Академический Документы

Профессиональный Документы

Культура Документы

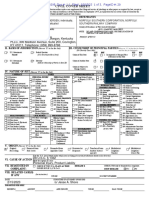

Oklahoma Insurance Department Claim Information

Загружено:

Wews WebStaff0 оценок0% нашли этот документ полезным (0 голосов)

4K просмотров2 страницыDetails from the Oklahoma Insurance Department on how to file a flood insurance claim

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDetails from the Oklahoma Insurance Department on how to file a flood insurance claim

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

4K просмотров2 страницыOklahoma Insurance Department Claim Information

Загружено:

Wews WebStaffDetails from the Oklahoma Insurance Department on how to file a flood insurance claim

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

How to File a HOME Insurance Claim

step 1: step 2: step 3: step 4:

Call your agent or Make any temporary After you have filed your When it comes to

insurance company repairs necessary to claim, the insurance paying your claim, you

to start your claim. keep your property company will arrange to may receive multiple

from receiving further send a claims adjuster checks. The payment for

damage. Save receipts to your home to assess the contents or personal

to mitigate damages. the damage. property will be made

Before moving any Obtain repair estimates out to you. However, if

debris or removing from trusted local there is a mortgage

damaged belongings, contractors to help when on your home, the

make sure to take photos you’re speaking with the payment for the

or video of the damage. insurance adjuster. structural damage may

Make a list to document be payable to you and

these losses. your mortgage holder.

Do not make any

permanent repairs until

the insurance company Still have questions?

reviews the damages. CALL CONSUMER ASSISTANCE

1.800.522.0071

OID.OK.GOV

How to File an AUTO Insurance Claim

step 1: step 2: step 3: step 4:

Call 911 if someone has Exchange license plate Contact your insurance The adjuster will

a life-threatening injury. numbers, contact company as soon examine your vehicle

If there’s no emergency, information and auto as possible. and determine an

call the police directly. insurance information estimate for repairs

(Not at fault) Advise your

Make sure to obtain a with the other parties carrier of the accident or total the vehicle.

police report. involved. Take photos of and file a claim with the You may be asked to

Liability and Collision: the scene, if possible. responsible party’s collect estimates for

Carrying liability only Make sure to get phone carrier. If the driver is repair of minor damage

protects against claims for numbers, including uninsured, discuss your and submit them to the

bodily injury and damages witnesses, if applicable. legal options and confirm responsible party’s

to another vehicle or uninsured motorists’ insurance carrier.

property in an accident for Do not admit fault at the coverage on your policy. The insurance company

which you are found liable. scene, as the adjuster will will cut a check in the

Collision coverage pays for determine negligence. (At fault) File a claim with

your carrier if you have amount of the repair. If

damage to your vehicle for a you are the at-fault party,

collision accident no matter Oklahoma law requires damages. The other party

who is at fault. 25/50/25 minimum insurance will likely file a claim the amount will be minus

coverage. Costs over these

for their damages with the collision deductible.

Comprehensive: limits will be your responsibility

Comprehensive coverage without additional coverage. your carrier.

pays for damage to your

If you and the company cannot reach an agreement regarding the claim, you can contact the

vehicle caused by something Oklahoma Insurance Department and request mediation; OID can also deal with your complaint

other than a collision. about an insurer. You can also consult an attorney to discuss your legal options, particularly if the

Follow steps 3 & 4 for these at-fault party is uninsured.

types of claims.

1.800.522.0071 • OID.OK.GOV • INSURANCE COMMISSIONER JOHN D. DOAK

Вам также может понравиться

- Parish and School Policy On Issues of Sexuality and Gender Identity 1Документ3 страницыParish and School Policy On Issues of Sexuality and Gender Identity 1Wews WebStaffОценок пока нет

- Certified Ballot Language For Issue 1Документ2 страницыCertified Ballot Language For Issue 1Wews WebStaffОценок пока нет

- Ohio Senate Bill To Eliminate Income TaxesДокумент57 страницOhio Senate Bill To Eliminate Income TaxesWews WebStaffОценок пока нет

- 14th Seminannual ReportДокумент59 страниц14th Seminannual ReportWews WebStaffОценок пока нет

- School Bus Report FinalДокумент13 страницSchool Bus Report FinalWews WebStaffОценок пока нет

- Denied Plates 2023Документ18 страницDenied Plates 2023Wews WebStaff100% (1)

- Certified Explanation For Issue 1Документ2 страницыCertified Explanation For Issue 1Wews WebStaffОценок пока нет

- Intent To Oral DepoДокумент5 страницIntent To Oral DepoWKYC.comОценок пока нет

- Federal Complaint Against Aimenn D. PennyДокумент8 страницFederal Complaint Against Aimenn D. PennyWews WebStaffОценок пока нет

- Akron Protestor Complaint 2022 To FileДокумент76 страницAkron Protestor Complaint 2022 To FileWKYC.comОценок пока нет

- Sister of Charity Media Statement 2023Документ1 страницаSister of Charity Media Statement 2023Wews WebStaff0% (1)

- CCA Notice - December 2022Документ1 страницаCCA Notice - December 2022Wews WebStaffОценок пока нет

- Lawsuit Filed Against Norfolk Southern by Morgan & MorganДокумент31 страницаLawsuit Filed Against Norfolk Southern by Morgan & MorganWews WebStaffОценок пока нет

- Letter Sent by PA Gov. Josh Shapiro To Norfolk SouthernДокумент3 страницыLetter Sent by PA Gov. Josh Shapiro To Norfolk SouthernWews WebStaffОценок пока нет

- East Palestine Remedial Action Work PlanДокумент10 страницEast Palestine Remedial Action Work PlanCincinnatiEnquirerОценок пока нет

- Shad Environotes - November 2007Документ2 страницыShad Environotes - November 2007Wews WebStaffОценок пока нет

- Akron Updates Designs and Communications - v2Документ1 страницаAkron Updates Designs and Communications - v2Wews WebStaffОценок пока нет

- 2022 Denied Special PlatesДокумент17 страниц2022 Denied Special PlatesWews WebStaffОценок пока нет

- EastPalestineResources02 16 23Документ1 страницаEastPalestineResources02 16 23Wews WebStaffОценок пока нет

- Certified Complaint Against GrendellДокумент61 страницаCertified Complaint Against GrendellWews WebStaffОценок пока нет

- Judge Timothy Grendell StatementДокумент11 страницJudge Timothy Grendell StatementWews WebStaffОценок пока нет

- APS Safety Plan UpdateДокумент1 страницаAPS Safety Plan UpdateWews WebStaffОценок пока нет

- 2022.10.25 Chief Gabbard Memo - Internal Review of Use of Force, Officer Robert HuberДокумент4 страницы2022.10.25 Chief Gabbard Memo - Internal Review of Use of Force, Officer Robert HuberWews WebStaffОценок пока нет

- Cleveland Division of Police 12th Status ReportДокумент28 страницCleveland Division of Police 12th Status ReportWews WebStaffОценок пока нет

- Fed Subpoena Cleveland RecordsДокумент4 страницыFed Subpoena Cleveland RecordsWews WebStaffОценок пока нет

- ARPA AllocationsДокумент20 страницARPA AllocationsWews WebStaffОценок пока нет

- Road Closures For 2022 MarathonДокумент1 страницаRoad Closures For 2022 MarathonWews WebStaffОценок пока нет

- Executive Order 2022-11DДокумент2 страницыExecutive Order 2022-11DWews WebStaffОценок пока нет

- New American EconomyДокумент17 страницNew American EconomyWews WebStaffОценок пока нет

- 2020 State Diaper Facts 3 2021Документ5 страниц2020 State Diaper Facts 3 2021Wews WebStaffОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Indemnity Agreement For Surety Bail BondДокумент1 страницаIndemnity Agreement For Surety Bail Bondclayborn9100% (1)

- Cargo Insurance Certificate-TEMPLATESДокумент1 страницаCargo Insurance Certificate-TEMPLATESadnanbajwa141Оценок пока нет

- Complete Neill Wycik Land Registry DocumentsДокумент305 страницComplete Neill Wycik Land Registry Documentsgrundlebugger100% (1)

- GT Capital: Up To P12B Bond IssueДокумент457 страницGT Capital: Up To P12B Bond IssueBusinessWorldОценок пока нет

- RRK CLIENT SERVICE CONTRACT. (As Revised)Документ8 страницRRK CLIENT SERVICE CONTRACT. (As Revised)Nonnatus P Chua100% (1)

- TourДокумент4 страницыTourAnup SahОценок пока нет

- Appointment RecieptДокумент3 страницыAppointment Recieptsiva5256Оценок пока нет

- FM 2-89 - Pipe Friction Loss TablesДокумент11 страницFM 2-89 - Pipe Friction Loss TableswastedsunsetsОценок пока нет

- ACAS Taxation 2 (Income Tax - Full Midterm Coverage)Документ15 страницACAS Taxation 2 (Income Tax - Full Midterm Coverage)Steven OrtizОценок пока нет

- MICB Membership PDFДокумент1 страницаMICB Membership PDFDarlene DarleneОценок пока нет

- SUD Life Protect ShieldДокумент4 страницыSUD Life Protect Shieldrajesh kumar guptaОценок пока нет

- Cultural Know HowДокумент5 страницCultural Know HowAlassfar AbdelОценок пока нет

- Employee Compensation BBA HRMДокумент52 страницыEmployee Compensation BBA HRMnavin9849Оценок пока нет

- Trust Administration WorksheetДокумент17 страницTrust Administration WorksheetRocketLawyer100% (3)

- Article 1207Документ4 страницыArticle 1207Milagros Isabel L. Velasco100% (1)

- CPOLICYdoc 01050048194100210965 PDFДокумент2 страницыCPOLICYdoc 01050048194100210965 PDFTanish MaanОценок пока нет

- Consti G1 G12Документ523 страницыConsti G1 G12River Mia RomeroОценок пока нет

- BailmentДокумент11 страницBailmentdee dee100% (1)

- Your Turn PT AssignmentДокумент2 страницыYour Turn PT Assignmentdrifter987Оценок пока нет

- Cebu Shipyard and Engineering Works Inc.: TORRES, Ma. Rafaella Ruth AДокумент4 страницыCebu Shipyard and Engineering Works Inc.: TORRES, Ma. Rafaella Ruth ANivla XolerОценок пока нет

- Jurisdiction DetailsДокумент80 страницJurisdiction Detailsu2prashantОценок пока нет

- Assets: Oracle E-Business Suite Release 12.2.6Документ6 страницAssets: Oracle E-Business Suite Release 12.2.6John Paul Neal RodriguezОценок пока нет

- Tax Code of GeorgiaДокумент270 страницTax Code of GeorgiaKate EloshviliОценок пока нет

- Application For CommutationДокумент12 страницApplication For CommutationVigneshwar Raju Prathikantam50% (2)

- Iiap Reviewer NewДокумент18 страницIiap Reviewer Newcindy100% (3)

- New Insurance Code of The PhilippinesДокумент10 страницNew Insurance Code of The PhilippinesSherlyn Paran Paquit-SeldaОценок пока нет

- Lifetime Income: An Immediate Annuity PlanДокумент9 страницLifetime Income: An Immediate Annuity PlanVandita KhudiaОценок пока нет

- ICICI Prudential Life InsuranceДокумент8 страницICICI Prudential Life Insuranceimamashraf1Оценок пока нет

- Homebuilding Operations Regional Manager in Houston TX Resume Richard ShaverДокумент3 страницыHomebuilding Operations Regional Manager in Houston TX Resume Richard ShaverRichardShaverОценок пока нет

- Ralph Geodesy S. Gabatin: ObjectivesДокумент4 страницыRalph Geodesy S. Gabatin: ObjectivesRam Brien Bungubung GundranОценок пока нет