Академический Документы

Профессиональный Документы

Культура Документы

Bristol Meyers Squibb Company - 2011

Загружено:

Jennifer AldoviboОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bristol Meyers Squibb Company - 2011

Загружено:

Jennifer AldoviboАвторское право:

Доступные форматы

Bristol Meyers Squibb Company – 2011

Forest David

A. Case Abstract

Bristol Meyers Squibb (BMY) is a comprehensive strategic management case that includes the company’s

year-end 2010 financial statements, organizational chart, competitor information and more. The case time

setting is the year 2011. Sufficient internal and external data are provided to enable students to evaluate

current strategies and recommend a three-year strategic plan for the company. Headquartered in New

York, New York, BMY’s common stock is publicly traded under the ticker symbol BMY.

Headquartered in New York City, Bristol-Myers Squibb is a huge pharmaceutical firm with such

blockbuster cardiovascular drugs as Plavix and Avapro for hypertension. BMY also produces antipsychotic

medication Abilify and HIV treatments Reyataz and Sustiva. BMY also has excellent products

in immunoscience, metabolics, neuroscience, oncology, and virology. BMY has 12 manufacturing

plants worldwide and conducts research and development in four countries, sells its products globally; the

US accounts for two thirds of BMY’s sales.

B. Vision Statement (proposed)

To become the number one drug manufacturer in the world.

C. Mission Statement (proposed)

We at Bristol-Myers Squibb pride ourselves with providing high-quality and innovative medicines (2) for

our customers (1). We globally (3) perform research to aid in the finding of cures for serious ailments. We

use the most advanced equipment (4) and people to ensure the most promising product development (7).

We keep our eyes open for opportunities in acquiring new firms to expand our company and product base,

in turn securing and maximizing our shareholder’s wealth (5). We believe with power comes great

responsibility (6) and we are focused on educating in health concerns and promoting awareness. We

embrace a diverse workforce (9) with a inclusive culture in which the health, professional development,

safety, work-life balance, and respectful treatment of our employees (8) are among our highest priorities.

1. Customers

2. Products or services

3. Markets

4. Technology

5. Concern for survival, growth, and profitability

6. Philosophy

7. Self-concept

8. Concern for public image

9. Concern for employees

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

D. External Audit

Opportunities

1. FDA approval for BMY drug Yervoy to fight melanoma.

2. Global pharmaceutical sales are expected to expand up to 7 percent over 2011.

3. Pfizer’s Lipitor and Lilly’s Zyprexa patents expire in 2011.

4. Specialty drugs have accounted for close to 2/3 of all new drugs launched.

5. The industry has some of the highest barriers to entry of any US industry.

6. Generic drugs are only slightly less expensive than branded ones in Japan and Europe.

7. FDA will often allow drugs to become OTC drugs as their patent ends.

Threats

1. The two provisions of the US health care over haul: 1) an annual fee on pharmaceutical companies,

and 2) new discounts for Medicare patients who hit the prescription coverage gap.

2. In May 2012, BMY patent protection on Plavix expires.

3. Bloomberg’s Business Week warned BMY has financial challenges ahead in 2012 and downgraded the

stock to “hold” from “buy.”

4. For every 5,000 compounds discovered only one reaches the pharmacist’s shelf.

5. Less than 1/3 of all marketed drugs achieve enough commercial success to recoup their R&D

investments.

6. With regulations it can take 12 to 15 years from time patent is received until the drug hits the market.

7. Many competitors in the market with Pfizer being the largest yet only having 8% of the market.

8. Patent infringement in developing countries not honoring patents from other nations.

9. FDA requires 3 phases of expensive human testing before a drug can be approved.

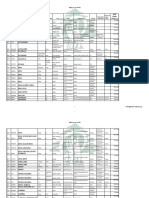

Competitive Profile Matrix

Bristol Meyers

Pfizer Merck

Squibb

Critical Success Factors Weight Rating Score Rating Score Rating Score

Advertising 0.05 2 0.10 4 0.20 3 0.15

Market Penetration 0.12 2 0.24 4 0.48 3 0.36

Sales 0.15 2 0.30 4 0.60 3 0.45

Product Quality 0.15 2 0.30 4 0.60 3 0.45

R&D 0.12 2 0.24 4 0.48 3 0.36

Products Offered 0.10 2 0.20 4 0.40 3 0.30

Financial Profit 0.16 2 0.32 4 0.64 3 0.48

Market Share 0.15 2 0.30 4 0.60 3 0.45

Totals 1.00 2.00 4.00 3.00

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

EFE Matrix

Opportunities Weight Rating Weighted Score

1. FDA approval for BMY drug Yervoy to fight melanoma. 0.09 4 0.36

2. Global pharmaceutical sales are expected to expand up to 7 0.09 3 0.27

percent over 2011.

3. Pfizer’s Lipitor and Lilly’s Zyprexa patents expire in 2011. 0.09 2 0.18

4. Specialty drugs have accounted for close to 2/3 of all new drugs 0.05 3 0.15

launched.

5. The industry has some of the highest barriers to entry of any US 0.05 4 0.20

industry.

6. Generic drugs are only slightly less expensive than branded 0.04 2 0.08

ones in Japan and Europe.

7. FDA will often allow drugs to become OTC drugs as their patent 0.03 2 0.06

ends.

Threats Weight Rating Weighted Score

1. The two provisions of the US health care over haul: 1) an annual

fee on pharmaceutical companies, and 2) new discounts for 0.04 2 0.08

Medicare patients who hit the prescription coverage gap.

2. In May 2012, BMY patent protection on Plavix expires. 0.15 3 0.45

3. Bloomberg’s Business Week warned BMY has financial

challenges ahead in 2012 and downgraded the stock to “hold” 0.03 3 0.09

from “buy.”

4. For every 5,000 compounds discovered only one reaches the

0.04 3 0.12

pharmacist’s shelf.

5. Less than 1/3 of all marketed drugs achieve enough commercial

0.07 3 0.21

success to recoup their R&D investments.

6. With regulations it can take 12 to 15 years from time patent is

0.06 3 0.18

received until the drug hits the market.

7. Many competitors in the market with Pfizer being the largest yet

0.05 2 0.10

only having 8% of the market.

8. Patent infringement in developing countries not honoring

0.07 3 0.21

patents from other nations.

9. FDA requires 3 phases of expensive human testing before a drug

0.05 3 0.15

can be approved.

TOTALS 1.00 2.89

E. Internal Audit

Strengths

1. BMY has 12 manufacturing plants worldwide and conducts R&D in 4 countries.

2. Inventory turnover of 4.1 versus industry average of 2.7.

3. BMY bought Amira Pharmaceuticals in 2011.

4. Produce a wide range of drugs to treat, HIV, Diabetes, Bi Polar Disorder among many others.

5. Low debt to equity ratio of 0.34.

6. Plavix provides protection against heart attack and stroke accounts for $6 billion in sales annually.

7. Many key drugs were approved in 2011 and many more are expected to be approved in 2012.

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

Weaknesses

1. Plavix accounts for 31% of revenue.

2. Revenue isn’t competitive enough to compete with R&D expenditures such as other top companies

like Pfizer and Merck.

3. Goodwill and intangibles account for over 50% of equity.

4. BMY is not in the top 10 of US based sales in 2010 for pharmaceutical companies.

5. Have not expanded into emerging markets well enough.

Financial Ratio Analysis

Growth Rate Percent BMY Industry S&P 500

Sales (Qtr vs year ago qtr) 11.40 6.00 14.50

Net Income (YTD vs YTD) NA NA NA

Net Income (Qtr vs year ago qtr) 2.30 64.80 47.20

Sales (5-Year Annual Avg.) 0.93 7.59 8.31

Net Income (5-Year Annual Avg.) 1.69 2.49 8.76

Dividends (5-Year Annual Avg.) 2.87 9.90 5.70

Profit Margin Percent

Gross Margin 73.0 69.7 39.8

Pre-Tax Margin 32.5 -28.9 18.2

Net Profit Margin 23.3 15.6 13.2

5Yr Gross Margin (5-Year Avg.) 70.3 71.2 39.8

Liquidity Ratios

Debt/Equity Ratio 0.34 1.03 1.00

Current Ratio 2.0 0.8 1.3

Quick Ratio 1.8 0.7 0.9

Profitability Ratios

Return On Equity 20.5 30.0 26.0

Return On Assets 15.2 8.8 8.9

Return On Capital 19.3 11.4 11.8

Return On Equity (5-Year Avg.) 18.8 22.9 23.8

Return On Assets (5-Year Avg.) 11.5 10.3 8.0

Return On Capital (5-Year Avg.) 15.3 13.8 10.8

Efficiency Ratios

Income/Employee 180,407 90,604 126,905

Revenue/Employee 774,111 652,532 1 Mil

Receivable Turnover 10.1 5.6 15.4

Inventory Turnover 4.1 2.7 12.5

Net Worth Analysis (in millions)

Stockholders Equity $ 15,713

Net Income x 5 $ 15,510

(Share Price/EPS) x Net Income $ 50,080

Number of Shares Outstanding x Share Price $ 52,931

Method Average $ 33,558

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

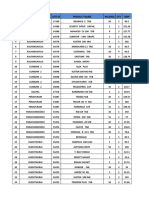

IFE Matrix

Strengths Weight Rating Weighted Score

1. BMY has 12 manufacturing plants worldwide and conducts R&D

0.10 4 0.40

in 4 countries.

2. Inventory turnover of 4.1 versus industry average of 2.7. 0.10 4 0.40

3. BMY bought Amira Pharmaceuticals in 2011. 0.08 3 0.24

4. Produce a wide range of drugs to treat, HIV, Diabetes, Bi Polar

0.10 4 0.40

Disorder among many others.

5. Low debt to equity ratio of 0.34. 0.08 4 0.32

6. Plavix provides protection against heart attack and stroke

0.10 3 0.30

accounts for $6 billion in sales annually.

7. Many key drugs were approved in 2011 and many more are

0.10 4 0.40

expected to be approved in 2012.

Weaknesses Weight Rating Weighted Score

1. Plavix accounts for 31% of revenue. 0.10 1 0.10

2. Revenue isn’t competitive enough to compete with R&D

0.06 2 0.12

expenditures such as other top companies like Pfizer and Merck.

3. Goodwill and intangibles account for over 50% of equity. 0.06 1 0.06

4. BMY is not in the top 10 of US based sales in 2010 for

0.04 2 0.08

pharmaceutical companies.

5. Have not expanded into emerging markets well enough. 0.08 2 0.16

TOTALS 1.00 2.98

F. SWOT

SO Strategies

1. Add 2 new manufacturing plants in China (S1, O1, O2).

2. Product generic versions of Lipitor and Zyprexa (S1, O3).

WO Strategies

1. Increase R&D by $200M for the production of specialty drugs (W1, W2, O2, O4).

2. Produce drugs losing their patents status in Japan and Europe (W4, O6).

ST Strategies

1. Initiate a $200M advertising campaign to market new drugs before they hit the market (S7, T2).

2. Start production of generic OTC drugs (S1, T6).

WT Strategies

1. Add a division for the production of OTC drugs for $200M (W4, T6).

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

G. SPACE Matrix

FP

Conservative Aggressive

7

CP IP

-7 -6 -5 -4 -3 -2 -1 1 2 3 4 5 6 7

-1

-2

-3

-4

-5

-6

-7

Defensive Competitive

SP

Internal Analysis: External Analysis:

Financial Position (FP) Stability Position (SP)

Gross Margin 5 Rate of Inflation -2

Sales 4 Technological Changes -6

Debt/Equity Ratio 7 Regulations -7

ROE 3 Competitive Pressure -5

ROA 4 R&D Expenses -7

Financial Position (FP) Average 4.6 Stability Position (SP) Average -5.4

Internal Analysis: External Analysis:

Competitive Position (CP) Industry Position (IP)

Market Share -4 Growth Potential 5

Product Quality -4 Financial Stability 5

Customer Loyalty -4 Ease of Entry into Market 6

Technological know-how -5 Resource Utilization 5

Control over Suppliers and Distributors -3 Profit Potential 5

Competitive Position (CP) Average -4.0 Industry Position (IP) Average 5.2

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

H. Grand Strategy Matrix

Rapid Market Growth

Quadrant II Quadrant I

BMY

Weak Strong

Competitive Competitive

Position Position

Quadrant III Quadrant IV

Slow Market Growth

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

I. The Internal-External (IE) Matrix

The Total IFE Weighted Scores

Strong Average Weak

4.0 to 3.0 2.99 to 2.0 1.99 to 1.0

4.0 I II III

High

3.0 IV V VI

The

EFE

Total Medium BMY

Weighted

Scores

2.0 VII VIII IX

Low

1.0

Segment 2010 Revenue

US $12,613

Europe $3,448

Japan, Asia, Canada $1,651

Latin America, Middle East, Africa $856

Emerging Markets $804

Other $112

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

J. QSPM

Add division

Add 2 plants for OTC

drugs

Opportunities Weight AS TAS AS TAS

1. FDA approval for BMY drug Yervoy to fight melanoma. 0.09 3 0.27 1 0.09

2. Global pharmaceutical sales are expected to expand up to 7

0.09 3 0.27 2 0.18

percent over 2011.

3. Pfizer’s Lipitor and Lilly’s Zyprexa patents expire in 2011. 0.09 2 0.18 3 0.27

4. Specialty drugs have accounted for close to 2/3 of all new drugs 0.05 4 0.20 1 0.05

5. launched.

The industry has some of the highest barriers to entry of any US 0.05 3 0.15 2 0.10

6. Generic drugs are only slightly less expensive than branded

0.04 4 0.16 2 0.08

ones in Japan and Europe.

7. FDA will often allow drugs to become OTC drugs as their patent

0.03 2 0.06 4 0.12

ends.

Threats Weight AS TAS AS TAS

1. The two provisions of the US health care over haul: 1) an annual

fee on pharmaceutical companies, and 2) new discounts for 0.04 1 0.04 4 0.16

Medicare patients who hit the prescription coverage gap.

2. In May 2012, BMY patent protection on Plavix expires. 0.15 0 0.00 0 0.00

3. Bloomberg’s Business Week warned BMY has financial

challenges ahead in 2012 and downgraded the stock to “hold” 0.03 1 0.03 3 0.09

from “buy.”

4. For every 5,000 compounds discovered only one reaches the

0.04 2 0.08 3 0.12

pharmacist’s shelf.

5. Less than 1/3 of all marketed drugs achieve enough commercial

0.07 0 0.00 0 0.00

success to recoup their R&D investments.

6. With regulations it can take 12 to 15 years from time patent is

0.06 1 0.06 3 0.18

received until the drug hits the market.

7. Many competitors in the market with Pfizer being the largest yet

0.05 0 0.00 0 0.00

only having 8% of the market.

8. Patent infringement in developing countries not honoring

0.07 0 0.00 0 0.00

patents from other nations.

9. FDA requires 3 phases of expensive human testing before a drug

0.05 1 0.05 3 0.15

can be approved.

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

Add division

Add 2 plants for OTC

drugs

Strengths Weight AS TAS AS TAS

1. BMY has 12 manufacturing plants worldwide and conducts R&D

0.10 4 0.40 2 0.20

in 4 countries.

2. Inventory turnover of 4.1 versus industry average of 2.7. 0.10 2 0.20 3 0.30

3. BMY bought Amira Pharmaceuticals in 2011. 0.08 2 0.16 1 0.08

4. Produce a wide range of drugs to treat, HIV, Diabetes, Bi Polar

0.10 4 0.40 1 0.10

Disorder among many others.

5. Low debt to equity ratio of 0.34. 0.08 3 0.24 2 0.16

6. Plavix provides protection against heart attack and stroke

0.10 0 0.00 0 0.00

accounts for $6 billion in sales annually.

7. Many key drugs were approved in 2011 and many more are

0.10 4 0.40 1 0.10

expected to be approved in 2012.

Weaknesses Weight AS TAS AS TAS

1. Plavix accounts for 31% of revenue. 0.10 0 0.00 0 0.00

2. Revenue isn’t competitive enough to compete with R&D 0.06 0 0.00 0 0.00

3. Goodwill and intangibles account for over 50% of equity. 0.06 0 0.00 0 0.00

4. BMY is not in the top 10 of US based sales in 2010 for 0.04 1 0.04 4 0.16

5. Have not expanded into emerging markets well enough. 0.08 4 0.32 3 0.24

TOTALS 3.71 2.93

K. Recommendations

1. Add 2 new manufacturing plants in China for $200M.

2. Product generic versions of Lipitor and Zyprexa for $100M.

3. Increase R&D by $200M for the production of specialty drugs.

4. Add a division for the production of OTC drugs for $200M.

L. EPS/EBIT Analysis (in millions)

Amount Needed: $700

Stock Price: $32.77

Shares Outstanding: 1,690

Interest Rate: 5%

Tax Rate: 25%

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

Common Stock Financing Debt Financing

Recession Normal Boom Recession Normal Boom

EBIT $4,000 $6,000 $8,000 $4,000 $6,000 $8,000

Interest 0 0 0 35 35 35

EBT 4,000 6,000 8,000 3,965 5,965 7,965

Taxes 1,000 1,500 2,000 991 1,491 1,991

EAT 3,000 4,500 6,000 2,974 4,474 5,974

# Shares 1,711 1,711 1,711 1,690 1,690 1,690

EPS 1.75 2.63 3.51 1.76 2.65 3.53

20 Percent Stock 80 Percent Stock

Recession Normal Boom Recession Normal Boom

EBIT $4,000 $6,000 $8,000 $4,000 $6,000 $8,000

Interest 28 28 28 7 7 7

EBT 3,972 5,972 7,972 3,993 5,993 7,993

Taxes 993 1,493 1,993 998 1,498 1,998

EAT 2,979 4,479 5,979 2,995 4,495 5,995

# Shares 1,694 1,694 1,694 1,707 1,707 1,707

EPS 1.76 2.64 3.53 1.75 2.63 3.51

M. Epilogue

For Q3 of 2011, BMY reported a 2 percent increase in profit, as price increases and higher sales of most

key medicines were nearly offset by higher R&D and marketing spending. BMS’s net income in Q3 was

$969 million, or 56 cents per share, up from $949 million, or 55 cents per share, a year earlier, while the

company’s revenue rose 11 percent to $5.35 billion. The company did acknowledge though that two

provisions of the U.S. health care overhaul cut profit by about 4 cents a share in Q3. The two provisions

were: 1) an annual fee on pharmaceutical companies, and 2) new discounts for Medicare patients who hit

the prescription coverage gap. Despite these new laws, BMY at Q3 2011 raised the low end of its full 2011

EPS forecast from $2.25 to $2.30 per share.

As Q3 2011 ended, CEO Lambertville Andreotti told analysts that BMY made five important deals recently

that led to its second straight quarter with double-digit sales growth, a rarity in this industry. In September

2011, BMS bought Amira Pharmaceuticals, a developer of treatments for the fatal lung disease pulmonary

fibrosis and other disorders. During Q3, Bristol made deals with three other companies to develop new

drugs for cancer, diabetes and other diseases. BMY also secured a licensing deal to develop a once-a-day

HIV pill combining its Reyataz and a Gilead Sciences Inc. drug now in testing.

The Food and Drug Administration (FDA) recently pushed back its review deadline until January 2012 for

a much-anticipated new type of diabetes drug. In July 2011, the FDA advisers recommended against

approving dapagliflozin, a drug developed by BMS and partner AstraZeneca PLC. The ruling was due to

higher rates of bladder and breast cancer seen in patient testing. The Type 2 drug works by eliminating

excess blood sugar via urine.

For Q3 2011, BMY’s U.S. sales totaled $3.5 billion; foreign sales hit $1.9 billion. Sales were led by

Plavix, the world's second-best-selling drug, up 8 percent to $1.79 billion. Another BMY drug, Abilify, for

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

schizophrenia and bipolar disorder, saw sales rise 14 percent to $691 million. HIV drugs Reyataz and

Sustiva both increased about 5 percent, for a total of $750 million. Yervoy, the first drug to improve

survival in malignant melanoma patients, had $121 million in sales in its second quarter on the market. But

during Q3, sales of blood pressure drugs Avapro and Avalide fell 29 percent, to $216 million. That's

because they have generic competition in Canada, a rival's similar drug has generic competition in many

countries and one of the three dosage forms isn't available since a recall a year ago.

During Q3, BMY’s spending on marketing, sales and administration jumped 14 percent, to $1 billion,

partly because of costs to launch new products, including Yervoy. Research and development costs

increased 18 percent, to $973 million, mostly for expensive late-stage human testing.

Copyright ©2013 Pearson Education, Inc. publishing as Prentice Hall.

Вам также может понравиться

- Eli Lilly & Company - 2011Документ12 страницEli Lilly & Company - 2011Nur NabilahОценок пока нет

- Case 06 Merck CompanyДокумент18 страницCase 06 Merck CompanyAzain UsmanОценок пока нет

- 09 PfizerДокумент15 страниц09 Pfizers4sabrin100% (1)

- 09 PfizerДокумент15 страниц09 PfizerSolmaz HashemiОценок пока нет

- Case Study Pfizer 4Документ17 страницCase Study Pfizer 4Veba ReksadirajaОценок пока нет

- Pfizer - 2005: A. Case AbstractДокумент16 страницPfizer - 2005: A. Case AbstractKristian JayОценок пока нет

- Activity Chapter 6 Strategic ManagementДокумент9 страницActivity Chapter 6 Strategic ManagementRoss John JimenezОценок пока нет

- Johnson & Johnson - 2009Документ27 страницJohnson & Johnson - 2009Aiden WilliamsОценок пока нет

- External Environment: Submitted by Amelita Artigas FernandezДокумент12 страницExternal Environment: Submitted by Amelita Artigas FernandezChristopher FernandezОценок пока нет

- Strategicmanagementcase Pfizer 150323230319 Conversion Gate01Документ15 страницStrategicmanagementcase Pfizer 150323230319 Conversion Gate01Ashi SiddiquiОценок пока нет

- 04 WalgreensДокумент11 страниц04 WalgreensOssama FatehyОценок пока нет

- Analysis RevlonДокумент15 страницAnalysis RevlonNoorulain Adnan100% (2)

- Bristol Meyers Squibb CompanyДокумент20 страницBristol Meyers Squibb CompanyAkmal Kemal Hadi100% (4)

- Ume Rabab Strategic ManagementДокумент21 страницаUme Rabab Strategic Managementrabab balochОценок пока нет

- Pfizer: Case AbstractДокумент4 страницыPfizer: Case AbstractRoss John JimenezОценок пока нет

- Course Title: Strategy Planning Assignment No: 3 Program: BSCM-BSAF Section: F-17Документ3 страницыCourse Title: Strategy Planning Assignment No: 3 Program: BSCM-BSAF Section: F-17Ayesha HamidОценок пока нет

- Question#1: IFE Matrix: Key Internal Factors Weight Rating Weighted Score StrengthsДокумент6 страницQuestion#1: IFE Matrix: Key Internal Factors Weight Rating Weighted Score StrengthsAHMAD ALIОценок пока нет

- Eli Lilly CoДокумент11 страницEli Lilly CoRashadAnwaarОценок пока нет

- Key External Factors Weight Rating Weighted ScoreДокумент2 страницыKey External Factors Weight Rating Weighted ScoreJoseph FinianosОценок пока нет

- Johnson & Johnson: Mujahid Iqbal Propide2017Mphilms05 Marketing Theory and PracticeДокумент7 страницJohnson & Johnson: Mujahid Iqbal Propide2017Mphilms05 Marketing Theory and PracticeMujahid IqbalОценок пока нет

- Bayer HealthДокумент14 страницBayer HealthKerryОценок пока нет

- Bản gốcДокумент7 страницBản gốcThảo ĐinhОценок пока нет

- Estée Lauder - 2008: A. Case AbstractДокумент14 страницEstée Lauder - 2008: A. Case AbstractHani HanifahОценок пока нет

- Presentation By:: Osama Masood Fahad JawedДокумент25 страницPresentation By:: Osama Masood Fahad JawedOsama MasoodОценок пока нет

- Moderna Strategic Plan Presentation - 7assona GroupДокумент36 страницModerna Strategic Plan Presentation - 7assona GroupBeshoy Zakaria100% (1)

- Accounting at BiovaiДокумент8 страницAccounting at BiovaiAgnes Heng100% (1)

- Pfizer-Strategic Management Case Study: Company DescriptionДокумент6 страницPfizer-Strategic Management Case Study: Company DescriptionabhinavmehraОценок пока нет

- Research Report On Pfizer LTD.: Sector: Pharmaceuticals Segment: Mid CapДокумент11 страницResearch Report On Pfizer LTD.: Sector: Pharmaceuticals Segment: Mid Capdarshan jainОценок пока нет

- PetMeds Analysis 2Документ10 страницPetMeds Analysis 2Марго КоваленкоОценок пока нет

- Case Study 23 Strategic Management MolsanДокумент11 страницCase Study 23 Strategic Management MolsanMX Creation100% (1)

- Strategic Management of Business Plan of A PharmacyДокумент45 страницStrategic Management of Business Plan of A PharmacyAtlantis Ong100% (2)

- CVS Analysis Part 2Документ22 страницыCVS Analysis Part 2mirwaisОценок пока нет

- Môn t6 StrategyДокумент23 страницыMôn t6 StrategyHải YếnОценок пока нет

- Re-Inventing BIOCON: Case StudyДокумент11 страницRe-Inventing BIOCON: Case Studytejas rane100% (1)

- Cvs Caremark Final Case Study Amanda StrimpelДокумент43 страницыCvs Caremark Final Case Study Amanda Strimpelapi-356135475100% (2)

- Questionnairesss 1Документ21 страницаQuestionnairesss 1Chai AishaОценок пока нет

- Analysis of Pharmaceutical Industry: by Vlss ConsultanciesДокумент25 страницAnalysis of Pharmaceutical Industry: by Vlss ConsultanciessagardextorОценок пока нет

- Industry Analysis - Pharma SectorДокумент25 страницIndustry Analysis - Pharma SectorLini Susan JohnОценок пока нет

- Merck and Company Case Analysis: MORALES, Faye Diane ALVARAN, Arianne Kaye AUSTRIA, Roda Jane GATORIAN, DorothyДокумент7 страницMerck and Company Case Analysis: MORALES, Faye Diane ALVARAN, Arianne Kaye AUSTRIA, Roda Jane GATORIAN, DorothyArianne AlvaranОценок пока нет

- Arab Center For Pharmaceutical and Chemical Industries Co.Документ20 страницArab Center For Pharmaceutical and Chemical Industries Co.Fathi Salem Mohammed AbdullahОценок пока нет

- Contoh Case Solution Kraft Foods Inc. - 2009Документ17 страницContoh Case Solution Kraft Foods Inc. - 2009Ami ATULОценок пока нет

- Pfizer and Lilly Case StudyДокумент35 страницPfizer and Lilly Case StudyAbdul Hameed Khan100% (2)

- Group 5 Wac3Документ16 страницGroup 5 Wac3agalbay02810Оценок пока нет

- Strat ManДокумент12 страницStrat ManPaul AngeloОценок пока нет

- CVS Case Study FinalДокумент62 страницыCVS Case Study FinalRaviChaudhary100% (1)

- External Factor Analysis SummaryДокумент5 страницExternal Factor Analysis SummaryRupok AnandaОценок пока нет

- Global Pharmaceuticals Credit Outlook: A Bumpy Ride Through 2012Документ9 страницGlobal Pharmaceuticals Credit Outlook: A Bumpy Ride Through 2012erroldanzigerОценок пока нет

- Summer Internship ReportДокумент48 страницSummer Internship ReportRohitSinghОценок пока нет

- The Bounce Back: (Business Today-July 2,2017 Edition)Документ10 страницThe Bounce Back: (Business Today-July 2,2017 Edition)AshishJoyОценок пока нет

- Abbott India LTD.: GeneralДокумент4 страницыAbbott India LTD.: Generalvishwa thakkerОценок пока нет

- Revlon Was Founded inДокумент18 страницRevlon Was Founded inKARISHMA RAJОценок пока нет

- Case Chapter 3Документ9 страницCase Chapter 3rupok50% (2)

- Ats Research Desk: Company Name - Cadila Healthcare Fundamental ReportДокумент16 страницAts Research Desk: Company Name - Cadila Healthcare Fundamental ReportVishal SinghОценок пока нет

- EssteДокумент3 страницыEsstezonanexОценок пока нет

- Mercury Drug CorporationДокумент6 страницMercury Drug CorporationAi Leen100% (2)

- DR - Reddy's Laboratories LTD.: Hold (Target Price Rs 2,100) Investment RationaleДокумент8 страницDR - Reddy's Laboratories LTD.: Hold (Target Price Rs 2,100) Investment RationaleKumar MОценок пока нет

- Strategic Marketing for Specialty Medicines: A Practical ApproachОт EverandStrategic Marketing for Specialty Medicines: A Practical ApproachОценок пока нет

- A Biotech Manager's Handbook: A Practical GuideОт EverandA Biotech Manager's Handbook: A Practical GuideM O'NeillРейтинг: 3.5 из 5 звезд3.5/5 (3)

- ATH Stocks, Technical Analysis ScannerДокумент4 страницыATH Stocks, Technical Analysis Scanneromkarambale1Оценок пока нет

- Aventis Sales Promotion StartegyДокумент12 страницAventis Sales Promotion StartegySandeep Mishra100% (1)

- HDFC Pharma and Healthcare Fund - Investor PresentationДокумент26 страницHDFC Pharma and Healthcare Fund - Investor Presentationsheikh abdullah aleemОценок пока нет

- Equity Note - Active Fine Chemicals Ltd.Документ3 страницыEquity Note - Active Fine Chemicals Ltd.Makame Mahmud DiptaОценок пока нет

- Fatal Fakes Counterfeit MedicinesДокумент2 страницыFatal Fakes Counterfeit MedicinesadhanazharyОценок пока нет

- List of Non Subsidized Drugs Imported and Locally Manufactured Under LicenseДокумент60 страницList of Non Subsidized Drugs Imported and Locally Manufactured Under LicenseHagop SabounjianОценок пока нет

- Drug Shortages-The Dimensions of A Critical ProblemДокумент12 страницDrug Shortages-The Dimensions of A Critical ProblemSodiq OyetundeОценок пока нет

- Pharmacy Career OptionsДокумент19 страницPharmacy Career OptionscoutinhoeОценок пока нет

- MB 102Документ2 страницыMB 102suryavamshirakeshОценок пока нет

- PMC Buys Isochem - Generics No 334 20171205Документ16 страницPMC Buys Isochem - Generics No 334 20171205Echo WackoОценок пока нет

- Base Simex Agust 18 - PriceДокумент2 страницыBase Simex Agust 18 - PriceCynthia noverinaОценок пока нет

- Clinical Pharmacology in Health Care Service: Slobodan M. JankovićДокумент5 страницClinical Pharmacology in Health Care Service: Slobodan M. Jankovićsome buddyyОценок пока нет

- Valid RRR Application 2013 - 2017 PDFДокумент22 467 страницValid RRR Application 2013 - 2017 PDFAyub NaveedОценок пока нет

- DMF PDFДокумент17 страницDMF PDFAl RammohanОценок пока нет

- Web Marketed 20220408Документ494 страницыWeb Marketed 20220408Darwiche DarwicheОценок пока нет

- PPPL Rejected Expiry 10 - Sep - 2019Документ34 страницыPPPL Rejected Expiry 10 - Sep - 2019ANANTHA BABU AОценок пока нет

- Site160 33589 en File1Документ1 страницаSite160 33589 en File1IbraheemsadeekОценок пока нет

- MBA Summer Internship ReportДокумент62 страницыMBA Summer Internship ReportGurvinder SidhuОценок пока нет

- Reo-Morocco Part2 2023Документ20 страницReo-Morocco Part2 2023Pablo MatosasОценок пока нет

- A Case StudyДокумент2 страницыA Case StudyjjОценок пока нет

- Drug War II Public CitizenДокумент51 страницаDrug War II Public CitizenGaby ArguedasОценок пока нет

- Federation of Medical and Sales Representatives' Associations of India - News - Apr - 2015Документ4 страницыFederation of Medical and Sales Representatives' Associations of India - News - Apr - 2015Arun KoolwalОценок пока нет

- Web Marketing For PharmaДокумент10 страницWeb Marketing For PharmaShawkat HaiderОценок пока нет

- MGT Case Study Organizing Eli LillyДокумент2 страницыMGT Case Study Organizing Eli LillyKobi AtienzaОценок пока нет

- CASE STUDY Roche Pakistan (A) Turning Around An Organization Through Cultural TransformationДокумент4 страницыCASE STUDY Roche Pakistan (A) Turning Around An Organization Through Cultural TransformationJet Neil Patrick GalicinaoОценок пока нет

- Roche Position On PricingДокумент2 страницыRoche Position On Pricingurcrony10Оценок пока нет

- Horizon Pharma Et. Al. v. Watson Laboratories, Inc. - Florida Et. Al.Документ78 страницHorizon Pharma Et. Al. v. Watson Laboratories, Inc. - Florida Et. Al.Patent LitigationОценок пока нет

- Generic Pharmaceutical Industry Yearbook Torreya Feb2016 GphaДокумент72 страницыGeneric Pharmaceutical Industry Yearbook Torreya Feb2016 GphaSheltie ForeverОценок пока нет

- Canamed 2019 - 2020Документ1 908 страницCanamed 2019 - 2020Cristian MihalacheОценок пока нет

- List of Firms Having Who (Own)Документ1 страницаList of Firms Having Who (Own)Ksusha ChernobrovaОценок пока нет