Академический Документы

Профессиональный Документы

Культура Документы

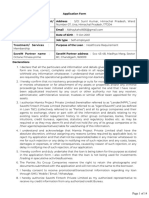

Project On MUDRA Bank

Загружено:

Suman KumariОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Project On MUDRA Bank

Загружено:

Suman KumariАвторское право:

Доступные форматы

The principal objectives of the MUDRA Bank are:

1. Regulate the lender and the borrower of microfinance and bring stability to the microfinance

system through regulation and inclusive participation.

2. Extend finance and credit support to Microfinance Institutions (MFI) and agencies that lend

money to small businesses, retailers, self-help groups and individuals.

3. Register all MFIs and introduce a system of performance rating and accreditation for the first

time. This will help last-mile borrowers of finance to evaluate and approach the MFI that meets

their requirement best and whose past record is most satisfactory. This will also introduce an

element of competitiveness among the MFIs. The ultimate beneficiary will be the borrower.

4. Provide structured guidelines for the borrowers to follow to avoid failure of business or take

corrective steps in time. MUDRA will help in laying down guidelines or acceptable procedures

to be followed by the lenders to recover money in cases of default.

5. Develop the standardised covenants that will form the backbone of the last-mile business in

future.

6. Offer a Credit Guarantee scheme for providing guarantees to loans being offered to micro

businesses.

7. Introduce appropriate technologies to assist in the process of efficient lending, borrowing and

monitoring of distributed capital.

8. Build a suitable framework under the Pradhan Mantri MUDRA Yojana for developing an

efficient last-mile credit delivery system to small and micro businesses.

Major Product Offerings

MUDRA Bank has rightly classified the borrowers into three segments: the

starters, the mid-stage finance seekers and the next level growth seekers.

To address the three segments, MUDRA Bank has launched three Mudra loan

instruments:

1. Shishu: covers loans upto Rs 50,000/-

2. Kishor: covers loans above Rs 50,000/- and upto Rs 5 lakh

3. Tarun: covers loans above Rs 5 lakh and upto Rs 10 lakh

Initially, sector-specific schemes will be confined to “Land Transport,

Community, Social & Personal Services, Food Product and Textile Product

sectors”. Over a period of time, new schemes will be launched to encompass

more sectors.

MUDRA operates as a refinancing institution through State/Regional level

intermediaries. It refinances NBFCs/MFIs and also banks, primary lending

institutions etc.

Some of the Offerings Planned for the Future:

1. MUDRA Card

2. Portfolio Credit Guarantee

3. Credit Enhancement

Mudra Loan Mela

The government is organising MUDRA loan melas in different parts of the

country. These melas are organised for few days where loans for small business

funding could be applied. In the melas, loans are granted ranging from Rs.

50,000 to Rs. 10 lakh.

To know more about the process of loan you can contact the Nodal officer of

your area. http://www.mudra.org.in/Nodal-Officers-MUDRA.pdf

Can MUDRA Really Be a Game Changer for India?

Yes it can. See the existing demographics. Majority of Indians are poor and live

in rural and interior parts of India. Most are excluded from getting facilities that

would be termed very basic, even by Indian standards.

Most people do not have access to farmland and in the absence of jobs, are left

to their own creativity to feed themselves and survive. They figure out ways to

do odd jobs in exchange of money or barter their services. Most of these people

belong to scheduled castes, scheduled tribes and other backward classes. It is to

be noted that most of the micro enterprises, retail or trading activity, are

initiated and controlled by women, with no exposure to education, formal

training or access to any form of banking support.

Now visualise this. If India could harness this free spirit of enterprise and offer

some guidance, support, training and financial assistance, the potential to get an

immediate jump in GDP is there for the asking. Narendra Modi recognises this

and was clear of the potential of this low-hanging fruit.

If MUDRA can continue to retain focus on the underprivileged and extend its

reach to the interiors, it can well emerge as a bigger success story than what

Grameen Bank of Bangladesh ever was or will be.

There is an old saying that goes like this: “Give a man a fish you feed him for a

day, teach him how to fish and he will never go hungry”. MUDRA Bank is a

step by the government that can be a game changer in giving birth to a new set

of entrepreneurs, some of whom may scale heights not imagined today. This is

far better than giving subsidy, which may seem welcoming at first, but does

little to help an individual strive for a better life. MUDRA is the way to go.

The modalities of functioning of MUDRA Bank are in place and it has been

decided that the funding activity will be carried out by microfinance institutions.

However, the small businesses have to wait to get full information on Mudra

Bank and have a clarity on who all are eligible for MUDRA loans and how to

get the benefits of this scheme.

Вам также может понравиться

- TATA INSTITUTE OF SOCIAL SCIENCES, MUMBAI LABOUR AND TECHNOLOGY IN A GLOBALISED WORLD MUDRA ASSIGNMENTДокумент6 страницTATA INSTITUTE OF SOCIAL SCIENCES, MUMBAI LABOUR AND TECHNOLOGY IN A GLOBALISED WORLD MUDRA ASSIGNMENTpande_dishaОценок пока нет

- Govt. Schemes and Recent Happening in StatesДокумент36 страницGovt. Schemes and Recent Happening in StatesJagannath JagguОценок пока нет

- Introduction To Mudra LoanДокумент18 страницIntroduction To Mudra Loankushal ghatoriyaОценок пока нет

- MUDRA BANK YOJANA - MICRO UNITS DEVELOPMENT AND REFINANCE AGENCYДокумент3 страницыMUDRA BANK YOJANA - MICRO UNITS DEVELOPMENT AND REFINANCE AGENCYkrithikОценок пока нет

- What Is MUDRA?Документ3 страницыWhat Is MUDRA?Ayush AgarwalОценок пока нет

- PRADHANA MANTRI MUDRA YOJANA-grp12Документ22 страницыPRADHANA MANTRI MUDRA YOJANA-grp12Anaswara C AОценок пока нет

- What Is Mudra Bank?Документ3 страницыWhat Is Mudra Bank?ayush gargОценок пока нет

- Microfinance and NgosДокумент8 страницMicrofinance and NgosFarhana MishuОценок пока нет

- 07 - Chapter 1 MudraДокумент16 страниц07 - Chapter 1 Mudrayogesh sharmaОценок пока нет

- CRISIL Ratings India Top 50 MfisДокумент68 страницCRISIL Ratings India Top 50 MfisDavid Raju GollapudiОценок пока нет

- Microfinance ReportДокумент68 страницMicrofinance ReportrohanОценок пока нет

- Mudra Bank LTDДокумент21 страницаMudra Bank LTDYASHASVI SHARMAОценок пока нет

- Micro FinanceДокумент64 страницыMicro Financewarezisgr8Оценок пока нет

- Micro Finance - Keys & Challenges:-A Review Mohit RewariДокумент13 страницMicro Finance - Keys & Challenges:-A Review Mohit Rewarisonia khuranaОценок пока нет

- Chapter 4 Rural Banking and Micro Financing 1Документ16 страницChapter 4 Rural Banking and Micro Financing 1saloniОценок пока нет

- Note On MFIДокумент2 страницыNote On MFIRachna TayalОценок пока нет

- The Functional Microfinance Bank: Strategies for SurvivalОт EverandThe Functional Microfinance Bank: Strategies for SurvivalОценок пока нет

- "Mudra Scheme-A Mission For Banking The Un-Banked": CFA A. Jajoo, Assistant Professor - Jagran Institute of ManagementДокумент7 страниц"Mudra Scheme-A Mission For Banking The Un-Banked": CFA A. Jajoo, Assistant Professor - Jagran Institute of ManagementAnu JajooОценок пока нет

- Micro FinanceДокумент30 страницMicro FinanceSakshi BhaskarОценок пока нет

- 01-An Analysis of Micro Finance in India & Its Impact On Financial InclusionДокумент95 страниц01-An Analysis of Micro Finance in India & Its Impact On Financial InclusionRajesh sharma50% (2)

- Notes - Unit 2Документ10 страницNotes - Unit 2ishita sabooОценок пока нет

- Sustainability of MFI's in India After Y.H.Malegam CommitteeДокумент18 страницSustainability of MFI's in India After Y.H.Malegam CommitteeAnup BmОценок пока нет

- Case Study On MicrofinanceДокумент18 страницCase Study On MicrofinanceTusharika RajpalОценок пока нет

- Power Point Presentation On Principles and Practices of BankingДокумент14 страницPower Point Presentation On Principles and Practices of Bankingdnes03 baishyaОценок пока нет

- SMART PUSHNOTE - An Agent Based Intelligent Push Notification System 2017-18Документ60 страницSMART PUSHNOTE - An Agent Based Intelligent Push Notification System 2017-18sachin mohanОценок пока нет

- Project On Micro FinanceДокумент68 страницProject On Micro FinanceKapil RaoОценок пока нет

- Microfinance Institutions in India:Salient Features: Hemant SinghДокумент3 страницыMicrofinance Institutions in India:Salient Features: Hemant Singhbeena antuОценок пока нет

- PM Mudra Loan - How To Take Loan PDFДокумент9 страницPM Mudra Loan - How To Take Loan PDFbhramaniОценок пока нет

- Awareness of MicrofinanceДокумент34 страницыAwareness of MicrofinanceDisha Tiwari100% (1)

- Project On Micro FinanceДокумент44 страницыProject On Micro Financeredrose_luv23o.in@yahoo.co.in88% (8)

- Practical 8: Visit A Bank/financial Institution To Enquire About Various Funding Schemes For Small Scale EnterpriseДокумент4 страницыPractical 8: Visit A Bank/financial Institution To Enquire About Various Funding Schemes For Small Scale Enterprise02 - CM Ankita Adam83% (6)

- Status of Microfinance and Its Delivery Models in IndiaДокумент13 страницStatus of Microfinance and Its Delivery Models in IndiaSiva Sankari100% (1)

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Документ63 страницыA Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Rohit KumarОценок пока нет

- EDP Pr-11 (CM6I - 92 Ankita Adam)Документ4 страницыEDP Pr-11 (CM6I - 92 Ankita Adam)02 - CM Ankita AdamОценок пока нет

- A Study of The Performance of Microfinance Institutions in India in Present Era - A Tool For Poverty AlleviationДокумент10 страницA Study of The Performance of Microfinance Institutions in India in Present Era - A Tool For Poverty AlleviationjyotivermaОценок пока нет

- Assignment No 6Документ4 страницыAssignment No 61346 EE Omkar PrasadОценок пока нет

- Banking and Microfinance - IIДокумент24 страницыBanking and Microfinance - IIKoyelОценок пока нет

- Group 9 - EE - Role of Microfinance - CompressedДокумент31 страницаGroup 9 - EE - Role of Microfinance - CompressedSwati PorwalОценок пока нет

- Operation, Issues and Challenges of Microfinance in India: R.C.Nagaraju, V.RameshreddyДокумент4 страницыOperation, Issues and Challenges of Microfinance in India: R.C.Nagaraju, V.RameshreddypavithragowthamnsОценок пока нет

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Документ55 страницA Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Rohit KumarОценок пока нет

- A Study and Review of Pradhan Mantri Mudra Yojana: April 2022Документ8 страницA Study and Review of Pradhan Mantri Mudra Yojana: April 2022Aditya SharmaОценок пока нет

- How Micro-Loans Help Small Businesses in the PhilippinesДокумент10 страницHow Micro-Loans Help Small Businesses in the PhilippinesTrixie Ros VillerozОценок пока нет

- Mudra YojnaДокумент5 страницMudra YojnaastikdubeyОценок пока нет

- Micro Finance Unit 3 FullДокумент7 страницMicro Finance Unit 3 Fulljaharlal MarathiОценок пока нет

- Everything You Need to Know About Mudra LoansДокумент8 страницEverything You Need to Know About Mudra LoansVELAYUTHAM95Оценок пока нет

- Edited MicrofinanceДокумент59 страницEdited Microfinancedarthvader005Оценок пока нет

- Self Help Groups in Mysore City Financed by Cauvery Kalpatharu Grameena BankДокумент130 страницSelf Help Groups in Mysore City Financed by Cauvery Kalpatharu Grameena BankYogi AnandОценок пока нет

- Annapurna ReportДокумент31 страницаAnnapurna ReportPritish KumarОценок пока нет

- How Microfinance Can Change LivesДокумент101 страницаHow Microfinance Can Change LivesManavAgarwalОценок пока нет

- Microfinance in India: Nidhi Bothra Vinod Kothari & CompanyДокумент4 страницыMicrofinance in India: Nidhi Bothra Vinod Kothari & CompanyNidhi BothraОценок пока нет

- Chapter - 1Документ53 страницыChapter - 1Divya RatnagiriОценок пока нет

- Mudra Loan Salient Features in EnglishДокумент2 страницыMudra Loan Salient Features in EnglishYogish KumbleОценок пока нет

- A STUDY ON THE IMPACT OF MICROFINANCEДокумент90 страницA STUDY ON THE IMPACT OF MICROFINANCESurinder Pal Singh0% (1)

- Microfinance 140113043356 Phpapp01Документ40 страницMicrofinance 140113043356 Phpapp01karanjangid17Оценок пока нет

- Microfinance in India ProjectДокумент59 страницMicrofinance in India ProjectApurva Bangera100% (1)

- Subhekhya Finance CoДокумент6 страницSubhekhya Finance CoJeetendra TripathyОценок пока нет

- A Study On Micro Finance Manpreet MbaДокумент79 страницA Study On Micro Finance Manpreet MbakaurmanОценок пока нет

- Micro Finance Research Paper....Документ14 страницMicro Finance Research Paper....Anand ChaudharyОценок пока нет

- Entrepreneur's Handbook: Establishing a Successful Money Broker BusinessОт EverandEntrepreneur's Handbook: Establishing a Successful Money Broker BusinessОценок пока нет

- Banking India: Accepting Deposits for the Purpose of LendingОт EverandBanking India: Accepting Deposits for the Purpose of LendingОценок пока нет

- Axis Bank Mutual FUndДокумент76 страницAxis Bank Mutual FUndSuman KumariОценок пока нет

- UTI Mutual FundДокумент77 страницUTI Mutual FundSuman KumariОценок пока нет

- Gramin Bank Rular BankingДокумент66 страницGramin Bank Rular BankingSuman KumariОценок пока нет

- PHP 5 Introduction: What You Should Already KnowДокумент194 страницыPHP 5 Introduction: What You Should Already KnowSuman KumariОценок пока нет

- A Project On Comparative Analysis of HDFC Mutual Fund With Other Mutual Funds in The City of Jamshedpur by Gopal Kumar Agarwal, CuttackДокумент80 страницA Project On Comparative Analysis of HDFC Mutual Fund With Other Mutual Funds in The City of Jamshedpur by Gopal Kumar Agarwal, Cuttackgopalagarwal238791% (23)

- DatastructureДокумент132 страницыDatastructureSuman KumariОценок пока нет

- 4aef PDFДокумент87 страниц4aef PDFViraj VoraОценок пока нет

- Internet Banking System OverviewДокумент51 страницаInternet Banking System OverviewSuman KumariОценок пока нет

- Final SIP - SBI - BANKДокумент65 страницFinal SIP - SBI - BANKSuman KumariОценок пока нет

- Project On MUDRA BankДокумент3 страницыProject On MUDRA BankSuman KumariОценок пока нет

- Coal CompositionДокумент12 страницCoal CompositionSuman KumariОценок пока нет

- Structure of A InstituteДокумент5 страницStructure of A InstituteSuman KumariОценок пока нет

- Features and Types of Computerized Accounting SystemsДокумент12 страницFeatures and Types of Computerized Accounting SystemsSuman KumariОценок пока нет

- A Study On Financial Performance of LifeДокумент4 страницыA Study On Financial Performance of LifeSuman KumariОценок пока нет

- Features and Types of Computerized Accounting SystemsДокумент12 страницFeatures and Types of Computerized Accounting SystemsSuman KumariОценок пока нет

- Constructor & DestructorДокумент2 страницыConstructor & DestructorSuman KumariОценок пока нет

- What Is HTMLДокумент66 страницWhat Is HTMLSuman KumariОценок пока нет

- CSSДокумент264 страницыCSSSuman KumariОценок пока нет

- CSSДокумент264 страницыCSSSuman KumariОценок пока нет

- What Is The Global WarmingДокумент1 страницаWhat Is The Global WarmingSuman KumariОценок пока нет

- PHP 5 Introduction: What You Should Already KnowДокумент194 страницыPHP 5 Introduction: What You Should Already KnowSuman KumariОценок пока нет

- Causes N EffectДокумент1 страницаCauses N EffectSuman KumariОценок пока нет

- Mergers & Acquisitions Due Diligence Executive SummaryДокумент6 страницMergers & Acquisitions Due Diligence Executive SummaryAndrew GallardoОценок пока нет

- Banking Offences ActДокумент6 страницBanking Offences ActAnjit Singh100% (1)

- Farhan ReportДокумент73 страницыFarhan ReportFurkan BelimОценок пока нет

- Petition For Extra Judicial Foreclosure of Real Estate Mortgage Under Act 3135 As AmendedДокумент2 страницыPetition For Extra Judicial Foreclosure of Real Estate Mortgage Under Act 3135 As AmendedaL_2k100% (7)

- Debt Reduction Calculator - 20CRДокумент7 страницDebt Reduction Calculator - 20CRSuhailОценок пока нет

- India's Auto Finance Industry GrowthДокумент7 страницIndia's Auto Finance Industry GrowthVikram KharviОценок пока нет

- CFR 2012 Title24 Vol5 Sec3500 21Документ4 страницыCFR 2012 Title24 Vol5 Sec3500 21Brandace HopperОценок пока нет

- CHR Report - 28 August 2023Документ12 страницCHR Report - 28 August 2023Alok G ShindeОценок пока нет

- Chore CommitteeДокумент4 страницыChore CommitteeSumit Koundal100% (1)

- Sample Questions For 96th BPE With AnswerДокумент41 страницаSample Questions For 96th BPE With AnswerAshfia ZamanОценок пока нет

- Access Bank Creative Sector LoanДокумент9 страницAccess Bank Creative Sector LoanPelumi AdewoyinОценок пока нет

- CREW: Department of Education: Regarding For-Profit Education: 12/3/10 - 10-01704-FДокумент163 страницыCREW: Department of Education: Regarding For-Profit Education: 12/3/10 - 10-01704-FCREWОценок пока нет

- Livelihoods ReportДокумент40 страницLivelihoods ReportNatalia WaratОценок пока нет

- What Is A Debt RatioДокумент11 страницWhat Is A Debt RatioshreyaОценок пока нет

- Chapter 6 Review QuestionsДокумент3 страницыChapter 6 Review Questionsapi-242667057100% (1)

- Tools Used by Banking Industry For Risk Measure MenДокумент9 страницTools Used by Banking Industry For Risk Measure Meninformatic1988Оценок пока нет

- Tobin, J. (1987) Financial IntermediariesДокумент14 страницTobin, J. (1987) Financial IntermediariesClaudia PalaciosОценок пока нет

- IFRS 9 - Impairment - Provision Matrix - Practical GuideДокумент20 страницIFRS 9 - Impairment - Provision Matrix - Practical GuideAbdallah Abdul JalilОценок пока нет

- Sanford H. Wallins, C.P.A. 2740 Evergreen Way, Cooper City, FLДокумент2 страницыSanford H. Wallins, C.P.A. 2740 Evergreen Way, Cooper City, FLswallinsОценок пока нет

- WINGS Business Skills Training ManualДокумент26 страницWINGS Business Skills Training ManualMohamedBenYedderОценок пока нет

- Chart of AccountsДокумент1 страницаChart of AccountsEfrelyn Grethel Baraya AlejandroОценок пока нет

- Resume-Murad 2021Документ2 страницыResume-Murad 2021aliz kОценок пока нет

- SAVEINSTPL-3249953316714 001 SignedДокумент14 страницSAVEINSTPL-3249953316714 001 SignedAbhayОценок пока нет

- Working CapitalДокумент7 страницWorking CapitalSreenath SreeОценок пока нет

- Credit Risk Modeling in Python Chapter1Документ27 страницCredit Risk Modeling in Python Chapter1FgpeqwОценок пока нет

- Ebook Ebook PDF Short Term Financial Management Fifth Edition PDFДокумент41 страницаEbook Ebook PDF Short Term Financial Management Fifth Edition PDFlaura.gray126100% (38)

- Loan Guidelines Us BankДокумент12 страницLoan Guidelines Us BankcraigscОценок пока нет

- Financial Markets GuideДокумент59 страницFinancial Markets GuideRaezel Louise VelayoОценок пока нет

- ITL TutorialДокумент14 страницITL TutorialSadhvi SinghОценок пока нет

- Thesis On Cooperative BanksДокумент8 страницThesis On Cooperative Bankscristinafranklinnewark100% (2)