Академический Документы

Профессиональный Документы

Культура Документы

Accounting Equation Explained

Загружено:

ASMARA HABIBИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accounting Equation Explained

Загружено:

ASMARA HABIBАвторское право:

Доступные форматы

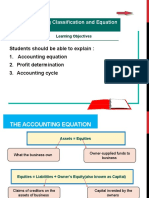

Accounting Equation

1. The owner invests personal cash in the business.

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

2. The owner withdraws cash from the business for personal use.

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

3. The company receives cash from a bank loan.

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

4. The company repays the bank that had lent money to the company.

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

5. The company purchases equipment with its cash.

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

6. The owner contributes his/her personal truck to the business.

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

7. The company purchases a significant amount of supplies on credit.

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

8. The company purchases land by paying half in cash and signing a note payable for the other half.

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

Company X provides consulting services to Client Q in May. Company X bills Client Q in May

for the agreed upon amount of $5,000. The sales invoice shows that the amount will be due in

June.

9. In May, Company X records the transaction by a debit to Accounts Receivable for $5,000 and a

credit to Service Revenues for $5,000. What is the effect of this entry upon the accounting

equation for Company X?

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

10. In June, Company X receives the $5,000. What is the effect on the accounting

equation and which accounts are affected at Company X?

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

11. What is the effect on Client Q's accounting equation in May when Client Q records the

transaction as a debit to Consultant Expense for $5,000 and a credit to Accounts Payable for

$5,000?

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

12. What is the effect on Client Q's accounting equation in June when Client Q remits the $5,000?

Also, which accounts will be involved?

Increase Decrease No Effect

Assets

Liabilities

Owner’s Equity

13. Which of the following will cause owner's equity to increase?

Expenses

Owner Draws

Revenue

14. Which of the following will cause owner's equity to decrease?

Net Income

Net Loss

Revenue

15. The accounting equation should remain in balance because every transaction affects how many

accounts?

Only One

Only Two

Two Or More

.

16. A corporation's quarterly __________ will cause a reduction in the corporation's retained

earnings, which in turn reduces the corporation's stockholders' equity. However, this will not

reduce the corporation's net income.

17. The financial statement with a structure that is similar to the accounting equation is the

__________

.

18. The financial statement that reports the portion of change in owner's equity resulting from

revenues and expenses during a specified time interval is the

__________

.

Вам также может понравиться

- Accounting Equation and Transactions ExplainedДокумент74 страницыAccounting Equation and Transactions ExplainedjhkcОценок пока нет

- ACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I The Accounting EquationДокумент11 страницACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I The Accounting EquationAyana Mae BaetiongОценок пока нет

- Accounting Basics: (Practice Quiz)Документ14 страницAccounting Basics: (Practice Quiz)Sanjay MehrotraОценок пока нет

- Fundamentals of Accounting I The Accounting EquationДокумент10 страницFundamentals of Accounting I The Accounting EquationericacadagoОценок пока нет

- ACCOUNTING BASICS QuizДокумент15 страницACCOUNTING BASICS QuizEunice Laarnie SimonОценок пока нет

- 1accounting EquationДокумент39 страниц1accounting EquationEaster LumangОценок пока нет

- Tutorial 1 - SsДокумент3 страницыTutorial 1 - SsChigoziem OnyekawaОценок пока нет

- Topic 3 - Accounting Classification and Accounting Equation LatestДокумент28 страницTopic 3 - Accounting Classification and Accounting Equation LatestKhairul AkmalОценок пока нет

- 1st Quarter ExaminationДокумент2 страницы1st Quarter ExaminationMarilyn Nelmida TamayoОценок пока нет

- Acctgchap 2Документ15 страницAcctgchap 2Anjelika ViescaОценок пока нет

- CFAB Accounting Chap02 Accounting EquationДокумент38 страницCFAB Accounting Chap02 Accounting EquationHoa NguyễnОценок пока нет

- Interview QuestionsДокумент5 страницInterview QuestionsanglrОценок пока нет

- Chapter 2Документ5 страницChapter 2Sundaramani SaranОценок пока нет

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownОт EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownОценок пока нет

- Fin Accounting 2 EquationДокумент25 страницFin Accounting 2 EquationIqbal Hanif100% (1)

- T8 BBFA2103 - Accounting For Liabilites and Owners EquityДокумент32 страницыT8 BBFA2103 - Accounting For Liabilites and Owners EquityHD DОценок пока нет

- Summative Test: Assets, Liabilities, Equity & Financial StatementsДокумент7 страницSummative Test: Assets, Liabilities, Equity & Financial StatementsJesse Kent Vincent BernadaОценок пока нет

- Midterm - Chapter 3Документ28 страницMidterm - Chapter 3JoshrylОценок пока нет

- Audit of Statement of Cash FlowsДокумент2 страницыAudit of Statement of Cash FlowsAndrew ManaloОценок пока нет

- Survey of Accounting 5th Edition Edmonds Solutions ManualДокумент35 страницSurvey of Accounting 5th Edition Edmonds Solutions Manualandrefloresxudd100% (21)

- Select One: A. B. C. DДокумент40 страницSelect One: A. B. C. DNguyễn Văn QuốcОценок пока нет

- Basic Accounting EquationДокумент42 страницыBasic Accounting Equationlily smithОценок пока нет

- Accounting Basics Quick Test 1Документ5 страницAccounting Basics Quick Test 1RoseОценок пока нет

- Hospitality QuizДокумент3 страницыHospitality QuizWycliffe Luther RosalesОценок пока нет

- ACC 311 PartnershipДокумент34 страницыACC 311 PartnershipokeowoОценок пока нет

- Compilation of IFA QuestionsДокумент67 страницCompilation of IFA QuestionsBugoy CabasanОценок пока нет

- Finance - Vocabulary in ContextДокумент2 страницыFinance - Vocabulary in ContextZbigniew WałowskiОценок пока нет

- Analyzing Business TransactionsДокумент21 страницаAnalyzing Business TransactionsDan Gideon Cariaga100% (1)

- College Accounting 14th Edition Price Test BankДокумент97 страницCollege Accounting 14th Edition Price Test BankJacobFoxgipbn100% (13)

- Describe How The Following Business Transactions Affect The Three Elements of The AccountingДокумент3 страницыDescribe How The Following Business Transactions Affect The Three Elements of The AccountingUserОценок пока нет

- PART 2 (Chapter 3, Lessons 3.1 - 3.3)Документ20 страницPART 2 (Chapter 3, Lessons 3.1 - 3.3)نيكو كورونيلОценок пока нет

- Balance SheetДокумент3 страницыBalance SheetDina JurķeОценок пока нет

- Problem Sets Security AnalysisДокумент24 страницыProblem Sets Security AnalysisK59 Tran Nguyen HanhОценок пока нет

- EL201 Accounting Learning Module Lessons 2Документ5 страницEL201 Accounting Learning Module Lessons 2Code BoredОценок пока нет

- 1.05__Asset_Liability_and_Stockholders_Equity_AccountsДокумент5 страниц1.05__Asset_Liability_and_Stockholders_Equity_AccountsDark ShadowОценок пока нет

- Effects of Business TransactionsДокумент4 страницыEffects of Business TransactionsP leeОценок пока нет

- Review Chương 6Документ40 страницReview Chương 6Nguyễn Văn QuốcОценок пока нет

- Online Quiz 4 Based FR Set AДокумент6 страницOnline Quiz 4 Based FR Set ARed AlbanoОценок пока нет

- Journal EntriesДокумент10 страницJournal EntriesLipu MohapatraОценок пока нет

- ACCT105 Accounting For Non Accounting MajorsДокумент31 страницаACCT105 Accounting For Non Accounting MajorsG JhaОценок пока нет

- What is a DebentureДокумент30 страницWhat is a DebentureRITIKAОценок пока нет

- Survey of Accounting Homework Written AssignmentДокумент22 страницыSurvey of Accounting Homework Written AssignmentEMZy ChannelОценок пока нет

- Accounting QuizДокумент1 страницаAccounting QuizRepunzel Raaj0% (1)

- TIF Problems 07-10 (2014)Документ141 страницаTIF Problems 07-10 (2014)Mariella NiyoyunguruzaОценок пока нет

- ACCT 210 - Chapter 2 Extra Problems-1Документ29 страницACCT 210 - Chapter 2 Extra Problems-1Ahmad AlayanОценок пока нет

- Pre ClassДокумент4 страницыPre Classnavjot2k2Оценок пока нет

- Partnership FormationДокумент6 страницPartnership FormationCorinne Gohoc100% (1)

- Chapter 7-The Accounting EquationДокумент30 страницChapter 7-The Accounting EquationIrene Mae BeldaОценок пока нет

- Acc030 Accounting EquationДокумент3 страницыAcc030 Accounting EquationAqilahОценок пока нет

- Financial Reporting & Analysis in 40 CharactersДокумент31 страницаFinancial Reporting & Analysis in 40 CharactersAbinash MishraОценок пока нет

- Dwnload Full Survey of Accounting 5th Edition Edmonds Solutions Manual PDFДокумент30 страницDwnload Full Survey of Accounting 5th Edition Edmonds Solutions Manual PDFfactivesiennesewwz2jj100% (11)

- Lesson 4: Analyzing TransactionsДокумент3 страницыLesson 4: Analyzing TransactionsDante SausaОценок пока нет

- Cash Flow StatementДокумент39 страницCash Flow StatementAmruta JadhavОценок пока нет

- Accounting Info and Financial Statements ExplainedДокумент5 страницAccounting Info and Financial Statements ExplainedJay GadОценок пока нет

- Finance Accounting & AnalysisДокумент7 страницFinance Accounting & AnalysisRochak SinglaОценок пока нет

- Accounting For Partnerships: Basic Considerations and FormationДокумент22 страницыAccounting For Partnerships: Basic Considerations and FormationAj CapungganОценок пока нет

- ABMFABM1 q3 Mod4 Types-of-Major-AccountsДокумент14 страницABMFABM1 q3 Mod4 Types-of-Major-AccountsEduardo john DolosoОценок пока нет

- Accounting Equation and Profit DeterminationДокумент19 страницAccounting Equation and Profit DeterminationNor LailyОценок пока нет

- Accounting EquationДокумент4 страницыAccounting EquationAbubaker ShahzadОценок пока нет

- In The Name of Allah, The Most Beneficent, The Most MercifulДокумент5 страницIn The Name of Allah, The Most Beneficent, The Most MercifulASMARA HABIBОценок пока нет

- Reporting & Interpreting Sales RevenueДокумент15 страницReporting & Interpreting Sales RevenueASMARA HABIBОценок пока нет

- Methods of Calculating Depreciation ExerciseДокумент17 страницMethods of Calculating Depreciation ExerciseASMARA HABIBОценок пока нет

- Methods of Calculating DepreciationДокумент11 страницMethods of Calculating DepreciationASMARA HABIBОценок пока нет

- Emotional Problems in Children With Special NeedsДокумент20 страницEmotional Problems in Children With Special NeedsASMARA HABIBОценок пока нет

- Time TableДокумент1 страницаTime TableASMARA HABIBОценок пока нет

- In The Name of Allah, The Most Beneficent, The Most MercifulДокумент10 страницIn The Name of Allah, The Most Beneficent, The Most MercifulASMARA HABIBОценок пока нет

- Books of Original EntryДокумент11 страницBooks of Original EntryASMARA HABIBОценок пока нет

- Capital Expenditure & Revenue Expenditure ExerciseДокумент21 страницаCapital Expenditure & Revenue Expenditure ExerciseASMARA HABIBОценок пока нет

- Calculating Capital, Assets and Profits from Business TransactionsДокумент3 страницыCalculating Capital, Assets and Profits from Business TransactionsASMARA HABIBОценок пока нет

- Final Assignment FSAДокумент14 страницFinal Assignment FSAASMARA HABIBОценок пока нет

- 10th Bio (Obj)Документ1 страница10th Bio (Obj)ASMARA HABIBОценок пока нет

- Quiz 19.11.2019Документ1 страницаQuiz 19.11.2019ASMARA HABIBОценок пока нет

- 14 06 2019Документ2 страницы14 06 2019ASMARA HABIBОценок пока нет

- Financial Accounting Course OutlineДокумент4 страницыFinancial Accounting Course OutlineASMARA HABIBОценок пока нет

- MSCI-3107 Managerial AccountingДокумент4 страницыMSCI-3107 Managerial AccountingASMARA HABIB100% (1)

- Quiz 05.07.2019 MS/MBA-Management SciencesДокумент1 страницаQuiz 05.07.2019 MS/MBA-Management SciencesASMARA HABIBОценок пока нет

- Chapter 1: Introducing Financial Accounting: I. Importance of AccountingДокумент10 страницChapter 1: Introducing Financial Accounting: I. Importance of AccountingASMARA HABIBОценок пока нет

- Quiz 05.07.2019 MS/MBA-Management SciencesДокумент2 страницыQuiz 05.07.2019 MS/MBA-Management SciencesASMARA HABIBОценок пока нет

- A. B. C. D.: EconomicsДокумент57 страницA. B. C. D.: EconomicsASMARA HABIBОценок пока нет

- Cost of CapitalДокумент19 страницCost of CapitalASMARA HABIBОценок пока нет

- EconomicsДокумент12 страницEconomicsASMARA HABIBОценок пока нет

- Deail of Miscellenous ExpensesДокумент1 страницаDeail of Miscellenous ExpensesASMARA HABIBОценок пока нет

- Cost of CapitalДокумент19 страницCost of CapitalASMARA HABIBОценок пока нет

- Cost of CapitalДокумент19 страницCost of CapitalASMARA HABIBОценок пока нет

- BusinessAdmin 2012 PDFДокумент240 страницBusinessAdmin 2012 PDFMuslima KanwalОценок пока нет

- Chapter 1: Introducing Financial Accounting: I. Importance of AccountingДокумент10 страницChapter 1: Introducing Financial Accounting: I. Importance of AccountingASMARA HABIBОценок пока нет

- Audit of The Capital Acquisition and Repayment CycleДокумент19 страницAudit of The Capital Acquisition and Repayment CyclenisasuriantoОценок пока нет

- PTCL Withholding Tax Statement for Aftab QuershiДокумент1 страницаPTCL Withholding Tax Statement for Aftab QuershiAbdullah EjazОценок пока нет

- Indian Insurance SectorДокумент18 страницIndian Insurance SectorSaket KumarОценок пока нет

- Spatial Tech IPO ValuationДокумент6 страницSpatial Tech IPO ValuationHananie NanieОценок пока нет

- Part 1 - Section D Cost Management 1.1 Cost Drivers and Cost FlowsДокумент114 страницPart 1 - Section D Cost Management 1.1 Cost Drivers and Cost FlowsGaleli PascualОценок пока нет

- Niddf PDFДокумент1 страницаNiddf PDFMuhammad MudassarОценок пока нет

- Chapter 22 Fiscal Policy and Monetary PolicyДокумент68 страницChapter 22 Fiscal Policy and Monetary PolicyJason ChungОценок пока нет

- Iqta SystemДокумент10 страницIqta SystemAnurag Sindhal75% (4)

- PESTEL ANALYSIS AND FIVE FORCES MODEL OF LIJJAT PAPADДокумент14 страницPESTEL ANALYSIS AND FIVE FORCES MODEL OF LIJJAT PAPADKeyur Popat100% (1)

- Part I - Introduction To AISДокумент46 страницPart I - Introduction To AISAgatОценок пока нет

- CA Inter Accounts Suggested Answer May 2022Документ33 страницыCA Inter Accounts Suggested Answer May 2022chitrada kumar swamyОценок пока нет

- Part. and Corp. - OcrДокумент30 страницPart. and Corp. - OcrRosemarie CruzОценок пока нет

- Withholding Tax Guide - Japan PDFДокумент45 страницWithholding Tax Guide - Japan PDFSteven OhОценок пока нет

- Rocco S Gourmet Foods Inc Provides The Following Data From TheДокумент2 страницыRocco S Gourmet Foods Inc Provides The Following Data From TheMuhammad ShahidОценок пока нет

- Asset AccountingДокумент19 страницAsset AccountingAniruddha SonpatkiОценок пока нет

- 2285Документ39 страниц2285Michael BarnesОценок пока нет

- Financial Statement Analysis: K R Subramanyam John J WildДокумент39 страницFinancial Statement Analysis: K R Subramanyam John J WildDwi Ahdini100% (1)

- Indian Taxation LawДокумент22 страницыIndian Taxation LawEngineerОценок пока нет

- Exercises IAS 8 SolutionДокумент5 страницExercises IAS 8 SolutionLê Xuân HồОценок пока нет

- Corporate Liquidation DisДокумент4 страницыCorporate Liquidation DisRenelyn DavidОценок пока нет

- Uniform System of Accounts For The Lodging IndustryДокумент10 страницUniform System of Accounts For The Lodging Industryvipul_khemkaОценок пока нет

- Appointment LetterДокумент9 страницAppointment Letterjyothis_c2476100% (1)

- A Project Management Bench Mark: Delhi MetroДокумент26 страницA Project Management Bench Mark: Delhi Metrodineshsoni29685Оценок пока нет

- Taxation NotesДокумент27 страницTaxation NotesRound RoundОценок пока нет

- Jennifer FEASIBILITY STUDY ON THE ESTABLISHMENT OF A FUEL STATION IN ASABAДокумент20 страницJennifer FEASIBILITY STUDY ON THE ESTABLISHMENT OF A FUEL STATION IN ASABAElikwu Michael70% (33)

- Atul Auto LTD.: Ratio & Company AnalysisДокумент7 страницAtul Auto LTD.: Ratio & Company AnalysisMohit KanjwaniОценок пока нет

- Doing Business in Latvia 2010Документ53 страницыDoing Business in Latvia 2010BDO TaxОценок пока нет

- Darlington Business Venture Balance Sheet BasicsДокумент10 страницDarlington Business Venture Balance Sheet BasicsVipul DesaiОценок пока нет

- Module 1, Chapter 1 Handout Introduction To Financial StatementsДокумент5 страницModule 1, Chapter 1 Handout Introduction To Financial StatementssdfsdfuignbcbbdfbОценок пока нет

- Insurance Commission Ruling on Life Insurance ClaimsДокумент8 страницInsurance Commission Ruling on Life Insurance ClaimsMarioneMaeThiamОценок пока нет