Академический Документы

Профессиональный Документы

Культура Документы

Carbon Market Report - September 2010

Загружено:

chlscАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Carbon Market Report - September 2010

Загружено:

chlscАвторское право:

Доступные форматы

NEW WORLD CARBON

Carbon Market Report – September 2010

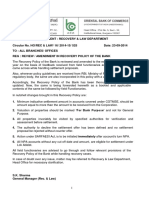

Voluntary Offset Prices

(Source Standard Carbon, ClearSky Carbon Solutions, The Carbon Neutral Company, Native Energy)

NEW WORLD CARBON

Last Sale Price

Agricultural Methane $ 15.00 Over the past year, NEW WORLD CARBON has been monitoring the

emergence of what many financial institutions are considering to be the

Landfill Methane $ 15.15 fastest growing market in the world: The Carbon Market. The market

has been primarily driven by European companies and investors where

Coal Bed Methane $ 15.15 it has grown from just under $10 Billion in 2005 to over $100 Billion in

2009.

Agricultural Soil $ 15.00

While this growth has been dramatic, the market is projected to rise

Renewable Energy $ 14.18 even more dramatically with several large financial institutions such as

Barclay’s Capital projecting the market to eventually reach $2 Trillion by

2020. Barclay’s and other leading institutions such as JP Morgan and

Goldman Sachs attribute these projections to eventual demand by the

Average Offset Price $ 14.89

United States as the nation looks to soon enact pollution controls in the

form of caps on carbon emissions. Other emerging markets such as

Expected Year End Price $ 18.00

China and India are also experimenting with ways to reduce their

carbon emissions with a Cap and Trade system similar to the one

Projected Cap & Trade Price $ 60.00 currently experiencing tremendous success in Europe. China has even

announced that they will begin Carbon trading as early as 2011.

Minimum Expected Return 300 % In this research report, NEW WORLD CARBON assesses the Carbon

Market’s potential as well as the risks involved with investing in this

rapidly growing specialty sector.

History of Carbon Trading

Europe was the world’s first region to warmly embrace the idea of Carbon Trading and currently has the world’s largest Carbon Market, trading upwards of US $100

billion worth of carbon-related trades in 2009, with more than 3 billion carbon spot, future, and options contracts. The European Union Emissions Trading Scheme

(EU ETS) was the first multinational and multi-sector compliance-based emissions trading system in the world. It has been in operations since 2005 and is now in its

second trading period, which ends in 2012 and is poised to be renewed for a third trading period soon.

Under the EU ETS, each member state of the European Union receives an annual emission allocation (CAP). These allocations are then divided among its worse

emissions-producing companies. Those companies are then legally obligated to not exceed the emissions that they are allowed. When a co mpany goes under its

allotted target, it can then sell (TRADE) its excess allowance as a “carbon credit” to other companies that have exceeded their caps. On the other hand, if a company

exceeds its target, it will subsequently have to pay a large penalty and/or then have to purchase carbon credits on the Carbon Markets to make up the difference.

Compared to the EU Carbon Market, The US market is still in its infancy, however it offers the most growth potential. The US voluntary Carbon market traded

nearly $500million in volume in 2009. Although this figure pales in comparison to the $100 Billion traded on the European markets, the number is still impressive

considering that this volume was done on a voluntary basis and not due to compliance or regulatory purposes. The most popular type of voluntary carbon offset

projects last year were those which captured methane (41%), followed by forestry projects (24%) and renewable energy projects (17%). With US President Barack

Obama pledging that the US will achieve a 20% emissions reductions by 2020, there is incredible growth potential in this sector. Barclay’s Capital has even predicted

that once the US implements a Federal “Cap and Trade” system, that the Carbon Market may become the biggest overall market in the world.

Copyright 2010, New World Carbon. All rights reserved. 1

NEW WORLD CARBON

Climate Change

"Warming of the climate system is unequivocal, as is now evident from the observations in global average air and ocean temperatures,

widespread melting of snow and ice, and rising average sea level."

With these words, the UN's Intergovernmental Panel on Climate Change (IPCC) made certain that the reduction of greenhouse gas (GHG)

emissions, which are widely believed to have contributed to global warming will be a policy issue for decades.

Exacerbating the issue is that humans currently generate about 38 Billion Tons of Carbon dioxide (Co2) every year. That number is expected

to nearly double over the next decade as developing nations such as China and India demand more energy that will be produced by

carbon intensive sources of fuel such as coal and oil.

In response to this dilemma, carbon trading markets have become the most popular solution for reducing GHG emissions, and in particular carbon

dioxide emissions, which are the largest constituent of GHG emissions.

Recent Activity/Acquisitions

"Interest in the pre-compliance carbon market in the U.S. is growing rapidly and we are excited to be able to offer our clients immediate access t o a

diverse selection of emission reductions to manage their carbon risk," Leslie Biddle, Global Head of Goldman Sach's commodit y sales

The above quote references Goldman Sachs investment in a US based Carbon Credit Developer named Blue Source in late 2008. According to the press

release, the investment would provide Goldman with over 60 million tons of voluntary emissions reduction carbon credits (VERs). We estimate the price

of the VERs could range anywhere from $10-$20 each ton, thus providing Goldman with anywhere from $600million to over $1 Billion worth of carbon

credits. Once the US establishes a Federal Carbon market, the price appreciation could result in a windfall profit in the tens of billions of dollars.

Goldman is not the only large financial institution betting on the future of the US Carbon Market. Since their investment in 2008, there has been a slew

of acquisition activity in the Carbon Market over the past year as many of the world’s leading companies are scrambling to ga in entry into the market

and establish themselves as the early leaders in this potentially Trillion Dollar industry.

Below are highlights of this activity:

General Electric (GE) invested over $400 million to launch the world’s largest Carbon capture project in Australia (October 2009)

JP Morgan Chase purchased leading UK Carbon Company, EcoSecurities for $200 million (November 2009)

Famed Investor, Warren Buffet purchased leading US rail company, Burlington Northern Santa Fe for $44Billion with intentions of capitalising

on potential billions of dollars worth of carbon credits that the rail company could generate (November 2009)

Leading electronic Futures and Commodities Exchange, Intercontinental Exchange (ICE) purchased London based, Climate Exchange, PLC

(owners of both the Chicago Climate Exchange and the European Climate CCX and ECX) for $600 million (April 2010)

Barclay’s Bank purchased leading Swedish Carbon Credit Developer, Tricorona for $145 million (June 2010)

Bloomberg, LP acquired UK data provider New Energy Finance for an undisclosed amount in order to offer products useful to inv estors in the

global carbon markets (December 2009)

Thomson Reuters acquired Norwegian based provider of Carbon Market news and content, Point Carbon for an undisclosed amount ( June

2010)

World’s largest Internet Company, Google announced its intention of becoming carbon neutral and purchased an undisclos ed amount

(rumored to be in the tens of millions) of US Carbon Credits from a landfill methane facility in South Carolina (June 2010)

Copyright 2010, New World Carbon. All rights reserved. 2

NEW WORLD CARBON

Comparison to oil market

There is a case to be made that the nascent Carbon Market can be compared to the Oil Market in the early 1970s. In the early 1970s, the price of

oil lay dormant at approximately $10 per barrel for several years. However, the formation of OPEC resulted in price controls that the market had

never experienced. These price controls resulted in a rapid spike in the price as seen in the chart below. Investors who held oil as a commodity prior

to the OPEC formation made 400+% returns in a very short period of time. We see a similar situation playing out in the Carbon Market; however

the price increase is widely expected to be even greater than that of oil in the 1970s. The reasoning for such a big price increase revolves around

simple supply and demand. As more international governments start to regulate their country’s emissions, and as mor e companies start to limit

their emissions (either voluntarily or due to regulatory purposes), the demand for available carbon credits are poised to rise dramatically.

Therefore, the price of Carbon could potentially experience exponential returns similar to those experienced by oil when price controls by OPEC

were introduced. Again, the key player for this scenario to play out is the United States. When the US establishes a Cap and Trade System similar to

the one in Europe, we concur with Barclay’s Capital that the Carbon Market will eventually surpass oil as the most widely traded commodity.

Copyright 2010, New World Carbon. All rights reserved. 3

NEW WORLD CARBON

Carbon Prices

European Carbon Credits on the European Climate Exchange (ECX) began trading at approximately 5 Euros in 2005. Within a couple of short years,

they experienced a rapid rise to over 30 Euros providing its first investors with very nice returns. The owners of both the ECX and CCX, Climate

Exchange PLC (Symbol CLE) began trading on the London Stock Exchange (AIM) in early 2005. The price of those shares experienced an even greater

rise and made early investors fortunes as its price rose by over 2000% from 2005 to mid 2007.The Climate Exchange was recently purchased for

$600 million (a 50% premium) in April 2010 by leading Futures and Commodities Exchange, The Intercontinental Exchange (ICE).

It is our strong belief at NEW WORLD CARBON that those who missed the remarkable Carbon Market growth in Europe a few years ago will be

provided with another and quite possibly more lucrative opportunity to capitalise on the Carbon Market’s tremendous profit potential before the

US enters the market with the passage of Cap and Trade legislation.

Trading Carbon Offsets

Trading in carbon offsets has become a robust market in only a few years. Many investors are purchasing carbon offsets for the

purpose of speculating that there will be an increase in value as more countries (including the United States) join existing carbon

trading schemes, or create their own mechanisms for capping the emissions of industry. It is expected that many of the carbon

instruments will increase in value as demand increases. In the case of the United States, some of the carbon instruments utilised in

the voluntary OTC markets may cross over into the compliance markets with the advent of Cap and Trade legislation.

Copyright 2010, New World Carbon. All rights reserved. 4

NEW WORLD CARBON

Risk Factors

As with any investment, there are several risk factors to consider with regard to the Carbon Market. Based on our research, these risk factors include: liquidity, political

stalling, transparency and barriers to entry for retail investors.

Liquidity

Currently, the Carbon Market does not possess the liquidity one would find on the major stock markets and/or commodity markets. Therefore, entering or exiting the

market cannot currently be performed as quickly as one can with traditional financial instruments such as stocks or bonds. However, as evidenced by the growth of the

Carbon Market over the past five years, liquidity has steadily improved and once the US and other growing countries s uch as China, India, and Australia join the market, it

is expected that the Carbon Market will be even bigger and thus more liquid than traditional markets, including the Oil Market.

Political stalemates

The passage of the Waxman Markey bill in the US Congress during the summer of 2008 positioned the US to enact caps on Carbon Emissions as well as a price on Carbon

credits which would trade in a centralised US marketplace.

US President Barack Obama has been a strong proponent of the bill. Currently, the bill solely needs to be passed by the US Senate in order to become law. The underlying

risk is that such as bill does not pass or that it gets stalled. However, in consideration of the current political, economic, and global landscape, we see the US joining

Europe and enacting a Federal Carbon Market possibly by the end of 2010 but no later than 2012.

The Role of the US Supreme Court and the EPA

Mitigating the aforementioned political risk is the fact that in 2007, the US Supreme Court passed a decision under the “Clean Air Act” which allows the Environmental

Protection Agency (EPA) to enact its own version of Greenhouse Gas Emission Regulation. This decision allows the EPA to bypas s both the US Congress and Senate should

they fail to reach an agreement on reducing GHG emissions. The EPA has publicly stated that it will act on these powers if an agreement is not reached sometime in the

near future. EPA Administrator Lisa P. Jackson has stated that the EPA plans to start targeting large facilities such as power plants no later than by 2011. The EPA has also

stated that it may impose its own form of Cap and Trade in order to honor its judicial obligation. The threat of EPA involvement has moved several prominent US Senators

such as John Kerry and Joe Lieberman to push harder to pass a Climate Bill which includes a price on Carbon as the focal poin t of the legislation. The Kerry-Lieberman Bill

entitled “The American Power Act” seeks to place an initial floor on the price of carbon at $12 and may even raise the floor in order to incentivise America’s largest

polluters to reduce their emissions. All of these factors should bode very well for the growth of the nascent US Carbon Market as well as for the price of Carbon Credits.

Lack of transparency

Another risk factor is finding a reputable dealer of bona-fide US Carbon Credits. We advise those looking to purchase carbon credits to make their purchase through a

verified member of either the Voluntary Carbon Standard (VCS) or the American Carbon Registry (ACR). The VCS and ACR are leading participants in the voluntary US

markets and their members include some of the world’s most prominent organisations such as the World Bank. Furthermore, most Carbon offset providers sell their

offsets and credits for the sole purpose of retirement (to offset one’s carbon footprint). There are only a handful of companies that allow those looking to speculate or

invest in the market in a manner that would not warrant retirement. Therefore, it is imperative to understand if the purchase is being ma de for retirement or investment.

Barriers to entry for retail investors

Currently, there are many barriers to entry in this market for the retail investor. Unfortunately, the market is an institutionally controlled market in which the major

financial institutions such as JP Morgan Chase, Morgan Stanley, Goldman Sachs, and Barclay’s Bank only deal with large hedge funds and/or Fortune 500 companies that

are solely looking to offset their carbon emissions. Retail investors have been chagrined to find that in most cases, they need very large capital outlays in order to enter

this market. The most well known firm that enables retail investors to join their fund, Climate Change Capital, recently required a minimum investment of $33.3 million.

Although it has been increasingly difficult for the smaller investor to join this emerging market, we strongly believe that once the US enacts a Federal Carbon Market, the

floodgates will open and the retail investor will able to participate as easily as they can with the major stock indices. The problem that the retail investor will likely

encounter is that the price of carbon credits will probably be trading at a much higher premium compared to where they are currently trading, with some projections

indicating that the price of Carbon may reach as high as $100 within the next few years.

Fortunately, based on our research, there are currently a handful of companies that will allow a smaller retail investor to enter the market with minimal initial

investments. However, as previously mentioned, the retail investor is urged to make sure that the Carbon Credits purchased are from a verifiable member of either the

VCS or ACR.

Copyright 2010, New World Carbon. All rights reserved. 5

NEW WORLD CARBON

Recommendation

As with any investment, it is extremely important that an investor perform their due diligence when exercising an investment decision. One must also

clearly identify the risk versus the reward inherent in the position being considered.

Based on our extensive research performed on the Carbon Market, it would appear as though the reward trumps the risk when it comes to investing

in this rapidly growing emerging market.

Clearly, there is an enormous amount of pressure on the US to join the rest of the world and develop methods to reduce its en ormous amount of

carbon emissions. President Barack Obama has already pledged that the US will reduce its carbon emissions by 20% of 2005 levels by 2020 and by 83%

of 2005 levels by 2050. This pledge will not be attainable without the US enacting a Federal Carbon Market that places a high enough price on Carbon

pollution in order to incentivise America’s largest polluters to reduce their carbon emissions.

Additional impetus for the US to move forward with a comprehensive Cap and Trade system is currently being provided by China. China has taken the

lead on clean energy development and just recently announced that it will establish its own Carbon Trading Market by 2011. China’s announcement

places extraordinary pressure on the US to follow suit. President Obama was quoted earlier this year in his State of the Unio n address as saying “The

nation that leads the world in clean energy development, will lead the world in the 21 st century.” Therefore, the pressure will increasingly mount on

the US to push forward with passing legislation that puts a price on carbon within the next couple of years.

Furthermore, the US is in desperate need to boost its economy and spur job creation. Adoption of a Federal Carbon Market will open the doors to a

vibrant clean energy economy that encompasses other a wide variety of sources of alternative energy infrastructure development such as solar,

windmill energy, and biofuels. This infrastructure may be the boost that the nation needs to spur innovation and job growth while simultaneously

reducing the environmental ravages of carbon emissions.

As a result of all these factors we have researched, it is our firm belief that it is not a matter of "if" the US follows Europe’s lead and adopts a Cap and

Trade system, but it is simply a matter of "when." Therefore, it is our recommendation that savvy investors seek ways to properly position themselves

in this emerging market in order to profit handsomely from this expected rapid market growth.

To maximise returns, such an investment should be made prior to the US adoption of a Federal Carbon Market. With voluntary US carbon credits

trading relatively low, we firmly believe that those with the foresight to enter at these current low levels stand to realistically earn 300-500% returns

within the next one to three year time period. Given the current dim global economic outlook, investors will be hard pressed to find other

opportunities that can compete with those expected returns.

Disclaimer

NEW WORLD CARBON is an independent research group offering information pertaining to the alternative energy. NEW WORLD

CARBON is not associated nor affiliated in any capacity with the Voluntary Carbon Standard (VCS), American Carbon Registry (ACR) or any

other financial organisation mentioned in this report. Information, opinions or recommendations contained in this report are for

informational purposes only and does not constitute any offer or solicitation to buy or sell. The information used and statements of fact

made have been obtained from sources considered reliable but we neither guarantee nor represent the completeness or accuracy. Such

information and the opinions expressed are subject to change without notice. All rights reserved. Unauthorised use, distribution, duplication

or disclosure without the prior written permission of NEW WORLD CARBON is prohibited by law and may result in prosecution.

Copyright 2010, New World Carbon. All rights reserved. 6

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Future Work Skills 2020Документ19 страницFuture Work Skills 2020Biblioteca Tracto100% (1)

- Titan Co Financial ModelДокумент15 страницTitan Co Financial ModelAtharva OrpeОценок пока нет

- DFA5058 Tutorial Chapter 3 SolutionДокумент9 страницDFA5058 Tutorial Chapter 3 SolutionArabella Summer100% (1)

- Big Bus Tour London Stop ListДокумент1 страницаBig Bus Tour London Stop ListchlscОценок пока нет

- Devon County Show 2011Документ3 страницыDevon County Show 2011chlscОценок пока нет

- Coal Grill Bar Main Menu EXETERДокумент2 страницыCoal Grill Bar Main Menu EXETERchlscОценок пока нет

- Sharp Brains Checklist - 10 Questions To Choose The Right Brain Fitness Program For YouДокумент1 страницаSharp Brains Checklist - 10 Questions To Choose The Right Brain Fitness Program For YouchlscОценок пока нет

- Etoro Weekly Market Review, Oct 10, 2010Документ6 страницEtoro Weekly Market Review, Oct 10, 2010chlscОценок пока нет

- The Invisible AnchorДокумент7 страницThe Invisible Anchorchlsc100% (1)

- UK Metropolitan AreasДокумент6 страницUK Metropolitan AreaschlscОценок пока нет

- Feast Menu, Shanghai Nights Chinese Restaurant at Exeter, UKДокумент6 страницFeast Menu, Shanghai Nights Chinese Restaurant at Exeter, UKchlscОценок пока нет

- Dim Sum Menu, Shanghai Nights Chinese Restaurant at ExeterДокумент3 страницыDim Sum Menu, Shanghai Nights Chinese Restaurant at ExeterchlscОценок пока нет

- Political SpectrumsДокумент1 страницаPolitical SpectrumschlscОценок пока нет

- Types of Insurances: - Car Servicing ManagementДокумент4 страницыTypes of Insurances: - Car Servicing ManagementchlscОценок пока нет

- (Sharing) 100 Quotes From The SecretДокумент5 страниц(Sharing) 100 Quotes From The SecretchlscОценок пока нет

- (Vocabulary) List of Possible Life ValuesДокумент1 страница(Vocabulary) List of Possible Life ValueschlscОценок пока нет

- MainMenuEnglishLevel-3 RLD2014016Документ291 страницаMainMenuEnglishLevel-3 RLD2014016Asif RafiОценок пока нет

- Day 12 Chap 7 Rev. FI5 Ex PRДокумент11 страницDay 12 Chap 7 Rev. FI5 Ex PRkhollaОценок пока нет

- Chapter-14 Accounting For Not For Profit Organization PDFДокумент6 страницChapter-14 Accounting For Not For Profit Organization PDFTarushi Yadav , 51BОценок пока нет

- Kepada Yth. /: Yudi Dwi SaputraДокумент1 страницаKepada Yth. /: Yudi Dwi SaputraRido PuteraОценок пока нет

- Module 07.5 - Foreign Currency Accounting PSДокумент5 страницModule 07.5 - Foreign Currency Accounting PSFiona Morales100% (2)

- Horngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Документ111 страницHorngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Sally MillerОценок пока нет

- Clubhouse & Pool Rent Reservation FormДокумент2 страницыClubhouse & Pool Rent Reservation FormLes SircОценок пока нет

- Qrrpa Report Sison Q3 2023Документ6 страницQrrpa Report Sison Q3 2023MPDC SISONОценок пока нет

- Ratio and Fs AnalysisДокумент74 страницыRatio and Fs AnalysisRubie Corpuz SimanganОценок пока нет

- Indian Railway Budget: A Brief SummaryДокумент4 страницыIndian Railway Budget: A Brief SummaryprasannamrudulaОценок пока нет

- 802818Документ2 страницы802818isabisabОценок пока нет

- Final Report - FM Project - HUL 2020Документ4 страницыFinal Report - FM Project - HUL 2020Barathy ArvindОценок пока нет

- City Laundry: Chart of Account Assets LiabilitiesДокумент6 страницCity Laundry: Chart of Account Assets LiabilitiesGina Calling DanaoОценок пока нет

- Affairscloud Com Current Affairs 9 November 2023 AmpДокумент11 страницAffairscloud Com Current Affairs 9 November 2023 AmpShubranil MajumderОценок пока нет

- Atty. Dionisio Calibo, vs. CA (Cred Trans)Документ2 страницыAtty. Dionisio Calibo, vs. CA (Cred Trans)JM CaupayanОценок пока нет

- Acc CH 4Документ16 страницAcc CH 4Tajudin Abba RagooОценок пока нет

- CAREER POWER - No 09 Sbi CLRK PlrmsДокумент59 страницCAREER POWER - No 09 Sbi CLRK PlrmsrangulasivakasiОценок пока нет

- FICO Vox Pop Report - Fine Tuning Our Financial FuturesДокумент16 страницFICO Vox Pop Report - Fine Tuning Our Financial FuturesChidera UnigweОценок пока нет

- 12th Commerce - 1st Revision Question Paper - English Medium PDF DownloadДокумент6 страниц12th Commerce - 1st Revision Question Paper - English Medium PDF DownloadAřúń .jřОценок пока нет

- Arielle Martin - IRS LetterДокумент2 страницыArielle Martin - IRS LetterArielle MartinОценок пока нет

- Spes Form 5 - Placement Report Cum Gsis - Dec2016Документ1 страницаSpes Form 5 - Placement Report Cum Gsis - Dec2016Joel AndalesОценок пока нет

- Evidence of FundsДокумент3 страницыEvidence of FundsMIrfanFananiОценок пока нет

- 5-Non-Banking Financial InstitutionsДокумент19 страниц5-Non-Banking Financial InstitutionsSharleen Joy TuguinayОценок пока нет

- Silo - Tips - Trading With An Edge Multiple Systems Multiple Time FramesДокумент44 страницыSilo - Tips - Trading With An Edge Multiple Systems Multiple Time Framesshailesh233Оценок пока нет

- Sky City Accounting and Financialy AnalysisДокумент6 страницSky City Accounting and Financialy AnalysisElenaWang1111Оценок пока нет

- Tabreed06 ProspectusДокумент142 страницыTabreed06 ProspectusbontyonlineОценок пока нет

- Books of Prime Entry: The Cash BookДокумент11 страницBooks of Prime Entry: The Cash Bookأحمد عبد الحميدОценок пока нет

- Taxation of Residual Income: Cma K.R. RamprakashДокумент25 страницTaxation of Residual Income: Cma K.R. RamprakashShriya JoseincheckalОценок пока нет