Академический Документы

Профессиональный Документы

Культура Документы

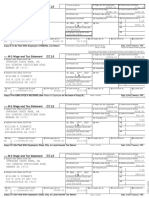

Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick Pay

Загружено:

Jesse NicholsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick Pay

Загружено:

Jesse NicholsАвторское право:

Доступные форматы

a Employee’s social security number

000-00-0000 OMB No. 1545-0008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

12-3456789 $40,000 $4,000

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

$40,000 $2,400

Fake Company

5 Medicare wages and tips 6 Medicare tax withheld

1234 Fake Dr

$40,000 $600

Augusta, GA 30909

7 Social security tips 8 Allocated tips

d Control number 9 10 Dependent care benefits

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a

C

o

d D $2,233.02

Casey Smith e

13 Statutory Retirement Third-party 12b

4321 Fake Dr employee plan sick pay C

Augusta, GA 30909 ✘

o

d

e

DD $2,687.04

14 Other 12c

C

o

d

e

12d

C

o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

GA 1234567YZ $20,000 $1,750

SC 7654321AB $20,000 $1,750

W-2 Wage and Tax Department of the Treasury—Internal Revenue Service

Form Statement

Copy 2—To Be Filed With Employee’s State, City, or Local

2019

Income Tax Return

Вам также может понравиться

- US Tax ReturnДокумент37 страницUS Tax ReturnMySPNN100% (2)

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnДокумент5 страницCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- 2019 W-2 and Earnings SummaryДокумент1 страница2019 W-2 and Earnings SummaryGeorge LucasОценок пока нет

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceДокумент2 страницыW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxОценок пока нет

- MGPTaxReturn 2021Документ93 страницыMGPTaxReturn 2021KGW NewsОценок пока нет

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnДокумент1 страницаCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahОценок пока нет

- Tax FormsДокумент2 страницыTax Formswilliam schwartz50% (2)

- Employee Pay StubДокумент2 страницыEmployee Pay StubTasnim jamil100% (1)

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Документ2 страницыJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Документ1 страницаThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekОценок пока нет

- PaystubsДокумент3 страницыPaystubsapi-418014547Оценок пока нет

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeДокумент2 страницы20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsДокумент2 страницыW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Wage and Tax Statement: Copy C-For Employee'S RecordsДокумент1 страницаWage and Tax Statement: Copy C-For Employee'S RecordslidiaОценок пока нет

- Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Документ2 страницыSebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Deborah Beth DarlingОценок пока нет

- 2021 W-2 Earnings SummaryДокумент2 страницы2021 W-2 Earnings Summaryseguins0% (1)

- form-w2-Ramona-Crawford 2Документ9 страницform-w2-Ramona-Crawford 2Nicole CarutherОценок пока нет

- OMB No. 1545-0008 OMB No. 1545-0008Документ2 страницыOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Документ2 страницыMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcОценок пока нет

- AutoPay Output Documents PDFДокумент2 страницыAutoPay Output Documents PDFAnonymous QZuBG2IzsОценок пока нет

- Fake PaystubДокумент1 страницаFake PaystubBrandon CarpenterОценок пока нет

- StubsДокумент2 страницыStubsAnonymous 8C2bCutL0100% (2)

- 2022 TaxReturnДокумент6 страниц2022 TaxReturnLALLOUS KHOURY100% (3)

- HERBERT HERNANDEZ 2019 Tax Return PDFДокумент31 страницаHERBERT HERNANDEZ 2019 Tax Return PDFSwazelleDiane50% (2)

- How to File Your 2020 W-2 FormДокумент5 страницHow to File Your 2020 W-2 FormVincent NewsonОценок пока нет

- January 2022 Debit Account Statement for Douglas Jon HarveyДокумент1 страницаJanuary 2022 Debit Account Statement for Douglas Jon HarveyMark Dewey0% (1)

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Документ1 страницаProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09rohit dasОценок пока нет

- Profit or Loss From Business: Schedule C (Form 1040) 09Документ2 страницыProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- Statement For 2022-1Документ2 страницыStatement For 2022-1Hengki Yono100% (1)

- Business Income Tax ReturnДокумент2 страницыBusiness Income Tax ReturnMNCOOhioОценок пока нет

- Ralston Medina W2Документ2 страницыRalston Medina W2bussinesl las100% (1)

- Wage and Tax Statement: Last Name SuffДокумент1 страницаWage and Tax Statement: Last Name SuffDavid RadОценок пока нет

- Proof of renters insurance documentДокумент1 страницаProof of renters insurance documentQuintinaОценок пока нет

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnДокумент1 страницаW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaОценок пока нет

- 2022 Form W-4 - fw4-22Документ4 страницы2022 Form W-4 - fw4-22Gloria FonteОценок пока нет

- U.S. Individual Income Tax Return: Boddu 629-68-1309 SAIДокумент3 страницыU.S. Individual Income Tax Return: Boddu 629-68-1309 SAIssi bodduОценок пока нет

- Dan Simon 2016 W2 PDFДокумент2 страницыDan Simon 2016 W2 PDFAnonymous ndTTXL80MnОценок пока нет

- IRS Form W2Документ1 страницаIRS Form W2nurulamin00023Оценок пока нет

- PDF DocumentДокумент1 страницаPDF DocumentAngelo DiloneОценок пока нет

- File W-2s ElectronicallyДокумент11 страницFile W-2s Electronicallyhossain ronyОценок пока нет

- Wage and Tax Statement: OMB No. 1545-0008Документ4 страницыWage and Tax Statement: OMB No. 1545-0008jgoldson235Оценок пока нет

- Wage and Tax Statement: OMB No. 1545-0008Документ6 страницWage and Tax Statement: OMB No. 1545-0008SuheilОценок пока нет

- Elina Shinkar w2 2014Документ2 страницыElina Shinkar w2 2014api-318948819Оценок пока нет

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnДокумент1 страницаW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaОценок пока нет

- A DP Payroll With CheckДокумент1 страницаA DP Payroll With CheckFuvv FreeОценок пока нет

- 623 Cce 3 BD 2 FB 0Документ1 страница623 Cce 3 BD 2 FB 0mondol miaОценок пока нет

- Filename PDFДокумент3 страницыFilename PDFIvette PizarroОценок пока нет

- Patricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Документ16 страницPatricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Maria Valentina Neira GonzalezОценок пока нет

- Uniform Residential Loan Application: Section 1: Borrower InformationДокумент12 страницUniform Residential Loan Application: Section 1: Borrower InformationJuan C100% (1)

- 2021 W2 Angela LiДокумент1 страница2021 W2 Angela LiDAISY CRAINОценок пока нет

- Wage and Tax Statement: Copy C-For Employee'S RecordsДокумент3 страницыWage and Tax Statement: Copy C-For Employee'S RecordsyoОценок пока нет

- 1099 Form Year 2021Документ8 страниц1099 Form Year 2021Candy Valentine100% (1)

- W-2 Form DetailsДокумент6 страницW-2 Form Detailsjacqueline corral0% (1)

- Adriano Alessandro Averzano 2019 Tax ReturnДокумент21 страницаAdriano Alessandro Averzano 2019 Tax ReturnMucho FacerapeОценок пока нет

- Review of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsОт EverandReview of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsОценок пока нет

- W 2Документ6 страницW 2prads1259Оценок пока нет

- 2019 Louisiana Resident - 2DДокумент4 страницы2019 Louisiana Resident - 2Djamo christine100% (1)

- Wells Fargo Everyday CheckingДокумент3 страницыWells Fargo Everyday CheckingTest000001Оценок пока нет

- Green Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueДокумент27 страницGreen Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueDickОценок пока нет

- SOP - HOtel Credit Policy and PRoceduresДокумент4 страницыSOP - HOtel Credit Policy and PRoceduresImee S. YuОценок пока нет

- Business Law and Regulations - CorporationДокумент15 страницBusiness Law and Regulations - CorporationMargie RosetОценок пока нет

- Hitech Security BrochureДокумент9 страницHitech Security BrochureKawalprit BhattОценок пока нет

- HeyДокумент35 страницHeyMarth0100% (1)

- The End of Ownership 2020Документ37 страницThe End of Ownership 2020Hugo Cocoletzi A100% (1)

- PEN KY Olicy: Need For Open Skies PolicyДокумент5 страницPEN KY Olicy: Need For Open Skies PolicyDebonair Shekhar100% (1)

- Cooperatives (Republic Act No. 9520 A.k, A. Philippine Cooperative Code of 2008)Документ14 страницCooperatives (Republic Act No. 9520 A.k, A. Philippine Cooperative Code of 2008)xinfamousxОценок пока нет

- Employee's W-2 FormДокумент1 страницаEmployee's W-2 FormDAISY CRAINОценок пока нет

- ITL TutorialДокумент14 страницITL TutorialSadhvi SinghОценок пока нет

- Importance of Market Research in Marketing ProgramsДокумент10 страницImportance of Market Research in Marketing ProgramsPrincessqueenОценок пока нет

- The Common Forms of Debt Restructuring: Asset SwapДокумент5 страницThe Common Forms of Debt Restructuring: Asset SwapJonathan VidarОценок пока нет

- HUMAN RESOURCE MANAGEMENT FUNCTIONS OBJECTIVES CHALLENGESДокумент71 страницаHUMAN RESOURCE MANAGEMENT FUNCTIONS OBJECTIVES CHALLENGESviper9930950% (2)

- Inventory Planning: Nazmun NaharДокумент29 страницInventory Planning: Nazmun NaharKamrulHassanОценок пока нет

- Flexible Budget Variances Review of Chapters David James Is AДокумент1 страницаFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghОценок пока нет

- Jummy's Final ThesisДокумент340 страницJummy's Final ThesisSucroses TxtОценок пока нет

- Significance of Corporate Law in Nigeria by Sheriffdeen AmoduДокумент7 страницSignificance of Corporate Law in Nigeria by Sheriffdeen AmoduSheriffdeenОценок пока нет

- Binu 500KДокумент11 страницBinu 500KAnonymous XdHQb0Оценок пока нет

- Meenachi RKДокумент7 страницMeenachi RKmeenachiОценок пока нет

- 空白信用证版本Документ5 страниц空白信用证版本ansontzengОценок пока нет

- Price MechanismДокумент10 страницPrice MechanismRyan ThomasОценок пока нет

- Company Member Details and Lean Management ReportДокумент17 страницCompany Member Details and Lean Management ReportAritra BanerjeeОценок пока нет

- Organization and Its EnvironmentДокумент39 страницOrganization and Its EnvironmentAntawnYo TreyОценок пока нет

- Garcia'S Data Encoders Trial Balance MAY Account Title Debit CreditДокумент4 страницыGarcia'S Data Encoders Trial Balance MAY Account Title Debit CreditChristel TacordaОценок пока нет

- Bandai Namco Holdings Financial ReportДокумент1 страницаBandai Namco Holdings Financial ReportHans Surya Candra DiwiryaОценок пока нет

- Human Population - Guided Viewing WorksheetДокумент2 страницыHuman Population - Guided Viewing Worksheetapi-235669157Оценок пока нет

- 1392628459421Документ48 страниц1392628459421ravidevaОценок пока нет

- Chapter 2 The Marketing Environment Social Responsibility and EthicsДокумент32 страницыChapter 2 The Marketing Environment Social Responsibility and EthicsAnhQuocTranОценок пока нет

- KU Internship Report on Nepal Investment BankДокумент39 страницKU Internship Report on Nepal Investment Bankitsmrcoolpb100% (1)

- Not Payable in Case Subsidized Canteen Facilities Are ProvidedДокумент1 страницаNot Payable in Case Subsidized Canteen Facilities Are Providedsurabhiarora1Оценок пока нет

- For A New Coffe 2 6Документ2 страницыFor A New Coffe 2 6Chanyn PajamutanОценок пока нет