Академический Документы

Профессиональный Документы

Культура Документы

Zero Based Budgeting Meaning and Definition

Загружено:

Rohan0 оценок0% нашли этот документ полезным (0 голосов)

272 просмотров3 страницыZero base budgeting

Оригинальное название

Zero Base Budgeting

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документZero base budgeting

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

272 просмотров3 страницыZero Based Budgeting Meaning and Definition

Загружено:

RohanZero base budgeting

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

Zero Based Budgeting Meaning and Definition

Zero based budgeting in management accounting involves preparing the budget

from the scratch with a zero-base. It involves re-evaluating every line item of

cash flow statement and justifying all the expenditure that is to be incurred by

the department.

Thus, zero-based budgeting definition goes as a method of budgeting whereby

all the expenses for the new period are calculated on the basis of actual

expenses that are to be incurred and not on the differential basis which involves

just changing the expenses incurred taking into account change in operational

activity. Under this method, every activity needs to be justified, explaining the

revenue that every cost will generate for the company.

Contrary to the traditional budgeting in which past trends or past

sales/expenditure are expected to continue, zero-based budgeting assumes that

there are no balances to be carried forward or there are no expenses that are

pre-committed. In the literal sense, it is a method for building the budget with

zero prior bases. Zero-based budgeting lays emphasis on identifying a task and

then funding these expenses irrespective of the current expenditure structure.

Zero Based Budgeting Steps

1) Identification of a task

2) Finding ways and means of accomplishing the task

3) Evaluating these solutions and also evaluating alternatives of sources of funds

4) Setting the budgeted numbers and priorities

To understand the Steps in Zero Based Budgeting, an example is given below to

understand how it works.

Zero Based Budgeting Example

Let us take an example of a manufacturing department of a company ABC that

spent $ 10 million last year. The problem is to budget the expenditure for the

current year. There are multiple ways of doing so:

1. The board of directors of the company decides to increase/decrease the

expenditure of the department by 10 percent. So the manufacturing

department of ABC Ltd will get $ 11 million or $ 9 million depending on the

management’s decision.

2. The senior management of the company may decide to give the department the

same amount as it got in the previous year without hiring more people in the

department, or increasing the production etc. This way, the department ends

up getting $ 10 million.

3. Another way is, as, against the traditional method, management may use zero-

based budgeting in which the previous year’s number of $ 10 million is not used

for calculation. Zero-based budgeting application involves calculating all the

expenses of the department and justifying each of these. This reflects the actual

requirement of the manufacturing department of company ABC which may be

$ 10.6 million.

Zero Based Budgeting Advantages

1. Accuracy: Against the regular methods of budgeting that involve just making

some arbitrary changes to the previous year’s budget, zero-based budgeting

makes every department relook each and every item of the cash flow and

compute their operation costs. This to some extent helps in cost reduction as it

gives a clear picture of costs against the desired performance.

2. Efficiency: This helps in efficient allocation of resources (department-wise) as it

does not look at the historical numbers but looks at the actual numbers

3. Reduction in redundant activities: It leads to the identification of opportunities

and more cost-effective ways of doing things by removing all the unproductive

or redundant activities.

4. Budget inflation: Since every line item is to be justified, zero-based budget

overcomes the weakness of incremental budgeting of budget inflation.

5. Coordination and Communication: It also improves coordination and

communication within the department and motivates employees by involving

them in decision-making.

Although zero-based budgeting merits make it look like a lucrative method, it is

important to know the disadvantages listed as under:

Zero Based Budgeting Disadvantages

1. Time-Consuming: Zero-based budgeting is a very time-intensive exercise for a

company or a government-funded entities to do every year as against

incremental budgeting, which is a far easier method.

2. High Manpower Requirement: Making an entire budget from the scratch may

require the involvement of a large number of employees. Many departments

may not have an adequate time and human resource for the same.

3. Lack of Expertise: Explaining every line item and every cost is a difficult task and

requires training the managers.

Conclusion: Zero-based budgeting aims at reflecting true expenses to be

incurred by a department or a state [in the case of budget making by the

government]. Although time-consuming, this is a more appropriate way of

budgeting. At the end of the day, it is a company’s call as whether it wants to

invest time and manpower in the budgeting exercise to provide more accurate

numbers or go for an easier method of incremental budgeting.

Вам также может понравиться

- The Skylane Pilot's CompanionДокумент221 страницаThe Skylane Pilot's CompanionItayefrat100% (6)

- Review Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Документ11 страницReview Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Ulaş GüllenoğluОценок пока нет

- A Critical Analysis of Twitter Inc. Sense of MissionДокумент11 страницA Critical Analysis of Twitter Inc. Sense of MissionMark Johnson100% (1)

- Coca Cola Final ProjectДокумент63 страницыCoca Cola Final ProjectanuuuuuzОценок пока нет

- State of The Internal Audit Profession in Africa PDFДокумент100 страницState of The Internal Audit Profession in Africa PDFSEGEBUОценок пока нет

- Action PlanningДокумент51 страницаAction PlanningShazma Khan100% (1)

- Resources AllocationДокумент7 страницResources AllocationAiAlleineОценок пока нет

- Zero Based BudgetingДокумент10 страницZero Based BudgetingYu-zap Mpesa OcampoОценок пока нет

- Rajasekhara Dasa - Guide To VrindavanaДокумент35 страницRajasekhara Dasa - Guide To VrindavanaDharani DharendraОценок пока нет

- Durst Caldera: Application GuideДокумент70 страницDurst Caldera: Application GuideClaudio BasconiОценок пока нет

- Herzberg's TheoryДокумент5 страницHerzberg's TheoryShashwat PathakОценок пока нет

- Participatory Governance in South AfricaДокумент12 страницParticipatory Governance in South AfricaThato50% (2)

- Special Issues in Public Personnel Management (PA-813) : by Commo Armando S. Rodriguez Afp (Ret), LLB, Mnsa, PH.DДокумент55 страницSpecial Issues in Public Personnel Management (PA-813) : by Commo Armando S. Rodriguez Afp (Ret), LLB, Mnsa, PH.DDanteArinez100% (1)

- Public Sector EnterprisesДокумент28 страницPublic Sector EnterprisesAnkita TyagiОценок пока нет

- Ngo Accountability PaperДокумент16 страницNgo Accountability Paperdrmsola9803Оценок пока нет

- Turabian Format Guidelines SheetДокумент1 страницаTurabian Format Guidelines Sheetapi-164301844Оценок пока нет

- What Is Economic DevelopmentДокумент2 страницыWhat Is Economic DevelopmentNna Yd UJОценок пока нет

- ARTA A Decade of Improving Public Service DeliveryДокумент95 страницARTA A Decade of Improving Public Service Deliverycalapan cityОценок пока нет

- Participatory Budgeting: Introduction and Case StudyДокумент33 страницыParticipatory Budgeting: Introduction and Case StudyGeorge Cristinel RotaruОценок пока нет

- ADB-SC Professional Public ProcurementДокумент37 страницADB-SC Professional Public ProcurementButch D. de la CruzОценок пока нет

- Theory of Change For Vrije Universiteit BrusselДокумент4 страницыTheory of Change For Vrije Universiteit BrusselTeachers Without BordersОценок пока нет

- 2019-20 Cmprehensive Exam Question Pool - 0 - 0Документ7 страниц2019-20 Cmprehensive Exam Question Pool - 0 - 0sheng cruzОценок пока нет

- Decision Making Processes For Effective Policy ImplementationДокумент12 страницDecision Making Processes For Effective Policy ImplementationjazzskyblueОценок пока нет

- Public Administration Meaning, NatureДокумент6 страницPublic Administration Meaning, NatureSammar EllahiОценок пока нет

- Zambia DebtДокумент74 страницыZambia DebtOxfam100% (1)

- What Are The Main Characteristics of Good GovernanceДокумент1 страницаWhat Are The Main Characteristics of Good GovernanceRSОценок пока нет

- Importance of StatisticsДокумент6 страницImportance of StatisticsTritoyОценок пока нет

- Bringing Budgets Alive - Participatory BudgetingДокумент39 страницBringing Budgets Alive - Participatory BudgetingBlackpool Community News at ScribdОценок пока нет

- Pa 1 ReviewerДокумент13 страницPa 1 Reviewershany davidОценок пока нет

- Syllabus - Conflict Analysis and Resolution F14-SIS-609-FisherДокумент12 страницSyllabus - Conflict Analysis and Resolution F14-SIS-609-FisherAnonymous Ume5MkWHK2100% (1)

- Treasury Management and ControlДокумент21 страницаTreasury Management and ControlSamrin RaufОценок пока нет

- Growth of Merit System in The PhilippinesДокумент10 страницGrowth of Merit System in The PhilippinesMelvin GarciaОценок пока нет

- Process of Public Policy Formulation in Developing CountriesДокумент12 страницProcess of Public Policy Formulation in Developing CountriesZakaria RahhilОценок пока нет

- Describe The Difference Your Work Makes: Build Your Framework For Evaluation (Blair 2013)Документ49 страницDescribe The Difference Your Work Makes: Build Your Framework For Evaluation (Blair 2013)NCVOОценок пока нет

- Policy Science - 06 - Chapter 1 - ShodhGangaДокумент34 страницыPolicy Science - 06 - Chapter 1 - ShodhGangaAnonymous j8laZF8Оценок пока нет

- State of Philippine Co-Operatives: Current Analysis: 1950 - 1970s: Three Decades of Self-AwarenessДокумент5 страницState of Philippine Co-Operatives: Current Analysis: 1950 - 1970s: Three Decades of Self-AwarenessromyvilОценок пока нет

- The Impact of Bureaucracy On Public Service Delivery-Kumasi Metropolitan AssemblyДокумент104 страницыThe Impact of Bureaucracy On Public Service Delivery-Kumasi Metropolitan AssemblyBMX2013100% (1)

- 0452 w03 QP 1Документ11 страниц0452 w03 QP 1MahmozОценок пока нет

- Speech About Women in PoliticsДокумент1 страницаSpeech About Women in PoliticsdevmountОценок пока нет

- Corporate Governance GuidelinesДокумент8 страницCorporate Governance GuidelinesAndreea VladОценок пока нет

- Development AdministrationДокумент4 страницыDevelopment AdministrationAngeliePidoMaungaОценок пока нет

- The Effective Use of VolunteersДокумент28 страницThe Effective Use of VolunteersInactiveAccountОценок пока нет

- Organizational AnalysisДокумент7 страницOrganizational AnalysisNursePearsonОценок пока нет

- Zero Based BudgetingДокумент7 страницZero Based Budgetingdivya dharmarajan0% (1)

- Public Versus Private AdministrationДокумент3 страницыPublic Versus Private AdministrationAnonymous T5v5yESz0Оценок пока нет

- Advantages of The Implementation of IPSASДокумент3 страницыAdvantages of The Implementation of IPSASShilpa KumarОценок пока нет

- Components of PFM SystemДокумент8 страницComponents of PFM SystemSsali Maria0% (1)

- Youth Entrepreneurship Final PresentationДокумент74 страницыYouth Entrepreneurship Final PresentationrajeevdudiОценок пока нет

- Policy CycleДокумент3 страницыPolicy CycleMd. Jasim UddinОценок пока нет

- Past Paper QuestionsДокумент4 страницыPast Paper QuestionsAmy 786Оценок пока нет

- Behavior LeadershipДокумент85 страницBehavior LeadershipYaszhmint DeynОценок пока нет

- Your Questions Answered: Top Questions About Working From HomeОт EverandYour Questions Answered: Top Questions About Working From HomeОценок пока нет

- Public Policy Formulation ProcessДокумент4 страницыPublic Policy Formulation ProcessAnshu0% (1)

- Performance Budgeting - Module 5Документ25 страницPerformance Budgeting - Module 5bermazerОценок пока нет

- Zero Based BudgetingДокумент16 страницZero Based BudgetingDОценок пока нет

- PBE PII Steve Fong - Apr12Документ4 страницыPBE PII Steve Fong - Apr12Song SongОценок пока нет

- AlantaДокумент3 страницыAlantarajkumarkalimuthu27Оценок пока нет

- BAF3105-Performance Measurement and ControlДокумент11 страницBAF3105-Performance Measurement and ControlJEFF SHIKALIОценок пока нет

- Zero Base BudgetingДокумент11 страницZero Base BudgetingRicha SachanОценок пока нет

- Cost Accountancy Continuous Assessment Semester 4Документ15 страницCost Accountancy Continuous Assessment Semester 4Jim BurgessОценок пока нет

- Incremental Budgeting: Session 2 Types of Budgets & Usages of The Budgetary SystemДокумент3 страницыIncremental Budgeting: Session 2 Types of Budgets & Usages of The Budgetary SystemSyed Attique KazmiОценок пока нет

- Zero Based BudgetingДокумент10 страницZero Based Budgetingmisbah mohamedОценок пока нет

- Master BudgetДокумент4 страницыMaster BudgetFawad Khan Waseem0% (1)

- 059 Night of The Werewolf PDFДокумент172 страницы059 Night of The Werewolf PDFomar omar100% (1)

- Approach To A Case of ScoliosisДокумент54 страницыApproach To A Case of ScoliosisJocuri KosoОценок пока нет

- 4Q 4 Embedded SystemsДокумент3 страницы4Q 4 Embedded SystemsJoyce HechanovaОценок пока нет

- KV3000 Programming TutorialДокумент42 страницыKV3000 Programming TutorialanthonyОценок пока нет

- Ikramul (Electrical)Документ3 страницыIkramul (Electrical)Ikramu HaqueОценок пока нет

- Tesmec Catalogue TmeДокумент208 страницTesmec Catalogue TmeDidier solanoОценок пока нет

- Pharmaniaga Paracetamol Tablet: What Is in This LeafletДокумент2 страницыPharmaniaga Paracetamol Tablet: What Is in This LeafletWei HangОценок пока нет

- 30rap 8pd PDFДокумент76 страниц30rap 8pd PDFmaquinagmcОценок пока нет

- Task 1: MonologueДокумент4 страницыTask 1: MonologueLaura Cánovas CabanesОценок пока нет

- August 2023 Asylum ProcessingДокумент14 страницAugust 2023 Asylum ProcessingHenyiali RinconОценок пока нет

- Financial Performance Report General Tyres and Rubber Company-FinalДокумент29 страницFinancial Performance Report General Tyres and Rubber Company-FinalKabeer QureshiОценок пока нет

- Topic 6Документ6 страницTopic 6Conchito Galan Jr IIОценок пока нет

- Catalogue 2021Документ12 страницCatalogue 2021vatsala36743Оценок пока нет

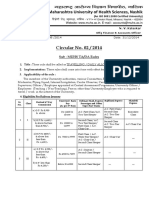

- Circular No 02 2014 TA DA 010115 PDFДокумент10 страницCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- Kumar-2011-In Vitro Plant Propagation A ReviewДокумент13 страницKumar-2011-In Vitro Plant Propagation A ReviewJuanmanuelОценок пока нет

- Damodaram Sanjivayya National Law University VisakhapatnamДокумент6 страницDamodaram Sanjivayya National Law University VisakhapatnamSuvedhya ReddyОценок пока нет

- Meditation For AddictionДокумент2 страницыMeditation For AddictionharryОценок пока нет

- Chemistry InvestigatoryДокумент16 страницChemistry InvestigatoryVedant LadheОценок пока нет

- TrematodesДокумент95 страницTrematodesFarlogy100% (3)

- 44) Year 4 Preposition of TimeДокумент1 страница44) Year 4 Preposition of TimeMUHAMMAD NAIM BIN RAMLI KPM-GuruОценок пока нет

- The Leaders of The NationДокумент3 страницыThe Leaders of The NationMark Dave RodriguezОценок пока нет

- Abnormal PsychologyДокумент4 страницыAbnormal PsychologyTania LodiОценок пока нет

- Land Building and MachineryДокумент26 страницLand Building and MachineryNathalie Getino100% (1)

- Filehost - CIA - Mind Control Techniques - (Ebook 197602 .TXT) (TEC@NZ)Документ52 страницыFilehost - CIA - Mind Control Techniques - (Ebook 197602 .TXT) (TEC@NZ)razvan_9100% (1)

- Weird Tales v14 n03 1929Документ148 страницWeird Tales v14 n03 1929HenryOlivr50% (2)

- For FDPB Posting-RizalДокумент12 страницFor FDPB Posting-RizalMarieta AlejoОценок пока нет