Академический Документы

Профессиональный Документы

Культура Документы

May 2018 Actual A Paper PDF

Загружено:

Manasa SureshОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

May 2018 Actual A Paper PDF

Загружено:

Manasa SureshАвторское право:

Доступные форматы

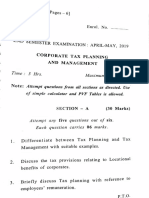

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT

Question No.1 is compulsory.

Attempt any four out of the remaining five questions.

Wherever appropriate, suitable assumptions should be made and indicated in the answer by

the candidate.

Working notes should form part of the answer.

Question 1

(a) Tatu Ltd. wants to takeover Mantu Ltd. and has offered a swap ratio of 1:2 (0.5 shares for

everyone share of Mantu Ltd.). Following information is provided

Tatu Ltd. Mantu Ltd.

Profit after tax ` 24,00,000 ` 4,80,000

Equity shares outstanding (Nos.) 8,00,000 2,40,000

EPS `3 `2

PE Ratio 10 times 7 times

Market price per share `30 ` 14

You are required to calculate:

(i) The number of equity shares to be issued by Tatu Ltd. for acquisition of Mantu Ltd.

(ii) What is the EPS of Tatu Ltd. after the acquisition?

(iii) Determine the equivalent earnings per share of Mantu Ltd.

(iv) What is the expected market price per share of Tatu Ltd. after the acquisition,

assuming its PE multiple remains unchanged?

(v) Determine the market value of the merged firm. (8 Marks)

(b) Following information is given:

Exchange rates: Canadian dollar 0.666 per DM (spot)

Canadian dollar 0.671 per DM (3-months)

Interest rates: DM 7.5% p.a.

Canadian Dollar - 9.5% p.a.

To take the possible arbitrage gains, what operations would be carried out? (8 Marks)

(c) Write a short note on Real Estate Regulatory Authority (RERA). (4 Marks)

Answer

(a) (i) The number of shares to be issued by Tatu Ltd.:

The Exchange ratio is 0.5

© The Institute of Chartered Accountants of India

2 FINAL (NEW) EXAMINATION: MAY, 2018

So, new Shares = 2,40,000 x 0.5 = 1,20,000 shares.

(ii) EPS of Tatu Ltd. after acquisition:

Total Earnings (` 24,00,000 + ` 4,80,000) `28,80,000

No. of Shares (8,00,000 + 1,20,000) 9,20,000

EPS (` 28,80,000)/ 9,20,000) `3.13

(iii) Equivalent EPS of Mantu Ltd.:

No. of new Shares 0.5

EPS `3.13

Equivalent EPS (` 3.13 x 0.5) `1.57

(iv) New Market Price of Tatu Ltd. (P/E remaining unchanged)

Present P/E Ratio of A Ltd. 10 times

Expected EPS after merger `3.13

Expected Market Price (`3.13 x 10) `31.30

(v) Market Value of merged firm:

Total number of Shares 9,20,000

Expected Market Price `31.30

Total value (9,20,000 x 31.30) `2,87,96,000

(b) In this case, DM is at a premium against the Can$.

Premium = [(0.671 – 0.666) /0.666] x (12/3) x 100 = 3.00 per cent

Interest rate differential = 9.5% - 7.5% = 2 per cent.

Since the interest rate differential is smaller than the premium, it will be profitable to place

money in Deutschmarks the currency whose 3-months interest is lower.

The following operations are carried out:

(i) Borrow Can$ 1000 at 9.5 per cent for 3- months;

(ii) Change this sum into DM at the spot rate to obtain DM

= (1000/0.666) = 1501.50

(iii) Place DM 1501.50 in the money market for 3 months to obtain a sum of DM

Principal: 1501.50

Add: Interest @ 7.5% for 3 months = 28.15

Total 1529.65

(iv) Sell DM at 3-months forward to obtain Can$= (1529.65x0.671) = 1026.40

(v) Refund the debt taken in Can$ with the interest due on it, i.e.,

© The Institute of Chartered Accountants of India

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT 3

Can$

Principal 1000.00

Add: Interest @ 9.5% for 3 months 23.75

Total 1023.75

Net arbitrage gain = 1026.40 – 1023.75 = Can$ 2.65

Note: The students may use any quantity of currency to arrive at the arbitrage gain since

no specific amount is mentioned in the question.

(c) Short Note on Real Estate Regulatory Authority (RERA): India has a vast population

with needs regarding food, house and jobs on an ever-increase mode. The housing among

these fields is one of the major ones. Thousands of people have grown to be rich and as

many of them have made loss in real estate business. It is the one of the leading revenue

generators for the government. Even though it has such strong presence in the country, it

never had a regulating body. Due to the failure of the government to observe this, many

people have become the victims of some scheming people doing the real estate business.

The buyers who come from a middle-class background have time and again fallen prey to

such petty real estate developers. There was a growing need to bring a transparent

government body which can check the developers.

Finally, the government delivered by making an authority known as RERA which stands

for Real Estate Regulatory Authority. It was passed in March 2016 by the parliament. This

promises to bring a justice to the buyer through making strict policies that have to be

fulfilled by the developers to sell their projects. The major problem that real estate in India

is facing is that of the delayed possession given to the home seeker by the rich and the

cunning builders. Thus, RERA will help people by bringing in a high level of transparency

and discipline that these builders must have to follow.

The laws under RERA are still in the early days of development but one thing is for sure

that there will be a huge relief for the buyers regarding developer-specific risk. The

mechanism of RERA will be made such that it provides a common ground for both the

buyers as well as the developers. Transparency is the key point regarding the rules under

RERA as the government wants that every aspect of information that the general public

should know should be made available on an informational portal.

The regulatory risk will also be laid upon the developer as he will have to pay compensation

if any mishap happens while giving the possession of a unit. All the builders will have to

register themselves under RERA which will see a low risk in the property business.

Question 2

(a) Consider the following information on two stocks, X and Y.

Year 2016 2017

Return on X (%) 10 16

Return on Y (%) 12 18

© The Institute of Chartered Accountants of India

4 FINAL (NEW) EXAMINATION: MAY, 2018

You are required to calculate:

(i) The expected return on a portfolio containing X and Y in the proportion of 40% and

60% respectively.

(ii) The Standard Deviation of return from each of the two stocks.

(iii) The Covariance of returns from the two stocks.

(iv) The Correlation coefficient between the returns of the two stocks.

(v) The risk of a portfolio containing X and Y in the proportion of 40% and 60%.

(10 Marks)

(b) Sabanam Ltd. has issued convertible debentures with coupon rate 11%. Each debenture

has an option to convert to 16 equity shares at any time until the date of maturity.

Debentures will be redeemed at ` 100 on maturity of 5 years. An investor generally

requires a rate of return of 8% p.a. on a 5-year security. As an advisor, when will you

advise the investor to exercise conversion for given market prices of the equity share of (i)

` 5, (ii) ` 6 and (iii) ` 7.10.

Cumulative PV factor for 8% for 5 years : 3.993

PV factor for 8% for year 5 : 0.681 (6 Marks)

(c) Explain the interface of Financial Policy and Strategic Management. (4 Marks)

Answer

(a) (i) Expected return of portfolio containing X and Y in the ratio 40%,60%

E (X) = (10 + 16) / 2 = 13%

E (Y) = (12 + 18) / 2 = 15%

N

Rp = X iR i 0.4(13) 0.6(15) 14.2%

i l

(ii) Standard Deviation of X and Y

Stock X:

Variance = 0.5 (10 – 13)² + 0.5 (16 – 13) ² = 9

Standard deviation = 3%

Stock Y:

Variance = 0.5 (12 – 15) ² + 0.5 (18 – 15) ² = 9

Standard deviation = 3%

(iii) CovXY = 0.5 (10 – 13) (12 – 15) + 0.5 (16 – 13) (18 – 15) = 9

𝐶𝑜𝑣 (𝑋,𝑌) 9

(iv) Correlation Coefficient =𝜌= 𝜎𝑥𝜎𝑦

=9=1

(v) Risk of portfolio containing 40% X and 60 % Y

© The Institute of Chartered Accountants of India

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT 5

𝜎𝑝= X 2X 2X X 2Y 2Y 2X X X Y (X YCorr.XY )

= 0.42 32 0.62 32 20.40.6331

= 1.44 3.24 4.32 3%

(b) If Debentures are not converted its value is as under: -

PVF @ 8 % `

Interest - ` 11 for 5 years 3.993 43.923

Redemption - ` 100 in 5th year 0.681 68.100

112.023

Value of equity shares:-

Market Price No. Total

`5 16 ` 80

`6 16 ` 96

` 7.10 16 ` 113.60

Hence, unless the market price is ` 7.10 conversion should not be exercised.

(c) The interface of strategic management and financial policy will be clearly understood if we

appreciate the fact that the starting point of an organization is money and the end point of

that organization is also money. No organization can run an existing business and promote

a new expansion project without a suitable internally mobilized financial base or both i.e.

internally and externally mobilized financial base.

Sources of finance and capital structure are the most important dimensions of a strategic

plan. The need for fund mobilization to support the expansion activity of firm is very vital

for any organization. The generation of funds may arise out of ownership capital and or

borrowed capital. A company may issue equity shares and / or preference shares for

mobilizing ownership capital and debenture to raise borrowed capital.

Policy makers should decide on the capital structure to indicate the desired mix of equity

capital and debt capital. There are some norms for debt equity ratio.

However this ratio in its ideal form varies from industry to industry. Another important

dimension of strategic management and financial policy interface is the investment and

fund allocation decisions. A planner has to frame policies for regulating investments in

fixed assets and for restraining of current assets. Investment proposals mooted by different

business units may be divided into three groups. One type of proposal will be for addition

of a new product, increasing the level of operation of an existing product and cost red uction

and efficient utilization of resources through a new approach and or closer monitoring of

the different critical activities. Dividend policy is another area for making financial policy

decisions affecting the strategic performance of the company. A close interface is needed

to frame the policy to be beneficial for all. Dividend policy decision deals with the extent of

© The Institute of Chartered Accountants of India

6 FINAL (NEW) EXAMINATION: MAY, 2018

earnings to be distributed as dividend and the extent of earnings to be retained for future

expansion scheme of the organization.

It may be noted from the above discussions that financial policy of a company cannot be

worked out in isolation of other functional policies. It has a wider appeal and closer link

with the overall organizational performance and direction of growth. As a result preference

and patronage for the company depends significantly on the financial policy framework.

Hence, attention of the corporate planners must be drawn while framing the financial

policies not at a later stage but during the stage of corporate planning itself.

Question 3

(a) Herbal World is a small, but profitable producer of beauty cosmetics using the plant Aloe

Vera. Though it is not a high-tech business, yet Herbal's earnings have averaged around

` 18.5 lakh after tax, mainly on the strength of its patented beauty cream to remove the

pimples.

The patent has nine years to run, and Herbal has been offered ` 50 lakhs for the patent

rights. Herbal's assets include ` 50 lakhs of property, plant and equipment and ` 25 lakhs

of working capital. However, the patent is not shown in the books of Herbal World.

Assuming Herbal's cost of capital being 14 percent, calculate its Economic Value Added

(EVA). (5 Marks)

(b) SG Mutual Fund Company has the following assets under it on the close of business

as on:

1st August 2017 2nd August 2017

Company No. of Shares Market price per share Market price per

(`) share (`)

Q Ltd. 2,000 200.00 205.00

R Ltd. 30,000 312.40 360.00

S Ltd. 40,000 180.60 191.55

T Ltd. 60,000 505.10 503.90

Total No. of Units issued by the Mutual Fund is 6,00,000.

(i) Calculate Net Assets Value (NAV) of the Fund.

(ii) Following information is also given:

Assuming that Mr. Zubin, an investor, submits a cheque of ` 30,00,000 to the Mutual Fund

and the Fund Manager of this entity purchases 8,000 shares of R Ltd; and the balance

amount is held in Bank. In such a case, what would be the position of the Fund?

(iii) Calculate new NAV of the Fund as on 2 nd August 2017. (10 Marks)

(c) Discuss what you understand about Embedded Derivatives. (5 Marks)

© The Institute of Chartered Accountants of India

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT 7

Answer

(a) EVA = NOPAT – WACC x Capital Employed.

Capital Employed: ` lacs

Property, etc. 50

Working Capital 25

Patent Value 50

Effective or Invested Capital 125

WACC x CE = 14% x ` 125 lacs= ` 17.5 lacs

EVA = ` 18.5 lacs – ` 17.5 lacs = ` 1 lac

(b) (i) NAV of the Fund

` 4,00,000 ` 93,72,000 ` 72,24,000 ` 3,03,06,000

=

6,00,000

` 4,73,02,000

= =` 78.8366 rounded to ` 78.84

6,00,000

Company 2/8/17 Value

Market Price /share

Q 205 4,10,000

R 360 108,00,000

S 191.55 76,62,000

T 503.90 302,34,000

Total 491,06,000

4,91,06,000

NAV per unit = 6,00,000

= 81.84

(ii) The revised position of fund shall be as follows:

Shares No. of shares Price Amount (`)

Q Ltd. 2000 200 4,00,000

R Ltd. 38,000 312.40 1,18,71,200

S Ltd. 40,000 108.60 72,24,000

T Ltd. 60,000 505.10 3,03,06,000

Cash 5,00,800

5,03,02,000

30,00,000

No. of units of fund = 6,00,000 = 6,38,053

78.8366

© The Institute of Chartered Accountants of India

8 FINAL (NEW) EXAMINATION: MAY, 2018

(iii) On 2nd August 2017, the NAV of fund will be as follows:

Shares No. of shares Price Amount (`)

Q Ltd. 2000 205 4,10,000

R Ltd. 38,000 360.00 1,36,80,000

S Ltd. 40,000 191.55 76,62,000

T Ltd. 60,000 503.90 3,02,34,000

Cash 5,00,800

5,24,86,800

` 5,24,86,800

NAV as on 2 ndAugust 2017 = = ` 82.26 per unit

6,38,053

(c) Embedded Derivatives: A derivative is defined as a contract that has all the following

characteristics:

• Its value changes in response to a specified underlying, e.g. an exchange rate,

interest rate or share price;

• It requires little or no initial net investment;

• It is settled at a future date;

• The most common derivatives are currency forwards, futures, options, interest rate

swaps etc.

An embedded derivative is a derivative instrument that is embedded in another contract -

the host contract. The host contract might be a debt or equity instrument, a lease, an

insurance contract or a sale or purchase contract.

Derivatives require to be marked-to-market through the income statement, other than

qualifying hedging instruments. This requirement on embedded derivatives are designed

to ensure that mark-to-market through the income statement cannot be avoided by

including - embedding - a derivative in another contract or financial instrument that is not

marked-to market through the income statement.

An embedded derivative can arise from deliberate financial engineering and intentional

shifting of certain risks between parties. Many embedded derivatives, however, arise

inadvertently through market practices and common contracting arrangeme nts. Even

purchase and sale contracts that qualify for executory contract treatment may contain

embedded derivatives. An embedded derivative causes modification to a contract's cash

flow, based on changes in a specified variable.

Question 4

(a) An established company is going to be de merged in two separate entities. The valuation

of the company is done by a well-known analyst. He has estimated a value of ` 5,000

lakhs, based on the expected free cash flow for next year of ` 200 lakhs and an expected

growth rate of 5%. While going through the valuation procedure, it was found that the

© The Institute of Chartered Accountants of India

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT 9

analyst has made the mistake of using the book values of debt and equity in his calculation.

While you do not know the book value weights he used, you have been provided with the

following information:

(i) The market value of equity is 4 times the book value of equity, while the market value

of debt is equal to the book value of debt,

(ii) Company has a cost of equity of 12%,

(iii) After tax cost of debt is 6%.

You are required to advise the correct value of the company. (8 Marks)

(b) Mr. KK purchased a 3-month call option for 100 shares in PQR Ltd. at a premium of

` 40 per share, with an exercise price of ` 560. He also purchased a 3-month put option

for 100 shares of the same company at a premium of ` 10 per share with an exercise price

of ` 460. The market price of the share on the date of Mr. KK's purchase of options, is

` 500. Compute the profit or loss that Mr. KK would make assuming that the market price

falls to ` 360 at the end of 3 months. (4 Marks)

(c) Interpret the Capital Asset Pricing Model (CAPM) and its relevant assumptions. (4 Marks)

(d) Explain the difference between Islamic Finance and Conventional Finance. (4 Marks)

Answer

𝐅𝐫𝐞𝐞 𝐂𝐚𝐬𝐡 𝐅𝐥𝐨𝐰 𝐚𝐭 𝐲𝐞𝐚𝐫 𝐞𝐧𝐝 𝟏

(a) Value of the Company = 𝐊𝐜−𝐠

, where Kc = weighted average cost of

capital.

𝟐𝟎𝟎

Value of the company = 5000 =

𝐊𝐜−𝟓

Kc – 5 = 200/5000 = 4%

Kc = 4% + 5% = 9%

We do not know the weights the analyst had taken for arriving at the cost of capital. Let w

be the proportion of equity. Then, (1-w) will be the proportion of debt.

Kc = 9 = w x 12 + (1-w) x 6

9 = 6 + 6w

6w = 3.

Hence w = 3/ 6 = 0.5 = 50 % or 1:1

The weights are equal i.e. 1:1 for equity and debt.

The correct weights should be market value of equity : market value of debts.

i.e. 4 times book value of equity : book value of debts. i.e. 4:1 equity : debt

Revised Kc = 4/5 x 12 + 1/5 x 6= 10.8 %

𝟐𝟎𝟎

Revised value of the company = = 200 / 5.8% = 3448.28 lacs.

𝟏𝟎.𝟖−𝟓

© The Institute of Chartered Accountants of India

10 FINAL (NEW) EXAMINATION: MAY, 2018

(b) Since the market price at the end of 3 months falls to ` 360 which is below the exercise

price under the call option, the call option will not be exercised. Only put option becomes

viable.

`

The gain will be:

Gain per share (`460 – ` 360) 100

Total gain per 100 shares 10,000

Cost or premium paid (` 40 x 100) + (` 10 x 100) 5,000

Net gain 5,000

(c) The Capital Asset Pricing Model was developed by Sharpe, Mossin and Linter in 1960. The

model explains the relationship between the expected return, non-diversifiable risk and the

valuation of securities. It considers the required rate of return of a security on the basis of

its contribution to the total risk.

It is based on the premises that the diversifiable risk of a security is eliminated when more

and more securities are added to the portfolio. However, the systematic risk cannot be

diversified and is or related with that of the market portfolio.

All securities do not have same level of systematic risk. The systematic risk can be

measured by beta, ß under CAPM, the expected return from a security can be expressed

as:

Expected return on security = Rf + Beta (Rm – Rf)

The model shows that the expected return of a security consists of the risk -free rate of

interest and the risk premium. The CAPM, when plotted on the graph paper is known as

the Security Market Line (SML). A major implication of CAPM is that not only every security

but all portfolios too must plot on SML.

This implies that in an efficient market, all securities are having expected returns

commensurate with their riskiness, measured by ß.

Relevant Assumptions of CAPM

(i) The investor’s objective is to maximize the utility of terminal wealth;

(ii) Investors make choices on the basis of risk and return;

(iii) Investors have identical time horizon;

(iv) Investors have homogeneous expectations of risk and return;

(v) Information is freely and simultaneously available to investors;

(vi) There is risk-free asset, and investor can borrow and lend unlimited amounts at the

risk-free rate;

(vii) There are no taxes, transaction costs, restrictions on short rates or other market

imperfections;

© The Institute of Chartered Accountants of India

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT 11

(viii) Total asset quantity is fixed, and all assets are marketable and divisible.

Thus, CAPM provides a conceptual framework for evaluating any investment decision,

where capital is committed with a goal of producing future returns.

(d) Major differences between Islamic finance and other form of finance (Conventional

Finance) are as follows:

Basis Islamic Finance Conventional Finance

Promotion Islamic Finance promotes just, Based on commercial objectives,

fair and balanced society. interest must be paid irrespective

Hence, interest is prohibited. of outcome of business.

Ethical framework Structured on ethical and moral No such framework.

framework of Sharia. Verses

from the holy Quran and

tradition from As-Sunnah are

two divine guidance.

Speculation The financial transactions No such restrictions.

should be free from the

element of uncertainty (Gharar)

and gambling (Maisir)

Unlawful Goods Islamic Finance must not be There are no such restrictions

and Services involved in any transactions not

allowed as per Islamic

principles such as alcohol,

armaments, pork and other

socially detrimental products.

Question 5

(a) Closing values of BSE Sensex from 6 th to 17th day of the month of January of the year 200

X were as follows:

Days Date Day Sense x

1 6 THU 29522

2 7 FRI 29925

3 8 SAT No Trading

4 9 SUN No Trading

5 10 MON 30222

6 11 TUE 31000

7 12 WED 31400

8 13 THU 32000

9 14 FRI No Trading

© The Institute of Chartered Accountants of India

12 FINAL (NEW) EXAMINATION: MAY, 2018

10 15 SAT No Trading

11 16 SUN No Trading

12 17 MON 33000

Compute Exponential Moving Average (EMA) of Sensex during the above period. The 30

days simple moving average of Sensex can be assumed as 30,000. The value of exponent

for 30 days EMA is 0.062.

Provide detailed analysis on the basis of your calculations. (8 Marks)

(b) Punjab Bank has entered into a plain vanilla swap through on Overnight Index Swap (OIS)

on a principal of ` 2 crore and agreed to receive MIBOR overnight floating rate for a fixed

payment on the principal. The swap was entered into on Monday, 24th July, 2017 and was

to commence on 25th July, 2017 and run for a period of 7 days.

Respective MIBOR rates for Tuesday to Monday were:

8.70%, 9.10%, 9.12%, 8.95%, 8.98% and 9.10%.

If Punjab Bank received ` 507 net on settlement, calculate Fixed rate and interest under

both legs.

Notes:

(i) Sunday is a Holiday.

(ii) Workout in rounded rupees and avoid decimal working.

(iii) Consider a year consists of 365 days. (8 Marks)

(c) Explain the advantages of bringing venture capital in the company. (4 Marks)

Answer

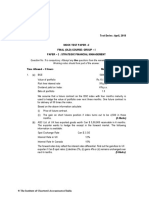

(a)

Date 1 2 3 4 5

Sensex EMA for EMA

Previous day 1-2 3×0.062 2+4

6 29522 30000 (478) (29.636) 29970.364

7 29925 29970.364 (45.364) (2.812) 29967.55

10 30222 29967.55 254.45 15.776 29983.32

11 31000 29983.32 1016.68 63.034 30046.354

12 31400 30046.354 1353.646 83.926 30130.28

13 32000 30130.28 1869.72 115.922 30246.202

17 33000 30246.202 2753.798 170.735 30416.937

Conclusion – The market is bullish. The market is likely to remain bullish for short term to

medium term if other factors remain the same. On the basis of this indicator (EMA) the

investors/brokers can take long position.

© The Institute of Chartered Accountants of India

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT 13

(b)

Day Principal (`) MIBOR (%) Interest (`)

Tuesday 2,00,00,000 8.70 4,767

Wednesday 2,00,04,767 9.10 4,987

Thursday 2,00,09,754 9.12 5,000

Friday 2,00,14,754 8.95 4,908

Saturday & Sunday (*) 2,00,19,662 8.98 9,851

Monday 2,00,29,513 9.10 4,994

Total Interest @ Floating 34,507

Less: Net Received 507

Expected Interest @ fixed 34,000

Thus Fixed Rate of Interest 0.0886428

Approx. 8.86%

(*) i.e. interest for two days.

(c) Advantages of bringing VC in the company:

❖ It injects long- term equity finance which provides a solid capital base for future

growth.

❖ The venture capitalist is a business partner, sharing both the risks and rewards.

Venture capitalists are rewarded with business success and capital gain.

❖ The venture capitalist is able to provide practical advice and assistance to the

company based on past experience with other companies which were in similar

situations.

❖ The venture capitalist also has a network of contacts in many areas that can add

value to the company.

❖ The venture capitalist may be capable of providing additional rounds of funding should

it be required to finance growth.

❖ Venture capitalists are experienced in the process of preparing a company for an

initial public offering (IPO) of its shares onto the stock exchanges or overseas stock

exchange such as NASDAQ.

❖ They can also facilitate a trade sale.

Question 6

(a) Omega Ltd. is interested in expanding its operation and planning to install manufacturing

plant at US. For the proposed project, it requires a fund of $10 million (net of issue

expenses or floatation cost). The estimated floatation cost is 2%. To finance this project, it

proposes to issue GDRs.

© The Institute of Chartered Accountants of India

14 FINAL (NEW) EXAMINATION: MAY, 2018

As a financial consultant, you are requested to compute the number of GDRs to be issued

and cost of the GDR with the help of following additional information:

(i) Expected market price of share at the time of issue of GDR is ` 250 (Face Value

being ` 100)

(ii) 2 shares shall underlay each GDR and shall be priced at 4% discount to market price.

(iii) Expected exchange rate ` 64/$

(iv) Dividend expected to be paid is 15% with growth rate 12%. (8 Marks)

(b) Neel holds ` 1 crore shares of XY Ltd. whose market price standard deviation is 2% per

day. Assuming 252 trading days in a year, determine maximum loss level over the period

of 1 trading day and 10 trading days with 99% confidence level. Assuming share prices are

normally for level of 99%, the equivalent Z score from Normal table of Cumulative Area

shall be 2.33. (4 Marks)

(c) Discuss briefly the steps involved in the Securitization mechanism.

OR

Explain the benefits of Securitization from the perspective of both originator as well as the

investor. (4 Marks)

(d) The risk free rate of return is 5%. The expected rate of return on the market portfolio is

11%. The expected rate of growth in dividend of X Ltd. is 8%. The last dividend paid was

` 2.00 per share. The beta of X Ltd. equity stock is 1.5.

(i) What is the present price of the equity stock of X Ltd.?

(ii) How would the price change when:

• The inflation premium increases by 3%

• The expected growth rate decreases by 3% and

• The beta decreases to 1.3. (4 Marks)

Answer

(a) Net Issue Size = $10 million

`10 million

Gross Issue = = $10.2041 million

0.98

Issue Price per GDR in ` (250 x 2 x 96%) ` 480

Issue Price per GDR in $ (` 480/ ` 64) $7.50

Dividend Per GDR (D 1) = ` 15 x 2 = ` 30

Net Proceeds Per GDR = ` 480 x 0.98 = ` 470.40

(i) Number of GDR to be issued

© The Institute of Chartered Accountants of India

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT 15

$10.2041 million

= 1.360547 million

$7.50

(ii) Cost of GDR to Omega Ltd.

30

ke 0.12 = 18.378%

470.40

(b) Assuming share prices are normally distributed, for level of 99%, the equivalent Z score

from Normal table of Cumulative Area is 2.33.

Volatility in terms of rupees is:

2% of ` 1 Crore = ` 2 lakh

The maximum loss for 1 day at 99% Confidence Level is

` 2 lakh x 2.33 = ` 4.66 lakh,

and expected maximum loss for 10 trading days shall be:

√10 x ` 4.66 lakh = 14.73 lakhs or 14.74 lakhs

(c) The steps involved in securitization mechanism are as follows:

Creation of Pool of Assets: The process of securitization begins with creation of pool of

assets by segregation of assets backed by similar type of mortgages in terms of interest

rate, risk, maturity and concentration units.

Transfer to SPV: One assets have been pooled, they are transferred to Special Purpose

Vehicle (SPV) especially created for this purpose.

Sale of Securitized Papers: SPV designs the instruments based on nature of interest,

risk, tenure etc. based on pool of assets. These instruments can be Pass Through Security

or Pay Through Certificates.

Administration of assets: The administration of assets in subcontracted back to

originator which collects principal and interest from underlying assets and transfer it to

SPV, which works as a conduct.

Recourse to Originator: Performance of securitized papers depends on the performance

of underlying assets and unless specified in case of default they go back to originator from

SPV.

Repayment of funds: SPV will repay the funds in form of interest and principal that arises

from the assets pooled.

Credit Rating of Instruments: Sometime before the sale of securitized instruments credit

rating can be done to assess the risk of the issuer.

OR

© The Institute of Chartered Accountants of India

16 FINAL (NEW) EXAMINATION: MAY, 2018

The benefits of securitization can be viewed from the angle of various parties

involved as follows:

(A) From the angle of originator: Originator (entity which sells assets collectively to

Special Purpose Vehicle) achieves the following benefits from securitization.

(i) Off – Balance Sheet Financing: When loan/receivables are securitized it

release a portion of capital tied up in these assets resulting in off Balance Sheet

financing leading to improved liquidity position which helps expanding the

business of the company.

(ii) More specialization in main business: By transferring the assets the entity

could concentrate more on core business as servicing of loan is transferred to

SPV. Further, in case of non-recourse arrangement even the burden of default

is shifted.

(iii) Helps to improve financial ratios: Especially in case of Financial Institutions

and Banks, it helps to manage Capital –To-Weighted Asset Ratio effectively.

(iv) Reduced borrowing Cost: Since securitized papers are rated due to credit

enhancement even they can also be issued at reduced rate as of debts and

hence the originator earns a spread, resulting in reduced cost of borrowings.

(B) From the angle of investor: Following benefits accrues to the investors of

securitized securities.

1. Diversification of Risk: Purchase of securities backed by different types of

assets provides the diversification of portfolio resulting in reduction of risk.

2. Regulatory requirement: Acquisition of asset backed belonging to a particular

industry say micro industry helps banks to meet regulatory requirement of

investment of fund in industry specific.

3. Protection against default: In case of recourse arrangement if there is any

default by any third party then originator shall make good the least amount.

Moreover, there can be insurance arrangement for compensation for any such

default.

(d) (i) Equilibrium price of Equity using CAPM

= 5% + 1.5(11% - 5%)

= 5% + 9%= 14%

D1 2.00(1.08) 2.16

P= = = = ` 36

ke - g 0.14 0.08 0.06

(ii) New Equilibrium price of Equity using CAPM (assuming 3% on 5% is inflation

increase)

= 5.15% + 1.3(11% - 5.15%)

= 5.15% + 7.61%= 12.76%

© The Institute of Chartered Accountants of India

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT 17

D1 2.00(1.05)

P= = = ` 27.06

ke - g 0.1276 0.05

Alternatively, it can also be computed as follows, assuming it is 3% in addition to 5%

= 8% + 1.3(11% - 8%)

= 8% + 3.9%= 11.9%

D1 2.00(1.05)

P= = = ` 30.43

ke - g 0.119 0.05

Alternatively, if all the factors are taken separately then solution of this part will be as

follows:

(i) Inflation Premium increase by 3%.

This raises R X to 17%. Hence, new equilibrium price will be:

2.00(1.08)

= = ` 24

0.17 0.08

(ii) Expected Growth rate decrease by 3%.

Hence, revised growth rate stand at 5%:

2.00(1.05)

= = `23.33

0.14 0.05

(iii) Beta decreases to 1.3.

Hence, revised cost of equity shall be:

= 5% + 1.3(11% - 5%)

= 5% + 7.8%= 12.8%

As a result New Equilibrium price shall be:

D1 2.00(1.08)

P= = = ` 45

ke - g 0.128 0.08

© The Institute of Chartered Accountants of India

Вам также может понравиться

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsОт EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsОценок пока нет

- CorpFinance Cheat Sheet v2.2Документ2 страницыCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Accounting StandardsДокумент296 страницAccounting StandardsPalbhai Divyasai100% (1)

- Cash Flow and Financial PlanningДокумент64 страницыCash Flow and Financial PlanningAmjad J AliОценок пока нет

- Study of NBFC Sector Growth and Role in Indian EconomyДокумент90 страницStudy of NBFC Sector Growth and Role in Indian EconomyShubham Gupta100% (1)

- Special Laws ReviewerДокумент13 страницSpecial Laws ReviewerMiguel Bueno100% (2)

- Question Paper PDFДокумент17 страницQuestion Paper PDFSaianish KommuchikkalaОценок пока нет

- AnswerQuiz - Module 6Документ4 страницыAnswerQuiz - Module 6Alyanna Alcantara100% (1)

- RCM Strategic PlanДокумент20 страницRCM Strategic PlanTubagus Donny SyafardanОценок пока нет

- 58804bos47896finalnew p2 PDFДокумент21 страница58804bos47896finalnew p2 PDFSatyam ThakurОценок пока нет

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionДокумент6 страницCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayОценок пока нет

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Документ15 страниц6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverОценок пока нет

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerДокумент17 страницQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidОценок пока нет

- MBA Advance Financial Management exam questionsДокумент4 страницыMBA Advance Financial Management exam questionsNishaTripathiОценок пока нет

- FMECO M.test EM 30.03.2021 QuestionДокумент6 страницFMECO M.test EM 30.03.2021 Questionsujalrathi04Оценок пока нет

- FIN AL (NEW COURSEДокумент7 страницFIN AL (NEW COURSEchandreshОценок пока нет

- Answer Paper 2 SFM May 17Документ22 страницыAnswer Paper 2 SFM May 17Ekta Saraswat VigОценок пока нет

- 7 Corporate Finance - Prof. Gagan SharmaДокумент4 страницы7 Corporate Finance - Prof. Gagan SharmaVampireОценок пока нет

- Accounting concepts and principlesДокумент8 страницAccounting concepts and principleslion kingОценок пока нет

- 7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BДокумент15 страниц7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BManish MishraОценок пока нет

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Документ5 страницBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22Оценок пока нет

- MTP 1 Nov 18 QДокумент6 страницMTP 1 Nov 18 QSampath KumarОценок пока нет

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsДокумент27 страницPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanОценок пока нет

- Final Exam 2020 CorrectionДокумент4 страницыFinal Exam 2020 Correctionmonaatallah1Оценок пока нет

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersДокумент25 страницCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahОценок пока нет

- Ac 8 PDFДокумент17 страницAc 8 PDFrAHULОценок пока нет

- Numericals On Financial ManagementДокумент4 страницыNumericals On Financial ManagementDhruv100% (1)

- Financial Management Project AnalysisДокумент10 страницFinancial Management Project AnalysisAlisha Shaw0% (1)

- Corporate Financial ManagementДокумент3 страницыCorporate Financial ManagementRamu KhandaleОценок пока нет

- Cainterseries 2 CompleteДокумент70 страницCainterseries 2 CompleteNishanthОценок пока нет

- Adv Accounts MTP M19 S2Документ22 страницыAdv Accounts MTP M19 S2Harshwardhan PatilОценок пока нет

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerДокумент5 страницQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerCA Dipesh JainОценок пока нет

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFДокумент7 страницCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavОценок пока нет

- Tax AakashДокумент6 страницTax AakashAkash ChauhanОценок пока нет

- Advanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Документ7 страницAdvanced Financial Accounting Degree Question Paper Free Download Goodwill Tuition Centre, Kochi, Kerala PH: 9567902805, 9846710963Rainy GoodwillОценок пока нет

- Dividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)Документ23 страницыDividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)amiОценок пока нет

- FM & Eco Grand Test 2Документ8 страницFM & Eco Grand Test 2moniОценок пока нет

- Ca Final New - Group 1: Paper 2Документ9 страницCa Final New - Group 1: Paper 2Priyanshu TomarОценок пока нет

- Advanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzeДокумент20 страницAdvanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzekaragujsОценок пока нет

- 1705383722Ch 5 Financial Decisions Capital Structure CA Inter CTSanswerДокумент6 страниц1705383722Ch 5 Financial Decisions Capital Structure CA Inter CTSanswerPratyushОценок пока нет

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementДокумент27 страницPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementSakshi KhandelwalОценок пока нет

- II PU Accountancy QPДокумент13 страницII PU Accountancy QPLokesh RaoОценок пока нет

- SFM MTP - May 2018 QuestionДокумент6 страницSFM MTP - May 2018 QuestionMajidОценок пока нет

- Solved Problems Chapter 11Документ6 страницSolved Problems Chapter 11nagendra reddy panyamОценок пока нет

- SFM QuesДокумент5 страницSFM QuesAstha GoplaniОценок пока нет

- Long-term Finance Options for Delite FurnitureДокумент4 страницыLong-term Finance Options for Delite FurnitureNaveen RaiОценок пока нет

- Maximizing Value Through Optimal Capital StructureДокумент4 страницыMaximizing Value Through Optimal Capital Structurehyp siinОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент26 страниц© The Institute of Chartered Accountants of IndiaChandana RajasriОценок пока нет

- Self Assessment TestДокумент7 страницSelf Assessment Testpppttt123Оценок пока нет

- sFikv8tLO3DuTOB3I8bY--4762Документ2 страницыsFikv8tLO3DuTOB3I8bY--4762dipusharma4200Оценок пока нет

- SFM New Sums AddedДокумент78 страницSFM New Sums AddedRohit KhatriОценок пока нет

- IFRS B.com SH College Model Question Paper 2017 March 2Документ2 страницыIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillОценок пока нет

- CRV - Valuation - ExerciseДокумент15 страницCRV - Valuation - ExerciseVrutika ShahОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент7 страниц© The Institute of Chartered Accountants of IndiaRahul AgrawalОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент13 страниц© The Institute of Chartered Accountants of IndiaHarsh KumarОценок пока нет

- APC Individual Assignment - CIC160097Документ10 страницAPC Individual Assignment - CIC160097Siti Nor Azliza AliОценок пока нет

- MTP Oct. 2018 FM and Eco QuestionДокумент6 страницMTP Oct. 2018 FM and Eco QuestionAisha MalhotraОценок пока нет

- 70067bos56011 Final p2qДокумент6 страниц70067bos56011 Final p2qVipul JainОценок пока нет

- Paper - 2: Strategic Financial Management Questions Future ContractДокумент24 страницыPaper - 2: Strategic Financial Management Questions Future ContractRaul KarkyОценок пока нет

- Econ F315 1923 CM 2017 1Документ3 страницыEcon F315 1923 CM 2017 1Abhishek GhoshОценок пока нет

- 4 Financial Management Questions Nov Dec 2019 PL PDFДокумент5 страниц4 Financial Management Questions Nov Dec 2019 PL PDFShahriar ShihabОценок пока нет

- Final Paper 2Документ258 страницFinal Paper 2chandresh0% (1)

- DEC 2016 AnswersДокумент37 страницDEC 2016 AnswersBKS SannyasiОценок пока нет

- FM Questions RevisedДокумент15 страницFM Questions RevisedRajarshi DaharwalОценок пока нет

- (CBCS) Commerce Paper - 4.6 (A) : Mutual FundsДокумент2 страницы(CBCS) Commerce Paper - 4.6 (A) : Mutual FundsSanaullah M SultanpurОценок пока нет

- RTP CA Final New Course Paper 2 Strategic Financial ManagemeДокумент26 страницRTP CA Final New Course Paper 2 Strategic Financial ManagemeTusharОценок пока нет

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFДокумент9 страницModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitОценок пока нет

- Nov 2018 RTP PDFДокумент21 страницаNov 2018 RTP PDFManasa SureshОценок пока нет

- Mock Test Q2 PDFДокумент5 страницMock Test Q2 PDFManasa SureshОценок пока нет

- Nov 2018 Actual A Paper PDFДокумент20 страницNov 2018 Actual A Paper PDFManasa SureshОценок пока нет

- May 2019 RTP PDFДокумент23 страницыMay 2019 RTP PDFManasa SureshОценок пока нет

- Nov 2018 Actual Q Paper PDFДокумент8 страницNov 2018 Actual Q Paper PDFManasa SureshОценок пока нет

- May 2018 Actual Q Paper PDFДокумент8 страницMay 2018 Actual Q Paper PDFManasa SureshОценок пока нет

- Bos 32721 P 2Документ28 страницBos 32721 P 2aankur97Оценок пока нет

- Mock Test A2 PDFДокумент15 страницMock Test A2 PDFManasa SureshОценок пока нет

- Mock Test Q1 PDFДокумент4 страницыMock Test Q1 PDFManasa SureshОценок пока нет

- Mock Test A1 PDFДокумент12 страницMock Test A1 PDFManasa SureshОценок пока нет

- Paper - 1: Financial Reporting Questions: © The Institute of Chartered Accountants of IndiaДокумент32 страницыPaper - 1: Financial Reporting Questions: © The Institute of Chartered Accountants of IndiaManasa SureshОценок пока нет

- Accounting & Finance Module: B: Ca R. C. JoshiДокумент131 страницаAccounting & Finance Module: B: Ca R. C. JoshiRahul GuptaОценок пока нет

- 67-3 Accountancy PDFДокумент24 страницы67-3 Accountancy PDFprerit100% (1)

- Derivatives and Risk Management Session on Options, Forwards and Futures ContractsДокумент23 страницыDerivatives and Risk Management Session on Options, Forwards and Futures ContractsSubhrodeep DasОценок пока нет

- FM Model Question PaperДокумент10 страницFM Model Question PaperSugandhaОценок пока нет

- Financial Ratio Reviewer PDFДокумент19 страницFinancial Ratio Reviewer PDFMichael John OliveriaОценок пока нет

- Financial Statement Analysis of Microsoft Corporation (Revised)Документ7 страницFinancial Statement Analysis of Microsoft Corporation (Revised)Adhikansh SinghОценок пока нет

- Annual General Meeting NoticeДокумент210 страницAnnual General Meeting NoticearunОценок пока нет

- Balance Sheet AccountsДокумент3 страницыBalance Sheet AccountsDail Xymere YamioОценок пока нет

- Answers - Chapter 6 Vol 2Документ6 страницAnswers - Chapter 6 Vol 2jamflox100% (2)

- Albatross Capital Budgeting ProglemДокумент1 страницаAlbatross Capital Budgeting Proglemنواف القحطانيОценок пока нет

- 2012 Part 2 FRM Practice Exam - v1213Документ35 страниц2012 Part 2 FRM Practice Exam - v1213NikОценок пока нет

- WIPRO Annual Report Analysis: Revenue Up 26%, Net Profit Rises 13Документ51 страницаWIPRO Annual Report Analysis: Revenue Up 26%, Net Profit Rises 13Shanmuganayagam RОценок пока нет

- BADVAC1X Answers PDFДокумент4 страницыBADVAC1X Answers PDFHero CourseОценок пока нет

- Lanao del Sur Municipality Financial Statements Management ResponsibilityДокумент3 страницыLanao del Sur Municipality Financial Statements Management ResponsibilitymocsОценок пока нет

- Derivatives (Futures and Options) MBA ProjectДокумент48 страницDerivatives (Futures and Options) MBA ProjectRuchi TiwariОценок пока нет

- Emis 1186121 2020-02-03 PDFДокумент26 страницEmis 1186121 2020-02-03 PDFGerman AnayaОценок пока нет

- Management Representation Letter 2021Документ11 страницManagement Representation Letter 2021stillwinmsОценок пока нет

- Accounting Manager Victor Thogode's ResumeДокумент2 страницыAccounting Manager Victor Thogode's ResumeVictor ThogodeОценок пока нет

- Amundi ETF Tracks World ex Europe StocksДокумент2 страницыAmundi ETF Tracks World ex Europe Stockshp24714303Оценок пока нет

- Dhanuka Agritech - Detailed Report - CRISIL - July 2013Документ27 страницDhanuka Agritech - Detailed Report - CRISIL - July 2013aparmarinОценок пока нет

- Partnership - Liquidation Multiple Choice and ProblemsДокумент8 страницPartnership - Liquidation Multiple Choice and Problemskogigi2205Оценок пока нет

- Pilipinas Shell Petroleum Corporation Engages in The Refining and MarketingДокумент4 страницыPilipinas Shell Petroleum Corporation Engages in The Refining and MarketingClemenia Rea FeОценок пока нет

- 9M2018 Financial Performance and Strategic UpdateДокумент11 страниц9M2018 Financial Performance and Strategic UpdateMahkota RambutОценок пока нет