Академический Документы

Профессиональный Документы

Культура Документы

About The Royal Bank of Scotland Group

Загружено:

AnandRaj0 оценок0% нашли этот документ полезным (0 голосов)

21 просмотров2 страницыRBS bank

Оригинальное название

RBS

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документRBS bank

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

21 просмотров2 страницыAbout The Royal Bank of Scotland Group

Загружено:

AnandRajRBS bank

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

About the Royal Bank of Scotland Group

The RBS Group is a large international banking and financial

services company. From its headquarters in Edinburgh, the Group

serves over 30 million customers in the United Kingdom, Europe,

the Middle East, the Americas and Asia. Our brands operate around

the globe to provide banking services for individuals, businesses and

institutions. We are working hard to make RBS one of the world’s

most admired, valuable and stable universal banks.

The Group provides a comprehensive range of financial services to

retail, corporate, and financial institutions. Markets and International

Banking, the investment banking arm of the Group, offers a broad

range of services enabling major corporations and institutions to

achieve their global financing, transactions services and risk

management objectives.

About RBS India

We have been in India since 1921. With our in-depth local market

knowledge coupled with our global network, we meet our clients’

needs by bringing together capabilities including debt capital

markets, international transaction services, FX and rates as well as

providing balance sheet advisory and structuring.

Our clients comprise blue-chip Indian corporations, leading

multinational corporations, large financial institutions, the Indian

Government and high net-worth Individuals.

Using our global reach and drawing on the expertise of our local

teams of professionals, we have led many of the biggest and most

innovative landmark transactions in India for our corporate and

institutional clients.

Markets and International Banking

In Markets and International Banking, we maintain a leading

position across international debt financing, transaction services and

risk management. We focus on our strengths in fixed income,

foreign exchange, risk management and transaction banking to offer

relevant solutions that enable our clients. RBS is the fourth largest

foreign transaction bank in India, supporting a multinational client

base through solutions which leverage state-of-the-art technology,

global product expertise and global network. We focus on long-term

client relationships and excellence in product execution underpinned

by global insight, local knowledge and a prudent and sustainable

banking model to meet the evolving market and regulatory backdrop.

Committed to serving clients' needs internationally, M&IB has on-

the-ground operations in 37 countries globally and 10 markets across

Asia Pacific.

Private Banking

Private Banking is part of the RBS Group’s Wealth Division, or

Coutts – a private bank and wealth manager that first opened its

doors for business in London in 1692. In India the business serves

the needs of the influential and wealthy, hence helping our clients

understand and resolve complex challenges with experienced

specialists and a comprehensive suite of bespoke products and

services. Our wealth managers listen to our clients understand their

individual context and requirements and help them achieve their

goals, through our suite of banking, investment, credit, and enhanced

referral services like wealth planning services and real estate services

offered through our non-banking arm - RBS Financial Services. RBS

Private Banking India has four offices in Mumbai, New Delhi,

Bengaluru and Chennai, providing clients with a complete and

seamless wealth management solution covering virtually every

aspect of their financial needs.

Retail Banking and Wealth Management Services

RBS offers a Retail Banking and Wealth Management proposition

through its branches located in ten cities, namely Bengaluru,

Chennai, Gurgaon, Hyderabad, Kolkata, Mumbai, New Delhi,

Noida, Pune and Vadodara. These ten locations form the core of a

revised and predominantly deposit-led Retail Banking and Wealth

Management proposition for the RBS Group in India fully

supporting RBS Group’s wider continuing business proposition.

Retail Banking business continues to offer products and services that

make banking convenient and easy. The business is building

capabilities to deliver transactional convenience through a state-of-

the-art Internet Banking platform by adopting innovative and

technology intensive features such as Online Wealth, Mobile

Banking and E-Commerce (e.g. online bill payments, retail

purchases through NetBanking and Debit Cards) to name a few. This

will enable the business to provide a seamless and convenient

banking experience to customers.

Microfinance

Our Microfinance program, the largest amongst its peer foreign

banks in India, is aimed at delivering credit to our target community

of impoverished rural woman through intermediaries called

microfinance institutions.

Financial products and services offered by Banks

Transactional accounts

o Checking accounts (American English)

o Current accounts (British English)

Savings accounts

Debit cards

ATM cards

Credit cards

Traveller’s cheques

Mortgages

Home equity loans

Personal loans

Certificates of deposit/Term deposits

Вам также может понравиться

- Finance Tips and Tricks for International Property InvestorsОт EverandFinance Tips and Tricks for International Property InvestorsОценок пока нет

- About RBSДокумент3 страницыAbout RBSRahul DahiyaОценок пока нет

- Entrepreneur's Handbook: Establishing a Successful Money Broker BusinessОт EverandEntrepreneur's Handbook: Establishing a Successful Money Broker BusinessОценок пока нет

- 3450 BranchesДокумент21 страница3450 Brancheshan051Оценок пока нет

- Annual Financial ReportДокумент99 страницAnnual Financial ReportMohit TanwaniОценок пока нет

- Wholesale BankingДокумент7 страницWholesale BankingSrinath SmartОценок пока нет

- HDFC Bank Was Incorporated in August 1994Документ6 страницHDFC Bank Was Incorporated in August 1994Deepu ShankerОценок пока нет

- MBA HR ProjectДокумент62 страницыMBA HR ProjectRajeshKumarJainОценок пока нет

- Introduction to CRM: Comprehensive Approach to Customer RelationshipsДокумент16 страницIntroduction to CRM: Comprehensive Approach to Customer Relationshipskrupal_desaiОценок пока нет

- Company Profile IndusindДокумент2 страницыCompany Profile IndusindabhshekОценок пока нет

- HDFC Project ReportДокумент56 страницHDFC Project ReportabhasaОценок пока нет

- Deutsche Bank India and Its 4P's of MarketingДокумент7 страницDeutsche Bank India and Its 4P's of MarketingvishwasacharyabОценок пока нет

- Foreign Banks in India Abn-Amro BankДокумент14 страницForeign Banks in India Abn-Amro BankhappytiwariОценок пока нет

- HSBC BackgroundДокумент2 страницыHSBC BackgroundNazim UddinОценок пока нет

- FX Market Impact on Indian EconomyДокумент51 страницаFX Market Impact on Indian Economynikitapatil420Оценок пока нет

- Axis Bank Launches Ripple-Powered Instant Payment Service For Retail and Corporate CustomersДокумент3 страницыAxis Bank Launches Ripple-Powered Instant Payment Service For Retail and Corporate CustomersNiyati BagweОценок пока нет

- Profitability Operational Efficiency of HDFC Bank LTDДокумент43 страницыProfitability Operational Efficiency of HDFC Bank LTDSonu K SinghОценок пока нет

- 3cet ReportДокумент12 страниц3cet ReportSarfaraz KhanОценок пока нет

- 34 Ashok HDFCBankLtdДокумент8 страниц34 Ashok HDFCBankLtdAshok ChoudharyОценок пока нет

- Instant Fund Transfers to Axis Bank Accounts Using ATMsДокумент76 страницInstant Fund Transfers to Axis Bank Accounts Using ATMsAshish Anil MataiОценок пока нет

- Introduction of BankingДокумент7 страницIntroduction of BankingNice NameОценок пока нет

- Background: PromoterДокумент6 страницBackground: Promotererajkumar_91Оценок пока нет

- Vision and MissionДокумент10 страницVision and MissionMun YeeОценок пока нет

- Return On Assets RatioДокумент21 страницаReturn On Assets RatioKaviya KaviОценок пока нет

- Banking Services for Individuals, SMEs & Corporates Across Global MarketsДокумент1 страницаBanking Services for Individuals, SMEs & Corporates Across Global MarketsuttamsudhirОценок пока нет

- Axis BankДокумент9 страницAxis BankPrasad MoreОценок пока нет

- Assignment On Historical Background of The City Bank LimitedДокумент12 страницAssignment On Historical Background of The City Bank LimitedAl-Amin SikderОценок пока нет

- Who Is HSBC?: Business Principles and ValuesДокумент5 страницWho Is HSBC?: Business Principles and Valuesrohitshetty84Оценок пока нет

- HDFC Bank's History, Operations and Business SegmentsДокумент34 страницыHDFC Bank's History, Operations and Business SegmentslovleshrubyОценок пока нет

- Fin 101 AssignmentДокумент8 страницFin 101 AssignmentOnnesha Sadia HossainОценок пока нет

- SCB Bangladesh Report: Overview of Standard Chartered BankДокумент23 страницыSCB Bangladesh Report: Overview of Standard Chartered BankSuvir SahaОценок пока нет

- The Housing Development Finance Corporation LimitedДокумент13 страницThe Housing Development Finance Corporation LimitedshibanibhОценок пока нет

- Presentation 1Документ5 страницPresentation 1apoorva_rastogi851261Оценок пока нет

- Dutch-Bangla Bank Banking OverviewДокумент13 страницDutch-Bangla Bank Banking OverviewShahed SharifОценок пока нет

- Standard Chartered Bank: A Global Financial Services CompanyДокумент37 страницStandard Chartered Bank: A Global Financial Services CompanyFiOna SalvatOreОценок пока нет

- Profitability & Operational Efficiency of HDFC Bank LTDДокумент82 страницыProfitability & Operational Efficiency of HDFC Bank LTDBharat Rijvani75% (4)

- Standard Chartered: Tagline: Here For GoodДокумент1 страницаStandard Chartered: Tagline: Here For GoodAyan PandaОценок пока нет

- India's 2nd largest bank ICICI Bank overviewДокумент2 страницыIndia's 2nd largest bank ICICI Bank overviewMd Sagir AlamОценок пока нет

- Ing Vysya BankДокумент4 страницыIng Vysya BankSudhanshu VermaОценок пока нет

- Project On HDFC BANKДокумент70 страницProject On HDFC BANKAshutosh MishraОценок пока нет

- Kotak Mahindra Bank: Submitted by Anas - NPДокумент15 страницKotak Mahindra Bank: Submitted by Anas - NPnoufaОценок пока нет

- Id 1Документ19 страницId 1UmeshОценок пока нет

- Origin and Milestones of Canara BankДокумент6 страницOrigin and Milestones of Canara BankSubramanya DgОценок пока нет

- HDFC Bank LoansДокумент75 страницHDFC Bank LoansSahil Sethi100% (2)

- Abn Amro Bank - Company ProfileДокумент20 страницAbn Amro Bank - Company ProfileSurpreet Singh PaviОценок пока нет

- Banking & Insurance Project on HDFC BankДокумент36 страницBanking & Insurance Project on HDFC Bankvrathi87Оценок пока нет

- Trade and Services SectorДокумент4 страницыTrade and Services Sectorsiddharth pandeyОценок пока нет

- Islamic Bank Vs Convention Bank ComparisonДокумент21 страницаIslamic Bank Vs Convention Bank ComparisonSheran HamidОценок пока нет

- HDFC Bank Guide: History, Products, Technology and SWOTДокумент31 страницаHDFC Bank Guide: History, Products, Technology and SWOTSakshi SharmaОценок пока нет

- FM ReportДокумент7 страницFM ReportMaryam KamranОценок пока нет

- Icici BankДокумент11 страницIcici Bankanish2408Оценок пока нет

- Dubai Islamic Bank PakistanДокумент65 страницDubai Islamic Bank PakistanKâíñåt KháànОценок пока нет

- Dubai Islamic Bank (E-Com)Документ23 страницыDubai Islamic Bank (E-Com)Zain Ul Abideen100% (1)

- HDFC Bank: We Understand Your WorldДокумент31 страницаHDFC Bank: We Understand Your WorldPalash Kumar DasОценок пока нет

- Company ProfileДокумент4 страницыCompany ProfileAshutoshSharmaОценок пока нет

- Analysis of Credit Risk in Banking IndustryДокумент23 страницыAnalysis of Credit Risk in Banking Industryshukhi89Оценок пока нет

- Profile and Values: "Banking That Helps You Get More Out of Every Opportunity"Документ4 страницыProfile and Values: "Banking That Helps You Get More Out of Every Opportunity"Darth BonОценок пока нет

- HDFC Bank: We Understand Your WorldДокумент31 страницаHDFC Bank: We Understand Your WorldSumit TokasОценок пока нет

- Objective of The ProjectДокумент25 страницObjective of The ProjectNazmul Islam Khan TutulОценок пока нет

- HSBC Fact PDFДокумент4 страницыHSBC Fact PDFShubakar ReddyОценок пока нет

- Law of DemandДокумент38 страницLaw of DemandAnandRajОценок пока нет

- BC CseetДокумент143 страницыBC CseetAnandRajОценок пока нет

- Legal Maxims and Phrases 16jan17Документ15 страницLegal Maxims and Phrases 16jan17Bikash KumarОценок пока нет

- Constitutional LawДокумент28 страницConstitutional LawAnandRaj100% (2)

- Indian Contract ActДокумент32 страницыIndian Contract ActAnandRajОценок пока нет

- NotesДокумент65 страницNotesAnandRajОценок пока нет

- Law of DemandДокумент38 страницLaw of DemandAnandRajОценок пока нет

- Marketing ManagementДокумент3 страницыMarketing ManagementAnandRajОценок пока нет

- Quantitative TechniquesДокумент17 страницQuantitative TechniquesAnandRajОценок пока нет

- YAДокумент1 страницаYAAnandRajОценок пока нет

- PLSQL Self NotesДокумент10 страницPLSQL Self NotesAnandRajОценок пока нет

- My FileДокумент1 страницаMy FileAnandRajОценок пока нет

- Interview TestДокумент2 страницыInterview TestAnandRajОценок пока нет

- Interview scenario questions analyzedДокумент10 страницInterview scenario questions analyzedAnandRajОценок пока нет

- RDBMS TablesДокумент1 страницаRDBMS TablesAnandRajОценок пока нет

- Framework For Preparation & Presentation of Financial StatementsДокумент9 страницFramework For Preparation & Presentation of Financial StatementsAyushi AgrawalОценок пока нет

- Sahyadri Ind IP Jun21Документ32 страницыSahyadri Ind IP Jun21NesNosssОценок пока нет

- Internship in Banking SIP ReportДокумент101 страницаInternship in Banking SIP ReportDaniel PedrosaОценок пока нет

- CH 01 - QS 1-17-18 Ac 3-4Документ14 страницCH 01 - QS 1-17-18 Ac 3-4Sharmi laОценок пока нет

- General Journal PowerpivotДокумент1 917 страницGeneral Journal PowerpivotJeanОценок пока нет

- Top 10 Indian Equity Diversified Mutual FundsДокумент18 страницTop 10 Indian Equity Diversified Mutual FundsShashwat ShrivastavaОценок пока нет

- Work Book RBPC - Without AnswersДокумент21 страницаWork Book RBPC - Without AnswersVipin VipsОценок пока нет

- Standalone Balance Sheet AnalysisДокумент4 страницыStandalone Balance Sheet AnalysisjayanathОценок пока нет

- IDX Statistic 2021Q2Документ216 страницIDX Statistic 2021Q2LisaОценок пока нет

- Drivers of Audit Failures A Comparative DiscourseДокумент6 страницDrivers of Audit Failures A Comparative DiscourseInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Reg E Compliance GuideДокумент2 страницыReg E Compliance GuideShahid RasheedОценок пока нет

- Summary Account Payable Statement: JiopayДокумент1 страницаSummary Account Payable Statement: JiopaySureka SwaminathanОценок пока нет

- Antares Crypto Bot? How To Top Up The Balance and StartДокумент9 страницAntares Crypto Bot? How To Top Up The Balance and StartBagas Dwi PОценок пока нет

- D Tomlinson Retail Seeks Your Assistance in Developing Cash andДокумент1 страницаD Tomlinson Retail Seeks Your Assistance in Developing Cash andAmit PandeyОценок пока нет

- Tutorial 12 Questions (Chapter 9)Документ3 страницыTutorial 12 Questions (Chapter 9)jiayiwang0221Оценок пока нет

- Important Yt LinksДокумент3 страницыImportant Yt Linksrosesingh00610Оценок пока нет

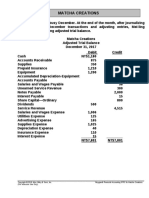

- MC4 Matcha Creations: (For Instructor Use Only)Документ2 страницыMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraОценок пока нет

- Faxon GroFin Financial PlanДокумент8 страницFaxon GroFin Financial PlanMasiko JamesОценок пока нет

- 1564409187209Документ11 страниц1564409187209divaОценок пока нет

- The General Ledger and Financial Reporting CycleДокумент12 страницThe General Ledger and Financial Reporting CycleNHОценок пока нет

- 3.Chapter3-Trial Balance and Correction of ErrorsДокумент9 страниц3.Chapter3-Trial Balance and Correction of ErrorsAhmad ShahОценок пока нет

- Principles of Bank LendingДокумент14 страницPrinciples of Bank LendingRishav Malik100% (1)

- E Receipt For State Bank Collect PaymentДокумент1 страницаE Receipt For State Bank Collect PaymentAyush MukhopadhyayОценок пока нет

- Milestone Two Management Brief Capital Lease vs Operating Lease ImpactДокумент4 страницыMilestone Two Management Brief Capital Lease vs Operating Lease ImpactAngela PerrymanОценок пока нет

- Application For Cancellation or Variation of Nomination in An Account Under National Savings SchemeДокумент1 страницаApplication For Cancellation or Variation of Nomination in An Account Under National Savings SchemeParul GuleriaОценок пока нет

- Linda Monkland Established Monkland LTD in Mid 2013 As The SoleДокумент1 страницаLinda Monkland Established Monkland LTD in Mid 2013 As The SoleHassan JanОценок пока нет

- Part A: Personal InformationДокумент2 страницыPart A: Personal InformationpreethishОценок пока нет

- Integrative Case 1Документ5 страницIntegrative Case 1NalynCasОценок пока нет

- Prepare and Process Financial DocsДокумент47 страницPrepare and Process Financial DocsEphraim PryceОценок пока нет

- Risk Management IIb SwapsДокумент58 страницRisk Management IIb SwapsFrisancho OrkoОценок пока нет

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceОт EverandValue: The Four Cornerstones of Corporate FinanceРейтинг: 4.5 из 5 звезд4.5/5 (18)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)От EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Рейтинг: 4.5 из 5 звезд4.5/5 (4)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanОт EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanРейтинг: 4.5 из 5 звезд4.5/5 (79)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorОт EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorОценок пока нет

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsОт EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsОценок пока нет

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityОт EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthОт EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthОценок пока нет

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000От EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Рейтинг: 4.5 из 5 звезд4.5/5 (86)

- Joy of Agility: How to Solve Problems and Succeed SoonerОт EverandJoy of Agility: How to Solve Problems and Succeed SoonerРейтинг: 4 из 5 звезд4/5 (1)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- LLC or Corporation?: Choose the Right Form for Your BusinessОт EverandLLC or Corporation?: Choose the Right Form for Your BusinessРейтинг: 3.5 из 5 звезд3.5/5 (4)

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionОт EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionРейтинг: 5 из 5 звезд5/5 (1)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsОт EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsОценок пока нет

- Product-Led Growth: How to Build a Product That Sells ItselfОт EverandProduct-Led Growth: How to Build a Product That Sells ItselfРейтинг: 5 из 5 звезд5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionОт EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionРейтинг: 5 из 5 звезд5/5 (3)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EОт EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EРейтинг: 4.5 из 5 звезд4.5/5 (6)

- Will Work for Pie: Building Your Startup Using Equity Instead of CashОт EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashОценок пока нет