Академический Документы

Профессиональный Документы

Культура Документы

Questionnarie - Appendix

Загружено:

ಚಂದ್ರ ಮೋಹನ್Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Questionnarie - Appendix

Загружено:

ಚಂದ್ರ ಮೋಹನ್Авторское право:

Доступные форматы

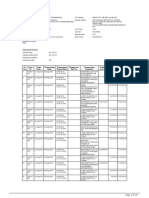

QUESTIONNAIRE

Dear Sir/Madam,

I am doing a Research on “STUDY ON THE INDIVIDUAL INVESTORS BEHAVIOR IN

CAPITAL MARKET WITH SPECIAL REFERENCE TO TAMIL NADU ” for my Ph.D. thesis. In this

connection I request you to read the following questions and answer them. The answers you

give will be held confidential and will be used only for the purpose of research.

I thank you for your time and co operation.

Mrs. P. Annal Lourdhu Regina,

Date : Associate Professor in Commerce,

Holy Cross College,

Trichy – 620 0002.

-----------------------------------------------------------------------------------------------------------------

A STUDY ON THE INDIVIDUAL INVESTORS BEHAVIOR IN CAPITAL MARKET WITH

SPECIAL REFERENCE TO TAMIL NADU

I. PERSONAL DETAILS (Please Tick)

1. Gender : 1) Male 2) Female

2. Age in completed years : ……………....... years

3. Academic qualifications : 1) School final 3) Post graduate

2) Graduate 4) Professional

4. Martial status : 1) Married 2) Unmarried

5. No of dependents : …………………….

6. Occupation : 1) Self employed 2) Employed in Government

3) Employed in Private 4) Retired\

7. Annual income in Rs. : 1) Below 2 lakhs 3) 4 lakhs to 6 lakhs

2) 2 lakhs to 4 lakhs 4) 6 lakhs and above

8. How much do you save : 1) Less than Rs. 25000 3) Rs. 50000 to 1 lakh

annually (In Rs Approx.) 2) Rs. 25000 to 50000 4) Rs. 1 lakh and above

9. Do you own a house : 1) Yes 2) No

10. Do you have a mortgage loan

on the house property : 1) Yes 2) No

II. DETAILS OF INVESTMENT PREFERENCES

1. I own the following assets (Please tick whichever is applicable)

1) Bank deposits 2) Shares 3) Mutual funds

4) Postal savings 5) Insurance Policies

2. My investments in capital market are

1) All in demat form 2) Mostly in demat form

3) All in physical form 4) Mostly in physical form

3. The number of companies in my portfolio is …………………………

4. The sectors which are represented in my portfolio are (Please tick whichever is applicable)

1) Banking 2) Auto 3) Telecom 4) Steel

5) Oil Gas 6) Pharma 7) Any other (Please specify)

5 I prefer to do the investment transactions

1) Through my broker/financial advisor 2) On my own using internet

3) Any other (Kindly specify)

6. The time I spend for investing activities is

1) 2 to 5 hrs per week 2) 2 to 5 hrs per month 3) 2 to 5 hrs per year

4) Most of my spare time 5) Everyday at least some time

7. I borrow and invest in stock market 1) Yes 2) No

8. The average rate of earnings on my investment for the past five years is

1) Below 10 percent 2)10 to 20 percent

3) Above 20 percent 4) Net loss

9. I have shares in delisted companies 1) Yes 2) No

10. My experience in the stock market is

1) Less than 5 years 2) 5 – 10 years 3) Above 10 years

III. OBJECTIVES OF SAVINGS, INVESTMENT PREFERENCES AND STRATEGIES

Please read the following statements and tick the appropriate column.

S.No. Item Strongly Agree No Disagree Strongly

Agree Opinion Disagree

1. I save for my children’s education.

2. I save for contingencies.

3. I save to purchase a house.

4. I save for tax benefits.

5. I save for my daughter’s marriage.

6. I save to provide for my

retirement.

7. I prefer investing in blue chip

companies.

8. I prefer investing in new upcoming

companies with good prospects.

9. I am interested in short term gains

from my investment in shares.

10. Invest in shares mainly for long

term capital gains.

11. Announcements regarding bonus,

rights and dividends motivate me

to buy those scripts.

12. I hold certain shares for a very

long time for sentimental reasons.

13. I prefer IPOs than secondary

market instruments.

14. When shares are allotted in an

IPO I sell it immediately on listing

at profit.

15. I prefer buying shares( large cap)

in small lots.

16. I prefer buying shares when the

market goes up.

17. I sell shares when there is news

about fall in market.

18. I am an active investor who trades

often.

19. I prefer investing in familiar

companies.

20. I book profits after I reach the

desired goals.

S.No. Item Strongly Agree No Disagree Strongly

Agree Opinion Disagree

21. A majority of my investments are

in gold and real estate.

22. I prefer mutual funds than shares.

23. Most of my investments are in

shares.

24. I buy shares based on the

company’s fundamental.

25. I buy shares based on technical

forecast.

IV. Please rank the INFLUENCE of the following in your FINANCIAL DECISION

MAKING PROCESS.

S.No. Item Very high High Not Low Very low

sure

1. Business News Channels like

CNBC,NDTV Profit

2. Investment websites

3. Professional Advisers

4. Family and Friends

5. Magazine or Newspapers

6. Books

V. Please rank the importance of the following qualities which you expect from

your Financial Adviser.

S.No. Item Highly Important Not sure Not Not at all

important important important

1. Maximizing return

2. Trust and Confidentiality

3. Handling problems

4. Protecting Capital

5. Experience

6. Fee structure

7. Brand name of the adviser

VI. SELECTION OF MUTUAL FUNDS

Please tick your preference for the following schemes

S.No. Item Highly Favourable Not Unfavour Highly

favourable sure able unfavourable

1. Growth Schemes

2. Balanced Schemes

3. Tax Saving Schemes

4. Income Schemes

5. Index Schemes

VII. QUALITIES IN A SCHEME

Please rate the importance you attach to the qualities in a scheme.

S.No. Item Highly Important Not Not Not at all

important Sure important important

1. Safety

2. Flexibility

3. Capital Appreciation

4. Liquidity

5. Good Return

6. Professional Management

7. Diversification

8. Fund Performance

9. Fund Reputation or Brand

name

10. Scheme Portfolio

11. Rating given

12. Tax Benefits

13. Sponsors reputation

14. Investor services

15. Fringe benefits like credit

card etc.

16. Disclosure of NAV

VIII. INVESTORS PERCEPTIONS ABOUT CAPITAL MARKET

Please read the following statements and tick the appropriate column.

S.No. Item Strongly Agree Not Disagree Strongly

Agree sure Disagree

1. Price fluctuation in Indian Stock

Market is high.

2. Indian stock markets are well

regulated.

3. Corporate mismanagement and

frauds are my biggest worries in

Indian stock market.

4. The brokers’ services are good.

5. The demat system is convenient

and cheap.

6. Adequate and reliable portfolio

management services are

available for individual investors.

7. Debentures as an investment

option are favorable.

8. Equities as an investment option

are favorable.

9. Mutual funds as an investment

option are favorable.

10. Government bonds as an

investment option is favorable.

11. Indian company managements

are not honest and sincere

towards their share holder.

12. Shareholders cannot rely on

company auditors in preventing

financial irregularities by

company managements.

13. Indian company managements

are now taking more care of the

shareholders interest.

14. Capital market in India is a safe

haven for investors.

15. Retail shareholders interests are

not protected.

IX. THE LEVEL OF INVESTOR AWARENESS

S.No. Item Yes Not No

sure

1 I know the meaning of technical analysis and

fundamental analysis.

2. Bank Deposits are totally risk free.

3. Mutual Fund Principal and Returns are not guaranteed.

4. Ups and Downs of Stock Market will affect the returns

from Mutual Fund.

5. I know what sensex and nifty are.

6. I have heard about SEBI.

7. An investor can have more than one demat account.

8. I understand the communication I receive from the

companies I invest in.

9. Maintain a systematic record of my investments and

monitor it periodically.

10. I read the offer document of an issue and understand it.

11. I am aware of the credit rating symbols for bonds and

deposits and know the meaning.

12. I can understand the business news analysis.

Вам также может понравиться

- The Four Walls: Live Like the Wind, Free, Without HindrancesОт EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesРейтинг: 5 из 5 звезд5/5 (1)

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesОт EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesОценок пока нет

- Questionnaire: . Part AДокумент4 страницыQuestionnaire: . Part A9425753715Оценок пока нет

- QuestionnaireДокумент6 страницQuestionnaireKenshin SophisticОценок пока нет

- Introduction To Feasib Study Script: Slide 2Документ10 страницIntroduction To Feasib Study Script: Slide 2Paula Marie De GuzmanОценок пока нет

- Feasibility Study Prepared By: Mohammad Marwan Al Ashi: First Term 08/09Документ32 страницыFeasibility Study Prepared By: Mohammad Marwan Al Ashi: First Term 08/09olive baniel100% (1)

- Asg 1 Role of Finance ManagerДокумент2 страницыAsg 1 Role of Finance ManagerRokov N ZhasaОценок пока нет

- Edp NotesДокумент48 страницEdp NotesSantosh SunnyОценок пока нет

- Me - Rnsit NotesДокумент71 страницаMe - Rnsit Notesantoshdyade100% (1)

- Financial Markets Final Requirement FormatДокумент4 страницыFinancial Markets Final Requirement FormatClaire BarbaОценок пока нет

- AFM Question Bank For 16MBA13 SchemeДокумент10 страницAFM Question Bank For 16MBA13 SchemeChandan Dn Gowda100% (1)

- Demat Services of Karvy Stock Broking LTDДокумент99 страницDemat Services of Karvy Stock Broking LTDSharn Gill100% (1)

- Bond Valuation NTHMCДокумент24 страницыBond Valuation NTHMCAryal LaxmanОценок пока нет

- Week 1FMДокумент52 страницыWeek 1FMchitkarashelly100% (1)

- Module 1 Unit I Principles of Risk and Risk ManagementДокумент15 страницModule 1 Unit I Principles of Risk and Risk ManagementGracia SuratosОценок пока нет

- (Part - I) Strategic Management (Eng)Документ209 страниц(Part - I) Strategic Management (Eng)vaishnavforever100% (3)

- Financial Statement Analysis 2Документ2 страницыFinancial Statement Analysis 2Deepak KumarОценок пока нет

- An Overview of Financial SystemДокумент6 страницAn Overview of Financial SystemAshwani BhallaОценок пока нет

- Market: Reference To Nepalese Stock Market" Part: AДокумент3 страницыMarket: Reference To Nepalese Stock Market" Part: AShresthaОценок пока нет

- 2f0d5LAW670 - Legal Aspects of BusinessДокумент4 страницы2f0d5LAW670 - Legal Aspects of BusinessvickkyОценок пока нет

- Project 3rd Sem FinalДокумент24 страницыProject 3rd Sem Finalprakash chavanОценок пока нет

- SAPM Punithavathy PandianДокумент22 страницыSAPM Punithavathy PandianVimala Selvaraj VimalaОценок пока нет

- A Project On Capital Market: Submitted To: Punjab Technical University, JalandharДокумент95 страницA Project On Capital Market: Submitted To: Punjab Technical University, JalandharSourav ChoudharyОценок пока нет

- Vidyalankar Marg, Wadala (East) Mumbai 400037.: Synopsis of The Project For The Subject AreaДокумент7 страницVidyalankar Marg, Wadala (East) Mumbai 400037.: Synopsis of The Project For The Subject AreaYaash ChogleОценок пока нет

- Portfolio Management Banking SectorДокумент133 страницыPortfolio Management Banking SectorNitinAgnihotri100% (1)

- Analysis AssignmentДокумент3 страницыAnalysis AssignmentmadyanoshieОценок пока нет

- Introduction To Security AnalysisДокумент456 страницIntroduction To Security AnalysisSandipan Das100% (2)

- Financial Markets and ServicesДокумент3 страницыFinancial Markets and Serviceshussainmba30Оценок пока нет

- Impact of Fiis On Performance of Nifty AДокумент54 страницыImpact of Fiis On Performance of Nifty AShinigami RyukОценок пока нет

- Blackmores' Financial Analysis & Accounting For LeasesДокумент9 страницBlackmores' Financial Analysis & Accounting For LeasesMalik TayyabОценок пока нет

- Report On Sumeru Securities PVT LTD 2Документ18 страницReport On Sumeru Securities PVT LTD 2sagar timilsinaОценок пока нет

- Case Study On Strategic ManagementДокумент15 страницCase Study On Strategic Management21E4114 Nithyashree IОценок пока нет

- BRM Final ProjectДокумент20 страницBRM Final ProjectRaja AhsanОценок пока нет

- Capital Market1Документ81 страницаCapital Market1Rajesh BathulaОценок пока нет

- Financial Services MbaДокумент251 страницаFinancial Services MbaMohammed Imran50% (2)

- Working Capital Management 15Документ75 страницWorking Capital Management 15Vany AprilianiОценок пока нет

- Financial Performance AnalysisДокумент106 страницFinancial Performance AnalysisVasu GongadaОценок пока нет

- Indian Banking System Syllabus PDFДокумент2 страницыIndian Banking System Syllabus PDFMahek BaigОценок пока нет

- Accounting For ManagementДокумент2 страницыAccounting For ManagementShibasish BhattacharyaОценок пока нет

- Departmentation - 1Документ20 страницDepartmentation - 1Vivek RajОценок пока нет

- Financial Policy and Corporate StrategyДокумент10 страницFinancial Policy and Corporate StrategyPravesh PangeniОценок пока нет

- Unit 10 Financial MarketsДокумент9 страницUnit 10 Financial MarketsDURGESH MANI MISHRA PОценок пока нет

- Divya Jaiswal - Upes Final Sip Report (Mba Finance), Sap Id 500084308Документ32 страницыDivya Jaiswal - Upes Final Sip Report (Mba Finance), Sap Id 500084308Biproteep Karmakar0% (1)

- MGA3033 Course Outline OBE 1092013Документ9 страницMGA3033 Course Outline OBE 1092013Nur FahanaОценок пока нет

- UNIT-4 Mergers, Diversification and Performance EvaluationДокумент13 страницUNIT-4 Mergers, Diversification and Performance EvaluationRavalika PathipatiОценок пока нет

- Unit I - Indian Financial Syaytem: An Overview: Dnyansagar Arts and Commerce College, Balewadi, Pune - 45Документ51 страницаUnit I - Indian Financial Syaytem: An Overview: Dnyansagar Arts and Commerce College, Balewadi, Pune - 45Nithin RajuОценок пока нет

- Capital Budgeting SHARIBДокумент103 страницыCapital Budgeting SHARIBfarzijii4Оценок пока нет

- Porfolio ManagementДокумент89 страницPorfolio ManagementTeddy DavisОценок пока нет

- Module No.3 - Handout PPДокумент26 страницModule No.3 - Handout PPAkhilОценок пока нет

- Professional Mis Conduct in AuditingДокумент6 страницProfessional Mis Conduct in Auditingsameerkhan855Оценок пока нет

- PGDFMДокумент6 страницPGDFMAvinashОценок пока нет

- CHP 2 - Issue ManagementДокумент32 страницыCHP 2 - Issue ManagementFalguni MathewsОценок пока нет

- Unit I - Overview of A Feasibility StudyДокумент11 страницUnit I - Overview of A Feasibility StudyEdgelly VitugОценок пока нет

- IntershipДокумент65 страницIntershipainashaikhОценок пока нет

- Management of Non Performing Assets - A Current Scenario: Chandan Chatterjee Jeet Mukherjee DR - Ratan DasДокумент11 страницManagement of Non Performing Assets - A Current Scenario: Chandan Chatterjee Jeet Mukherjee DR - Ratan DasprabindraОценок пока нет

- Indian Financial System PDFДокумент29 страницIndian Financial System PDFPravesh YadavОценок пока нет

- Value Chain Management Capability A Complete Guide - 2020 EditionОт EverandValue Chain Management Capability A Complete Guide - 2020 EditionОценок пока нет

- Building Your Financial Future: A Practical Guide For Young AdultsОт EverandBuilding Your Financial Future: A Practical Guide For Young AdultsОценок пока нет

- FIN3621 Review 9Документ2 страницыFIN3621 Review 9KhoaNamNguyenОценок пока нет

- 03 - Literature ReviewДокумент7 страниц03 - Literature ReviewVienna Corrine Q. AbucejoОценок пока нет

- Mcom Ind As 33 Theory.Документ11 страницMcom Ind As 33 Theory.Umang PatelОценок пока нет

- NCFM Modules Study MaterialДокумент1 страницаNCFM Modules Study MaterialIntelivisto Consulting India Private Limited50% (2)

- Diluted EPS NotesДокумент7 страницDiluted EPS NotesArchana DevdasОценок пока нет

- Context - ZerodhaДокумент2 страницыContext - ZerodhaParam ShahОценок пока нет

- Guidelines For Listing: ChecklistДокумент6 страницGuidelines For Listing: ChecklistParag MogarkarОценок пока нет

- Avenue Supermarts LTD.: Margin Reset UnderwayДокумент9 страницAvenue Supermarts LTD.: Margin Reset UnderwayAshokОценок пока нет

- Cost CapitalДокумент28 страницCost Capitalaliashour123Оценок пока нет

- Quiz 6 Market Value ApproachДокумент4 страницыQuiz 6 Market Value ApproachRissa AgapeОценок пока нет

- Orange FinancialДокумент35 страницOrange Financialosama aboualamОценок пока нет

- Curso Larry WilliansДокумент226 страницCurso Larry WilliansJose Calachahuin100% (6)

- Mba Project NfoДокумент73 страницыMba Project NfoHitesh Mittal50% (2)

- Selected Indian Case Studies On Insider TradingДокумент27 страницSelected Indian Case Studies On Insider TradingYASH RAJОценок пока нет

- Financial Freedom Through ForexДокумент144 страницыFinancial Freedom Through Forexvishnukant123100% (6)

- TECHREVIEWNJULY20101Документ2 страницыTECHREVIEWNJULY20101VishalОценок пока нет

- Debt J-LДокумент621 страницаDebt J-LkenindiОценок пока нет

- The Early History of Stock Market IndicesДокумент29 страницThe Early History of Stock Market IndicesTôThànhPhongОценок пока нет

- A Study On Ipo Issue Documents and Their Past Listing PerformanceДокумент73 страницыA Study On Ipo Issue Documents and Their Past Listing Performancerahul7332Оценок пока нет

- Ifm AssignmentДокумент15 страницIfm AssignmentRockstar KshitijОценок пока нет

- Value StocksДокумент8 страницValue Stocksvikas yadavОценок пока нет

- Volatality in Indian Stock MarketДокумент79 страницVolatality in Indian Stock Marketmuthuananda0% (1)

- Screen (HTS) - WINPro 200 DocumentationДокумент83 страницыScreen (HTS) - WINPro 200 DocumentationBob ClarksonОценок пока нет

- Chapter 10 Risks and Returns - BobadillaДокумент24 страницыChapter 10 Risks and Returns - BobadillaJohn Rey EnriquezОценок пока нет

- Osmium Partners Presentation - Spark Networks IncДокумент86 страницOsmium Partners Presentation - Spark Networks IncCanadianValue100% (1)

- Detailed StatementДокумент18 страницDetailed Statementwolf8585.inОценок пока нет

- News Profiteer - Henry LiuДокумент113 страницNews Profiteer - Henry LiuGopikrishnanОценок пока нет

- Mineral Economics 2nd Ed. Monograph 29. AUSIMMДокумент311 страницMineral Economics 2nd Ed. Monograph 29. AUSIMMMelody Maker93% (14)

- SEBI Circular 10102019Документ6 страницSEBI Circular 10102019Anujan RamanujanОценок пока нет

- Portfolio Sharpe RatioДокумент7 страницPortfolio Sharpe RatioPooja SivayoganОценок пока нет