Академический Документы

Профессиональный Документы

Культура Документы

Form No. 15G: (See Rule 29C)

Загружено:

MKОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form No. 15G: (See Rule 29C)

Загружено:

MKАвторское право:

Доступные форматы

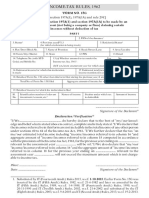

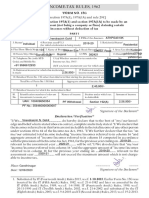

FORM NO.

15G

[See rule 29C]

Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to

be made by an individual or a person (not being a company or a firm) claiming

Certain receipts without deduction of tax

I/We*

__________________________________________________*son/daughter/wifeof__________

_____________________________________resident of_________________________ @ do

hereby declare—

1. *that I am a shareholder

in________________________________________________________(name and address of the

company) and the shares in the said company, particulars of which are given in Schedule I

below, stand in my name and are beneficially owned by me, and the dividends There from are

not includible in the total income of any other person under sections 60 to 64 of the Income-tax

Act, 1961;

Or

*#that the securities or sums, particulars of which are given in Schedule II or Schedule III or

Schedule IV below, stand in *my/our name and beneficially belong to *me/us, and the *interest

in respect of such securities or sums and/or income in respect of units is/are not Includible in the

total income of any other person under sections 60 to64 of the Income-tax Act, 1961;

Or

*that the particulars of my account under the National SavingsScheme and the amount of

withdrawal are as per the Schedule V below;

2. That *my/our present occupation is;

3. That the tax on *my/our estimated total income, including—*the dividends from shares

referred to in Schedule I below;

and/or

*#interest on securities, interest other than “interest on securities” and/or income in respect of

units, referred to in Schedule II, Schedule III and/or Schedule IV below;

and/or

*the amount referred to in clause (a) of sub-section (2) of section80CCA, mentioned in Schedule

V below,

Computed in accordance with the provisions of the Income-tax Act, 1961, for the previous year

ending on ______ relevant to the assessment year _____ — _____ will be nil;

4. That *my/our income from *dividend/interest on securities/interest other than “interest on

securities”/units/amounts referred to in clause(a) of sub-section (2) of section 80CCA or the

aggregate of such incomes, computed in accordance with the provisions of the Income tax Act,

1961, for the previous year ending on ________ relevant to the assessment year 20____-20____

will not exceed the maximum amount which is not chargeable to income-tax;

5. That *I/we have not been assessed to income-tax at any time in the past but I fall within the

jurisdiction of the Chief Commissioner or Commissioner of Income-tax ___________;

Or

That *I was/we were last assessed to income-tax for the assessment year______________—

____________by the Assessing Officer Circle/Ward/District and the permanent account number

allotted to me is ____________ ;

6. That I *am/am not resident in India within the meaning of section 6of the Income-tax Act,

1961;

Вам также может понравиться

- 15G FormДокумент2 страницы15G Formsurendar147Оценок пока нет

- Bar Review Companion: Taxation: Anvil Law Books Series, #4От EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Оценок пока нет

- PAN No.Документ5 страницPAN No.haldharkОценок пока нет

- Form 15GДокумент2 страницыForm 15GSrinivasa RaghavanОценок пока нет

- 1040 Exam Prep: Module II - Basic Tax ConceptsОт Everand1040 Exam Prep: Module II - Basic Tax ConceptsРейтинг: 1.5 из 5 звезд1.5/5 (2)

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidДокумент7 страницSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaОценок пока нет

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- New Form 15G Form 15H PDFДокумент6 страницNew Form 15G Form 15H PDFdevender143Оценок пока нет

- 15 G Form (Blank)Документ2 страницы15 G Form (Blank)nst27Оценок пока нет

- Form No. 15-I: See Rule 29C (3A) )Документ2 страницыForm No. 15-I: See Rule 29C (3A) )kinnari bhutaОценок пока нет

- 15G FormДокумент2 страницы15G Formgrover.jatinОценок пока нет

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyОт EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyОценок пока нет

- Form No. 15G: (See Rule 29C)Документ4 страницыForm No. 15G: (See Rule 29C)MKОценок пока нет

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnОт EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnОценок пока нет

- Tax Form 15H PDFДокумент4 страницыTax Form 15H PDFraviОценок пока нет

- Icici Form 15GДокумент2 страницыIcici Form 15Grajanikant_singhОценок пока нет

- PDF 4Документ3 страницыPDF 47ola007Оценок пока нет

- New FORM 15H Applicable PY 2016-17Документ2 страницыNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- "Form No. 15GДокумент2 страницы"Form No. 15GJayvin ShiluОценок пока нет

- "Form No. 15G: AO No. AO Type Range Code Area CodeДокумент2 страницы"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaОценок пока нет

- TAX SAVING Form 15g Revised1 SBTДокумент2 страницыTAX SAVING Form 15g Revised1 SBTrkssОценок пока нет

- PDFДокумент4 страницыPDFushapadminivadivelswamyОценок пока нет

- 15 G Form (Pre-Filled)Документ2 страницы15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- IT NotesДокумент58 страницIT NotesIshitaОценок пока нет

- Form 27CДокумент2 страницыForm 27CrajdeeppawarОценок пока нет

- 103120000000007845Документ3 страницы103120000000007845arjunv_14100% (1)

- AY 2005-06 Saral Form 2DДокумент2 страницыAY 2005-06 Saral Form 2DVinod VarmaОценок пока нет

- OBC Bank Form - 15H PDFДокумент2 страницыOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- 15G PDFДокумент2 страницы15G PDFSudhendu ChauhanОценок пока нет

- 15gh TC - DocumentДокумент2 страницы15gh TC - Documentvighnarthaagency2255Оценок пока нет

- New Form 15H For Fixed Deposits Editable in PDFДокумент2 страницыNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519Оценок пока нет

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovДокумент3 страницыFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanОценок пока нет

- Form 15g TaxguruДокумент3 страницыForm 15g Taxguruulhas_nakasheОценок пока нет

- Bonds Form 15gДокумент3 страницыBonds Form 15gRishi TОценок пока нет

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Документ4 страницыIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evОценок пока нет

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Документ7 страницTax Credit Statement (: Instructions For Filling FORM ITR-2Manyam JainiОценок пока нет

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Документ6 страницTax Credit Statement (: Instructions For Filling FORM ITR-2ajey_p1270Оценок пока нет

- Pan Card Number-Customer Number - 504979-PUNДокумент3 страницыPan Card Number-Customer Number - 504979-PUNVishu JoshiОценок пока нет

- Form 15 HДокумент2 страницыForm 15 Hsingh ramanpreetОценок пока нет

- Instructions For Filling Out FORM ITR-2Документ7 страницInstructions For Filling Out FORM ITR-2Harminder Singh DhamОценок пока нет

- Form 15 GДокумент2 страницыForm 15 GRahul SahaniОценок пока нет

- Declaration 206AA 206ABДокумент2 страницыDeclaration 206AA 206ABskikhtiarОценок пока нет

- Income Tax DepartmentДокумент6 страницIncome Tax DepartmentRajasekar SivaguruvelОценок пока нет

- BLANK IOCL Form 15GДокумент3 страницыBLANK IOCL Form 15Gsaiboyshostel37Оценок пока нет

- Basic Concepts of Income Tax ActДокумент14 страницBasic Concepts of Income Tax ActRaghu CkОценок пока нет

- Instructions For Filling Out FORM ITR-2Документ8 страницInstructions For Filling Out FORM ITR-2Ganesh KumarОценок пока нет

- 15h Form (1) - CompressedДокумент4 страницы15h Form (1) - Compressedrekha safarirОценок пока нет

- 15 G Form (Pre-Filled)Документ2 страницы15 G Form (Pre-Filled)Pawan Yadav0% (2)

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxДокумент3 страницы"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanОценок пока нет

- Quarterly Corporate Income Tax Annual Declaration and Quarterly Payments of Income TaxesДокумент2 страницыQuarterly Corporate Income Tax Annual Declaration and Quarterly Payments of Income TaxesshakiraОценок пока нет

- IncomeTax Law and Practice-SBAX1022Документ124 страницыIncomeTax Law and Practice-SBAX1022Kaushal DidwaniaОценок пока нет

- Saral: ITS-2D Form No. 2DДокумент2 страницыSaral: ITS-2D Form No. 2DPrasanta KarmakarОценок пока нет

- Module - 1 Basic Concepts.Документ11 страницModule - 1 Basic Concepts.Dimple JainОценок пока нет

- Income From SalaryДокумент12 страницIncome From SalaryAPОценок пока нет

- CTPMДокумент28 страницCTPMIndu Shekhar PoddarОценок пока нет

- FWD PaymentДокумент2 страницыFWD PaymentMKОценок пока нет

- NonReceipt of Annuity AmtДокумент3 страницыNonReceipt of Annuity AmtMKОценок пока нет

- Covering Letter For Nominee Change After DeathДокумент3 страницыCovering Letter For Nominee Change After DeathMKОценок пока нет

- Non Receipt of Shares Against Allotment Under Public IssueДокумент3 страницыNon Receipt of Shares Against Allotment Under Public IssueMKОценок пока нет

- Non Recei Pot of Bond Cert HДокумент5 страницNon Recei Pot of Bond Cert HMKОценок пока нет

- Non Re of Refuorder (F)Документ5 страницNon Re of Refuorder (F)MKОценок пока нет

- Non Recei Pot of Interest WarrantДокумент3 страницыNon Recei Pot of Interest WarrantMKОценок пока нет

- Indemnity Bond Duplicate KVPДокумент3 страницыIndemnity Bond Duplicate KVPMKОценок пока нет

- Non Receipt of Refund OrderДокумент3 страницыNon Receipt of Refund OrderMKОценок пока нет

- IssueofNewShareCert (HLL) PDFДокумент1 страницаIssueofNewShareCert (HLL) PDFMKОценок пока нет

- Indemnity Bond Duplicate Kvp1Документ1 страницаIndemnity Bond Duplicate Kvp1MKОценок пока нет

- Letter of UndertakingДокумент1 страницаLetter of UndertakingMKОценок пока нет

- Non Receipt of Exit PAn OptionsДокумент2 страницыNon Receipt of Exit PAn OptionsMKОценок пока нет

- Indemnity Bond (Income Tax Refund ) PDFДокумент1 страницаIndemnity Bond (Income Tax Refund ) PDFMKОценок пока нет

- FIR Application Lost Certificates PDFДокумент1 страницаFIR Application Lost Certificates PDFMKОценок пока нет

- Form No 15G 3Документ1 страницаForm No 15G 3MKОценок пока нет

- Form No 15G 2Документ1 страницаForm No 15G 2MKОценок пока нет

- Form No. 15G: (See Rule 29C)Документ4 страницыForm No. 15G: (See Rule 29C)MKОценок пока нет

- Permit6 PDFДокумент1 страницаPermit6 PDFMKОценок пока нет

- Minimum Scales For Different Categories.: Annexure-VДокумент1 страницаMinimum Scales For Different Categories.: Annexure-VMKОценок пока нет

- Annexure-II (Consulate Permit Form) Consulate General of India Dubai DUBA/LAB/383/1/2001 DateДокумент1 страницаAnnexure-II (Consulate Permit Form) Consulate General of India Dubai DUBA/LAB/383/1/2001 DateMKОценок пока нет

- Slaoui The Rising Issue of Repeat ArbitratorsДокумент19 страницSlaoui The Rising Issue of Repeat ArbitratorsJYhkОценок пока нет

- Indian Horary Shatpanchashika VAKAyer PDFДокумент46 страницIndian Horary Shatpanchashika VAKAyer PDFSunОценок пока нет

- A Liberal Upheaval - Dror ZeigermanДокумент65 страницA Liberal Upheaval - Dror ZeigermanfnfjerusalemОценок пока нет

- Farewell Speech (Csupt Roel Jeremy G Diaz) Greetings:: (Ad-Lib)Документ2 страницыFarewell Speech (Csupt Roel Jeremy G Diaz) Greetings:: (Ad-Lib)rizaОценок пока нет

- A 53Документ15 страницA 53annavikasОценок пока нет

- PhptoДокумент13 страницPhptoAshley Jovel De GuzmanОценок пока нет

- United States v. Ottens, 1st Cir. (1996)Документ32 страницыUnited States v. Ottens, 1st Cir. (1996)Scribd Government DocsОценок пока нет

- Kino No TabiДокумент122 страницыKino No TabiSiavosh TehraniОценок пока нет

- Case DigestДокумент14 страницCase DigestMerxeilles Santos100% (5)

- Saep 134Документ5 страницSaep 134Demac SaudОценок пока нет

- Flow Chart For Installation of Rooftop Solar PV System Under Net Metering ArrangementДокумент1 страницаFlow Chart For Installation of Rooftop Solar PV System Under Net Metering Arrangementjai parkashОценок пока нет

- Workflow of Strata Title Application in MalaysiaДокумент1 страницаWorkflow of Strata Title Application in MalaysiaAfiq MunchyzОценок пока нет

- Korean Foreign Legal Consultants Act - Legal Profession of American Lawyers in South KoreaДокумент14 страницKorean Foreign Legal Consultants Act - Legal Profession of American Lawyers in South Koreamsk149Оценок пока нет

- Calculus Early Transcendentals 2nd Edition Briggs Solutions ManualДокумент12 страницCalculus Early Transcendentals 2nd Edition Briggs Solutions Manualcrenate.bakshish.7ca96100% (28)

- Business law-Module+No.2Документ34 страницыBusiness law-Module+No.2Utkarsh SrivastavaОценок пока нет

- FIS V Plus ETAДокумент14 страницFIS V Plus ETAHOANG KHANH SONОценок пока нет

- Interpretation of StatutesДокумент8 страницInterpretation of StatutesPradeepkumar GadamsettyОценок пока нет

- List of ObligationДокумент118 страницList of ObligationAngelica SolisОценок пока нет

- J.K Shah Full Course Practice Question PaperДокумент16 страницJ.K Shah Full Course Practice Question PapermridulОценок пока нет

- AT - Activity - No. 11 - Auditor's Report in The Financial Statements PDFДокумент7 страницAT - Activity - No. 11 - Auditor's Report in The Financial Statements PDFDanielle VasquezОценок пока нет

- Entrepreneurship DevelopmentДокумент12 страницEntrepreneurship DevelopmentRohit ShindeОценок пока нет

- Home Improvement Business Exam GuideДокумент10 страницHome Improvement Business Exam GuideAl PenaОценок пока нет

- P1 (Corporate Governance, Risks & Ethics)Документ34 страницыP1 (Corporate Governance, Risks & Ethics)Šyed FarîsОценок пока нет

- Letter About Inadmissibility MP Majid Johari 2016-03-05Документ6 страницLetter About Inadmissibility MP Majid Johari 2016-03-05api-312195002Оценок пока нет

- 1629 Criminal LawДокумент22 страницы1629 Criminal LawprdyumnОценок пока нет

- Business Ethics - Jai Prakash SinghДокумент3 страницыBusiness Ethics - Jai Prakash SinghmitulОценок пока нет

- T.O. 1F-106A-4 - Technical Manual - Illustrated Parts Breakdown - F-106A (15!04!1986)Документ2 633 страницыT.O. 1F-106A-4 - Technical Manual - Illustrated Parts Breakdown - F-106A (15!04!1986)Kliment VoroshilovОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProОт EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProРейтинг: 4.5 из 5 звезд4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОт EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОценок пока нет

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОт EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОценок пока нет

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОт EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОценок пока нет

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyОт EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyРейтинг: 4 из 5 звезд4/5 (52)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesОт EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesРейтинг: 4 из 5 звезд4/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОт EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsОценок пока нет

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideОт EverandTax Savvy for Small Business: A Complete Tax Strategy GuideРейтинг: 5 из 5 звезд5/5 (1)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОт EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОценок пока нет

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessОт EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessРейтинг: 5 из 5 звезд5/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОт EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОценок пока нет

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)От EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Рейтинг: 4.5 из 5 звезд4.5/5 (43)

- S Corporation ESOP Traps for the UnwaryОт EverandS Corporation ESOP Traps for the UnwaryОценок пока нет

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthОт EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthОценок пока нет

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsОт EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsРейтинг: 3.5 из 5 звезд3.5/5 (9)

- Bookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesОт EverandBookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesОценок пока нет

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012От EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Оценок пока нет

- The Payroll Book: A Guide for Small Businesses and StartupsОт EverandThe Payroll Book: A Guide for Small Businesses and StartupsРейтинг: 5 из 5 звезд5/5 (1)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionОт EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionРейтинг: 5 из 5 звезд5/5 (27)