Академический Документы

Профессиональный Документы

Культура Документы

Moderating Effect of CEO Tenure and Managerial Experience On Firm Specific Determinants of Corporate Cash Holdings

Загружено:

Tahir KhanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Moderating Effect of CEO Tenure and Managerial Experience On Firm Specific Determinants of Corporate Cash Holdings

Загружено:

Tahir KhanАвторское право:

Доступные форматы

SSRG International Journal of Economics and Management Studies (SSRG-IJEMS) – volume2 issue2 March to April 2015

Moderating Effect of CEO Tenure and Managerial Experience on

Firm Specific Determinants of Corporate Cash Holdings

Samuel Nduati Kariuki1, Prof. Gregory S. Namusonge2, Dr. George O. Orwa3

1

Jomo Kenyatta University of Agriculture and Technology (JKUAT), Juja, Kenya

2

Professor, Dean School of Entrepreneurship, Procurement and Management, JKUAT, Kenya

3

HOD, Department of Statistics and Actuarial Science, JKUAT, Kenya

ABSTRACT experience remarkable transaction costs though

The study examines the moderating effect of CEO either debt or equity issues (Faulkender & Wang,

tenure and managerial experience on firm specific 2006). Along the same line of thought, Opler et al.

determinants of corporate cash holdings among (1999) claim that companies with low leverage,

private manufacturing firms in Kenya. The small assets, strong investment opportunities and

research employed the upper echelons theory to

risky investments stockpile comparatively huge

identify CEO characteristics that are linked to

various organizational processes and outcomes cash reserves. In sharp contrast, Jensen (1986)

such as cash holding. This survey-based study conjectures that cash holdings may also present

selected a sample of 156 private manufacturing opportunities for managers to over-invest in sub-

firms from the firms registered with the KAM that optimal projects at the expense of the shareholders

are located in Nairobi and surrounding area using or seek private benefits through consumption of

stratified random sampling technique. The supplementary discretionary perquisites. As such,

research collected primary data using self-

cash reserves are vital ingredients in establishing

administered questionnaires to gather self-reported

financial measures from the CFOs. The study firms’ financial architecture. Arguably, recent

employed stepwise multiple regression analysis to empirical evidence augments the idea that cash

determine the moderating effect of CEO tenure and holdings epitomize a significant constituent of

managerial experience on independent and firms’ optimal financing structure.

dependent variables. The study concludes that the Several studies, try to explain why

CEO tenure significantly moderates firm size,

companies hold cash using theoretical models.

growth opportunities, and likelihood of financial

distress as determinants of corporate cash Harford et al. (2008) particularly employs the

holdings. Further, the study concludes that CEO trade-off theory to illuminate corporate cash

managerial experience in other industries retention behavior and observe that firms determine

significantly moderates firm size and cash flow their optimal level of cash holding by weighting the

volatility determinants of corporate cash holdings costs of cash retention against marginal benefits.

among private manufacturing firms in Kenya. However, Bates et al. (2009) extending pecking

order theory to explain the determinants of cash

Keywords: Cash holdings, CEO managerial

holding contends that there is no optimal cash

experience, CEO tenure, Upper echelons theory

level. As such, there is no consensus from the

1. Introduction extant literature on motives of holding cash given

The decision of firms to hold substantial that the theoretical predictions are ambiguous.

cash reserves has lately been put under the Thus, it remains an empirical question whether the

spotlight in the corporate finance literature recent increase in corporate cash holdings could be

(Dittmar et al., 2003; Ozkan & Ozkan, 2004). The explained by optimal financial planning or

extant literature, notably Mickelson and Patch precautionary motive as opposed to managerial

(2002) recognizes that holding a certain level of opportunism (Faulkender & Wang, 2006).

cash might enhance a firm’s performance. Indeed, Daher (2010) presents evidence of

cash holdings empower firms not only to fund day increasing cash holding ratio, specifically he shows

to day operations but also enable firms to undertake that cash holding of private firms almost double

investment opportunities without having to between 1994 and 2005. The finding buttresses the

assertion by Nyabwanga et al. (2012) that

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 30

SSRG International Journal of Economics and Management Studies (SSRG-IJEMS) – volume2 issue2 March to April 2015

businesses reserve cash surpluses and maintain CEO characteristics is linked to various

moderately high current ratios to safeguard them organizational processes and outcomes, such as

against running out of cash. The assertion is in line company financial disclosure (Bamber et al., 2010),

with the observation by Mitau (2013) that most R&D spending (Barker & Mueller, 2002),

businesses set minimum cash balance level which innovation (Kitchell, 1997), internationalization

guards them against running out of cash. As a (Herrmann, 2002), development of business

result, understanding cash holding seems to be a strategy (Gibbons & O’Connor, 2005) and

vital component in enriching knowledge of how corporate performance (Weinzimmer, 1997).

firms are financed. It is striking that a review of Hambrick and Mason (1984) argue that under

extant literature shows that most of the empirical UET, managerial decision making is greatly

work on cash holdings concentrates on data derived influenced by top managers’ intellectual,

from developed economies (Kabui, 2003) and large psychological and societal settings due to bounded

firms listed on stock exchanges (Majiwa, 2011). In rationality. Consequently, managers make entirely

contrast, little has been done in terms of developing different decisions despite being exposed to similar

market context and Africa’s emerging markets objective inputs due to their unique way of

have been left largely unexplored (Mugumisi & processing information. As such, organizations are

Mawanza, 2014). Moreover, Kariuki and Kamau a reflection of their top managers (Carpenter et al.,

(2014) underscore the importance of researching on 2004). Hambrick and Finkelstein (1987) contend

the private firms as they form the vast majority of that CEO discretion is an important moderating

the firms globally. factor that influences organizational processes and

firm’s performance through CEO unique cognitive,

1.1 Research Objectives social and psychological attributes.

1. To assess whether the CEO tenure Hambrick (2007) hold the view that CEO

moderates the firm specific determinants discretion is influenced by environmental

of corporate cash holdings among private conditions and organizational factors amongst

manufacturing firms in Kenya others. The UET specifies that CEO characteristics

2. To assess whether the CEO managerial features (such as background, tenure, education,

experience in other industries moderates gender and age) are satisfactory proxies to measure

the firm specific determinants of corporate the CEO’s underlying cognitive, psychological and

cash holdings among private social features (Hambrick, 2007). Along the same

manufacturing firms in Kenya line of thought, Graham, Harvey, and Puri (2013)

using psychometric tests identify behavioral

1.3 Research Hypothesis

characteristics of CEOs related to corporate

The study tested the following null

financial policies. The present study considers CEO

hypothesis;

tenure and CEO managerial experience in other

H01: CEO tenure does not moderate the firm

industries as CEO characteristics moderating the

specific determinants of corporate cash holdings

influence of the hypothesized firm specific

among private manufacturing firms in Kenya.

determinants of corporate cash holding.

H02: CEO managerial experience does not moderate

the firm specific determinants of corporate cash 3.0 Methodology

holdings among private manufacturing firms in The researchers considered the most

Kenya. appropriate research design to be descriptive

survey design. The target population for this study

2.0 Literature Review

was all the 650 private manufacturing firms listed

Upper Echelons Theory

with the Kenya Association of Manufacturers

The theory was advanced by Hambrick

(KAM) at the close of 2012 as published in the

and Mason (1984). Their basic idea is that different

2013 members’ directory. However, an

top managers greatly influence organizational

overwhelming majority of these companies (80%)

outcomes by the choices they make. Indeed, the

carry out their manufacturing operations in Nairobi

upper echelons theory (UET) literature shows that

and its vicinity. The study therefore, selected a

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 31

SSRG International Journal of Economics and Management Studies (SSRG-IJEMS) – volume2 issue2 March to April 2015

sample of 156 private manufacturing firms from X4 = Likelihood of Financial Distress

the firms enumerated with the KAM that are X5= Cash Flow Variability

situated in Nairobi using stratified random Ε = Error term

sampling technique. The research collected primary βo = Intercept

data using self- administered questionnaires to Z = the theorized moderator

gather self-reported financial measures from the Β1-β5 = Slope coefficients representing the

Chief Finance Officers (CFOs). The study influence of the associated independent variable on

employed stepwise multiple regression analysis to the dependent variable

determine the moderating effect of CEO tenure and βz = Slope coefficient representing the influence of

managerial experience on independent and moderator variable on the dependent variable

dependent variables. β1Z – β5Z = βiz = Slope coefficient representing the

influence of the interaction between the moderator

3.1 Variables Measurement and each of the independent variable (Xi*Z) for I =

Corporate Cash Holdings - Ratio of total cash and 1,2,3, 4 and 5

equivalent items to total assets

Growth Opportunities - Yearly sales growth rate 4.0 Results and Discussions

Leverage - Total liabilities/Total assets 4.1 CEO Tenure and Determinants of Corporate

Firm Size - Natural logarithm of total assets Cash Holdings

Likelihood of Financial Distress - Research & The study findings reveal that when CEO

development expenditure standardized by year-end tenure was used as the moderator on the

sales determinants of cash holdings, the MMR model

Cash Flow Variability - Standard deviation of the had R2 value of 70.6%. Table 1 shows the

pretax profit plus depreciation divided by the total regression analysis slope coefficients for the

assets over a period of 5 years estimated MMR model. The t- statistic was used to

CEO Tenure - Number of years that the CEO holds test the hypothesis on the significance of the slope

the current position in the firm coefficients at 5 per cent level of significance. In

CEO Managerial experience - Measured as one if applying MMRA to examine the regression model

the current CEO previously served in firms from the following hypothesis was tested; H0: βiz = 0 and

other non- manufacturing industries as a CEO or H1: βiz ≠ 0. Rejection of H0 and acceptance of H1 at

else it was zero the 5% level of significance confirms the existence

of a moderating (interaction) effect. The results

3.2 Model Specification show that there was significant interaction between

The study employed stepwise multiple firm size and CEO tenure (β3z = 0.050, P = 0.000 <

regression analysis to assess the moderating effect 0.05), CEO tenure and growth opportunities (β1z = -

of CEO tenure and CEO experience in other 0.005, P = 0.026 < 0.05), CEO tenure and

industries on the firm specific determinants of likelihood of financial distress (β4z = -0.012, P =

corporate cash holding. Regression was important 0.018 < 0.05). The test of beta coefficients shows

in showing the interactive effect of each that CEO tenure significantly moderates the firm

independent variable as new variables were size, growth opportunities and financial distress

introduced into the model on step by step basis. In determinants of corporate cash holdings among

particular, the following linear regression model private manufacturing firms in Kenya. The

was applied. estimated MMR model is as follows;

Y= β0 + β1X1 + β2X2 + β3X3 + β4X4 + β5X5+ βz Z + CH= 0.05 ZFS + 0.139 LEV - 0.005 ZGO - 0.012

β1zX1Z + β2zX2Z + β3zX3Z +β4zX4Z + β5zX5Z + ε ZLFD + 0.117 CFV + ε ……………………….. (2)

…………………………………………………. (1) Where;

Where: ZFS = Interaction between firm size and CEO

Y = Cash Holding tenure

X1 = Growth Opportunities LEV = Leverage

X2 = Leverage ZGO = Interaction between CEO tenure and

X3 = Firm Size growth opportunities

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 32

SSRG International Journal of Economics and Management Studies (SSRG-IJEMS) – volume2 issue2 March to April 2015

ZLFD = Interaction between CEO tenure and is an indication that CEO tenure significantly

likelihood of financial distress moderates the determinants of corporate cash

CFV = Cash Flow Volatility holdings among private manufacturing firms. The

study findings indicate that CEO tenure enhances

Table 1: Corporate Cash Holdings Moderated the predicting power of the model explaining

Regression Coefficients corporate cash holdings in addition to the most

Coefficients prominent firm specific characteristics explaining

Model B Std. Error t Sig. cash holding among private manufacturing firms in

(Constant) -.255 .671 -.381 .704 Kenya. Richard et al. (2009) argue that new CEOs

ZFS .050 .006 7.734 .000 have to gain knowledge about the organization and

LEV .139 .023 6.067 .000 the environment in which the firm operates and are

ZGO -.005 .002 -2.255 .026 more likely to consider numerous alternatives, have

ZLFD -.012 .005 -2.394 .018 a more external focus, and are more open to fresh

CFV .117 .019 6.096 .000 ideas, change and experimentation than long

tenured CEOs.

The ANOVA test findings (Table 2) Consequently, longer tenured CEOs are

indicate that the value of computed F statistic was likely to retain higher cash levels compared to

53.224 (P value = 0.000) which is sufficiently low shorter tenured ones. This could be attributed to

(0.000 < 0.005) at the 5% level of significance. longer tenured CEOs exhibiting a higher aversion

Thus, the MMR model fit is acceptable implying towards risk and change, giving rise to a higher

that CEO tenure significantly moderates firm size, importance attached to the precautionary role of

likelihood of financial distress and growth cash and a lower importance to the opportunity

opportunities determinants of corporate cash cost of cash, resulting in higher cash levels in

holdings among private manufacturing firms in line with a combination of upper echelons theory

Kenya. and trade-off theory.

Table 2: Corporate Cash Holdings Moderated 4.3 CEO Managerial Experience and

Regression ANOVA Determinants of Corporate Cash Holdings

The study findings show that when CEO

Sum of Mean

managerial experience was used as the moderator

Model Squares df Square F Sig.

on the determinants of cash holdings, the MMR

Regression 1996.05 5 399.21 53.224 .000

model had R2 value of 58.9%. The t- statistic was

Residual 832.560 111 7.50 used to test the hypothesis on the significance of

Total 2828.61 116 the slope coefficients at 5 per cent level of

1

a. Dependent Variable: Corporate Cash Holdings significance. The results show that there was

h. Predictors: (Constant), ZFS, LEV, ZGO, ZLFD, significant interaction between CEO managerial

CFV experience and firm size (β3z = -0.233, P = 0.000 <

0.05), and CEO managerial experience and cash

4.2 Discussion on CEO Tenure and

flow volatility (β1z = 0.123, P = 0.022 < 0.05). The

Determinants of Corporate Cash Holdings

test of beta coefficients shows that CEO managerial

The results of the regression analysis in

experience significantly moderates the firm size

Table 1 revealed that CEO tenure significantly

and cash flow volatility determinants of corporate

moderates firm size, growth opportunities, and

cash holdings among private manufacturing firms

likelihood of financial distress as determinants of

in Kenya. The estimated MMR model is as follows;

corporate cash holdings among private

manufacturing firms in Kenya. The study CH= -3.611 + 0.122 CFV+ 0.139 LDS + 0.63 FS -

established that when CEO tenure was used as the 0.233 ZFS - 0.128 LFD + 0.123 ZCFV+ ε …..... (3)

moderator on the determinants of cash holdings,

the model had R2 value of 70.6% while without the Where;

moderator the model had R2 value of 53.0%. This CFV = Cash flow volatility

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 33

SSRG International Journal of Economics and Management Studies (SSRG-IJEMS) – volume2 issue2 March to April 2015

LEV = Leverage 4.4 Discussion on CEO Managerial Experience

FS = Firm size and Determinants of Corporate Cash Holdings

ZFS = Interaction between CEO managerial The study findings indicate that there was

experience and firm size an interaction effect when CEO managerial

LFD = Likelihood of financial distress experience was used as the moderator on the

ZCFV = Interaction between CEO managerial determinants of cash holdings, with both firm size

experience and cash flow volatility and cash flow volatility. The R2 value when

managerial experience was used as a moderator

was 58.9% which was significantly different from

53.0% without the moderator. This empirical

evidence suggest that CEO managerial experience

significantly moderates firm size and cash flow

volatility determinants of corporate cash holdings

among private manufacturing firms in Kenya. It is

expected that CEOs with experience in only one

Table 3: Corporate Cash Holdings Moderated industry hold more cash than CEOs with

Regression Coefficients experience in varied industries due to their high

Coefficients degree of risk aversion regardless of the firm

Model B Std. Error t Sig. specific determinants. This buttresses the assertion

(Constant) -3.611 1.776 -2.034 .044 by Orens and Reheul, (2013) that a greater

CFV .122 .025 4.820 .000 diversity in CEOs experience is likely to trigger a

LEV .139 .022 6.368 .000 more optimistic attitude towards risk, change and

FS .630 .123 5.134 .000 innovation. As a result, the managerial experience

ZFS -.233 .058 -4.009 .000 in other industries broadens CEOs capital and

LFD -.128 .049 -2.582 .011 liquidity decision making capability. This

ZCFV .123 .053 2.327 .022 subsequently leads to retention of lesser levels of

cash. Moreover, industry experience broadens

Table 4 presents the result of ANOVA CEOs’ professional networks (Richard et al.,

test. The findings indicate that the value of 2009). This might increase CEOs’ view of more

computed F statistic was 26.267 with a P value of opportunities to invest cash resources. In contrast,

0.000 which is sufficiently low (0.000 < 0.005) at executives who have spent their career in the same

the 5% level of significance. Thus, the MMR industry are more committed to industry

model fit is acceptable implying that CEO conventions.

managerial experience significantly moderates firm

size and cash flow volatility firm specific 5.0 Conclusions and Recommendations

determinants of corporate cash holdings among 5.1 Conclusions

private manufacturing firms in Kenya. Based on findings, the study concludes

that the CEO tenure and CEO managerial

Table 4: Cash Flow Variability and Corporate experience in other industries moderate the firm

Cash Holdings ANOVA specific determinants of corporate cash holdings

Sum of Mean among private manufacturing firms in Kenya. The

Model Squares df Square F Sig. results confirmed that CEO tenure significantly

Regression 1665.89 6 277.650 26.267 .000 moderates firm size, growth opportunities, and

Residual 8

1162.71 110 10.570 likelihood of financial distress as determinants of

Total 3

2828.61 116 corporate cash holdings among private

1 manufacturing firms in Kenya. Further, the study

a. Dependent Variable: Corporate Cash Holdings

concludes that CEO managerial experience in other

g. Predictors: (Constant), CFV, LEV, FS, ZFS,

industries significantly moderates firm size and

LFD, ZCFV

cash flow volatility determinants of corporate cash

holdings among private manufacturing firms in

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 34

SSRG International Journal of Economics and Management Studies (SSRG-IJEMS) – volume2 issue2 March to April 2015

Kenya. The study findings indicate that CEO Bates, T.W., Khale, K.M., Stulz, R.M. (2009). Why

demographics enhance the predicting power of the do US firms hold so much more cash than they

model explaining corporate cash holdings in used to? Journal of Finance, 64, 1985–2021.

addition to the most prominent firm specific

determinants explaining cash policy among private Carpenter, M.A., Geletkanycz, M.A. & Sanders,

manufacturing firms in Kenya. W.G. (2004). Upper echelons research revisited:

Antecedents, elements, and consequences of top

5.2 Recommendations management team composition. Journal of

The shareholders should consider the Management 30(6), 749-778.

cash holding practices associated with current or

Daher, M. (2010). The Determinants of Cash

potential new CEO’s characteristics to assess the

Holdings in UK Public and Private Firms.

extent to which these propensities are acceptable

Doctoral dissertation, Lancaster University.

given the wider organizational setting, and

should try to adapt these tendencies if necessary Dittmar, A., Mahrt-Smith, J., & Servaes, H. (2003).

to avoid excess cash levels causing opportunity International Corporate Governanceand Corporate

costs which is detrimental to value of the firm. Cash Holdings. Journal of Financial and

With regard to CEO experience as a moderator of Quantitative Analysis, 38 (1), 111-133.

determinants of corporate cash holding the study

only considered whether the CEO had any Egbe O. J. (2015). A dynamic analysis of the

experience outside the manufacturing industries, determinants of international reserves in Nigeria.

and does not focus on the number of years and the International Journal of Economics and

functional experience such as; accounting, Management Studies, 2(1), 1-7.

marketing, human resources management,

operations management, finance management Faulkender, M. & Wang, R., (2006). Corporate

among others. Future studies should therefore, Financial Policy and the Value of Cash. Journal of

explore whether different types of functional Finance 61(4), 1957-1990.

experiences and number of years moderate CEO

Hambrick D.C. & Finkelstein, S. (1987).

behavior with regard to determinants of cash

Managerial discretion: a bridge between polar

holdings. Future research could also determine

views of organizations. Organizational Behavior 9,

whether CEO’s type and level of education such as

369-406.

a high level business-oriented degree course or a

more technical-oriented degree course/ training Hambrick D.C. & Fukutomi, G.D.S. (1991). The

significantly moderates the determinants of seasons of a CEO's tenure. Academy of

corporate cash holdings in Kenya. Management Review 16(4), 719-742.

5.3 Limitations of the Study Hambrick, D.C. (2007). Upper echelons theory: an

The major limitation in this study was that update. Academy of Management Review 32(2),

most private manufacturing firms considered 334-343.

financial information as confidential and hence

were not willing to unveil the financial reports. Hambrick, D.C. & Mason, P. (1984). Upper

Nonetheless, the study relied upon self-reported echelons: The organization as a reflection of its top

financial measures for private manufacturing firms managers. Academy of Management Review 9, 193-

from the CFOs. The respondents were also assured 206.

that no individual’s responses or firm information

would be identified and the identity of persons/ Hambrick, D.C., Geletkancyz, M. & Fredrickson,

firms participating in the study would be treated J.W. (1993). Top executive commitment to the

with utmost confidentiality. status quo: some tests of its determinants. Strategic

Management Journal 14, 401- 418.

References

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 35

SSRG International Journal of Economics and Management Studies (SSRG-IJEMS) – volume2 issue2 March to April 2015

Harford, J., Mansi, S., & Maxwell, W. (2008). Kisii South District, Kenya. African Journal of

Corporate Governance and Firm Cash Holdings in Business Management 6(18), 5807-5817.

the U.S. Journal of Financial Economics 87, 535-

555. Opler, T., Pinkowitz, L., Stulz, R., & Williamson,

R. (1999). The determinants and implications of

Jensen, M.C. (1986). Agency costs of free cash corporate cash holdings. Journal of Financial

flow, corporate finance and takeovers. American Economics, 52, 3-46.

Economic Review, 76(2), 323-331.

Ozkan, A., & Ozkan, N. (2004). Corporate cash

Kabui, M. (2003). Determinants of corporate cash holdings: An empirical investigation of UK

holdings: the case of Kenyan quoted companies. companies. Journal of Banking & Finance, 28,

Unpublished MBA thesis, University of Nairobi, 2103-2134.

Kenya.

Richard, O.C., Wu, P. and Chadwick, K. (2009).

Kariuki S.N. & Kamau C.G. (2014). Determinants The impact of entrepreneurial orientation on firm

of corporate capital structure among private performance: the role of CEO position tenure and

manufacturing firms in Kenya: A survey of food industry tenure. The International Journal of

and beverage manufacturing firms. International Human Resource Management 20(5), 1078-1095.

Journal of Academic Research in Accounting,

Finance & Management Science. 4(3), 49-62. Varga F. F. (2015). A firm-specific analysis of

taiwan foreign exchange rate exposure: A panel

Majiwa, C. (2011). A survey of excess cash data approach. International Journal of Economics

management practices for companies listed at the and Management Studies, 2(1), 45-53.

Nairobi Stock Exachange. Unpublished MBA

thesis, Nairobi University, Kenya. Weinzimmer, L.G. (1997). Top management team

correlates of organizational growth in a small

Mikkelson, W.H., & Partch, M.M. (2002). Do business context: a comparative study. Journal of

persistent large cash reserves hinder performance? Small Business Management 35(3), 1-10.

Journal of Financial and Quantitative Analysis, 38

(2), 275–294.

Miller, D. & Shamsie, I. (2001). Learning across

the life cycle: experimentation and performance

among the Hollywood studio heads. Strategic

Management Journal 22, 725-745.

Mitau, M. (2013). Working capital management

and its effect on firm’s profitability in Kenya: a

survey of non-financial institutions listed on the

Nairobi Securities Exchange. Unpublished MBA

thesis, Nairobi University, Kenya.

Mugumisi, N. & Mawanza, W. (2014). Corporate

cash holding under liquidity crisis: A Panel

analysis of Zimbabwean firms. Research Journal of

Economics & Business Studies, 3 (3), 66-76.

Nyabwanga, R., Ojera, P., Lumumba, M.,

Alphonce, J., & Otieno, S. (2012). Effect of

working capital management practices on financial

performance: A study of small scale enterprises in

ISSN: 2393 - 9125 www.internationaljournalssrg.org Page 36

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Presentation On: Venture Capital & SebiДокумент14 страницPresentation On: Venture Capital & Sebivineeta4604Оценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- How Do Small Business Loans Work?Документ3 страницыHow Do Small Business Loans Work?Soumyajit Das MazumdarОценок пока нет

- Registration of Domestic Corporation - SecДокумент6 страницRegistration of Domestic Corporation - SecJuan FrivaldoОценок пока нет

- Financial Planning and ForecastingДокумент25 страницFinancial Planning and ForecastingAhsan100% (2)

- Banking Memory AidДокумент10 страницBanking Memory AidEdz Votefornoymar Del RosarioОценок пока нет

- PMS Agreement SampleДокумент9 страницPMS Agreement SamplesureshvgkОценок пока нет

- Self Sabotage Reexamined: by Van K. Tharp, PH.DДокумент8 страницSelf Sabotage Reexamined: by Van K. Tharp, PH.DYashkumar JainОценок пока нет

- Fac 3703Документ99 страницFac 3703Nozipho MpofuОценок пока нет

- Caps W 9Документ4 страницыCaps W 9api-215255337Оценок пока нет

- 1 - Solution 2013Документ10 страниц1 - Solution 2013Yamer YusufОценок пока нет

- List of Lawyers in Bangladesh: Prepared by The British High Commission, DhakaДокумент66 страницList of Lawyers in Bangladesh: Prepared by The British High Commission, DhakaMosiur Rahman75% (4)

- Powerponit Presentation of Mr. Dolce RamirezДокумент65 страницPowerponit Presentation of Mr. Dolce RamirezCharisse Ann MonsaleОценок пока нет

- Medical Group: 1-888-236-2263. Our Office Hours Are Monday Through Friday 8:00a.m.to 4:30p.mДокумент3 страницыMedical Group: 1-888-236-2263. Our Office Hours Are Monday Through Friday 8:00a.m.to 4:30p.menergizerabbyОценок пока нет

- Factors Affecting The Success Failure of PDFДокумент12 страницFactors Affecting The Success Failure of PDFavishain1Оценок пока нет

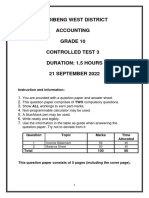

- 2022 Grade 10 Controlled Test 3 QP EngДокумент5 страниц2022 Grade 10 Controlled Test 3 QP EngkellzylesediОценок пока нет

- CA FInal DT SampleДокумент8 страницCA FInal DT SampleprasannaОценок пока нет

- Efficiency RatiosДокумент17 страницEfficiency Ratiosfelize padllaОценок пока нет

- Financial AccountingДокумент4 страницыFinancial AccountingManish KushwahaОценок пока нет

- MOJAKOE AK1 UTS 2012 GasalДокумент15 страницMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudОценок пока нет

- Registration of Corporations Stock Corporation Basic RequirementsДокумент27 страницRegistration of Corporations Stock Corporation Basic RequirementsRhyz Taruc-ConsorteОценок пока нет

- Auditing & Cost AccountingДокумент10 страницAuditing & Cost AccountingSachin MoreОценок пока нет

- Vision My Sbi My Customer First My SBI First in Customer Satisfaction MissionДокумент4 страницыVision My Sbi My Customer First My SBI First in Customer Satisfaction MissionAnandJollyОценок пока нет

- Government GrantДокумент4 страницыGovernment GrantMary Jescho Vidal AmpilОценок пока нет

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementДокумент12 страницCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiОценок пока нет

- The Performance of Cooperative Banking in India.: EconomicsДокумент3 страницыThe Performance of Cooperative Banking in India.: EconomicsmovinОценок пока нет

- GAMUDA - Financial StatementДокумент214 страницGAMUDA - Financial StatementAnonymous fE2l3DzlОценок пока нет

- RODGEN Fs Subject For SofboundДокумент40 страницRODGEN Fs Subject For SofboundMara Jean Marielle CalapardoОценок пока нет

- FIN-1149-Finance For Non-Finance Managers-Module HANDBOOK - 2022-23 - UpdatedДокумент26 страницFIN-1149-Finance For Non-Finance Managers-Module HANDBOOK - 2022-23 - UpdatedTyka TrầnОценок пока нет

- As2114 2021 QPДокумент8 страницAs2114 2021 QPTuff BubaОценок пока нет

- Changes in The Indian Financial System Since 1991Документ8 страницChanges in The Indian Financial System Since 1991Samyra RathoreОценок пока нет