Академический Документы

Профессиональный Документы

Культура Документы

QB GST

Загружено:

Jeevitha ReddyИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

QB GST

Загружено:

Jeevitha ReddyАвторское право:

Доступные форматы

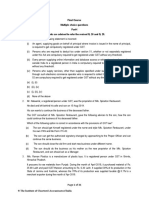

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

Model Questions

Section A

1. What is the taxable event in GST?

2. What is the composition of the GST Council?

3. Differentiate between Interstate and Intra state supply.

4. Who is a taxable person?

5. What do you mean by reverse charge?

6. Differentiate between Zero rated supply and Exempt supply.

7. Mention any two Exempted services.

8. Write a note on refund.

9. Write a note on Intra state supply and mention the type of GST to be levied?

10. Define ‘Continuous Supply of goods’.

11. What is composite supply?

12. What do you mean by Job Work Services?

13. Give a note on ‘Negative list’ in GST.

14. What is the significance of the expression “Supply made in the course or in furtherance

of business”?

15. Distinguish between composite supply and mixed supply.

16. What is meant by related persons in GST?

17. Write a note on distinct persons.

18. Give a note on time of supply of goods.

19. Write a note on ITC (Input Tax Credit).

20. What do you mean by composition scheme?

21. Write a note on transaction value.

22. Write a note on Invoice.

23. What do you mean by aggregate turnover?

24. Give a note on time of supply of services.

25. What do you mean by debit note?

26. Give a note on e - way bill.

27. What is compensation cess?

28. Which are the actionable claims subjected to GST?

29. Who is a ‘small tax payer’ in GST?

30. State the rules for determining the value of taxable supply in case of lottery run by a State

Government.

Section B (Theory)

31. Discuss the significance of consideration in GST.

32. What are the activities that are treated as supply under Schedule II/

33. Discuss the activities that are treated as supply even when consideration is absent.

34. What are the different types of supply under GST?

35. Discuss the provisions regarding the determination of the place of supply of goods and

services.

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

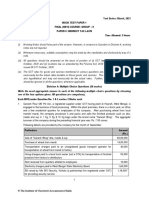

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

36. Explain the rules relating to the determination of the time of supply of goods and

services.

37. Discuss the provisions relating to Reverse Charge Mechanism.

38. What are the conditions for taking Input Tax Credit?

39. What are the different GST returns?

Section B (Theory)

40. Composition Scheme

41. Procedure for registration under GST.

42. Different assessments under GST.

43. Provisions relating to E-Way Bills in GST.

44. Provisions relating E-Commerce in GST.

45. Discuss the tax liability of following services under GST (Chargeable or not chargeable)

a. Services pertaining to soil testing for construction of dam

b. Issue of birth certificate by municipality

c. I class AC ticket in train

d. Sale of cashew nuts

e. Transportation of Passengers by radio taxi

f. Transportation of Passengers by monorail

g. Fees collected for vocational courses approved by UGC

h. Fees collected by a school

i. Fee collected by chartered accountant

j. Mid-day meals for school teachers.

46. X ltd is a furniture manufacturing company in Bangalore. It generally gives a trade

discount of 20% in the list price when the goods are sold to the distributors. During

December 2018 it offers Christmas discount of 10% in addition to normal discount. A

ltd, one of the distributors from Kerala purchases 100 chairs @Rs.1500 per chair on 30

Nov 2018 and 200 chairs on 1 December 2018. GST rate is 12%. Calculate the GST

liability.

47. On July 5 2017, X supplies 25 tons of chemical to Y from Chennai to Madurai at the rate

of 80000/- per ton. Besides he changes the following:

Freight -- 312000/-

Packing charges --72000/-

Weighing charges --30000/-

Inspection charges -- 12000/-

Cost of an instrument which is specially purchased by X to manufacture this particular

chemical is Rs.11000/- (This instrument cannot be used for any other chemical

manufacturing). Rate of GST is 18%. X charges 11000/- interest for the late payment.

Calculate GST liability

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

48. X is a manufacturer from Karnataka. He purchased raw material from Kerala for

2,00,000/-, & Karnataka for 4,00,000/-. Input service received from Bangalore for

manufacturing 100000/-. Manufacturing expenses incurred - 150000/- Profit is 10% of

cost 50% of the products manufactured is sold to Kerala and the balance is sold in

Karnataka. GST on sale 12%, GST on raw material 5%, GST on services rendered is

18%.

49. Mr. X from Bangalore supplies goods of 5,00,000/- to Y in Mysore, Mr. Y after making

value addition of 40%, supplied the goods to Mr. Z in Trivandrum, Mr. Z after making

value addition of 30%, supplies the same to Mr. A in Calicut. GST applicable to these

goods is 12%, calculate the GST payable by Mr. X, Y, & Z.

50. Calculate the GST liability of Mr. X who is a chartered accountant registered in

Karnataka. The following services were provided by him during January 2019.

Consultancy charges received from A ltd Bangalore Rs.5,00,000 (GST applicable 18%

collected from A ltd)

Book keeping charges from B ltd Rs.5, 00,000 (GST applicable 18% collected from B

ltd)

Rs.1,00,000 received from C ltd for providing services in the month of June 2019.

Calculate the GST liability.

51. X ltd is registered supplier of goods in Maharashtra. They supplied goods through an E-

Commerce Operator from UK. A ltd Mumbai is the representative of E-Commerce

operator in India.

Discuss

a. Who are liable for registration in India

b. Who will be liable to pay GST to Government

c. Whether TCS under sec 52 is applicable.

52. Mr.X, Exchanged 1000 $ into Indian Rupees for Rs.68 through a dealer. RBI Reference

rate is Rs.68.75. Find out the taxable value of supply.

53. Check the tax liability of following services under GST (Chargeable or not chargeable)

a. Services pertaining to soil testing for agriculture

b. Issue of birth certificate by municipality

c. II class sleeper ticket in train

d. Sale of branded wheat

e. Transportation of Passengers by air to Arunachal pradesh

f. Transportation of Passengers by metro

g. Fees collected for vocational courses approved by Cambridge university

h. Fees collected by a school

i. LIC Agent commission

j. Mid day meals for students.

54. X ltd is a cake manufacturing company in Bangalore. It generally gives a trade discount

of 15% in the list price when the goods are sold to the distributors. During December

2018 it offers Christmas special discount of 10% in addition to normal discount. A ltd

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

one of the distributors from Kerala purchases 100 packets of cakes @Rs.150 per packet

on 30 Nov 2018 and 200 packets of the same cakes on 1 December 2018. GST rate is

18%. Calculate the GST liability.

55. Calculate the GST liability of Mr. X who is an architect registered in Karnataka. The

following services were provided by him during January 2019.

Consultancy charges from A ltd Bangalore Rs.300000 (GST applicable 18% collected

from A ltd)

Drawing charges from ITC Gardenia for the new hotel in Bangalore Rs.500000 (GST

applicable 18% collected from ITC Gardenia)

Rs.100000 received from ITC for not providing similar services to any other industry in

the world. But X is in the view that he need not pay GST for this consideration. (GST

was not collected from ITC Gardenia).

56. X ltd is registered under GST in Maharashtra, They do not have registration in any other

states in India. Following services were rendered by them during Dec 2018. Find out the

GST liability.

Machinery supplied to A Ltd Karnataka Rs.4000000 (GST applicable 18%)

Installation services provided in Karnataka to install the machinery Rs.20000 (GST

applicable 18%).

57. X, a dealer of textile apparels, has a shop at Garuda Mall Bangalore. His turnover is less

than 1 crore but he is not registered under composition scheme. Rate of return of Mr. X is

10 percent, you are a tax consultant. Advise him suitably. Assume that applicable GST

rate is 18%.

58. X ltd is registered under GST in Maharashtra, They do not have registration in any other

states in India. Following services were rendered by them during dec 2018 find out the

GST liability.

Machinery supplied to A Ltd Karnataka Rs.4000000 (GST applicable 18%)

Installation services provided in Karnataka for installing the machinery was charged

Rs.20000 (GST applicable 18%).

59. Discuss whether GST is applicable in the following transactions.

a) X transfers 1000 debentures of A ltd for a consideration of 475000/-

b) Z transfers a plot of land situated in Bangalore for a consideration of 4000000/-

c) X a registered person in GST, is a flower dealer in Pune, he sells roses for

decoration purpose 150000/-

d) X deposits 100000/- in cash in savings account with State Bank of INDIA (SBI)

e) Transfer of debentures by Y for consideration of 410000/-

f) Z takes a housing loan of 150000/- from Kotak Mahindra Bank, rate of interest is

7.5%, loan repayment after 3years, 1000/- for document charges.

g) X supplies 50 non-stick cookers to Y (X is a registered manufacturer under GST

& Y is an unregistered dealer in GST).

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

h) X gives a vacant plot of land situated in a residential area to Y ltd for parking

unsold cars at Delhi.

i) Z gives his vacant land in village for rent for agricultural purpose.

60. X located in Mumbai is a technical consultant to many company. He is a registered

person. He has been providing technical support to A Ltd, Nagpur since 2011.

On December 10 2017, A ltd has paid 100000/- to Mr. X on his promise of not providing

similar technical services to any other business entity in India or abroad for a period of 10

years.

X is of the view that the 1000000/- is not chargeable under GST, do you agree?

If not, calculate GST liability of Mr. X. (Technical services provided by X is normally

taxable @ 18 %.)

61. Calculate the GST liability of Mr. X who is a designer registered in Karnataka. The

following services were provided by him during January 2019.

Consultancy charges from A ltd Bangalore Rs.500000 (GST applicable 18% collected

from A ltd)

Drawing charges from Pothys for the new design in Bangalore Rs.200000 (GST

applicable 18% collected from ITC Gardenia)

Rs.100000 received from Pothys for not providing similar services to any other industry

in the world. But X is of the view that he need not pay GST for this consideration. (GST

was not collected from Pothys).

Calculate the GST liability.

62. Mr. .X exchanges 1000 $ @ Rs.66, But RBI rate is Rs.65. Find out the transaction value.

63. Explain the procedure of assessment

64. Explain the types of Assessment

65. X an architect who is in Mumbai, during December 2017 he prepared building plan of a

new hotel for ITC which will be constructed near Nariman Point in Mumbai, for this

purpose he charges 5500000 from ITC, in addition ITC has provided traveler cheques of

1000000 which can be utilized only outside India and a complementary voucher for stay

of 3 nights at ITC grand at Chennai, value of voucher is 44000/- , X is of the view that

only monetary consideration of 5500000 is chargeable to GST at the rate of 18% and the

value of traveler cheque & complementary vouchers is not taxable. Do you agree? If not

calculate GST in this case which will be borne by ITC additionally.

66. X provides computer maintenance service since 2002 in Odessa. During the month

ending March 31 2018, he provides computer maintenance services in Puri to A ltd. X

received 25000 from A ltd and 1640000 from the holding company of A ltd. A ltd is of

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

the view that only 25000 is chargeable to tax, A ltd paid GST @ 18% to Mr. X on 25000.

Calculate the GST payable by Mr. X to government.

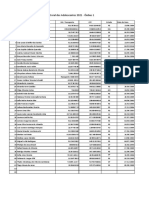

67. X ltd Bangalore is a wholesale dealer in car glasses; GST rate for the supply is 28%. The

following details are noted from the records of the company for December 2017.

Date of Recipient of Place of Nos Rate Discount

Supply Supply Supply

2/12/17 A Ltd Jaipur 3 67000 10%

6/12/17 B Ltd Patna 8 69000 9%

18/12/17 C Ltd Mysore 10 64000 5%

20/12/17 D Ltd Tumkur 12 70000 1%

28/12/17 E Ltd Coimbatore 4 59000 6%

30/12/17 F Ltd Delhi 6 58800 3%

Calculate the GST payable.

68. X Ltd owns a hotel at Raj road Shimla, from the information given below, find out GST

liability pertaining to these transactions:

Name of Guest Declared tariff Discount Extra charges Amt chargeable

before GST

A 900 10% 200 1010

B 2400 5% - 2280

C 7000 20% 2000 7600

D 7000 40% - 4200

E 10000 40% 1000 7000

69. X is a chartered account based in Chennai. He has GST registration from Tamilnadu (he

does not have registration in any other state). He provides tax consultancy to Y ltd

(consultancy fees being 350000/-), Y ltd has transferred residential building situated near

its Nasik factory. X has provided tax consultancy from his Chennai office and

consultancy pertains to minimizing capital gain tax liability of Y ltd. Determine the

nature of supply and compute GST payable.

70. A ltd is engaged in fertilizer manufacturing in Karnataka. It has GST registration in

Karnataka and no other state in India. X is the head of finance department of the

company. During January 2018 he went to Mumbai to attend a 3 days conference for this

purpose he incurs the following:

a. Bangalore to Mumbai air tickets paid to indigo Bangalore 26000(GST @ 26%)

b. Conference participation fees Mumbai 150000/- (GST 18%)

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

c. Hotel expenditure 60000/- (GST 18%)

d. Mumbai to Bangalore air ticket 32000/- (GST 18%)

Calculate GST payable by A ltd to different suppliers.

71. On July 5th 2017, X supplies 25 tons of chemical to Y from Chennai to Madurai

At the rate of 80000 per ton besides he charges the following:

Freight 372000

Packing charge 72000

Waving charge 30000

Inspection charge 12000

Cost of instrument which is specially purchased by X to manufacture this particular

chemical 110000(this instrument cannot be used for any other chemical manufacturing)

GST rate is 18%. X charges 11000/- interest for the late payment. Calculate the GST

payable

Sections C/D

72. X ltd is located in Coimbatore and engaged in manufacture of mechanical appliances. It

submits the following information pertaining to inward supply of inputs / input services

and capital goods during December 2018.

Particulars Taxable value of GST paid to

inward supply suppliers

Steel rods (invoice is not available) 750000 135000

Machine tools 100000 18000

Stainless steel sheets ( I installment is 500000 90000

received, II installment will be received in

January 2019)

Tax consultancy received 40000 7200

Air conditioner for office (depreciation will 25000 7000

be claimed on 32000 as per income tax act)

Corporate membership of Times club 50000 9000

Calculate the input tax credit available to X ltd for the month of December 2018.

73. X ltd is located in Hyderabad and engaged in in manufacture of kitchen appliances for

domestic market. It submits the following information pertaining to inward supply of

inputs / input services and capital goods during December 2018.

Particulars Taxable value of GST paid to

inward supply suppliers

Steel from Mumbai 300000 54000

Steel rods from Hyderabad 70000 12600

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

50 LED lamps from Hyderabad 50000 6000

Machinery for GYM from Andhra (Gym 650000 78000

used by employees)

Mediclaim Insurance 300000 54000

Calculate the input tax credit available to X ltd for the month of December 2018 taking

into consideration the following information-

a) Opening balance of electronic credit ledger CGST 2000, SGST Rs. 7000, IGST

Rs.3000

b) GST on outward supply during December 2018 are as follows

CGST SGST IGST

Invoice issued during December 2018 80000 80000 600

Advance received Rs.100000 (supply will be

made in January 2018)

c) Apart from kitchen appliances X ltd also provides technical consultancy to other

manufactures. X ltd has received Rs.10000 from Y ltd for providing consultancy

services in the month of March 2018 (GST rate is 18%).

d) Out of 50 LED lamps 10 are stolen.

Determine the GST payable by X ltd.

74. Y ltd is chemical manufacturing company; it gives following information pertaining to

December 2018.

GST on outward supply of Product A Rs.144000

GST on outward supply of Product B Rs.336000

GST on outward supply of Product C Rs.55000

Y ltd supplies 80 units of chemical to Z ltd for a nominal consideration of Rs.100 (but the

market value is Rs.300000) GST rate is 18%. X hold 27% share capital in Y ltd and 29%

share capital in Z ltd.

Opening balance of Electronic credit ledger is Rs.8000. Y Ltd purchased raw material

from A Ltd (Taxable value Rs.200000 GST Rate is 18%).

Find out the GST payable for December 2018.

75. Calculate the GST Tax liability of Thiru &Co, a service provider of different services

whose turnover in the last year was Rs. 10, 05,000.

a. Commission received from insurance agency for serving as an agent Rs.4000

b. Services provided to WHO Rs.10000

c. Examination conducted on behalf of a recognized management school Rs.75000

d. Commission for Booking Train ticket as a rail travel agent Rs.4000

e. Penalty collected from customers for the late payments Rs.8000

f. Package tour to Goa Rs.75000

g. Non package tour to Mysore Rs.10000

h. Accommodation in relation to tour Rs.100000

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

i. Acting as a referee for a cricket tournament Rs.35000

j. Legal services provided through lawyers Rs.8000

k. Supply of securities Rs15000

76. X ltd is located in Bangalore and engaged in manufacture of Kitchen appliances. It

submits the following information pertaining to inward supply of inputs / input services

and capital goods during December 2018.

Particulars Taxable value of GST paid to

inward supply suppliers

Steel rods (invoice is not available) 750000 135000

Machine tools 100000 18000

Stainless steel sheets ( I installment is 500000 90000

received, II installment will be received in

January 2019)

Tax consultancy received 40000 7200

Air conditioner for office (depreciation will 25000 7000

be claimed on 32000 as per income tax act)

Corporate membership of Times club 50000 9000

Calculate the input tax credit available to x ltd for the month of December 2018.

77. X ltd is located in Coimbatore and engaged in manufacture of mechanical appliances. It

submits the following information pertaining to inward supply of inputs / input services

and capital goods during December 2018.

Particulars Taxable value of GST paid to

inward supply suppliers

Steel rods (invoice is not available) 750000 135000

Machine tools 100000 18000

Stainless steel sheets ( I installment is 500000 90000

received, II installment will be received in

January 2019)

Tax consultancy received 40000 7200

Air conditioner for office (depreciation will 25000 7000

be claimed on 32000 as per income tax act)

Corporate membership of Times club 50000 9000

Calculate the input tax credit available to x ltd for the month of December 2018.

78. X ltd is located in Hyderabad and engaged in in manufacture of kitchen appliances for

domestic market. It submits the following information pertaining to inward supply of

inputs / input services and capital goods during December 2018.

Particulars Taxable value of GST paid to

inward supply suppliers

Steel from Mumbai 300000 54000

Steel rods from Hyderabad 70000 12600

50 LED lamps from Hyderabad 50000 6000

Machinery for GYM from Andhra (Gym 650000 78000

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

used by employees)

Mediclaim Insurance 300000 54000

Calculate the input tax credit available to x ltd for the month of December 2018 taking

into consideration the following information-

e) Opening balance of electronic credit ledger CGST 2000, SGST Rs. 7000, IGST

Rs.3000

f) GST on outward supply during December 2018 are as follows

CGST SGST IGST

Invoice issued during December 2018 80000 80000 600

Advance received Rs.100000 (supply will be

made in January 2018)

g) Apart from kitchen appliance X ltd also provides technical consultancy to other

manufactures. X ltd has received Rs.10000 from Y ltd for providing consultancy

services in the month of March 2018 (GST rate is 18%).

h) Out of 50 LED lamps 10 are stolen.

Determine the GST payable by X ltd.

79. X ltd is located in Bangalore and engaged in manufacture of kitchen appliances. It

submits the following information pertaining to inward supply of inputs / input services

and capital goods during January 2019.

Particulars Taxable value of GST paid to

inward supply suppliers

Steel 1000000 50000

Tools 200000 36000

Stainless steel sheets ( I installment is 1000000 180000

received, II installment will be received in

February 2019)

Technical consultancy received 50000 9000

Air conditioner for office (depreciation will 25000 7000

be claimed on 32000 as per income tax act)

Corporate membership of Times club 50000 9000

Calculate the input tax credit available to x ltd for the month of January 2019.

80. Calculate the GST liability of Mr. X who is a designer registered in Karnataka. The

following services were provided by him during January 2019.

Consultancy charges from A ltd Bangalore Rs.500000 (GST applicable 18% collected

from A ltd)

Advance amount received from B ltd Bangalore Rs.100000 but the services will be

provided in the month of August 2019.

Drawing charges from Pothys for the new design in Bangalore Rs.200000 (GST

applicable 18% collected from ITC Gardenia)

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

Rs.100000 received from Pothys for not providing similar services to any other industry

in the world. But X is in the view that he need not pay GST for this consideration. (GST

was not collected from Pothys).

Calculate the GST liability.

81. Y is in the business of labour supply and renting of electrical equipment, he gives

following information pertaining to December 2018.

Supply of farm labour Rs.30000

Supply of domestic labour Rs.100000

Renting of generators to A ltd. No rent is received. Market value is Rs.200000. ( Y is the

shareholder of A ltd)

Renting of generators to B ltd. No rent is received . Market value is Rs.300000. ( Mrs.Y

is the shareholder of B ltd)

Renting of generators to C. No rent is received. Market value is Rs.200000. ( C is the

younger brother of Y)

Opening balance of ITC Rs.20000

Purchase of Generators Rs.100000 (GST paid 12%)

Consultancy charges paid Rs.100000 (GST paid 18%)

Find out the GST payable for December 2018.

82. X of Bangalore own 7 properties in Karnataka from the information given below, find out

the quarter ending March 31 2018. GST rate is @ 18%, municipal taxes is 44000/-,

expenses on repairs is 132000/-, fire insurance premium 48000/-.

Rent of residential building-I --1500000/- given on rent to Y to a salaried employee for

his residence.

Rent of residential building-II -- 2200000/- for residence.

Rent of vacant plot of land given on rent to manufacturing company -- 600000/-

Rent of vacant plot given for agricultural purpose -- 350000/-

Rent of residential building-V -- 400000/- given on rent to Z ltd for residence of its

employees.

Rent of commercial building to Mr. A, A is a sole proprietor --150000 /-

Rent on residential building-VII -- 850000/- for commercial purpose.

Calculate GST payable.

83. X of Hyderabad owns the following properties in Telangana, find GST liability for the

quarter ending 31/3/2018, GST @ 18%.

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

KRISTU JAYANTI SCHOOL OF MANAGEDMENT

VI TRIMESTESTER MBA/PGDM

PMG176A02: GOODS AND SERVICES TAX

Commercial property given on rent to a recognized college in Telangana ( municipal

tax paid 100000/-) 3350000/-

A vacant plot of land given on rent for animal husbandry ( municipal tax 10000/-)

200000/-

Residential building given on rent to a departmental store for placing vending machines

300000/-

Terrace of a residential building for Airtel for erecting communication tower 700000/-

Renting of a building for organizing entertainment events 500000/-

Rent of a theatre ( rent not received, profit is received under profit sharing agreements)

700000/-

Compiled from different sources by Dr. M. K. Baby & Dr. Muthukumar M.

Вам также может понравиться

- Chpter 1, Scope & Levy, Nat & POS, AllДокумент14 страницChpter 1, Scope & Levy, Nat & POS, AllBhavika KhetleОценок пока нет

- Practical Question Bank: Faculty of Commerce, Osmania UniversityДокумент4 страницыPractical Question Bank: Faculty of Commerce, Osmania Universitymekala sailajaОценок пока нет

- Theory & Practice of GSTДокумент3 страницыTheory & Practice of GSTnishatОценок пока нет

- Taxguru - in-MCQs On GST For CACMACSДокумент14 страницTaxguru - in-MCQs On GST For CACMACSOm KambleОценок пока нет

- Input Tax CreditДокумент8 страницInput Tax Creditloey xafОценок пока нет

- GST RevisionДокумент10 страницGST RevisionSumit rautelaОценок пока нет

- A This Question Paper Contains Three Pages.: Be Used Throughout The PaperДокумент3 страницыA This Question Paper Contains Three Pages.: Be Used Throughout The PaperTushar KumarОценок пока нет

- Mock Test Series 2 QuestionsДокумент10 страницMock Test Series 2 QuestionsSuzhana The WizardОценок пока нет

- MTP 2 Idt 2019Документ10 страницMTP 2 Idt 2019kartikОценок пока нет

- CA Final IDT RTP For May 2023Документ19 страницCA Final IDT RTP For May 2023Nick VincikОценок пока нет

- GST - Index PageДокумент2 страницыGST - Index PageLuccha RaiОценок пока нет

- 1idt PDFДокумент19 страниц1idt PDFShantanuОценок пока нет

- Cl10 Math Revision WS-GSTДокумент2 страницыCl10 Math Revision WS-GSTpreetakaran12Оценок пока нет

- Final Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Документ31 страницаFinal Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Sanket Mhetre100% (1)

- MCQ IdtДокумент30 страницMCQ IdtkartikОценок пока нет

- GST Question PaperДокумент6 страницGST Question Paperramaswamy dОценок пока нет

- Practicesheet - Input Tax CreditДокумент5 страницPracticesheet - Input Tax CreditHemmu sahuОценок пока нет

- Final Examination: Suggested Answers To QuestionsДокумент17 страницFinal Examination: Suggested Answers To QuestionsRohit KunduОценок пока нет

- Theory and Precatice of GSTДокумент3 страницыTheory and Precatice of GSTakking0146Оценок пока нет

- Icai 3Документ14 страницIcai 3Raghav TibdewalОценок пока нет

- MTP May 2021 QДокумент10 страницMTP May 2021 QÑïkêţ BäûðhåОценок пока нет

- Value of SupplyДокумент4 страницыValue of SupplySachin SinghОценок пока нет

- Telecom Sector - GST Project - Group M - Sec (C)Документ37 страницTelecom Sector - GST Project - Group M - Sec (C)0443GomathinayagamОценок пока нет

- Indirect TaxДокумент10 страницIndirect TaxAishwarya TiwariОценок пока нет

- Icse Class X Maths Practise Sheet 1 GST PDFДокумент2 страницыIcse Class X Maths Practise Sheet 1 GST PDFHENA KHANОценок пока нет

- Exemption of GST @icmaifamilyДокумент27 страницExemption of GST @icmaifamilypriyababu4701Оценок пока нет

- GST Law (Set 2)Документ4 страницыGST Law (Set 2)studywagishaОценок пока нет

- GST Model Paper - 1Документ3 страницыGST Model Paper - 1Joshua StarkОценок пока нет

- GST Internal IIДокумент6 страницGST Internal IIAyush singhОценок пока нет

- Indirect Taxation Finals Question PaperДокумент3 страницыIndirect Taxation Finals Question PaperShubham NamdevОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент9 страниц© The Institute of Chartered Accountants of IndiaSuresh TamangОценок пока нет

- Goods and Services Tax (MCQ) Grade 10: Answer: BДокумент10 страницGoods and Services Tax (MCQ) Grade 10: Answer: BsMОценок пока нет

- Inter Past Question Exemption-GSTДокумент10 страницInter Past Question Exemption-GSTKaylee WrightОценок пока нет

- 4 GSTДокумент4 страницы4 GSTafsiya.mjОценок пока нет

- Project Report: Month & Year of SubmissionДокумент53 страницыProject Report: Month & Year of SubmissionAritra SenОценок пока нет

- Dec 18 Cma SuggДокумент13 страницDec 18 Cma Suggamit jangraОценок пока нет

- Handbook On GST On Service SectorДокумент276 страницHandbook On GST On Service SectorABC 123100% (1)

- CT 1 - QP - Icse - X - GSTДокумент2 страницыCT 1 - QP - Icse - X - GSTAnanya IyerОценок пока нет

- Mock Test Series 1 QuestionsДокумент11 страницMock Test Series 1 QuestionsSuzhana The WizardОценок пока нет

- GST Ca Interg9 QuestionДокумент6 страницGST Ca Interg9 QuestionVishal Kumar 5504Оценок пока нет

- MCQ On GST Class 10 ICSEДокумент27 страницMCQ On GST Class 10 ICSEmanassaraf18Оценок пока нет

- GST - Ch. 3,4,5,7 - NS - Dec. 23Документ3 страницыGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorОценок пока нет

- Indirect Tax GST Tybcom 1Документ13 страницIndirect Tax GST Tybcom 1Vikas YadavОценок пока нет

- Report 2k17 BBA IV Sem Kshitij VijayДокумент52 страницыReport 2k17 BBA IV Sem Kshitij VijayKshitij VijayvergiaОценок пока нет

- Topic:: Law of TaxationДокумент8 страницTopic:: Law of TaxationNeelam KejriwalОценок пока нет

- Charge of GSTДокумент4 страницыCharge of GSTpujitha vegesnaОценок пока нет

- GST ImplentationДокумент60 страницGST ImplentationMohan Kumar100% (2)

- Theory Questions For PracticeДокумент2 страницыTheory Questions For Practice04 Sourabh BaraleОценок пока нет

- GST ScannerДокумент48 страницGST ScannerdonОценок пока нет

- GST Practical Questions Vol - 1 (New) by CA Vivek GabaДокумент13 страницGST Practical Questions Vol - 1 (New) by CA Vivek Gabavamshi9686Оценок пока нет

- Tax Test 1 QPДокумент4 страницыTax Test 1 QPmshivam617Оценок пока нет

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationДокумент5 страницAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationRoshan ZamirОценок пока нет

- Chapter 3 Charge Under GSTДокумент10 страницChapter 3 Charge Under GSTabhay javiyaОценок пока нет

- Module III Valuation in GSTДокумент89 страницModule III Valuation in GSTAyushi TiwariОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionОценок пока нет

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyОт EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyРейтинг: 5 из 5 звезд5/5 (1)

- Sample OTsДокумент5 страницSample OTsVishnu ArvindОценок пока нет

- Icici History of Industrial Credit and Investment Corporation of India (ICICI)Документ4 страницыIcici History of Industrial Credit and Investment Corporation of India (ICICI)Saadhana MuthuОценок пока нет

- Upsc 1 Year Study Plan 12Документ3 страницыUpsc 1 Year Study Plan 12siboОценок пока нет

- Hospital List (Noida & GZB)Документ3 страницыHospital List (Noida & GZB)prince.bhatiОценок пока нет

- Week 8 - 13 Sale of GoodsДокумент62 страницыWeek 8 - 13 Sale of Goodstzaman82Оценок пока нет

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascДокумент1 страницаCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaОценок пока нет

- Blockchain For The Cybersecurity of Smart CityДокумент66 страницBlockchain For The Cybersecurity of Smart CityGiovanni PintoОценок пока нет

- Art. 19 1993 P.CR - LJ 704Документ10 страницArt. 19 1993 P.CR - LJ 704Alisha khanОценок пока нет

- Gillette vs. EnergizerДокумент5 страницGillette vs. EnergizerAshish Singh RainuОценок пока нет

- 10 LasherIM Ch10Документ30 страниц10 LasherIM Ch10Erica Mae Vista100% (1)

- Campaign Period: Terms and Conditions "CIMB 4.7% FD/FRIA-i Bundle With CASA/-i"Документ6 страницCampaign Period: Terms and Conditions "CIMB 4.7% FD/FRIA-i Bundle With CASA/-i"Tan Ah LiannОценок пока нет

- Postcolonial FeministReadingДокумент10 страницPostcolonial FeministReadinganushkamahraj1998Оценок пока нет

- 10 Types of Innovation (Updated)Документ4 страницы10 Types of Innovation (Updated)Nur AprinaОценок пока нет

- Coding Decoding 1 - 5311366Документ20 страницCoding Decoding 1 - 5311366Sudarshan bhadaneОценок пока нет

- On Islamic Branding Brands As Good DeedsДокумент17 страницOn Islamic Branding Brands As Good Deedstried meОценок пока нет

- Group 5Документ38 страницGroup 5krizel rebualosОценок пока нет

- Priyanshu Mts Answer KeyДокумент34 страницыPriyanshu Mts Answer KeyAnima BalОценок пока нет

- Implications - CSR Practices in Food and Beverage Companies During PandemicДокумент9 страницImplications - CSR Practices in Food and Beverage Companies During PandemicMy TranОценок пока нет

- Annamalai University: Accounting For Managerial DecisionsДокумент307 страницAnnamalai University: Accounting For Managerial DecisionsMALU_BOBBYОценок пока нет

- Ice Cream CaseДокумент7 страницIce Cream Casesardar hussainОценок пока нет

- Nurlilis (Tgs. Bhs - Inggris. Chapter 4)Документ5 страницNurlilis (Tgs. Bhs - Inggris. Chapter 4)Latifa Hanafi100% (1)

- JUNE 2018 QUESTION (1) (B)Документ6 страницJUNE 2018 QUESTION (1) (B)BryanОценок пока нет

- ATI PN Maternal Newborn Proctored Exam Test Bank (38 Versions) (New-2022)Документ7 страницATI PN Maternal Newborn Proctored Exam Test Bank (38 Versions) (New-2022)kapedispursОценок пока нет

- Edgeworth, Matt. 2018. Rivers As Material Infrastructure: A Legacy From The Past To The FutureДокумент14 страницEdgeworth, Matt. 2018. Rivers As Material Infrastructure: A Legacy From The Past To The FutureMauro FernandezОценок пока нет

- Presidential Form of GovernmentДокумент4 страницыPresidential Form of GovernmentDivy YadavОценок пока нет

- English L 18 - With AnswersДокумент9 страницEnglish L 18 - With AnswersErin MalfoyОценок пока нет

- 202E13Документ28 страниц202E13Ashish BhallaОценок пока нет

- 21 Century Literature From The Philippines and The World: Department of EducationДокумент20 страниц21 Century Literature From The Philippines and The World: Department of EducationAoi Miyu ShinoОценок пока нет

- Lease FinancingДокумент17 страницLease FinancingPoonam Sharma100% (2)

- Reflective EssayДокумент5 страницReflective EssayBrandy MorganОценок пока нет