Академический Документы

Профессиональный Документы

Культура Документы

Emanuel Swedenborg Menny Es Pokol

Загружено:

Imre VíghАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Emanuel Swedenborg Menny Es Pokol

Загружено:

Imre VíghАвторское право:

Доступные форматы

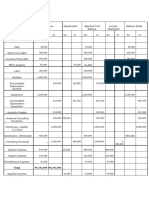

Appendix: The work sheet for a merchandising company

Exhibit 40 shows a work sheet for a merchandising company. Lyons Company is a small

sporting goods firm. The illustration for Lyons Company focuses on merchandise-related

accounts. Thus, we do not show the fixed assets (land, building, and equipment). Except for

the merchandise-related accounts, the work sheet for a merchandising company is the same as

for a service company. Recall that use of a work sheet assists in the preparation of the adjusting

and closing entries. The work sheet also contains all the information needed for the preparation

of the financial statements.

To further simplify this illustration, assume Lyons needs no adjusting entries at month-end. The

trial balance is from the ledger accounts at 2010 December 31. The $7,000 merchandise

inventory in the trial balance is the beginning inventory. The sales and sales-related accounts

and the purchases and purchases-related accounts summarize the merchandising activity for

December 2010.

Lyons carries any revenue accounts (Sales) and contra purchases accounts (Purchase Discounts,

Purchase Returns and Allowances) in the Adjusted Trial Balance credit columns of the work

sheet to the Income Statement credit column. It carries beginning inventory, contra revenue

accounts (Sales Discounts, Sales Returns and Allowances), Purchases, Transportation-In, and

expense accounts (Selling Expenses, Administrative Expenses) in the Adjusted Trial Balance debit

column to the Income Statement debit column.

Assume that ending inventory is $8,000. Lyons enters this amount in the Income Statement

credit column because it is deducted from cost of goods available for sale (beginning inventory

plus net cost of purchases) in determining cost of goods sold. It also enters the ending

inventory in the Balance Sheet debit column to establish the proper balance in the Merchandise

Inventory account. The beginning and ending inventories are on the Income Statement because

Lyons uses both to calculate cost of goods sold in the income statement. Net income of

$ 5,843 for the period balances the Income Statement columns. The firm carries the net income

to the Statement of Retained Earnings credit column. Retained earnings of $18,843 balances the

Statement of Retained Earnings columns. Lyons Company carries the retained earnings to the

Balance Sheet credit column.

Lyons carries all other asset account balances (Cash, Accounts Receivable, and ending

Merchandise Inventory) to the Balance Sheet debit column. It also carries the liability

(Accounts Payable) and Capital Stock account balances to the Balance Sheet credit column.

The balance sheet columns total to $29,543.

Once the work sheet has been completed, Lyons prepares the financial statements. After

entering any adjusting and closing entries in the journal, the firm posts them to the ledger. This

process clears the records for the next accounting period. Finally, it prepares a post-closing trial

balance.

Income statement Exhibit 41 shows the income statement Lyons prepared from its work sheet in

exhibit 40. The focus in this income statement is on determining the cost of goods sold.

Statement of retained earnings The statement of retained earnings, as you recall, is a financial

statement that summarizes the transactions affecting the Retained Earnings account balance.

In exhibit 42, the statement of retained earnings shows an increase in equity resulting from net

income and a decrease in equity resulting from dividends.

1 Principles of Accoiunting Merchandising Transactions

Appendix: The work sheet for a merchandising company

Acct. Account Titles Trial Balance Adjustments Adjusted Trial Income Statement Statement of Balance Sheet

No. Balance Retained Earnings

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

100 Cash 19,663 19,663 19,663

103 Accounts Receivable 1,880 1,880 1,880

Merchandise Inventory, 7,000 8,000 8,000

105 December 1 7,000 7,000

200 Accounts Payable 700 700 700

300 Capital Stock 10,000 10,000 10,000

310 Retained Earnings 2010 Dec 31 15,000 15,000 15,000

320 Dividends 2,000 2,000 2,000

410 Service Revenue 14,600 14,600 14,600

411 Sales Discounts 44 44 44

412 Sales Returns and Allowances 20 20 20

500 Purchases 6,000 6,000 6,000

501 Purchases Discounts 82 82 82

502 Purchase Returns and Allowances 100 100 100

503 Transportation-In 75 75 75

Miscellaneous Selling 2,650 2,650

557

Expenses 2,650

567 Miscellaneous Administrative 1,150 1,150 1,150

Expenses

40,482 40,482 0 0 40,482 40,482

Net Income 5,843 5,843

22,782 22,782 2,000 20,843

Retained Earnings, 2010 Dec 31 18,843 18,843

20,843 20,843 29,543 29,543

2 Principles of Accoiunting Merchandising Transactions

Appendix: The work sheet for a merchandising company

LYONS COMPANY

Income Statement

For the Month Ended 2010 December 31

Operating revenues:

Gross sales 14,600

Less: Sales discounts 44

Sales return and allowances 20 64

Net sales 14,536

Cost of goods sold:

Merchandise inventory, 2010

7,000

January 1

Purchases 6,000

Less: Purchase discount 82

Purchase returns and

100 182

allowances

Net purchases 5,818

Add: Transportation-in 75

Net cost of purchases 5,893

12,89

Cost of goods available for sale

3

Less: Merchandise inventory,

8,000

2010 December 31

Cost of goods sold 4,893

Gross Margin 9,643

Operating expenses:

Miscellaneous selling expense 2,650

Miscellaneous administrative

1,150

expense

Total operating expenses 3,800

Net income 5,843

Exhibit 41: Income statement for a merchandising company

LYONS COMPANY

Statement of Retained Earnings

For the Month Ended 2010 December 31

Retained earnings, 2010 December 1 15,000

Add: Net income for the month 5,843

Total 20,843

Deduct: Dividends 2,000

Retained earnings, 2010 December 31 18,843

Exhibit 42: Statement of retained earnings

3 Principles of Accoiunting Merchandising Transactions

Appendix: The work sheet for a merchandising company

LYONS COMPANY

Balance Sheet 2010 December 31

Assets

Cash 19663

Accounts receivable 1880

Merchandise inventory 8000

Total assets 29543

Liabilities and Stockholders' Equity

Liabilities:

Accounts payable 700

Stockholders' equity:

Capital stock 10,000

Retained earnings 18,843

Total stockholders' equity 28843

Total liabilities and stockholders' equity 29543

Exhibit 43: Balance sheet for a merchandising company

Balance sheet The balance sheet, exhibit 43, contains the assets, liabilities, and stockholders' equity

items taken from the work sheet. Note the $8,000 ending inventory is a current asset. The Retained

Earnings account balance comes from the statement of retained earnings.

Recall from chapter 4 that the closing process normally takes place after the accountant has

prepared the financial statements for the period. The closing process closes revenue and expense

accounts by transferring their balances to a clearing account called Income Summary and then to

Retained Earnings. The closing process reduces the revenue and expense account balances to zero

so that information for each accounting period may be accumulated separately.

Lyons's accountant would prepare closing entries directly from the work sheet in exhibit 40 using

the same procedure presented in chapter 4. The closing entries for Lyons Company follow.

The first journal entry debits all items appearing in the Income Statement credit column of the

work sheet and credits Income Summary for the total of the column, $22,782

2010

Dec. 31 Merchandise Inventory (ending) 8,000

Sales 14,600

Purchase Discounts 82

Purchase Returns and Allowances 100

1st entry

Income Summary 22,782

To close accounts with a credit

balance in the Income Statement

columns and to establish ending

merchandise inventory.

4 Principles of Accoiunting Merchandising Transactions

Appendix: The work sheet for a merchandising company

The second entry credits all items appearing in the Income Statement debit column and debits

Income Summary for the total of that column, $16,939.

2010

Dec. 31 Income Summary 16,939

Merchandise Inventory (beginning) 7,000

Sales Discounts 44

Sales Returns and Allowances 20

2nd entry Purchases 6,000

Transportation-In 75

Miscellaneous Selling Expenses 2,650

Miscellaneous Administrative Expenses 1,150

To close accounts with a debit balance

in the Income Statement columns.

The third entry closes the credit balance in the Income Summary account of $5,843 to the Retained

Earnings account.

2010

Dec. 31 Income Summary 5,843

3rd entry Retained Earnings 5,843

To close the Income Summary account

to the Retained Earnings account..

The fourth entry closes the Dividends account balance of $2,000 to the Retained Earnings account

by debiting Retained Earnings and crediting Dividends.

2010

Dec. 31 Retained Earnings 2,000

4th entry Dividends 2,000

To close the Dividends account to the

Retained Earnings account

Note how the first three closing entries tie into the totals in the Inc

ome Statement columns of the work sheet in Exhibit 40. In the first closing journal entry, the credit

to the Income Summary account is equal to the total of the Income Statement credit column. In the

second entry, the debit to the Income Summary account is equal to the subtotal of the Income

Statement debit column. The difference between the totals of the two Income Statement columns

(USD 5,843) represents net income and is the amount of the third closing entry.

5 Principles of Accoiunting Merchandising Transactions

Appendix: The work sheet for a merchandising company

Demonstration problem

The following transactions occurred between Companies C and D in June 2010:

June 10 Company C purchased merchandise from Company D for $80,000; terms 2/10/EOM, n/60,

FOB destination, freight prepaid.

11 Company D paid freight of $1,200.

14 Company C received an allowance of $4,000 from the gross selling price because of

damaged goods.

23 Company C returned $8,000 of goods purchased because they were not the quality

ordered.

30 Company D received payment in full from Company C.

a. Journalize the transactions for Company C.

b. Journalize the transactions for Company D.

General Journal

Date Account Titles and Explanation Post. Debit Credit

Ref

2010 10 Company C

June

Purchases 80000

Accounts Payable 80000

Purchased merchandise from Company D;

terms 2/10/EOM, n/60

14 Accounts Payable 40000

Purchase Return and Allowances 40000

Received an allowance from Company D for

damaged goods.

23 Accounts Payable 80000

Purchase Return and Allowances 80000

Returned merchandise to Company D

because of improper quality

30 Accounts Payable ($80,000 - $4,000 - $8,000) 68000

Purchase Discounts ($68,000 x 0.02) 1360

Cash ($68,000 - $1,360) 66640

Paid the amount due to Company D.

6 Principles of Accoiunting Merchandising Transactions

Appendix: The work sheet for a merchandising company

General Journal

Date Account Titles and Explanation Post. Debit Credit

Ref

2010 10 Company C

June

Accounts Receivable 80000

Sales 80000

Sold merchandise to Company C; terms

2/10/EOM, n/60

11 Delivery Expense 1200

Cash 1200

Paid freight on sale of merchandise shipped

FOB destination, freight prepaid.

14 Sales Returns and Allowances 4000

Accounts Receivable 4000

Merchandise returned from Company C due

to improper quality.

8000

23 Sales Returns and Allowances 8000

Accounts Receivable

Merchandise returned from Company C due

to improper quality

30 Cash ($68,000 - $1,360) 66640

Sales Discounts ($68,000 x 0.02) 1360

Accounts Receivable ($80,000 - $4,000 -

68000

$8,000)

Received the amount due from Company C.

7 Principles of Accoiunting Merchandising Transactions

Вам также может понравиться

- FFS - Numericals 2Документ3 страницыFFS - Numericals 2Funny ManОценок пока нет

- Technopreneurship PPT Presentation Group 1Документ57 страницTechnopreneurship PPT Presentation Group 1Mia ElizabethОценок пока нет

- Equity MethodДокумент2 страницыEquity MethodJeane Mae BooОценок пока нет

- Unit 1 - QuestionsДокумент4 страницыUnit 1 - QuestionsMohanОценок пока нет

- Preparing WorksheetДокумент4 страницыPreparing Worksheet6z5qstn8wsОценок пока нет

- FM-Cash Budget)Документ9 страницFM-Cash Budget)Aviona GregorioОценок пока нет

- Jawaban No 3 A Dan BДокумент6 страницJawaban No 3 A Dan BAndi Rahmat HidayatОценок пока нет

- Karkits Corporation Excel Copy PasteДокумент2 страницыKarkits Corporation Excel Copy PasteCoke Aidenry SaludoОценок пока нет

- AccountsДокумент4 страницыAccountsVencint LaranОценок пока нет

- Chapter 5 Exercises-Exercise BankДокумент9 страницChapter 5 Exercises-Exercise BankPATRICIUS ALAN WIRAYUDHA KUSUMОценок пока нет

- Fundamentals of Accountancy Business and ManagementДокумент7 страницFundamentals of Accountancy Business and ManagementJayОценок пока нет

- Cash Flow StatementДокумент9 страницCash Flow StatementPiyush MalaniОценок пока нет

- Cash Flow (Exercise)Документ5 страницCash Flow (Exercise)abhishekvora7598752100% (1)

- Act1111 Final ExamДокумент7 страницAct1111 Final ExamHaidee Flavier SabidoОценок пока нет

- Statement of Cash Flow - MerchandisingДокумент43 страницыStatement of Cash Flow - Merchandisingissachar barezОценок пока нет

- Pa Revision For FinalsДокумент9 страницPa Revision For FinalsKhải Hưng NguyễnОценок пока нет

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Документ2 страницыBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiОценок пока нет

- Cash FlowsДокумент12 страницCash FlowsEjaz AhmadОценок пока нет

- Welcome To The Presentation On Study (Chapter - 5) : Assalamu AlaikumДокумент18 страницWelcome To The Presentation On Study (Chapter - 5) : Assalamu AlaikumIQBAL MAHMUDОценок пока нет

- LEARNING KIT Accounting2 Week 3Документ4 страницыLEARNING KIT Accounting2 Week 3Asahi HamadaОценок пока нет

- HW 4 - Wilmot Shirts ProblemДокумент5 страницHW 4 - Wilmot Shirts Problemkartik lakhotiyaОценок пока нет

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditДокумент2 страницыTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaОценок пока нет

- ACCN 304 Revision QuestionsДокумент11 страницACCN 304 Revision QuestionskelvinmunashenyamutumbaОценок пока нет

- ULOa Let's Analyze Week 8 9Документ2 страницыULOa Let's Analyze Week 8 9emem resuentoОценок пока нет

- Adjusting EntriesДокумент5 страницAdjusting EntriesM Hassan BrohiОценок пока нет

- CSS Ratio AnalysisДокумент9 страницCSS Ratio AnalysisMasood Ahmad AadamОценок пока нет

- Problem CH 11 Alfi Dan Yessy AKT 18-MДокумент4 страницыProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Attachment AccountingДокумент6 страницAttachment Accountingtaylor swiftyyyОценок пока нет

- Ais ExerciseДокумент26 страницAis ExerciseLele DongОценок пока нет

- Asdos Pert 2Документ2 страницыAsdos Pert 2mutiaoooОценок пока нет

- Worksheet Quiz ExampleДокумент5 страницWorksheet Quiz ExampleFrenzearl ArmadaОценок пока нет

- Statement of Cash Flows Lecture Questions and AnswersДокумент9 страницStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiОценок пока нет

- Bata AnaylsisДокумент22 страницыBata Anaylsiszuhaib732Оценок пока нет

- CH 12 Wiley Plus Kimmel Quiz & HWДокумент9 страницCH 12 Wiley Plus Kimmel Quiz & HWmkiОценок пока нет

- For Students - Interpretation of FS - Ratio Analysis - Example, ExercisesДокумент10 страницFor Students - Interpretation of FS - Ratio Analysis - Example, ExercisesdimniousОценок пока нет

- Cash FlowДокумент6 страницCash FlowKailaОценок пока нет

- For Lecturers - Interpretation of FS - Ratio Analysis - Example, Exercises, SolutionsДокумент13 страницFor Lecturers - Interpretation of FS - Ratio Analysis - Example, Exercises, SolutionsdimniousОценок пока нет

- Cash Flow 8 AprilДокумент17 страницCash Flow 8 AprilMayank MalhotraОценок пока нет

- FABM1 11 Quarter 4 Week 6 Las 3Документ4 страницыFABM1 11 Quarter 4 Week 6 Las 3Janna PleteОценок пока нет

- Accounting Assignment3Документ12 страницAccounting Assignment3Ann Catherine SeeОценок пока нет

- Cash Flow Statement-ExampleДокумент18 страницCash Flow Statement-ExampleAnakha RadhakrishnanОценок пока нет

- Session 11,12&13 AssignmentДокумент3 страницыSession 11,12&13 AssignmentMardi SutiosoОценок пока нет

- Cashflow ActivityДокумент2 страницыCashflow ActivityHannie CaratОценок пока нет

- Reign Gagalac 2-7-22Документ5 страницReign Gagalac 2-7-22Rouise GagalacОценок пока нет

- Complete Financial Statements With SCF Direcdt MethodДокумент23 страницыComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoОценок пока нет

- Illustrative Full Set of IFRS For SME Financial StatementsДокумент16 страницIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashОценок пока нет

- 8447809Документ11 страниц8447809blackghostОценок пока нет

- Irene LaguioДокумент18 страницIrene LaguioAlvinNoay100% (2)

- Kids Play PLC: Consolidated Financial Statements For The Year Ended 31 December 2009Документ15 страницKids Play PLC: Consolidated Financial Statements For The Year Ended 31 December 2009shazОценок пока нет

- 5 6336743075766863237 PDFДокумент75 страниц5 6336743075766863237 PDFshagufta afrin100% (1)

- Instructor Questionaire AccountingДокумент4 страницыInstructor Questionaire AccountingjovelioОценок пока нет

- Financial Statement AnalysisДокумент4 страницыFinancial Statement AnalysisAsad RehmanОценок пока нет

- Ce Quiz II (A+b+c)Документ3 страницыCe Quiz II (A+b+c)Mohaiminur ArponОценок пока нет

- Fundamentals of Accountancy, Business and Management 1 (Q4W5-7)Документ6 страницFundamentals of Accountancy, Business and Management 1 (Q4W5-7)tsuki100% (1)

- 286practice Questions - AnswerДокумент17 страниц286practice Questions - Answerma sthaОценок пока нет

- Cash Flow Statement Cash AnalysisДокумент21 страницаCash Flow Statement Cash Analysisshrestha.aryxnОценок пока нет

- Session 5a Cash Flow Statement: HI5020 Corporate AccountingДокумент11 страницSession 5a Cash Flow Statement: HI5020 Corporate AccountingFeku RamОценок пока нет

- Unit 3 - Business Finance - AppendixДокумент5 страницUnit 3 - Business Finance - Appendixmhmir9.95Оценок пока нет

- Mock Test (Final Exam) KeyДокумент4 страницыMock Test (Final Exam) KeyKhoa TrầnОценок пока нет

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- PT Registry Assistant Job PackДокумент6 страницPT Registry Assistant Job PackImre VíghОценок пока нет

- Imre Vigh: Work ExperienceДокумент2 страницыImre Vigh: Work ExperienceImre VíghОценок пока нет

- Introduction To Bookkeeping and AccountingДокумент68 страницIntroduction To Bookkeeping and Accountingapic20Оценок пока нет

- Career Change CV TemplateДокумент3 страницыCareer Change CV TemplateImre VíghОценок пока нет

- Team Member - Reception: Job ProfileДокумент3 страницыTeam Member - Reception: Job ProfileImre VíghОценок пока нет

- Career Change CV TemplateДокумент1 страницаCareer Change CV TemplateRyad BelОценок пока нет

- Career Change CV TemplateДокумент1 страницаCareer Change CV TemplateRyad BelОценок пока нет

- OHSC ProspectusДокумент79 страницOHSC Prospectusvaradhdan 1971Оценок пока нет

- IDK2014 Hosszú Felhívás - ENGДокумент2 страницыIDK2014 Hosszú Felhívás - ENGImre VíghОценок пока нет

- ST Christopher'sДокумент2 страницыST Christopher'sImre VíghОценок пока нет

- Text Picture Music 2014 CFPДокумент1 страницаText Picture Music 2014 CFPImre VíghОценок пока нет

- Vigh Abstract ReviewedДокумент1 страницаVigh Abstract ReviewedImre VíghОценок пока нет

- Nations&Stereotypes Call For PapersДокумент1 страницаNations&Stereotypes Call For PapersImre VíghОценок пока нет

- Information For Scholarship HoldersДокумент23 страницыInformation For Scholarship HoldersImre VíghОценок пока нет

- So Pup Load ControllerДокумент1 страницаSo Pup Load ControllerImre VíghОценок пока нет

- Some Analyzing Aspects of Ladies Day From Gyula KrúdyДокумент1 страницаSome Analyzing Aspects of Ladies Day From Gyula KrúdyImre VíghОценок пока нет

- So Pup Load Controller 4Документ2 страницыSo Pup Load Controller 4Imre VíghОценок пока нет

- So Pup Load Controller 3Документ3 страницыSo Pup Load Controller 3Imre VíghОценок пока нет

- Space & Time in Lit CFPДокумент1 страницаSpace & Time in Lit CFPImre VíghОценок пока нет

- AccauntingДокумент37 страницAccauntingSamurai JackОценок пока нет

- Minutes of Shareholder MeetingДокумент3 страницыMinutes of Shareholder Meetingpedersen1961Оценок пока нет

- L&T 2013-14 Balance Sheet PDFДокумент343 страницыL&T 2013-14 Balance Sheet PDFAkshat RastogiОценок пока нет

- Profit and Loss AccountДокумент9 страницProfit and Loss AccountMurad Shah PatelОценок пока нет

- Anti Dummy LawДокумент75 страницAnti Dummy LawSean Palacpac-ResurreccionОценок пока нет

- The Business of Ethics RemixedДокумент2 страницыThe Business of Ethics RemixedMayank Vilas SankheОценок пока нет

- Basics of Share MarketДокумент15 страницBasics of Share MarketashutoshОценок пока нет

- Barretto Vs La Previsora FilipinaДокумент2 страницыBarretto Vs La Previsora FilipinaHariette Kim TiongsonОценок пока нет

- Corporate Accounting FraudДокумент10 страницCorporate Accounting FraudUmar IftikharОценок пока нет

- Brand Extension SuccessДокумент12 страницBrand Extension SuccessSadhana YadavОценок пока нет

- Module 3 Case 11Документ2 страницыModule 3 Case 11OnanaОценок пока нет

- DeVos LetterДокумент7 страницDeVos LetterMLive.comОценок пока нет

- Company PresentationДокумент3 страницыCompany PresentationJames HammondОценок пока нет

- Annual ReportДокумент219 страницAnnual ReportSwagat ShovonОценок пока нет

- 4 11 4 A Motoomul Vs de La Paz 1Документ1 страница4 11 4 A Motoomul Vs de La Paz 1King BautistaОценок пока нет

- Tema: Rema 1000: Focus: 1. Business PerformanceДокумент11 страницTema: Rema 1000: Focus: 1. Business PerformanceGuo Meng100% (1)

- Business Combination-Acquisition of Net AssetsДокумент2 страницыBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanОценок пока нет

- MAA716 Assignment Part 3 T1 2015Документ2 страницыMAA716 Assignment Part 3 T1 2015ashibhallauОценок пока нет

- Apollo TyresДокумент37 страницApollo TyresBandaru NarendrababuОценок пока нет

- HW4 EfДокумент12 страницHW4 EfDaniel ChiuОценок пока нет

- ch19 SM Leo 10eДокумент66 страницch19 SM Leo 10eLSAT PREPAU183% (6)

- Chapter 4 Events After Reporting PeriodДокумент2 страницыChapter 4 Events After Reporting Periodsonchaenyoung2Оценок пока нет

- Investor Presentation (Company Update)Документ32 страницыInvestor Presentation (Company Update)Shyam SunderОценок пока нет

- Far 300 WorksheetДокумент3 страницыFar 300 WorksheetAhmad Junaidi JuritОценок пока нет

- 3 CorporationДокумент5 страниц3 CorporationKenneth BactulОценок пока нет

- Investment in Associates& Reclassification - AnswersДокумент5 страницInvestment in Associates& Reclassification - AnswersyelenaОценок пока нет

- Hock Seng Lee Berhad: Secures A RM47.1m Road Job in Sarawak - 23/08/2010Документ3 страницыHock Seng Lee Berhad: Secures A RM47.1m Road Job in Sarawak - 23/08/2010Rhb InvestОценок пока нет

- Joy Prasad Sen - 3680Документ17 страницJoy Prasad Sen - 3680pranta senОценок пока нет

- 072&091-Republic Planters Bank vs. Agana 269 Scra 1Документ5 страниц072&091-Republic Planters Bank vs. Agana 269 Scra 1wewОценок пока нет

- Rural Banks ActДокумент2 страницыRural Banks ActveehneeОценок пока нет