Академический Документы

Профессиональный Документы

Культура Документы

Wesleyan University Handouts Home Office

Загружено:

nivea gumayagayАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Wesleyan University Handouts Home Office

Загружено:

nivea gumayagayАвторское право:

Доступные форматы

COLLEGE OF BUSINESS AND ACCOUNTANCY

MATERIALS AND HANDOUTS ON ADVANCED ACCOUNTING AND REPORTING ONE

WESLEYAN UNIVERSITY – PHILIPPINES

ADVANCED ACCOUNTING AND REPORTING 1 ANGELUS EDWARD R. JOSE, CPA, MBA

INSTALLMENT SALES

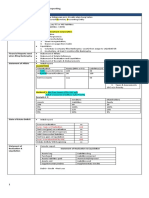

PROBLEM I.

The following selected accounts were taken from the trial balance of Survival Company

as of December 31, 2012.

Accounts Receivable P 187 500

Installment Receivable-2010 37 500

Installment Receivable-2011 112 500

Installment Receivable-2012 675 000

Merchandise Inventory 131 250

Purchases 975 000

Freight-in 7 500

Repossessed Merchandise 37 500

Repossession Loss 60 000

Cash Sales 225 000

Charge Sales 450 000

Installment Sales 1 115 000

Deferred Gross Profit-2010 55 500

Deferred Gross Profit-2011 98 400

Operating Expenses 37 500

Shipment on Installment Sales 696 875

Additional Information:

Gross Profit Rate for 2010 and 2011 installment sales were 30% and 32%,

respectively.

The entry for repossessed goods was:

Repossessed Merchandise 37 500

Repossession Loss 60 000

Installment Receivable-2010 45 000

Installment Receivable-2011 52 500

Merchandise on hand at the end of 2012(new and repossessed) was P70 500.

REQUIRED: COMPUTE FOR THE FOLLOWING

1. Total Realized Gross Profit in 2012?

2. Balance of Deferred Gross Profit as of December 31, 2012?

3. Net Income in 2012?

PROPERTY OF MR. ANGELUS EDWARD DELA ROSA JOSE

CERTIFIED PUBLIC ACCOUNTANT (CPA) AND MASTER OF BUSINESS ADMINISTRATION (MBA)

COLLEGE OF BUSINESS AND ACCOUNTANCY

MATERIALS AND HANDOUTS ON ADVANCED ACCOUNTING AND REPORTING ONE

PROBLEM II.

Achievement Company which began operations on January 1, 2012 appropriately uses

the installment method of accounting. The following data pertain to Achievement’s

operations for year 2012.

Installment Sales (before over/under-allowance) P 3 150 000

Operating expenses 367 500

Regular sales 1 312 500

Total collections for the year

(excluding interest of P84 000) 2 088 000

Cost of regular sales 752 500

Cost of installment sales 2 205 000

Accounts Receivable-12/31/2012 512 500

Installment receivable written-off

(no provision was made) 154 000

Estimated resale value of repossessed merchandise 290 000

Profit usual on the sale of repossessed merchandise 15%

Repossessed accounts 350 000

Actual value of trade-in Merchandise 280 000

Trade-in allowance 490 000

Reconditioning cost of the repossessed merchandise 57 500

How much is the deferred gross profit at December 31, 2012? What is the net income for

the year ended December 31, 2012?

PROBLEM III.

The following data were taken from the records of Challenge Company, before the

accounts are closed for the year ended December 31, 2012. The company sells

exclusively on installment basis and uses installment method of recognizing revenue.

For the year ended For the year ended For the year ended

December 31, 2010 December 31, 2011 December 31, 2012

Installment Sales P2 800 000 P3 500 000 P4 200 000

Cost of Goods Sold 2 100 000 2 100 000 2 730 000

Salaries Expense 84 000 91 000 98 000

Rent Expense 42 000 42 000 42 000

Balances as of: December 31, 2010 December 31, 2011 December 31, 2012

Installment AR, 1 750 000 840 000 210 000

2010

Installment AR, 2 660 000 980 000

2011

Installment AR, 437 500 3 430 000

2012

Deferred Gross 210 000 210 000

Profit, 2010

Deferred Gross 1 064 000 1 052 800

Profit, 2011

PROPERTY OF MR. ANGELUS EDWARD DELA ROSA JOSE

CERTIFIED PUBLIC ACCOUNTANT (CPA) AND MASTER OF BUSINESS ADMINISTRATION (MBA)

COLLEGE OF BUSINESS AND ACCOUNTANCY

MATERIALS AND HANDOUTS ON ADVANCED ACCOUNTING AND REPORTING ONE

Deferred Gross 1 470 000

Profit, 2012

On January 2012, a customer defaulted and Challenge Company repossessed

merchandise appraised at P17 500 after costs of reconditioning at P2 520. The

merchandise had been purchased in 2011 by a customer who still owed the company a

certain amount at the date of repossession.

How much was the net income for the fiscal year ended December 31, 2012?

PROBLEM IV.

The following account balances appear on the books of Fulfillment Company as of

December 31, 2012:

Cash P 150 000

Receivables 800 000

Merchandise Inventory 75 000

Accounts Payable 30 000

Deferred Gross Profit-2010 261 250

Sales 1 250 000

Purchases 640 000

Expenses 425 000

The Receivables account is a controlling account for three subsidiary ledgers

which show the following totals:

2011 installment contracts P150 000

2012 installment contracts P600 000

Charge accounts (terms 30 days, net) P 50 000

The gross profit on sales on installment contract for 2011 was 55%, on

installment contracts for 2012, 50%.

Collections on installment contracts for 2011 total P300 000 for the year just

closed; on installment contracts for 2012, P400 000; on charge accounts, P200

000.

Account balances from installment sales made prior to 2011 were also collected.

Repossession for the year was on installment contracts for 2011 on which the

uncollected balance at the time of repossession amounted to P50 000.

Merchandise repossessed was erroneously debited as a newly acquired

merchandise equal to the amount defaulted by the customer.

Appraisal reports show that this repossessed merchandise has a true worth of P20

000 at the time of repossession and remain unsold at year end.

The final inventory of the merchandise (new) valued at cost amounted to P45 000.

REQUIRED: COMPUTE THE FOLLOWING

1. Total Realized Gross Profit in 2012?

2. Net Income in 2012?

PROPERTY OF MR. ANGELUS EDWARD DELA ROSA JOSE

CERTIFIED PUBLIC ACCOUNTANT (CPA) AND MASTER OF BUSINESS ADMINISTRATION (MBA)

Вам также может понравиться

- Entrep1 Prelim ReviewerДокумент7 страницEntrep1 Prelim ReviewerJoseph John SarmientoОценок пока нет

- Entrepreneurship Chapter 2.2Документ20 страницEntrepreneurship Chapter 2.2nivea gumayagayОценок пока нет

- Entrep 2Документ27 страницEntrep 2nivea gumayagayОценок пока нет

- 00232017100200159Документ3 страницы00232017100200159nivea gumayagayОценок пока нет

- Auditing - MasterДокумент11 страницAuditing - MasterJohn Paulo SamonteОценок пока нет

- Entrepreneurship: Wesleyan University-PhilippinesДокумент20 страницEntrepreneurship: Wesleyan University-Philippinesnivea gumayagayОценок пока нет

- Wesleyan University Handouts Home OfficeДокумент3 страницыWesleyan University Handouts Home Officenivea gumayagayОценок пока нет

- App LettДокумент1 страницаApp Lettnivea gumayagayОценок пока нет

- Power Review Law - NewДокумент17 страницPower Review Law - NewVladimir Marquez100% (4)

- Wesleyan University Handouts Home OfficeДокумент5 страницWesleyan University Handouts Home Officenivea gumayagayОценок пока нет

- Mas Capital Budgeting ReviewersДокумент16 страницMas Capital Budgeting ReviewersNo Mi ViОценок пока нет

- CAT Chall 2018 - Nivea GumayagayДокумент3 страницыCAT Chall 2018 - Nivea Gumayagaynivea gumayagayОценок пока нет

- Wesleyan University Handouts Home OfficeДокумент5 страницWesleyan University Handouts Home Officenivea gumayagayОценок пока нет

- Wesleyan University Handouts Home OfficeДокумент5 страницWesleyan University Handouts Home Officenivea gumayagayОценок пока нет

- BOA TOS TaxДокумент2 страницыBOA TOS TaxMr. CopernicusОценок пока нет

- CAT Chall 2018 - Nivea GumayagayДокумент3 страницыCAT Chall 2018 - Nivea Gumayagaynivea gumayagayОценок пока нет

- Chapter 17 - AnswerДокумент13 страницChapter 17 - AnswerFlexmanОценок пока нет

- Auditibg Problems Purchase CommitmentДокумент1 страницаAuditibg Problems Purchase Commitmentnivea gumayagay0% (1)

- TOS FAR RevisedДокумент7 страницTOS FAR RevisedAdmin ElenaОценок пока нет

- Power Review TaxДокумент13 страницPower Review Taxnivea gumayagayОценок пока нет

- InventoryДокумент1 страницаInventorynivea gumayagayОценок пока нет

- Power Review TaxДокумент13 страницPower Review Taxnivea gumayagayОценок пока нет

- Power Review TaxДокумент13 страницPower Review Taxnivea gumayagayОценок пока нет

- CAT Challenge - Answers PDFДокумент6 страницCAT Challenge - Answers PDFnivea gumayagayОценок пока нет

- Auditing - MasterДокумент11 страницAuditing - MasterJohn Paulo SamonteОценок пока нет

- Aud TheoДокумент2 страницыAud Theonivea gumayagayОценок пока нет

- FarДокумент8 страницFarnivea gumayagay71% (7)

- CAT Challenge - AnswersДокумент2 страницыCAT Challenge - Answersnivea gumayagayОценок пока нет

- App LettДокумент1 страницаApp Lettnivea gumayagayОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Assets Non-Current Assets: Equity and Liabilities Share Capital and ReservesДокумент10 страницAssets Non-Current Assets: Equity and Liabilities Share Capital and ReservesM Bilal KОценок пока нет

- Almarai AR2018 8mb Final EnglishДокумент19 страницAlmarai AR2018 8mb Final EnglishtahirfaridОценок пока нет

- 6 Variable Full Costing Ue Caloocan May 2023Документ8 страниц6 Variable Full Costing Ue Caloocan May 2023Trisha Marie LeeОценок пока нет

- FM Graphs and Ratios TableДокумент10 страницFM Graphs and Ratios TableNehal SharmaОценок пока нет

- Revision1 2 3Документ4 страницыRevision1 2 3Diệu QuỳnhОценок пока нет

- Ch02 In-Class Problems - SolutionsДокумент15 страницCh02 In-Class Problems - SolutionsWalaa I. MatalqahОценок пока нет

- PDF Topic 2 COST CONCEPT AND CLASSIFICATIONДокумент53 страницыPDF Topic 2 COST CONCEPT AND CLASSIFICATIONJessaОценок пока нет

- Cost Volume Profit Analysis PDFДокумент11 страницCost Volume Profit Analysis PDFSayma LinaОценок пока нет

- Conceptual Framework and Accounting Standards - Chapter 5 - NotesДокумент4 страницыConceptual Framework and Accounting Standards - Chapter 5 - NotesKhey KheyОценок пока нет

- How Much Money Does Your New Venture NeedДокумент10 страницHow Much Money Does Your New Venture NeedFabiana Elena AparicioОценок пока нет

- 10081-How To Efficiently Handle Period-Close Process in Oracle EBS R12 - A Critical Study-Presentation With Notes - 105Документ73 страницы10081-How To Efficiently Handle Period-Close Process in Oracle EBS R12 - A Critical Study-Presentation With Notes - 105shankar pОценок пока нет

- Afar - Corporate LiquidationДокумент2 страницыAfar - Corporate Liquidationfarah mae raquinioОценок пока нет

- AFAR Integ Business Combi2023Документ12 страницAFAR Integ Business Combi2023Angelica B. MartinОценок пока нет

- PROBLEM 2 - Two Sole Proprietors Form A Partnership PROBLEM 2 - Two Sole Proprietors Form A PartnershipДокумент7 страницPROBLEM 2 - Two Sole Proprietors Form A Partnership PROBLEM 2 - Two Sole Proprietors Form A PartnershipRudy LugasОценок пока нет

- BDO Annual Report Volume 2Документ150 страницBDO Annual Report Volume 2Deb AlejandroОценок пока нет

- Document 1Документ16 страницDocument 1Pravallika RavikumarОценок пока нет

- Kunci Jawaban ElisaДокумент52 страницыKunci Jawaban ElisaElisa EndrianiiОценок пока нет

- Final EXIT 2015Документ110 страницFinal EXIT 2015naolmeseret22Оценок пока нет

- Chapter 6 - Solution ManualДокумент20 страницChapter 6 - Solution ManualCheng Yuet Joe75% (8)

- Week 6 Tutorial SolutionsДокумент13 страницWeek 6 Tutorial SolutionsFarah PatelОценок пока нет

- Accounting Assignment 2Документ4 страницыAccounting Assignment 2Laddie LMОценок пока нет

- Adhi Karya: Sixth Payment of Jabodebek LRTДокумент7 страницAdhi Karya: Sixth Payment of Jabodebek LRTPutri CandraОценок пока нет

- Introduction To Accounting: Basic Financial StatementsДокумент15 страницIntroduction To Accounting: Basic Financial StatementsStellaОценок пока нет

- ACT1104 Assignment 4Документ5 страницACT1104 Assignment 4cjorillosa2004Оценок пока нет

- Far 5Документ9 страницFar 5Sonu NayakОценок пока нет

- Joan Robinson Opens Her Own Law Office On July 1Документ5 страницJoan Robinson Opens Her Own Law Office On July 1nasim khanОценок пока нет

- Inventory Cost Flow Deadline Aug 23 PDFДокумент7 страницInventory Cost Flow Deadline Aug 23 PDFGrace ReyesОценок пока нет

- EMB 834 Test - Aliyu ObabiOlorunkosi GafaarДокумент7 страницEMB 834 Test - Aliyu ObabiOlorunkosi GafaarAliyu GafaarОценок пока нет

- Depreciation Types and ExamplesДокумент7 страницDepreciation Types and ExamplesShimelis Tesema100% (1)

- Residual Income Valuation:: Valuing Common EquityДокумент39 страницResidual Income Valuation:: Valuing Common EquitywinwinОценок пока нет