.9 12.8

8.1% #N/A 9.9

6.0% 20.1 12.8

5.8% 20.5 13.2

10.7% 7.4 8.6

6.6% 9.5 #N/A

11.6% 8.2 7.6

5.6% 15.9 31.4

7.1% 12.3 14.1

11.9% 6.8 8.4

7.1% 14.1 #N/A

11.9% 6.6 8.3

12.1% 6.1 8.3

5.7% 15.0 #N/A

10.3% 8.7 9.5

8.0% 10.4 12.7

10.9% 6.1 8.0

6.6% 21.2 16.6

8.7% 9.2 9.8

5.5% 20.5 21.6

7.5% 14.1 #N/A

9.5% 11.7 9.7

7.3% 12.3 10.6

6.2% 20.5 17.8

6.6% 11.1 14.1

12.2% 6.2 8.5

5.5% 13.2 13.7

13.1% 5.2 9.8

7.4% #N/A 7.0

13.4% 20.5 #N/A

11.3% 10.3 #N/A

5.9% 12.5 12.0

9.8% 7.6 9.0

9.1% 8.7 6.8

7.6% #N/A 11.7

5.1% 14.9 11.6

5.4% 11.7 61.0

7.6% 9.1 9.9

9.1% 9.1 #N/A

5.2% 12.1 14.5

10.6% 26.5 5.3

5.6% 3.6 12.4

6.3% 13.2 26.4

6.2% #N/A 8.1

10.8% 5.7 9.1

6.4% 10.3 10.2

7.0% 34.4 #N/A

6.1% 13.4 12.1

9.4% 6.4 11.9

6.1% 12.2 11.7

12.2% 5.2 7.6

8.1% 6.4 12.6

6.3% 9.0 14.0

10.2% 22.9 #N/A

5.7% 10.6 8.5

6.5% 9.1 #N/A

5.4% 13.7 11.9

5.9% 9.2 8.8

11.6% 5.0 8.7

6.2% 9.4 8.8

6.6% 11.4 9.5

10.5% 4.3 9.0

8.6% 6.4 26.1

5.5% #N/A 12.1

5.0% 10.3 23.0

9.5% 4.7 4.8

6.6% 10.5 10.7

6.0% 8.3 22.4

8.2% 6.8 4.1

5.5% 7.7 10.5

12.1% 2.4 8.2

6.0% 6.7 7.5

9.2% 10.9 #N/A

5.2% 2.7 #N/A

6.1% 41.7 16.4

5.8% 5.5 6.6

5.5% #N/A #N/A

12.5% 1.4 #N/A

5.2% 16.9 12.3

5.2% 20.6 56.9

6.0% 12.1 4.7

25.3% 3.6 #N/A

5.4% 19.0 #N/A

22.1% 4.1 #N/A

5.5% 6.7 8.5

6.0% 7.5 6.5

7.0% 2.0 #N/A

5.2% 8.0 #N/A

12.7% 11.3 10.0

9.5% 2.4 #N/A

6.9% #N/A #N/A

5.2% 1.9 2.4

12.3% 4.9 #N/A

8.4% 13.7 14.0

9.0% 14.6 10.5

39.1% #N/A #N/A

24.9% 5.5 #N/A

24.4% 5.7 #N/A

18.0% 4.6 #N/A

15.9% 6.2 #N/A

14.2% 7.0 #N/A

12.9% 11.5 #N/A

11.1% 21.2 8.0

10.5% #N/A #N/A

10.5% 7.8 9.1

10.3% 10.2 #N/A

9.6% 11.2 #N/A

9.0% 15.9 #N/A

8.9% 10.6 #N/A

8.5% 5.5 7.6

8.4% 27.7 14.4

8.2% 17.9 15.0

7.9% 21.8 16.7

7.9% #N/A #N/A

7.5% #N/A #N/A

7.1% 68.2 9.7

6.7% #N/A #N/A

6.7% #N/A #N/A

6.6% #N/A 32.2

6.6% 14.4 #N/A

6.6% 4.3 #N/A

6.5% 13.4 4.7

6.4% #N/A #N/A

6.0% #N/A 10.4

5.6% 24.3 #N/A

5.2% 14.8 #N/A

39.7% #N/A #N/A

17.1% #N/A #N/A

13.4% #N/A #N/A

6.8% #N/A #N/A

457.5% #N/A #N/A

5.1% #N/A 13.6

6.3% #N/A #N/A

7.0% #N/A 10.6

7.7% #N/A 6.6

24.9% #N/A #N/A

10.6% #N/A #N/A

5.9% #N/A #N/A

10.1% #N/A #N/A

6.5% #N/A #N/A

10.7% #N/A 8.8

6.2% #N/A #N/A

10.0% #N/A #N/A

7.8% #N/A 11.3

5.6% #N/A 18.1

16.8% #N/A #N/A

10.2% #N/A #N/A

5.5% #N/A 9.6

5.1% #N/A 66.3

5.5% #N/A #N/A

7.4% #N/A 13.3

5.7% #N/A #N/A

6.9% #N/A 6.1

9.8% #N/A #N/A

10.3% #N/A 11.2

9.8% #N/A 5.9

15.6% #N/A 7.5

8.8% #N/A #N/A

35.2% #N/A 5.6

21.4% #N/A #N/A

6.7% #N/A #N/A

11.9% #N/A 8.2

6.5% #N/A #N/A

8.0% #N/A #N/A

12.6% #N/A #N/A

9.6% #N/A 68.5

11.0% #N/A 7.4

10.4% #N/A 9.8

5.9% #N/A #N/A

11.4% #N/A 40.6

13.1% #N/A 23.4

27.0% #N/A #N/A

6.2% #N/A 10.8

7.3% #N/A 12.4

8.0% #N/A #N/A

12.0% #N/A 121.3

12.3% #N/A 11.8

8.7% #N/A 29.6

8.5% #N/A 25.3

8.4% #N/A 25.2

5.4% #N/A #N/A

6.5% #N/A 71.9

16.3% #N/A 267.1

8.0% #N/A #N/A

13.3% 30.3 14.2

6.9% #N/A #N/A

5.3% #N/A 9.6

8.1% #N/A 19.1

13.4% #N/A 7.2

5.5% #N/A 19.4

10.5% #N/A 45.9

8.7% #N/A 22.7

Payout Ratio (TTM) Beta (5Y)

#N/A 0.56

#N/A 1.44

#N/A 0.61

#N/A 0.78

#N/A 0.29

#N/A #N/A

#N/A 0.22

#N/A 0.67

#N/A 0.72

#N/A #N/A

19052% 1.10

15791% 0.73

5209% 1.53

3724% 0.95

3541% 1.89

3383% 0.33

1700% 0.73

1582% 2.05

1398% 1.04

1212% #N/A

1201% 1.10

1050% #N/A

1022% 1.22

938% 0.27

852% 0.50

849% 0.83

832% #N/A

797% 1.63

700% 0.66

696% #N/A

687% #N/A

662% 1.46

607% #N/A

564% 0.95

531% 1.15

523% 0.46

498% 1.76

490% 0.65

476% #N/A

476% 1.84

464% 1.03

458% 0.83

452% 0.39

451% 1.14

449% 1.58

443% 0.47

416% 1.32

397% #N/A

392% 0.70

388% 1.16

381% 1.17

375% 0.87

363% 0.53

359% #N/A

344% 0.75

338% 0.42

335% 0.24

323% 0.37

308% 1.26

308% 0.47

306% 0.94

303% 1.01

298% 1.22

294% 0.59

289% 0.60

286% 0.60

284% 1.32

281% 0.71

276% 1.25

274% 2.32

273% 0.83

268% 0.37

265% 0.78

262% 0.95

254% 0.28

251% 0.48

251% 1.24

250% 1.34

249% 0.07

247% 1.22

247% 0.69

242% 2.17

240% 0.42

239% 0.90

233% 0.21

233% #N/A

230% 0.71

229% 0.29

229% #N/A

221% 0.95

221% 1.80

218% 0.22

217% 0.82

214% 1.25

207% 0.55

203% 0.91

201% 0.93

195% 1.32

194% 1.85

193% 1.34

191% 0.53

191% 1.04

191% 0.56

189% 0.81

189% 1.29

187% 1.17

186% 0.95

182% 0.98

180% 0.44

180% 2.95

179% 1.16

177% 0.93

176% 0.36

173% 0.95

168% 0.34

164% 0.94

162% #N/A

160% 1.06

156% 0.65

156% 1.30

155% 0.85

153% 1.12

150% 0.75

149% 0.92

149% 1.14

149% 0.93

148% 1.26

147% #N/A

145% 0.34

145% 1.37

144% 0.60

142% 1.41

142% 1.00

139% 0.61

138% 0.71

138% 1.41

136% #N/A

135% 1.09

134% 1.20

134% 1.65

132% 0.62

132% 0.57

131% #N/A

131% #N/A

130% 0.34

130% 0.16

129% 1.18

128% 0.77

128% 0.86

127% 0.83

127% 1.05

125% 0.38

124% 0.61

124% 1.12

123% 0.95

123% 0.16

122% 1.96

121% 0.08

120% 0.75

120% 0.43

120% 0.69

120% #N/A

120% 0.89

119% 0.34

119% 0.50

118% 0.93

117% 0.42

117% 0.75

117% 1.13

116% 1.17

116% 0.47

115% 1.28

114% 0.35

114% 0.67

114% 0.52

114% 0.46

113% 0.82

113% 0.92

112% 1.37

111% 0.24

110% 0.94

109% 2.88

108% 0.57

108% 1.30

107% 1.16

107% 0.89

107% 1.16

106% 2.29

106% 1.87

106% 0.38

105% 0.96

105% 0.03

105% 0.18

105% 0.49

105% 0.71

105% 0.79

103% 0.03

102% 0.17

100% 0.46

99% 0.96

99% 0.12

99% 0.63

98% 1.35

98% 0.69

96% 1.55

96% 0.61

96% 0.43

96% 0.48

96% 0.62

96% 0.55

95% 1.19

95% 0.48

94% 0.89

94% 0.62

92% 1.84

92% 0.71

91% 0.72

91% 0.36

91% 1.03

90% 0.46

90% #N/A

90% 41.13

90% 1.11

89% 0.67

88% 0.60

88% 0.37

87% 2.52

87% 0.69

87% 0.45

87% 1.50

87% #N/A

87% 0.97

87% 1.10

87% 1.07

87% 0.55

86% 0.11

85% 1.88

85% #N/A

84% 1.12

84% 1.20

83% 0.66

83% 1.39

83% 0.62

83% 1.31

82% 0.64

82% 0.53

81% -0.05

81% 1.08

80% 1.20

80% 0.46

79% 0.58

79% -1.71

79% 0.76

78% 0.65

78% 0.63

77% 1.06

76% 0.48

76% 0.18

76% 1.04

75% 1.47

74% 1.72

74% 0.80

72% 0.59

72% 0.43

71% 0.95

70% 0.07

70% 0.09

70% 0.54

68% 0.33

68% #N/A

68% #N/A

65% 0.91

65% 0.31

63% 0.77

62% 2.25

62% 0.76

62% 1.06

61% 0.55

61% 0.16

61% #N/A

61% 0.71

60% 1.07

60% 0.57

60% 1.26

60% -0.46

60% 1.15

60% 0.97

59% 0.52

57% 0.19

57% #N/A

56% 1.87

56% 0.22

55% 1.62

53% 1.12

52% 0.26

52% 1.70

52% 2.10

52% 0.61

51% #N/A

50% 1.19

46% 1.38

44% 1.26

44% 1.89

44% 0.67

44% 0.69

41% 0.39

41% 0.32

39% #N/A

38% 0.44

37% 1.81

36% 0.65

34% 1.12

34% 0.04

32% 1.92

31% 0.78

30% 0.93

29% 0.64

24% 0.75

24% 0.17

24% 0.85

23% 2.46

19% 0.64

18% #N/A

18% 1.40

15% 0.74

11% 1.77

7% -0.68

5% 0.55

4% 1.57

1% 1.19

0% #N/A

0% 1.43

0% -0.58

0% 1.00

0% 0.35

0% 1.19

0% -0.72

0% 0.34

0% 1.50

0% -0.01

0% #N/A

0% 0.94

0% -0.17

0% 0.30

0% 0.57

0% #N/A

0% 2.23

0% 1.16

0% 1.04

0% 1.26

0% 1.84

0% -0.09

0% 1.00

0% 0.80

0% #N/A

0% 0.53

0% 1.58

0% 1.10

0% 1.11

0% 0.51

0% -1.95

0% 1.08

-3% 0.03

-3% 0.67

-3% 1.25

-5% -0.03

-6% 1.53

-6% 1.09

-7% 0.94

-8% 1.16

-8% 1.89

-11% 1.09

-12% 1.90

-15% 1.70

-23% 1.10

-23% 0.21

-30% 0.08

-33% 0.55

-35% 2.18

-36% 0.16

-37% 0.92

-39% 0.25

-40% 1.12

-53% 1.57

-55% 0.84

-55% 0.85

-57% #N/A

-58% 1.31

-60% #N/A

-65% 1.80

-66% 0.44

-68% 1.23

-71% 1.24

-72% 2.62

-88% #N/A

-100% 0.04

-106% 1.88

-107% 2.15

-115% 0.98

-116% 1.43

-123% 1.03

-127% 0.61

-133% 2.06

-178% 0.81

-179% #N/A

-247% 0.87

-248% 0.74

-265% 0.99

-289% 0.21

-291% 0.29

-317% 1.22

-323% -15.43

-341% 1.39

-518% 0.47

-558% 1.18

-758% 2.01

-769% 1.16

-1040% 0.20

-1076% #N/A

-1182% 0.66

-1268% 1.55

-1618% 0.99

-2020% 1.35

-2134% #N/A

-2344% 0.56

-3196% 0.54

-15805% 2.16

-18800% 2.02

Вам также может понравиться

- NIU Foundation Endowment Fund As of June 2021Документ1 страницаNIU Foundation Endowment Fund As of June 2021Kierra FrazierОценок пока нет

- 1221212Документ18 страниц1221212Arun DSIОценок пока нет

- Ran K H1B Visa Sponsor Number of LCA Average SalaryДокумент7 страницRan K H1B Visa Sponsor Number of LCA Average SalaryKitty FitzgeraldОценок пока нет

- Supplemental Information (Not Required by EESA 114 (A) ) Home Affordable Modification Program Incentive Payments (As of November 30, 2010)Документ5 страницSupplemental Information (Not Required by EESA 114 (A) ) Home Affordable Modification Program Incentive Payments (As of November 30, 2010)Vernon AustinОценок пока нет

- Madoff's StocksДокумент4 страницыMadoff's StocksDenis100% (1)

- Blue Chip StocksДокумент24 страницыBlue Chip StocksdlОценок пока нет

- Database Functions BeforeДокумент12 страницDatabase Functions BeforeSaddam KhanОценок пока нет

- Crypto Data EntryДокумент98 страницCrypto Data EntryMicky S TilahunОценок пока нет

- April Dividend StocksДокумент84 страницыApril Dividend StockshxcdОценок пока нет

- Quotes NDДокумент12 страницQuotes NDdeni_2013Оценок пока нет

- Compensation Page 2018 PDFДокумент1 страницаCompensation Page 2018 PDFVidit GuptaОценок пока нет

- Potential MKTДокумент67 страницPotential MKTReevesОценок пока нет

- Company Name Stock Total Revenue Market Cap R&D Spend Employee SizeДокумент4 страницыCompany Name Stock Total Revenue Market Cap R&D Spend Employee SizeMujib AlamОценок пока нет

- Binayao Edma Estremos Moreno I. Nature, Forms, KindsДокумент2 страницыBinayao Edma Estremos Moreno I. Nature, Forms, KindsNaiza Mae R. BinayaoОценок пока нет

- 49304752.xls / Sheet1 1Документ3 страницы49304752.xls / Sheet1 1LaSassyMeliОценок пока нет

- Rhidon Mallari Stock Analysis AssignmentДокумент5 страницRhidon Mallari Stock Analysis Assignmentapi-706718394Оценок пока нет

- Metro Schools Budget SurveyДокумент1 страницаMetro Schools Budget SurveyPatch MinnesotaОценок пока нет

- Ford Fact Sheet - Economic FootprintДокумент6 страницFord Fact Sheet - Economic FootprintFord Motor Company100% (30)

- T&D Projection 2019-20R1Документ92 страницыT&D Projection 2019-20R1Saurabh GuptaОценок пока нет

- UPTREND 5 Percent DividendДокумент1 страницаUPTREND 5 Percent DividendalphatrendsОценок пока нет

- Highest Paid Ceos, 2008: Nam E Com Pany Com PensationДокумент1 страницаHighest Paid Ceos, 2008: Nam E Com Pany Com Pensationapi-25932755Оценок пока нет

- TamkfДокумент2 страницыTamkfapi-3754242Оценок пока нет

- Plants For Show Pty LTD: Client Sales January To December 2019Документ6 страницPlants For Show Pty LTD: Client Sales January To December 2019Giang PhamОценок пока нет

- FHA HecmSnapshot Apr2021Документ562 страницыFHA HecmSnapshot Apr2021mark tateОценок пока нет

- Excel Challenge 1Документ80 страницExcel Challenge 1mlmullen83Оценок пока нет

- PH Stocks Financial Data - January 22, 2021Документ3 368 страницPH Stocks Financial Data - January 22, 2021Dave UmeranОценок пока нет

- ASX Companies With Ops in LATAMДокумент2 страницыASX Companies With Ops in LATAMIvan VujicicОценок пока нет

- Fantasy Freako 2019: Is This The Real Life Is This Just FantasyДокумент23 страницыFantasy Freako 2019: Is This The Real Life Is This Just FantasySamuel AsherОценок пока нет

- RealEstate GlobalTop10Документ2 страницыRealEstate GlobalTop10M N ZAKIОценок пока нет

- Venture Capital FirmsДокумент36 страницVenture Capital FirmsGopalakrishna100% (1)

- Arenas 992Документ2 страницыArenas 992Erick A. Velázquez SosaОценок пока нет

- Azipper 0008560Документ270 страницAzipper 0008560Diana VelozaОценок пока нет

- Dividend GrowersДокумент4 страницыDividend GrowersBrunoОценок пока нет

- North Carolina To Get $403.6 Million in Affordable HousingДокумент1 страницаNorth Carolina To Get $403.6 Million in Affordable HousingDillon Davis100% (1)

- Appendix E - DSU Stocks To Be Divested Nov 2014Документ1 страницаAppendix E - DSU Stocks To Be Divested Nov 2014Dalhousie GazetteОценок пока нет

- FP500 Top Calgary Based Companies by Employees 2017 06Документ3 страницыFP500 Top Calgary Based Companies by Employees 2017 06anon_196354931Оценок пока нет

- Gulf OilДокумент10 страницGulf OilVijay SamОценок пока нет

- Ranking Data Records AfterДокумент12 страницRanking Data Records AfterSaddam KhanОценок пока нет

- LDS StocksДокумент41 страницаLDS Stocksrafaelperaza100% (1)

- Appendix 1: List of Potentially Regulated Entities: Fossil Fuel SuppliersДокумент5 страницAppendix 1: List of Potentially Regulated Entities: Fossil Fuel SuppliersPortland Business JournalОценок пока нет

- Acorns Securities, LLC - Member FINRA/SIPC: Trade ConfirmationДокумент1 страницаAcorns Securities, LLC - Member FINRA/SIPC: Trade ConfirmationJuan ColoradoОценок пока нет

- Production: For the three months ending 31 December, 2007 ARBN 087 423 998 Stock Code: (ASX: ATM; IDX: ANTM)Документ14 страницProduction: For the three months ending 31 December, 2007 ARBN 087 423 998 Stock Code: (ASX: ATM; IDX: ANTM)Devandro MahendraОценок пока нет

- Hurricane Ian SummaryДокумент4 страницыHurricane Ian SummaryderesensОценок пока нет

- PFMPLДокумент3 страницыPFMPLRohit_1987Оценок пока нет

- Mid YearSurveyofLargeCMBSServicersДокумент6 страницMid YearSurveyofLargeCMBSServicersj_mason2010Оценок пока нет

- Hotel Convention Center Construction Bids Variance1Документ3 страницыHotel Convention Center Construction Bids Variance1LancasterFirstОценок пока нет

- Calpers Annual Investment Report - Fees 2004-2008Документ8 страницCalpers Annual Investment Report - Fees 2004-2008SpotUsОценок пока нет

- CB Insights - Tech IPO Pipeline 2024Документ72 страницыCB Insights - Tech IPO Pipeline 2024Razvan CosmaОценок пока нет

- Lista Dos 66 Dividend Aristocrats No Índice S&P 500Документ2 страницыLista Dos 66 Dividend Aristocrats No Índice S&P 500Antonio TavaresОценок пока нет

- Template HpeДокумент2 страницыTemplate HpeOscar Zamora GuardiaОценок пока нет

- Learntron May-18 Learntron Dec-16 Varthana Oct-16 Varthana Mar-16 Wiziq Nov-16Документ3 страницыLearntron May-18 Learntron Dec-16 Varthana Oct-16 Varthana Mar-16 Wiziq Nov-16Nikhil KurmalaОценок пока нет

- Canadian Dividend All Star List July 31 2020Документ228 страницCanadian Dividend All Star List July 31 2020Na NaОценок пока нет

- VertexДокумент75 страницVertexDev DesaiОценок пока нет

- Financing For Top 20 Upstream OG Expansion Companies BOCC 2023Документ6 страницFinancing For Top 20 Upstream OG Expansion Companies BOCC 2023Valen CookОценок пока нет

- SR5 TOOL Equipment, Communication & Deck Related, CompiledДокумент5 страницSR5 TOOL Equipment, Communication & Deck Related, CompiledBeki LokaОценок пока нет

- Visual Inspection: Question 1. We Can See From The Graph Below That The Number of Hedge Funds On The Data IncreasesДокумент2 страницыVisual Inspection: Question 1. We Can See From The Graph Below That The Number of Hedge Funds On The Data IncreasesCharles LeeОценок пока нет

- MDA Tourism Rebate ProgramДокумент1 страницаMDA Tourism Rebate ProgramSteve WilsonОценок пока нет

- China Global Investment Tracker1Документ252 страницыChina Global Investment Tracker1indiabhagat101Оценок пока нет

- Calculating Monthly Totals BeforeДокумент12 страницCalculating Monthly Totals BeforeSaddam KhanОценок пока нет

- Engaging With The Danish Young GenerationДокумент26 страницEngaging With The Danish Young GenerationQuang Minh NguyenОценок пока нет

- Ferrer 0000 12312022Документ1 страницаFerrer 0000 12312022Vincent FerrerОценок пока нет

- Pengaruh Corporate Governance Terhadap Manajemen Laba Di Industri Perbankan IndonesiaДокумент26 страницPengaruh Corporate Governance Terhadap Manajemen Laba Di Industri Perbankan IndonesiaryaalwiОценок пока нет

- How Operational Excellence and Continuous Improvement Have Helped Shape Shell Chemicals StrategyДокумент8 страницHow Operational Excellence and Continuous Improvement Have Helped Shape Shell Chemicals StrategychrysobergiОценок пока нет

- MBA 502 Supply Chain Management Lesson 2Документ44 страницыMBA 502 Supply Chain Management Lesson 2smsishaОценок пока нет

- Chapter 5 Bonds and Stock ValuationДокумент16 страницChapter 5 Bonds and Stock ValuationEstores Ronie M.Оценок пока нет

- HLA Venture Income Fund May 22Документ3 страницыHLA Venture Income Fund May 22ivyОценок пока нет

- Fajardo IntmgtAcctg3Exer3Документ6 страницFajardo IntmgtAcctg3Exer3Adrasteia ZachryОценок пока нет

- Wiley Cmaexcel Learning System Exam Review 2015: Part 1: Financial Reporting, Planning, Performance, and ControlДокумент31 страницаWiley Cmaexcel Learning System Exam Review 2015: Part 1: Financial Reporting, Planning, Performance, and Controlvipul_khemkaОценок пока нет

- Screenshot 2023-06-16 at 10.17.17 AMДокумент12 страницScreenshot 2023-06-16 at 10.17.17 AMPatel KevalОценок пока нет

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Документ6 страницGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Javier Noel ClaudioОценок пока нет

- Soil Compactor 1Документ2 страницыSoil Compactor 1JD SОценок пока нет

- Global Ad Spends Forbes 2023Документ1 страницаGlobal Ad Spends Forbes 2023Sanjay BhoirОценок пока нет

- 02 - PFM - Chapter 1 - Introduction To Personal Financial ManagementДокумент9 страниц02 - PFM - Chapter 1 - Introduction To Personal Financial ManagementLee K.Оценок пока нет

- Chapter 2 Accounting 300 Exam ReviewДокумент2 страницыChapter 2 Accounting 300 Exam Reviewagm25Оценок пока нет

- Thesis On Financial RiskДокумент7 страницThesis On Financial Riskheatheredwardsmobile100% (2)

- New Woreda 13 No Woreda-143 Yeka Addis Ababa EthiopiaДокумент1 страницаNew Woreda 13 No Woreda-143 Yeka Addis Ababa EthiopiaKalkidan NigussieОценок пока нет

- BFBV Course OutlineДокумент7 страницBFBV Course OutlinePuneet Garg100% (1)

- Chapter 16Документ25 страницChapter 16Wedaje AlemayehuОценок пока нет

- Assignment 1 - Accounting StandardsДокумент4 страницыAssignment 1 - Accounting StandardsJason wibisonoОценок пока нет

- English For Logistics VocabularyДокумент2 страницыEnglish For Logistics VocabularyOla WodaОценок пока нет

- Elegant & Luxury Project Proposal XL by SlidesgoДокумент87 страницElegant & Luxury Project Proposal XL by SlidesgoH ramadanОценок пока нет

- VE IT Tests Unit05Документ2 страницыVE IT Tests Unit05Đặng Phi LongОценок пока нет

- Mock Test of Jaiib Principles & Practices of Banking.: AnswerДокумент12 страницMock Test of Jaiib Principles & Practices of Banking.: Answeraao wacОценок пока нет

- 2019 DecemberДокумент14 страниц2019 DecemberHsaung HaymarnОценок пока нет

- ECO 561 INTERNATIONAL MICROECONOMIC (Group Assignment Rafie, Redzuan & Helmie)Документ8 страницECO 561 INTERNATIONAL MICROECONOMIC (Group Assignment Rafie, Redzuan & Helmie)MOHD REDZUAN BIN A KARIM (MOH-NEGERISEMBILAN)Оценок пока нет

- 20568235407Документ3 страницы20568235407Meghan kotakОценок пока нет

- Scope of Total Income U/S. 5: Presented To:-Prof. SeemaДокумент17 страницScope of Total Income U/S. 5: Presented To:-Prof. SeemaRaksha ShettyОценок пока нет

- SLM Module in Fabm2 Q1Документ53 страницыSLM Module in Fabm2 Q1Fredgy R BanicoОценок пока нет

- Minn NC DeyДокумент13 страницMinn NC Deyjob infoОценок пока нет