Академический Документы

Профессиональный Документы

Культура Документы

"Fete N Fiesta" Management Team: Names Shareholding

Загружено:

Muskan Ali0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров9 страницFete n Fiesta is a management team consisting of Maryam Shiekh, Lubaina Malik, and Hamza Iqbal who each own 33.34%, 33.34%, and 33.32% respectively. The document provides financial projections for a 3 year period including estimated revenues, expenses, cash flows, and a net present value and benefit-cost analysis of the project. The analysis shows the project has a positive net present value of over $7 million and a benefit-cost ratio of 9.507, indicating it would be a profitable venture.

Исходное описание:

Business model

Оригинальное название

Fete n Fiesta Word Doc

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документFete n Fiesta is a management team consisting of Maryam Shiekh, Lubaina Malik, and Hamza Iqbal who each own 33.34%, 33.34%, and 33.32% respectively. The document provides financial projections for a 3 year period including estimated revenues, expenses, cash flows, and a net present value and benefit-cost analysis of the project. The analysis shows the project has a positive net present value of over $7 million and a benefit-cost ratio of 9.507, indicating it would be a profitable venture.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров9 страниц"Fete N Fiesta" Management Team: Names Shareholding

Загружено:

Muskan AliFete n Fiesta is a management team consisting of Maryam Shiekh, Lubaina Malik, and Hamza Iqbal who each own 33.34%, 33.34%, and 33.32% respectively. The document provides financial projections for a 3 year period including estimated revenues, expenses, cash flows, and a net present value and benefit-cost analysis of the project. The analysis shows the project has a positive net present value of over $7 million and a benefit-cost ratio of 9.507, indicating it would be a profitable venture.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

“Fete n Fiesta”

Management Team

Names Shareholding

Maryam Shiekh 33.34%

Lubaina Malik 33.34%

Hamza Iqbal 33.32%

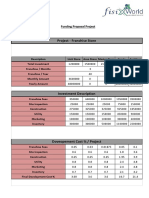

Sale Price and Cost Per month

Product Description Per event/dinning/take Cost (rs)

away Prices (rs)

Décor materials 6000 70%

Outsource Food(Italian, Pastas (800-800) 70%

Chinese)

Salads (500-700)

Soft Drinks (100)

Pure Water(50-100)

Materials for making food (1000-5000) 70%

Project Capital & Operating Cost (Debt &equity)

Items Amount Comments

Operating Expenses:

Building rent 1,00,000 Based on area and location in DHA

2,Downtown Giga, Sector C, in front of

Lignum Tower

Products Materials 50,000 Based on quotation +taxes

Working capital 1,00,000 Estimated

Capital Expense:

Furniture(Tables, chairs, 3,00,000 Estimated

sofas)

Office Furniture 80,000 Computer, chairs, tables etc

Cutlery 1,00,000 Estimated

Machinery 1,00,000 Estimated

Invertors, Boilers Fans 5,00,000 Estimated

Rest room 30,000 Estimated

Contingency 1,00,000 Estimated

IDC 65,000 Interest rate, repayment schedule

Total project Cost 1525000 50% our investment & 50% Loan

Debt/Equity ratio 50%-50%

***Project WC Requirement

Items Amount

Raw Material (30 days) 100000

Cash requirements 50000

Total Working Capital Req. 150000

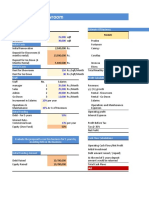

Assumptions for Income Statement:

Year 1: 100 % capacity utilization

5 % increase in inflation in each year

Cost of goods sold each year: 70% of sale

2% maintenance expenses

5% increase in Administrative, staff & Utilities expenses each year

20,000 rs salary per month

Depreciation @ 30,000 Rs. yearly

Increase in 10 % land rent in each year

Revenue Model

(Calculations)

Items Year 1 Year 2 Year 3

Products line in per month For Gazebo 7500 10,000

(6000), Per

head (1200, 1350 1700

estimated)

Revenues:

Product line (No. of

customers) 8064000

1: (6000*12+1200*500*12)

2: (7500*25+1350*900*12)

3: 16830000

(10,000*50+1600*1300*12)

30960000

Total revenue 8064000 16830000 30960000

Income Statement

(Margins)

Sales 8064000 16830000 30960000

CGS 5644800 11781000 21672000

GP margin 2419200 5049000 9288000

Adm. & Utilities 400000 420000 441000

Expenditures & salaries

Depreciation 30000 30000 30000

Maintenance Expense 161280 336600 619299

rent 100000 100000 121000

Total Operating Expense 691280 886600 1211299

EBIT 1727920 4162400 8076701

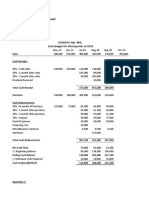

CASH INFLOW

Cash Inflow YR0 Yr1 YR2 YR3

Loan (3 years) 7625000

Owner Equity 7625000

EBIT 1727920 4162400 8076701

Depreciation 30000 30000 30000

Total Cash 1525000 1757920 4192400 8106701

Inflow

CASH OUTFLOW

YR 0 YR 1 YR 2 YR 3

Capital Exp. 1525000

Loan Pmt 645871 645871 645871

Interest 13% 198250 140059 74303

Income tax 5% 86396 208120 403835

Total Cash Outflow 930517 994050 1124009

Net Cash 0 827403 3198350 6982692

Project Selection (NPV & B/C Ratio:

Year Cash flows PVIF @ 13%(cost of PV

capital) for 3 years

1 827403 0.8849 732168.91

2 3198350 0.7631 2440660.88

3 6982692 0.6930 4839005.56

Total PV 8011835.35

Investment 762500

Net PV 7249335.35

B/C Ratio 7249335.35/762500 =

9.507

Вам также может понравиться

- FBF Final Project Report (Financial Plan)Документ6 страницFBF Final Project Report (Financial Plan)Afaq BhuttaОценок пока нет

- Dairy ProjectДокумент8 страницDairy ProjectPraveen SinghОценок пока нет

- VIII. Financial Plan: A. Current Funding RequirementsДокумент15 страницVIII. Financial Plan: A. Current Funding RequirementsSaad AkramОценок пока нет

- Feasibility Report 2Документ2 страницыFeasibility Report 2Jawad ahmadОценок пока нет

- Investment PlanДокумент23 страницыInvestment PlanKhizar WaheedОценок пока нет

- Mr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Документ7 страницMr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Ajay KumarОценок пока нет

- Finance&Accounts T3 SolutionДокумент4 страницыFinance&Accounts T3 Solutionkanika thakurОценок пока нет

- Mr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Документ9 страницMr. M S/o R Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Santhosh Kumar BattaОценок пока нет

- Sample Restaurant Training ProposalДокумент7 страницSample Restaurant Training ProposalSenami ZambaОценок пока нет

- FM2 Assignment 4 - Group 5Документ7 страницFM2 Assignment 4 - Group 5TestОценок пока нет

- Project Report Dary FarmДокумент7 страницProject Report Dary FarmAbdul Hakim ShaikhОценок пока нет

- Financial StatementДокумент36 страницFinancial StatementJigoku ShojuОценок пока нет

- Q1Документ31 страницаQ1Bhaskkar SinhaОценок пока нет

- Butle 1Документ17 страницButle 1Gursharan KohliОценок пока нет

- Total Project Cost Fixed Assets/ Capital InvestmentsДокумент8 страницTotal Project Cost Fixed Assets/ Capital InvestmentsLorna BacligОценок пока нет

- Financial Plan OkДокумент7 страницFinancial Plan OkSYED ARSALANОценок пока нет

- Budgeting PlanДокумент14 страницBudgeting PlanWanzОценок пока нет

- Ch29 The Birdie GloveДокумент8 страницCh29 The Birdie GloveSiska Kurniawan0% (1)

- Mr. Ezhil S/o Perumal Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Документ7 страницMr. Ezhil S/o Perumal Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Babufarmer123Оценок пока нет

- Bifanet Cash FlowДокумент14 страницBifanet Cash Flowssembatya reaganОценок пока нет

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsДокумент36 страницMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (1)

- CB Numericals 1Документ13 страницCB Numericals 1Vedashree MaliОценок пока нет

- Unit 5, 6 & 7 Capital Budgeting 1Документ14 страницUnit 5, 6 & 7 Capital Budgeting 1ankit mehtaОценок пока нет

- Basaveshwar Engineering College (Autonomous) BagalkotДокумент20 страницBasaveshwar Engineering College (Autonomous) Bagalkotsagar sherkhaneОценок пока нет

- IBF AssignmentДокумент8 страницIBF AssignmentBashir Langra TitiОценок пока нет

- Capital BudgetingДокумент14 страницCapital BudgetingbhaskkarОценок пока нет

- Example 5.7Документ7 страницExample 5.7Omar KhalilОценок пока нет

- Software AssociatesДокумент6 страницSoftware Associatesshshank pandeyОценок пока нет

- STATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Документ5 страницSTATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Fatima Ansari d/o Muhammad AshrafОценок пока нет

- Project Telehealth - Health at Home: Equipment InformationДокумент1 страницаProject Telehealth - Health at Home: Equipment InformationSenapati Prabhupada DasОценок пока нет

- Rs. 500,000 Rs.600,000 RsДокумент8 страницRs. 500,000 Rs.600,000 RsRizwan GhafoorОценок пока нет

- Funding Proposal ProjectДокумент4 страницыFunding Proposal ProjectSatvir SinghОценок пока нет

- Financial Plan AtstyleДокумент4 страницыFinancial Plan AtstyleM.ShahnamОценок пока нет

- Essay FIN202Документ5 страницEssay FIN202thaindnds180468Оценок пока нет

- Mine Investment AnalysisДокумент6 страницMine Investment AnalysisTriAnggaBayuPutra50% (2)

- Fin Strategy Ass 1Документ3 страницыFin Strategy Ass 1mqondisi nkabindeОценок пока нет

- 3 Months PlanДокумент8 страниц3 Months PlanWaleed ZakariaОценок пока нет

- Capital Expenses (CAPEX) :: 7.0 Financial PlanДокумент3 страницыCapital Expenses (CAPEX) :: 7.0 Financial PlanHassan QadarОценок пока нет

- Financial Planning and Control AssignmentДокумент3 страницыFinancial Planning and Control AssignmentnkwatalindiweОценок пока нет

- Q3a. Capital Budget AssignmentДокумент1 страницаQ3a. Capital Budget AssignmentMorgan MunyoroОценок пока нет

- Financial Plan: Start-Up Capital:: Profit Loss StatementДокумент6 страницFinancial Plan: Start-Up Capital:: Profit Loss Statementparthi 23Оценок пока нет

- Franchise - CarДокумент14 страницFranchise - Carshrish guptaОценок пока нет

- Lecture 9Документ21 страницаLecture 9Hồng LêОценок пока нет

- Assignment 3 Feb MBA 1Документ17 страницAssignment 3 Feb MBA 1shahzad aliОценок пока нет

- Test 1 (2019672728) (NBF2D)Документ5 страницTest 1 (2019672728) (NBF2D)Masnur Aina Md RajehОценок пока нет

- Business PlanДокумент12 страницBusiness PlanPapa HarjaiОценок пока нет

- Financial Management 1Документ8 страницFinancial Management 1KaranОценок пока нет

- Acc Final 2Документ15 страницAcc Final 2Tanvir OnifОценок пока нет

- Hungry PediaДокумент19 страницHungry PediaPrashannaОценок пока нет

- Items Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairaДокумент4 страницыItems Cost Cost ( N ) : Cleaners Food Technicians Security Guards Other Total Salary Labor Salary in NairababatundeОценок пока нет

- Chapter 23Документ8 страницChapter 23Matahari PagiОценок пока нет

- Delta Project and Repco AnalysisДокумент9 страницDelta Project and Repco AnalysisvarunjajooОценок пока нет

- Case Bco: IncomeДокумент19 страницCase Bco: IncomeMuhammad Abdullah FarooqОценок пока нет

- Edited FSДокумент40 страницEdited FShello kitty black and whiteОценок пока нет

- Nov. 6 DeadlineДокумент11 страницNov. 6 DeadlineAngelinee C.Оценок пока нет

- Income StatementДокумент3 страницыIncome StatementBiswajit SarmaОценок пока нет

- Current Year Base Year Base Year X 100Документ4 страницыCurrent Year Base Year Base Year X 100Kathlyn TajadaОценок пока нет

- Financial Analysis LiquidityДокумент22 страницыFinancial Analysis LiquidityRochelle ArpilledaОценок пока нет

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- Fare Comparision - ReportДокумент6 страницFare Comparision - ReportMohammed Saber Ibrahim Ramadan ITL World KSAОценок пока нет

- Provisional Certificate H402HHL0713483Документ1 страницаProvisional Certificate H402HHL0713483sivavm4Оценок пока нет

- 50,000 Rupees in Usd - Google SearchДокумент1 страница50,000 Rupees in Usd - Google SearchMoris GomezОценок пока нет

- Unit-III Time Study (Work Measurement) Time Study: DefinitionsДокумент15 страницUnit-III Time Study (Work Measurement) Time Study: DefinitionsAbhishek AruaОценок пока нет

- Analisis Penentuan Harga Jual Apartemen - CompressДокумент14 страницAnalisis Penentuan Harga Jual Apartemen - Compressriko andreanОценок пока нет

- Report On Private BankДокумент72 страницыReport On Private BankNajmul TuhinОценок пока нет

- European Standard Contract For Coffee ESCC 2018 Edition As Amended - Feb 21Документ27 страницEuropean Standard Contract For Coffee ESCC 2018 Edition As Amended - Feb 21Andrés Felipe Bahamón MonjeОценок пока нет

- Goodyear AnalysisДокумент2 страницыGoodyear AnalysisSakshi ShardaОценок пока нет

- Quiz 1Документ8 страницQuiz 1Kurt dela TorreОценок пока нет

- Intro To Contract Review SlidesДокумент19 страницIntro To Contract Review SlidesBảo Uyên Nguyễn TrầnОценок пока нет

- Eir LandlineДокумент4 страницыEir LandlineSean DalyОценок пока нет

- 001 BPI V de RenyДокумент2 страницы001 BPI V de RenyPatrick ManaloОценок пока нет

- Chapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxДокумент27 страницChapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxSatheesh KannaОценок пока нет

- Chapter - 3 Prospectus & Allotment of SecuritiesДокумент15 страницChapter - 3 Prospectus & Allotment of SecuritiesShoayebОценок пока нет

- Central Action Plan 2021-22Документ73 страницыCentral Action Plan 2021-22raj27385Оценок пока нет

- Gamuda AR2016Документ356 страницGamuda AR2016UstazFaizalAriffinOriginalОценок пока нет

- LAtihan CH 18Документ19 страницLAtihan CH 18laurentinus fikaОценок пока нет

- Corpo 2 J.R.S. Business Corp. vs. Imperial Insurance, Inc., 11 SCRA 634, No. L-19891 July 31, 1964Документ9 страницCorpo 2 J.R.S. Business Corp. vs. Imperial Insurance, Inc., 11 SCRA 634, No. L-19891 July 31, 1964Claudia LapazОценок пока нет

- WHLP Fabm2 Sy 2022 2023 Q1Документ9 страницWHLP Fabm2 Sy 2022 2023 Q1Ja MesОценок пока нет

- 74841bos60509 cp14Документ80 страниц74841bos60509 cp14Satish BhorОценок пока нет

- SOIC-My JourneyДокумент24 страницыSOIC-My JourneyPrateekОценок пока нет

- Jundit Meroz Zilfa-ASSIGNMENT-Financial-Planning-and-BudgetДокумент4 страницыJundit Meroz Zilfa-ASSIGNMENT-Financial-Planning-and-BudgetMeroz JunditОценок пока нет

- FA2 Mock 3 ExamДокумент12 страницFA2 Mock 3 ExamRameen ChОценок пока нет

- Docu Robeco Sustainability Risk PolicyДокумент25 страницDocu Robeco Sustainability Risk PolicyDiana IrimescuОценок пока нет

- 2020 Mini ProjectДокумент22 страницы2020 Mini ProjectPema NingtobОценок пока нет

- 342210210082022INAPL6SB22120820221409Документ7 страниц342210210082022INAPL6SB22120820221409INTERWORLD PACIFIC CONTAINER LINEОценок пока нет

- XYZ Health FoundationДокумент7 страницXYZ Health FoundationAKINREMI AYODEJIОценок пока нет

- Patterns in Stock Prices PIVOTE Jesse LivermoreДокумент7 страницPatterns in Stock Prices PIVOTE Jesse Livermorekuky6549369Оценок пока нет

- Estimate NCS/NW/582: Nexsus Cyber Solutions Opc PVT LTDДокумент2 страницыEstimate NCS/NW/582: Nexsus Cyber Solutions Opc PVT LTDmkm969Оценок пока нет

- ReplacedДокумент4 страницыReplacedLuno coin100% (1)