Академический Документы

Профессиональный Документы

Культура Документы

Bill of Entry (Electronic Integrated Declaration) Regulations, 2011

Загружено:

Latest Laws TeamАвторское право

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Bill of Entry (Electronic Integrated Declaration) Regulations, 2011

Загружено:

Latest Laws TeamАвторское право:

LatestLaws.

com

Bill of Entry (Electronic Integrated Declaration) Regulations, 2011

Notification No. 79/2011 Cus (N.T.), Dated 25.11.2011 amended by Notification No. 45/2016 - Customs (N.T.) Dated 01.04.2016

In exercise of the powers conferred by section 157 read with section 46 of the Customs Act, 1962 (52 of 1962)

and in supersession of the Bill of Entry (Electronic Integrated Declaration) Regulations,1995, except as respects

things done or omitted to be done before such supersession, the Central Board of Excise and Customs hereby

makes the following regulations, namely:-

1. Short title, extent and commencement. -

(1) These regulations may be called the Bill of Entry (Electronic Integrated Declaration) Regulations, 2011.

(2) They shall apply to the import of goods through all customs stations where the Indian Customs Electronic

Data Interchange System is in operation.

(3) They shall come into force on the date of their publication in the Official Gazette.

2.Definitions.-

In these regulations, unless the context otherwise requires, -

(a) "authorised person" means an importer or a person authorised by him who has a valid licence under the

Customs Brokers Licensing Regulations, 2013;

(b) "annexure" means annexure to these regulations;(OMITTED)

(c) "bill of entry" means electronic integrated declaration accepted and assigned a unique number by the Indian

Customs Electronic Data Interchange System, and includes its electronic records or print-outs;

Explanation.- For the purposes of this clause, the electronic record shall have the meaning assigned to it in the

Information Technology Act, 2000 (21 of 2000);

(d) "electronic integrated declaration" means particulars relating to the imported goods that are entered in the

Indian Customs Electronic Data Interchange System;

(e) "ICEGATE" means Indian Customs Electronic Data Interchange Gateway, an e-commerce portal of the

Central Board of Excise and Customs;

(f) "service centre" means the place specified by the Commissioner of Customs where the data entry of an

electronic integrated declaration, is carried out;

(g) words and expressions used and not defined herein but defined in the Customs Act, 1962 (52 of 1962) shall

have the same meaning as assigned to them in the said Act.

3. The authorised person may enter the electronic Integrated declaration in the Indian Customs Electronic Data

Interchange System by himself through ICEGATE or by way of data entry through the service centre by

furnishing the particulars in the electronic form provided at the websitehttps://www.icegate.gov.in

4. The bill of entry shall be deemed to have been filed and self-assessment of duty completed when, after entry

of the electronic integrated declaration in the Indian Customs Electronic Data Interchange System either through

ICEGATE or by way of data entry through the service centre, a bill of entry number is generated by the Indian

Customs Electronic Data Interchange System for the said declaration.

5. After the completion of assessment, the authorised person shall present the original bill of entry (customs

copy) and duty-paid challan and supporting import documents to the proper officer of customs for making an

order permitting clearance, after examination of the imported goods if so required.

6. After making an order under regulation 5, the proper officer shall generate duplicate bill of entry (importer's

copy) and the triplicate bill of entry (exchange control copy).

7. The original bill of entry (customs copy) along with supporting import documents shall be retained by the

proper officer of customs and after suitable endorsements the duplicate bill of entry (importer's copy) and the

triplicate bills of entry (exchange control copy) shall be handed over to the authorized person.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Australian/New Zealand StandardДокумент10 страницAustralian/New Zealand StandardMatt Fizz0% (2)

- 1Документ4 страницы1Latest Laws TeamОценок пока нет

- PDF Upload 369036Документ6 страницPDF Upload 369036Latest Laws Team100% (1)

- Pmla-Appl 1 2019 06 03 2020 Final OrderДокумент38 страницPmla-Appl 1 2019 06 03 2020 Final OrderLatest Laws Team100% (2)

- Abail (A) 1094 2020Документ36 страницAbail (A) 1094 2020Latest Laws TeamОценок пока нет

- 1476 2020 9 1502 21186 Judgement 28-Feb-2020Документ27 страниц1476 2020 9 1502 21186 Judgement 28-Feb-2020Latest Laws TeamОценок пока нет

- 2013 3 1502 21150 Judgement 05-Mar-2020Документ68 страниц2013 3 1502 21150 Judgement 05-Mar-2020Latest Laws TeamОценок пока нет

- Rahul ChaudharyДокумент3 страницыRahul ChaudharyLatest Laws TeamОценок пока нет

- Kun Motor CompanyДокумент12 страницKun Motor CompanyLatest Laws TeamОценок пока нет

- OrdjudДокумент18 страницOrdjudLatest Laws TeamОценок пока нет

- Vishal EngineeringДокумент3 страницыVishal EngineeringLatest Laws TeamОценок пока нет

- OrdjudДокумент22 страницыOrdjudLatest Laws TeamОценок пока нет

- Pinaki Panani Bogus PurchasesДокумент6 страницPinaki Panani Bogus PurchasesLatest Laws TeamОценок пока нет

- Gujarat High CourtДокумент13 страницGujarat High CourtLatest Laws Team0% (1)

- Fao-M 10 2020 27 01 2020 Final OrderДокумент4 страницыFao-M 10 2020 27 01 2020 Final OrderLatest Laws TeamОценок пока нет

- DownloadedДокумент12 страницDownloadedLatest Laws Team100% (1)

- Display PDFДокумент10 страницDisplay PDFLatest Laws TeamОценок пока нет

- Punjab Govt. Action Plan For Protection of Property of Parents SR CtznsДокумент4 страницыPunjab Govt. Action Plan For Protection of Property of Parents SR CtznsLatest Laws TeamОценок пока нет

- OrdjudДокумент7 страницOrdjudLatest Laws TeamОценок пока нет

- Introduction To Partnership Accounting Partnership DefinedДокумент33 страницыIntroduction To Partnership Accounting Partnership DefinedMarcus MonocayОценок пока нет

- Specialized Crime Investigation 1 With Legal Medicine: Bataan Heroes CollegeДокумент10 страницSpecialized Crime Investigation 1 With Legal Medicine: Bataan Heroes CollegePatricia Mae HerreraОценок пока нет

- Philippine Drug Enforcement Agency: Regional Office VIIIДокумент2 страницыPhilippine Drug Enforcement Agency: Regional Office VIIIBerga Hi TaaОценок пока нет

- Judy Dench Case - Sindikat 2Документ3 страницыJudy Dench Case - Sindikat 2Bangtan RuniОценок пока нет

- Synd UPI TCДокумент9 страницSynd UPI TCneel bhangureОценок пока нет

- CIPPE Question Bank V2.0Документ137 страницCIPPE Question Bank V2.0Aman GargОценок пока нет

- Organistion and ManagementДокумент5 страницOrganistion and ManagementmielatmiluОценок пока нет

- Rules World Armwrestling Federation (WAF)Документ14 страницRules World Armwrestling Federation (WAF)Ison StudiosОценок пока нет

- STF Final Rule Summary & User Guide WEB 2.0Документ11 страницSTF Final Rule Summary & User Guide WEB 2.0AfnanParkerОценок пока нет

- Closed Economy With GovernmentДокумент8 страницClosed Economy With GovernmentRandyScribdОценок пока нет

- II Sem English NotesДокумент8 страницII Sem English NotesAbishek RajuОценок пока нет

- Petition in Support of RomaniaДокумент3 страницыPetition in Support of RomaniaVladLeventeViskiОценок пока нет

- Ang Alamat NG GubatДокумент5 страницAng Alamat NG GubatJason SebastianОценок пока нет

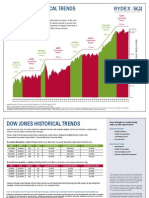

- Rydex Historical TrendsДокумент2 страницыRydex Historical TrendsVinayak PatilОценок пока нет

- LILIA V. PERALTA-LABRADOR, Petitioner, vs. SILVERIO BUGARIN, Substituted by His Widow, CONSOLACION BugarinДокумент3 страницыLILIA V. PERALTA-LABRADOR, Petitioner, vs. SILVERIO BUGARIN, Substituted by His Widow, CONSOLACION BugarinMarie CruzОценок пока нет

- CH 12 - Fraud and ErrorДокумент5 страницCH 12 - Fraud and ErrorJwyneth Royce DenolanОценок пока нет

- Essentially Contested Concepts by WB GallieДокумент17 страницEssentially Contested Concepts by WB GallieJames DwyerОценок пока нет

- Pemex Vs HPДокумент36 страницPemex Vs HPOmarVargasОценок пока нет

- Re-Engaging The Public in The Digital Age: E-Consultation Initiatives in The Government 2.0 LandscapeДокумент10 страницRe-Engaging The Public in The Digital Age: E-Consultation Initiatives in The Government 2.0 LandscapeShefali VirkarОценок пока нет

- Group2 CooperativesДокумент20 страницGroup2 CooperativesMark Angelo SonОценок пока нет

- Deen Is NaseehaДокумент3 страницыDeen Is NaseehaSobia QasimОценок пока нет

- Pcd!3aportal Content!2fcom - Sap.portal - Migrated!2ftest!2fcom - ril.RelianceCard!2fcom - RilДокумент16 страницPcd!3aportal Content!2fcom - Sap.portal - Migrated!2ftest!2fcom - ril.RelianceCard!2fcom - Rildynamic2004Оценок пока нет

- SOP Regulation Rate Charges and Terms&ConditionДокумент12 страницSOP Regulation Rate Charges and Terms&ConditionSPIgroupОценок пока нет

- Subsection B12 - Discharge Value and Width of Required Staircase Clause B12.1Документ3 страницыSubsection B12 - Discharge Value and Width of Required Staircase Clause B12.1Yk YkkОценок пока нет

- Appointment of Beneficiary FormДокумент2 страницыAppointment of Beneficiary FormAnkithaОценок пока нет

- Freedom - What Is Bible Freedom. What Does John 8:32 Promise?Документ64 страницыFreedom - What Is Bible Freedom. What Does John 8:32 Promise?kgdieckОценок пока нет

- TOPIC 2 - Topic 2 - Consolidated and Separate Financial StatementsДокумент6 страницTOPIC 2 - Topic 2 - Consolidated and Separate Financial Statementsduguitjinky20.svcОценок пока нет

- Va Tech ReportДокумент260 страницVa Tech Reportbigcee64Оценок пока нет

- Presentation On Home Loan DocumentationДокумент16 страницPresentation On Home Loan Documentationmesba_17Оценок пока нет