Академический Документы

Профессиональный Документы

Культура Документы

Local Issues

Загружено:

Atirah AsnaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Local Issues

Загружено:

Atirah AsnaАвторское право:

Доступные форматы

Electrification of energy demand

The digital economy has the potential to shift energy demand in multiple fronts, including: growing

usage of equipment powered by electricity; decentralization of energy production, with consumers

also playing the role of generators; and a shift in the consumer base from passive to active through

smart meters and internet-of-things that manage load and add flexibility to the energy grid. Some of

the impacts are more speculative, such as gradual reduction of global physical trade through

decentralized manufacturing via 3D-printing or widespread deployment of more efficient logistics

through driverless cars and trucks, both of which have the potential to reduce liquid fuel consumption

(Helm 2017). From energy-hungry data centers that serve as cloud storage to mobile phones at the

hands of hundreds of millions of users, the digital economy is powered by electricity. The backbone of

the contemporary economy runs on electricity, even for intensive and perhaps spurious usage, such as

purely bitcoin mining.

The challenges towards sustainable electrical sources

Over-dependency to Fossil Fuel

This highly dependency of fossil fuels coupled with the dwindling domestic fossil fuel reserves

constraint will definitely force Malaysia to import more fossil fuel at high market price where the fuel

price is volatile if thorough fuel mix diversification is not carefully consider. For power generation

sector, concerns are towards energy supply security for the fuels for the power plants. As stated in

section above, more than 80% of electricity is produced using coal and natural gas with almost equal

share among the two fuels. However, the declining domestic gas production and over stretching of

supply system has led to frequent supply interruptions in the power generation industry. As for coal,

almost all of the coals used in the power plants are imported. The amount of imported coal has

increased steadily for Peninsular Malaysia, increasing from 11.9 million tonnes in 2009 to 19.2 million

tonnes in 2011. In term of price, coal is subjected to market forces. The prices of coals even though

has been stable for decades have increased beyond 2003 and surged to a new level due to the increase

of global demand of the fuel source

Increasing dependence on energy imports

Increasing demand for fossil fuels, coupled with the depleting domestic fossil fuel reserves, is

expected to result in increasing the country’s net import. To fulfill the demand the primary energy

import has grown at a fast rate of average 7.2 percent per year while the primary energy export has

grown at a slow rate 1.9 percent per year. Malaysia’s is showing vulnerability on its energy security

particularly due to increasing dependency on oil import and compounded by the nature of oil market

and contract that normally allow for greater price volatility. Oil production has remain almost constant

from 1990 to 2010 at 0.2 percent average growth rate per year, on the other hand the oil primary

demand has grown at a fast rate of 4.8 percent per year from 1990 to 2010. In order to fulfill the

demand the primary oil import has grown at a fast rate of average 10.5 percent per year while the

primary energy export has shrink at a rate of 1.4 percent per year

Issues and challenges of renewable energy development

Financial barriers

Presently, many green energy projects are implemented. With the assistance of grants.

This is because new technologies bear a certain amount of uncertainty, thus it creates a

barrier for its development. This uncertainty results in high financing costs for research,

development

and deployment. This in turn artificially raises the price of clean energy options, delaying

their full integration into the energy marketplace. Frequently, the initial cost for efficient

equipment is substantially higher than the standard alternative and the payback period or

economic return may be unacceptable. Renewable or green energy projects generally face

difficulty in getting financing and bank loan approval due to the high risk involved and

also the lack of technical knowledge on the part of the financiers.

Technical barriers

there are uncertainty in some technologies that may not be suitable because of unreliable

power supply of some developing countries. Also, being unproventechnology, it may not

be able to survive competitively with more established options. Secondly, there is limited

local expertise on efficient practices and equipment handling. Thirdly, there is uncertainty

of securing the long term biomass supply and price volatility. Project that do not have

biomass residues associated with their operation are subject to price volatility in the

biomass market. Finally, the nature of the electricity tariff undermines renewable energy

efforts. Generation of energy from renewable resources is economically unattractive due

to high cost of energy generation and

availability of cheaper alternatives energy. The relatively high costs of energy generation

from

renewable resources, both in terms of investment costs and final energy costs, compared

to conventional energy further restrain the efforts to promote the utilization of renewable

energy

Information barriers

There is a lack of information and awareness on the benefits of renewable energy.

Investment allowances and capital allowances were made available for RE

implementation since 2008. However, not many companies are aware of the special

incentives. There is a clear need for government agencies to help and advise applicants

and potential recipients how to go about

applying for RE incentives and the need for more channels for dissemination of

information.

Вам также может понравиться

- Kilic Mert Turkey Final ReportДокумент19 страницKilic Mert Turkey Final Reportmert kılıçОценок пока нет

- Philippine Cobp Phi 2014 2016 Ssa 02Документ6 страницPhilippine Cobp Phi 2014 2016 Ssa 02LuthfieSangKaptenОценок пока нет

- Cobp Phi 2013 2015 Ssa 02 PDFДокумент6 страницCobp Phi 2013 2015 Ssa 02 PDFMhay VelascoОценок пока нет

- Record Clean Energy Spending Is Set To Help Global Energy Investment Grow by 8% in 2022Документ3 страницыRecord Clean Energy Spending Is Set To Help Global Energy Investment Grow by 8% in 2022GerardoОценок пока нет

- P Lutchman Embedded GX AMEU 19Документ13 страницP Lutchman Embedded GX AMEU 19Poonam HutheramОценок пока нет

- World Energy Outlook: Executive SummaryДокумент10 страницWorld Energy Outlook: Executive SummaryJean Noel Stephano TencaramadonОценок пока нет

- Power FinancingДокумент8 страницPower Financing013203Оценок пока нет

- World energy markets and the future of oilДокумент10 страницWorld energy markets and the future of oilRisang PrasajiОценок пока нет

- C 4: P F P C: Hapter Olicy Ramework For Romoting OgenerationДокумент10 страницC 4: P F P C: Hapter Olicy Ramework For Romoting OgenerationbarmarwanОценок пока нет

- Sustainability and Climate Change Issues (Green House Gases/CO2 Emission)Документ5 страницSustainability and Climate Change Issues (Green House Gases/CO2 Emission)Kopal VermaОценок пока нет

- A Report on the Prospect of Producing Two Third of the Electricity from Renewable Energy by 2050Документ6 страницA Report on the Prospect of Producing Two Third of the Electricity from Renewable Energy by 2050Helter SkelterОценок пока нет

- Global Energy Perspective Accelerated Transition November 2018Документ52 страницыGlobal Energy Perspective Accelerated Transition November 2018sarahОценок пока нет

- Energy PDFДокумент22 страницыEnergy PDFSultan AhmedОценок пока нет

- Energy EfficiencyДокумент34 страницыEnergy EfficiencyDiego ArimateiaОценок пока нет

- McKinsey Global Institute Report On Promoting Energy Efficiency in The Developing WorldДокумент5 страницMcKinsey Global Institute Report On Promoting Energy Efficiency in The Developing WorldankurtulsОценок пока нет

- Worl Energy Outlook 2011 - Executive SummaryДокумент11 страницWorl Energy Outlook 2011 - Executive SummaryDrugs DirkmansОценок пока нет

- The Importance of Wind Energy and Government Regulations in Achieving Energy Self-SufficiencyДокумент9 страницThe Importance of Wind Energy and Government Regulations in Achieving Energy Self-Sufficiencyrakeshb11Оценок пока нет

- 08-13 1M801 - ENG72dpi PDFДокумент6 страниц08-13 1M801 - ENG72dpi PDFRuben Dario SolarteОценок пока нет

- Pest Analysis of Energy Industry of PakistanДокумент6 страницPest Analysis of Energy Industry of PakistanUrooj FatimaОценок пока нет

- Deploy Renew SumДокумент16 страницDeploy Renew SumEnergiemediaОценок пока нет

- Renewable Energy Advantages and ChallengesДокумент8 страницRenewable Energy Advantages and Challengesengrhabib781Оценок пока нет

- Energy BalanceДокумент23 страницыEnergy BalancelovleshrubyОценок пока нет

- The Future of The Battery Industry and Its Impact On Minerals DemandДокумент12 страницThe Future of The Battery Industry and Its Impact On Minerals DemandNigel BullОценок пока нет

- Nuclear Power's Economic PotentialДокумент6 страницNuclear Power's Economic PotentialMZ Virtual TVОценок пока нет

- Renewable Energy in IndiaДокумент20 страницRenewable Energy in IndiabenoypОценок пока нет

- Usmanu Danfodiyo University Sokoto, Department of Pure and Applied Chemistry Mre807 AssignmentДокумент6 страницUsmanu Danfodiyo University Sokoto, Department of Pure and Applied Chemistry Mre807 AssignmentMZ Virtual TVОценок пока нет

- Energy CrisisДокумент12 страницEnergy CrisisAnas TufailОценок пока нет

- 2024 Oil and Gas Industry Outlook - Deloitte InsightsДокумент28 страниц2024 Oil and Gas Industry Outlook - Deloitte InsightsCarlos Alberto Chavez Aznaran IIОценок пока нет

- Philippines Energy Consumption and Shortage ReportДокумент6 страницPhilippines Energy Consumption and Shortage ReportM' Rayz AbliterОценок пока нет

- Africa Latin America Asia CEE India Mediterrannean Countries OECD CountriesДокумент6 страницAfrica Latin America Asia CEE India Mediterrannean Countries OECD CountriesTulika ShreeОценок пока нет

- 澳大利亚电价趋势分析Документ118 страниц澳大利亚电价趋势分析ashoho1Оценок пока нет

- INDIAN ENERGY SECTOR - An OverviewДокумент20 страницINDIAN ENERGY SECTOR - An OverviewB R RavichandranОценок пока нет

- Energy Efficiency Strategical Document 2012Документ18 страницEnergy Efficiency Strategical Document 2012chevirmenОценок пока нет

- Economic Viability of Wind Energy Examined Through Policy LensДокумент54 страницыEconomic Viability of Wind Energy Examined Through Policy LensEng Bile LastroОценок пока нет

- Research Title: Coal-Based Power Generation in Bangladesh: Problems and ProspectsДокумент18 страницResearch Title: Coal-Based Power Generation in Bangladesh: Problems and ProspectsRafiaZamanОценок пока нет

- Energising The Way To 2020: Current Energy Scenario in IndiaДокумент7 страницEnergising The Way To 2020: Current Energy Scenario in IndiaPooja AroraОценок пока нет

- Submitted To: MR Rauf Akhter: Report On Energy Crises in PakistanДокумент44 страницыSubmitted To: MR Rauf Akhter: Report On Energy Crises in PakistanArslan TariqОценок пока нет

- No Guaranteed Future For Imported Gas in The Philippines - May 2021Документ35 страницNo Guaranteed Future For Imported Gas in The Philippines - May 2021BernardОценок пока нет

- India Power Sector ReportДокумент37 страницIndia Power Sector ReportSahil MatteОценок пока нет

- Executive Summary: Key PointsДокумент9 страницExecutive Summary: Key PointsBurchell WilsonОценок пока нет

- Energy EconomicsДокумент5 страницEnergy EconomicsMahnoor WaqarОценок пока нет

- RE Technologies Cost Analysis-BIOMASS PDFДокумент60 страницRE Technologies Cost Analysis-BIOMASS PDFHeri SetyantoОценок пока нет

- GRID Integration of Renewable Energy SourcesДокумент9 страницGRID Integration of Renewable Energy SourcesmanasasurendraОценок пока нет

- Cost of Electricity Generation From Hydropower Plants-2Документ1 страницаCost of Electricity Generation From Hydropower Plants-2Awais AliОценок пока нет

- Wind Energy Sarvesh - KumarДокумент26 страницWind Energy Sarvesh - Kumaranon_228506499Оценок пока нет

- 1.1 Global Energy Demand: Sector OverviewДокумент6 страниц1.1 Global Energy Demand: Sector Overviewlavkush_khannaОценок пока нет

- Energ CrisisДокумент9 страницEnerg CrisisRocky LawajuОценок пока нет

- Case StudyДокумент2 страницыCase StudyRomar De LunaОценок пока нет

- Effects of Covid-19 On Energy InvestmentДокумент4 страницыEffects of Covid-19 On Energy InvestmentSaagar SenniОценок пока нет

- Story: CoverДокумент3 страницыStory: Covershanki359Оценок пока нет

- Caribbean Policy Research Institute (CaPRI), Energy Diversification and The Caribbean, 12-2009Документ11 страницCaribbean Policy Research Institute (CaPRI), Energy Diversification and The Caribbean, 12-2009Detlef LoyОценок пока нет

- Energy Outlook in Pakistan: Exploring Renewable PotentialДокумент6 страницEnergy Outlook in Pakistan: Exploring Renewable PotentialUmar SubzwariОценок пока нет

- POWER SECTOR Industry AnalyticsДокумент74 страницыPOWER SECTOR Industry AnalyticsKanchan RaiОценок пока нет

- Twin Peaks: Surmounting The Global Challenges of Energy For All and Greener, More Efficient Electricity ServicesДокумент10 страницTwin Peaks: Surmounting The Global Challenges of Energy For All and Greener, More Efficient Electricity ServicesnguyenductuyenОценок пока нет

- India's Growing Renewable Energy SectorДокумент24 страницыIndia's Growing Renewable Energy SectorAWARARAHIОценок пока нет

- Renewable Energy: Policy Analysis of Major ConsumersДокумент8 страницRenewable Energy: Policy Analysis of Major ConsumersAwaneesh ShuklaОценок пока нет

- Energy: Mostafa Farangi, Ebrahim Asl Soleimani, Mostafa Zahedifar, Omid Amiri, Jafar PoursafarДокумент9 страницEnergy: Mostafa Farangi, Ebrahim Asl Soleimani, Mostafa Zahedifar, Omid Amiri, Jafar PoursafarGeo MatzarОценок пока нет

- Energy Efficient Commercial Lighting in India: A Lighting Transformations PerspectiveДокумент6 страницEnergy Efficient Commercial Lighting in India: A Lighting Transformations PerspectiveRahul ShankarОценок пока нет

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesОт EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesОценок пока нет

- Marking Scheme For Assignment 1Документ2 страницыMarking Scheme For Assignment 1Atirah AsnaОценок пока нет

- 2 Tutorial Economy FactorДокумент3 страницы2 Tutorial Economy FactorAizul FaizОценок пока нет

- Teaching Plan: Engineering Economy and ManagementДокумент5 страницTeaching Plan: Engineering Economy and ManagementAtirah AsnaОценок пока нет

- Faculty of Manufacturing Engineering SEM II 2020/2021 4BMFG-1 BMFR 3523 Cad/Cam Lab Activity 6Документ5 страницFaculty of Manufacturing Engineering SEM II 2020/2021 4BMFG-1 BMFR 3523 Cad/Cam Lab Activity 6Atirah AsnaОценок пока нет

- Groups Count Sum AverageДокумент2 страницыGroups Count Sum AverageAtirah AsnaОценок пока нет

- Ch2 FactorsДокумент28 страницCh2 FactorsAtirah AsnaОценок пока нет

- Option AДокумент1 страницаOption AAtirah AsnaОценок пока нет

- BMF S 2613021617Документ11 страницBMF S 2613021617Atirah AsnaОценок пока нет

- IVДокумент3 страницыIVAtirah AsnaОценок пока нет

- Past Year Te UtemДокумент8 страницPast Year Te UtemayasumireОценок пока нет

- Electrification shifts energy demand to electricityДокумент2 страницыElectrification shifts energy demand to electricityAtirah AsnaОценок пока нет

- Chapter 5 - Control Chart For AttributesДокумент28 страницChapter 5 - Control Chart For AttributesAtirah AsnaОценок пока нет

- Marketing AssignmentДокумент23 страницыMarketing AssignmentGUTA HAILE TEMESGENОценок пока нет

- General Administration, HR, IR, and Operations ExperienceДокумент4 страницыGeneral Administration, HR, IR, and Operations ExperienceDeepak MishraОценок пока нет

- Tax Invoice: (Original For Recipient)Документ3 страницыTax Invoice: (Original For Recipient)Apurv MathurОценок пока нет

- Chapter 1: Hospitality Spirit. An OverviewДокумент26 страницChapter 1: Hospitality Spirit. An OverviewKhairul FirdausОценок пока нет

- LCG LCPharma EN 160421Документ11 страницLCG LCPharma EN 160421Patrick MontegrandiОценок пока нет

- Downsizing Best PracticesДокумент26 страницDownsizing Best PracticescorfrancescaОценок пока нет

- Assignment 1: Course Name & Code: Assignment Title: Student Name: Student ID: Submitted To: Date of SubmissionДокумент7 страницAssignment 1: Course Name & Code: Assignment Title: Student Name: Student ID: Submitted To: Date of Submission4basilalhasaniОценок пока нет

- Accounting Standard As 1 PresentationДокумент11 страницAccounting Standard As 1 Presentationcooldude690Оценок пока нет

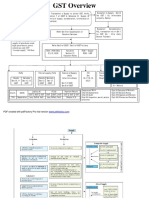

- GST OverviewДокумент17 страницGST Overviewprince2venkatОценок пока нет

- India's Power Sector: Ambitious Goals and Massive Investment NeedsДокумент20 страницIndia's Power Sector: Ambitious Goals and Massive Investment Needsyadavmihir63Оценок пока нет

- Chapter 5 Theory of Production UpdateДокумент35 страницChapter 5 Theory of Production Updatehidayatul raihanОценок пока нет

- SDM Pre ReadДокумент16 страницSDM Pre ReadArka BoseОценок пока нет

- PROBATIONARY EMPLOYMENT CONTRACT - Elyan TambongДокумент4 страницыPROBATIONARY EMPLOYMENT CONTRACT - Elyan TambongBeeboi SeetОценок пока нет

- Umang PDF Fo MathДокумент24 страницыUmang PDF Fo MathAlok RajОценок пока нет

- AmazonianДокумент19 страницAmazonianbapt100% (1)

- Mondrian Group Tax StrategyДокумент2 страницыMondrian Group Tax StrategyJuan Daniel Garcia VeigaОценок пока нет

- KSCAA September 10 NewsletterДокумент28 страницKSCAA September 10 Newsletterramachandran_ca8060Оценок пока нет

- Changhong Zhu’s PARS IV fund earned 61 percent for Bill Gross’s PimcoДокумент11 страницChanghong Zhu’s PARS IV fund earned 61 percent for Bill Gross’s PimcoMichael BenzingerОценок пока нет

- Catherine Austin Fitts Financial Coup D'etatДокумент10 страницCatherine Austin Fitts Financial Coup D'etatStephanie White Tulip Popescu67% (3)

- China Power Plant DocumentДокумент1 страницаChina Power Plant DocumentFahad SiddikОценок пока нет

- Smith Company Statement of Realization and LiquidationДокумент5 страницSmith Company Statement of Realization and LiquidationTRCLNОценок пока нет

- CH IndiaPost - Final Project ReportДокумент14 страницCH IndiaPost - Final Project ReportKANIKA GORAYAОценок пока нет

- Assignment Classification Table: Topics Brief Exercises Exercises ProblemsДокумент125 страницAssignment Classification Table: Topics Brief Exercises Exercises ProblemsYang LeksОценок пока нет

- Multiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionДокумент36 страницMultiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionKing MercadoОценок пока нет

- Setting The Right Price at The Right TimeДокумент5 страницSetting The Right Price at The Right TimeTung NgoОценок пока нет

- Session 4 - Internal Control Procedures in AccountingДокумент15 страницSession 4 - Internal Control Procedures in AccountingRej PanganibanОценок пока нет

- Live Case Study - Lssues For AnalysisДокумент4 страницыLive Case Study - Lssues For AnalysisNhan PhОценок пока нет

- Word Family ECONOMY - VežbeДокумент16 страницWord Family ECONOMY - VežbeNevena ZdravkovicОценок пока нет

- Sample Assignment 1-1Документ20 страницSample Assignment 1-1Nir IslamОценок пока нет

- HSTM CatalogДокумент10 страницHSTM CatalogcccheelОценок пока нет