Академический Документы

Профессиональный Документы

Культура Документы

Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice Questions

Загружено:

nikhil diwanИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice Questions

Загружено:

nikhil diwanАвторское право:

Доступные форматы

Chapter : Accounting Of Bonus Issue & Right Issue

Topic 1: Bonus Issue

Practice Questions

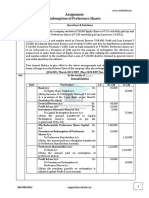

Question 1.

Following items appear in the Trial Balance of ABCD ltd as at 31st March, 2015

1 40,000 equity shares of ₹ 10 each, ₹ 7.50 paid up ₹ 3,00,000

2 Capital redemption Reserve ₹ 30,000

3 Plant Revaluation Reserve ₹ 10,000

4 Securities Premium Account ₹ 35,000

5 General Reserve ₹ 1,00,000

6 Profit and Loss account ₹ 50,000

7 Capital Reserve (including ₹ 25,000 being profit on sale of Machinery) ₹ 75,000

The company decided to convert the partly paid equity shares into fully paid shares by way of bonus.

Required: Pass the necessary journal entries. It is desired that there should be minimum reduction in free

reserves.

Solution:

Journal Entries in the books of ABCD Ltd.

Date Particulars L.F. Dr. Cr.

(₹) (₹)

i) Equity share Final call a/c Dr. 1,00,000

To Equity share capital a/c 1,00,000

(Being the final call of ₹ 2.50 each on 40,000 equity shares to make

them fully paid up)

ii) Capital reserve a/c Dr. 25,000

General reserve a/c 75,000

To Bonus to shareholders a/c 1,00,000

(Being the t/f of ₹ 25,000 from Capital Reserve & 75,000 from

General reserve to make the partly paid up shares fully paid up)

iii) Bonus to shareholders a/c Dr. 1,00,000

To Equity share final call a/c 1,00,000

(Being the amount due on final call adjusted against transfer from

General Reserves to Bonus to Shareholders a/c

Contact - 9228446565 www.konceptca.com info@konceptca.com

Question 2.

Following items appear in the Trial balance of XYZ ltd as at 31st March, 2015

1 40,000 Equity shares of ₹ 10 each ₹ 4,00,000

2 Capital Redemption Reserve ₹ 30,000

3 Plant Revaluation Reserve ₹ 10,000

4 Securities Premium Account ₹ 35,000

5 General reserve ₹ 1,00,000

6 Profit and loss account ₹ 50,000

7 Capital Reserve (including ₹ 25,000 being Profit on sale of Machinery) ₹ 75,000

The company decided to issue bonus shares to its shareholders at the rate of one share for every four

shares held.

Required: Pass the necessary journal entries. It is desired that there should be minimum reduction in

free reserves.

Solution:

Journal Entries in the books of XYZ Ltd.

Date Particulars L.F Dr (₹) Cr(₹)

(i) Capital Reserve A/c Dr. 25,000

Capital Redemption Reserve a/c Dr. 35,000

Securities Premium A/c Dr. 35,000

General Reserve a/c Dr. 10,000

To Bonus to shareholders a/c 10,000

(Being the bonus declared by issuing 1 bonus share for every 4

shares held as per general body’s resolution dated)

ii) Bonus to shareholders a/c Dr. 1,00,000

To equity share capital a/c

(Being the issue of 10,000 shares of ₹ 10 each by way of bonus) 1,00,000

Notes:

i) For issue of Bonus Shares, Plant Revaluation Reserve cannot be utilized.

ii) Capital Reserve realized in cash can be utilized for bonus issue

Contact - 9228446565 www.konceptca.com info@konceptca.com

Question 3.

Following items appear in the Trial Balance of PQR Ltd. AS at 31st March 2015

1 40,000 equity shares of ₹ 10 each, ₹ 7.50 paid up ₹ 3,00,000

2 60, 000 Equity Shares of ₹ 10 each ₹ 6,00,000

3 Capital Redemption Reserve ₹ 1,30,000

4 Plant Revaluation Reserve ₹ 10,000

5 Securities Premium Account ₹ 60,000

6 General Reserve ₹ 1,00,000

7 Profit & Loss Account ₹ 50,000

8 Capital Reserve (Including ₹ 25,000 being profit on Sale of Machinery) ₹ 75,000

The company decided to convert the party paid equity shares into fully paid shares by way of bonus and to

issue fully paid-up Bonus Shares to the holders of fully paid up shares in the same ratio.

Required:

Pass the necessary journal entries, it is desired that there should be minimum reduction in free reserves.

Solution:

Journal Entries in the books of PQR Ltd.

Date Particulars L.F Dr. Cr.

(₹) (₹)

i) Equity Share Final Call A/c Dr. 1,00,000

To Equity share capital A/c 1,00,000

(Being the final call of ₹ 2.50 each on 40,000 equity shares to make them fully

paid up)

ii) Capital Reserve A/c Dr. 25,000

General Reserve A/c Dr. 75,000

To Bonus to Shareholders A/c 1,00,000

(Being the transfer of ₹ 25,000 from Capital Reserve & ₹ 75,000 from General

Reserve to make the partly paid up shares fully paid up)

iii) Bonus to Shareholders A/c Dr. 1,00,000

To Equity Share final call a/c 1,00,000

(Being the amount due on final call adjusted against transfer from transfer

from Capital Reserve & General Reserves to Bonus to Shareholders

iv) Capital Redemption Reserve A/c Dr 1,30,000

Securities Premium A/c Dr 60,000

General Reserve A/c Dr 10,000

To Bonus to Shareholders A/c 2,00,000

(Being the bonus declared by issuing 1 bonus share for every 3 shares held

as per general body’s resolution)

v) Bonus to shareholders a/c Dr. 2,00,000

To Equity share capital a/c 2,00,000

(Being the issue of 20,000 shares of ₹ 10 each by way of bonus)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Notes :

i. Capital Redemption Reserve and Securities Premium can be utilized to issue fully paid-up Bonus

shares and not for converting partly paid shares into fully paid shares.

ii. Capital Reserve realized in cash can be utilized for bonus issue.

iii. Plant Revaluation Reserve cannot be utilized to issue bonus shares.

iv. Ratio of Bonus declared is ₹ 2.50 for every ₹ 7.50 Paid-up capital i.e 1/3rd or 1 for every 3.

Hence, the amount of Bonus = (60,000 × 1/3) × ₹ 10 = ₹ 2,00,000.

Question 4.

The paid up capital of COJHI Ltd. is ₹ 10,00,000 Consisting of ₹ 60,000 Equity Shares of ₹ 10 each fully paid

up and 50,000 Equity Shares of ₹ 10 each, ₹ 8 per share paid up. It has ₹ 40,000 in Securities premium

Account, ₹ 2,00,000 in Profit and Loss Account (Cr.) ₹ 3,00,000 in General Reserve and ₹ 60,000 in Capital

Redemption Reserve Account. By way of Bonus Dividend the partly paid-up shares are converted into fully

paid-up shares and the holders of fully paid up shares are also allotted fully paid-up Bonus shares in the

same ratio.

Required: Pass Journal Entries showing separately the two types of Bonus issues stated above.

Solution:

Journal Entries in the books of COJHI Ltd.

Date Particulars L.F Dr (₹) Cr (₹)

I. General Reserve A/c Dr. 1,00,000

To Bonus to shareholders A/c 1,00,000

(Being the bonus to Shareholders declared for making partly paid shares

fully paid as per Shareholders Resolution dated…)

II. Share Final Call A/c Dr. 1,00,000

To Equity Share Capital A/c 1,00,000

(Being the final call of t 2 per share due on 50, 000 shares as per Board's

Resolution dated....)

III. Bonus to Shareholders A/c Dr. 1,00,000

To Share final call a/c 1,00,000

(Being the utilisation of Bonus to Shareholders towards payment of the

final call of ₹ 2 per share on 50,000 shares)

IV. Securities Premium a/c Dr. 40,000

Capital Redemption Reserve A/c Dr. 60,000

General reserve a/c Dr. 50,000

To bonus to shareholders a/c 1,50,000

(Being the bonus to shareholders declared for issuing fully paid shares

as per Shareholders Resolution dated)

V. Bonus to Shareholders A/c Dr 1,50,000

To Equity Share Capital A/c 1,50,000

(Being the utilisation of Bonus to shareholders towards issue of 15, 000

fully paid shares of t 10 each to be distributed in the ratio of one share

for every four held, as per Board’s resolution dated---)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Notes

a) General Reserve has been utilised for making partly paid shares fully paid, because Securities

Premium A/c or Capital Redemption Reserve A/c cannot be utilised for the purpose.

b) Ratio of Bonus declared is r 2 for every f 8 paid-up capital i.e. 1/4th or 1 for every 4, Hence the

amount of Bonus = (60,000 × 1/4) × ₹ 10 = ₹ 1,50,000.

Question 5.

Following is the extract of the Balance Sheet of CAS Ltd. As at 31st March, 2015

Particulars ₹

Authorised Capital

10,00012% Preference shares of ₹ 10 each 1,00,000

1,00,000 Equity shares of ₹10 each 10,00,000

Issued and Subscribed Capital 11,00,000

8,000 12% Preference shares of ₹ 10 each fully paid 80,000

90,000 Equity shares of ₹ 10 each ₹ 8 paid up 7,20,000

Reserves and Surplus

Capital redemption Reserve 20,000

General Reserve 1,20,000

Capital Reserve 75,000

Securities premium 25,000

Profit and Loss account 1,80,000

Secured Loans

12% Partly convertible Debentures @ ₹ 100 each 5,00,000

On 1st April, 2015 the Company has made final call @ 2 each on 90,000 equity shares. The call money

was received by 20th April, 2015. Thereafter the company decided to capitalize its reserves by way of

bonus at the rate of one share for every four shares held. Securities premium of ₹ 25,000 includes a

premium of ₹ 5,000 shares issued to vendors pursuant to a scheme of amalgamation. Capital reserves

include ₹ 40,000 being profit on sales of plant and machinery. 20% of 12% Debentures are convertible

into equity shares of ₹10 each fully paid on 1st June 2015

Required: Show necessary entries in the books of the Company and prepare the extract of the Balance

Sheet immediately after bonus issue but before conversion of debentures. Are the convertible debenture

holders entitled to bonus shares?

Contact - 9228446565 www.konceptca.com info@konceptca.com

Solution:

Journal Entries in the books of CAS ltd.

Date Particulars L.F. Dr (₹) Cr. (₹)

April 1 Equity share final call a/c Dr. 1,80,000

To Equity share capital a/c 1,80,000

(Being the final call of ₹ 2 per share on 90,000 equity shares due as per

Board’s Resolution dated..)

April 20 Bank a/c Dr. 1,80,000

To Equity share capital a/c 1,80,000

(Being the final call money on 90,000 equity shares received)

Capital Redemption Reserve a/c Dr. 20,000

Capital Reserve a/c (Realized in cash) Dr. 40,000

Securities Premium a/c (25,000 – 5,000) Dr. 20,000

General Reserve a/c Dr. 1,20,000

Profit and loss a/c Dr. 25,000

To Bonus to shareholders a/c 2,25,000

(Being the bonus issue @ one share for every four shares held by utilizing

various reserves as per Boards resolution dated…)

April 20 Bonus to shareholder’s a/c Dr. 2,25,000

To Equity share capital a/c 2,25,000

An extract of BALANCE SHEET as at 30TH APRIL, 2015 (After Bonus Issue)

Particulars Note No ₹

1. EQUITY AND LIABILTHES

(1) Shareholder’s Funds

(a) Share Capital 1 12,05,000

(b) Reserves and Surplus 2 1,95,000

(2) Non-Current Liabilities

(a) Long term borrowings 3 5,00,000

Total 19,00,000

Notes to Accounts:

Particulars ₹

1. Share Capital

Authorised Share Capital

1,25,000 Equity shares of ₹ 10 each 12,50,000

10,000, 12% Preference shares of ₹ 10 each 1,00,000

13,50,000

Issued, Subscribed and fully paid share capital

1,12,500 Equity shares of ₹ 10 each, fully paid 11,25,000

(Out of the above 22,500 equity shares @ ₹ 10 each were issued by way of bonus)

8,000 12% Preference Shares of ₹ 10 each 80,000

Total 12,05,000

2. Reserves and Surplus

Capital Reserves (75,000 – 40,000) 35,0000

Securities Premium Reserves (25,000 – 20,000) 5,000

Surplus (profit and loss account) (1,80,000 – 25,000) 1,55,000

Total 1,95,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

3. Long term borrowings

Secured

Secured 12% Convertible Debentures @ ₹ 100 each (out of above 1,00,000 5,00,000

Debentures @ ₹ 100 each to be converted into 10,000 Equity shares @ ₹ 10 each on

1st July, 2015)

Total 5,00,000

Working Notes:

(i) Capital Reserve realized in cash can be utilised for issue of fully paid bonus shares.

(ii) As per SEBI guidelines securities premium collected in cash can only be utilized for bonus issue.

(Iii) As per pare (ii) of SEBI guidelines, no company can issue bonus shares to its shareholders without

extending similar benefit to convertible debentures Holders Pending such conversion necessary number of

shares should be earmarked for convertible debentures Holders Therefore, convertible debentures holders

are also entitled to the bonus shares in the same ratio as the equity share Holders

(iv) It is assumed that the company will pass necessary resolution at its general meeting for increasing the

authorized capital by ₹ 2,50,000.

Question 6.

Following is Me Balance Sheet of Happy limited as on March 31, 2015

Balance Sheet As On 31-3-2015

Particulars ₹

Authorised share capital

2,00,000 equity shares of ₹ 10 each 20,00,0000

Issued and Subscribed share capital

2,00,000 Equity shares of ₹ 10 each. ₹ 7 paid up 14,00,000

Reserves and Surplus

Capital reserve (Profit on sale of fixed assets) 1,30,000

Securities Premium (includes ₹ 20,000 received otherwise than in cash) 90,000

General reserve 2,40,000

Profit and loss a/c 5,20,000

Secured loans

12% fully convertible debentures @ ₹ 100 each 4,00,000

Current liabilities 2,20,000

Fixed assets 20,00,000

Investments 4,40,000

Current Assets 5,60,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

On April 01,2015, company has made final call @ ₹ 3 on 2,00,000 equity shares and received Complete

call money by April 30, 2015.

The company wants to issue bonus shares to its shareholders @ one share for every four shares held.

12% Debentures are convertible into equity shares of ₹ 10 each fully paid on June 01, 2015. Necessary

resolutions were passed and requisite legal requirements were complied with. For issue of bonus shares

it was decided that reserves and surplus, other than Profit and Loss Account, should be first capitalized.

Required:

Prepare Balance Sheet as on May 15, 2015, date on which all the formalities related to the issue of bonus

shares completed. For the purpose of preparation of Balance Sheet, assume that, Balance Sheet items as

on March 31, 2015, which are not affected by issue of bonus shares as above, remains unchanged as on

May 15, 2015. Also pass necessary Journal Entries in the books of the company related to issue of bonus

shares, for the period from April 01, 2015 to May 15, 2015.

Solution:

Balance sheet of Happy ltd. as at 15.5.2015

Particulars Note No ₹

(lakhs)

1. Equity and liabilities

1) Shareholder’s Funds

a) Share capital (10 each) 1 25,00,000

b) Reserves and Surplus 2 4,80,000

2) Non-current liabilities (12% Debentures) 4,00,000

3) Current liabilities 2,20,000

Total 36,00,000

II Assets

1) Non-current assets

a) Fixed assets( Tangible Assets) 20,00,000

b) Non-current investments 4,40,000

2) Current Assets (5,60,000 + 6,00,000) 11,60,000

Total 36,00,000

Notes to Accounts:

Particulars ₹ (Lakhs)

1. Share Capital

2,50,000 equity shares of ₹10 each 25,00,000

(Of the above 50,000 shares were issued by way of bonus for consideration otherwise than cash)

2. Reserves and Surplus

Debentures Redemption Reserve

Profit and Loss Account (5,20,000 – 60,000) 4,60,000

Securities Premium 20,000

Total 4,80,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

Journal Entries in the books of Happy Ltd.

Date Particulars Dr. Cr

(₹) (₹)

01.04.2015 Equity share capital a/c Dr. 6,00,000

To Equity Share capital a/c 6,00,000

(Being final call of ₹ 3 per share on 2,00,000 equity shares made)

30.04.2015 Bank a/c Dr. 6,00,000

To Equity share final call a/c 6,00,000

(Being final call money on 2,00,000 equity shares received)

15.05.2015 Capital Reserve a/c Dr. 1,30,000

Securities Premium A/c (90,000 – 20,000) Dr. 70,000

General reserve A/c Dr. 2,40,000

Profit and Loss a/c Dr. 60,000

To bonus to shareholders a/c 5,00,000

(being bonus issue @ one share for every four shares held, by utilizing

various reserves)

15.05.2015 Bonus to shareholder’s a/c Dr. 5,00,000

To equity share capital a/c 5,00,000

(being capitalization of reserves and profits)

Working Notes:

(I) Authorised share capital

Particulars Number of shares

Existing number of authorized share capital 2,00,000

Add: Issue of bonus shares to existing equity shareholders 50,000

Add: Shares required for conversion of debentures 40,000

Add: Bonus shares to be issued to debenture holders after conversion 10,000

Total authorized share capital as on May 15, 2015 should be 3,00,000

(II) As per SEBI guidelines, no company can issue bonus shares to its shareholders without extending

similar benefit to convertible debenture Holders Pending such conversion, necessary number of

shares should be earmarked for convertible debenture Holders Therefore, convertible debenture

holders are also entitled to the bonus shares in the same ratio as the equity shareholders on

conversion.

(III) As per SEBI guidelines, Securities premium collected in cash can only be utilized for bonus issue.

Contact - 9228446565 www.konceptca.com info@konceptca.com

Question 7.

Following items appear in the trial balance of Bharat ltd. (a listed company) as on 31st March, 2015

₹

40,000 equity Shares of ₹ 10 each 4,00,000

Capital Reserve (including 30,000 being profit on sale of machinery) 75,000

Capital Redemption Reserve 25,000

Securities Premium 30,000

General Reserve 1,05,000

Surplus i.e credit balance of Profit and loss Account 50,000

The company decided to issue to equity shareholders bonus shares at the rate of 1 share for every 4 shares

held and for this purpose, it decided that three should be the minimum reduction in free reserve.

Pass necessary journal entries.

Solution:

Journal Entries in the books of Bharat Ltd.

Particulars Dr. Cr.

(₹) (₹)

Capital Reserve A/c Dr. 30,000

Capital Redemption Reserve A/c Dr. 25,000

Securities Premium A/c Dr. 30,000

General Reserve A/c Dr. 15,000

To Bonus to shareholders a/c 1,00,000

(Bonus issue of one share for every four shares held by utilizing various

reserves as per Board’s resolution dated----)

Bonus to Shareholder’s A/c 1,00,000

To Equity share capital a/c 1,00,000

(Capitalisation of profit)

Note: Capital reserve amounting ₹ 30,000 realized in cash can only be used for bonus issue.

Contact - 9228446565 www.konceptca.com info@konceptca.com

Question 8.

Following is the extract of the Balance sheet of Solid ltd. as at 31st March, 2015:

₹

Authorised Capital:

10,000 12% preference shares of ₹ 10 each 1,00,000

1,00,000 Equity shares of ₹ 10 each 10,00,000

11,00,000

Issued and Subscribed capital:

8,000 12% Preference shares of ₹ 10 each fully paid 80,000

90,000 Equity shares of ₹ 10 each, ₹ 8 paid up 7,20,000

Reserves and Surplus:

General reserve 1,60,000

Revaluation reserve 35,000

Securities Premium 20,000

Profit and loss account 2,05,000

Secured loan:

12% Debentures @ ₹ 100 each 5,00,000

On 1st April, 2015 the company has made final call @ ₹ 2 each on 90,000 equity shares. The call money was

received by 20th April, 2015. Thereafter the company decided to capitalize its reserves by way of bonus at

the rate of one share for every four shares held. Show necessary entries in the books of the company and

prepare the extract of the Balance Sheet immediately after bonus issue assuming that the company and

prepare the extract of the Balance sheet immediately after bonus issue assuming that the company has

passed necessary resolution at its general body meeting for increasing the authorized capital.

Solution: Solid Ltd.

Journal Entries in the books of SOLID Ltd.

2015 Dr. Cr.

(₹) (₹)

April 1. Equity Share Final call a/c Dr. 1,80,000

To Equity share capital a/c 1,80,000

(final call of ₹ 2 per share on 90,000 equity shares due as per Board’s

Resolution dated)

April Bank a/c Dr. 1,80,000

20. To equity share final call a/c 1,80,000

(final call money on 90,000 equity shares received)

Securities Premium A/c Dr. 20,000

General reserve A/c Dr. 1,60,000

Profit and loss A/c Dr. 45,000

To Bonus to Shareholder’s A/c 2,25,000

(Bonus issue @ one share for every four shares held by utilizing various

reserves as per Board’s Resolution dated.)

April Bonus to Shareholders a/c Dr. 2,25,000

20. To equity share capital a/c 2,25,000

(Capitalization of profit)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Balance Sheet (Extract) as on 30th April, 2015 (after bonus issue)

Particulars Notes Amount (₹)

Equity and Liabilities

1 Shareholder’s fund

a Share Capital 1 12,05,000

b Reserves and surplus 2 1,95,000

2 Non-current liabilities

a Long-term borrowings 3 5,00,000

Total 19,00,000

Notes to Accounts:

1 Share Capital

Equity share capital

Authorized share capital

1,25,000 Equity shares of ₹ 10 each 12,50,000

Issued, subscribed and fully paid share capital

1,12,500 Equity shares of ₹ 10 each, fully paid

(Out of the Above 22,500 equity shares @ ₹ 10 each were issued by way of bonus)

(A) 11,25,000

Preference share capital

Authorized share capital

10,000, 12% preference shares of ₹ 10 each 1,00,000

Issued, Subscribed and fully paid share capital 1,12,500 Equity shares of ₹ 10 each,

fully paid

(out of above, 22,500 equity shares @ ₹ 10 each were issued by way of bonus)

(A) 11,25,000

Preference share capital

Authorized share capital

10,000 12% preference shares of ₹ 10 each 1,00,000

Issued, subscribed and fully paid share capital

8,000 12% Preference shares of ₹ 10 each (B) 80,000

Total (A+B) 12,05,000

2 Reserves and Surplus

Revaluation Reserves 35,000

Securities Premium 20,000

Less: Utilized for bonus issue (20,000) Nil

General Reserve 1,60,000

Less: Utilized for bonus issue (1,60,000) Nil

Profit and loss Account 2,05,000

Less: Utilised for bonus shares (45,000) 1,60,000

Total 1,95,000

3 Long term borrowings

Secured

12% debentures @ ₹ 100 each 5,00,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

Question 9.

The following is the summarised balance sheet of BumBum Limited as at 31st March, 2015:

₹

Source of funds

Authorized capital 5,00,000

50,000 Equity shares of ₹10 each. 10,00,000

10,000 preference shares of ₹100 each (8% redeemable) 15,00,000

Issued subscribed and paid up

30,000 equity shares of ₹10 each 3,00,000

5,000 8% Redeemable Preference shares of ₹100 each 5,00,000

Reserve & Surplus

Securities premium 6,00,000

General reserve 6,50,000

Profit & loss A/c 40,000

2,500, 9% debentures of ₹100 each 2,50,000

Trade payables 1,70,000

25,10,000

Application of funds

Fixed assets (net) 7,80,000

Investments (market value ₹5,80,000) 4,90,000

Deferred tax assets 3,40,000

Trade receivable 6,20,000

Cash & bank balance 2,80,000

25,10,000

In annual general meeting held on 20th June, 2015 the company passed the following resolutions:

(i) To split equity share of ₹10 each into 5 equity share of ₹2 each from 1st July, 5.

(ii) To redeem 8% preference shares at a premium of 5%.

(iii) To redeem 9% debentures by making offer to debentures holders to convert their holdings into equity

shares at ₹10 per share or accept cash or redemption.

(iv) To issue fully paid bonus share in the ratio of one equity share for every 3 shares held on record date.

On 10th July, 2015 Investment were sold for ₹5, 55,000 and preference shares were redeemed.

40% of debentures exercised their option to accept cash and their claims were settled on 1st August, 2015.

The company fixed 5th September, 2015 as record date and bonus issue was concluded by 12 th September,

2015.

You are required to journalize the above transactions including cash transactions and prepare balance sheet

as at 30th September, 2015. All working notes should form part of the answer.

Contact - 9228446565 www.konceptca.com info@konceptca.com

Solution: Journal Entries in the books of Bumbum Limited.

2015 Dr. (₹) Cr.(₹)

July 1 Equity share capital A/c (₹10 each) Dr. 3,00,000

To Equity share capital A/c (₹2 each) 3,00,000

(being equity share of ₹10 each splitted into 5 equity shares of ₹ 2 each)

{1,50,000 x 2}

July 10 Cash & bank balance A/c Dr. 5,55,000

To investment A/c 4,90,000

To Profit & loss A/c 65,000

(being investment sold out and profit on sale credited to Profit & loss A/c)

July 10 8% redemption preference share capital A/c Dr. 5,00,000

Premium on redemption of preference share A/c Dr. 25,000

To Preference shareholders A/c 5,25,000

(being amount payable to preference shareholders on redemption)

July 10 Preference shareholders A/c Dr. 5,25,000

To cash & bank A/c 5,25,000

(being amount paid to preference shareholders)

July 10 General reserve A/c Dr. 5,00,000

To capital redemption reserve A/c 5,00,000

(being amount equal to nominal value of preference shares transferred to

capital redemption reserve A/c on its redemption as per the law)

Aug 1 9% debentures A/c Dr. 2,50,000

Interest on debentures Dr. 7,500

To debenture holders A/c 2,57,500

(being amount payable to debenture holders along with interest payable)

Aug 1 Debentures holders A/c Dr. 2,57,500

To cash & bank A/c (1,00,000 + 7,500) 1,07,500

To equity shares capital A/c 30,000

To securities premium A/c 1,20,000

(Being claims of debentures holder satisfied)

Sept. 5 Capital Redemption Reserve A/c Dr. 1,10,000

To bonus to shareholders A/c 1,10,000

(being balance in capital redemption reserve capitalized to issue bonus

shares)

Sept.12 Bonus to shareholders A/c Dr. 1,10,000

To equity share capital A/c 1,10,000

(being 55,000 fully paid equity shares of ₹2 each issued as bonus in ratio of 1

share for every 3 shares held)

Sept.30 Securities premium A/c Dr. 25,000

To premium on redemption of preference shares A/c 25,000

(being premium on preference shares adjusted from securities premium

account)

Sept.30 Profit & loss A/c Dr. 7,500

To interest on debentures A/c 7,500

(being interest on debentures transferred to profit and loss Account)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Balance sheet as at 30th September, 2015

Particulars Notes ₹

Equity & liabilities

1. shareholder’s funds

a. Share capital 1 4,40,000

b. Reserve and surplus 2 13,32,500

2. Current liabilities

a. Trade payables 1,70,000

Total 19,42,500

Assets

1. Non -current assets

a. Fixed assets

Tangible assets 7,80,000

b. deferred tax asset 3,40,000

2. Current assets

Trade receivable 6,20,000

Cash and cash equivalents 2,02,500

Total 19,42,500

Notes to Accounts:

1. Share capital ₹ ₹

Authorised share capital

2,50,000 equity share of ₹2 each 5,00,000

10,000 preference share of ₹100 each 10,00,000 15,00,000

Issued subscribed and paid up

2,20,000 equity shares of ₹ 2 each 4,40,000

2. Reserves and surplus

Securities premium A/c 6,00,000

Balance as per balance sheet

Add: premium on equity shares issued on conversion of debentures 1,20,000

(15,000 x 8)

7,20,000

Less: Adjustment for premium on preference shares 25,000 6,95,000

Balance 3,90,000

Capital redemption reserve (5,00,000 – 1,10,000) 1,50,000

General reserve (6,50,000 – 5,00,000)

Profit & loss A/c 40,000

Add: profit on sale of investment 65,000

Less: interest on debentures 7,500 97,500

13,32,500

Contact - 9228446565 www.konceptca.com info@konceptca.com

Working Notes:

₹

1. Redemption of preference share:

5,000 preference share of ₹100 each 5,00,000

Premium on redemption @ 5% 25,000

Amount payable 5,25,000

2. Redemption of debentures:

2,500 debentures of ₹100 each

Less: cash option exercised by 40%holders 2,50,000

Conversion option exercised by remaining 60% 1,00,000

Equity shares issued on conversion = 1,50,000/10 = 15,000 shares 1,50,000

3. Issue of bonus shares

Existing equity shares after split (30,000x5) 1,50,000 shares

Equity shares issued on conversion 15,000 shares

Equity shares entitled for bonus 1,65,000 shares

Bonus share (1share for every 3 shares held) to be issued 55,000 shares

4. Cash and bank Balance

Balance as per balance sheet 2,80,000

Add: Realization on sale of investment 5,55,000

8,35,000

Less: Paid to preference share holders 5,25,000

Paid to debentures holders (7,500+1,00,000) 1,07,500

Balance 2,02,500

5. Balance of ₹7,500 paid to debenture holders have been debited to Profit & loss Account

Question 10.

Following is the extract of the Balance sheet of Preet Ltd as at 31st March, 2015:

Authorised capital : ₹

15,000 12% Preference shares of ₹10 each 1,50,000

1,50,000 Equity shares of ₹10 each 15,00,000

16,50,000

Issued & subscribed capital:

12,000 12% preference shares of ₹10 each 1,20,000

1,35,000 Equity shares of ₹10 each, ₹8 paid up 10,80,000

Reserves and Surplus:

General reserve 1,80,000

Capital reserve (profit realized on sale of plant) 60,000

Securities premium 37,500

Profit and loss Account 3,00,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

On 1st April, 2015, the company has made final call @ ₹2 each on 1, 35,000 equity shares. The call money

was received by 20th April, 2015. Thereafter, the company decided to capitalize its reserve by way of

bonus at the rate of one share for every four shares held. Company decides to use capital reserve for bonus

issue as it has been realized in cash.

Show necessary journal entries in the books of the company and prepare the extract of the balance sheet

as on 30th April, 2015 after bonus issue.

Solution:

Journal Entries in the books of Preet Ltd.

Date Particulars ₹ ₹

1-4-2015

Equity share final call A/c Dr. 2,70,000

To Equity share capital A/c 2,70,000

(For final calls of ₹2 per share on 1,35,000 equity shares due as per

Board’s Resolution dated)

20-4-2015 Bank A/c Dr. 2,70,000

To Equity share final call A/c 2,70,000

(for final call money on 1,35,000 equity shares received)

Securities premium A/c Dr. 37,500

Capital reserve A/c Dr. 60,000

General reserve A/c Dr. 1,80,000

Profit and loss A/c Dr. 60,000

To bonus to shareholders A/c 3,37,500

(For making provision for bonus issue of one share for every four

shares held)

Bonus to shareholders A/c Dr. 3,37,500

To Equity share capital A/c 3,37,500

Extract of balance Sheet as at 30th April, 2015 (After bonus issue)

₹

Authorise capital:

15,000 12% Preference shares of ₹10 each 1,50,000

1,83,750 Equity shares of ₹10 each (W.N-2) 18,37,500

Issued and subscribed capital

12,000 12% preference shares of ₹10 each, fully paid 1,20,000

1,68,750 Equity shares of ₹10 each, fully paid 16,87,500

(out of above, 33,750 equity shares @ ₹10 each were issued by way of bonus)

Reserve and surplus

Profit and loss Account 2,40,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

Working Notes:

The authorized capital should be increased as per details given below: ₹

Existing authorized Equity share capital 15, 00,000

Add: Issue of bonus shares to equity shareholders

(25% of ₹13, 50,000) 3, 37,500

18, 37,500

Question 11.

The following is the summarized Balance sheet of trinity Ltd as at 31-3-2014

Liabilities ₹ Assets ₹

Share capital Fixed assets

Authorised Gross block 3,00,000

10,000 10% Redeemable Preference Less: Depreciation 1,00,000

shares of ₹10 each 1,00,000 2,00,000

90,000 Equity shares of ₹10 each 9,00,000

10,00,000 Investments 1,00,000

Issued, Subscribed and paid-up capital Current assets and loans and advances

10,000 10% Redeemable Preference 1,00,000 Inventory 45,000

shares of ₹10 each

10,000 Equity shares of ₹10 each 1,00,000 Trade receivables 25,000

(A) 2,00,000 Cash and bank balances 50,000

Reserve and surplus

General reserve 1,20,000

Securities premium 70,000

Profit & loss A/c 18,500

(B) 2,08,500

Current liabilities and provisions (C) 11,500

Total A+B+C 4,20,000 4,20,000

For the year ended 31-3-2015, the company made a net profit of ₹35,000 after providing ₹20,000

depreciation.

The following additional information is available with regard to company’s operation:

Contact - 9228446565 www.konceptca.com info@konceptca.com

1. The preference dividend for the year ended 31-3-2015 was paid.

2. Except cash and bank balances other current assets and current liabilities as on 31-3-2015, was the same

as on 31-3-2014.

3. The company redeemed the preference shares at a premium of 10%.

4. The company issued bonus shares in the ratio of one share for every equity share held as on 31-3-2015.

5. To meet the cash requirements of redemption, the company sold investments.

6. Investment was sold at 90% of cost on 31-3-2015.

You are required to prepare necessary journal entries to record redemption and issue of bonus shares.

Solution:

Journal Entries in the books of Trinity Ltd.

Particulars Dr. Cr.

₹ ₹

Securities Premium A/c Dr. 10,000

To premium on redemption of preference shares 10,000

(being amount of premium payable on redemption of preference share)

10% Redemption Preference capital Dr. 1,00,000

Premium on redemption of preference shares Dr. 10,000

To preference shareholders 1,10,000

(being the amount payable to preference shareholders on redemption)

General reserve A/c Dr. 1,00,000

To capital redemption Reserve 1,00,000

(being transfer to the latter account on redemption of shares)

Bank A/c Dr. 90,000

Profit and loss A/c Dr. 10,000

To Investments 1,00,000

(being amount realised on sale of investments and loss thereon adjusted)

Preference Shareholders A/c Dr. 1,10,000

To bank 1,10,000

(being payment made to preference shareholders)

Capital redemption reserve A/c Dr. 1,00,000

To bonus to shareholders 1,00,000

(Amount adjusted for issuing bonus share in the ratio of 1:1)

Bonus to shareholders A/c Dr. 1,00,000

To Equity share capital 1,00,000

(balance on former account transferred to latter)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Question 12.

The following notes pertain to Brite Ltd.’s Balance Sheet as on 31st March, 2015:

Notes ₹ in lakhs

(1) Share Capital

Authorised:

20 crore shares of ₹ 10 each 20,000

Issued and Subscribed:

10 crore Equity shares of ₹10 each 10,000

2 crore 11% Cumulative Preference Shares of ₹10 each 2,000

Total 12,000

Called and paid up:

10 crore Equity shares of ₹10 each, ₹8 per share called and paid up 8,000

2 crore 11% Cumulative preference shares of ₹10 each, fully called and paid up 2,000

Total 10,000

(2) Reserve and surplus:

Capital reserve (profit on fixed assets realized in cash) 485

Capital redemption reserve 1,000

Securities premium 2,000

General reserve 1,040

Surplus i.e. credit balance of profit & loss Account 273

Total 4,798

On 2nd April, 2015, the company made the final call on equity shares @ ₹2 per share. The entire money

was received in the month of April, 2015.

On 1st June 2015, the company decided to issue to Equity shareholders bonus shares at the rate of 2 shares

for every 5 shares held and for this purpose, it decided to utilize the capital reserves to the maximum

possible extent.

Pass Journal entries for all the above mentioned transactions. Also prepare the notes on share capital and

reserves and surplus relevant to the balance sheet of the company immediately after the issue of bonus

shares.

Solution:

Journal Entries in the books of Brite Ltd.

2015 Dr. Cr.

Particulars In ₹ lakhs In ₹ lakhs

April 2 Equity share final call A/c Dr. 2,000

To Equity share capital A/c 2,000

(final call of ₹2 per share on 10 crore equity shares made due)

Bank A/c Dr. 2,000

To equity share final call A/c 2,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

(Final call money on 10 crore equity shares received)

June 1 Capital reserve A/c 485

Capital redemption reserve A/c 1,000

Securities premium A/c 2,000

General Reserve A/c 515

To bonus to shareholders A/c 4,000

(bonus issue of 2 shares for every five shares held, by utilising various

reserves as per board’s resolution dated)

Bonus to shareholders A/c Dr. 4,000

To Equity share capital A/c 4,000

(Capitalisation of profit)

Notes to Accounts:

₹ in lakhs

1. Share capital

Authorised share capital

20 crore shares of ₹10 each 20,000

Issued, subscribed and fully paid up share capital

14 crore Equity shares of ₹10 each, fully paid up 14,000

(out of the above, 4 crore equity shares @ ₹10 each were issued by way of bonus)

2 crore, 11% cumulative preference share capital of ₹10 each, fully paid up 2,000

Total 16,000

2. Reserve & Surplus

Capital reserves 485

Less: Utilized for bonus issue (485) -

Capital redemption reserve 1,000

Less: Utilized for bonus issue (1,000) -

Securities Premium 2,000

Less: Utilized for bonus issue (2,000) -

General Reserve 1,040

Less: Utilized for bonus issue (515) 525

Surplus (profit and loss Account) 273

Total 798

Contact - 9228446565 www.konceptca.com info@konceptca.com

Question 13.

Following items appear in the Trail balance of Saral Ltd. as on 31st March, 2014:

Particulars Amount (₹)

4,500 equity shares of ₹100 each 4,50,000

Capital reserve (including ₹40,000 being profit on sale of profit) 90,000

Securities Premium 40,000

Capital Redemption Reserve 30,000

General Reserve 1,05,000

Profit and loss Account (Cr. Balance) 65,000

The company decided to issue to equity shareholders bonus shares at the rate of 1 share for every 3 shares

held. Company decided that there should be the minimum reduction in free reserves. Pass necessary

Journal Entries in the books Saral Ltd.

Solution:

Journal Entries in the book of Saral Ltd.

Particulars Dr. Cr.

(₹) (₹)

Capital redemption reserve A/c Dr. 30,000

Securities premium A/c Dr. 40,000

Capital reserve (Realized in cash) Dr. 40,000

General reserve A/c Dr. 40,000

To bonus to shareholders 1,50,000

( Being issued of bonus shares by utilization of various reserves, as per

resolution dated)

Bonus to shareholders A/c Dr. 1,50,000

To Equity share capital A/c 1,50,000

( Being capitalization of profit)

Contact - 9228446565 www.konceptca.com info@konceptca.com

Question 14.

The Balance Sheet of CANIE Ltd. as at 31.3.2015 as follows:

Liabilities ₹ Assests ₹

Share Capital: Non Current assets 10,00,000

Authorised Current asses 7,00,000

1,50,000 Equity Shares of ₹10 each 15,00,000

Issued and Subscribed :

80,000 equity shares of ₹7.50 each 6,00,000

called-up and paid-up

Reserve & Surplus:

Capital Redemption Reserve 1,50,000

Plant Revaluation Reserve 20,000

Securities Premium account 1,50,000

Development rebate Reserve 2,30,000

Investment Allowance reserve 2,50,000

General Reserve 3,00,000

17,00,000 17,00,000

The company wanted to issue bonus shares to its share to its share holders at the rate of one share for

every two share held. Necessary resolutions were passed: Requisite legal requirements were compiled

with:

(a)You are required to give effect to the proposal by passing journal entries in the books of CANIE Ltd.

(b)Show the amended Balance Sheet.

Solution.

Journal

Date Particulars L.F. Dr.(₹) Cr.(₹)

(i) Equity share Final Call A/c Dr. 2,00,000

To Equity Share Capital A/c 2,00,000

(Being the Final call of ₹ 2.50 each on 80,000 equity shares to

make them fully paid up)

(ii) General Reserve A/c Dr. 2,00,000

To Bonus to shareholder A/c 2,00,000

(Being the Transfer of ₹2,00,000 from general Reserve to make

the partly paid up)

(iii) Bonus to shareholders A/c Dr. 2,00,000

To Equity share Final Call A/c 2,00,000

(Being the amount due on final call adjusted against transfer from

General Reserves to Bonus to Shareholders A/c)

(iv) General Reserves Dr. 1,00,000

Securities Premium A/c Dr. 1,50,000

Capital Redemption Reserve A/c 1,50,000

To Bonus to Share Holders A/c Dr. 4,00,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

(Being the appropriation made as above to facilitate issues of fully

paid up bonus shares at the rate of the one share for every two

shares held)

(V) Bonus To Share holders A/c Dr. 4,00,000

To Equity Share Capital A/c 4,00,000

(Being the issuance of 40,000 fully paid up shares of ₹10 each by

way of bonus)

Notes:

(i) Reserve other than capital Redemption Reserve, Plant Revaluation Reserve and Securities premium

account can be utilized for making the partly paid up shares fully paid up.

(ii) Plant Revaluation Reserve, Can’t be utilized to make the bonus issues.

Balance sheet of CANIE, Ltd. as at 1st April, 2015

Particulars Note No. ₹(In Lacs)

1.equity and Liabilities

(1) Shareholders’ Funds

(a)Share Capital 1 12,00,000

(b)Reserves and Surplus 2 5,00,000

(2) Non Current Liabilities

(3) Current Liabilities

Total 17,00,000

2. Assets

(1) Non-current Assets 10,00,000

(2) Current assets 7,00,000

Total 17,00,000

Notes to Accounts:

Note 1: Share capital

Authorised 15,00,000

1,50,000 Equity Shares of ₹10, each

Issued & Subscribed 12,00,000

1,20,000 Equity Shares of ₹10 each

(of the above 40,000 Shares were issued as bonus shares )

Note 2: Reserves and Surplus

Development Debate Reserve 2,30,000

Investment allowance Reserve 2,50,000

Plant Revaluation Reserve 20,000

5,00,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

Question 15.

Following is the extract from the balance Sheet of M/s Yahoo Ltd. as at 31st March, 2015:

In ₹

Authorised Capital:

50,000, 10% Preference shares of ₹10 each 5,00,000

2,00,000 Equity Shares of ₹10 each 20,00,000

Issued and Subscribed Capital:

40,000; 10% Preference Shares of ₹10 each fully paid 4,00,000

1,80,000 Equity shares of ₹10 each, of which ₹7.50 paid up 13,50,000

Reverse and Surplus:

General reserve 2,40,000

Capital Reserve 1,50,000

Securities Premium 50,000

Profit and Loss account 3,00,000

On 1st April the company has made a final call @ ₹2.50 each on 1,80,000 equity shares. The Call Money was

received By 30th April. There after the company decided to capitalize its reserves by issuing bonus shares at

the rate of one share for every three shares held. Securities premium of ₹50,000 includes a premium of ₹

20,000 for shares issues to vendor for purchase of a special machinery. Capital reserve includes ₹60,000

being profit on exchange of plant and machinery.

Required: Show necessary journal entries in the books of the company and prepare the extract of the

Balance sheet after bonus issues. Necessary assumption, if any should form part of your answer.

Solution.

In The Books Of M/s. Yahoo Ltd.

Journal of M/s. Yahoo. Ltd.

Date Particulars Dr. Cr.

1.4.2015 Equity Share Final Call A/c Dr. 4,50,000

To Equity Share Capital A/c 4,50,000

(Being the final call of ₹2.50 per share on 1,80,000 equity share made)

30.4.2015 Bank A/c 4,50,000

To Equity Share Final Call A/c 4,50,000

(Being Final call money on 1,80,000 shares received)

30.4.2015 Securities premium A/c (50,000-20,000) Dr. 30,000

Capital Reserve A/c (1,50,000-60,000) Dr. 90,000

General reserve A/c Dr. 2,40,000

Profit and Loss A/c Dr. 2,40,000

To Bonus To share holders A/c 6,00,000

(Being utilization of reserves for bonus issues of one share for every

three shares held)

30.4.2015 Bonus to Equity shareholders /c Dr. 6,00,000

ToEquity Share capital A/c 6,00,000

(Being bonus shares issued)

Contact - 9228446565 www.konceptca.com info@konceptca.com

An Extract of Balance Sheet (after Bonus Issue)

Equity & Liabilities ₹ in ‘000

Share Holders Funds

Share Capital 28,00,000

Reserves & Surplus 1,40,000

Note: 1 Authorised Capital:

50,000, 10% preference shares of ₹ 10each 5,00,000

2,40,000, Equity shares of ₹ 10 each (refer W.N.) 24,00,000

Issued and subscribed capital:

40,000, 10% Preference shares of ₹10 each fully paid

2,40,000, Equity shares of ₹ 10 each fully paid

(out of the above, 60,000 equity shares of ₹ 10 each have been issued by the way of bonus)

Note 2: Reserves and Surplus :

Capital Reserve 60,000

Securities Premium 20,000

Profit and Loss A/c (3,00,000-2,40,000) 60,000

Assumption:

1. As per SEBI Guidelines, Capital Reserve and Securities Premium collected in cash only can be

utilized for the purpose of issue of bonus shares. It is assumed that balance of capital Reserve and

Securities Premium is collected in cash only.

2. It is also assumed that the necessary revolutions have been passed and requisite legal

requirements related to the issue of bonus shares have been complied with before issues of bonus

shares.

Working Note:

On the basis of the above assumptions, the authorized Capital should be increased as under:

Required for bonus issues ₹6,00,000

Less: Balance of authorized Equity share capital (available) (₹2,00,000)

Authorised Capital to be increased ₹4,00,000

Total Authorised equity share Capital after bonus issues (₹20,00,000+₹4,00,000) = ₹24,00,000

Contact - 9228446565 www.konceptca.com info@konceptca.com

Вам также может понравиться

- 5 6084915055709651012Документ8 страниц5 6084915055709651012Ajit Yadav100% (1)

- Pe2 Acc Nov05Документ19 страницPe2 Acc Nov05api-3825774Оценок пока нет

- Accounting from Incomplete Records: Trading and Profit Loss StatementДокумент21 страницаAccounting from Incomplete Records: Trading and Profit Loss StatementbinuОценок пока нет

- Decemeber 2020 Examinations: Suggested Answers ToДокумент41 страницаDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariОценок пока нет

- DEPARTMENTAL ACCOUNTSДокумент17 страницDEPARTMENTAL ACCOUNTSAyush AcharyaОценок пока нет

- Branch Accounting Examination BankДокумент71 страницаBranch Accounting Examination BankNicole TaylorОценок пока нет

- Bos 28432 CP 10Документ45 страницBos 28432 CP 10hiral dattaniОценок пока нет

- Cash ManagementДокумент14 страницCash ManagementSushant MaskeyОценок пока нет

- Study Note 4.3, Page 198-263Документ66 страницStudy Note 4.3, Page 198-263s4sahithОценок пока нет

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFДокумент13 страницGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiОценок пока нет

- Chap 6Документ27 страницChap 6Basant OjhaОценок пока нет

- PT 06 (Partnership) (5 Dec)Документ8 страницPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (1)

- Compiler CAP II Cost AccountingДокумент187 страницCompiler CAP II Cost AccountingEdtech NepalОценок пока нет

- Cost & Finance RTP Nov 15Документ41 страницаCost & Finance RTP Nov 15Aaquib ShahiОценок пока нет

- Chartered Accountancy Professional CAP-II TitleДокумент104 страницыChartered Accountancy Professional CAP-II TitleBAZINGAОценок пока нет

- Problems On Internal ReconstructionДокумент24 страницыProblems On Internal ReconstructionYashodhan Mithare100% (4)

- Branch: ? AccountingДокумент36 страницBranch: ? AccountingbinuОценок пока нет

- Chapter 9 Accounting For Branches Including Foreign Branches PDFДокумент61 страницаChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanОценок пока нет

- Scanner CAP II Income Tax VATДокумент162 страницыScanner CAP II Income Tax VATEdtech NepalОценок пока нет

- Study Note 3, Page 114-142Документ29 страницStudy Note 3, Page 114-142s4sahithОценок пока нет

- Chap 12 PDFДокумент15 страницChap 12 PDFTrishna Upadhyay50% (2)

- Paper - 3: Cost and Management Accounting Questions Material CostДокумент31 страницаPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuОценок пока нет

- Suggested Answer CAP II June 2018Документ128 страницSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- Account Past Questions Compilation (2009june - 2020 Dec.)Документ246 страницAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- 13 17227rtp Ipcc Nov09 Paper3aДокумент24 страницы13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyОценок пока нет

- Bos 28432 CP 14Документ53 страницыBos 28432 CP 14Basant Ojha100% (1)

- Activity Based CostingДокумент26 страницActivity Based CostingVishal BabuОценок пока нет

- Home Work Section Working CapitalДокумент10 страницHome Work Section Working CapitalSaloni AgrawalОценок пока нет

- 11 AmalgmationДокумент38 страниц11 AmalgmationPranaya Agrawal100% (1)

- 02 Financing Decisions - Leverages - Practice SheetДокумент22 страницы02 Financing Decisions - Leverages - Practice SheetPatrick LoboОценок пока нет

- Unit - 4: Amalgamation and ReconstructionДокумент54 страницыUnit - 4: Amalgamation and ReconstructionAzad AboobackerОценок пока нет

- 3246accounting - CA IPCCДокумент116 страниц3246accounting - CA IPCCPrashant Pandey100% (1)

- Cost Sheet PreparationДокумент25 страницCost Sheet PreparationShiva AP100% (2)

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFДокумент28 страницCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NОценок пока нет

- 19732ipcc CA Vol2 Cp3Документ43 страницы19732ipcc CA Vol2 Cp3PALADUGU MOUNIKAОценок пока нет

- Study Note 4.4 Page (264-289)Документ26 страницStudy Note 4.4 Page (264-289)s4sahith75% (24)

- 6.46 Accounting - Advanced Partnership AccountsДокумент28 страниц6.46 Accounting - Advanced Partnership AccountsDivakara ReddyОценок пока нет

- Partnership PDFДокумент28 страницPartnership PDFBasant OjhaОценок пока нет

- Chapter 4: LeverageДокумент15 страницChapter 4: LeverageSushant MaskeyОценок пока нет

- Operating CostingДокумент34 страницыOperating Costinganon_672065362Оценок пока нет

- CH 16Документ4 страницыCH 16Riya Desai100% (5)

- DepartmentalДокумент17 страницDepartmentalPapiya DeyОценок пока нет

- Cost Acc Nov06Документ27 страницCost Acc Nov06api-3825774Оценок пока нет

- Over Heads Additional Sums PDFДокумент40 страницOver Heads Additional Sums PDFShiva AP100% (1)

- Chapter 9 Accounting For Branches Including Foreign Branches PMДокумент48 страницChapter 9 Accounting For Branches Including Foreign Branches PMviji88mba60% (5)

- MAKE and BUY DECISIONДокумент14 страницMAKE and BUY DECISIONAkriti Prasad50% (2)

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearДокумент6 страницReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoОценок пока нет

- Coc Departmental Accounting Ca/Cma Santosh KumarДокумент11 страницCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaОценок пока нет

- Capital Gains IllustrationДокумент15 страницCapital Gains IllustrationSarvar PathanОценок пока нет

- Paper 1 Advanced AccountingДокумент576 страницPaper 1 Advanced AccountingExcel Champ60% (5)

- 47 Branch AccountsДокумент53 страницы47 Branch AccountsShivaram Krishnan70% (10)

- 18 Chapter4 Unit 1 2 Hire Purchase and Instalment PaymentДокумент17 страниц18 Chapter4 Unit 1 2 Hire Purchase and Instalment Paymentnarasimha_gudiОценок пока нет

- 7948final Adv Acc Nov05Документ16 страниц7948final Adv Acc Nov05Kushan MistryОценок пока нет

- Cost Sheet - Pages 16Документ16 страницCost Sheet - Pages 16omikron omОценок пока нет

- Chapter 12 Service CostingДокумент3 страницыChapter 12 Service CostingMS Raju100% (1)

- 616806cf0cf2b988fbcdbd97 OriginalДокумент20 страниц616806cf0cf2b988fbcdbd97 OriginalTM GamingОценок пока нет

- Accounting Redemption of Debentures 1642416359Документ19 страницAccounting Redemption of Debentures 1642416359Shashank SikarwarОценок пока нет

- Bv2018 Revised Conceptual FrameworkДокумент18 страницBv2018 Revised Conceptual FrameworkTeneswari RadhaОценок пока нет

- 9 Bonus & Right IssueДокумент9 страниц9 Bonus & Right Issueanilrj14pc8635jprОценок пока нет

- 9 Bonus and Right IssueДокумент4 страницы9 Bonus and Right IssueRohith KumarОценок пока нет

- Terms ConditionsДокумент2 страницыTerms Conditionsnikhil diwanОценок пока нет

- DetailДокумент4 страницыDetailnikhil diwanОценок пока нет

- NameofwholesaleAgentsnew PDFДокумент112 страницNameofwholesaleAgentsnew PDFankit singhviОценок пока нет

- WWW SlidДокумент1 страницаWWW Slidnikhil diwanОценок пока нет

- Multicultural Management: Presented By: Yogesh Narang Vanshit Yadav Karan Singh Nikhil Devyank RastogiДокумент19 страницMulticultural Management: Presented By: Yogesh Narang Vanshit Yadav Karan Singh Nikhil Devyank Rastoginikhil diwan0% (1)

- CRM Challenges: Defining Objectives & ProcessesДокумент7 страницCRM Challenges: Defining Objectives & Processesnikhil diwanОценок пока нет

- CG and Other StakeholdersДокумент13 страницCG and Other StakeholdersFrandy KarundengОценок пока нет

- 47 Iii 2Документ2 страницы47 Iii 2Vaalu MuthuОценок пока нет

- Angelica Alexis Allorde - As#1-SFPДокумент2 страницыAngelica Alexis Allorde - As#1-SFPangelica alexis allordeОценок пока нет

- B067L094 Pascua Hans Racel CloresДокумент1 страницаB067L094 Pascua Hans Racel CloresArcel JingОценок пока нет

- Accuride Wheel End Solution BrakeДокумент56 страницAccuride Wheel End Solution Brakehebert perezОценок пока нет

- Freezing of subcooled water and entropy changeДокумент3 страницыFreezing of subcooled water and entropy changeAchmad WidiyatmokoОценок пока нет

- Digest of MIAA v. CA (G.R. No. 155650)Документ2 страницыDigest of MIAA v. CA (G.R. No. 155650)Rafael Pangilinan100% (12)

- Rizal's annotations to Morga's 1609 Philippine historyДокумент27 страницRizal's annotations to Morga's 1609 Philippine historyNovelyn Kaye Ramos CalanogaОценок пока нет

- Accounting for Partnerships and ReceivablesДокумент5 страницAccounting for Partnerships and Receivablesmohamed atlamОценок пока нет

- Modified Accrual Accounting: Including The Role of Fund Balances and Budgetary Authority Multiple ChoiceДокумент5 страницModified Accrual Accounting: Including The Role of Fund Balances and Budgetary Authority Multiple ChoiceAbdifatah AbdilahiОценок пока нет

- ACCA Financial Reporting Workbook June 2022Документ864 страницыACCA Financial Reporting Workbook June 2022muhammad iman bin kamarudin100% (2)

- Edward Waters College Stay Woke BriefingДокумент2 страницыEdward Waters College Stay Woke BriefingActionNewsJaxОценок пока нет

- Updated Manual 1 To 18Документ53 страницыUpdated Manual 1 To 18mybestfriendgrewalОценок пока нет

- GLXXMobil Delvac 1 ATF PDFДокумент3 страницыGLXXMobil Delvac 1 ATF PDFLeo SihombingОценок пока нет

- Route 797 & 792Документ6 страницRoute 797 & 792hummbumОценок пока нет

- Diane Leto Controller at Dewey Yaeger Pharmaceutical IndustriesДокумент1 страницаDiane Leto Controller at Dewey Yaeger Pharmaceutical IndustriesM Bilal SaleemОценок пока нет

- Transportation Law ReviewerДокумент34 страницыTransportation Law Reviewerlengjavier100% (1)

- Organic Theory: HL Bolton (Engineering) Co LTD V TJ Graham & Sons LTDДокумент3 страницыOrganic Theory: HL Bolton (Engineering) Co LTD V TJ Graham & Sons LTDKhoo Chin KangОценок пока нет

- Constitution 8 Review Pages For Opt inДокумент16 страницConstitution 8 Review Pages For Opt inChristinaОценок пока нет

- Book Egypt flight reservation under processДокумент2 страницыBook Egypt flight reservation under processmaged wagehОценок пока нет

- Judicial Power and Authority of the Supreme CourtДокумент96 страницJudicial Power and Authority of the Supreme CourtJoVic2020Оценок пока нет

- Ieee-Pc57 12 80-2002Документ4 страницыIeee-Pc57 12 80-2002Dioven A. CadungogОценок пока нет

- Group Reflection Paper On EthicsДокумент4 страницыGroup Reflection Paper On EthicsVan TisbeОценок пока нет

- Bank Victoria International Tbk2019-03-11 - Annual-Report-2012Документ537 страницBank Victoria International Tbk2019-03-11 - Annual-Report-2012sofyanОценок пока нет

- List 2014 Year 1Документ3 страницыList 2014 Year 1VedОценок пока нет

- Matrix - ITA Software by GoogleДокумент1 страницаMatrix - ITA Software by GoogleEddy ErvineОценок пока нет

- CGTMSE PresentationДокумент20 страницCGTMSE Presentationsandippatil03Оценок пока нет

- Amazon NG Photo Ark Book Invoice PDFДокумент1 страницаAmazon NG Photo Ark Book Invoice PDFvivxtractОценок пока нет

- Alexander Hauschild - UNESCO-ENGДокумент18 страницAlexander Hauschild - UNESCO-ENGPurbaningsih Dini SashantiОценок пока нет

- Abu Bakr GumiДокумент9 страницAbu Bakr GumiajismandegarОценок пока нет