Академический Документы

Профессиональный Документы

Культура Документы

COM0004057712 REG Dist SIP Application

Загружено:

raj tripathiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

COM0004057712 REG Dist SIP Application

Загружено:

raj tripathiАвторское право:

Доступные форматы

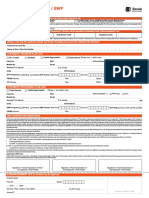

SIP & SIP-Top up Registration / Renewal (Form

2)

Application No.

Distributor Sub-Distributor Internal Code for EUIN RIA

Code ARN-141765 Code Sub-broker/ Employee No. Code

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this is an

EUIN “execution-only” transaction without any interaction or advice by the employee/relationship

manager/sales person of the above distributor or notwithstanding the advice of

First Holder Second Holder Third Holder

Declaration

in-appropriateness, if any, provided by the employee/relationship manager/sales person of the

RIA "I/We hereby give you my/our consent to share/provide the transactions data feed/portfolio

holdings/NAV etc. in respect of my/our investments under Direct Plan of all Schemes

First Holder Second Holder Third Holder

Declaration

UNIT HOLDER INFORMATION

Existing Folio Number Name of the First Holder

Please Tick (ü) SIP Registration SIP with Top-up Registration SIP - Change in Bank Details

Please mention relevant SIP details below and also in the CAMS Common Mandate (CAMS OTM).

SYSTEMATIC INVESTMENT PLAN DETAILS

Name of the Scheme/Plan/Option

Initial SIP Installment Amount Rs.

My existing CAMS OTM registered to be used for initial & subsequent

SIP instalments (mention CAMS OTM No. in the boxes)

Cheque No. Bank Name

Monthly SIP Date

SIP Period SIP Top-up (Optional) (Refer J (viii)) (Please ü to avail this facility)

(10, if no date is mentioned)

(Any date except 29, 30 and 31 of the month)

From M M Y Y Y Y

(The Top-up amount should be Rs. 500 and

Top-up Amount (Rs.)

D D To M M Y Y Y Y multiples of Rs. 500 thereafter)

SIP

(Default Top-up option is

Instalment Amount (Rs.) OR SIP Top-up Frequency: Half-yearly Yearly

Yearly)

(Please fill below CAMS OTM)

1 2 2 0 9 9

Registration for this facility is subject to the investor's bankers accepting the mandate for SIP Top-up registration.

Default end date is Dec

Please specifically mention the MICR code of you bank branch in case you have a 2099 payable at par cheque book. In case of incorrect/ incomplete bank details it will be captured

from attached cheque copy on a best effort basis.

Having read and understood the contents of the Statement of Additional Information (SAI) of IDFC Mutual Fund, Scheme Information Document (SID) and Key Information

Memorandum (KIM) of the scheme(s) and the Addenda issued till date, I/we hereby apply for registration of Systematic Investment Plan (SIP) as indicated above and agree to SIGNATURE/S AS PER

abide by the terms, conditions, rules and regulations governing the Scheme(s) and the SIP. I/ We hereby declare that the amount invested in the Scheme(s) is through legitimate IDFC MUTUAL FUND (MANDATORY)

sources only and does not involve and is not designed for the purpose of the contravention of any Act, Rules, Regulations, Notifications or Directions of the Taxation Laws, Anti

Money Laundering Laws, Anti Corruption Laws or any other applicable laws as applicable to me/us from time to time. I / We confirm that the funds invested in the Scheme(s),

legally belong to me / us and I / we have not received nor have been induced by any rebate or gifts, directly or indirectly in making this investment. I/We am/are eligible Investor(s)

as per the scheme related documents and am/are authorised to make this investment as per the Constitutive documents/ authorisation(s). I/We further confirm that I am not /we

are not prohibited from accessing capital markets under any order/ruling/judgment etc., of any judicial or regulatory authority.

In the event " Know Your Customer" process is not completed by me / us to the satisfaction of the Mutual Fund, I / we hereby authorise the Mutual Fund, to redeem the funds First / Sole Applicant / Guardian /

invested in the Scheme(s), in favour of the applicant, at the applicable NAV prevailing on the date of such redemption subject to applicable exit load and undertake such other

action with such funds that may be required by the Law. Authorised Signatory

I/We undertake to keep sufficient funds in the funding account on the date of execution of standing instruction. I/We hereby declare that the particulars given above are correct

and complete. If the transaction is delayed or not effected at all for reasons of incomplete or incorrect information, I/We would not hold the Mutual Fund or the bank responsible.

I/We further undertake that any changes in my/our Bank details will be informed to the Mutual Fund immediately.

I/We hereby acknowledge and confirm that the information provided above is/are true, correct and complete to the best of my/our knowledge and belief. In case any of the above

specified information is found to be false or untrue or misleading or misrepresenting, I/we shall be liable for it. I/We also undertake to keep you informed immediately in writing

about any changes/modification to the above information in future and also undertake to provide any other additional information as may be required at your end. I/We hereby

authorise you to disclose, share, remit in any form, mode or manner, all / any of the information provided by me/ us, including all changes, updates to such information as and

when provided by me/ us to the Mutual Fund, its Sponsor, Asset Management Company, Trustees, their employees, agents / service providers, other SEBI registered Second Applicant

intermediaries or any Indian or foreign governmental or statutory or judicial authorities / agencies, the tax / revenue authorities and other investigation agencies without any

obligation of advising me/us of the same.

The ARN holder has disclosed to me / us all the commissions (in the form of trail commission or any other mode), payable to him for the different competing Schemes of

various Mutual Funds from amongst which the Scheme is being recommended to me / us.

For micro-investments only : I/We confirm that I/we do not have any other existing investment in the schemes of IDFC Mutual Fund which together with this proposed investment

will result in aggregate investments exceeding Rs.50,000/- in a year.

For NRIs / PIOs / FPIs only : I / We confirm that I am / we are Non Residents Indians / Person(s) of Indian Origin / Foreign Portfolio Investors but not United States persons within

the meaning of Regulation (S) under the United States Securities Act of 1933, or as defined by the U.S. Commodity Futures Trading Commission, as amended from time to time

or residents of Canada, and that I / we have remitted funds from abroad through approved banking channels or from funds in my / our Non-Resident External / Non-Resident

Ordinary / FCNR Account maintained in accordance with applicable RBI guidelines. Third Applicant

& &

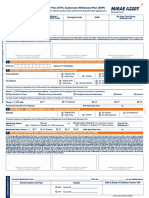

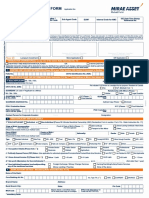

CAMS Common Mandate (CAMS OTM)

UMRN FOR OFFICE USE ONLY Date 1 7 0 9 2 0 1 8

Tick (ü) Sponsor Bank Code FOR OFFICE USE ONLY Utility Code FOR OFFICE USE ONLY

CREATE ü I/We hereby authorize Computer Age Management Services Pvt. Ltd. to debit (tick ü)

SB CA SB-NRE SB-NRO

MODIFY X

X

Bank A/c number

CANCEL

with Bank IFSC or MICR

an amount of Rupees

FREQUENCY X Monthly X Quarterly X Half Yearly X Yearly ü As & when presented DEBIT TYPE X Fixed Amount ü Maximum Amount

PAN No. Mobile No.

Reference Email ID

I agree for the debit mandate processing charges by the bank whom I am authorizing to debit my account as per latest schedule for charges of the bank.

PERIOD

From D D M M Y Y Y Y Signature of Primary Account Holder Signature of Account Holder Signature of Account Holder

To D D M M Y Y Y Y

1. Name as in bank records 2. Name as in bank records 3. Name as in bank records

Or Until Cancelled

This is to confirm the declaration has been carefully read, understood and made by me / us. I am authorising the user entity/corporate to debit my account, based on the instructions as agreed and signed by me.

I have understood that I am authorised to cancel/amend this mandate by appropriately communicating the cancellation/amendment request to the user entity/corporate or the bank where I have authorised the debit.

& &

Вам также может понравиться

- Long Tom SluiceДокумент6 страницLong Tom SluiceJovanny HerreraОценок пока нет

- Partnership Dissolution Lecture NotesДокумент7 страницPartnership Dissolution Lecture NotesGene Marie PotencianoОценок пока нет

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)От EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Рейтинг: 3 из 5 звезд3/5 (1)

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Документ17 страницGuide To Original Issue Discount (OID) Instruments: Publication 1212Theplaymaker508Оценок пока нет

- University of Mumbai Project On Investment Banking Bachelor of CommerceДокумент6 страницUniversity of Mumbai Project On Investment Banking Bachelor of CommerceParag MoreОценок пока нет

- Fund UtilizationДокумент3 страницыFund Utilizationbarangay kuyaОценок пока нет

- 2.01 Economic SystemsДокумент16 страниц2.01 Economic SystemsRessie Joy Catherine FelicesОценок пока нет

- Unit Holder Information: Web FormДокумент2 страницыUnit Holder Information: Web FormDibyaranjan SahooОценок пока нет

- Mirae Sip FormДокумент2 страницыMirae Sip Formitkahs120Оценок пока нет

- Systematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationДокумент2 страницыSystematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationAnonymous MAQrYFQDzVОценок пока нет

- SIP DebitMandateNACH-FormДокумент2 страницыSIP DebitMandateNACH-FormDevesh SinghОценок пока нет

- SIP Facility Appl Form V 1Документ4 страницыSIP Facility Appl Form V 1DBCGОценок пока нет

- Av Birla Sip FormДокумент1 страницаAv Birla Sip FormVikas RaiОценок пока нет

- Sip Cum Nach FormДокумент8 страницSip Cum Nach FormAmit GuptaОценок пока нет

- HDFC Sip Nach FormДокумент6 страницHDFC Sip Nach FormPraveen KumarОценок пока нет

- Sip Enrolment FormДокумент1 страницаSip Enrolment FormYankit SoniОценок пока нет

- Family Solutions Transaction FormДокумент2 страницыFamily Solutions Transaction FormSelva KumarОценок пока нет

- HDFC Sip FormДокумент3 страницыHDFC Sip FormspeedenquiryОценок пока нет

- HDFC Sip CancellationДокумент1 страницаHDFC Sip CancellationMaluОценок пока нет

- Equity SIP Application Form April 2022Документ8 страницEquity SIP Application Form April 2022Selva KumarОценок пока нет

- SIP Form DebtДокумент6 страницSIP Form DebtNilesh MahajanОценок пока нет

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Документ2 страницыApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Gargi ShuklaОценок пока нет

- Sip Registration Cum Mandate Form: For Investment Through NACH/Direct DebitДокумент2 страницыSip Registration Cum Mandate Form: For Investment Through NACH/Direct DebitAbhijit patraОценок пока нет

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Документ2 страницыApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Chintan JainОценок пока нет

- Baroda BNP Paribas SIP Form 127Документ2 страницыBaroda BNP Paribas SIP Form 127custodian.archiveОценок пока нет

- SBI SIP Registration FormДокумент3 страницыSBI SIP Registration FormPrakash JoshiОценок пока нет

- Common Transaction Form Financial Transaction Kk3i5z51Документ8 страницCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghОценок пока нет

- Bandhan MF - STP FormДокумент2 страницыBandhan MF - STP FormserviceОценок пока нет

- Transaction Form For Existing InvestorsДокумент4 страницыTransaction Form For Existing InvestorsRRKОценок пока нет

- JM Finance MF - Sip NachДокумент1 страницаJM Finance MF - Sip NacharunimaapkОценок пока нет

- Tata Nach FormДокумент1 страницаTata Nach FormvanshjainОценок пока нет

- STP and SWP Form May17 FillPrintДокумент2 страницыSTP and SWP Form May17 FillPrintRohan KapoorОценок пока нет

- Canara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormДокумент2 страницыCanara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormSudhansuSekharОценок пока нет

- Sole / First Applicant Second Applicant Third ApplicantДокумент2 страницыSole / First Applicant Second Applicant Third ApplicantAnkur KaushikОценок пока нет

- Amc Copy: Enrolment FormДокумент4 страницыAmc Copy: Enrolment FormAhmad ZaibОценок пока нет

- SIP Registation Form-With One Time MandateДокумент4 страницыSIP Registation Form-With One Time MandatePrince AОценок пока нет

- Sip - 1Документ1 страницаSip - 1Lamar Wealth solutionsОценок пока нет

- A Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingДокумент2 страницыA Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingProfessional positiveОценок пока нет

- SIP1018 Kotak - CDRДокумент1 страницаSIP1018 Kotak - CDRNikesh MewaraОценок пока нет

- Multi Scheme CSIP Facility Application FormatДокумент6 страницMulti Scheme CSIP Facility Application FormatKiranmayi UppalaОценок пока нет

- Common SIP Form MAHINDRAДокумент2 страницыCommon SIP Form MAHINDRAsathisha123Оценок пока нет

- Systematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Документ3 страницыSystematic Transfer Plan Enrollement Form (Please Fill in Block Letters)Ankur KaushikОценок пока нет

- Sip Multiple FormДокумент2 страницыSip Multiple FormAmit SharmaОценок пока нет

- Kotak - Transaction SlipДокумент2 страницыKotak - Transaction SlipJephiasОценок пока нет

- SIP Auto Debit Form 2011Документ4 страницыSIP Auto Debit Form 2011Anirudha MohapatraОценок пока нет

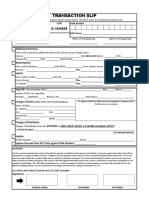

- Transaction Slip: E-154428 ARN-110547Документ1 страницаTransaction Slip: E-154428 ARN-110547Money Manager OnlineОценок пока нет

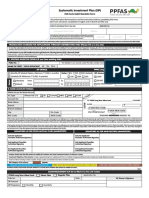

- Ppfas Sip FormДокумент2 страницыPpfas Sip FormAmol ChikhalkarОценок пока нет

- Sip Enrollment DetailsДокумент2 страницыSip Enrollment DetailsDBCGОценок пока нет

- Micro SIP Auto Debit 140110Документ2 страницыMicro SIP Auto Debit 140110Harneet SinghОценок пока нет

- Application Form STP / SWP: Distributor InformationДокумент1 страницаApplication Form STP / SWP: Distributor InformationSatya Prakash TrivediОценок пока нет

- Birla SIP Cum NACH FormДокумент6 страницBirla SIP Cum NACH FormarunimaapkОценок пока нет

- SBI MF SIP ECS FormДокумент1 страницаSBI MF SIP ECS FormSHIRISH1973Оценок пока нет

- SIP Pause-Cancellation - Form PDFДокумент1 страницаSIP Pause-Cancellation - Form PDFdatadisk10Оценок пока нет

- SIP Pause Cancellation FormДокумент1 страницаSIP Pause Cancellation Formdatadisk10Оценок пока нет

- Axis CTF FillableДокумент1 страницаAxis CTF FillablemayankОценок пока нет

- Multi Scheme Sip Csip Facility Application Form V 1 RevДокумент6 страницMulti Scheme Sip Csip Facility Application Form V 1 Revkjai786Оценок пока нет

- ARN-156449 E282034: 0369910844010 Franklin India Prima Fund - GrowthДокумент1 страницаARN-156449 E282034: 0369910844010 Franklin India Prima Fund - GrowthAnuj SharmaОценок пока нет

- Axis Common Application With SIPДокумент7 страницAxis Common Application With SIPRakesh LahoriОценок пока нет

- Common Application AxisДокумент5 страницCommon Application AxisCubicle CoderОценок пока нет

- Mirae SIP FormДокумент5 страницMirae SIP FormdurgeshОценок пока нет

- Common Transaction Form: First Unitholder Second Unitholder Third UnitholderДокумент1 страницаCommon Transaction Form: First Unitholder Second Unitholder Third UnitholderKailash VijayvargiaОценок пока нет

- Common Application FormДокумент5 страницCommon Application FormNeeraj KumarОценок пока нет

- IIFL MF Common Transaction Unit Holders 022819Документ2 страницыIIFL MF Common Transaction Unit Holders 022819Sabyasachi ChatterjeeОценок пока нет

- Application Form For Existing Investors: My DetailsДокумент8 страницApplication Form For Existing Investors: My Detailsvikas9saraswatОценок пока нет

- One Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitДокумент2 страницыOne Time Mandate Registration Form/ Debit Mandate Form NACH/ ECS/ Direct DebitAnand KopareОценок пока нет

- HDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantДокумент7 страницHDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantAltamash FaridОценок пока нет

- Full Download Business in Action 6th Edition Bovee Solutions ManualДокумент35 страницFull Download Business in Action 6th Edition Bovee Solutions Manuallincolnpatuc8100% (32)

- 13 Chapter V (Swot Analysis and Compitetor Analysis)Документ3 страницы13 Chapter V (Swot Analysis and Compitetor Analysis)hari tejaОценок пока нет

- HL HP 05338 BWДокумент1 страницаHL HP 05338 BWErzsébetMészárosnéGyurkaОценок пока нет

- Countries With Capitals and Currencies PDF Notes For All Competitive Exams and Screening TestsДокумент12 страницCountries With Capitals and Currencies PDF Notes For All Competitive Exams and Screening Testsabsar ahmedОценок пока нет

- Commissioner of Internal Revenue vs. Primetown Property Group, Inc.Документ11 страницCommissioner of Internal Revenue vs. Primetown Property Group, Inc.Queenie SabladaОценок пока нет

- Compact Heat Exchangers Heat Exchanger Types and ClassificationsДокумент39 страницCompact Heat Exchangers Heat Exchanger Types and Classificationsasyer aryoОценок пока нет

- Effect of Vishal Mega Mart On Traditional RetailingДокумент7 страницEffect of Vishal Mega Mart On Traditional RetailingAnuradha KathaitОценок пока нет

- P2P and O2CДокумент59 страницP2P and O2Cpurnachandra426Оценок пока нет

- Deloitte With World Economic Forum Future of Food - Partnership-GuideДокумент40 страницDeloitte With World Economic Forum Future of Food - Partnership-GuideFred NijlandОценок пока нет

- CH 8 The Impacts of Tourism On A LocalityДокумент19 страницCH 8 The Impacts of Tourism On A LocalityBandu SamaranayakeОценок пока нет

- Byju'S Global Expansion: International Business ProjectДокумент13 страницByju'S Global Expansion: International Business ProjectGauravОценок пока нет

- Kendriya Vidyalaya Island Grounds: Cluster Level-1 Session Ending Examination - 2008 Model Question PaperДокумент20 страницKendriya Vidyalaya Island Grounds: Cluster Level-1 Session Ending Examination - 2008 Model Question Paperbiswajit1990Оценок пока нет

- MCX MarginДокумент2 страницыMCX MarginKUMAR RОценок пока нет

- Chapter 6 - An Introduction To The Tourism Geography of EuroДокумент12 страницChapter 6 - An Introduction To The Tourism Geography of EuroAnonymous 1ClGHbiT0JОценок пока нет

- Phil Government Procument Policy BoardДокумент4 страницыPhil Government Procument Policy BoardRyan JD LimОценок пока нет

- Microeconomics - CH9 - Analysis of Competitive MarketsДокумент53 страницыMicroeconomics - CH9 - Analysis of Competitive MarketsRuben NijsОценок пока нет

- Statistical Appendix Economic Survey 2022-23Документ217 страницStatistical Appendix Economic Survey 2022-23vijay krishnaОценок пока нет

- AntiglobalizationДокумент26 страницAntiglobalizationDuDuTranОценок пока нет

- Contoh Presentasi PerusahaanДокумент20 страницContoh Presentasi PerusahaanTafrihan Puput SantosaОценок пока нет

- IRCTC Next Generation ETicketing SystemДокумент2 страницыIRCTC Next Generation ETicketing SystemGopinathОценок пока нет

- Fees and ChecklistДокумент3 страницыFees and ChecklistAdenuga SantosОценок пока нет

- Lack of Modern Technology in Agriculture System in PakistanДокумент4 страницыLack of Modern Technology in Agriculture System in PakistanBahiОценок пока нет

- Franklin 2018 SIP-PresentationДокумент24 страницыFranklin 2018 SIP-PresentationRajat GuptaОценок пока нет

- Wec12 01 Que 20240120Документ32 страницыWec12 01 Que 20240120Hatim RampurwalaОценок пока нет