Академический Документы

Профессиональный Документы

Культура Документы

Accountancy Xii

Загружено:

Rusken CH MominАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accountancy Xii

Загружено:

Rusken CH MominАвторское право:

Доступные форматы

www.iisriyadh.

com

INTERNATIONAL INDIAN SCHOOL, RIYADH

CLASS - XII WORKSHEET OF ACCOUNTANCY – II TERM – 2009

1. ‘L’ limited purchased assets of Rs.6,30,000 from Amit limited and issued equity

shares of Rs.100 each fully paid in consideration, What journal entries will be made,

If the shares are issued:

(a) At par

(b) At discount of 10% and

(c) At a premium of 20%

2. Alka Ltd. Invited applications for 60,000 equity shares of Rs.50 each issued at a

premium of Rs.10 per share. The amount was payable as follows:

On application Rs.10

On allotment Rs.20(including premium)

Balance on a call

Applications for 80,000 shares were received. Applications for 20,000 shares were

rejected and full allotment was made to the remaining applicants. All calls were made

and were duly received except the call on 600 shares which were allotted to M. His

shares were forfeited. The forfeited shares were re-issued at Rs.60 fully paid up. Pass

journal entries in the books of Alka Ltd.

3. K Ltd. has been registered with an authorized capital of Rs.2,00,000 divided into

2000 shares of Rs.100 each of which, 1000 shares were offered for public

subscription at a premium of Rs.5 per share, payable as under:

On application Rs.10, on allotment Rs,25 including premium, on 1 st call Rs.40 and on

second call Rs.30.

Applications were received for 1800 shares of which application for 300 shares were

rejected outright, the rest of the application were allotted 1000 shares on pro-rate

basis. Excess application money was transferred to allotment.

All the monies were duly received except from R, holder of 100 shares, who failed to

pay first call money. His shares were later forfeited and reissued to Shyam at Rs.60

per share Rs.70 paid up. Final call has not been made.

Pass necessary journal entries in the books of K Ltd.

IISR Worksheets/2009 Page 1

www.iisriyadh.com

4. The Delhi Cloth Mills Ltd. Invited application for 10,000 shares of Rs.100 each at a

premium of Rs.10 each payable as follows: Rs.50 on application, Rs.35 on allotment

(including premium) and Rs.25 on a call.

Applications for 15000 shares were received. Applications for 2500 shares did not

get ant allotment and their money refunded. Allotment was made pro-rate to the

remaining applicants.

Mr. A allotted 160 shares. He failed to pay the amount due on allotment and call

money. The company forfeited his shares and subsequently reissued Rs.105 per

share. Show the journal entries in the books of the company.

5. M Ltd. Issued 30,000 equity shares of Rs.10 each at a discount of Rs.1 per share

(to be adjusted on allotment) payable as follows: Rs.3 per share on application, Rs.2

per share on allotment and Rs.4 per share on a call.

Applications for 40,000 shares were received and pro-rate allotment was made

without rejecting of any application.

Mr. R allotted 100 shares. He failed to pay the amount due on allotment and call

money. His shares were forfeited and re-issued at Rs.8 per share as fully paid.

Pass the necessary journal entries to record the above transactions.

6. A Ltd. Invited application for 80000 shares of Rs.10 each payable at a premium of

Rs.4 per share. The amount was payable as follows; on application Rs.5 per share,

on allotment Rs.9 per share (including premium). Applications were received for 14,

0000 shares. Allotment was made on the following basis:

(i) To applicants for 80,000 shares-60000 shares.

(ii) To applicants for 60,000 shares-20,000 shares.

Money overpaid on application was utilized towards sums due on allotment.Rajiv who

had applied for 1200 shares failed to pay his dues and his shares were forfeited. (Ist

category of allotment)

Pass necessary journal entries in the books of A Ltd. To record the above

transactions.

7. X Ltd. Offered 10,000 shares of Rs.10 each at a premium of Rs.2 per share. Full

amount is payable on applications, 15000 applications were received and pro-rata

allotment was made without any rejection. Write journal entries in the books of X Ltd

8. Give Journal entries to record forfeiture and re-issue of share in the following cases:

(i) 50 Shares of Rs.10 each issued at a premium of Rs.4 each payable with

allotment were forfeited for non-payment of allotment money of Rs.9 per

share including premium. The first and final call on these shares of Rs.3 per

share was not made. The forfeited shares were reissued at Rs.12 per share

fully paid up.

IISR Worksheets/2009 Page 2

www.iisriyadh.com

(j) VT Ltd. Forfeited 20 shares of Rs.10 each (Rs.7 called up) issued at a discount

of 10% to Meena on which she had paid Rs.2 per share. Out of these 18

shares were re-issued to Neeta as Rs.8 called up for Rs.6 per share

9. X Ltd. invited applications for 10,000 equity shares of Rs.10 each for public

subscription. The amount of these shares was payable as under: On application Rs.1

per share, on allotment Rs.2 per share, on first call Rs.3 per share, on second call

Rs.4 per share, All sums payable on application, allotment and calls were duly

received with the following exceptions:

(i) A, who holds 200 shares failed to pay the money on allotment and calls

(j) B, to whom 150 shares were allotted failed to pay the money on first call and

final call

(k) C, who holds 50 shares did not pay the amount of final call.

The shares of A, B and C were forfeited and were subsequently reissued for cash

as fully paid at a discount of 5% journalise.

10. X Ltd has an authorized capital of Rs.10, 00,000 divided into equity shares of Rs.10

each. The company invited applications for 50,000 shares; applications for 40,000

shares were received. All calls were made and duly received except the final call Rs.2

per share on 1000 shares.500 of the shares on which final call was not received were

forfeited show how share capital will appear in the Balance sheet of the company as

per schedule-vi part I of company’s Act 1956.

IISR Worksheets/2009 Page 3

Вам также может понравиться

- Revision 2 Share CapitalДокумент3 страницыRevision 2 Share CapitalGopika BaburajОценок пока нет

- COA Unit 2 Issue of Shares - ProblemsДокумент3 страницыCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraОценок пока нет

- Share CapitalДокумент10 страницShare CapitalShreyas PremiumОценок пока нет

- Worksheet - Accounting For Share CapitalДокумент6 страницWorksheet - Accounting For Share CapitalPrisha SharmaОценок пока нет

- Questions For My GirlДокумент11 страницQuestions For My Girladhishreesinghal24Оценок пока нет

- Company Accounts RevisionДокумент4 страницыCompany Accounts RevisionAnu SoniОценок пока нет

- SHARESДокумент5 страницSHARESMohammad Tariq AnsariОценок пока нет

- CompanyДокумент11 страницCompanyBijendra DasОценок пока нет

- Issue of Shares Cbse Question BankДокумент7 страницIssue of Shares Cbse Question Bankabhayku1689Оценок пока нет

- Worksheet-Issue of SharesДокумент4 страницыWorksheet-Issue of SharesBhavika LargotraОценок пока нет

- CBSE Class 12 Accountancy - Issue of SharesДокумент3 страницыCBSE Class 12 Accountancy - Issue of SharesSahyogОценок пока нет

- Hots CompanyДокумент5 страницHots CompanySaloni JainОценок пока нет

- Shivaraj Corrporeting Acconting 3rd SemДокумент9 страницShivaraj Corrporeting Acconting 3rd Semshivaraj gowdaОценок пока нет

- Numerical QuestionsДокумент3 страницыNumerical QuestionsArchi JainОценок пока нет

- 5th Account Gobind Kumar Jha 9874411552Документ69 страниц5th Account Gobind Kumar Jha 9874411552binay chaudharyОценок пока нет

- Accounting For Shares - Notes 2Документ9 страницAccounting For Shares - Notes 2AviОценок пока нет

- Accounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsДокумент9 страницAccounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsbinuОценок пока нет

- Share Capital Assignment PDFДокумент6 страницShare Capital Assignment PDFBHUMIKA JAINОценок пока нет

- Accounting For Share Capital Extra Questions Part 2Документ2 страницыAccounting For Share Capital Extra Questions Part 2NICOLAОценок пока нет

- Corporate AccountingДокумент32 страницыCorporate AccountingSaran Ranny100% (1)

- Practice Sheet Issue of SharesДокумент5 страницPractice Sheet Issue of SharesAryan VermaОценок пока нет

- 21 March Live Most Imp Questions Shares To Debent 240321 230837Документ3 страницы21 March Live Most Imp Questions Shares To Debent 240321 230837seemaanil029Оценок пока нет

- Share Comprehensive QuestionsДокумент1 страницаShare Comprehensive QuestionsLaxmi Kant Sahani0% (2)

- Issue of Shares Most Important Part 1Документ25 страницIssue of Shares Most Important Part 1mainikunal09Оценок пока нет

- SharesДокумент2 страницыSharesHannah Ann JacobОценок пока нет

- Issue of Shares Comprehensive Sums Part IIДокумент5 страницIssue of Shares Comprehensive Sums Part IIHamza MudassirОценок пока нет

- CBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetДокумент3 страницыCBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetJenneil CarmichaelОценок пока нет

- Issue of SharesДокумент3 страницыIssue of SharesPratiksha PatelОценок пока нет

- Accounting of Issue of SharesДокумент17 страницAccounting of Issue of SharesAnkit Tiwari0% (1)

- DR AKL Corporate Oct21 CIA 2021Документ2 страницыDR AKL Corporate Oct21 CIA 2021Saif UddeenОценок пока нет

- Issue of ShareДокумент2 страницыIssue of ShareavtaranОценок пока нет

- Class XiithДокумент11 страницClass XiithSantvana ChaturvediОценок пока нет

- Shares - HTPДокумент2 страницыShares - HTPPavithra AnupОценок пока нет

- Chapter 1 - Company Account - Accounting For Share CapitalДокумент143 страницыChapter 1 - Company Account - Accounting For Share CapitalAvi yadavОценок пока нет

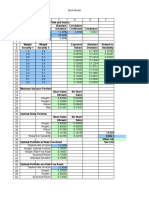

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityДокумент13 страницAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- Company Accounts-Issue of Shares - (Module 8)Документ2 страницыCompany Accounts-Issue of Shares - (Module 8)Manshi GolchhaОценок пока нет

- Assignment Unit 1Документ4 страницыAssignment Unit 1vsraviОценок пока нет

- PT I Acc Xii - 2023Документ3 страницыPT I Acc Xii - 2023sindhuОценок пока нет

- Shares Forfeiture & ReissueДокумент5 страницShares Forfeiture & ReissueUnknownОценок пока нет

- Issue of SharesДокумент8 страницIssue of Sharesmdatif00777Оценок пока нет

- Mathabit Smart Classes: Class - XII Accounts TestДокумент2 страницыMathabit Smart Classes: Class - XII Accounts TestanoymousОценок пока нет

- Worksheet For Issue of Share and DebentureДокумент2 страницыWorksheet For Issue of Share and DebentureLaxmi Kant SahaniОценок пока нет

- Document 11Документ2 страницыDocument 11KHUSHI PANDEYОценок пока нет

- Company AccountsДокумент3 страницыCompany AccountsYATTIN KHANNAОценок пока нет

- Issue of Shares Day 2Документ3 страницыIssue of Shares Day 2CSCharlie GahlotОценок пока нет

- Practice Questions of Issue of SharesДокумент2 страницыPractice Questions of Issue of SharesBook SpacesОценок пока нет

- CBSE Class 12 Accountancy Company Accounts Worksheet Set AДокумент2 страницыCBSE Class 12 Accountancy Company Accounts Worksheet Set AJenneil CarmichaelОценок пока нет

- ACCOUNTING FOR SHARE CAPITAL PART-1 (Extra Questions)Документ2 страницыACCOUNTING FOR SHARE CAPITAL PART-1 (Extra Questions)NICOLAОценок пока нет

- Accounting For Share Capital (2019-20)Документ20 страницAccounting For Share Capital (2019-20)niyatiagarwal25Оценок пока нет

- Admsn ShareДокумент2 страницыAdmsn Shareak99archana1999Оценок пока нет

- Company - Forfeiture and ReissueДокумент2 страницыCompany - Forfeiture and ReissueTrilok ChandОценок пока нет

- Issue OF SHARE CAPITAL PRACTISE QUESTIONSДокумент5 страницIssue OF SHARE CAPITAL PRACTISE QUESTIONSCSCharlie GahlotОценок пока нет

- Xii Mcqs CH - 9 Issue of SharesДокумент7 страницXii Mcqs CH - 9 Issue of SharesJoanna Garcia100% (1)

- Accounting For Share Capital: Test (20 MARKS)Документ1 страницаAccounting For Share Capital: Test (20 MARKS)Stanzin NawangОценок пока нет

- Company Account Review Questions-1Документ3 страницыCompany Account Review Questions-1JustineОценок пока нет

- Issue of Shares QuestionsДокумент5 страницIssue of Shares Questionsgson52310Оценок пока нет

- DPP 05 Shares Sunil PandaДокумент2 страницыDPP 05 Shares Sunil Pandaxrixn11Оценок пока нет

- CM11 3C CacДокумент2 страницыCM11 3C CacHaRiPrIyA JaYaKuMaRОценок пока нет

- Accts PT 2 JK REVISED PDFДокумент3 страницыAccts PT 2 JK REVISED PDFIshaan KanoiОценок пока нет

- Frequency Inverter: User's ManualДокумент117 страницFrequency Inverter: User's ManualCristiano SilvaОценок пока нет

- BKM 10e Ch07 Two Security ModelДокумент2 страницыBKM 10e Ch07 Two Security ModelJoe IammarinoОценок пока нет

- Plumbing Breakup M 01Документ29 страницPlumbing Breakup M 01Nicholas SmithОценок пока нет

- Industries Visited in Pune & LonavalaДокумент13 страницIndustries Visited in Pune & LonavalaRohan R Tamhane100% (1)

- Me3391-Engineering Thermodynamics-805217166-Important Question For Engineering ThermodynamicsДокумент10 страницMe3391-Engineering Thermodynamics-805217166-Important Question For Engineering ThermodynamicsRamakrishnan NОценок пока нет

- A Conceptual Framework For Characterizing M - 2019 - International Journal of MiДокумент7 страницA Conceptual Framework For Characterizing M - 2019 - International Journal of MiKENNY BRANDON MAWODZWAОценок пока нет

- Ancon Tension Systems March 2008Документ16 страницAncon Tension Systems March 2008Slinky BillОценок пока нет

- CP 1Документ22 страницыCP 1api-3757791100% (1)

- ANATOMY 1 NILEM and Cat FISHДокумент19 страницANATOMY 1 NILEM and Cat FISHAnisatul Khabibah ZaenОценок пока нет

- SSP 465 12l 3 Cylinder Tdi Engine With Common Rail Fuel Injection SystemДокумент56 страницSSP 465 12l 3 Cylinder Tdi Engine With Common Rail Fuel Injection SystemJose Ramón Orenes ClementeОценок пока нет

- Paterno Report: Dr. Fred S. Berlin, M.D., PH.D Final Report 2-7-2013Документ45 страницPaterno Report: Dr. Fred S. Berlin, M.D., PH.D Final Report 2-7-2013The Morning CallОценок пока нет

- PV2R Series Single PumpДокумент14 страницPV2R Series Single PumpBagus setiawanОценок пока нет

- Vaccination Schedule in Dogs and CatsДокумент3 страницыVaccination Schedule in Dogs and CatsAKASH ANANDОценок пока нет

- Cleaning of Contact Points and Wiring HarnessesДокумент3 страницыCleaning of Contact Points and Wiring HarnessesRafa Montes MOralesОценок пока нет

- Aplikasi Metode Geomagnet Dalam Eksplorasi Panas BumiДокумент10 страницAplikasi Metode Geomagnet Dalam Eksplorasi Panas Bumijalu sri nugrahaОценок пока нет

- Section 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsДокумент7 страницSection 80CCD (1B) Deduction - About NPS Scheme & Tax BenefitsP B ChaudharyОценок пока нет

- Iso 9227Документ13 страницIso 9227Raj Kumar100% (6)

- B - Cracked Tooth SyndromeДокумент8 страницB - Cracked Tooth SyndromeDavid TaylorОценок пока нет

- Vital Statistics: Presented by Mrs - Arockia Mary Associate ProfДокумент17 страницVital Statistics: Presented by Mrs - Arockia Mary Associate ProfraghumscnОценок пока нет

- ContinueДокумент2 страницыContinueNeal ReppОценок пока нет

- Family Stress TheoryДокумент10 страницFamily Stress TheoryKarina Megasari WinahyuОценок пока нет

- Blood DonationДокумент19 страницBlood DonationsuruthiОценок пока нет

- Bitumen BasicsДокумент25 страницBitumen BasicsMILON KUMAR HOREОценок пока нет

- Emission Estimation Technique Manual: For Mining and Processing of Non-Metallic MineralsДокумент84 страницыEmission Estimation Technique Manual: For Mining and Processing of Non-Metallic MineralsAbdelaziem mahmoud abdelaalОценок пока нет

- Cemco T80Документ140 страницCemco T80Eduardo Ariel Bernal100% (3)

- Probni Test 1. Godina - Ina KlipaДокумент4 страницыProbni Test 1. Godina - Ina KlipaMickoОценок пока нет

- User Manual: 3603807 CONTACT US - 09501447202,8070690001Документ1 страницаUser Manual: 3603807 CONTACT US - 09501447202,8070690001Arokiaraj RajОценок пока нет

- Aromatic Electrophilic SubstitutionДокумент71 страницаAromatic Electrophilic SubstitutionsridharancОценок пока нет

- Water Quality Index Determination of Malathalli LakeДокумент16 страницWater Quality Index Determination of Malathalli Lakeajay kumar hrОценок пока нет

- 2-Product Spec PDFДокумент10 страниц2-Product Spec PDFMhooMOoChaappHteenОценок пока нет