Академический Документы

Профессиональный Документы

Культура Документы

Almaty Ind 4q18

Загружено:

ririОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Almaty Ind 4q18

Загружено:

ririАвторское право:

Доступные форматы

KAZAKHSTAN

Almaty Industrial

Market Snapshot

Fourth Quarter | 2018

Overview Supply

2

The Almaty logistics market remains resilient despite the persisting The total industrial inventory reached approx. 350,000 m of

uncertainty of the Kazakhstan economy, political climate, and the quality space with the top 5 industrial and logistics operators

2

national currency volatility. However, the class A leasing market in the Almaty region managing almost 310,000 m of

had a record-breaking year owing to retail sales growth translated speculative prime industrial and warehousing stock.

into increasing demand for quality warehousing space. Indicated in

USD and KZT the annual retail sales volume increased by 13.7% Pent-up demand for quality warehousing space is finding an

and 20.3% correspondingly. outlet through speculative development, with a post-financial

2

crisis high 15,000 m of principally B class premises being

As of the end of 2018 Almaty continues to head the list of the most under construction as of the end of 2018.

developed industrial markets across Kazakhstan regions. The city is

recognised as the most important transport, logistics and Outlook

distribution hub in the country, serving as an indispensable Regardless of the national currency volatility, the structural

transport node along the international transit route between Europe change driven by recovering retail sales will continue to

and Western China. benefit the market. An increase in speculative development

is helping to rebalance a market driven by occupiers seeking

Demand to relocate to more quality warehousing space, while pricing

Logistics property has continued to outperform other commercial levels recently achieved illustrate developers’ continued

rd

sectors during Q4 2018. Following an exceptionally strong 3 appetite for the sector. Given the tight market conditions

quarter, leasing activity in class A has held up well in the remainder persist, we expect developers to break ground on additional

of the year. The occupiers’ appetite remained strong throughout Q4 speculative projects in the mid-term, which will help bring

for quality well-located industrial developments with high ceiling and supply and demand fundamentals closer to balance in prime

access to transportation nodes, such as rail, and intermodal development submarket.

services pushing vacancy rates in such locations close to zero.

The pent-up demand for class A warehousing facilities contributed MARKET INDICATORS

to the highest volume of speculative space absorbed during the Market Outlook

year since 2014 pushing the overall vacancy up to 3% across Prime Rents: Low vacancy may cause further rentals’ upward

primary industrial & warehousing developments as of 2018. Class A correction in Class A submarket

occupancy has risen by almost 10% over the year, despite an Vacancy: Is expected to be limited in the short-run

2

increase in speculative development with 10,000 m commissioned

during the last 12 months. Supply: The continuing upward trend in retail sales will

trigger development activity in the mid-term so we

expect developers to start construction to rebalance

Backed by increasing retail sales, healthy demand from occupiers the supply and demand

and limited leasing opportunities across class A submarket are Demand: Occupier demand is expected to remain strong

fuelling rent growth with major players continue to command the

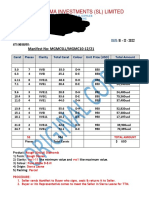

most aggressive overall rates. The prime rentals (denominated in Industrial Asking Rents* – December 2018

KZT) in Q4 2018 were adjusted further upwards in respond to the LOGISTICS LOCATION KZT US$ USD

increasing demand for prime industrial space, yet quoted in USD SQ.M SQ.M Q3 Q3

also ticked up despite strengthening USD. MONTH MONTH 2018 2017

Class A 2,006 5.2 4.9 4.1

For class B warehousing space occupational demand remained Class B 1,704 2.6 - 3.2

selective increasing the gap between class A and class B rentals

Vacancy – December 2018

with demand for class A logistic space continue to drive the market.

LOGISTICS LOCATION Q4 Q3 Q3

Retailers continued targeting industrial developments located on the (FIGURES ARE NET, %) 2018 2018 2017

city fringe as local retail distribution hubs considering customer Class A 3.1 3.1 11.3

proximity to be a key factor in determining optimal ship locations.

Class B 7.4 - 10.0

Rentals in such industrial developments may reach the level of class

A rental rates. Location is set to remain key factor affecting demand - rents are based on the KZT/USD rate of 384.2 provided by the National Bank of the

Republic of Kazakhstan as of 31/12/2018, are indicated VAT exclusive, OPEX inclusive

for class B industrial developments. * asking (marketing rents) may deviate from real transaction rents by 10-25% downwards

** weighted average

This report has been produced by Cushman & Wakefield Kazakhstan for use by those with an interest in commercial Madina Kerimbayeva

property solely for information purposes. It is not intended to be a complete description of the markets or developments to Associate | Consultancy Services

which it refers. The report uses information obtained from public sources which Cushman & Wakefield Kazakhstan believe CDC 2 Business Centre,

to be reliable, but we have not verified such information and cannot guarantee that it is accurate and complete. No warranty 240V Nazarbayev Avenue,

or representation, express or implied, is made as to the accuracy or completeness of any of the information contained herein Almaty, A26F8D3, Kazakhstan

and Cushman & Wakefield Kazakhstan shall not be liable to any reader of this report or any third party in any way Tel: +7 727 334 40 00

whatsoever. All expressions of opinion are subject to change. Our prior written consent is required before this report can be Madina.kerimbayeva@cushwake.kz

reproduced in whole or in part. ©2018 Cushman & Wakefield Kazakhstan. All rights reserved. cushmanwakefield.kz

Вам также может понравиться

- Triple Net Lease Cap Rate ReportДокумент3 страницыTriple Net Lease Cap Rate ReportnetleaseОценок пока нет

- China HousingMarketДокумент31 страницаChina HousingMarketshashankgowdaОценок пока нет

- Indian Stock MarketДокумент60 страницIndian Stock Marketmokshasinchana100% (1)

- About Me-1Документ2 страницыAbout Me-1Don't Talking100% (1)

- CB Richard Ellis Report - India Office Market View - q3, 2010 - FinalДокумент12 страницCB Richard Ellis Report - India Office Market View - q3, 2010 - FinalMayank19mОценок пока нет

- Net Lease Market Report 2018Документ3 страницыNet Lease Market Report 2018netleaseОценок пока нет

- Air Passenger Service Quality in Bangladesh: An Analysis On Biman Bangladesh Airlines LimitedДокумент55 страницAir Passenger Service Quality in Bangladesh: An Analysis On Biman Bangladesh Airlines LimitedRupa Banik100% (1)

- C&W India Real Estate Outlook 2009Документ52 страницыC&W India Real Estate Outlook 2009rayvk18Оценок пока нет

- India Betting On Warehousing BoomДокумент10 страницIndia Betting On Warehousing BoomSajiОценок пока нет

- Hindalco Annual Report 2019 PDFДокумент379 страницHindalco Annual Report 2019 PDFDharmnath Prasad Srivatava100% (1)

- Astana Office Market Snapshot: KazakhstanДокумент2 страницыAstana Office Market Snapshot: KazakhstanririОценок пока нет

- Romania Ind 4q18Документ1 страницаRomania Ind 4q18ririОценок пока нет

- Colliers CMIS - Market - Snapshots - Q219 - FINALДокумент20 страницColliers CMIS - Market - Snapshots - Q219 - FINALmilan khatriОценок пока нет

- Bulgaria Ind 4q18Документ1 страницаBulgaria Ind 4q18ririОценок пока нет

- BAMOДокумент4 страницыBAMOKevin ParkerОценок пока нет

- 2018 Canada Market Outlook-Final enДокумент51 страница2018 Canada Market Outlook-Final enWhatОценок пока нет

- Colliers APAC Research Talking Points 8 Mar 2021Документ4 страницыColliers APAC Research Talking Points 8 Mar 2021Match PointОценок пока нет

- 2023 Midyear BigBox ReportДокумент68 страниц2023 Midyear BigBox ReportzhaoyynОценок пока нет

- Kalaari Logistics ReportДокумент18 страницKalaari Logistics ReportNavin JollyОценок пока нет

- Canada Cap Rate Report Q2 2023Документ20 страницCanada Cap Rate Report Q2 2023abahomed12Оценок пока нет

- CBRE - PR - Industrial & Logistics Sector Leasing Increases by 26% Y-o-Y To 8.0 Mn. Sq. Ft. in Jan-Mar'23Документ5 страницCBRE - PR - Industrial & Logistics Sector Leasing Increases by 26% Y-o-Y To 8.0 Mn. Sq. Ft. in Jan-Mar'23Moiz SayОценок пока нет

- Real Estate Market Outlook: CambodiaДокумент23 страницыReal Estate Market Outlook: CambodiaJay YuanОценок пока нет

- SH Commercial Vehicles Q3 1 March 2017Документ7 страницSH Commercial Vehicles Q3 1 March 2017saurabharora102Оценок пока нет

- Condominium Rates Hold Steady Amidst Spike in Supply: Phnom Penh, Q4 2018Документ6 страницCondominium Rates Hold Steady Amidst Spike in Supply: Phnom Penh, Q4 2018Jay YuanОценок пока нет

- SH-Commercial Vehicles-Q4-1-October 2018Документ6 страницSH-Commercial Vehicles-Q4-1-October 2018Kunal KashyapОценок пока нет

- Q3 2018 Philadelphia Metro Industrial MarketViewДокумент5 страницQ3 2018 Philadelphia Metro Industrial MarketViewAnonymous Feglbx5Оценок пока нет

- (Colliers) APAC Cap Rate Report Q4.2022Документ6 страниц(Colliers) APAC Cap Rate Report Q4.2022Khoi NguyenОценок пока нет

- NCR Warehousing Market Report 2016 3845 PDFДокумент28 страницNCR Warehousing Market Report 2016 3845 PDFPiyush JainОценок пока нет

- The Outlook of The Philippine Real Estate Industry in 2019Документ2 страницыThe Outlook of The Philippine Real Estate Industry in 2019Ma Cristina Lascano-ZapantaОценок пока нет

- RSH - 5348 - APAC - Market Intel - 0717Документ14 страницRSH - 5348 - APAC - Market Intel - 0717Akshay ArwadeОценок пока нет

- 3Q19 Atlanta Local Apartment ReportДокумент4 страницы3Q19 Atlanta Local Apartment ReportAnonymous amHficr9RОценок пока нет

- Ciudad Juárez, Mexico: MarketbeatДокумент2 страницыCiudad Juárez, Mexico: MarketbeatPepitofanОценок пока нет

- Indianapolis - Retail - 4/1/2008Документ4 страницыIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Colliers - Market Overview BiH - 00202Документ19 страницColliers - Market Overview BiH - 00202Dražen ŠОценок пока нет

- GCC Real Estate Update - May 2020Документ10 страницGCC Real Estate Update - May 2020munaft100% (1)

- JLL Real Estate Market Overview - Dubai - Q3 2016Документ8 страницJLL Real Estate Market Overview - Dubai - Q3 2016Beshoy GirgisОценок пока нет

- Real Estate - Opportunities Challenges and Outlook - CAREДокумент11 страницReal Estate - Opportunities Challenges and Outlook - CAREbangaloretoonsОценок пока нет

- BostonДокумент4 страницыBostonAnonymous Feglbx5Оценок пока нет

- India Real Estate July December 2019 6897 PDFДокумент238 страницIndia Real Estate July December 2019 6897 PDFArnab RoyОценок пока нет

- Logistics and Warehousing Covid19 2Документ5 страницLogistics and Warehousing Covid19 2Mukhlis .mОценок пока нет

- 2Q20 Boston Industrial Market ReportДокумент4 страницы2Q20 Boston Industrial Market ReportWilliam HarrisОценок пока нет

- 106 PDFДокумент6 страниц106 PDFkeinОценок пока нет

- 2017 Midyear Industrial Forecast - Miami-DadeДокумент1 страница2017 Midyear Industrial Forecast - Miami-DadeAnonymous Feglbx5Оценок пока нет

- 3Q18 Atlanta LARДокумент4 страницы3Q18 Atlanta LARAnonymous Feglbx5Оценок пока нет

- Commercial Vehicle: PowerДокумент8 страницCommercial Vehicle: PowerHariramОценок пока нет

- Real Estate Market Outlook Spain 2018Документ44 страницыReal Estate Market Outlook Spain 2018alejandroОценок пока нет

- Q3 2017 ColliersQuarterly JakartaДокумент43 страницыQ3 2017 ColliersQuarterly JakartaNovia PutriОценок пока нет

- PhiladelphiaДокумент4 страницыPhiladelphiaAnonymous Feglbx5Оценок пока нет

- Drivers SlideДокумент1 страницаDrivers SlideAjay KathuriaОценок пока нет

- Transport Logistics Ma 2018Документ32 страницыTransport Logistics Ma 2018Pritesh RoyОценок пока нет

- Milwaukee - Retail - 4/1/2008Документ4 страницыMilwaukee - Retail - 4/1/2008Russell KlusasОценок пока нет

- Bangkok Condominium Market q2 2023 10536Документ5 страницBangkok Condominium Market q2 2023 10536alexm.linkedОценок пока нет

- QuarterlyConstructionCostReviewQ3HKandChina PDFДокумент17 страницQuarterlyConstructionCostReviewQ3HKandChina PDFPietrus NimbusОценок пока нет

- 2017 Q4 US Industrial Market ReportДокумент14 страниц2017 Q4 US Industrial Market ReportCoy DavidsonОценок пока нет

- Real Estate Sector: Residential - The Cycle Has Turned Office - Cyclical Upswing Continues Post CovidДокумент7 страницReal Estate Sector: Residential - The Cycle Has Turned Office - Cyclical Upswing Continues Post Covidpal kitОценок пока нет

- Baltimore Industrial MarketView Q2 2018 PDFДокумент4 страницыBaltimore Industrial MarketView Q2 2018 PDFAnonymous Feglbx5Оценок пока нет

- !! Architectural Services Market - 2022 - 27 - Industry Share, Size, Growth - Mordor IntelligenceДокумент6 страниц!! Architectural Services Market - 2022 - 27 - Industry Share, Size, Growth - Mordor IntelligenceAlexОценок пока нет

- Uk Ind 4q18Документ1 страницаUk Ind 4q18Nguyen SKThaiОценок пока нет

- (Housing) RSW-PR-01Документ9 страниц(Housing) RSW-PR-01Denise Angeli YuОценок пока нет

- Insite 2018: HyderabadДокумент6 страницInsite 2018: HyderabaddfdsgfsdgfsОценок пока нет

- CW Q3 2018 MarketBeat - IndustrialДокумент11 страницCW Q3 2018 MarketBeat - IndustrialpradoОценок пока нет

- FICCI India Office Repurposed To Scaleup ReportДокумент17 страницFICCI India Office Repurposed To Scaleup ReportRitesh KurarОценок пока нет

- Markets from Networks: Socioeconomic Models of ProductionОт EverandMarkets from Networks: Socioeconomic Models of ProductionРейтинг: 3.5 из 5 звезд3.5/5 (2)

- Tech Mahindra Integrated Report 2018 19 PDFДокумент153 страницыTech Mahindra Integrated Report 2018 19 PDFfilmcer100% (1)

- Open Electricity Economics - 3. The Cost of Electricity PDFДокумент13 страницOpen Electricity Economics - 3. The Cost of Electricity PDFfaheemshelotОценок пока нет

- Manifest 232Документ2 страницыManifest 232Elev8ted MindОценок пока нет

- Expected Utility and Risk Aversion George Pennacchi University of IllinoisДокумент56 страницExpected Utility and Risk Aversion George Pennacchi University of Illinoisrobertclee1234Оценок пока нет

- 6 Ch14 - Central BanksДокумент63 страницы6 Ch14 - Central BanksNgọc Ngô Thị MinhОценок пока нет

- Farewell Address WorksheetДокумент3 страницыFarewell Address Worksheetapi-261464658Оценок пока нет

- Sanjeev Kr. YadavДокумент3 страницыSanjeev Kr. YadavSahil KumarОценок пока нет

- ISO 9000 For Textile and RMG IndustryДокумент3 страницыISO 9000 For Textile and RMG IndustryZahid RahmanОценок пока нет

- Balance Sheet of Tech MahindraДокумент3 страницыBalance Sheet of Tech MahindraPRAVEEN KUMAR M 18MBR070Оценок пока нет

- THAILAND Community Watershed Management and Agriculture DevelopmentДокумент2 страницыTHAILAND Community Watershed Management and Agriculture DevelopmentAdriaRDОценок пока нет

- Marketing Program - Product StrategyДокумент43 страницыMarketing Program - Product StrategybetsaidaОценок пока нет

- MP Ekramul Karim ChowdhuryДокумент5 страницMP Ekramul Karim ChowdhurySaifSaemIslamОценок пока нет

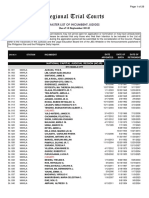

- Regional Trial Courts: Master List of Incumbent JudgesДокумент26 страницRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaОценок пока нет

- Exercise - Sesi 11Документ2 страницыExercise - Sesi 11GomiОценок пока нет

- Org Management Week 10Документ15 страницOrg Management Week 10Jade Lyn LopezОценок пока нет

- 00 Case Study BtechДокумент3 страницы00 Case Study BtechAnupam DeОценок пока нет

- European Business Assignment 1Документ5 страницEuropean Business Assignment 1Serwaa AkotoОценок пока нет

- 1923 Baragwanath The Ballarat Goldfield, Memoir 14 - pt-2Документ143 страницы1923 Baragwanath The Ballarat Goldfield, Memoir 14 - pt-2Yuri Vladimir Ordonez LamaОценок пока нет

- Business Chapter 1 - 24 4 2018Документ14 страницBusiness Chapter 1 - 24 4 2018Aishani ToolseeОценок пока нет

- AP Govt Latest DA Arrears Software For 27.248%Документ1 страницаAP Govt Latest DA Arrears Software For 27.248%shabbir ahamed SkОценок пока нет

- EFU LIFE PresentationДокумент20 страницEFU LIFE PresentationZawar Afzal Khan0% (1)

- Assignment On BelgiumДокумент21 страницаAssignment On Belgiumgalib gosnoforОценок пока нет

- Evolution of Asian RegionalismДокумент1 страницаEvolution of Asian Regionalismaimee0dayaganonОценок пока нет

- Income Tax: Click HereДокумент3 страницыIncome Tax: Click HereRrrОценок пока нет

- The Rotary Club of Payson: Today... September 18th Is..Документ2 страницыThe Rotary Club of Payson: Today... September 18th Is..api-35893633Оценок пока нет

- Competitive Analyses of Bajaj PulsarДокумент93 страницыCompetitive Analyses of Bajaj PulsarHitesh Jogani100% (2)