Академический Документы

Профессиональный Документы

Культура Документы

Deferred Taxation Working

Загружено:

Muhammad TuriАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Deferred Taxation Working

Загружено:

Muhammad TuriАвторское право:

Доступные форматы

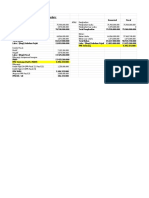

ABC Co. Ltd.

Deferred Taxation

As at June 30, 2005

Applicable Tax rate 35%

RUPEES RUPEES

Accelerated Tax Depreciation

Accounting WDV of owned assets as on june 30, 2005. 310,650,000

Tax WDV as on june 30, 2005. (196,985,164)

113,664,836 35% 39,782,693

z

Impact of finance lease

as per books

WDV of leased assets 148,608,000

Financial charges allocated to future period 18,315,000

166,923,000

As per tax

Outstanding lease rentals (Principle + Markup) 130,146,000

36,777,000 35% 12,871,950

Provisions

Gratuity (27,536,438)

doubtful debts (8,436,780)

doubtful advances (5,250,153)

Obsolescence (6,160,833)

(47,384,204) 35% (16,584,471)

Assessed Losses (35,248,632) 35% (12,337,021)

Excess of Turnover Tax over Normal Tax (6,432,835)

Deferred tax Liability / (Asset) as at june 30, 2005 17,300,315

Less: Deferred tax Liability / (Asset) as at june 30, 2004 15,436,488

Net Provison / (Reversal) during the year 1,863,827

Вам также может понравиться

- Tax Assignment 4Документ5 страницTax Assignment 4pfungwaОценок пока нет

- Earnings Statement AnalysisДокумент8 страницEarnings Statement AnalysisLinh NguyenОценок пока нет

- Contoh DTA DTLДокумент23 страницыContoh DTA DTLZahra MawarОценок пока нет

- Berkshire Partners Bidding For Carter S Group 6Документ21 страницаBerkshire Partners Bidding For Carter S Group 6Þorgeir DavíðssonОценок пока нет

- Tax Rate Impact on WACC CalculationДокумент21 страницаTax Rate Impact on WACC CalculationVersha100% (1)

- Illustrative Example Income TaxesДокумент4 страницыIllustrative Example Income Taxes22700021maaeОценок пока нет

- Earnings and Financial Ratios StatementДокумент10 страницEarnings and Financial Ratios StatementGiovani R. Pangos RosasОценок пока нет

- Income Statements: Brown & Company PLCДокумент5 страницIncome Statements: Brown & Company PLCprabathdeeОценок пока нет

- 3F Rice and Eggs Supply Projected Cash Flows For September 2019 To December 2021 Pre-Operation 2019 2020 2021Документ4 страницы3F Rice and Eggs Supply Projected Cash Flows For September 2019 To December 2021 Pre-Operation 2019 2020 2021Bea Cassandra EdnilaoОценок пока нет

- Solution FAR 2Документ20 страницSolution FAR 2AОценок пока нет

- Capital Contribution: Stockholder TINДокумент17 страницCapital Contribution: Stockholder TINEddie ParazoОценок пока нет

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Документ2 страницыAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuОценок пока нет

- HMC DCF ValuationДокумент31 страницаHMC DCF Valuationyadhu krishnaОценок пока нет

- Cashflow Net Room RevenueДокумент4 страницыCashflow Net Room RevenueAshadi CahyadiОценок пока нет

- Adv Level Corporate Reporting (CR)Документ24 страницыAdv Level Corporate Reporting (CR)FarhadОценок пока нет

- Acquisition Cash FlowДокумент3 страницыAcquisition Cash Flowkaeya alberichОценок пока нет

- Misc Accounts FilesДокумент229 страницMisc Accounts Filesapi-19622983Оценок пока нет

- NPV Lesson 2Документ5 страницNPV Lesson 2Barack MikeОценок пока нет

- Eeff Ilustrativos Niif PymesДокумент16 страницEeff Ilustrativos Niif PymesjgilzamoraОценок пока нет

- Grasim Q3FY09 PresentationДокумент47 страницGrasim Q3FY09 PresentationJasmine NayakОценок пока нет

- ZittiДокумент3 страницыZittiAbid AliОценок пока нет

- Complete Financial ModelДокумент47 страницComplete Financial ModelArrush AhujaОценок пока нет

- Capital Budgeting Techniques and Cash Flows Class ExerciseДокумент6 страницCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasОценок пока нет

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBДокумент13 страницCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreОценок пока нет

- FAP - Bodie Industrial Supply - LT 2Документ16 страницFAP - Bodie Industrial Supply - LT 2Marcus McWile MorningstarОценок пока нет

- Taxation ProblemsДокумент11 страницTaxation ProblemsKai Son-MyoiОценок пока нет

- Analyze Financial Reports PT XYZДокумент2 страницыAnalyze Financial Reports PT XYZMuh HisyamОценок пока нет

- Zeco Holdings Vertical and Horizontal AnalysisДокумент26 страницZeco Holdings Vertical and Horizontal AnalysisAvenues Women's ClinicОценок пока нет

- Business - Valuation - Modeling - Assessment FileДокумент6 страницBusiness - Valuation - Modeling - Assessment FileGowtham VananОценок пока нет

- ButlercaseДокумент3 страницыButlercaseAn HuОценок пока нет

- AssetsДокумент2 страницыAssetsJoshua ChavezОценок пока нет

- Balance Sheet: Current AssetsДокумент3 страницыBalance Sheet: Current AssetsMustafa IbrahimОценок пока нет

- Spinning Project FeasibilityДокумент19 страницSpinning Project FeasibilityMaira ShahidОценок пока нет

- STI Education Systems Holdings Inc. Consolidated StatementsДокумент20 страницSTI Education Systems Holdings Inc. Consolidated StatementschenlyОценок пока нет

- Abans QuarterlyДокумент14 страницAbans QuarterlyGFMОценок пока нет

- United MetalДокумент2 страницыUnited MetalshakilnaimaОценок пока нет

- Example of Deferred Tax LiabilityДокумент1 страницаExample of Deferred Tax Liabilityarjun-chopra-4887Оценок пока нет

- Ias 36 Example Simple Impairment Test of CGU Based On Value in UseДокумент7 страницIas 36 Example Simple Impairment Test of CGU Based On Value in Usedevanand bhawОценок пока нет

- Workshop 2Документ11 страницWorkshop 2Trần Ánh DươngОценок пока нет

- Yates Financial ModellingДокумент18 страницYates Financial ModellingJerryJoshuaDiazОценок пока нет

- ENTI Ver 1Документ72 страницыENTI Ver 1krishna chaitanyaОценок пока нет

- Carry Over Next Period (Excl. Incentive)Документ5 страницCarry Over Next Period (Excl. Incentive)Divina BidarОценок пока нет

- Income Statement and Balance SheetДокумент8 страницIncome Statement and Balance SheetMyustafizzОценок пока нет

- Advanced Corporate Finance Case 2Документ3 страницыAdvanced Corporate Finance Case 2Adrien PortemontОценок пока нет

- Fa Pilot Paper AnswerДокумент11 страницFa Pilot Paper Answer刘宝英Оценок пока нет

- DCF Case Sample 1Документ4 страницыDCF Case Sample 1Gaurav SethiОценок пока нет

- PG - P&L: P&G Income StatementДокумент3 страницыPG - P&L: P&G Income StatementMi TvОценок пока нет

- Quiz 2 KeysДокумент15 страницQuiz 2 KeysLeslieCastro100% (1)

- Engineering Management 3000/5039: Tutorial Set 5Документ5 страницEngineering Management 3000/5039: Tutorial Set 5SahanОценок пока нет

- DCF Model - Blank: Strictly ConfidentialДокумент5 страницDCF Model - Blank: Strictly ConfidentialaeqlehczeОценок пока нет

- Simulasi Corporate TaxДокумент9 страницSimulasi Corporate TaxANDIYANA ANSARОценок пока нет

- Contoh Simple FCFFДокумент5 страницContoh Simple FCFFFANNY KRISTIANTIОценок пока нет

- AllafsДокумент17 страницAllafsKim Jong YungОценок пока нет

- Apit CalculatorДокумент2 страницыApit CalculatorShármílá FerdinandesОценок пока нет

- Multi Finance PLC: Interim Financial StatementsДокумент7 страницMulti Finance PLC: Interim Financial StatementsCr CryptoОценок пока нет

- Snack Corner Restaurant Input Variables For The Proposed Investment Particulars Data ValueДокумент12 страницSnack Corner Restaurant Input Variables For The Proposed Investment Particulars Data ValueReagan SsebbaaleОценок пока нет

- Ship BV Depreciation and Cash Flow AnalysisДокумент1 страницаShip BV Depreciation and Cash Flow AnalysisnairicaaОценок пока нет

- Financial AnalysisДокумент24 страницыFinancial AnalysisSwathi ShanmuganathanОценок пока нет

- Audit of FS QuizДокумент3 страницыAudit of FS QuizGwyneth TorrefloresОценок пока нет

- Plant BiotechnologyДокумент2 страницыPlant BiotechnologyMuhammad TuriОценок пока нет

- RP23 Developing Biotechnology Innovations enДокумент44 страницыRP23 Developing Biotechnology Innovations enSan SОценок пока нет

- Volte Deep AnalysisДокумент4 страницыVolte Deep AnalysisMuhammad TuriОценок пока нет

- Carrier AggregationДокумент994 страницыCarrier Aggregationaman_sn33% (3)

- eRAN18.1 LTE FDD Massive MIMO Solution User GuideДокумент105 страницeRAN18.1 LTE FDD Massive MIMO Solution User Guideturi313100% (1)

- VoLTE Features - HuaweiДокумент255 страницVoLTE Features - HuaweiDJRashDownloadОценок пока нет

- Screenshot 2022-04-12 at 7.58.39 PMДокумент1 страницаScreenshot 2022-04-12 at 7.58.39 PMMuhammad TuriОценок пока нет

- CMPak 3G North KPI Report - 12 - JanДокумент42 страницыCMPak 3G North KPI Report - 12 - JanMuhammad TuriОценок пока нет

- .Archivetempen-Us Bookmap 0001807697.html PDFДокумент44 страницы.Archivetempen-Us Bookmap 0001807697.html PDFMuhammad TuriОценок пока нет

- 5G RAN2.0 Beam ManagementДокумент42 страницы5G RAN2.0 Beam Managementturi313Оценок пока нет

- LTE Mobile Optimization-A Definitive Guide PDFДокумент20 страницLTE Mobile Optimization-A Definitive Guide PDFMuhammad TuriОценок пока нет

- .Archivetempen-Us Bookmap 0001807697.html PDFДокумент44 страницы.Archivetempen-Us Bookmap 0001807697.html PDFMuhammad TuriОценок пока нет

- 3G (Umts) Handover Issues: Team Members: Cuong Pham & Thomas TruongДокумент37 страниц3G (Umts) Handover Issues: Team Members: Cuong Pham & Thomas TruongSovy TaingОценок пока нет

- Ericsson LTE Architecture KPIs and Troubleshooting AircomДокумент54 страницыEricsson LTE Architecture KPIs and Troubleshooting AircomMuhammad TuriОценок пока нет

- 3G (Umts) Handover Issues: Team Members: Cuong Pham & Thomas TruongДокумент37 страниц3G (Umts) Handover Issues: Team Members: Cuong Pham & Thomas TruongSovy TaingОценок пока нет

- 3G (Umts) Handover Issues: Team Members: Cuong Pham & Thomas TruongДокумент37 страниц3G (Umts) Handover Issues: Team Members: Cuong Pham & Thomas TruongSovy TaingОценок пока нет

- Entity SolutionsДокумент2 страницыEntity SolutionsMuhammad TuriОценок пока нет

- Etihad Group Offer Letter 2148506538 6697 PDFДокумент2 страницыEtihad Group Offer Letter 2148506538 6697 PDFMuhammad TuriОценок пока нет

- Role of PSCCH To Increase Cell Chapacity-5Документ5 страницRole of PSCCH To Increase Cell Chapacity-5Muhammad TuriОценок пока нет

- LTE Mobile Optimization-A Definitive Guide PDFДокумент20 страницLTE Mobile Optimization-A Definitive Guide PDFMuhammad TuriОценок пока нет

- Etihad Group Offer Letter 2148506538 6697 PDFДокумент2 страницыEtihad Group Offer Letter 2148506538 6697 PDFMuhammad TuriОценок пока нет

- Electrical Engineering Core Areas BreakdownДокумент5 страницElectrical Engineering Core Areas BreakdownMashood Nasir33% (3)

- LTE Mobile Optimization-A Definitive Guide PDFДокумент20 страницLTE Mobile Optimization-A Definitive Guide PDFMuhammad TuriОценок пока нет

- Entity SolutionsДокумент2 страницыEntity SolutionsMuhammad TuriОценок пока нет

- ProformaДокумент1 страницаProformadidin291994Оценок пока нет

- Role of PSCCH To Increase Cell Chapacity-5Документ5 страницRole of PSCCH To Increase Cell Chapacity-5Muhammad TuriОценок пока нет

- 12 Month Cash Flow StatementДокумент2 страницы12 Month Cash Flow StatementMuhammad TuriОценок пока нет

- Etihad Group Offer Letter 2148506538 6697 PDFДокумент2 страницыEtihad Group Offer Letter 2148506538 6697 PDFMuhammad TuriОценок пока нет