Академический Документы

Профессиональный Документы

Культура Документы

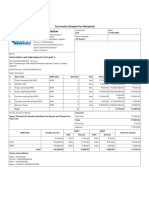

BC Pool Annual Tax Increase Estimates

Загружено:

Boulder City Review0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров1 страницаTax table for Ballot Question 2

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTax table for Ballot Question 2

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров1 страницаBC Pool Annual Tax Increase Estimates

Загружено:

Boulder City ReviewTax table for Ballot Question 2

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

Estimated Annual Tax Increase

Property Net Bond Amount

Assessed Value

$30,000,000 $35,000,000 $40,000,000

$25,000 $67 $77 $90

$50,000 $135 $155 $180

$75,000 $202 $232 $270

$100,000 $270 $310 $360

$150,000 $405 $465 $540

$200,000 $540 $620 $720

$250,000 $675 $775 $900

$300,000 $810 $930 $1,080

$350,000 $945 $1,085 $1,260

$400,000 $1,080 $1,240 $1,440

$450,000 $1,215 $1,395 $1,620

$500,000 $1,350 $1,550 $1,800

$550,000 $1,485 $1,705 $1,980

$600,000 $1,620 $1,860 $2,160

$650,000 $1,755 $2,015 $2,340

$700,000 $1,890 $2,170 $2,520

$750,000 $2,025 $2,325 $2,700

$800,000 $2,160 $2,480 $2,880

$850,000 $2,295 $2,635 $3,060

$900,000 $2,430 $2,790 $3,240

$950,000 $2,565 $2,945 $3,420

$1,000,000 $2,700 $3,100 $3,600

Mil levy (per $100 net assessed value)

0.27 0.31 0.36

Website to search for your Net Assessed Value to calculate the tax impact on your home:

https://trweb.co.clark.nv.us/

Вам также может понравиться

- 620 G Avenue - Complaint LetterДокумент1 страница620 G Avenue - Complaint LetterBoulder City ReviewОценок пока нет

- Draft Ordinance AmendmentДокумент4 страницыDraft Ordinance AmendmentBoulder City ReviewОценок пока нет

- Noyola Lawsuit RedactedДокумент46 страницNoyola Lawsuit RedactedBoulder City ReviewОценок пока нет

- March 11 Hearing TranscriptДокумент43 страницыMarch 11 Hearing TranscriptBoulder City ReviewОценок пока нет

- Reinstated PositionsДокумент5 страницReinstated PositionsBoulder City ReviewОценок пока нет

- Memo To Finance DirectorДокумент1 страницаMemo To Finance DirectorBoulder City ReviewОценок пока нет

- Terry Chastain Criminal ComplaintДокумент1 страницаTerry Chastain Criminal ComplaintBoulder City ReviewОценок пока нет

- New MotionДокумент21 страницаNew MotionBoulder City Review100% (1)

- Ethics Complaint FINALДокумент69 страницEthics Complaint FINALBoulder City ReviewОценок пока нет

- Staff DeclarationsДокумент176 страницStaff DeclarationsBoulder City ReviewОценок пока нет

- Temporary Restraining OrderДокумент5 страницTemporary Restraining OrderBoulder City ReviewОценок пока нет

- Nov. 13 Stipulation and OrderДокумент8 страницNov. 13 Stipulation and OrderBoulder City ReviewОценок пока нет

- Lorene Krumm Contract and ResolutionДокумент8 страницLorene Krumm Contract and ResolutionBoulder City ReviewОценок пока нет

- CASE NO: A-20-818973-C Department 24: Attorneys For Plaintiff Alfonso NoyolaДокумент19 страницCASE NO: A-20-818973-C Department 24: Attorneys For Plaintiff Alfonso NoyolaBoulder City ReviewОценок пока нет

- Temporary Restraining OrderДокумент5 страницTemporary Restraining OrderBoulder City ReviewОценок пока нет

- AG Opinion OML OpinionДокумент16 страницAG Opinion OML OpinionBoulder City ReviewОценок пока нет

- Bridgford 7-31-20Документ3 страницыBridgford 7-31-20Boulder City ReviewОценок пока нет

- 2020 08 06 Agenda PacketДокумент219 страниц2020 08 06 Agenda PacketBoulder City ReviewОценок пока нет

- BC Police Arrest 13 in Suspected Crime RingДокумент3 страницыBC Police Arrest 13 in Suspected Crime RingBoulder City ReviewОценок пока нет

- CASE NO: A-20-816602-B Department 11Документ14 страницCASE NO: A-20-816602-B Department 11Boulder City ReviewОценок пока нет

- BFE LLC ComplaintДокумент14 страницBFE LLC ComplaintBoulder City ReviewОценок пока нет

- Howard & Howard Attorneys PLLC: Istrict Ourt Lark Ounty EvadaДокумент55 страницHoward & Howard Attorneys PLLC: Istrict Ourt Lark Ounty EvadaBoulder City ReviewОценок пока нет

- Stantec Facilities Draft ReportДокумент762 страницыStantec Facilities Draft ReportBoulder City ReviewОценок пока нет

- 13 ArrestedДокумент3 страницы13 ArrestedBoulder City ReviewОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- GST - Unit 2 (Illustration Sums)Документ10 страницGST - Unit 2 (Illustration Sums)subash minecraft creatorОценок пока нет

- Chapter 12: Assessment of Various Entities: Section - A: Statutory UpdateДокумент49 страницChapter 12: Assessment of Various Entities: Section - A: Statutory UpdateAmol TambeОценок пока нет

- Corporate Social Responsibility (CSR) As A Model of "Extended" Corporate Governance. An Explanation Based On The Economic Theories of Social Contract, Reputation and Reciprocal ConformismДокумент49 страницCorporate Social Responsibility (CSR) As A Model of "Extended" Corporate Governance. An Explanation Based On The Economic Theories of Social Contract, Reputation and Reciprocal ConformismronaqvОценок пока нет

- Alkurdi (2020) - Ownership and The Board of Directors On Tax AvoidanceДокумент18 страницAlkurdi (2020) - Ownership and The Board of Directors On Tax AvoidanceAhmad RifaiОценок пока нет

- 09 - 108 Real Estate Investing With Rental PropertyДокумент129 страниц09 - 108 Real Estate Investing With Rental PropertyImee Loren AbonalesОценок пока нет

- AnnualReport Eng 2016-17 0Документ224 страницыAnnualReport Eng 2016-17 0AvijitSinharoyОценок пока нет

- Tax Q&A - Employment IncomeДокумент5 страницTax Q&A - Employment IncomeHadifli100% (1)

- Ayush - Verma - SIP ReportДокумент28 страницAyush - Verma - SIP ReportKanha MishraОценок пока нет

- Heavy Metal and Tube India PVT LTD Unit 1 - 272 - 17-06-2022Документ1 страницаHeavy Metal and Tube India PVT LTD Unit 1 - 272 - 17-06-2022pragnesh prajapatiОценок пока нет

- Itr 2022-2023Документ1 страницаItr 2022-2023Deepak ThangamaniОценок пока нет

- Journal of Cleaner Production: Yan Qin, Julie Harrison, Li ChenДокумент27 страницJournal of Cleaner Production: Yan Qin, Julie Harrison, Li ChenTABAH RIZKIОценок пока нет

- Member MemberReportDisplayДокумент12 страницMember MemberReportDisplayAmapola VillalobosОценок пока нет

- US Department of Justice Official Release - 02267-07 Tax 306Документ3 страницыUS Department of Justice Official Release - 02267-07 Tax 306legalmatters100% (1)

- Invoice 4596898136 230124 120841Документ2 страницыInvoice 4596898136 230124 120841RavindranathОценок пока нет

- Provisions: B22 Major Changes in TaxДокумент9 страницProvisions: B22 Major Changes in TaxasdjkfnasdbifbadОценок пока нет

- Interpretation of Statutes AssignmentДокумент32 страницыInterpretation of Statutes AssignmentHimanish ChakrabortyОценок пока нет

- Article VI Legislative DepartmentДокумент87 страницArticle VI Legislative DepartmentDjumeil Gerard TinampayОценок пока нет

- ACTIVITY 1 MabalaДокумент5 страницACTIVITY 1 MabalaJulie mabuyoОценок пока нет

- Tax Invoice: Excitel Broadband Pvt. LTDДокумент1 страницаTax Invoice: Excitel Broadband Pvt. LTDMittal GalaxyОценок пока нет

- Ch1 - General Principles and Concepts of TaxationДокумент3 страницыCh1 - General Principles and Concepts of TaxationJuan FrivaldoОценок пока нет

- Organization Study ReportДокумент25 страницOrganization Study Reporttharunarunnaik100% (1)

- Form PDF 345858330310722Документ10 страницForm PDF 345858330310722narasimhahanОценок пока нет

- W6-Module Concept of Income-Part 1Документ14 страницW6-Module Concept of Income-Part 1Danica VetuzОценок пока нет

- City of Fort St. John - Pandemic Effect On The Operating Budget, March 2020Документ4 страницыCity of Fort St. John - Pandemic Effect On The Operating Budget, March 2020AlaskaHighwayNewsОценок пока нет

- Chair Bill - AmazonДокумент1 страницаChair Bill - AmazonIrfan AzmiОценок пока нет

- Financial ManagementДокумент24 страницыFinancial ManagementVindicate LeeОценок пока нет

- Jawad Hussain: SkillsДокумент2 страницыJawad Hussain: SkillsghaziaОценок пока нет

- Group Activity Mina HanДокумент4 страницыGroup Activity Mina HanLevi's DishwasherОценок пока нет

- Documentary Stamp TaxДокумент2 страницыDocumentary Stamp TaxMary Therese Anne DequiadoОценок пока нет