Академический Документы

Профессиональный Документы

Культура Документы

Business Organizations

Загружено:

Courtney TirolИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Business Organizations

Загружено:

Courtney TirolАвторское право:

Доступные форматы

Tirol, C.

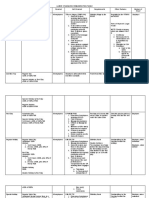

BUSINESS ORGANIZATION CHARTS

Sole Proprietorship Corporation

Neither a creature of statute nor contract; does not A creature of statute/contract.

involve complexity or expense required of

business associations.

Unorganized business owned by a person Organized business of a group of persons

No separate legal personality; owner has unlimited Has a separate legal personality distinct from

personal liability for all the debts and obligations, persons in corporation.

and all actions are enforced against him. SP can’t

file an action separate from proprietor.

Only available methods of obtaining funds are Contributions obtained from components

personal contributions and loans from financial

institutions or private sources (limited by potential

of business, credit standing, extent of properties

for collateral)

Totally dependent on life of proprietor. If he dies, Death of one member of a corporation does not

business operation may cease. He will have to rely necessarily dissolve the corporation.

on his heirs or other interested persons to ensure

the business will continue after his death.

Joint Accounts Partnerships

Juridical personality No juridical personality Has personality distinct from partners

Business name No commercial name common to Can adopt a partnership name

all participants can be adopted

Management Only ostensible partner manages General partners are all managers in

and transacts business in his own partnership

name and under his individual

liability

Parties in case Only ostensible partner can be All general partners may be liable

sued by and is liable to persons even up to extent of their

transacting with the former personalities and may therefore be

sued by third persons

Tirol, C.

Partnership Corporation

Manner of creation By mere agreement Commences only from issuance of

a Certificate of Registration of SEC

or passage of a special law

Number of organizers 2+ persons At least 5 persons

Powers Subject to what partners More restricted in its powers

agreed upon because of its limited personality

Authority Mutual agency; each can bind Stockholders are not agents in

the partnership absence of express authority

Transfer of interest Interest in partnership cannot Corporate shares are freely

be transferred without consent transferable without content of

of other partners other stockholders

Liability May be liable beyond their Liability of stockholders and

investment members for corporate obligations

is limited to their investment

Rights of Succession No right of succession; death There is a right of succession

of general partner dissolves

partnership

Juridical personality

Groups of persons

Capitals derived from components

Similarities

Distribution of profits

Both act only through agents

Organized only where there is law authorizing such

Advantages of Corporations Disadvantages of Corporations

1. The capacity to act as a legal unit 1. Prone to “double taxation”

2. Limitation of or exemption from individual 2. Subject to greater governmental regulation

liability of shareholders and control

3. Continuity of existence 3. May be burdened with an inefficient

4. Transferability of shares management if stockholders cannot

5. Centralized management of board of organize to oppose management

directors 4. Limited liability of stockholders may at times

6. Professional management translate to limited liability to raise creditor

7. Standardized method of organization, and capital

finance 5. Harder to organize compared to other

8. Easy capital generation business organizations

6. Harder or more complicated to maintain

7. “Owners” or stockholders do not participate

in day-to-day management

Вам также может понравиться

- Dividend Investing: The best Techniques and Strategies to Get Financial Freedom and Build Your Passive IncomeОт EverandDividend Investing: The best Techniques and Strategies to Get Financial Freedom and Build Your Passive IncomeОценок пока нет

- CORPO LAW ReviewДокумент39 страницCORPO LAW ReviewPea Del Monte AñanaОценок пока нет

- Ga MatrixДокумент11 страницGa MatrixVanessa May Caseres GaОценок пока нет

- Partnership Act Notes Fast Track FinalДокумент14 страницPartnership Act Notes Fast Track Finalsamsfib420Оценок пока нет

- Law On CorporationДокумент9 страницLaw On Corporationlord kwantoniumОценок пока нет

- Differences Between A Partnership and CorporationДокумент3 страницыDifferences Between A Partnership and CorporationJoyce JadulcoОценок пока нет

- CORPO and SEC Law Sections 1 80Документ68 страницCORPO and SEC Law Sections 1 80CG100% (1)

- Advanced Accounting Part 1Документ26 страницAdvanced Accounting Part 1Myrna LaquitanОценок пока нет

- Entrep - Module 5 - 0Документ31 страницаEntrep - Module 5 - 0Nooo.Оценок пока нет

- Law On CorporationДокумент10 страницLaw On CorporationShaira Mea GulaОценок пока нет

- UntitledДокумент3 страницыUntitledMaetherese SaradponОценок пока нет

- Ownership and OrganizationДокумент9 страницOwnership and OrganizationJasmin VillamorОценок пока нет

- CHAPTER 14 Corporations Basic ConsiderationsДокумент8 страницCHAPTER 14 Corporations Basic ConsiderationsGabrielle Joshebed AbaricoОценок пока нет

- Partnership (Hand Out)Документ43 страницыPartnership (Hand Out)Roy Kenneth LingatОценок пока нет

- Corporate Law Lectures 1-9-MergedДокумент202 страницыCorporate Law Lectures 1-9-MergedAnkur AnandОценок пока нет

- Company Law Notes For MCCДокумент38 страницCompany Law Notes For MCCAllan StanleyОценок пока нет

- ParcorДокумент4 страницыParcorJolliza SibugОценок пока нет

- Requirement 1: Aspect Sole Proprietorship Partnership Corporation 1. DefinitionДокумент4 страницыRequirement 1: Aspect Sole Proprietorship Partnership Corporation 1. DefinitionRosette SANTOSОценок пока нет

- Chapter 28-Nature and Kinds of CompaniesДокумент34 страницыChapter 28-Nature and Kinds of CompaniesPooja SKОценок пока нет

- Rules in The Determination of Corporate NationalityДокумент7 страницRules in The Determination of Corporate NationalityRafael Renz DayaoОценок пока нет

- Corpo Law PrelimsДокумент14 страницCorpo Law PrelimsKatrina San MiguelОценок пока нет

- Sole Proprietorship: Types of Business OrganizationsДокумент25 страницSole Proprietorship: Types of Business OrganizationsApple Ke-eОценок пока нет

- Introduction To PartnershipДокумент21 страницаIntroduction To PartnershipRejean Dela CruzОценок пока нет

- Corporation 1 34Документ24 страницыCorporation 1 34Annamarisse parungaoОценок пока нет

- Corpo Notes LadiaДокумент125 страницCorpo Notes Ladiakyle terence viloria100% (1)

- Quiz CorpoДокумент2 страницыQuiz CorpoCharina Balunso-BasiloniaОценок пока нет

- Quality Apparel vs. Win Multi Rich, G.R. No. 175048 Dated 10 February 2009)Документ9 страницQuality Apparel vs. Win Multi Rich, G.R. No. 175048 Dated 10 February 2009)Lara WynonaОценок пока нет

- PartnershipДокумент2 страницыPartnershipMyra BarandaОценок пока нет

- Corporation Law ReviewerДокумент41 страницаCorporation Law ReviewerRik GarciaОценок пока нет

- Chapter 7Документ27 страницChapter 7Daisy RomaresОценок пока нет

- LAW ON BUSINESS ORGS Midterm ReviewerДокумент6 страницLAW ON BUSINESS ORGS Midterm ReviewerAdenielle DiLaurentisОценок пока нет

- Present EntreДокумент19 страницPresent EntreThurkhesan MuruganОценок пока нет

- BANDULA - COMPARE-Partnership vs. CorporationДокумент2 страницыBANDULA - COMPARE-Partnership vs. CorporationCharena BandulaОценок пока нет

- Module 6 RPHДокумент5 страницModule 6 RPHMaye PilapilОценок пока нет

- Forms of Business OrganizationДокумент9 страницForms of Business Organizationcristin l. viloriaОценок пока нет

- Partnership ActДокумент5 страницPartnership ActAhmad Ali AmjadОценок пока нет

- Corpo Reviewer MidtermsДокумент10 страницCorpo Reviewer MidtermscrisОценок пока нет

- Section 2 Attributes of A CorporationДокумент6 страницSection 2 Attributes of A CorporationMikaОценок пока нет

- 1.5 Partneship LawДокумент9 страниц1.5 Partneship LawGastor Hilary MtweveОценок пока нет

- Forms of Business OrganizationsДокумент17 страницForms of Business OrganizationscassyОценок пока нет

- Introduction To Business Administration: BS MathematicsДокумент12 страницIntroduction To Business Administration: BS Mathematicskanwal hafeezОценок пока нет

- Note On Corp CodeДокумент38 страницNote On Corp CodeRochelle CiprianoОценок пока нет

- ScriptsДокумент7 страницScriptsBusiness100% (1)

- Topic 4 - Business Entities, Rules and Support UpdatedДокумент64 страницыTopic 4 - Business Entities, Rules and Support UpdatedSharveni SivamaniОценок пока нет

- COMPANY LAW 1 Final EdДокумент48 страницCOMPANY LAW 1 Final EdNuwamanya DerrickОценок пока нет

- Chapter 9 The Organization Plan Group 3Документ52 страницыChapter 9 The Organization Plan Group 3Riel Mancera, RM, RN, USRN, NP, MANОценок пока нет

- Legal AspectДокумент12 страницLegal AspectVhin BaldonОценок пока нет

- Company 1Документ48 страницCompany 1mcyhndhieОценок пока нет

- Reviewer (Partnership)Документ13 страницReviewer (Partnership)JasminAubreyОценок пока нет

- V. Imperial Insurance)Документ3 страницыV. Imperial Insurance)Di CanОценок пока нет

- Corporation Law Notes by AquinoДокумент3 страницыCorporation Law Notes by AquinoBaesittieeleanor Mamualas100% (1)

- Forms of Business OrganizationДокумент41 страницаForms of Business OrganizationAlexa Maglaya-Miranda GabrielОценок пока нет

- Module 2Документ12 страницModule 2Shayek tysonОценок пока нет

- ch3 EntreДокумент60 страницch3 EntreeyoyoОценок пока нет

- Characteristics of CompanyДокумент3 страницыCharacteristics of Companyjainsomya869Оценок пока нет

- NOTES Corporation LawДокумент43 страницыNOTES Corporation LawwhatrichОценок пока нет

- CHAPTER 1 L1.1 Forms of Business in Social Economic DevelopmentДокумент5 страницCHAPTER 1 L1.1 Forms of Business in Social Economic DevelopmentSyrill CayetanoОценок пока нет

- CompanylawДокумент19 страницCompanylawarunvklplmОценок пока нет

- Corpo Midterms Notes 501 PDFДокумент83 страницыCorpo Midterms Notes 501 PDFPhil JaramilloОценок пока нет

- Labor Standards Benefits - Remunerations TableДокумент8 страницLabor Standards Benefits - Remunerations TableCourtney TirolОценок пока нет

- Philippine Geothermal, Inc. Employees Union (PGIEU) vs. Chevron Geothermal Phils. Holdings, Inc.Документ3 страницыPhilippine Geothermal, Inc. Employees Union (PGIEU) vs. Chevron Geothermal Phils. Holdings, Inc.Courtney TirolОценок пока нет

- VIII. Education, Science, Technology, Arts, Culture and SportsДокумент8 страницVIII. Education, Science, Technology, Arts, Culture and SportsCourtney TirolОценок пока нет

- X. Public International LawДокумент29 страницX. Public International LawCourtney TirolОценок пока нет

- Consti Law 2 ReviewerДокумент16 страницConsti Law 2 ReviewerCourtney Tirol100% (1)

- Iran V NLRCДокумент3 страницыIran V NLRCCourtney TirolОценок пока нет

- Pacific Metals v. Edgar TamayoДокумент4 страницыPacific Metals v. Edgar TamayoCourtney TirolОценок пока нет

- VI. Bill of Rights - A To EДокумент87 страницVI. Bill of Rights - A To ECourtney TirolОценок пока нет

- IX. National Economy and PatrimonyДокумент31 страницаIX. National Economy and PatrimonyCourtney TirolОценок пока нет

- VI. Bill of Rights - O To TДокумент70 страницVI. Bill of Rights - O To TCourtney TirolОценок пока нет

- Diambrang v. COMELEC (2016)Документ2 страницыDiambrang v. COMELEC (2016)Courtney Tirol100% (1)

- 82 Lagman V Medialdea (2017)Документ7 страниц82 Lagman V Medialdea (2017)Courtney TirolОценок пока нет

- Philippine Airlines (PAL) vs. NLRCДокумент2 страницыPhilippine Airlines (PAL) vs. NLRCCourtney TirolОценок пока нет

- Caranto vs. Bergesen D.Y. Phils., Inc.Документ3 страницыCaranto vs. Bergesen D.Y. Phils., Inc.Courtney TirolОценок пока нет

- Alilin v. Petron (2014)Документ13 страницAlilin v. Petron (2014)Courtney TirolОценок пока нет

- Baguio v. NLRC (1991)Документ9 страницBaguio v. NLRC (1991)Courtney TirolОценок пока нет

- Labor Finals CasesДокумент221 страницаLabor Finals CasesCourtney TirolОценок пока нет

- PICOP Resources v. de GuilaДокумент3 страницыPICOP Resources v. de GuilaCourtney TirolОценок пока нет

- Fortun v. Macapagal-ArroyoДокумент5 страницFortun v. Macapagal-ArroyoCourtney TirolОценок пока нет

- Lagman v. Pimentel III, 854 SCRA 184 (G.R. Nos. 235935, Et Al., 6 February 2018)Документ6 страницLagman v. Pimentel III, 854 SCRA 184 (G.R. Nos. 235935, Et Al., 6 February 2018)Courtney TirolОценок пока нет

- Padilla v. Congress of The Philippines, 832 SCRA 282 (2017)Документ4 страницыPadilla v. Congress of The Philippines, 832 SCRA 282 (2017)Courtney TirolОценок пока нет

- Department of Foreign Affairs v. NLRCДокумент3 страницыDepartment of Foreign Affairs v. NLRCCourtney Tirol100% (1)

- Belyca Corporation v. Ferrer-CallejaДокумент4 страницыBelyca Corporation v. Ferrer-CallejaCourtney TirolОценок пока нет

- 2003 - Tirol - Transportation LawДокумент2 страницы2003 - Tirol - Transportation LawCourtney TirolОценок пока нет

- 2003 - TIROL - Credit TransactionsДокумент2 страницы2003 - TIROL - Credit TransactionsCourtney TirolОценок пока нет

- UST Faculty Union v. USTДокумент3 страницыUST Faculty Union v. USTCourtney TirolОценок пока нет

- Associated Trade Unions (ATU) v. Ferrer-CallejaДокумент3 страницыAssociated Trade Unions (ATU) v. Ferrer-CallejaCourtney TirolОценок пока нет

- INSURANCE BAR Q&As 2003Документ1 страницаINSURANCE BAR Q&As 2003Courtney TirolОценок пока нет

- 2003 - TIROL - Corporation LawДокумент2 страницы2003 - TIROL - Corporation LawCourtney TirolОценок пока нет

- San Miguel Foods, Inc. (SMFI) v. San Miguel Corporation Employees Union-PTWGOДокумент2 страницыSan Miguel Foods, Inc. (SMFI) v. San Miguel Corporation Employees Union-PTWGOCourtney TirolОценок пока нет

- Accounting MechanicsДокумент21 страницаAccounting MechanicsPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (1)

- Project Report Format For Bank LoanДокумент7 страницProject Report Format For Bank LoanRaju Ramjeli70% (10)

- Securities Regulation OutlineДокумент27 страницSecurities Regulation OutlineWaseem Barazi100% (2)

- Investment Planning (Finally Done)Документ146 страницInvestment Planning (Finally Done)api-3814557100% (2)

- Statistical Cost AccountingДокумент20 страницStatistical Cost AccountingBirat Sharma100% (1)

- Little Paris Expansion PresentationДокумент12 страницLittle Paris Expansion PresentationKeith KhooОценок пока нет

- SEC Opinion Rules-Governing-Redeemable-and-Treasury-Shares PDFДокумент2 страницыSEC Opinion Rules-Governing-Redeemable-and-Treasury-Shares PDFLarisa SerzoОценок пока нет

- The Bcci DocsДокумент86 страницThe Bcci DocsScripts8100% (1)

- Paradigm Development Corp. v. BPIДокумент9 страницParadigm Development Corp. v. BPIMitch BarandonОценок пока нет

- Assignment-Self Service LaundryДокумент11 страницAssignment-Self Service LaundryRowellPaneloSalapare100% (1)

- The Charles Schwab Corporation: United States Securities and Exchange Commission FORM 10-KДокумент113 страницThe Charles Schwab Corporation: United States Securities and Exchange Commission FORM 10-KVikas SinghОценок пока нет

- Airbus Figure Loaned Money To Former AltaДокумент2 страницыAirbus Figure Loaned Money To Former AltaCharles RusnellОценок пока нет

- Capital Markets ProjectДокумент54 страницыCapital Markets Projectjaggis1313100% (4)

- Bill Newland Fidelity Lender Processing ServicesДокумент325 страницBill Newland Fidelity Lender Processing ServicesForeclosure FraudОценок пока нет

- 0452 s04 QP 1Документ11 страниц0452 s04 QP 1MahmozОценок пока нет

- AppendixДокумент4 страницыAppendixJayanga JayathungaОценок пока нет

- Chapter 16: Fixed Income Portfolio ManagementДокумент20 страницChapter 16: Fixed Income Portfolio ManagementSilviu TrebuianОценок пока нет

- Financial Statements, Cash Flow, and TaxesДокумент30 страницFinancial Statements, Cash Flow, and TaxesSumitMadnaniОценок пока нет

- Shirt Size: Ys Ym Yl S M L: 469 Strathmore Dr. Sharpsburg, Ga. 30277Документ1 страницаShirt Size: Ys Ym Yl S M L: 469 Strathmore Dr. Sharpsburg, Ga. 30277api-253063636Оценок пока нет

- Bendigo Final ReportДокумент26 страницBendigo Final ReportHumayra Sharif0% (1)

- BRI Briefing Paper English PDFДокумент26 страницBRI Briefing Paper English PDFRizki Fajar Novanto100% (1)

- The Madhya Pradesh Treasury Code: Section I-GeneralДокумент14 страницThe Madhya Pradesh Treasury Code: Section I-GeneralMONISH NAYARОценок пока нет

- WorksheetДокумент3 страницыWorksheetRonnie Lloyd Javier100% (3)

- 1285760544turn092910webДокумент32 страницы1285760544turn092910webCoolerAdsОценок пока нет

- Rs 55,000 Crore Air India ScamДокумент19 страницRs 55,000 Crore Air India Scamhindu.nationОценок пока нет

- Tulip InfrastructureДокумент57 страницTulip InfrastructuretauchachaОценок пока нет

- Types of Working CapitalДокумент44 страницыTypes of Working CapitalrajeevmbaОценок пока нет

- Ashok Commercial Enterprises vs. Parekh Aluminex LTDДокумент3 страницыAshok Commercial Enterprises vs. Parekh Aluminex LTDChitra ChakrapaniОценок пока нет

- Rofessional ThicsДокумент43 страницыRofessional ThicsNovita A. N. LelyОценок пока нет

- Mortgage Tax StatementДокумент1 страницаMortgage Tax StatementAriz10Оценок пока нет