Академический Документы

Профессиональный Документы

Культура Документы

Employee Tax Declaration - AY 2019-20

Загружено:

mathuАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Employee Tax Declaration - AY 2019-20

Загружено:

mathuАвторское право:

Доступные форматы

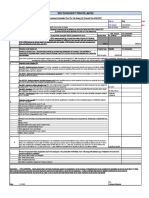

INCOME TAX DECLARATION FORM - F.Y.

2018-19

(To be used to declare investment that will be made during the period from 01/04/2018 to 31/03/2019 for Income Tax purpose)

Company Name Emp ID

PAN of Employee

Employee Name

(compulsory)

As per section 206AA, in case PAN is not submitted, TDS will be deducted at flat rate of 20%

ITEMS PARTICULARS MAXIMUM LIMIT DECLARED AMOUNT

DEDUCTION U/S 10

I am staying in a rented house and I agree to submit Leave &

METRO /

HOUSE RENT Licence A'ment when required.The Rent Paid is (Rs.

NON METRO

_____________ X _______ months) & the house is located in

a METRO / NON METRO (Tick whichever is applicable)

Max Limit Declared Amount

Sec 80D - Medical Insurance Premium (If the policy covers a

senior citizen then exemption is Rs.30,000/-)

Sec 80DD - Handicapped Dependent

Sec 80E - Repayment of Loan for higher education (only Interest)

DEDUCTION UNDER Sec 80GG - Rent Paid

CHAPTER - VI A Sec 80U - Handicapped

Sec 80CCG - Rajeev Gandhi Equity Saving Scheme

(Investment max upto Rs.50,000, would get a deduction of 50%

on the amount invested)

Sec 80TTA - Interest on saving a/c

Any other Deduction (Please specify)

Max Limit Declared Amount

Contribution to Pension Fund (Jeevan Suraksha)

Life Insurance Premium on life of self/spouse/child only

Deferred Annuity

Public Provident Fund in own name/spouse/child only

ULIP of UTI/LIC in own name or spouse and child only

Repayment of Housing Loan (Only principal)

Contribution to Pension Fund or UTI or Notified Mutual Fund

DEDUCTION U/S 80C

Investment in ELSS made in units of Notified Mutual Fund

Children Tuition Fee: Restricted to a max of 2 Children

Deposit in home loan account scheme of NHB/HDFC

5 yrs. Term deposit in a Sch.Bank

Others (please specify)

Others (please specify)

DEDUCTION U/S 80CCC Annuity/Pension Plan

DEDUCTION U/S 80CCD Notified Pension Scheme

Aggregate Deduction U/S 80C, 80CCC & 80CCD cannot exceed Rs. 150000/-

Additional Deduction U/S 80CCD (1b) of Rs. 50000/-

Max Limit Declared Amount

Interest on Housing Loan on fully constructed accomodation

only

DEDUCTION U/S 24

Interest if the loan is taken before 01/04/99 on fully

constructed accomodation only

DECLARATIONS:

1. I hereby declare that the information given above is correct and true in all respects. I am also aware that the company will be

considering the above details in utmost good faith based on the details provided by me and that I am personally liable for any

consequences arising out of errors, if any, in the above information.

2. I am also aware that any person making a false statement / declaration in the above form shall be liable to be fined and prosecution

u/s 277 of the Income Tax Act, 1961

3. The proof of payment / Supportings for claim, will be provided latest by _________________

Note -

Date :

Place: SIGNATURE OF THE EMPLOYEE

Вам также может понравиться

- Employee Tax Declaration - AY 2019-20Документ4 страницыEmployee Tax Declaration - AY 2019-20mathuОценок пока нет

- Employee Declaration Form 15Документ4 страницыEmployee Declaration Form 15Bliss BilluОценок пока нет

- DeclarationДокумент3 страницыDeclarationPatrick Jude Lucas PsychologyОценок пока нет

- Investment Declaration Form11-12Документ2 страницыInvestment Declaration Form11-12girijasankar11Оценок пока нет

- (Company Name) : Income Tax Declaration Form For Fy 2022-23Документ3 страницы(Company Name) : Income Tax Declaration Form For Fy 2022-23Jude Philip WilfredОценок пока нет

- Investment PlanДокумент1 страницаInvestment PlanNitin AgarwalОценок пока нет

- Atria Institute of TechnologyДокумент3 страницыAtria Institute of TechnologykiranОценок пока нет

- Employee Declaration Form FY 2020-21Документ2 страницыEmployee Declaration Form FY 2020-21Harsha I100% (2)

- Investment Declaration Form - 2022-2023Документ3 страницыInvestment Declaration Form - 2022-2023Bharathi KОценок пока нет

- Employee Declaration Form 1Документ4 страницыEmployee Declaration Form 1rifas caОценок пока нет

- Employee Tax Declaration - FY 22-23-DBMPДокумент3 страницыEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023Оценок пока нет

- IT Declaration Form 2019-20Документ1 страницаIT Declaration Form 2019-20KarunaОценок пока нет

- Income Tax Declaration Form FY 22023 24 AY2024 25Документ1 страницаIncome Tax Declaration Form FY 22023 24 AY2024 25mrleftyftwОценок пока нет

- Investment Declaration Form 21-22Документ14 страницInvestment Declaration Form 21-22Jigar PatelОценок пока нет

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationДокумент1 страницаThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantОценок пока нет

- Investment Declaration Form For FY - 2017-18Документ2 страницыInvestment Declaration Form For FY - 2017-18arunОценок пока нет

- WLT Proof Form - 2022Документ2 страницыWLT Proof Form - 2022Jebis DosОценок пока нет

- On Employee Tax SavingДокумент21 страницаOn Employee Tax SavingChaitanya MadisettyОценок пока нет

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Документ4 страницыOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BОценок пока нет

- D COMPUTATION OF TOTAL INCOME (TAX) LatestДокумент6 страницD COMPUTATION OF TOTAL INCOME (TAX) LatestOmkar NakasheОценок пока нет

- Declaration Form 12BB 2022 23Документ4 страницыDeclaration Form 12BB 2022 23S S PradheepanОценок пока нет

- Income Tax Declaration Form FY 22 23 AY 23 24Документ2 страницыIncome Tax Declaration Form FY 22 23 AY 23 24kishoreОценок пока нет

- Form No 12BB FY 2020-21 (AY 2021-22)Документ6 страницForm No 12BB FY 2020-21 (AY 2021-22)Avinash ChandraОценок пока нет

- 4 Chapter VI-AДокумент11 страниц4 Chapter VI-AVENKATESWARLUMCOMОценок пока нет

- Employees Declaration For IncomeДокумент1 страницаEmployees Declaration For Incomehareesh13hОценок пока нет

- Tax Decalaration 2023-24Документ3 страницыTax Decalaration 2023-24thetrilight2023Оценок пока нет

- IT Declaration Form FY 2018-19Документ3 страницыIT Declaration Form FY 2018-19sgshekar3050% (2)

- Investment Declaration Form F.Y 2023-24Документ4 страницыInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- AIL-Investment Declaration Form 2013-2014Документ2 страницыAIL-Investment Declaration Form 2013-2014G A PATELОценок пока нет

- Investment Declaration Form - 2021-22Документ3 страницыInvestment Declaration Form - 2021-22rajamani balajiОценок пока нет

- IT Declaration Form 2020-21Документ1 страницаIT Declaration Form 2020-21Akshay AcchuОценок пока нет

- Tax Declaration Form 2021 22Документ4 страницыTax Declaration Form 2021 22Kasiviswanathan ChinnathambiОценок пока нет

- Investment Declaration FY 22-23Документ2 страницыInvestment Declaration FY 22-23Ahfaz ShaikhОценок пока нет

- Deductions On Section 80CДокумент12 страницDeductions On Section 80CViraja GuruОценок пока нет

- Summary Charts Deduction Chapter ViaДокумент4 страницыSummary Charts Deduction Chapter ViaUttam Gagan18Оценок пока нет

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenДокумент8 страницInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaОценок пока нет

- Deductions From Gross Total IncomeДокумент4 страницыDeductions From Gross Total Income887 shivam guptaОценок пока нет

- Section 80 Deduction ListДокумент6 страницSection 80 Deduction ListMURALIDHARA S VОценок пока нет

- Bos 48771 Finalp 7Документ24 страницыBos 48771 Finalp 7Mahaveer DhelariyaОценок пока нет

- Income Tax Declaration Form - F.Y. 2020-21Документ8 страницIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagОценок пока нет

- Income Tax Material: Unit 9 - DeductionsДокумент9 страницIncome Tax Material: Unit 9 - DeductionsKARAN WADHWA 2012168Оценок пока нет

- Final-Investment Declaration Form FY 19 - 20Документ12 страницFinal-Investment Declaration Form FY 19 - 20Bhupender RawatОценок пока нет

- HGS-Investment Proof Guidelines FY2021-22 V1.1Документ14 страницHGS-Investment Proof Guidelines FY2021-22 V1.1jasОценок пока нет

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Документ3 страницыEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaОценок пока нет

- Investment Declaration Form - FY 2022-23Документ7 страницInvestment Declaration Form - FY 2022-23varaprasadОценок пока нет

- Investment Declaration Form (Hemarus)Документ4 страницыInvestment Declaration Form (Hemarus)Shashi NaganurОценок пока нет

- DownloadДокумент6 страницDownloadpankhewalegОценок пока нет

- Income Tax Ready Reckoner 2011-12Документ28 страницIncome Tax Ready Reckoner 2011-12kpksscribdОценок пока нет

- Computing Adjusted Gross Total Income: Investment Based Deductions Income Based Deduction Special DeductionsДокумент5 страницComputing Adjusted Gross Total Income: Investment Based Deductions Income Based Deduction Special Deductions6804 Anushka GhoshОценок пока нет

- 2-Income Tax Rules For The Year 2011-12Документ6 страниц2-Income Tax Rules For The Year 2011-12Nataraj PvnОценок пока нет

- BUFIN ITDeclarationFormДокумент2 страницыBUFIN ITDeclarationFormdpfsopfopsfhopОценок пока нет

- Deductions Available Under Chapter VI of Income TaxДокумент4 страницыDeductions Available Under Chapter VI of Income TaxDeepanjali NigamОценок пока нет

- Auto Income Tax Calculator Version 5.1 2010-11Документ19 страницAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyОценок пока нет

- TAX Saving Investment ProofДокумент1 страницаTAX Saving Investment ProofAmit ShuklaОценок пока нет

- Tax Declaration FormatДокумент1 страницаTax Declaration FormatrameshbabumeelaОценок пока нет

- IT PPT For F.Y 2023-24Документ24 страницыIT PPT For F.Y 2023-24pritesh.ks1409Оценок пока нет

- TaxPlanning06 07Документ17 страницTaxPlanning06 07Lathif PashaОценок пока нет

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОт EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОценок пока нет

- Setting up, operating and maintaining Self-Managed Superannuation FundsОт EverandSetting up, operating and maintaining Self-Managed Superannuation FundsОценок пока нет

- Guide To IS 3370 2021 1691778126Документ99 страницGuide To IS 3370 2021 1691778126mathuОценок пока нет

- Ssu Load CombinationДокумент6 страницSsu Load CombinationmathuОценок пока нет

- Final Baseplate1Документ1 страницаFinal Baseplate1mathuОценок пока нет

- 20kv Unit With D400 Cover SlabДокумент1 страница20kv Unit With D400 Cover SlabmathuОценок пока нет

- SSU-time Period Calculation - X-DirectionДокумент2 страницыSSU-time Period Calculation - X-DirectionmathuОценок пока нет

- IS 13920 Ductail DetailingДокумент2 страницыIS 13920 Ductail DetailingmathuОценок пока нет

- Insulation Wall Panel DesignДокумент46 страницInsulation Wall Panel DesignmathuОценок пока нет

- Ssu-Seismic Overturning CheckДокумент1 страницаSsu-Seismic Overturning CheckmathuОценок пока нет

- Design of Boundary Element From ETABS Analysis ResultДокумент10 страницDesign of Boundary Element From ETABS Analysis ResultmathuОценок пока нет

- Column CapcityДокумент1 страницаColumn CapcitymathuОценок пока нет

- 04-01-2023-WIND LOAD-SEND IIT-SSU - High Rise Buildings Design BasisДокумент30 страниц04-01-2023-WIND LOAD-SEND IIT-SSU - High Rise Buildings Design BasismathuОценок пока нет

- Precast Dowel ConnectionДокумент1 страницаPrecast Dowel ConnectionmathuОценок пока нет

- Mathu Sub Structure DesignДокумент3 страницыMathu Sub Structure DesignmathuОценок пока нет

- Advanced Road Design Roads-EДокумент2 страницыAdvanced Road Design Roads-EmathuОценок пока нет

- Basement Concrete WallДокумент14 страницBasement Concrete WallHabibur RahmanОценок пока нет

- Foundation LoadДокумент2 страницыFoundation LoadmathuОценок пока нет

- Simply Supported Precast Plank Design To Aci318 & Pci SpecificationsДокумент1 страницаSimply Supported Precast Plank Design To Aci318 & Pci SpecificationsmathuОценок пока нет

- 001 AutoCAD 2D and 3D Practice Drawing CourseДокумент11 страниц001 AutoCAD 2D and 3D Practice Drawing CoursemathuОценок пока нет

- Precast Concrete PlankДокумент2 страницыPrecast Concrete Plankmathu100% (1)

- Two Way Slabs PDFДокумент5 страницTwo Way Slabs PDFmathuОценок пока нет

- Pilescarrying Capacity AnalysisДокумент7 страницPilescarrying Capacity AnalysismathuОценок пока нет

- Embedment Strength of Stud PlateДокумент3 страницыEmbedment Strength of Stud Platemathu100% (1)

- Summer Internship Report at Future Generali Insurance LTDДокумент44 страницыSummer Internship Report at Future Generali Insurance LTDpratiksha2467% (3)

- Team Deloitte - E2Документ10 страницTeam Deloitte - E2Praveen DSОценок пока нет

- Financial Markets AND Financial Services: Chapter-31Документ7 страницFinancial Markets AND Financial Services: Chapter-31Dipali DavdaОценок пока нет

- IKEA CaseДокумент2 страницыIKEA CaseHoneyОценок пока нет

- Mining, Communities and Sustainable Development - Case Study Hima CementДокумент16 страницMining, Communities and Sustainable Development - Case Study Hima CementAfrican Centre for Media Excellence100% (1)

- BimДокумент180 страницBimBOOKSHELF123Оценок пока нет

- Fundamentals of Power System Economics: Daniel Kirschen Goran StrbacДокумент5 страницFundamentals of Power System Economics: Daniel Kirschen Goran StrbacGurdeep singh BaliОценок пока нет

- Nabard Gpat Farming Project Report PDF FileДокумент12 страницNabard Gpat Farming Project Report PDF FileAjai chagantiОценок пока нет

- Presentation On Financial InstrumentsДокумент20 страницPresentation On Financial InstrumentsMehak BhallaОценок пока нет

- Tutorial Revision W13 QsДокумент1 страницаTutorial Revision W13 QsLim XinYiОценок пока нет

- 1801 SilvozaДокумент1 страница1801 SilvozaKate Hazzle JandaОценок пока нет

- David Baldt DecisionДокумент31 страницаDavid Baldt Decisionroslyn rudolphОценок пока нет

- SolutionManual (Project Managment)Документ9 страницSolutionManual (Project Managment)Ayan Ahmed0% (1)

- Dr. Nikolai's Medical Clinic Assets: No. Cash Account Receivable Supplies Furniture & Fixture EquipmentДокумент6 страницDr. Nikolai's Medical Clinic Assets: No. Cash Account Receivable Supplies Furniture & Fixture EquipmentJeof RebornОценок пока нет

- Summer Internship Report 8.10Документ83 страницыSummer Internship Report 8.10Alok0% (1)

- Travel and Tourism Notes For Gate College StudentДокумент106 страницTravel and Tourism Notes For Gate College StudentSandesh Shrestha100% (1)

- Aron Smith: Head of MarketingДокумент2 страницыAron Smith: Head of MarketingRAYMOND DUNCANОценок пока нет

- Labor Law Chapter-2Документ9 страницLabor Law Chapter-2Toriqul IslamОценок пока нет

- Causes of Industrial Backward NessДокумент2 страницыCauses of Industrial Backward NessFawad Abbasi100% (1)

- Commerce: Paper 7100/01 Multiple ChoiceДокумент7 страницCommerce: Paper 7100/01 Multiple Choicemstudy123456Оценок пока нет

- The Prudential Regulations of State Bank PakistanДокумент33 страницыThe Prudential Regulations of State Bank PakistanSaad Bin Mehmood88% (17)

- Busp Pres Ryanair 04Документ45 страницBusp Pres Ryanair 04lОценок пока нет

- Refining GRMДокумент12 страницRefining GRMVivek GoyalОценок пока нет

- AFM Module 1Документ8 страницAFM Module 1santhosh GowdaОценок пока нет

- Jindi Enterprises: Anushka Gambhir Section - B 170101121Документ9 страницJindi Enterprises: Anushka Gambhir Section - B 170101121Himanish BhandariОценок пока нет

- Decision MakingДокумент5 страницDecision MakinganupsuchakОценок пока нет

- Coca Cola Beverages BotswanaДокумент8 страницCoca Cola Beverages BotswanaTshepiso RankoОценок пока нет

- Feasib ScriptДокумент3 страницыFeasib ScriptJeremy James AlbayОценок пока нет

- Schumpeter's Theory of Economic Development - EconomicsДокумент24 страницыSchumpeter's Theory of Economic Development - EconomicsreggydevvyОценок пока нет

- GeM PPT - IRILMM GP PDFДокумент30 страницGeM PPT - IRILMM GP PDFp v mahawana100% (1)