Академический Документы

Профессиональный Документы

Культура Документы

Coca-Cola Co., Economic Profit Calculation

Загружено:

Niomi Golrai0 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров4 страницыddddd

Оригинальное название

Economic-Profit (1) (1)

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документddddd

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров4 страницыCoca-Cola Co., Economic Profit Calculation

Загружено:

Niomi Golraiddddd

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

Coca-Cola Co.

, economic profit calculation

USD $ in millions

12 months ended Dec 31, 2018

Net operating profit after taxes (NOPAT) 6,685

Cost of capital 6.92%

Invested capital 68,598

Economic profit 1,937

Source: Based on data from Coca-Cola Co. Annual Reports

Source: https://www.stock-analysis-on.net

Copyright © 2019 Stock Analysis on Net

Economic profit = NOPAT – Cost of capital × Invested capital

= 6,685 – 6.92% × 68,598 = 1,937

Dec 31, 2017 Dec 31, 2016 Dec 31, 2015 Dec 31, 2014

-18 5,782 7,572 7,253

6.66% 6.62% 6.72% 6.71%

72,598 79,169 77,538 76,173

-4,851 541 2,358 2,139

Yea

Plant 1 Plant 2

r

1 $7,000 ###

2 $12,000 ###

3 $12,000 $7,000

4 $5,000 $5,000

5 $4,000 $4,000

Plant 1

Year 0 1 2 3 4 5 6

II ($30,000)

Positive CF $7,000 $12,000 $12,000 $5,000 $4,000 $2,000

Net CF ($30,000) $7,000 $12,000 $12,000 $5,000 $4,000 $2,000

Discount Rate 0 0.909 0.826 0.751 0.683 0.621 0.54

Present Value ($30,000) $6,363 $9,912 $9,012 $3,415 $2,484 $1,080

Discount Rate = 10%

NPV = $2,266

IRR = 2.80%

Payback Period - Plant 1

0 1 2 3 4 5 6

Cash Flow ($30,000) $7,000 $12,000 $12,000 $5,000 $4,000 $2,000

Cummulative CF ($30,000) ($23,000) ($11,000) $1,000 $6,000 $10,000 $12,000

Plant 2

Year 0 1 2 3 4 5 6

II ($40,000)

Positive CF $22,000 $12,000 $7,000 $5,000 $4,000 $3,000

Net CF ($40,000) $22,000 $12,000 $7,000 $5,000 $4,000 $3,000

Discount Rate 0 0.909 0.826 0.751 0.683 0.621 0.54

Present Value ($40,000) $19,998 $9,912 $5,257 $3,415 $2,484 $1,620

Discount Rate = 10%

NPV = $2,686

IRR = 3.13%

Payback Period - Plant 2

0 1 2 3 4 5 6

Cash Flow ($40,000) $22,000 $12,000 $7,000 $5,000 $4,000 $3,000

Cummulative CF ($40,000) ($18,000) ($6,000) $1,000 $6,000 $10,000 $13,000

Вам также может понравиться

- 6-Astore 20190424 113509Документ3 060 страниц6-Astore 20190424 113509Niomi GolraiОценок пока нет

- Ain20190418028 ModifiedДокумент5 страницAin20190418028 ModifiedNiomi GolraiОценок пока нет

- By Aftab AhmedДокумент5 страницBy Aftab AhmedNiomi GolraiОценок пока нет

- Auditee Feedback Form: Internal Audit DepartmentДокумент2 страницыAuditee Feedback Form: Internal Audit DepartmentNiomi GolraiОценок пока нет

- Auditee Response File Report Mutiple RecommandationДокумент37 страницAuditee Response File Report Mutiple RecommandationNiomi GolraiОценок пока нет

- Financial Reporting WorkingДокумент2 страницыFinancial Reporting WorkingNiomi GolraiОценок пока нет

- For The Period 01-Dec-2018 To 31-Dec-2018: Resource Name Occupancy Month Entity RoleДокумент2 страницыFor The Period 01-Dec-2018 To 31-Dec-2018: Resource Name Occupancy Month Entity RoleNiomi GolraiОценок пока нет

- Closing 317,725: Income StatusДокумент12 страницClosing 317,725: Income StatusNiomi GolraiОценок пока нет

- Total Balance Date Month Type Ref Discription Transaction (Debit/Credit) Transfer To FlexiДокумент17 страницTotal Balance Date Month Type Ref Discription Transaction (Debit/Credit) Transfer To FlexiNiomi GolraiОценок пока нет

- PPTДокумент50 страницPPTNiomi Golrai100% (1)

- PIP Data Homestyles 2018Документ2 страницыPIP Data Homestyles 2018Niomi GolraiОценок пока нет

- Risk Assessment ExcelДокумент9 страницRisk Assessment ExcelNiomi GolraiОценок пока нет

- S.No Reference Transaction Type Status of Pay VENDORS Status of OrderДокумент9 страницS.No Reference Transaction Type Status of Pay VENDORS Status of OrderNiomi GolraiОценок пока нет

- Auditee Feedback Form: Internal Audit DepartmentДокумент2 страницыAuditee Feedback Form: Internal Audit DepartmentNiomi GolraiОценок пока нет

- The Impact of The Internet and Social Media On BusinessesДокумент11 страницThe Impact of The Internet and Social Media On BusinessesNiomi Golrai100% (1)

- ToyotaДокумент10 страницToyotaNiomi GolraiОценок пока нет

- ModifiedДокумент15 страницModifiedNiomi GolraiОценок пока нет

- Coca-Cola Co., NOPAT CalculationДокумент2 страницыCoca-Cola Co., NOPAT CalculationNiomi GolraiОценок пока нет

- By Talha SheikhДокумент18 страницBy Talha SheikhNiomi GolraiОценок пока нет

- Assignment Case in Furniture IndustryДокумент12 страницAssignment Case in Furniture IndustryNiomi GolraiОценок пока нет

- Running Head: Enviromental and Ecological Security 1Документ13 страницRunning Head: Enviromental and Ecological Security 1Niomi GolraiОценок пока нет

- Project PosterДокумент1 страницаProject PosterNiomi GolraiОценок пока нет

- Operational Risk Management in NigerianДокумент73 страницыOperational Risk Management in NigerianNiomi GolraiОценок пока нет

- Threat of Substitutes of Uber in Uae: Name of Student Name of Instructor DateДокумент5 страницThreat of Substitutes of Uber in Uae: Name of Student Name of Instructor DateNiomi GolraiОценок пока нет

- Running Head: History of Uae 1Документ4 страницыRunning Head: History of Uae 1Niomi GolraiОценок пока нет

- Running Head: Organizational Behaviour 1Документ6 страницRunning Head: Organizational Behaviour 1Niomi GolraiОценок пока нет

- Enviromental and Ecological Security: Name of Student Name of Instructor DateДокумент14 страницEnviromental and Ecological Security: Name of Student Name of Instructor DateNiomi GolraiОценок пока нет

- Enviromental and Ecological Security: Name of Student Name of Instructor DateДокумент14 страницEnviromental and Ecological Security: Name of Student Name of Instructor DateNiomi GolraiОценок пока нет

- Running Head: History of Uae 1Документ4 страницыRunning Head: History of Uae 1Niomi GolraiОценок пока нет

- Running Head: Unit I Assessment Question 1 1Документ31 страницаRunning Head: Unit I Assessment Question 1 1Niomi GolraiОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- What Is 17.99 Dollars in Peso - Google Search PDFДокумент1 страницаWhat Is 17.99 Dollars in Peso - Google Search PDFLeizy LautanОценок пока нет

- What Is Additional Paid-In CapitalДокумент12 страницWhat Is Additional Paid-In CapitalblezylОценок пока нет

- Finance T CodeДокумент580 страницFinance T CodeSisir PradhanОценок пока нет

- 2008 TCFA Annual ConferenceДокумент48 страниц2008 TCFA Annual ConferenceaОценок пока нет

- MT 760 Bank InstrumentsДокумент1 страницаMT 760 Bank InstrumentskdelaozОценок пока нет

- Aviva (Pension) H-Av My Future Focus Growth S2Документ4 страницыAviva (Pension) H-Av My Future Focus Growth S2Jason FitchОценок пока нет

- Bachelor'S Degree Programme Term-End Examination December, 2017 Elective Course: Commerce Eco-011: Elements of Income TaxДокумент6 страницBachelor'S Degree Programme Term-End Examination December, 2017 Elective Course: Commerce Eco-011: Elements of Income TaxAnkit KumarОценок пока нет

- February 2022 Bank StatementДокумент4 страницыFebruary 2022 Bank Statementmondol miaОценок пока нет

- Ratio Analysis:-Ratio Analysis Is The Process of Determining andДокумент19 страницRatio Analysis:-Ratio Analysis Is The Process of Determining andSam SmartОценок пока нет

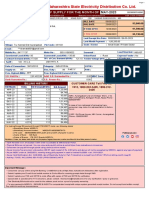

- Bill 670 502039075170 202305Документ5 страницBill 670 502039075170 202305pravin ghatgeОценок пока нет

- What Is The Consolidated Net Income Before Allocation To The Controlling and Noncontrolling Interests?Документ81 страницаWhat Is The Consolidated Net Income Before Allocation To The Controlling and Noncontrolling Interests?Lê Thiên Giang 2KT-19Оценок пока нет

- OpTransactionHistory19 11 2019Документ14 страницOpTransactionHistory19 11 2019maheshОценок пока нет

- CapitaLand Limited SGX C31 Financials Income StatementДокумент3 страницыCapitaLand Limited SGX C31 Financials Income StatementElvin TanОценок пока нет

- Number Go Up - PrologueДокумент5 страницNumber Go Up - PrologueOnPointRadioОценок пока нет

- HW #1 Financial ManagemenrДокумент3 страницыHW #1 Financial ManagemenrHaidie DiazОценок пока нет

- MentahanДокумент2 страницыMentahanNoviyanti 008Оценок пока нет

- Alhaj Textile Mills LTDДокумент22 страницыAlhaj Textile Mills LTDMohammad Sayad ArmanОценок пока нет

- Chapter 8 CaseДокумент3 страницыChapter 8 CaseAbdulrehman0% (1)

- Role of BSPДокумент21 страницаRole of BSPRea RioОценок пока нет

- Financial Analysis of Tesco PLCДокумент7 страницFinancial Analysis of Tesco PLCSyed Toseef Ali100% (1)

- All About Cash: Name: Section: Score: ProblemsДокумент7 страницAll About Cash: Name: Section: Score: ProblemsAira Mae Hernandez CabaОценок пока нет

- Working Capital Project by HILAL AHMADДокумент74 страницыWorking Capital Project by HILAL AHMADLeo SaimОценок пока нет

- Banking and Finance PDFДокумент2 страницыBanking and Finance PDFFaculty of Business and Economics, Monash UniversityОценок пока нет

- Government and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualДокумент30 страницGovernment and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualJessicaHardysrbxd100% (14)

- BR Long-Term Approach To Equity InvestingДокумент2 страницыBR Long-Term Approach To Equity InvestingJordan MorleyОценок пока нет

- WadiahДокумент11 страницWadiahareep94100% (1)

- Unit 3 Money and Budgeting: Ebe 1 Adina Oana NicolaeДокумент15 страницUnit 3 Money and Budgeting: Ebe 1 Adina Oana NicolaedanielaОценок пока нет

- Full Download Ebook PDF Personal Financial Planning 14th Edition PDFДокумент27 страницFull Download Ebook PDF Personal Financial Planning 14th Edition PDFjames.sepulveda805100% (29)

- Ebook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFДокумент67 страницEbook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFjohn.gallardo475100% (24)

- Marketing of Banking ServicesДокумент97 страницMarketing of Banking ServicesAvtaar Singh100% (1)