Академический Документы

Профессиональный Документы

Культура Документы

Betterment: General Investing Goal

Загружено:

Cecilia ChowОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Betterment: General Investing Goal

Загружено:

Cecilia ChowАвторское право:

Доступные форматы

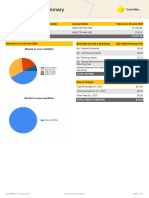

Betterment

Transaction Confirmation

Betterment Securities, Broker-Dealer Cecilia Chow

61 West 23rd Street, 4th Floor ceciliachw@gmail.com

New York, NY 10010 111 east ave

646.600.8263 rochester, NY 14605

General Investing Goal

Dividend Payment Detail

Payment Date Fund Description Amount

Mar 28 2019 VWO Vanguard FTSE Emerging Markets $0.01

Mar 28 2019 VTI Vanguard Total Stock Market ETF $0.09

Total $0.10

Dividend Reinvestment Detail

Change Balance

Transaction 1 Date 2 Fund Price Shares Value Shares Value

Dividend Reinvestment Apr 2 2019 VEA $41.25 0.002 $0.10 0.255 $10.53

1Betterment Securities acted as an agent for you and bought or sold securities on your behalf.

2Unless otherwise noted, the settlement date is two market days after the transaction date. For Mutual Funds, denoted by an underlined fund symbol, the

settlement date is one market day after the transaction date.

Note: If this transaction included a sale of non-covered securities (purchased outside of Betterment and transferred into your account with incomplete lot

information), the purchase date with respect to those lots may be an estimate.

Please review this document carefully. If details of any transaction are incorrect, you must immediately notify Betterment Securities at

support@bettermentsecurities.com. Failure to make such notification within three (3) days of notification of this document constitutes your acceptance of the

transactions.

Please take the opportunity to review the settings and restrictions, if any, on your account. This could include your portfolio allocation settings or your tax loss

harvesting settings (which you may want to review if you expect to be subject to a substantially lower tax rate) among others. Please contact

support@betterment.com, your investment adviser, if you wish to impose any reasonable restrictions on the management of your account or reasonably modify

existing restrictions.

Please contact support@betterment.com, your investment adviser, if you would like to speak with someone knowledgeable about the account.

CUSTODY OF ASSETS: Betterment Securities is the custodian of assets in your Betterment Securities account.

MARKETS: Securities are often traded on multiple markets and we will exercise discretion as to the market or markets in which your order is executed.

AGGREGATION: Your orders with Betterment Securities may be aggregated with the orders of other clients for purposes of execution. If orders are aggregated,

each client receives the average price of the aggregate group order.

TRANSACTION TYPES: A "Deposit" is a purchase of securities made on account of an order that was generated by new money being transferred into your

account. A "Withdrawal" is a sale of securities made on account of an order that was generated by a new withdrawal from your account. "Dividend" is a purchase

of securities made according to an order resulting from dividends that accrue to your account. "Allocation" is a purchase or sale of securities made on account of a

change to your account Allocation. "Rebalance" is a purchase or sale of securities made according to an order that was generated by the rebalancing of your

account assets. "Advisory Fee" is a sale of securities liquidated to fund the payment of advisory fees to Betterment. If you are on the Betterment Institutional

platform and have a separate investment advisor, the "Advisory Fee" is a sale of securities liquidated to fund the payment of advisory fees to Betterment and that

investment advisor. "Portfolio Update" is a purchase or sale of securities made on account of a change to your portfolio. "Position Transfer" is a transfer of

securities from one goal to another, either within your account or between different accounts. Note that position transfers may also refer to assets transferred into

or out of Betterment from / to external providers.

REPRESENTATIONS: Descriptive words in the title of any security are used for identification purposes only and do not constitute representations.

EXECUTION: The time of execution, the name of the buyer or seller, and the commission charged to the other party if we acted as a dual agent, are available

upon written request.

FRACTIONAL SHARES: Your account holds fractional share interests in securities. Please note that fractional share amounts are typically unrecognized and

illiquid outside the Betterment platform and fractional shares might not be marketable outside the Betterment platform or transferrable to another brokerage

account.

REGULATIONS: These transactions are subject to the rules, regulations, and customs of the exchange or market on which they are made and to any and all

applicable federal, state and/or foreign statutes or regulations.

GOVERNING LAW: The terms and conditions of this confirmation shall be governed by and construed in accordance with the laws of the state of Delaware,

without giving effect to the conflict of law provision thereof.

IRA CUSTODIAN: Sunwest Trust, Inc., P.O. Box 36371, Albuquerque, NM 87176., is the custodian of IRA accounts.

The products available through Betterment are investment products and as such: (i) are not insured by the Federal Deposit Insurance Corporation ("FDIC"); (ii)

carry no bank or government guarantees, and are not a deposit or other obligation of, or guaranteed by, a bank; and (iii) have associated risks. Client understands

that investments in securities are subject to investment risks, including possible loss of the principal amount invested. Your uninvested cash balances are subject

to the terms in the Cash Activity section of your statement.

If you believe there is an inaccuracy or discrepancy between this statement and your account, you should immediately send written notification to Betterment

Securities Customer Experience at support@bettermentsecurities.com and retain a copy for your records. If you have any oral communications with Betterment

Securities or its affiliates regarding inaccuracies or discrepancies, such communications should be re-confirmed in writing.

Complaints about your Betterment Securities brokerage account may be directed to Betterment Securities at support@bettermentsecurities.com, via phone by

calling 212-228-1328, or by mail at 61 West 23rd Street, 4th Floor, New York, NY 10010.

Copies of statements and confirmations are available securely at bettermentsecurities.com.

Page 1 of 1

Вам также может понравиться

- Property Securitization Memorandum: Consumer Defense ProgramsДокумент31 страницаProperty Securitization Memorandum: Consumer Defense ProgramsFrederick DeMarques Thomas100% (2)

- Securitization and Foreclosure by Robert RamersДокумент8 страницSecuritization and Foreclosure by Robert RamersBob Ramers100% (2)

- Your Portfolio Value:: Contact InformationДокумент31 страницаYour Portfolio Value:: Contact Informationdown load nigrОценок пока нет

- Lin PrimerДокумент14 страницLin PrimerPhil KaneОценок пока нет

- $CASHOUTДокумент22 страницы$CASHOUTEnz DavieОценок пока нет

- Study Unit 20Документ13 страницStudy Unit 20Hazem El SayedОценок пока нет

- Options Strategies ExcelДокумент16 страницOptions Strategies ExcelIshan MishraОценок пока нет

- Wire Reciept For DaveДокумент9 страницWire Reciept For DaveNicoleОценок пока нет

- Captial Bank PDFДокумент6 страницCaptial Bank PDFayaОценок пока нет

- Final Exam Review QuestionsДокумент18 страницFinal Exam Review QuestionsArchiePatelОценок пока нет

- Document PDFДокумент4 страницыDocument PDFSusan LumОценок пока нет

- MCQ in Engineering EconomicsДокумент355 страницMCQ in Engineering EconomicsKen Joshua ManaloОценок пока нет

- Since All The Data Needed To Construct An Income Statement Are AvailableДокумент3 страницыSince All The Data Needed To Construct An Income Statement Are AvailableShay MortonОценок пока нет

- SAP Foreign Currency Valuation ProcessДокумент15 страницSAP Foreign Currency Valuation ProcessSrinivas MsrОценок пока нет

- Tradingview ScriptsДокумент3 страницыTradingview ScriptsAlex LeongОценок пока нет

- Credit InstrumentsДокумент67 страницCredit InstrumentsAnne Gatchalian100% (2)

- (John Tuld) : Professional ExperienceДокумент2 страницы(John Tuld) : Professional Experienceدولت ابد مدت Devlet-i Aliyye-i OsmâniyyeОценок пока нет

- Equity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Документ5 страницEquity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Test000001Оценок пока нет

- BCG Report - Grwoth Thru AcquisitionsДокумент28 страницBCG Report - Grwoth Thru AcquisitionschengadОценок пока нет

- PPM Private Equity Fund SampleДокумент18 страницPPM Private Equity Fund Samplenzcruiser100% (1)

- Valuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCДокумент12 страницValuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCCecil PearsonОценок пока нет

- Dividend Investing: The Ultimate Guide to Create Passive Income Using Stocks. Make Money Online, Gain Financial Freedom and Retire Early Earning Double-Digit ReturnsОт EverandDividend Investing: The Ultimate Guide to Create Passive Income Using Stocks. Make Money Online, Gain Financial Freedom and Retire Early Earning Double-Digit ReturnsОценок пока нет

- Maurece Schiller - StubsДокумент15 страницMaurece Schiller - StubsMihir ShahОценок пока нет

- Chapter 2 Branches of Accounting and Users of Accounting InformationДокумент14 страницChapter 2 Branches of Accounting and Users of Accounting InformationAngellouiza MatampacОценок пока нет

- Financial Management 16th Edition Chapter 7Документ32 страницыFinancial Management 16th Edition Chapter 7drcoolzОценок пока нет

- Quizzer 16 FinalДокумент14 страницQuizzer 16 FinalCamelle ArellanoОценок пока нет

- EConfirm Q5A-243J-B Jun 2021Документ2 страницыEConfirm Q5A-243J-B Jun 2021Cliff McAuleyОценок пока нет

- Intacc Ass 1Документ5 страницIntacc Ass 1Pixie CanaveralОценок пока нет

- B - Understanding Bank FS Part 2Документ31 страницаB - Understanding Bank FS Part 2PROMIT CHAKRABORTYОценок пока нет

- Reviewer - IntaccДокумент36 страницReviewer - IntaccPixie CanaveralОценок пока нет

- Unit 3 AДокумент19 страницUnit 3 Akanwal preetОценок пока нет

- Sprott Money Ltd. DAF and Referral DisclosureДокумент4 страницыSprott Money Ltd. DAF and Referral DisclosureSoodooNavindraОценок пока нет

- Global Investment Centre - Statement - DocumentДокумент11 страницGlobal Investment Centre - Statement - DocumentjohnОценок пока нет

- Safari - Jul 12, 2019 at 2:32 PM PDFДокумент1 страницаSafari - Jul 12, 2019 at 2:32 PM PDFNick SitarasОценок пока нет

- Us Ishares Template Ishares Gold Trust Biau39Документ2 страницыUs Ishares Template Ishares Gold Trust Biau39Caroline CostaОценок пока нет

- You Invest Trade - Commission Schedule: Online Representative-Assisted U.S. Listed Stocks & Exchange-Traded FundsДокумент2 страницыYou Invest Trade - Commission Schedule: Online Representative-Assisted U.S. Listed Stocks & Exchange-Traded FundsBrian JonesОценок пока нет

- Securitizacion Primer (Scotia Capital)Документ14 страницSecuritizacion Primer (Scotia Capital)gastonriosОценок пока нет

- General Information: Indicative Terms & ConditionsДокумент8 страницGeneral Information: Indicative Terms & ConditionsRudy RodriguezОценок пока нет

- Tax Financial Statement LagosДокумент2 страницыTax Financial Statement Lagosagboolamichael4realОценок пока нет

- 2022EOFYSummaryДокумент3 страницы2022EOFYSummaryHanny KeeОценок пока нет

- CohenSteers Senior Variable Rate 2020-1 FCДокумент2 страницыCohenSteers Senior Variable Rate 2020-1 FCA RОценок пока нет

- Distribution For Q3 2020 Announced by Caldwell U.S. Dividend Advantage FundДокумент2 страницыDistribution For Q3 2020 Announced by Caldwell U.S. Dividend Advantage FundCaldwell Investment Management LtdОценок пока нет

- Robinhood S-1Документ396 страницRobinhood S-1Zerohedge Janitor100% (1)

- CohenSteers Senior Variable 2019-3 FCДокумент2 страницыCohenSteers Senior Variable 2019-3 FCA RОценок пока нет

- 2017CFIT - Offering Memorandum (FINAL)Документ99 страниц2017CFIT - Offering Memorandum (FINAL)Annie ZhangОценок пока нет

- 2020EOFYTransactionsДокумент3 страницы2020EOFYTransactionsManthan VekariyaОценок пока нет

- Disclosure Statement Pursuant To The Pink Basic Disclosure GuidelinesДокумент24 страницыDisclosure Statement Pursuant To The Pink Basic Disclosure GuidelinesRenato GoncalvesОценок пока нет

- Contribution Remittance FormДокумент1 страницаContribution Remittance FormAsfand Yar BajwaОценок пока нет

- 2019EOFYSummaryДокумент3 страницы2019EOFYSummarysidney drecotteОценок пока нет

- WP Tas Cash Free Debt-Free TransactionsДокумент9 страницWP Tas Cash Free Debt-Free Transactionsbat0oОценок пока нет

- Your June Statement: A Snapshot of Your Super AccountДокумент12 страницYour June Statement: A Snapshot of Your Super AccountjennijnewlingОценок пока нет

- Pbcregd 02012011Документ28 страницPbcregd 02012011Mark Anthony GrishajОценок пока нет

- ATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Документ5 страницATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Glenda ReyesОценок пока нет

- SoFiMoneyStatement - 2023 12 31Документ5 страницSoFiMoneyStatement - 2023 12 31minhdang03062017Оценок пока нет

- Deposit Slip Template 26Документ2 страницыDeposit Slip Template 26MassiОценок пока нет

- Wassim Zhani Income Taxation of Corporations (Chapter 3)Документ20 страницWassim Zhani Income Taxation of Corporations (Chapter 3)wassim zhaniОценок пока нет

- Capital ManagementДокумент32 страницыCapital ManagementAngel TumamaoОценок пока нет

- CH 17 InvestmentsДокумент18 страницCH 17 InvestmentsAbdi hasenОценок пока нет

- Order Execution Only Account Transaction Confirmation Trade Date: 2022-05-03Документ2 страницыOrder Execution Only Account Transaction Confirmation Trade Date: 2022-05-03shubhashish sharmaОценок пока нет

- DriveWealth LLC - 2020 Short Form Public Audit ReportДокумент10 страницDriveWealth LLC - 2020 Short Form Public Audit ReportMihai FoxОценок пока нет

- Sanfilippo.2022 RPTДокумент8 страницSanfilippo.2022 RPTThomas JonesОценок пока нет

- Evolve en Finalprosp BitsДокумент69 страницEvolve en Finalprosp BitsForkLogОценок пока нет

- Claim: HealthДокумент2 страницыClaim: Healthheidigirard1985Оценок пока нет

- Prospectus 07 10 2019 Wahed Definitive Prospectus FINAL PublicДокумент15 страницProspectus 07 10 2019 Wahed Definitive Prospectus FINAL PublicNajmi IshakОценок пока нет

- To Client - Trust Funding InstructionsДокумент6 страницTo Client - Trust Funding InstructionsdaristovОценок пока нет

- Week 3 Workshop SolutionsДокумент10 страницWeek 3 Workshop SolutionsAssessment Help SolutionsОценок пока нет

- BSEДокумент43 страницыBSEShashank VarmaОценок пока нет

- Accounting For Investment SecuritiesДокумент9 страницAccounting For Investment Securitiesxpac_53Оценок пока нет

- Metra Schedule PDFДокумент2 страницыMetra Schedule PDFCecilia ChowОценок пока нет

- Rings Debussy 2008 PDFДокумент32 страницыRings Debussy 2008 PDFCecilia Chow100% (1)

- Audition Repertoire PDFДокумент1 страницаAudition Repertoire PDFCecilia ChowОценок пока нет

- DMA Program Qualifying Examination ReportДокумент1 страницаDMA Program Qualifying Examination ReportCecilia ChowОценок пока нет

- Group X Spring ScheduleДокумент2 страницыGroup X Spring ScheduleCecilia ChowОценок пока нет

- Mystères Limpides:: Time and Transformation in Debussy's Des Pas Sur La NeigeДокумент31 страницаMystères Limpides:: Time and Transformation in Debussy's Des Pas Sur La NeigeCecilia ChowОценок пока нет

- Taubman TechniqueДокумент3 страницыTaubman TechniqueCecilia Chow100% (1)

- CPT ApplicationДокумент1 страницаCPT ApplicationCecilia ChowОценок пока нет

- Contract PDFДокумент4 страницыContract PDFCecilia ChowОценок пока нет

- The Private Music LEssonДокумент4 страницыThe Private Music LEssonCecilia ChowОценок пока нет

- Keyboard Skills Observation FormДокумент1 страницаKeyboard Skills Observation FormCecilia ChowОценок пока нет

- Strt-460-Winter2019 Levy Final 19Документ10 страницStrt-460-Winter2019 Levy Final 19Cecilia ChowОценок пока нет

- Symphonic Band: Nformation For Riday ArchДокумент1 страницаSymphonic Band: Nformation For Riday ArchCecilia ChowОценок пока нет

- Lined Portrait Letter CollegeДокумент1 страницаLined Portrait Letter CollegeCecilia ChowОценок пока нет

- Huawei Enters The United StatesДокумент9 страницHuawei Enters The United StatesCecilia ChowОценок пока нет

- Group ClassesДокумент5 страницGroup ClassesCecilia ChowОценок пока нет

- Private Lesson GuidelinesДокумент1 страницаPrivate Lesson GuidelinesCecilia ChowОценок пока нет

- (7 Lenovo Entering Global Competition)Документ27 страниц(7 Lenovo Entering Global Competition)Cecilia Chow100% (1)

- Renault Nissan The Challenge of Sustaining ChangeДокумент12 страницRenault Nissan The Challenge of Sustaining ChangeCecilia ChowОценок пока нет

- WTO and OECD (2012) Trade in Value-Added Concepts, Methodologies and ChallengesДокумент28 страницWTO and OECD (2012) Trade in Value-Added Concepts, Methodologies and ChallengesCecilia ChowОценок пока нет

- Embraer in ChinaДокумент21 страницаEmbraer in ChinaCecilia ChowОценок пока нет

- Yang Dissertation 2014 PDFДокумент50 страницYang Dissertation 2014 PDFCecilia ChowОценок пока нет

- Desai, Mihir (2009) The Decentering of The Global FirmДокумент20 страницDesai, Mihir (2009) The Decentering of The Global FirmCecilia ChowОценок пока нет

- Evaluation of Student TeachingДокумент2 страницыEvaluation of Student TeachingCecilia ChowОценок пока нет

- Nutrition Guide: Limited Time Only & Featured OfferingsДокумент13 страницNutrition Guide: Limited Time Only & Featured OfferingsCecilia ChowОценок пока нет

- Correct The Citations 2018Документ2 страницыCorrect The Citations 2018Cecilia ChowОценок пока нет

- Personal Data Form: Please Type or Print LegiblyДокумент1 страницаPersonal Data Form: Please Type or Print LegiblyCecilia ChowОценок пока нет

- Sep 25, 2018, 12:28Документ4 страницыSep 25, 2018, 12:28Cecilia ChowОценок пока нет

- Development Intern (3 Positions) : Chamber Music Festival and Institute - David Finckel Wu Han, Artistic DirectorsДокумент2 страницыDevelopment Intern (3 Positions) : Chamber Music Festival and Institute - David Finckel Wu Han, Artistic DirectorsCecilia ChowОценок пока нет

- Plan de Financement Et Montage Du CréditДокумент8 страницPlan de Financement Et Montage Du CréditNhật Minh Nguyễn ĐặngОценок пока нет

- Accounting Application by Computer (TallyPrime) - BAAC 2205 - HandoutДокумент77 страницAccounting Application by Computer (TallyPrime) - BAAC 2205 - HandoutWijdan Saleem EdwanОценок пока нет

- Cash Flows at Warf Computers - Group 5 v.28.09Документ8 страницCash Flows at Warf Computers - Group 5 v.28.09Zero MustafОценок пока нет

- Accountinf 101675824567Документ3 страницыAccountinf 101675824567elsana philipОценок пока нет

- CCCCCCC CCCCCCCCC C CCCCCC CCCCCCCCCCCCCCCCCCCCCCCCCCC: CCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCДокумент30 страницCCCCCCC CCCCCCCCC C CCCCCC CCCCCCCCCCCCCCCCCCCCCCCCCCC: CCCCCCCCCCCCCCCCCCCCCCCCCCCCCCCRajat SharmaОценок пока нет

- Ifrs Versus GaapДокумент25 страницIfrs Versus GaapNigist Woldeselassie100% (1)

- Assignment1 SolutionДокумент6 страницAssignment1 SolutionAnonymous dpWU6H5Lx2Оценок пока нет

- Weekly Financial Market Review - Week Ending 04-06-2021Документ2 страницыWeekly Financial Market Review - Week Ending 04-06-2021Fuaad DodooОценок пока нет

- Adani Ports and Sez Economic Zone Companyname: Strong Quarter Encouraging GuidanceДокумент13 страницAdani Ports and Sez Economic Zone Companyname: Strong Quarter Encouraging GuidanceAmey TiwariОценок пока нет

- Principles of Finance - 1Документ82 страницыPrinciples of Finance - 1FTU-ERОценок пока нет

- The Chapel 2019 - 2020 Audited Financial StatementДокумент21 страницаThe Chapel 2019 - 2020 Audited Financial StatementTodd WilhelmОценок пока нет

- SAPM 1st Internal Assessment Test QPДокумент2 страницыSAPM 1st Internal Assessment Test QPVasantha NaikОценок пока нет

- P2-T6-Credit-Risk-Quiz-709-715 - v5.3 - Interactive QuizДокумент25 страницP2-T6-Credit-Risk-Quiz-709-715 - v5.3 - Interactive QuizsdivyamitОценок пока нет

- MBA-03-2015 - Su Wei Hnin Aung, Aye Phyu Phyu, Htet Aung Shine, Myat Myo Swe, Kyi Lai Han, Myat Wut Yee - (Strategic Marketing Management)Документ32 страницыMBA-03-2015 - Su Wei Hnin Aung, Aye Phyu Phyu, Htet Aung Shine, Myat Myo Swe, Kyi Lai Han, Myat Wut Yee - (Strategic Marketing Management)suwaihninnaung.sbsОценок пока нет

- Investment Management Module 1Документ21 страницаInvestment Management Module 1rijochacko87Оценок пока нет

- Sem VI Financial Accounting MCQДокумент7 страницSem VI Financial Accounting MCQSneha GopalОценок пока нет

- Financial Marketing Group 4Документ31 страницаFinancial Marketing Group 4Emijiano RonquilloОценок пока нет

- Qii2007 AbcpДокумент64 страницыQii2007 Abcpkarasa1Оценок пока нет

- Suresh Rathi Mana Ram JangidДокумент56 страницSuresh Rathi Mana Ram Jangidmanajangid786Оценок пока нет

- Summary, Findings and ConclusionДокумент10 страницSummary, Findings and ConclusionmgajenОценок пока нет

- FS Ultj Q3 2018Документ94 страницыFS Ultj Q3 2018DianasyОценок пока нет